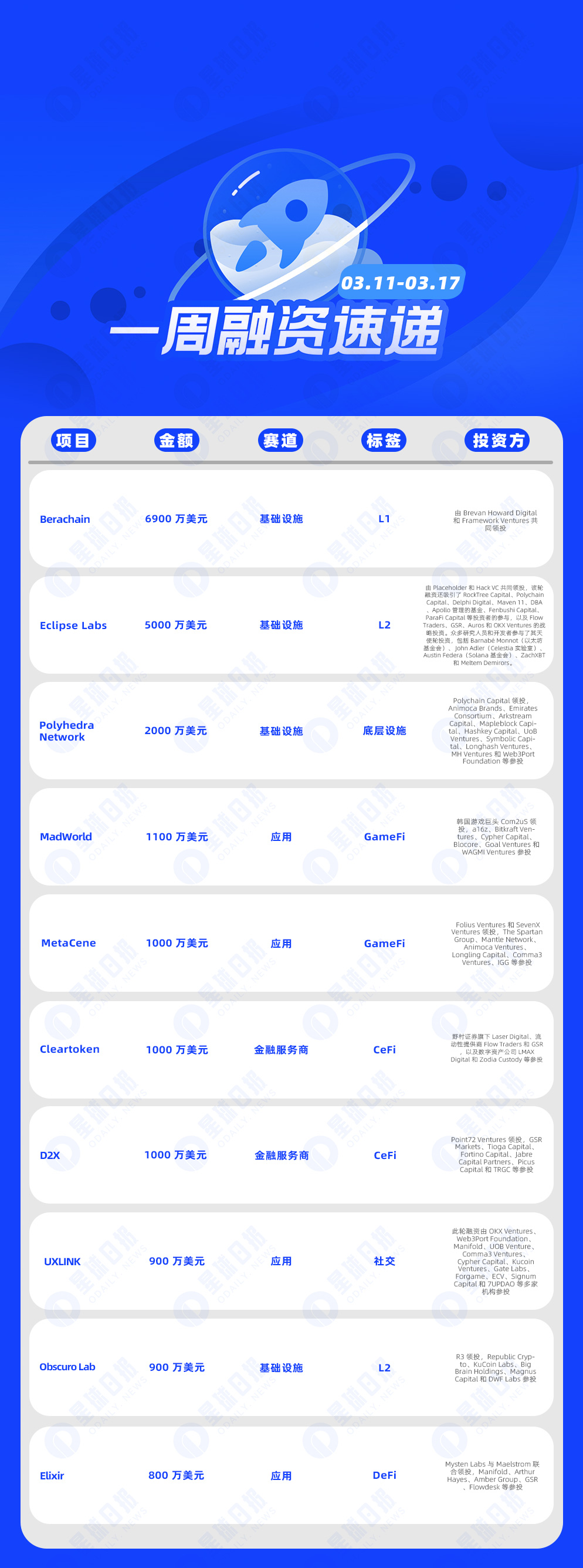

One-week financing express | 35 projects received investment, with a total disclosed financing amount of approximately US$260 million (3.11-3.17)

According to incomplete statistics from Odaily, a total of 35 blockchain financing events at home and abroad were announced from March 11 to March 17, an increase from last week’s data (26 cases). The total amount of financing disclosed was approximately US$260 million, an increase from last weeks figure (US$223 million).

Last week, the project that received the largest amount of investment was L1 platform Berachain (USD 69 million); L2 platform Eclipse Labs followed closely (USD 50 million).

The following are specific financing events (Note: 1. Sorted according to the announced amount; 2. Excludes fund raising and mergers and acquisitions; 3. *Represents companies in the traditional field where some of the business involves blockchain):

