การตีความราคาธุรกรรม L2 จากมุมมองอัลกอริทึม: ผลกระทบของรายได้ ค่าธรรมเนียม และข้อตกลง

ชื่อระดับแรก

การรวบรวมข้อความต้นฉบับ: Deep Tide TechFlow

สารละลายชั้นที่สอง

ปัจจุบัน Ethereum mainnet ประมวลผลธุรกรรมโดยเฉลี่ย 12 รายการต่อวินาที และในช่วงที่มีกิจกรรมเครือข่ายสูงสุด ต้นทุนการทำธุรกรรมสูงถึงระดับที่ผู้ใช้ส่วนใหญ่ยอมรับไม่ได้ ปัญหาความสามารถในการปรับขนาดนี้เกิดขึ้นจากความต้องการทุกโหนดในเครือข่ายในการจัดเก็บและตรวจสอบธุรกรรมทั้งหมดที่เกิดขึ้นบนเครือข่าย

ชื่อรอง

Rollups

Rollups คือโซลูชัน L2 ที่ประมวลผลธุรกรรม L1 ก่อนที่จะกลับสู่ L1 ธุรกรรมมาตรฐานบน Ethereum โดยทั่วไปจะมีขนาด 156 ไบต์ โดยลายเซ็นเป็นส่วนที่มีข้อมูลหนาแน่นที่สุด ดังนั้น Rollups จะประมวลผลธุรกรรมหลายรายการในสภาพแวดล้อมการดำเนินการ L2 จากนั้นรวมเป็นธุรกรรมเดียว ซึ่งถูกส่งไปยัง L1 สำหรับการตรวจสอบสถานะปกติ การรวมธุรกรรมหลายรายการไว้ในธุรกรรมเดียวจะช่วยลดค่าธรรมเนียม Gas ที่จ่ายต่อธุรกรรม เนื่องจากค่าธรรมเนียม Gas จะกระจายไปยังธุรกรรมหลายรายการ ไม่ใช่เพียงธุรกรรมเดียว อย่างไรก็ตาม Rollups ทั้งหมดไม่เหมือนกัน Rollups มีหลายประเภท:

การยกเลิกสัญญาอัจฉริยะ: การยกเลิกสัญญาในแง่ดี (Arbitrum, การมองในแง่ดี), การยกเลิกความรู้เป็นศูนย์ (zkEVM ของ Matic, zkSync, Scroll);

Celestiums;

Enshrined Rollups;

Sovereign Rollups.

การยกเลิกสัญญาอัจฉริยะ

Smart Contract Rollups เป็นที่ที่ผู้ใช้ส่งเงินไปยัง Rollup smart Contract บน L1 ซึ่งจะจัดการธุรกรรมและการเปลี่ยนแปลงสถานะ

องค์ประกอบสำคัญของ Rollups และบล็อกเชนคือแผนผัง Merkle ต้นไม้ Merkle เป็นโครงสร้างข้อมูลที่จัดเก็บสถานะของเงินทุนของแต่ละคนและธุรกรรมที่เกิดขึ้น ทำให้ L1 สามารถตรวจสอบสถานะบน L2 ได้โดยไม่ต้องดาวน์โหลดสถานะทั้งหมด กล่าวง่ายๆ ก็คือ ผู้ใช้โต้ตอบและทำธุรกรรมกับ L2 (ซึ่งจะเป็นการเปลี่ยนสถานะ) และ L2 จะส่ง Merkle root ของสถานะไปที่ L1 เป็นระยะๆ เพื่อให้ L1 สามารถตรวจสอบสถานะของห่วงโซ่ได้

นอกเหนือจากการเผยแพร่ Merkle root ไปยัง L1 แล้ว L2 ยังต้องเผยแพร่ข้อมูลการเปลี่ยนแปลงแผนผัง Merkle ที่เพียงพอ เพื่อให้ผู้ใช้สามารถสร้างแผนผัง Merkle ใหม่ได้อย่างสมบูรณ์ หาก L2 หยุดทำงานด้วยเหตุผลบางประการ ผู้ใช้จะค้างอยู่ที่ L2 หากไม่ได้ให้ข้อมูลนี้ ดังนั้น สัญญาอัจฉริยะ L1 จึงมี ฟังก์ชันฉุกเฉิน ซึ่งผู้ใช้สามารถถอนเงินออกจากการยกเลิกสัญญาอัจฉริยะได้เมื่อ L2 หยุดทำงาน

