เจาะลึก "นัยสำคัญทางสถิติ" ของ Halving: Bitcoin กระทิงเป็นเหตุการณ์ที่สามารถซื้อขายได้หรือไม่?

การรวบรวมต้นฉบับ: Frank, Foresight News

สรุป:

โดยเผินๆ เหตุการณ์การลดจำนวนลงครึ่งหนึ่งของ Bitcoin ที่คาดหวังไว้สูงนั้นโดยทั่วไปแล้วจะเป็นภาวะกระทิงในอดีต

อย่างไรก็ตาม เนื่องจากมีประวัติการลดลงครึ่งหนึ่งเกิดขึ้นน้อยกว่าและการดูประสิทธิภาพของ Bitcoin ในสภาพแวดล้อมตลาดโดยรวมอย่างรอบคอบมากขึ้น จึงเป็นการยากที่จะตัดสินด้วยความเชื่อมั่นสูงโดยพิจารณาจากเหตุการณ์การลดลงครึ่งหนึ่งเพียงอย่างเดียว

โดยรวมแล้ว Bitcoin halving อาจไม่ใช่เหตุการณ์ที่สามารถซื้อขายได้จากมุมมองของอุปทาน แต่ก็มีองค์ประกอบที่เป็นกระทิง และหากมีการสนับสนุนลมมาโครที่เหมาะสม Bitcoin อาจดีดตัวขึ้นอีกครั้งหลังจากการลดลงครึ่งหนึ่ง

ฉันทามติเกี่ยวกับการลดจำนวนลงครึ่งหนึ่งของ Bitcoin นั้นเป็นไปในทางกระทิงและเชื่อกันอย่างกว้างขวางว่าเป็นเหตุการณ์ที่สามารถซื้อขายได้ แต่เป็นเช่นนั้นจริงหรือ? ในรายงานนี้ เราเจาะลึกเหตุการณ์การลดจำนวนลงครึ่งหนึ่งในอดีต และทำการวิเคราะห์ข้อมูลอุปทานและมหภาคในช่วงครึ่งปีของปี 2024 เพื่อรับข้อมูลที่ครอบคลุมมากขึ้นว่าเหตุการณ์ที่ได้รับการคาดการณ์อย่างกว้างขวางนี้มีความหมายต่อนักลงทุนอย่างไร

Bitcoin Halving คืออะไร?

Halving เป็นกิจกรรมที่ตั้งโปรแกรมไว้ล่วงหน้าในเครือข่าย Bitcoin ซึ่งจะตัดรางวัลสำหรับนักขุด Bitcoin ลงครึ่งหนึ่ง นี่เป็นกลไกสำคัญในนโยบายการเงินของ Bitcoin ซึ่งทำให้มั่นใจได้ว่าในที่สุดจะมีเพียง 21 ล้าน BTC เท่านั้นที่จะเข้าสู่การหมุนเวียนเพื่อป้องกันเงินเฟ้อและลดการออก BTC ใหม่ในภายหลัง

โปรแกรมนี้ได้รับการอัปเดตทุกๆ 210,000 บล็อค ซึ่งเทียบเท่ากับทุกๆ สี่ปีโดยประมาณ และเมื่อ Bitcoin เปิดตัวในปี 2009 รางวัลการขุดก็ถูกกำหนดไว้ที่ 50 BTC เนื่องจากการลดลงครึ่งหนึ่งของวันนี้เป็นครั้งที่สี่ บวกกับการลดครึ่งหนึ่งครั้งก่อนหน้าสามครั้ง (ปี 2012) , 2016 และ 2020) รางวัลลดลงเหลือ 3.125 BTC ต่อบล็อก

ดังที่เราทุกคนทราบกันดีว่า Bitcoin ใช้กลไกฉันทามติ Proof of Work (PoW) เพื่อตรวจสอบและรักษาความปลอดภัยธุรกรรมบนบล็อกเชน ใน PoW นักขุดจำเป็นต้องแข่งขันกันเองเพื่อแก้ไขปัญหาทางคณิตศาสตร์ที่ซับซ้อน และผู้ขุดคนแรกที่แก้ไขได้อย่างถูกต้องสามารถทำได้ ผ่านบล็อกถัดไปของธุรกรรมจะถูกเพิ่มในบล็อคเชน

เพื่อเป็นการชดเชยสำหรับการตรวจสอบธุรกรรมและการเพิ่มบล็อกในบล็อกเชน นักขุดที่ชนะจะได้รับรางวัลเป็น Bitcoins ที่สร้างขึ้นใหม่ ซึ่งเป็นรางวัลที่ "ลดลงครึ่งหนึ่ง" ในเหตุการณ์การลดครึ่งหนึ่งของวันนี้