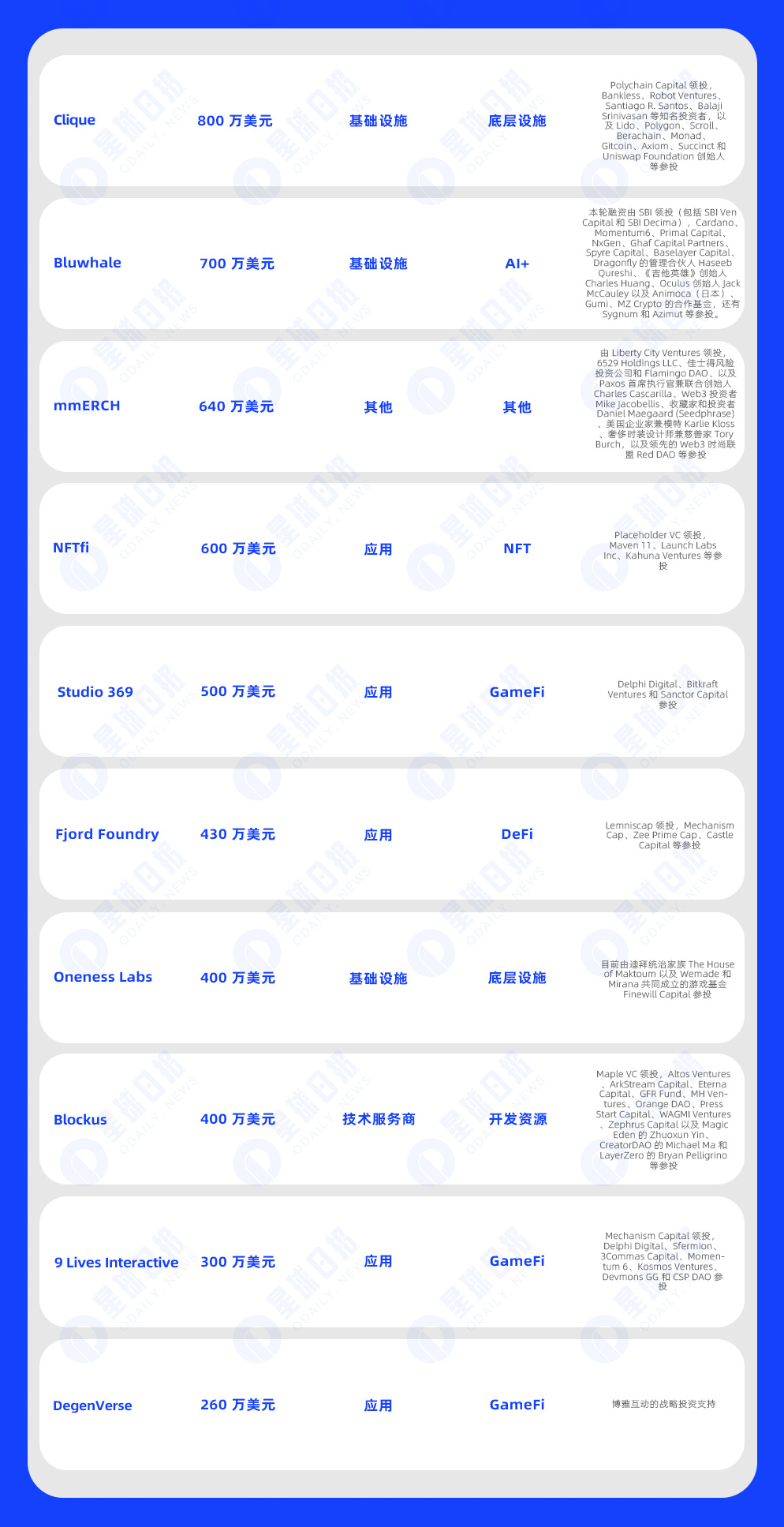

On March 15, L1 platform Berachain received a round of financing of more than US$69 million, co-led by Brevan Howard Digital and Framework Ventures. This round of financing was currency rights financing, and its post-money valuation will reach US$1.5 billion.

On March 11, Eclipse Labs announced the completion of a $50 million Series A round of financing, co-led by Placeholder and Hack VC, bringing the total financing to $65 million. The round also attracted participation from investors such as RockTree Capital, Polychain Capital, Delphi Digital, Maven 11, DBA, Apollo-managed funds, Fenbushi Capital, ParaFi Capital, as well as strategic investments from Flow Traders, GSR, Auros and OKX Ventures. Numerous researchers and developers have participated in its angel round of investment, including Barnabé Monnot (Ethereum Foundation), John Adler (Celestia Labs), Austin Federa (Solana Foundation), ZachXBT and Meltem Demirors.

On March 14, Polyhedra Network, the team behind the zero-knowledge interoperability protocol zkBridge, today announced the completion of a US$20 million strategic round of financing with a valuation of US$1 billion, led by Polychain Capital, Animoca Brands, Emirates Consortium, Arkstream Capital, Mapleblock Capital , Hashkey Capital, UoB Ventures, Symbolic Capital, Longhash Ventures, MH Ventures and Web3Port Foundation participated in the investment. It is reported that this is the fifth round of financing conducted by Polyhedra Network in the past two years.