L1 ต้องการการพิสูจน์บางอย่างเพื่อให้แน่ใจว่ารูท Merkle ที่ L2 ส่งนั้นถูกต้อง ซึ่งเป็นความแตกต่างระหว่าง Rollup สัญญาอัจฉริยะหลักสองรายการ หลักฐานหลักสองประเภทที่ใช้คือหลักฐานการฉ้อโกงและหลักฐานที่ไม่มีความรู้

Optimistic Rollup

OptimisticRollups เช่น Arbitrum และ Optimism ใช้หลักฐานการฉ้อโกงเพื่อให้บรรลุผลขั้นสุดท้าย หลักฐานการฉ้อโกงทำงานดังนี้:

โหนด L2 เผยแพร่รากของ Merkle ลงในสัญญาอัจฉริยะ L1 พร้อมด้วยเงินประกันเล็กน้อย

สัญญาอัจฉริยะ L1 เชื่อถือโหนด L2 ตามค่าเริ่มต้น ซึ่งเป็นความหมายของคำว่า ในแง่ดี - L1 มีทัศนคติเชิงบวกเกี่ยวกับการอัปเดต L2

อย่างไรก็ตาม การเปลี่ยนแปลงสถานะนี้จะยังไม่เสร็จสิ้นภายใน 7 วัน

ในช่วง 7 วันนี้ ทุกคนสามารถส่งหลักฐานว่ารูท Merkle ที่ส่งมานั้นฉ้อโกง ซึ่งจะย้อนกลับการอัปเดตและลงโทษโหนด L2 โดยมอบเงินประกันให้กับใครก็ตามที่รายงานการอัปเดตที่ฉ้อโกง

ผู้รายงานสามารถพิสูจน์ได้ว่าการอัปเดตเป็นการฉ้อโกงโดยการตรวจสอบธุรกรรมทั้งหมดที่เกิดขึ้นในการเปลี่ยนแปลงรูทสถานะ และยืนยันว่าทุกลายเซ็นในธุรกรรมเหล่านั้นนั้นถูกต้อง เนื่องจากโหนด L2 เผยแพร่รากของ Merkle และ Merkle เพียงพอที่จะเปลี่ยนแปลงข้อมูลเพื่อสร้างแผนผัง Merkle ขึ้นมาใหม่

หากไม่มีการโต้แย้งการเปลี่ยนสถานะภายในระยะเวลาการโต้แย้ง 7 วัน การอัปเดตจะถือเป็นที่สิ้นสุดและถือว่าไม่เปลี่ยนรูป

ZK Rollup

ZK Rollup ใช้การพิสูจน์ที่ไม่มีความรู้ พวกเขาทำงานดังนี้:

โหนดเลเยอร์ 2 เผยแพร่รูท Merkle ไปยังสัญญาอัจฉริยะ L1 พร้อมด้วยการพิสูจน์ว่า L2 ประมวลผลธุรกรรมอย่างถูกต้อง และสร้างรูท Merkle ใหม่

หากโหนดเลเยอร์ 2 พยายามออกการอัปเดตที่ฉ้อโกง พวกเขาจะไม่สามารถสร้างหลักฐานความรู้ที่เป็นศูนย์ที่ถูกต้องได้ ดังนั้นสัญญาอัจฉริยะ L1 จะไม่ยอมรับรูท Merkle ใหม่

เมื่อหลักฐานความรู้เป็นศูนย์ได้รับการตรวจสอบแล้ว การอัปเดตสถานะจะดำเนินการทันที

เครื่องคัดแยก

ผู้สั่งซื้อเป็นกลไกที่ L2 รวบรวมและเผยแพร่ธุรกรรมกลับไปยังห่วงโซ่ฐาน Ethereum ในสถานะรวมศูนย์ในปัจจุบัน พวกมันทำงานดังนี้:

