การตีความข้อมูล: Ethereum มีการไหลออก 3.6 พันล้านดอลลาร์สหรัฐในไตรมาสแรก เงินทุนไปอยู่ที่ไหน?

ผู้เขียนต้นฉบับ: Michael Nadeau

ต้นฉบับเรียบเรียง: ลูฟี่, Foresight News

พวกเขาบอกว่าการลงทุนต้องใช้เงินอย่างชาญฉลาด และสิ่งที่ยอดเยี่ยมเกี่ยวกับบล็อกเชนสาธารณะก็คือเราสามารถทำสิ่งนี้ได้อย่างง่ายดายโดยใช้ข้อมูลออนไลน์

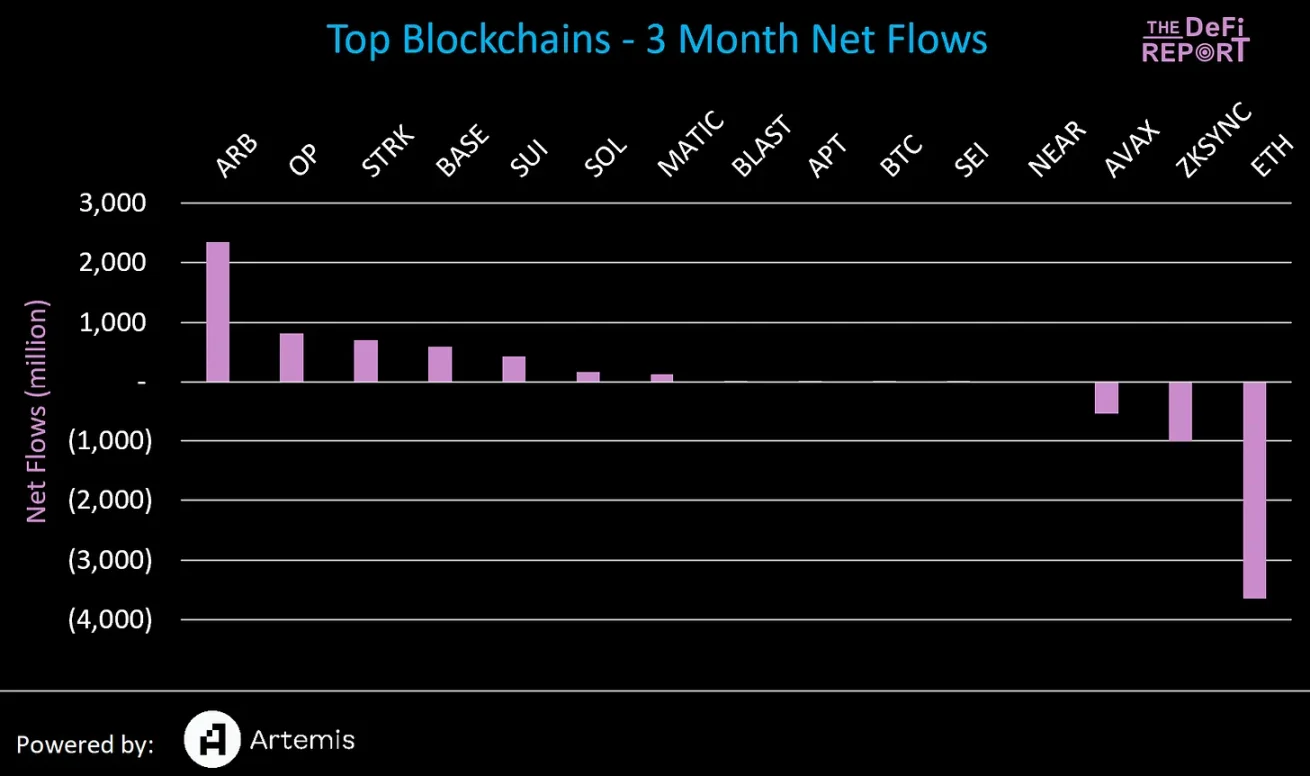

เนื่องจากโครงสร้างพื้นฐานที่เชื่อมต่อกับบล็อกเชนได้รับการปรับปรุง ผลกระทบของเครือข่ายและคูเมืองทางเศรษฐกิจภายในเครือข่ายเดียวอาจกลายเป็นเรื่องยากมากขึ้นในการบรรลุผล ดังนั้นเราจึงได้ศึกษากระแสเงินทุนสุทธิของ L1 และ L2 15 อันดับแรก เพื่อเปิดเผยทิศทางการไหลของมูลค่าในเครือข่ายบล็อกเชนสาธารณะอย่างแม่นยำ และตอนนี้ก็ถึงเวลาที่จะแบ่งปันสิ่งที่เราค้นพบกับคุณ

บล็อกเชนใดที่มีเงินทุนไหลเข้าสุทธิมากที่สุด?

ผู้ชนะ:

เราจะเห็นได้ว่า Arbitrum เป็นผู้ชนะที่ยิ่งใหญ่ที่สุด Arbitrum ได้รับปริมาณการใช้งานสุทธิมากกว่า 2.3 พันล้านดอลลาร์จากบล็อกเชนอื่น ๆ ในช่วง 3 เดือนที่ผ่านมา

การมองในแง่ดีอยู่ในอันดับที่สอง โดยมีการไหลเข้าสุทธิเกือบ 800 ล้านดอลลาร์ในช่วงเวลาเดียวกัน

StarkWare อยู่ในอันดับที่สามด้วยเงินทุนไหลเข้าสุทธิมากกว่า 700 ล้านดอลลาร์