On March 16, Carbonated, the development studio for the NFT shooting game MadWorld, announced the completion of an $11 million Series A round of financing, led by South Korean gaming giant Com 2 uS, with participation from a16z, Bitkraft Ventures, Cypher Capital, Blocore, Goal Ventures and WAGMI Ventures. The studio previously received $8.5 million in funding in 2020, with a16z and Bitkraft Ventures also participating.

MetaCene raises US$10 million in Series A funding, led by Folius Ventures and SevenX Ventures

On March 12, Web3 MMO game platform MetaCene announced the completion of a $10 million Series A round of financing, led by Folius Ventures and SevenX Ventures, with participation from The Spartan Group, Mantle Network, Animoca Ventures, Longling Capital, Comma 3 Ventures, IGG and others. Previously, MetaCene completed a seed round of financing led by Hash Global and SevenX, with participation from WeMade, Emurgo, MixMarvel DAO Venture, Sinovation Ventures and LK Venture.

On March 13, cryptocurrency clearing platform Cleartoken announced on Wednesday the completion of a seed round of over US$10 million in financing, with participation from Nomura Securities’ Laser Digital, liquidity providers Flow Traders and GSR, as well as digital asset companies LMAX Digital and Zodia Custody. ClearToken will provide digital assets with the benefits of horizontal clearing and settlement, the company said.

Derivatives trading platform D 2

On March 17, the Netherlands-based cryptocurrency derivatives trading platform D2 Waiting for participation.

On March 13, according to official news, Web3 social infrastructure UXLINK completed a total of US$9 million in financing, focusing on ecological construction based on the RWS protocol. This round of financing was participated by OKX Ventures, Web3Port Foundation, Manifold, UOB Venture, Comma 3 Ventures, Cypher Capital, Kucoin Ventures, Gate Labs, Forgame, ECV, Signum Capital and 7 UPDAO. Singapore company registration information shows that HongShan, Matrixport Ventures, and ZhenFund are also listed investment institutions.

On March 16, Obscuro Lab, the developer of Ethereum’s second-layer network TEN, announced the completion of US$9 million in financing at a valuation of US$30 million, led by R 3, with participation from Republic Crypto, KuCoin Labs, Big Brain Holdings, Magnus Capital and DWF Labs. . TEN is currently in testnet mode and is expected to launch the mainnet in October. It is reported that TENs native token will be launched in June.

On March 13, DeFi protocol Elixir announced the completion of an $8 million Series B round of financing. Mysten Labs and Maelstrom co-led the investment, with participation from Manifold, Arthur Hayes, Amber Group, GSR, Flowdesk, etc.

It is reported that Elixir allows users to provide liquidity directly to trading pairs on order book exchanges and receive market maker rewards similar to AMM. Its network supports a large amount of liquidity from exchanges such as Vertex, Bluefin, RabbitX, and will cooperate with dYdX and dYdX. Integration with platforms such as ApeX.

On March 14, blockchain infrastructure company Clique announced the completion of an $8 million Series A round of financing, led by Polychain Capital, with well-known investors such as Bankless, Robot Ventures, Santiago R. Santos, and Balaji Srinivasan, as well as Lido, Polygon, Scroll, Berachain, Monad, Gitcoin, Axiom, Succinct and the founders of Uniswap Foundation participated in the investment. The company currently mainly provides data computing infrastructure services for the blockchain.

AI Web3 startup Bluwhale completes US$7 million in seed round financing, led by SBI

On March 11, Bluwhale, an AI Web3 startup based in Silicon Valley, announced the completion of a US$7 million seed round of financing. This round of financing was led by SBI (including SBI Ven Capital and SBI Decima), Cardano, Momentum 6, Primal Capital, NxGen, Ghaf Capital Partners, Spyre Capital, Baselayer Capital, Dragonfly managing partner Haseeb Qureshi, Guitar Hero founder Charles Huang, Oculus founder Jack McCauley and partner funds of Animoca (Japan), Gumi, MZ Crypto, as well as Sygnum and Azimut Waiting for participation.

Web3 fashion startup mmERCH completed a $6.4 million seed round led by Liberty City Ventures

On March 14, Web3 fashion startup mmERCH announced the completion of a $6.4 million seed round of financing, led by Liberty City Ventures, 6529 Holdings LLC, Christie’s Ventures and Flamingo DAO, as well as Paxos CEO and co-founder Charles Cascarilla, Web3 investor Mike Jacobellis, collector and investor Daniel Maegaard (Seedphrase), American entrepreneur and model Karlie Kloss, luxury fashion designer and philanthropist Tory Burch, and leading Web3 fashion alliance Red DAO participated in the investment. Post-investment estimates Value is $25.7 million.