ผู้ใช้ส่งธุรกรรมบน L2 — DeFi, NFT, ส่ง/รับ ฯลฯ

ธุรกรรมเหล่านี้ถูกรวบรวมโดยผู้สั่งซื้อจากส่วนกลาง

ธุรกรรมเหล่านี้ (ความแตกต่างของข้อมูลการโทร/สถานะ) จะถูกจัดลำดับโดยซีเควนเซอร์ (การสร้างบล็อก) ให้เป็นบล็อกเดียวหรือเป็นชุดของธุรกรรม

ในปัจจุบัน เครื่องคัดแยก L2 เรียงลำดับธุรกรรมเหล่านี้โดยใช้วิธีการเรียงลำดับเข้าก่อนออกก่อน (FIFO)

จากนั้นผู้สั่งซื้อจะส่งชุดธุรกรรมกลับไปที่ Ethereum mainnet เพื่อรวมไว้ในบล็อก

ในสถานะปัจจุบัน ผู้สั่งซื้อของ Rollup จะถูกรวมศูนย์และควบคุมโดยหน่วยงานเดียว (Offchain Labs ของ Arbitrum และ Optimism PBC ของ Optimism) การรวมศูนย์นี้สร้างความล้มเหลวจุดเดียวสำหรับ Rollup และอาจนำไปสู่ปัญหาความมีชีวิตชีวา (และขาดการต่อต้านการเซ็นเซอร์) - หากผู้สั่งซื้อล้มเหลว L2 จะทำงานไม่ถูกต้อง

ชื่อระดับแรก

ค่าน้ำมัน L2

ตอนนี้เรามาดูกันว่าชุดรวมอัปเดตสัญญาอัจฉริยะหลักทั้งสองนี้คำนวณค่าธรรมเนียมแก๊สที่ผู้ใช้จะจ่ายและผลกระทบต่อตัวเรียงลำดับแบบรวมศูนย์อย่างไร

ใน Arbitrum และ Optimism ผู้ใช้จะต้องจ่ายค่าธรรมเนียมสองรายการเมื่อทำการซื้อขาย:

L2 ค่าแก๊ส/การดำเนินการ;

ชื่อรอง

ค่าธรรมเนียมการใช้แก๊ส L2/การดำเนินการ

ชื่อรอง

L1 ข้อมูลการโทร/ค่าธรรมเนียมความปลอดภัย

ชื่อระดับแรก

แบบจำลองรายได้ตัวเรียงลำดับ

ในรูปแบบปัจจุบัน Optimistic Rollup (ORU) สร้างรายได้ผ่านการดำเนินงานของเครื่องคัดแยกแบบรวมศูนย์เพียงเครื่องเดียว ในอนาคต คาดว่า ORU จะกลายเป็นการกระจายอำนาจในที่สุด ซึ่งจะเปิดประตูสู่แหล่งรายได้อื่นๆ ผ่านทาง MEV (การเพิ่มมูลค่า Ethereum สูงสุด) หรือกำหนดให้ผู้ดำเนินการซีเควนเซอร์ต้องเดิมพันโทเค็นดั้งเดิม/ส่วนแบ่งรายได้

แต่สำหรับตอนนี้ ในการนำเสนอที่ง่ายที่สุด เราสามารถคิดว่าเครื่องคัดแยกจะเรียกเก็บค่าธรรมเนียมธุรกรรม L2 ของผู้ใช้ ORU (รายได้ของซีเควนเซอร์) และจำเป็นต้องจ่ายค่าธรรมเนียม L1 Gas เพื่อส่งข้อมูลธุรกรรม L2 ของผู้ใช้เป็นชุดไปยังเครือข่าย Ethereum (ต้นทุน 1) และชำระค่าดำเนินการในการรันซีเควนเซอร์ (ต้นทุน 2)

ชื่อรอง

ชื่อรอง

Fees = L1_gas_price_estimate * (L1_calldata_size + L1_buffer) + L2_gas_price * L2_gas_used

ชื่อระดับแรก

Costs = L1_actual_gas_price * L1_calldata_size + Sequencer_operational_costs

การกำหนดราคาค่าธรรมเนียม L2

ใน ORU ทั้งหมด ราคาค่าธรรมเนียม L2 เป็นฟังก์ชันของขนาดการประมวลผล L1, ต้นทุนการประมวลผล L1, ขนาดการประมวลผล L2 และต้นทุนการประมวลผล L2