ความจริงอันเยือกเย็นของ "การลดลงครึ่งหนึ่ง" ในประวัติศาสตร์

โดยเผินๆ การลดลงครึ่งหนึ่งได้รับการพิสูจน์แล้วว่ามีประโยชน์อย่างมากต่อ BTC ในอดีต

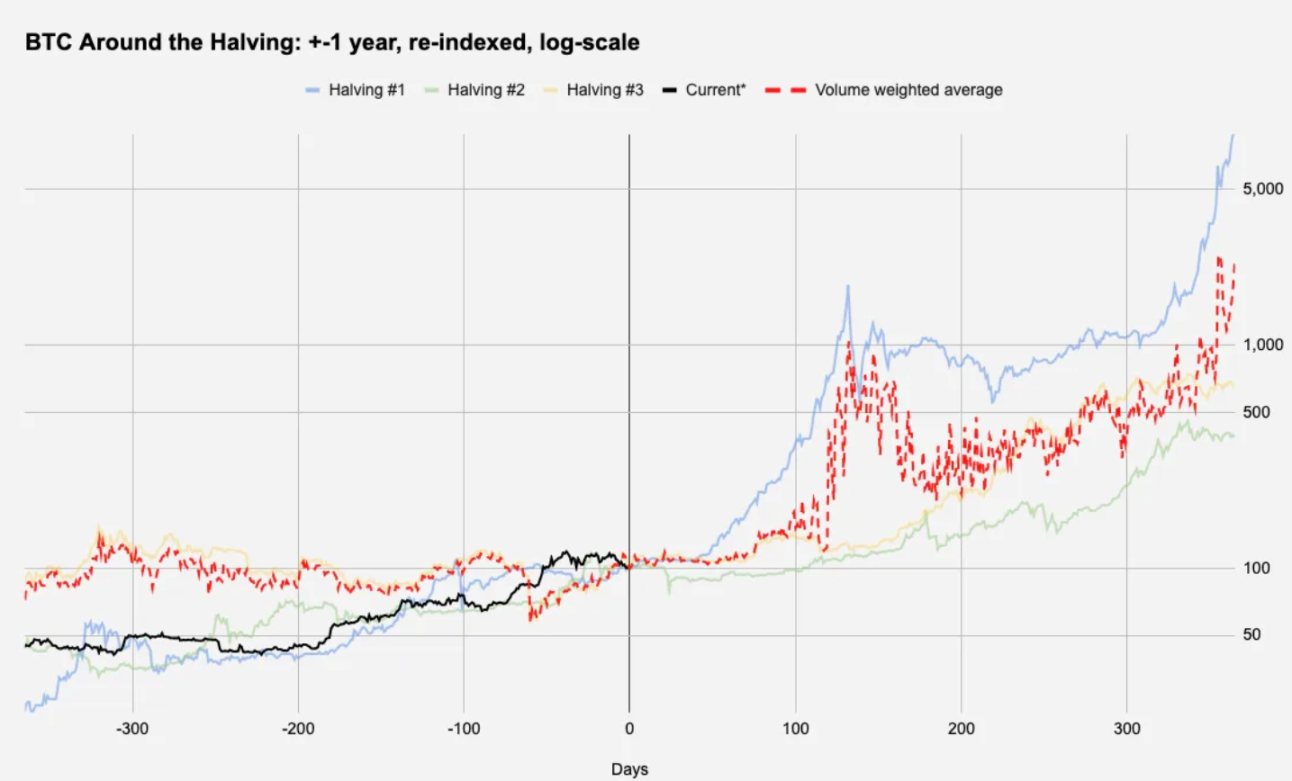

แผนภูมิด้านบนแสดงแนวโน้มราคาในอดีตของ BTC ก่อนและหลังการลดจำนวนลงครึ่งหนึ่งในแต่ละวัน (ช่วงคือตั้งแต่ 1 ปีก่อนการลดจำนวนลงครึ่งหนึ่งถึง 1 ปีหลังจากการลดลงครึ่งหนึ่ง) เส้นประสีแดงแสดงค่าเฉลี่ยถ่วงน้ำหนักของปริมาณการลดลงครึ่งหนึ่งในอดีต และ เส้นสีดำแสดงสถานการณ์ข้อมูล BTC ในปัจจุบัน

รูปด้านล่างสรุปข้อมูลที่เกี่ยวข้องในรูปแบบตาราง หมายเหตุ: วันที่ 0 บนแกนนอน = วันที่ลดลงครึ่งหนึ่ง, วันที่ 0 = 100 บนแกนตั้ง นอกจากนี้ บทความนี้ยังใช้ข้อมูลราคาในวันที่ 17 เมษายนในการอนุมาน