ฐานอยู่ในอันดับที่สี่ โดยมีการไหลเข้าสุทธิเกือบ 600 ล้านดอลลาร์สหรัฐในช่วงสามเดือนที่ผ่านมา

ในที่สุด Sui อยู่ในห้าอันดับแรกด้วยการไหลเข้า 423 ล้านดอลลาร์ และเป็นเครือข่ายเดียวที่ไม่ใช่ EVM ที่มีการไหลเข้าที่สำคัญในช่วง 90 วันที่ผ่านมา

คนขี้แพ้:

Ethereum มีการไหลออกสุทธิมากกว่า 3.6 พันล้านดอลลาร์ในช่วง 90 วันที่ผ่านมา ในช่วงเวลาเดียวกัน เงินมากกว่า 4.4 พันล้านดอลลาร์เข้าสู่ระบบนิเวศ Ethereum ผ่านทาง L2 L2 จ่ายค่าธรรมเนียมการชำระให้กับ ETH L1 ดังนั้นเงินจะไม่ออกจาก Ethereum จริงๆ

ในช่วง 3 เดือนที่ผ่านมา zkSync มีการไหลออกมากกว่า 1 พันล้านดอลลาร์

Avalanche มีเงินมากกว่า 500 ล้านดอลลาร์ออกจากระบบนิเวศ

การไหลเข้าสุทธิของ Arbitrum มาจากไหน?

เราจะเห็นได้ว่าการไหลเข้าของ Arbitrum ส่วนใหญ่ (70%) มาจาก Ethereum L1 การไหลเข้าประมาณ 25% เป็นเหรียญที่มีเสถียรภาพ และโทเค็นอื่น ๆ คิดเป็น 75% เราคาดว่าเงินทุนจะออกจาก Ethereum L1 ต่อไปและไหลเข้าสู่ L2 ที่ได้รับความนิยมสูงสุดแทน

แต่โดยไม่คาดคิด เงินทุนเกือบ 500 ล้านดอลลาร์ได้ออกจากระบบนิเวศ Avalanche และไหลไปที่ Arbitrum หากเรากลับมาดูกราฟแรก Avalanche เป็นหนึ่งในผู้แพ้รายใหญ่ที่สุดของกลุ่ม โดยมีมูลค่า 543 ล้านดอลลาร์ออกจากระบบนิเวศในไตรมาสที่แล้ว โดย 84% ตกเป็นของ Arbitrum