เนื่องจากผู้สั่งซื้อ L2 ทั้งหมดต้องเสียค่าใช้จ่ายเมื่อมีการเผยแพร่ชุดงาน/การพิสูจน์ไปยังเมนเน็ต L1 จึงสมเหตุสมผลที่จะส่งต่อต้นทุนแบบไดนามิกของการชำระบัญชีเมนเน็ตให้กับผู้ใช้เมื่อดำเนินการธุรกรรม L2

ชื่อรอง

Arbitrum

การกำหนดราคาค่าธรรมเนียม L2 ของอนุญาโตตุลาการใช้แนวคิด ค่าธรรมเนียมก๊าซสองมิติ โดยที่ขีดจำกัดก๊าซเป็นฟังก์ชันของหน่วยก๊าซที่ใช้โดย L2 หน่วยก๊าซที่ใช้โดย L1 และราคาก๊าซ L1 โดยประมาณ

จากนี้เราสามารถสรุปได้ดังต่อไปนี้:

ขีดจำกัดของ L2 Gas จะลดลงเมื่อราคา L2 Gas เพิ่มขึ้น

ชื่อรอง

Optimism

เช่นเดียวกับ Arbitrum ค่าธรรมเนียมการทำธุรกรรมของ Optimism จะพิจารณาต้นทุนของการคำนวณ L1 และ L2 การมองในแง่ดีหมายถึงค่าธรรมเนียมการดำเนินการ L2 และค่าธรรมเนียมข้อมูล/ความปลอดภัย L1

สังเกต:

ตัวแปร dynamic_overhead เป็นตัวแปรที่ทีม Optimism กำหนดไว้เพื่อให้แน่ใจว่าผู้สั่งซื้อได้รับการชดเชยเพียงพอที่จะครอบคลุมต้นทุนค่าน้ำมันที่เกิดขึ้นเมื่อส่งชุดธุรกรรมกลับไปยังเครือข่าย L1

ปัจจุบันตั้งค่าไว้ที่ 0.684 ซึ่งบ่งชี้ว่าซีเควนเซอร์กำลังอุดหนุนต้นทุนก๊าซ

ชื่อรอง

ค่าธรรมเนียมสเกลาร์ค่าโสหุ้ยแบบไดนามิก/L1 เมื่อเวลาผ่านไป

EIP-4844

ปัจจุบัน Rollup ของ Optimistic มีราคาถูกกว่าในแง่ของการดำเนินการและการจัดเก็บข้อมูลของ Layer-2 แต่ก็ยังมีราคาแพงสำหรับผู้ใช้ในการเผยแพร่ข้อมูลไปยัง Layer-1 เพื่อให้สอดคล้องกับความพร้อมใช้งานของข้อมูล

ข้อมูลถูกเผยแพร่ไปยังเลเยอร์ 1 ของ Ethereum โดยใช้ opcode calldata ดังนั้นทั้ง Arbitrum และ Optimism จึงใช้อัลกอริธึมการบีบอัด calldata เช่น Zlib และ brotli อัลกอริธึมการบีบอัด การเผยแพร่ข้อมูลนี้มีราคาแพงและคิดเป็น 80-90% ของค่าธรรมเนียมการทำธุรกรรมที่ผู้ใช้ L2 ชำระ

อย่างไรก็ตาม ระหว่างเดือนตุลาคม 2023 ถึงกุมภาพันธ์ 2024 ข้อเสนอการปรับปรุง Ethereum ที่มีชื่อเสียงระดับสูง (EIP-4844, Proto-danksharding) มีกำหนดจะเปิดตัว EIP-4844 เสนอให้เพิ่มประเภทธุรกรรมใหม่ให้กับ Ethereum ที่อนุญาตให้ยอมรับ บล็อก ชิ้นส่วน เหล่านี้จะถูกลบหรือตัดออกหลังจากผ่านไปประมาณสองสัปดาห์ และจะไม่ถูกเก็บไว้อย่างถาวรเหมือนกับข้อมูลการโทรที่มีอยู่ ขนาดของบล็อกข้อมูลเหล่านี้ได้รับการออกแบบให้มีขนาดเล็กพอที่จะลดค่าใช้จ่ายในการจัดเก็บข้อมูลบนเครือข่ายเมนเน็ต