แกน Y ที่ปรับขนาดตามบันทึกของแผนภูมิแรกแสดงให้เห็นว่าการลดลงครึ่งหนึ่งเป็นตัวเร่งปฏิกิริยากระทิง แต่เนื่องจากเรามีเพียงสามข้อสังเกต และอย่างแรกคือเมื่อ BTC อยู่ที่ $12.80 เท่านั้น ส่วนครั้งที่สามเกิดขึ้นในเดือนพฤษภาคม 2020 ซึ่งเป็นช่วงที่สินทรัพย์เสี่ยงทั้งหมด เพิ่มขึ้นอย่างรวดเร็วในการชุมนุมของ Covid ดังนั้นดูเหมือนว่าการตีความข้อมูลใด ๆ จะต้องคำนึงถึง

นอกจากนี้ เมื่อเราดูผลตอบแทนเฉลี่ย 1 ปีของ BTC นับตั้งแต่กลางปี 2011 เราพบว่ายกเว้นการลดลงครึ่งหนึ่งครั้งแรกในปี 2012 ผลตอบแทน 1 ปีหลังจากการลดลงครึ่งหนึ่งดูไม่เหมือนเดิม

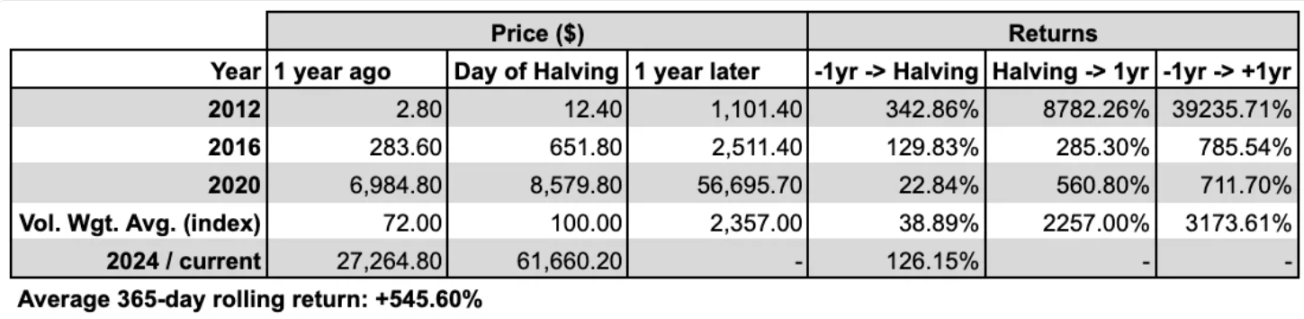

ในขณะเดียวกัน การลดลงครึ่งหนึ่งในปี 2020 ทำให้เกิดคำถามที่น่าสนใจว่าตลาดโลกจะมีผลการดำเนินงานโดยรวมอย่างไรในขณะนั้น ในแผนภูมิด้านล่าง เราเปรียบเทียบการใช้หุ้น (โดยเฉพาะ S&P 500) เป็นเกณฑ์มาตรฐานสำหรับสินทรัพย์ที่มีความเสี่ยง

ในขณะที่ผลตอบแทนต่อเนื่องเฉลี่ย 1 ปีของ SPX ตั้งแต่กลางเดือนกรกฎาคม 2554 อยู่ที่ +11.42% (ตรงกับข้อมูลราคา BTC ในอดีต) ประสิทธิภาพเฉลี่ย 1 ปีที่เริ่มต้นหลังจากการลดลงครึ่งหนึ่งของ Bitcoin นั้นมากกว่า +27 % ซึ่งมากกว่าค่าเฉลี่ยมากกว่าสองเท่า!

สิ่งนี้เน้นย้ำความเป็นจริงที่สำคัญซึ่งเรื่องเล่าทั่วไปมักมองข้าม ด้วยเหตุผลเดียวกัน เราไม่สามารถสรุปได้ว่าการอัปเดตโปรแกรมในเครือข่าย Bitcoin ที่ผู้ขุดได้รับลดลงครึ่งหนึ่งจะส่งผลดีต่อ S&P 500 อย่างมาก เราอาจไม่สามารถสรุปผลการดำเนินงานในอดีตของ BTC ได้ คำแถลง.

มิฉะนั้น ด้วยตัวชี้วัดบางอย่าง เช่น อัตราการเข้าถึงที่ดีกว่าค่าเฉลี่ย คุณสามารถสรุปได้ว่า Bitcoin halving นั้นเป็นผลบวกต่อ S&P 500 มากกว่า Bitcoin เอง!