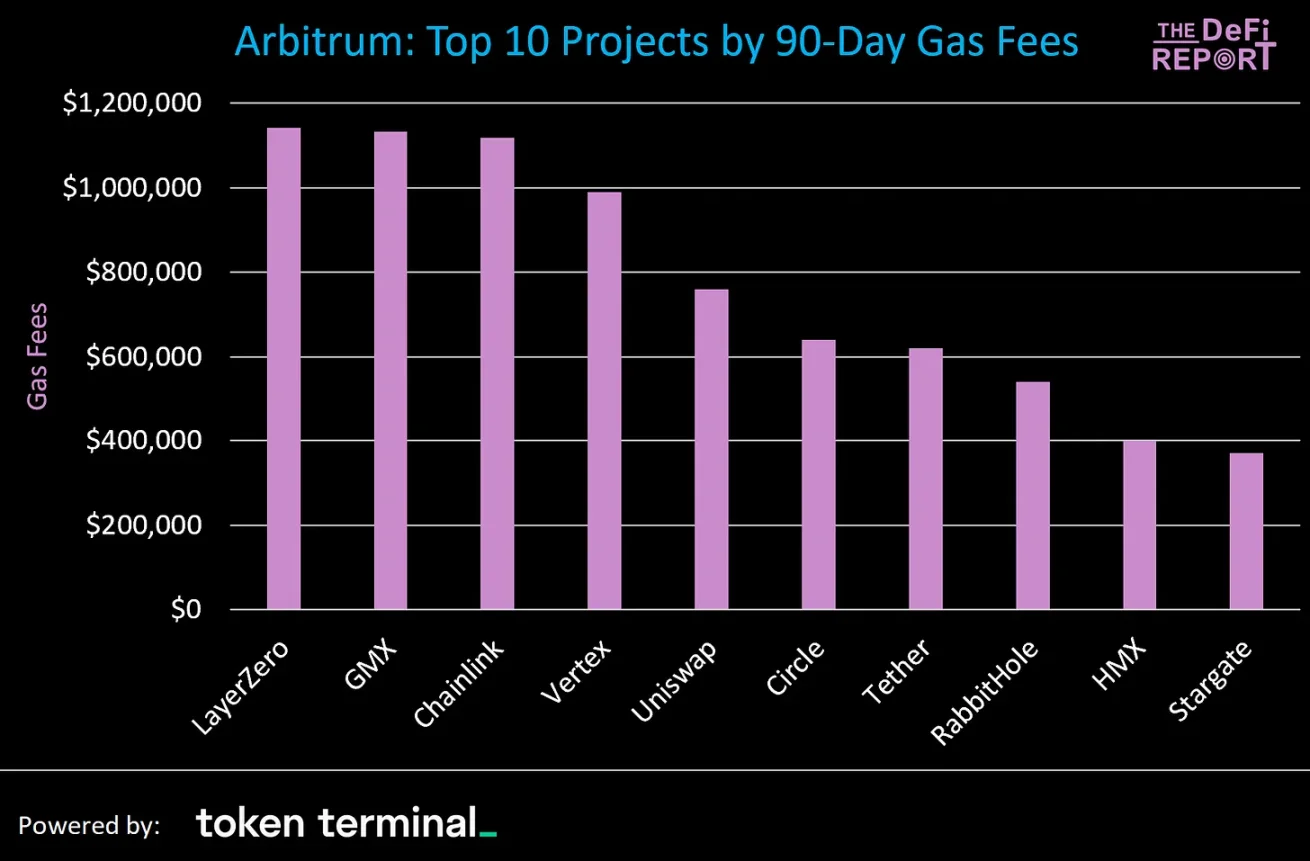

โครงการใดใน Arbitrum ที่ได้รับกระแสไหลเข้าเหล่านี้

เราไม่สามารถพูดได้อย่างแน่นอนว่าโครงการใดใน Arbitrum ที่จับกระแสไหลเข้าเหล่านี้ แต่โครงการที่กล่าวถึงข้างต้นคิดเป็นปริมาณการใช้ก๊าซมากที่สุดใน Arbitrum ในไตรมาสที่ผ่านมา