ชื่อรอง

ภาพรวมระดับสูงของผลกระทบต่อรายได้ของซีเควนเซอร์

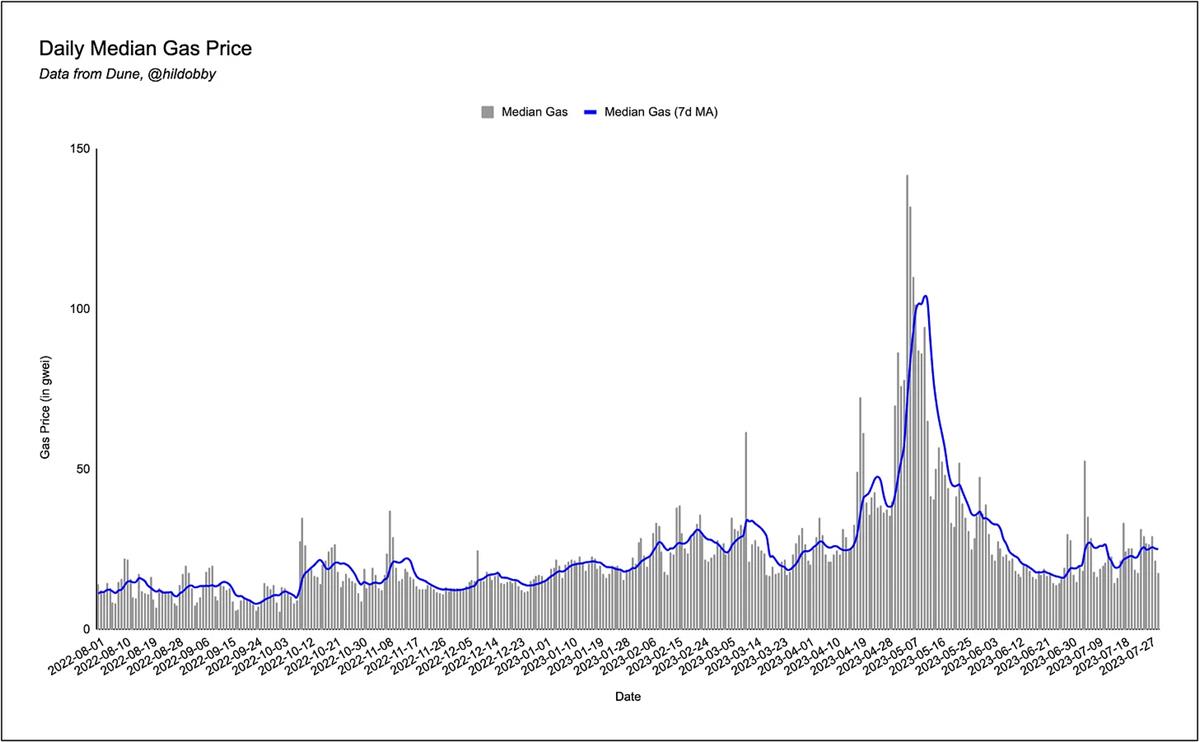

ก่อนที่จะเจาะลึกถึงการเปลี่ยนแปลงที่เราคาดว่าจะเห็นใน Arbitrum และ Optimism สิ่งสำคัญคือเราต้องพิจารณาความแตกต่างในราคาประมวลผล L1 ระหว่าง Arbitrum และ Optimism (ตามที่อธิบายไว้ก่อนหน้านี้ในส่วนราคาค่าธรรมเนียม L2) เมื่อพิจารณาจากออราเคิลการกำหนดราคา L1 ของ Arbitrum ตอนนี้เรารู้แล้วว่ามีแนวโน้มที่จะส่งค่าธรรมเนียม 100% ให้กับผู้ใช้ (เว้นแต่เราจะเห็นการโหวตแบบกำกับดูแล) นี่ไม่ใช่กรณีของการมองในแง่ดี เนื่องจากยังคงควบคุมตัวแปรโอเวอร์เฮดแบบไดนามิก

