深度解读Aptos生态:游戏基础设施和工具会成为增长引擎吗?

原文作者:Xangle

原文编译:PANews

重点速览

Aptos 是由前 Meta Diem 团队开发的 PoS 区块链,注重速度和可靠性。Aptos 的设计目标是实现超过 100, 000 的理论吞吐量和亚秒级延迟。它支持 Move 编程语言,提供稳定、快速、灵活的开发环境。

技术本身并不能保证成功。Aptos 采用两项关键策略来确保可持续性并在 L1 战争中生存: 1) 通过可升级性实施面向未来的网络, 2) 通过 Web2 合作伙伴关系扩展其生态系统。这种方法涉及引入经过验证的产品和服务,并利用 Web2 公司的知识产权和用户群。这也是对区块链行业未来的押注,它预测区块链行业的未来将由全球重量级企业而非 Web3 初创公司推动。

Aptos 很可能会围绕游戏领域建立自己的生态系统。它是少数几个在技术上能够支持 3 A 游戏的公共区块链之一。Aptos 还积极与 METAPIXEL 合作,利用他们丰富的游戏开发专业知识,共同构建 Web3 游戏开发所需的基础设施和工具。我们预计目前正在开发的功能,包括代币对象模型、代理 gas 费支付、VRF 和游戏 SDK 将简化游戏公司的开发流程。此外,备受期待的《Gran Saga: Unlimited》(GSU)采用了 NPIXEL 的著名 IP,计划于明年 1 月推出。

1. 简介

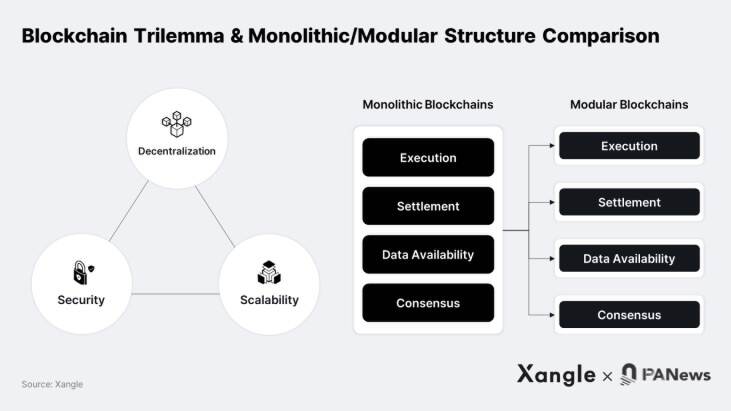

所有L1区块链的最终目标都是通过解决区块链不可能三角的问题,成为一个能够容纳数千万用户同时访问的全球数据库基础设施。自 2009 年比特币诞生以来的 13 年内,还没有任何区块链能够解决这个问题。现有的区块链遇到了限制,通常需要权衡,例如妥协去中心化程度或减缓速度,这也就导致了一系列问题,例如网络过载、关闭和过高的 gas 费。

为此,区块链行业近年来提出了模块化架构,不同的链分别处理共识、数据可用性、结算和执行。模块化架构的主要优点是每条链都可以专门从事特定的角色,减少节点的负载并提高区块链的整体性能。许多区块链,包括以太坊、Avalanche 和 Cosmos,目前都正在围绕模块化架构调整其路线图。

但模块化也有其局限性。它会削弱 dApp 之间的互操作性和可组合性、碎片化流动性并阻碍用户体验。最重要的是,模块化区块链比单一区块链面临更广泛的攻击媒介,引发了安全问题。Aptos 是一种新的基于 PoS 的区块链,在整体架构下设计,以应对此类安全挑战。它旨在为世界各地的用户提供稳定、快速的区块链基础设施。