เมื่อเราดูแนวโน้มในช่วง 90 วัน RabbitHole (หนึ่งเกม) มีความโดดเด่นเนื่องจากปริมาณการใช้ก๊าซเพิ่มขึ้น 1,147% ในไตรมาสที่ผ่านมา

ข้อสังเกตที่น่าสนใจอีกประการหนึ่งเกี่ยวกับ Arbitrum ก็คือ Pyth Network (ออราเคิลข้อมูลชั้นนำภายใน Solana) ประสบปัญหาการใช้ก๊าซเพิ่มขึ้น 600% ในไตรมาสที่ผ่านมาหลังจากสนับสนุน Arbitrum

Blockchains ที่มีเงินทุนไหลออกมากที่สุด

เราได้พูดคุยเกี่ยวกับ Avalanche และยิ่งไปกว่านั้น zkSync (Ethereum L2) สูญเสียเงินไปกว่า 1 พันล้านดอลลาร์ในช่วง 90 วันที่ผ่านมา เงินไปไหน?

กระแสเงิน 328 ล้านดอลลาร์เข้าสู่ภาวะมองโลกในแง่ดี

เงินจำนวน 313 ล้านดอลลาร์ไหลเข้าสู่ Ethereum

เงินจำนวน 232 ล้านดอลลาร์ไหลเข้าสู่อนุญาโตตุลาการ

เงิน 37 ล้านดอลลาร์ไหลเข้าสู่ฐาน

ประเด็นสำคัญ: เงินทั้งหมดที่ไหลออกจาก zkSync อยู่ภายในระบบนิเวศ Ethereum

แล้วอีเธอเรียมล่ะ? เรารู้ว่า Arbitrum ได้รับเงิน 1.6 พันล้านดอลลาร์จาก Ethereum แต่เงินที่เหลือไปอยู่ที่ไหน?

การไหลออกสุทธิของ Ethereum ส่วนใหญ่ยังคงอยู่ในระบบนิเวศของ Ethereum โดยไหลไปยัง Starknet, Base และ Optimism

Sui เป็นผู้รับผลประโยชน์ที่ไม่ใช่ EVM รายใหญ่ที่สุดจากการไหลออกของ Ethereum โดยได้รับเงิน 452 ล้านดอลลาร์ นอกจากนี้ Solana ยังได้รับเงินไหลเข้าจาก Ethereum จำนวน 152 ล้านดอลลาร์

สรุปประเด็นสำคัญ

เมื่อเครือข่ายบล็อกเชนสาธารณะเติบโตเต็มที่ เราคาดว่าปริมาณเงินทุนในกลุ่มเทคโนโลยีจะเพิ่มขึ้น

นอกจากนี้เรายังคาดหวังว่าในที่สุดจะมีบล็อกเชน L1 หลัก 3-5 รายการ (และอาจเป็นชุดของบล็อกเชน L1 ที่มีความสำคัญน้อยกว่า)

แต่เมื่อโครงสร้างพื้นฐานแบบ cross-chain และบัญชีที่เป็นนามธรรมเติบโตเต็มที่ เราคาดหวังว่ามูลค่าจะไหลเวียนอย่างอิสระผ่านเครือข่ายและระบบนิเวศต่างๆ ส่งผลให้เครือข่ายที่เข้าถึงไม่ได้และคูเมืองทางเศรษฐกิจทำได้ยากยิ่งขึ้น

ต้องบอกว่า เราได้ข้อสรุปที่สำคัญบางประการจากการวิเคราะห์โฟลว์ใน L1 และ L2 หลัก

อีเธอเรียม

L1 ที่ใหญ่ที่สุดสูญเสียเงินไปมาก แต่กลับขึ้นมาที่ระดับ L2 ในความคิดของฉัน นี่เป็นสิ่งที่ดีสำหรับ Ethereum มันจะเป็นธงสีแดงหากเราเห็นเงินทุนออกจาก L1 แทนที่จะไปที่ L2 แต่ออกจากระบบนิเวศ Ethereum โดยสิ้นเชิง เพื่อความชัดเจน เราไม่ได้เห็นสิ่งนี้ในวันนี้