NFT lending protocol NFTfi completes $6 million in Series A financing

On March 11, NFT lending protocol NFTfi announced the completion of a US$6 million Series A financing, led by Placeholder VC, with participation from Maven 11, Launch Labs Inc, Kahuna Ventures, etc. Its total financing so far has reached US$15 million. NFTfi stated that future plans include enhancing dApp functionality, expanding SDK functionality, and creating an open settlement layer for NFT finance. NFTfi allows NFT holders to borrow ETH, USDC, or DAI from lenders in a trustless P2P manner, using their NFT as collateral.

March 14, Blockchain Video Games"MetalCore"Developer Studio 369 announced the completion of a new round of financing of US$5 million, with participation from Delphi Digital, Bitkraft Ventures and Sanctor Capital. The game is expected to be in public beta at the end of 2024 and is currently in a closed beta phase.

Fjord Foundry completes $4.3 million in seed round led by Lemniscap

On March 13, token sales platform Fjord Foundry announced the completion of a US$4.3 million seed round of financing, led by Lemniscap, with participation from Mechanism Cap, Zee Prime Cap, Castle Capital and others. The team at Fjord Foundry stated that the platform offers a range of token sale methods, including its unique Liquidity Bootstrapping Pools (LBPs), which are designed to achieve fair distribution and reduce the risk of market manipulation and bot trading by large traders.

On March 12, Oneness Labs completed a US$4 million seed round of financing, currently participated by Dubais ruling family The House of Maktoum and Finewill Capital, a gaming fund jointly established by Wemade and Mirana.

On March 11, Web3 game infrastructure service provider Blockus announced the completion of a $4 million Pre-Seed round of financing, led by Maple VC, Altos Ventures, ArkStream Capital, Eterna Capital, GFR Fund, MH Ventures, Orange DAO, Press Start Capital , WAGMI Ventures, Zephrus Capital, Zhuoxun Yin of Magic Eden, Michael Ma of CreatorDAO and Bryan Pelligrino of LayerZero participated in the investment.

Web3 game developer 9 Lives Interactive completed $3 million in financing, led by Mechanism Capital

On March 14, Singapore-based Web3 shooter developer 9 Lives Interactive announced the completion of US$3 million in financing, led by Mechanism Capital, with participation from Delphi Digital, Sfermion, 3 Commas Capital, Momentum 6, Kosmos Ventures, Devmons GG and CSP DAO. The new funding will be used to support the global launch of its first game, Nyan Heroes.

On March 13, according to official news, Web3 gaming e-sports entertainment platform DegenVerse announced the completion of a $2.6 million Pre-Seed round of financing and received strategic investment support from Boyaa Interactive. The two parties will cooperate in depth in the field of live poker events.

On March 14, Pallet Exchange, an NFT market based on the Sei ecosystem, announced the completion of a $2.5 million private placement round, with participation from Spartan Group, Symbolic Capital, Cypher, and angel investors from Coinbase and MoonPay.

On March 15, Merlin Chain ecological lending protocol Avalon Finance announced the completion of a US$1.5 million seed round of financing, including participation from SNZ Capital, Summer Capital, Matrixport Ventures, Spark Digital Capital and Web3Port Foundation. This round of financing will be used for platform construction and technological innovation.

UniSat completes a new round of strategic financing, with CGV participating in the investment

On March 11, UniSat, a Bitcoin Ordinals/BRC-20 protocol open source wallet and infrastructure/service provider, announced the completion of a new round of strategic financing. Japanese cryptocurrency investment institution CGV participated in the investment. The specific amount has not yet been disclosed. According to Dune data, the UniSat wallet currently accounts for approximately 10% to 20% of market trading volume and trading time, with approximately 800,000 weekly active users.

Bitcoin cross-chain bridge project XLink completes first round of financing

On March 12, according to official news, the Bitcoin cross-chain bridge project XLink announced the completion of its first round of financing. Foresight Ventures, Bitcoin Frontier Fund, Bitcoin Lab, LK Venture, Avid 3, BlockBooster, Cypher, Gate Venture, GSG, Incuba Alpha, Kucoin, Kyros and Oak Grove Ventures participated in the investment. XLink plans to use the new funds to provide a seamless user experience for the Bitcoin economy and will provide the XLink recommendation system, points system and community rewards program.