2. Aptos 内部:技术和功能

2-1.技术:通过高效共识和并行处理技术实现高可扩展性

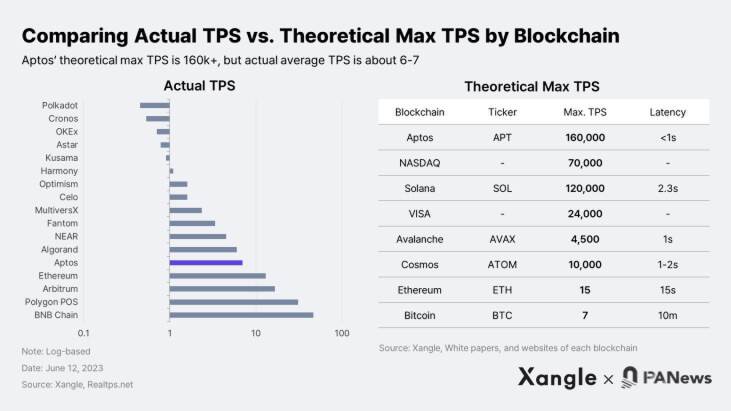

无需许可的公共区块链的一大挑战是可扩展性。可扩展性主要与区块链的处理速度相关,通常通过吞吐量和延迟来衡量。目前,Aptos 区块空间的实际需求相对较低,平均为 6-7 TPS,不过该技术理论上能够实现 100, 000+ TPS 和亚秒级延迟。考虑到 VISA 和 Mastercard 每秒处理大约 3000 到 4000 笔交易,这无疑是一个令人印象深刻的数字。Aptos 能够实现如此高的可扩展性很大程度上归功于 Quorom Store(Narwhal)、State Delta Synchronization、Jellyfish Merkle Tree(JMT)等技术的采用。其核心在于其自己的共识机制(AptosBFT v4)和并行处理引擎(BlockSTM)。

AptosBFT v4 是基于 DiemBFT 的共识算法,由 Meta 的前区块链项目 Diem(原 Libra)开发。它具有网络负载低、共识速度快的特点,较之前流行的 PBFT 共识机制有显著改进。功劳应归功于: 1)提高延迟和网络效率的线性通信和链接技术, 2)通过有效超时实现验证者之间快速同步,以及 3)快速分析链上状态的信誉系统在领导节点选择过程中过滤掉不合格的验证者。

BlockSTM 是一个智能合约的并行执行引擎,它利用软件事务内存(一种将数据库事务的 ACID 属性扩展到并行编程的技术)。与现有的需要按照区块顺序处理交易的机制不同,BlockSTM 将独立的交易分散到多个线程中并行执行。通过预先定义顺序,可以实现预执行、后验证和共识。这意味着 BlockSTM 的引入可以解决区块链的瓶颈问题,并在交易处理速度上取得突破。

2-2.语言:用 Move 构建稳定、灵活的开发环境

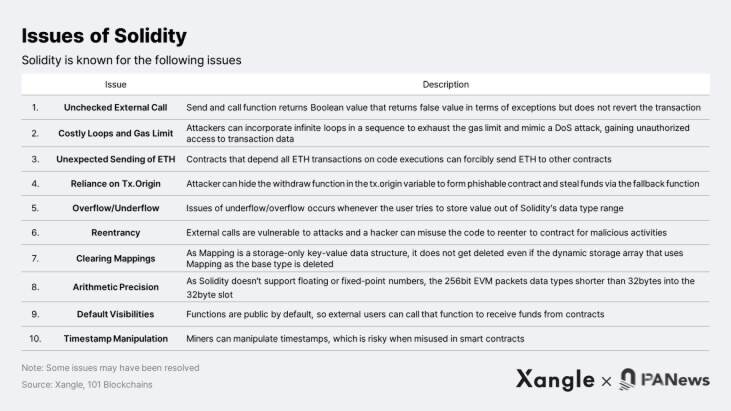

随着以太坊成为加密货币领域的主要组成部分,“EVM 兼容性”已成为一个强有力的叙述。事实上,只有少数非 EVM L1 不使用 Solidity,即 Rust 上的 Solana、Cosmwasm 上的 Cosmos、Clarity 上的 Stacks 以及 Move 上的 Sui 和 Aptos。然而,EVM 环境和 Solidity 容易受到攻击已经不是什么秘密了。过去几年中,许多黑客攻击让此类漏洞显现。根据 Chainalysis 的数据,从 2016 年到 2022 年,过去七年里,黑客攻击给加密行业造成了近 99 亿美元的损失。