นอกจากนี้ TVL ของ Ethereum เพิ่มขึ้น 60% ในช่วง 3 เดือนที่ผ่านมา แม้ว่าจะมีเงินไหลออกมากกว่า 3 พันล้านดอลลาร์ก็ตาม สิ่งนี้เน้นให้เห็นข้อบกพร่องของ TVL ในฐานะ KPI (ราคาของสินทรัพย์อ้างอิงมีความผันผวนสูงและถูกจัดการได้ง่าย)

Solana

ในช่วง 3 เดือนที่ผ่านมา การไหลเข้าสุทธิของ Solana จาก L1 และ L2 ที่ใหญ่ที่สุด 15 แห่งมีมูลค่าเพียง 169 ล้านดอลลาร์ ในช่วงเวลาเดียวกัน TVL ของ Solana เพิ่มขึ้นจาก 1.4 พันล้านดอลลาร์เป็น 4.5 พันล้านดอลลาร์ (เพิ่มขึ้น 221%)

แล้วสิ่งนี้เกิดขึ้นได้อย่างไร?

ในช่วง 3 เดือนที่ผ่านมา ราคาของ SOL เพิ่มขึ้นจาก $100 เป็น $171 (เพิ่มขึ้น 77%)

มีการเพิ่ม SOL มากขึ้นเรื่อยๆ ในโซลูชันการวางเดิมพันสภาพคล่อง (Marinade, Jito, BlazeStake)

หลายโครงการภายในระบบนิเวศของ Solana ได้ออกโทเค็น เช่น Jito, Pyth, Jupiter และ Tensor โครงการเหล่านี้สร้างความมั่งคั่งใหม่นับพันล้านดอลลาร์ ซึ่งบางส่วนยังคงอยู่ใน Solana DeFi

Memecoin บน Solana ได้รับความนิยมอย่างล้นหลามมาเป็นเวลาหลายเดือน โดยปริมาณธุรกรรมที่เพิ่มขึ้นและ การล็อคมูลค่า

การเติบโตของ Solana ใน TVL ส่วนใหญ่เป็นการเติบโตแบบออร์แกนิกภายในระบบนิเวศ

Sui

Sui เป็นผู้ชนะที่ยิ่งใหญ่ที่สุดในยุคใหม่ของบล็อกเชน ปริมาณงานสูง ได้รับเงินไหลเข้าสุทธิ 423 ล้านดอลลาร์ ซึ่งส่วนใหญ่มาจาก Ethereum สิ่งนี้ดูเหมือนจะเป็นตัวเร่งหลักในการผลักดัน Sui TVL จาก 220 ล้านดอลลาร์เป็น 660 ล้านดอลลาร์ในปัจจุบัน

สะพานข้ามโซ่

ดังที่กล่าวไว้ข้างต้น เมื่อโครงสร้างพื้นฐานแบบ cross-chain เติบโตเต็มที่ การไหลของมูลค่าผ่านเครือข่ายต่างๆ ก็มีแนวโน้มที่จะเร่งตัวขึ้น โดยผลักมูลค่าออกจาก L1 ใดๆ ที่กำหนด และอาจมุ่งสู่ตัวสะพานแบบ cross-chain ด้วย เพื่อความชัดเจน ขณะนี้เราไม่เห็นเหตุการณ์นี้เกิดขึ้นแต่ยังคงติดตามดูอยู่

Wormhole เป็นหนึ่งในสะพานข้ามโซ่ที่ใหญ่ที่สุดในปัจจุบัน ให้การทำงานร่วมกันระหว่าง Solana, Ethereum, Arbitrum, BNB, Avalanche, Optimism, Near และ Polygon ทีมงานเพิ่งเปิดตัวโทเค็น และ FDV เคยมีมูลค่าเกิน 10 พันล้านดอลลาร์ ตัวเลขนี้ใกล้เคียงกับ Ethereum L2 ซึ่งเป็นสัญญาณตลาดว่าโครงสร้างพื้นฐานแบบ cross-chain มีความแข็งแกร่งและคุ้มค่าที่จะให้ความสนใจ