재스테이킹 섹션에서는 FDV의 약 100억 이더리움을 해석하는 바이낸스의 새로운 통화 마이닝을 선보입니다.fi

오리지널 - 오데일리

저자 - Nan Zhi

지난 밤, 바이낸스는 새로운 코인 채굴 프로젝트의 49단계 출시를 발표했습니다.ether.fi(ETHFI), 이 프로젝트는 바이낸스에 로그인하는 Restake 트랙의 첫 번째 프로젝트입니다. Odaily는 이번 글에서 ether.fi의 주요 사업과 기능, 런치풀 정보, 토큰 가격 예측 등을 소개하겠습니다.

프로젝트 소개

Restake 개념은 Eigenlayer 창립자인 Sreeram Kannan이 제안한 것으로, 핵심 메커니즘을 통해 약속된 ETH(다양한 유형의 LST 포함)를 다른 프로토콜 및 DApp에서 다시 약속하고 검증 프로세스에 참여할 수 있습니다. EigenLayer는 AVS(Actively Validated Services)를 통해 이더리움의 보안성과 유동성을 직접 연결해 별도의 경제 및 검증 시스템을 구축할 필요 없이 이더리움의 보안성을 누릴 수 있다. 간단히 말해서, EigenLayer는 다음을 제공합니다.토큰 경제 보안(암호경제적 보안) 임대 시장.

그리고ether.fi는 이 트랙에서 TVL 순위 1위의 프로토콜입니다., 현재 619,000 ETH가 스테이킹되어 있으며 이는 24억 6천만 달러 상당입니다. 또한 ether.fi는 ETH, stETH, RS-stETH, cbETH, RS-cbETH, wBETH 및 RS-wBETH를 포함한 다양한 자산을 지원합니다.

ether.fi는 현재 LRT가 직접 종료할 수 있는 유일한 프로토콜입니다., 다른 프로토콜은 LP 풀 교환(Curve, Balancer 등)을 통해 종료되지만 유동성 보유량에 따라 출금 시간이 변경된다는 점에 유의해야 합니다. 유동성이 부족할 경우 검증인 종료 및 EigenLayer Pod를 완료해야 합니다. 종료하기 전에 처리하십시오.