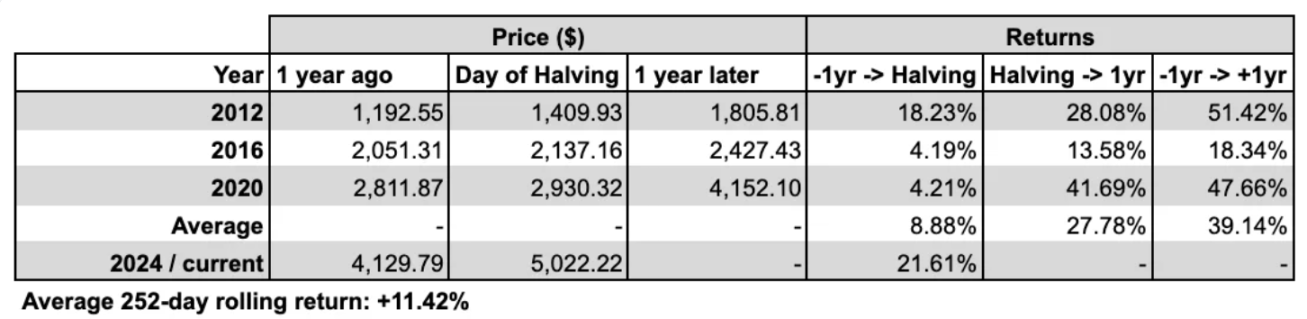

ในขณะเดียวกัน สำหรับผู้ที่สนใจเรื่องความผันผวน ข้อมูลแสดงให้เห็นว่าความผันผวนไม่มีความสัมพันธ์ที่ชัดเจนกับวันที่หรือช่วงเวลาการลดลงครึ่งหนึ่ง แผนภูมิด้านล่างแสดงความผันผวนจริง 30 วันก่อนและหลังวันที่ลดลงครึ่งหนึ่ง (+-365 วัน) : :

ธีม Halving ปี 2024 #1: ผู้ถือครองระยะยาว

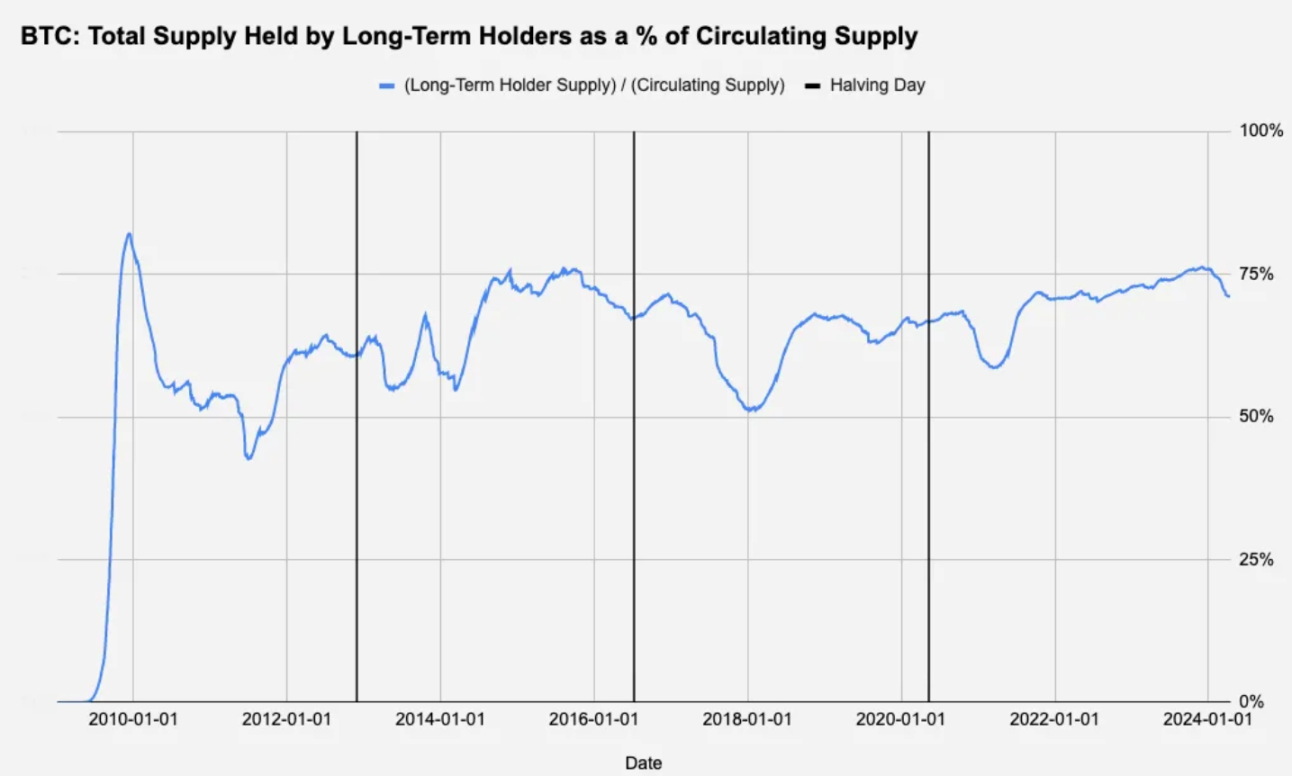

ที่นี่เราจะดูจำนวน BTC ทั้งหมดที่ถือครองโดยผู้ถือระยะยาว ซึ่งปรับตามอุปทานของ BTC