ชื่อรอง

Arbitrum

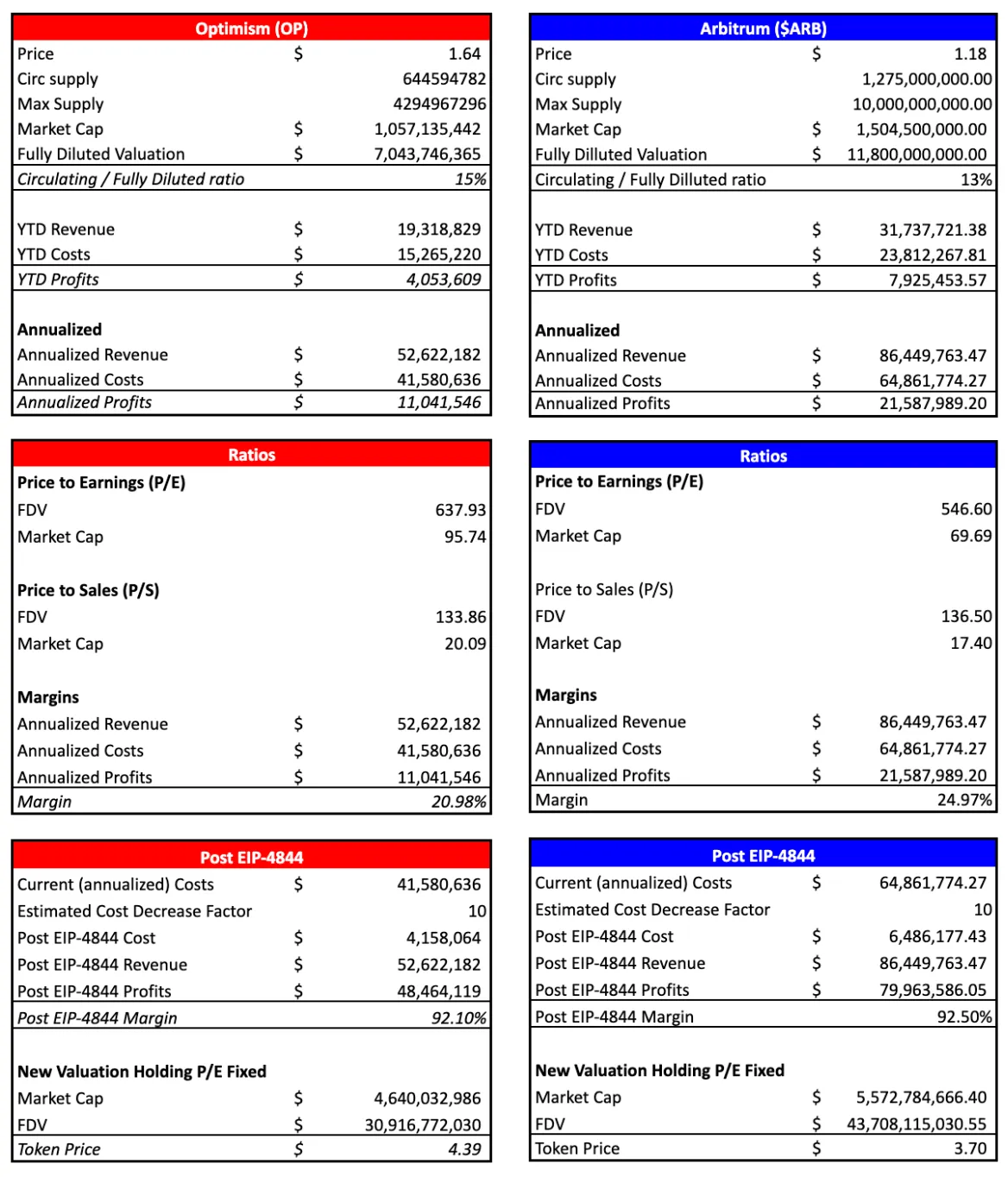

เมื่อพิจารณาสถานะปัจจุบันของสถานะทางการเงินของอนุญาโตตุลาการในส่วนข้างต้น เราจะสำรวจการเปลี่ยนแปลงที่เป็นไปได้ในการประเมินมูลค่าของอนุญาโตตุลาการภายใต้สมมติฐานบางประการ เนื่องจากต้นทุนคาดว่าจะลดลงอย่างมากหลัง EIP-4844 จึงคาดว่ากำไรและอัตรากำไรจะเพิ่มขึ้นในขณะที่รายได้ยังคงที่