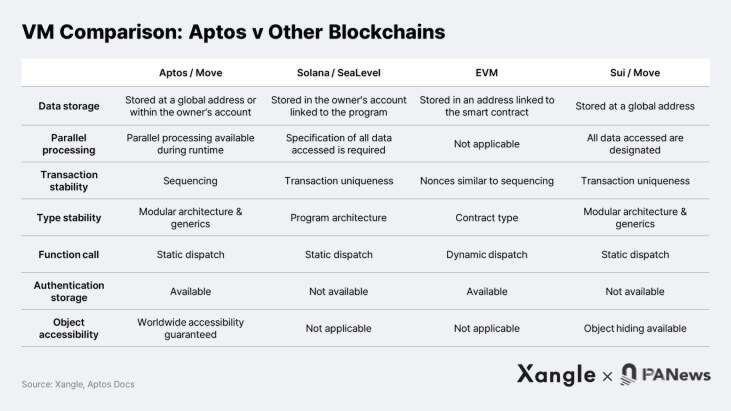

智能合约部署后很难修改。这就是项目在发布 dapp 之前要经过多轮技术审核的原因。然而,困难在于 Solidity 合约的动态调度,因为在执行之前无法预测可能发生的其他意外变量。随着对更安全的编程语言的需求不断增长,开发人员越来越被Move和 MoveVM 的安全性和优势所吸引。

Move 是由 Meta 开发的一种基于 Rust 的开源编程语言。它以其优于 Solidity 的稳定性而闻名,并且可以加快从开发、测试到部署的过程。这得益于 Move 的几个关键特性: 1)支持一级资产,防止任意发行和删除资产;2)支持静态调度,增强代码验证;3)通过证明者减少验证时间;4)确保代码按开发人员的预期工作;5)提供内存安全性,类似于 Rust,使管理内存变得更容易。这些功能共同使 Move 成为开发人员可靠且快速的开发环境。

2-3.生态系统:在 Aptos 基金会的全力支持下蓬勃发展

自 2022 年 10 月主网上线以来,Aptos 的增长一直处于稳定上升趋势。根据 Aptoscan 的数据,总共创建了 400 万个钱包,估计每天会创建 5-1 万个新钱包。日均交易量也保持在 50 万笔左右。截至 2023 年 6 月 13 日,Aptos 生态系统已有 275 个项目上线,其中 NFT 项目 113 个,基础设施和中间件项目 67 个,DeFi 项目 46 个,游戏项目 18 个。按 TVL(锁定总价值)计算,Pancakeswap、Thala(Thalaswap、ThalaCDP)和 Liquidswap 三个项目主导 DeFi 市场,合计占 Aptos 4400 万美元 TVL 的 95% 。

其中在游戏领域,NPIXEL 的 Web3 游戏平台 METAPIXEL 在 Aptos 生态系统中获得了巨大的关注。尤其是《Gran Saga: Unlimited》,这是一款 MMORPG 链游,融合了 NPIXEL 热门游戏《Gran Saga》的 IP,是最受期待的游戏之一。