เมื่อพิจารณาว่าอุปทานหมุนเวียนของ Bitcoin จะยังคงเพิ่มขึ้นต่อไปจนกว่าจะถึงขีดจำกัดฮาร์ดแคปที่ 21 ล้าน Bitcoins เราจึงหารจำนวนผู้ถือระยะยาวด้วยอุปทานหมุนเวียนในขณะนั้นเพื่อดูการถือครองเป็นเปอร์เซ็นต์:

แม้ว่าปี 2020 จะมีความแตกต่างกันเล็กน้อย รูปที่ 5 แสดงให้เห็นว่าผู้ถือครองระยะยาวอาจทำกำไรก่อนการลดจำนวนลงครึ่งหนึ่ง โดยจะลดลงในปี 2024 เช่นกัน ยอดขายที่เปลี่ยนแปลงไปนี้มักเกิดจากนักขุด เนื่องจากการลดจำนวนลงครึ่งหนึ่งจะลดรายได้ต่อบล็อกลง 50% นักขุดมักจะขายคลังบางส่วนเพื่ออัปเกรดฮาร์ดแวร์เมื่อรางวัลลดลงเพื่อให้การขุดมีประสิทธิภาพมากขึ้น แรงกดดันด้านการขายเชิงโครงสร้างนี้อาจเกิดขึ้นในขณะนี้ เนื่องจากเราเหลืออีกไม่กี่วันจากการลดลงครึ่งหนึ่งในปี 2024

แม้ว่าสิ่งต่างๆ จะยังไม่ชัดเจนในปี 2020 แต่แผนภูมิด้านบนแสดงให้เห็นว่าผู้ถือครองระยะยาวอาจถอนเงินออกก่อนการลดจำนวนลงครึ่งหนึ่ง และสิ่งนี้ก็จะเกิดขึ้นในปี 2024 เช่นกัน

ตัวเลือกการขายนี้มักเกิดจากนักขุด เนื่องจากการลดจำนวนลงครึ่งหนึ่งจะลดรายได้ต่อบล็อกลง 50% นักขุดมักจะขายส่วนหนึ่งของที่เก็บ BTC เพื่ออัปเกรดฮาร์ดแวร์เพื่อดำเนินการต่อเมื่อรางวัลลดลง แรงกดดันในการขายโครงสร้างประเภทนี้อาจเกิดขึ้นในขณะนี้