จากข้อมูลนี้ เราได้สร้างตารางที่แสดงผลลัพธ์ที่เป็นไปได้ต่างๆ รวมถึงชุดค่าผสมต่างๆ ของการประหยัด EIP-4844 ที่ส่งต่อไปยังผู้ใช้ (แกน Y) และปัจจัยการลดต้นทุน EIP-4844 (แกน X ที่มีจำนวนมากกว่า = EIP 4844 ยิ่งสูง การประหยัดต้นทุน)

เราได้แรเงาชุดค่าผสมที่เราคิดว่าน่าจะเกิดขึ้นหลังจาก EIP-4844

หากเงินออม 100% ถูกส่งไปยังผู้ใช้ เราสามารถสรุปได้ว่าการประหยัดต้นทุนนี้มีแนวโน้มที่จะเพิ่มจำนวนธุรกรรมใน Arbitrum (ประเภท dApp ใหม่ ผู้ใช้มากขึ้น)

ตั้งสมมติฐานบางประการ:

รักษาอัตราส่วนราคาต่อกำไร (P/E) ในปัจจุบัน

สมมติว่าต้นทุนลดลง 10 เท่า

การเติบโตของปริมาณธุรกรรมเนื่องจากการประหยัดค่าธรรมเนียม

ชื่อรอง

Optimism

ชื่อรอง

ในปัจจุบัน การสะสมมูลค่าเพียงอย่างเดียวของ Arbitrum และ Optimism คือการกำกับดูแล นี่เป็นฟังก์ชันเดียวของ ARB และ OP อย่างไรก็ตาม การสะสมมูลค่าของ ARB และ OP อาจมาจากแหล่งอื่นสองแหล่ง: ค่าธรรมเนียมการทำธุรกรรมและ MEV

ในปัจจุบัน การสะสมมูลค่าเพียงอย่างเดียวของ Arbitrum และ Optimism คือการกำกับดูแล นี่เป็นฟังก์ชันเดียวของ ARB และ OP อย่างไรก็ตาม การสะสมมูลค่าของ ARB และ OP อาจมาจากแหล่งอื่นสองแหล่ง: ค่าธรรมเนียมการทำธุรกรรมและ MEV

ในสถานะปัจจุบัน โซลูชัน L2 ทั้งสองนี้อาศัยผู้สั่งซื้อแบบรวมศูนย์เป็นอย่างมาก ซึ่งผลกำไรทั้งหมดในการสร้างบล็อกและข้อเสนอแบบรวมศูนย์จะถูกส่งไปยัง Arbitrum Foundation และ Optimism Foundation อย่างไรก็ตาม ทั้งสองโซลูชั่นได้สัญญาว่าจะก้าวไปสู่กลไกผู้สั่งซื้อแบบกระจายอำนาจ โดยที่รากฐานไม่ได้เป็นเพียงการสร้างเอนทิตีและเสนอบล็อก L2 เท่านั้น ขั้นตอนแรกในการสะสมมูลค่าสำหรับโทเค็น L2 คือการกระจายอำนาจของผู้สั่งซื้อ ซึ่งไม่ใช่เรื่องง่าย แต่สามารถทำให้ผู้ถือโทเค็น L2 มีส่วนร่วมในมูลค่าที่สร้างขึ้นผ่านกระบวนการสร้างและข้อเสนอ

การกระจายอำนาจของเครื่องคัดแยกมีแนวโน้มที่จะทำได้ผ่านกลไก PoS ซึ่งผู้ใช้จะจำนำโทเค็น L2 ดั้งเดิม หากผู้เดิมพันไม่ปฏิบัติหน้าที่หรือประพฤติตนมุ่งร้าย เงินเดิมพันจะถูกฟัน ผู้เดิมพันสามารถรับค่าธรรมเนียมการทำธุรกรรมบางส่วน, MEV (ในโลกหลัง FIFO) หรือรางวัลการปักหลักเป็นโทเค็นดั้งเดิม

ความสำคัญของเครื่องคัดแยกแบบกระจายอำนาจก็คือ เครื่องคัดแยกแบบรวมศูนย์อาจทำให้ธุรกรรมของผู้ใช้ถูกเซ็นเซอร์ ดึงค่าเช่าที่มากเกินไป หรือสร้าง MEV ที่เป็นอันตราย ซึ่งส่งผลเสียต่อผู้ใช้