Ethena Labs completes new round of financing, Avon Ventures participated

On March 12, according to official news, USDe developer Ethena Labs announced that it had completed a new round of financing. Avon Ventures, a venture fund under FMR LLC, the parent company of Fidelity Investments, participated in the investment. The specific amount has not yet been disclosed.

Web3 security company ShentuChain receives investment from Binance Labs, OKX Ventures, etc.

On March 12, according to official news, Web3 security company Shentu Chain announced the completion of a new round of financing, with participation from Binance Labs, OKX Ventures, Bitmain, KuCoin Ventures, Neo, DHVC, DraperDragon, Fenbushi Capital, Matrix Partners, Lightspeed Venture Partners, etc. , the specific financing amount has not yet been disclosed.

On March 12, the gamification incentive layer protocol Kaskade Finance announced the completion of a Pre-Seed round of financing, Marshland, NxGen.xyz, Artemis Capital, Andromeda Capital, Hercules Ventures, 369 Capital, Crypto Oasis Ventures, as well as VirtualBacon, Brian D Evans, CryptoJack Waiting to participate in the investment, but the specific financing amount has not been disclosed yet. It is reported that Kaskade Finance mainly provides a cross-chain liquidity guidance layer for DeFi protocols and cross-chain networks, using incentives centered on transaction volume to increase more fees in the liquidity pool.

On March 13, Finboot, a blockchain supply chain solution, announced the completion of a new round of financing, with participation from Wealth Club and others. The specific amount has not yet been disclosed. Finboot’s solution enables enterprises to incorporate blockchain into supply chain services, bringing traceability, transparency and compliance, and the new funding will be used to accelerate the construction of its code-free supply chain tracking blockchain platform MARCO.

On March 14, SHUI, the Conflux ecological liquidity staking protocol incubated by BlockBooster, announced the completion of its seed round of financing, led by BlockBooster and participated by Conflux Foundation. This investment will support the development of SHUI and further improve the Conflux ecological infrastructure. Since the mainnet launch on February 8, protocol TVL currently exceeds $2.5 million.

SHUI is currently holding a CFX staking incentive event, where users have the opportunity to win rewards worth approximately $5,000.

On March 14, BitRealms, an open metaverse game developer based on Merlin Chain, announced the completion of a Pre-Seed round of financing, led by Comma 3 Ventures, with participation from Bitvalue Capital, Big Brain Holdings, Negentropy Capital, Bscstation and Cogient Ventures. The specific financing amount Not disclosed yet. It is reported that BitRealms plans to launch in mid-March, supporting participants to obtain in-game rewards and BRC-420 NFT, aiming to use inscriptions to provide a community-centered gaming experience.

On March 14, Param Labs, a UAE-based Web3 game infrastructure startup, announced the completion of a strategic round of financing, with Animoca Brands participating in the investment. The specific financing amount has not yet been disclosed. The new funds will be used to accelerate Param Labs’ scalable Web3 foundation. facilities while expanding the ecosystem.

On March 15, Web3 data infrastructure developer Syntropy announced the completion of a new round of financing from CMCC Global, Polygon Ventures, HV Capital, Faculty Group, Wave Capital, Moonrock Capital, DVNCI Capital, TRGC Capital, Mapleblock Capital, AntAlpha and Public Works The specific amount has not yet been disclosed. The new funds will be used by Syntropy to build a modular and interoperable data infrastructure on the chain. The main network is expected to be launched in the second quarter.

On March 15, Solana ecological MR infrastructure DeMR announced the completion of angel round financing, with participation from Kucoin Labs, DWF Labs, LD Capital, JDI, Redline Labs, Meteorite Labs, and Paka.

DeMR said it is preparing for the upcoming airdrop and listing of DMR tokens.

Waterdrip Capital invests in Web3 application Jambo

On March 15, according to official news, Waterdrip Capital invested in Web3 application Jambo to help it develop emerging markets. Jambo was founded in early 2022 and is committed to building Web3 super applications to gain revenue opportunities through the logic of learn, play, and make money. Jambo recently launched the Web3 Earn mobile phone JamboPhone, priced at only $99.

According to reports, Jambo is headquartered in Congo and has completed a US$7.5 million seed round and a US$30 million Series A financing in 2022. Investors include Paradigm, Coinbase Ventures, Pantera Capital and other institutions.

On March 16, Berachain ecological project Honeypot Finance announced the completion of a seed round of financing, with participation from DEXT Force Ventures, Candaq Ventures, PudgyAlpha, Sanyuan Capital, 0x sky 404 and Khans Kitchen. The financing amount was not disclosed.