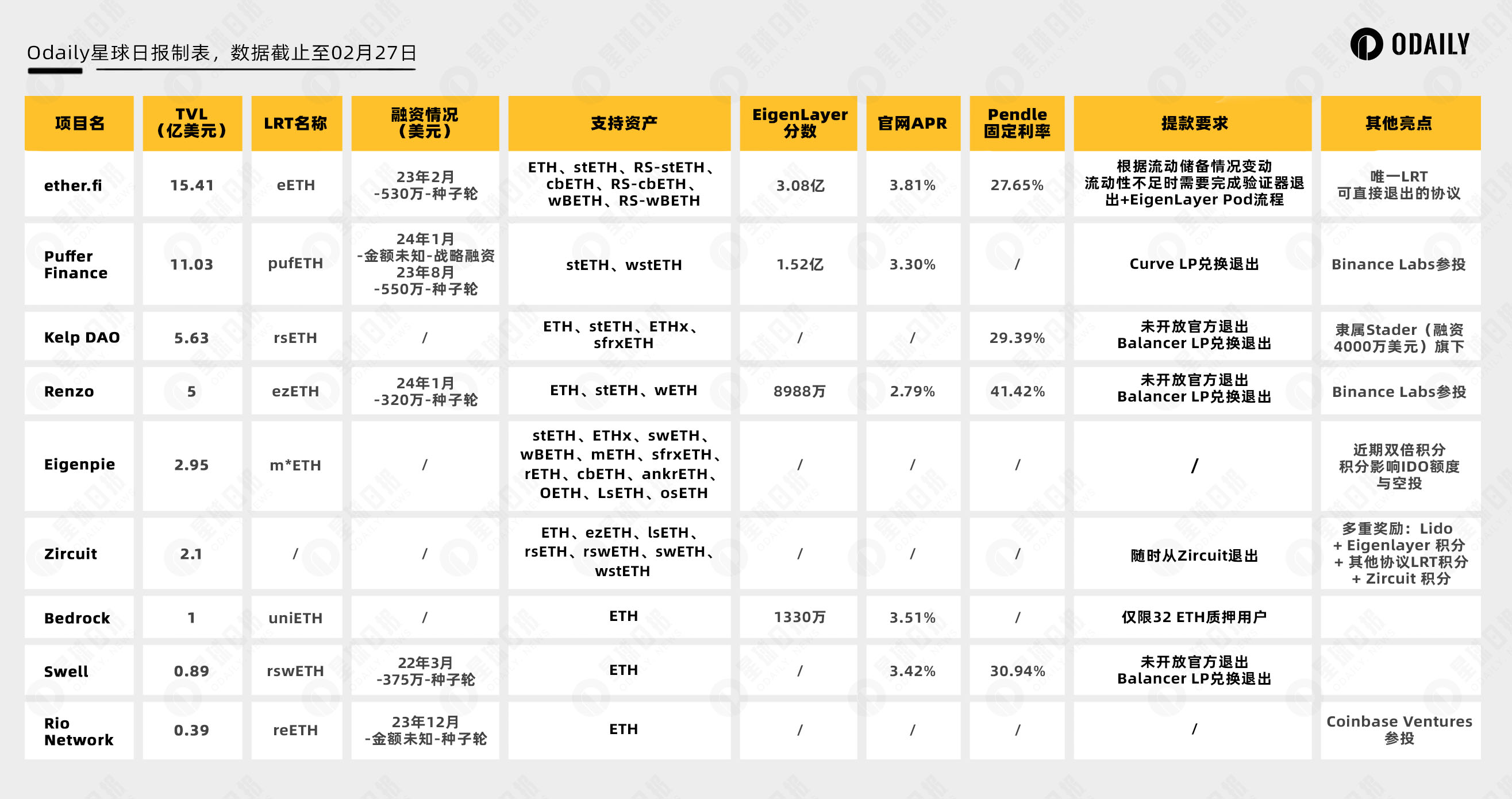

아래 그림은 독자들이 프로젝트 메커니즘의 차이점을 참고할 수 있도록 2주 전에 오데일리가 제작한 Restake 프로젝트를 비교한 것입니다.

자금조달 상황

ether.fi는 가장 최근인 올해 2월 말에 두 차례의 자금 조달을 실시했습니다.ether.fi 2,700만 달러 자금 조달 완료 발표, 이번 자금 조달은 Bullish와 CoinFund가 주도했으며, 이번 자금 조달은 95명 이상의 투자자가 지원했습니다.

2023년 2월에 완료된 초기 라운드에서 ether.Fi는 BitMex 창립자 Arthur Hayes가 참여하고 North Island Ventures, Chapter One 및 Node Capital이 주도하는 530만 달러의 자금 조달이 완료되었다고 발표했습니다.

런치풀 이용 약관

채굴 시작 시간: 2024년 3월 14일 08:00(UTC+ 8), 4일간 지속됩니다.

거래 시작 시간: 2024년 3월 18일 20:00 (UTC+ 8)

최대 토큰 공급량: 1,000,000,000 ETHFI;

초기 유통량: 115,200,000 ETHFI(토큰 최대 공급량의 11.52%)

총 채굴량: 20,000,000 ETHFI(토큰 최대 공급량의 2%)

채굴 풀: BNB 채굴 풀은 총 16,000,000 ETHFI(80%)를 채굴할 수 있으며, FDUSD 채굴 풀은 총 4,000,000 ETHFI(20%)를 채굴할 수 있습니다.