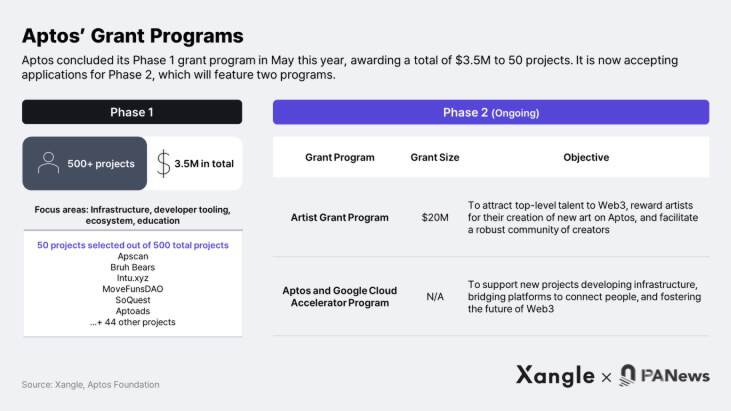

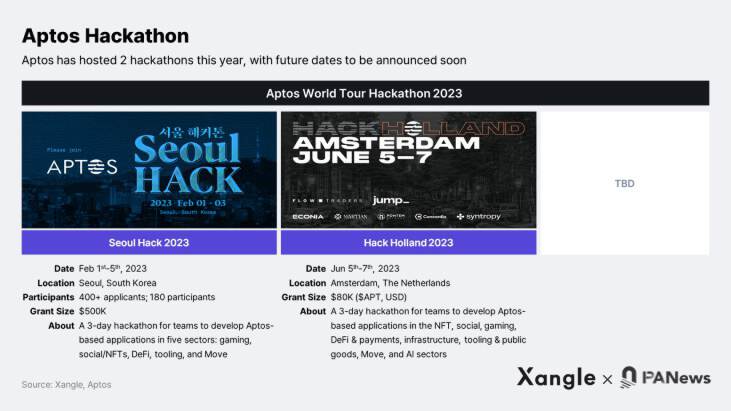

不过,Aptos 目前仍明显小于以太坊、Polygon、Arbitrum 和 BNB 链等其他著名区块链。该生态系统目前缺乏杀手级 dApp 或备受瞩目的 NFT 项目。Aptos 基金会清楚地意识到这一点,并积极开展各种资助计划,包括黑客马拉松。今年早些时候,Aptos 结束了其第一阶段拨款计划,向 Apscan、Bruhbears 和 Intu.xyz 等 50 多个项目提供了 350 万美元。随后启动了第二阶段资助计划,该计划由两类组成:艺术家资助计划以及 Aptos 和谷歌云加速器计划。

2-4.代币经济学:较长的兑现期限和稳定的通胀率

以下是有关 Aptos 原生代币 $APT 的一些关键数据:

最大供应量:无穷大

总供应量: 1, 038, 484, 105 $APT ( 100% )

当前流通量: 200, 288, 451 $APT ( 19.3% )

通胀率: 5.6% (逐年下降,最低约为 2.6% )

质押率: 860, 195, 091 $APT ( 82.8% )

$APT 质押奖励从每年 7% 开始,逐年减少 1.5% ,直至达到 3.25% 。初始通胀率估计约为 5.6% ,预计随着时间的推移将降至 2.6% 。由于超过 50% 的初始发行量将在大约两年内流通,$APT 将存在一些潜在的风险。然而,由于 $APT 的释放期限长达 10 年,因此与其他 L1 代币相比,$APT 的初始通胀率并不高。例如,根据 Xangle Analytics 的数据,以太坊的通胀率曾在 2016 年至 2017 年徘徊在 10% 以上,但合并后已逐渐下降至 4% 。。此外,$APT 的通胀率低于大多数其他 L1 代币,这些代币在主网启动初期通常会经历超过 10% 的高通胀率(BNB: 16% ,AVAX: 800% ,MATIC: 80% ,NEAR: 200% )。

目前,$APT 的质押率约为 82.8% ,超过了流通量的百分比。这归因于 Aptos 的设计,它允许锁定代币的质押。虽然社区的一些成员表达了他们的担忧,但假如通货膨胀率不太高,该设计可能会对网络产生积极影响,因为: 1)PoS 链的安全性与质押代币的价值成正比, 2)希望加入 Aptos 生态的协议可以利用锁定的$APT 来享受质押奖励。