หัวข้อการลดลงครึ่งหนึ่งปี 2024 #2: แลกเปลี่ยนยอดคงเหลือ BTC

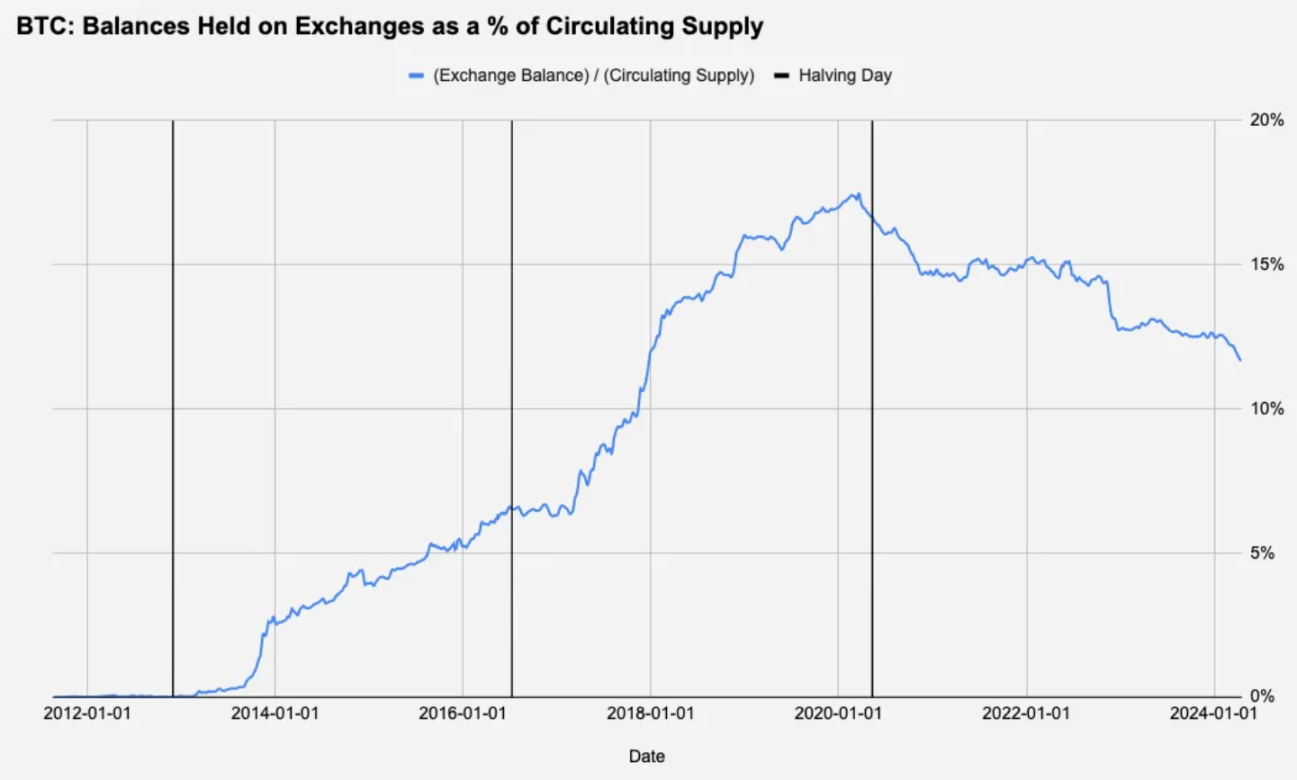

แม้ว่าบริษัทแลกเปลี่ยนจะไม่วางเดิมพันแบบมีทิศทาง แต่เรายังคงพิจารณาการถือครอง BTC สำรองของตลาดแลกเปลี่ยน (และโดยการขยาย อาจเป็นผู้ดูแลสภาพคล่องภายใน) เพื่อดูว่ามีความเป็นไปได้บางอย่างในช่วงวันที่ลดลงครึ่งหนึ่งหรือไม่ รูปแบบที่ต้องปฏิบัติตาม:

แผนภูมิด้านบนคืออุปทานทั้งหมดของ Bitcoin ที่ถือโดยการแลกเปลี่ยนสกุลเงินดิจิตอล หารด้วยอุปทานหมุนเวียนในขณะนั้น และดูเหมือนจะไม่มีอะไรน่าสนใจเกี่ยวกับเรื่องนี้ แนวโน้มเดียวที่สังเกตได้คือแนวโน้มระยะยาว หลังจากที่การแลกเปลี่ยนประสบกับช่วงสะสมประมาณ 6 ปี การถือครอง BTC ก็เริ่มลดลงอย่างต่อเนื่องเมื่อตลาดกระทิงครั้งสุดท้ายเริ่มต้นขึ้น