가격 추정

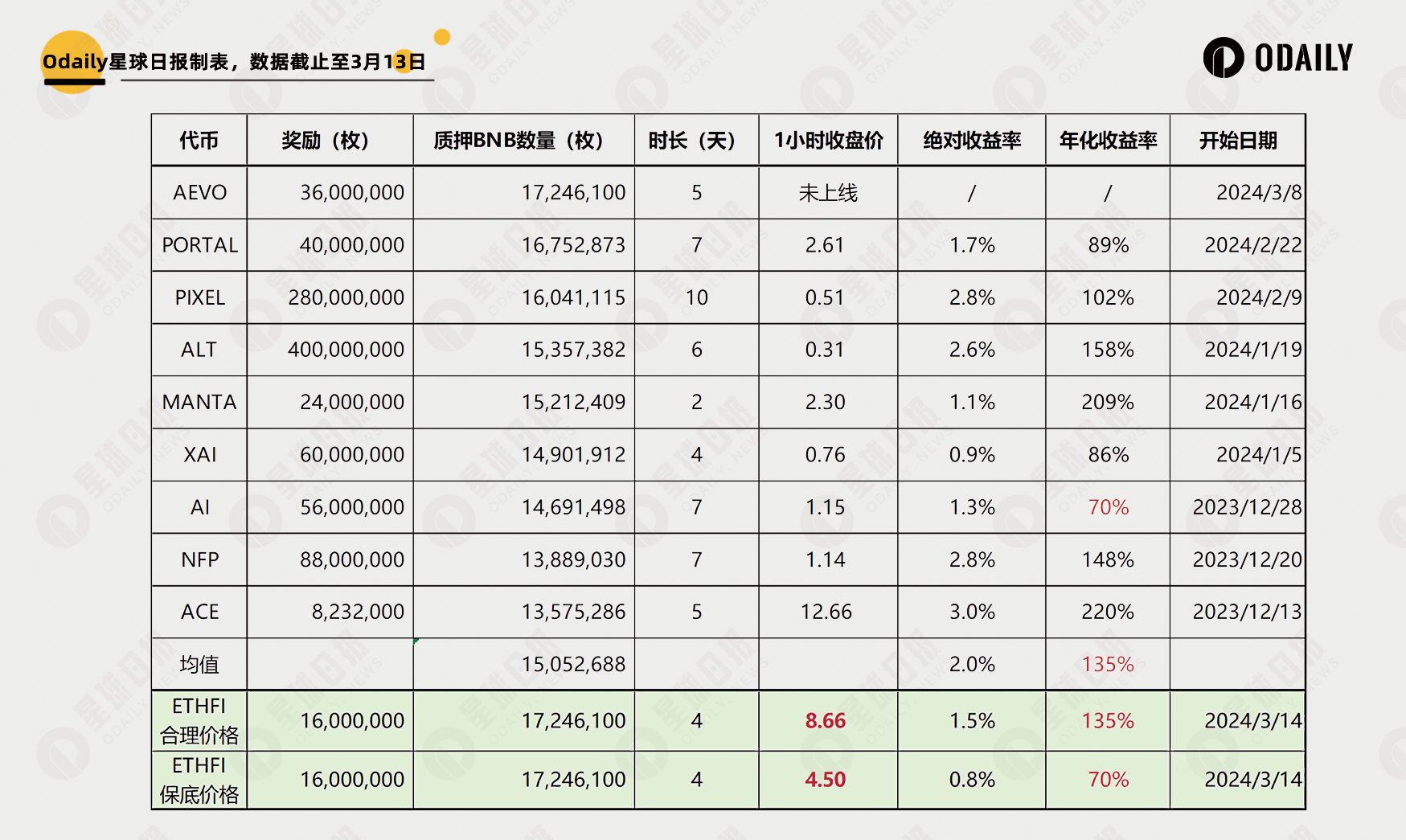

과거 BNB 풀을 기반으로 계산한 결과, 처음 8개 기간의 평균 연간 수익률은 135%입니다.(온라인이 아닌 경우 AEVO는 포함되지 않음) 이번 채굴의 연간 수익률도 135%라고 가정하면, 4일간의 채굴을 기준으로 계산하면 토큰 가격은 8.66 USDT입니다. AI의 최소 수익률 70%를 기준으로 계산하면 보장 가격은 4.5 USDT입니다.

ETHFI의 총량은 10억개이고, 초기 유통량은 1억 1,500만개입니다.8.66 USDT의 합리적인 가격으로 계산하면 ETHFI의 초기 유통 시장 가치는 미화 10억 달러이고 FDV는 미화 86억 6천만 달러입니다.; 보장 가격을 기준으로 계산하면 ETHFI의 초기 유통 시장 가치는 US$5억 1,800만, FDV는 US$45억입니다. 초기 유통 시장 가치와 FDV는 바이낸스가 최근 진행한 런치풀 프로젝트 중 가장 높은 수준이며, 바이낸스에 로그인하는 첫 번째 리스태킹 프로젝트인 만큼 급격한 가격 변동이 있을 수 있으니 신중하게 투자하시기를 바랍니다.

또한, 현재 ether.fi 로열티 포인트는 350억 7천만 포인트이며, Whales Market 포인트 마켓에는 남아있는 대기 주문이 많지 않습니다.나머지 주문 중 현재 최저 가격은 0.00241 USDT/포인트이며, 해당 포인트는 상당합니다. 미화 8,450만 달러. 또한 EigenLayer의 추정 가치는 약 8,660만 달러입니다. 바이낸스는 아직 자세한 할당 및 에어드랍 데이터를 공개하지 않았기 때문에 독자들은 해당 비율에 따라 시장 가치를 계산하여 토큰의 합리적인 가격을 결정할 수 있습니다.