Dữ liệu: Binance sẽ chứng kiến dòng vốn vào 21,6 tỷ USD vào năm 2024 và cơ sở người dùng toàn cầu của sàn đã tăng lên 244 triệu

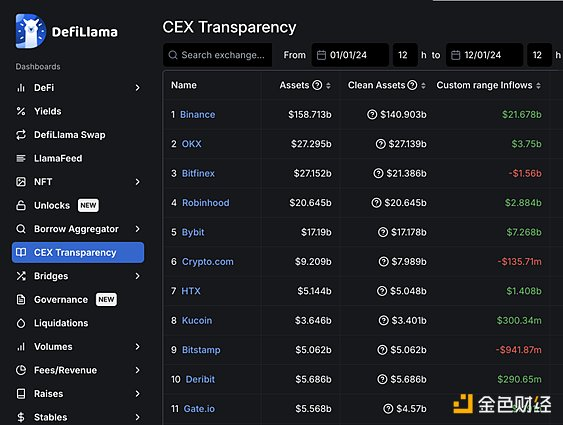

Theo bảng xếp hạng của DefiLlama, dòng người dùng đổ vào Binance, sàn giao dịch tài sản kỹ thuật số lớn nhất thế giới tính theo số lượng người dùng đã đăng ký và khối lượng giao dịch, đã cao hơn gần 40% so với 10 sàn giao dịch tiền điện tử tiếp theo cộng lại trong năm nay. Theo nền tảng dữ liệu, Binance sẽ chứng kiến dòng vốn vào 21,6 tỷ USD cho đến năm 2024, trong khi 10 sàn giao dịch tiếp theo sẽ chứng kiến 15,9 tỷ USD (thêm 36%).

Dòng vốn vào Binance được hỗ trợ bởi sự lạc quan ngày càng tăng trên toàn cầu về tài sản kỹ thuật số trong năm nay, được thúc đẩy bởi những phát triển quan trọng về quy định, mức độ áp dụng ngày càng tăng và các mốc giá lịch sử.

Cơ sở người dùng toàn cầu của Binance đã tăng lên 244 triệu khi ngày càng có nhiều người dùng chuyển tiền sang sàn giao dịch Binance để tham gia vào thời kỳ hoàng kim của tiền điện tử. Một động lực mạnh mẽ khác của dòng vốn có thể là sự thành công của chương trình Binance Launchpool năm nay, phản ánh sự quan tâm ngày càng tăng của người dùng đối với các đồng tiền mới. Binance quan sát thấy rằng những khoản tiền này có xu hướng vẫn còn trên nền tảng.

Năm 2024, ngành công nghiệp tiền điện tử đã đạt được một cột mốc lịch sử. Bitcoin ETF đã được phê duyệt tại các thị trường lớn bao gồm Hoa Kỳ, Brazil, Hồng Kông và Úc, báo hiệu sự chấp nhận rộng rãi hơn đối với tài sản kỹ thuật số. Chỉ trong một năm, dòng vốn ròng vào các quỹ ETF BTC đã vượt qua các quỹ ETF vàng, một minh chứng cho vai trò ngày càng tăng của tiền điện tử trong tài chính và sự tích hợp sâu sắc hơn của chúng với các tổ chức và hệ thống truyền thống hơn.

Sự ra mắt của các quyền chọn Bitcoin ETF, giúp các nhà đầu tư tổ chức dễ dàng tiếp cận rủi ro hơn và phòng ngừa rủi ro, đã góp phần đáng kể vào đợt phục hồi gần đây. Với lượng tiền lớn chảy vào các quỹ ETF này, Bitcoin dự kiến sẽ hội nhập sâu hơn vào các thị trường tài chính chính thống.

“2024 là một năm mang tính bước ngoặt đối với ngành công nghiệp tiền điện tử và chúng tôi vô cùng biết ơn 244 triệu người dùng, những người tiếp tục tin tưởng Binance là nền tảng giao dịch mà họ lựa chọn vì sự hỗ trợ và niềm tin không ngừng nghỉ của họ đã thúc đẩy chúng tôi đổi mới và cung cấp. trải nghiệm tốt nhất trong thế giới tài sản kỹ thuật số,” Giám đốc điều hành Binance Richard Teng cho biết.

Một cột mốc khác được ghi nhận gần đây càng làm nổi bật sự dẫn đầu của Binance trong thị trường tiền điện tử, trở thành sàn giao dịch tiền điện tử tập trung đầu tiên vượt qua khối lượng giao dịch trọn đời 100 nghìn tỷ USD, theo nhà cung cấp dữ liệu tài sản kỹ thuật số CCData.

Nhà cung cấp phân tích dữ liệu thị trường và chuỗi, CryptoQuant nhấn mạnh: “Năm nay đánh dấu một sự thay đổi lớn đối với ngành công nghiệp tiền điện tử, với việc các sàn giao dịch báo cáo mức tăng mạnh về số tiền gửi trung bình đối với Bitcoin và USDT, cho thấy mức độ tham gia trung bình của các tổ chức trên tất cả các sàn giao dịch đã tăng lên. 0,36 BTC vào năm 2023 lên 1,65 BTC, trong khi tiền gửi USDT đã tăng từ 19.600 USD lên 23 USD triệu khoản tiền gửi lớn hơn này phản ánh sự quan tâm ngày càng tăng từ các nhà đầu tư chuyên nghiệp và doanh nghiệp, phân biệt hoạt động của tổ chức với giao dịch bán lẻ.”

Báo cáo của họ nêu rõ rằng “Binance dẫn đầu ngành về tăng trưởng tổ chức, với mức tăng lớn nhất về số tiền gửi Bitcoin trung bình trong số các sàn giao dịch lớn”.