หัวข้อการลดลงครึ่งหนึ่งปี 2024 #3: พื้นหลังมาโคร

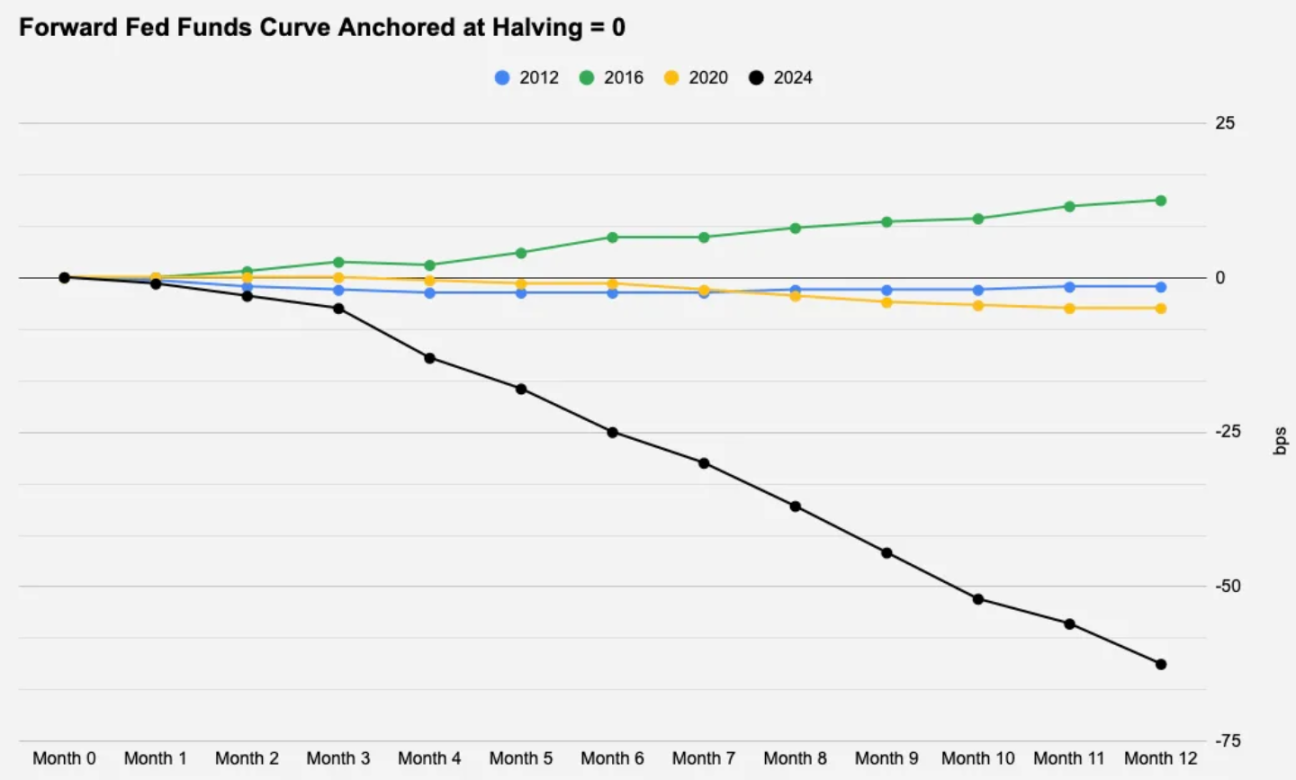

ความเกี่ยวข้องของเงื่อนไขมหภาคกับ Bitcoin มักจะถูกถกเถียงกัน แต่วัฏจักรมหภาค โดยเฉพาะอย่างยิ่งสภาพคล่องของ USD (ในฐานะหน้าที่ของนโยบายการเงิน/อัตราดอกเบี้ย ความเสี่ยงที่ยอมรับได้ ฯลฯ) ยังคงเป็นตัวขับเคลื่อนหลักของราคาสินทรัพย์ในระยะกลางถึงระยะยาว ด้วยเหตุนี้ เราจึงพิจารณาราคาตลาดสำหรับอัตราเงินกองทุนของรัฐบาลกลางในช่วง 12 เดือนข้างหน้าอย่างใกล้ชิดยิ่งขึ้น หลังจากวันที่ลดลงครึ่งหนึ่งในแผนภูมิด้านล่าง

เป็นที่ชัดเจนว่าการลดอัตราดอกเบี้ยลงครึ่งหนึ่งในปี 2024 นั้นถือว่าผิดปกติ โดยมีการปรับลดอัตราดอกเบี้ยเกือบสามครั้ง หรือพูดง่ายๆ ก็คือตลาดคาดการณ์ถึงการเคลื่อนไหวของอัตราดอกเบี้ยทุกรูปแบบ

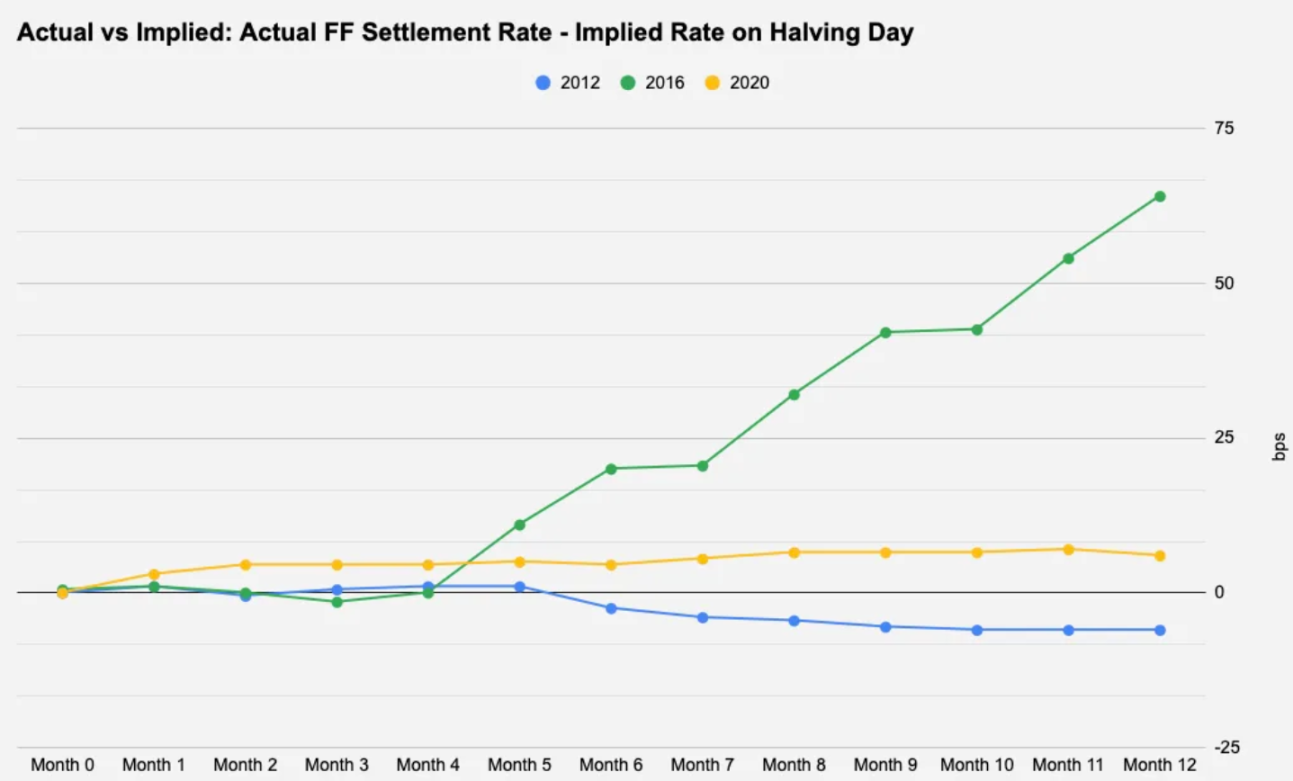

โดยทั่วไปการปรับลดอัตราดอกเบี้ยจะดีต่อสินทรัพย์เสี่ยง แต่สิ่งสำคัญสำหรับการเคลื่อนไหวของราคามักจะไม่ใช่ราคาที่มีอยู่แล้ว แต่เป็นระดับความเบี่ยงเบนจากการคาดการณ์ของตลาด ไม่ว่าจะเป็นข้อมูลเงินเฟ้อหรือคำแถลงจากประธานเฟด ในแผนภูมิด้านล่าง เราเปรียบเทียบความแตกต่างระหว่างอัตราโดยนัยของการชำระบัญชีจริงและการคาดการณ์ของตลาดในแต่ละวันที่ลดลงครึ่งหนึ่ง เพื่อดูว่าราคาล่วงหน้าในแผนภูมิด้านบนมีความแม่นยำเพียงใด

ตัวเลขในปี 2555 และ 2563 ค่อนข้างน้อยเกินไปที่ +-10 จุดพื้นฐานจากการคาดการณ์เบื้องต้น แต่ปี 2559 ก็คุ้มค่าที่จะพิจารณา เนื่องจากเฟดขึ้นอัตราดอกเบี้ยสองครั้งในตอนนั้น และตลาดไม่ได้กำหนดราคาไว้ในขณะนั้น

สิ่งที่น่าสนใจคือ รูปที่ 1 และ 2 ด้านบนแสดงให้เห็นว่าช่วง 12 เดือนหลังจากการลดลงครึ่งหนึ่งในปี 2016 ถือเป็นเดือนที่เลวร้ายที่สุดสำหรับ BTC ในบรรดาการลดลงครึ่งหนึ่งสามครั้งก่อนหน้านี้ และเป็นเพียงครั้งเดียวที่ทำได้ต่ำกว่าเดือนที่ผลตอบแทนเฉลี่ย 1 ปี ดังนั้น ด้วยการปรับลดอัตราดอกเบี้ยมากกว่าสองครั้งในช่วง 12 เดือนข้างหน้าซึ่งกำหนดราคาไว้แล้วในปัจจุบัน แรงผลักดันที่สำคัญกว่าหลังจากการลด BTC ลงครึ่งหนึ่งอาจเป็นอัตราเงินเฟ้อของสหรัฐฯ อย่างต่อเนื่องหรือสิ่งอื่นใดที่อาจกระตุ้นให้ Fed ยืนหยัดต่อไปโดยไม่ลดอัตราดอกเบี้ย

สรุปแล้ว

เราจะสำรวจฉากหลังมาโครอันเป็นเอกลักษณ์ของการลดลงครึ่งหนึ่งนี้โดยสังเขป แต่ข้อควรพิจารณาอื่นๆ เช่น BTC ETF ที่เพิ่งเปิดตัว ฯลฯ ไม่ได้กล่าวถึงในรายงานนี้ ด้วยความสนใจทั้งหมดที่ BTC ได้รับเมื่อเร็ว ๆ นี้ นี่จึงเป็นการลดลงครึ่งหนึ่งที่คาดหวังมากที่สุดจนถึงปัจจุบัน BTC ที่แพร่หลายได้แนะนำผู้เล่นใหม่ ๆ ที่อาจเปลี่ยนแปลงการเปลี่ยนแปลงของอุปสงค์ อุปทาน และการเคลื่อนไหวของราคา เป็นที่น่าสังเกตว่า ETF ที่เพิ่งเปิดตัวใหม่ ถือมากกว่า 4.1% ของอุปทานหมุนเวียนของ BTC ในขณะที่ MicroStrategy ถือครองมากกว่า 1% ของอุปทาน

เนื่องจากมีการลดลงครึ่งหนึ่งก่อนหน้านี้เพียงสามครั้ง จึงเป็นเรื่องยากที่จะได้ข้อสรุปที่มีนัยสำคัญทางสถิติจากผลการดำเนินงานที่ผ่านมาว่าเหตุการณ์นี้เป็นเหตุการณ์ที่สามารถซื้อขายได้หรือไม่ อย่างไรก็ตาม ในเชิงโครงสร้างจากมุมมองของอุปทาน นี่เป็นเหตุการณ์เชิงบวกอย่างไม่ต้องสงสัย