3. Aptos 的未来愿景

Aptos 的核心战略涉及两个关键方面: 1)通过可升级性确保网络面向未来, 2)利用广泛的资本和网络吸引Web2企业。

3-1.增长策略 ( 1):通过可升级性打造面向未来的网络

Aptos 打算利用其可升级性来打造一个能够容纳 10 亿用户的面向未来的网络。与以太坊、Solana 和 Cosmos 等其他区块链通常每六个月到一年部署一次主要协议更新不同,Aptos 的目标是通过其快速高效的升级系统,从长远来看成为最强大的区块链。事实上,Aptos 自 2022 年 10 月 12 日主网上线以来的八个月内已经通过了24 个 AIP,其中包括核心层升级,即AIP 4 、AIP 17 和AIP 26 (Quorum Store)。

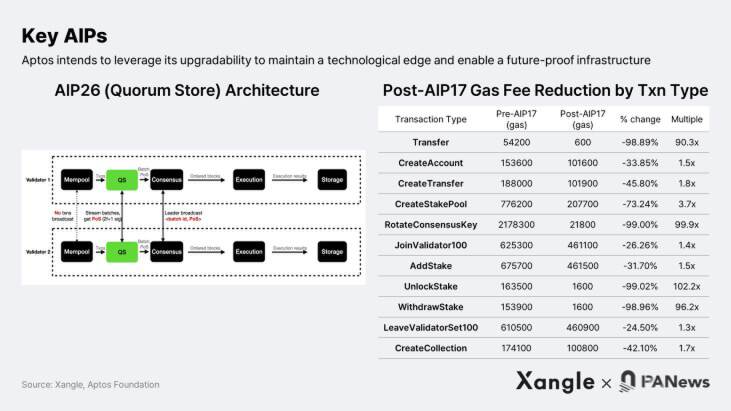

AIP 17 于 2023 年 3 月实施,旨在通过分离与存储和执行交易相关的 Gas 费逻辑来降低交易执行成本。这个想法是根据交易类型为存储 Gas 费用分配绝对值,同时保留执行 Gas 费用的现有费用市场机制。通过这种方式,Aptos 能够将 UnlockStake、RotateConsensusKey、Transfer 和 WithdrawStake 等类型的交易的 Gas 费降低约 99% 。Quorum Store 也称为 AIP 26 ,是一个专为 Aptos 架构设计的 NarwhalBFT 共识。其目的是解决现有的共识瓶颈,例如区块共识过程中节点带宽的浪费或相同交易数据的重复传播。Aptos 在 Previewnet 上测试了 Quorum Store,报告网络吞吐量增加了 3 倍以上。最近,Aptos 一直在研究Shoal,这是一个将引入流水线(pipelining)和领导节点信誉机制的框架。Shoal 的引入预计将减少 Bullshark、Tusk 和 DAG-Rider 等基于 Narwhal 的共识算法的延迟约 40-80% 。

Aptos 能够支持快速、即时的升级,这得益于其模块化架构,无需硬分叉即可实现协议升级,以及有利于实时发布升级的链上治理系统。这些功能确保了 Aptos 在 AIP 更新期间不会出现任何停机情况。

3-2.增长战略 ( 2):以 Web2 公司入驻为中心的生态系统扩张

与大多数优先考虑 Web3 项目进行生态系统开发的 L1 不同,Aptos 的生态系统扩展将围绕大型企业展开。这种方法的目标是推出可靠的产品和服务以及引入 Web2 公司的 IP 和用户群。

Aptos 正在战略性地利用其资金和网络来吸引 Web2 公司。去年,Aptos 完成了种子、A 轮融资,融资总额达 350 万美元,投资方包括 a16z、Paypal Ventures、Apollo Global Investment、Tiger Global Management、Griffin Gaming Partners、Multicoin Capital 和 Jump 等。考虑到 Aptos 已承诺将 $APT 发行量的 51% 分配给生态系统开发,它似乎已经为合作伙伴提供了足够的资金。

Aptos 联合创始人 Mo Shaikh 曾在 BlackRock、BCG、Consensys 和 Meta 工作过,另一位联合创始人兼首席技术官 Avery Ching 曾任雅虎、Meta、Novi 和 Apache 软件基金会的软件工程师,此外,其经验丰富的团队和知名投资者网络对于保持公司的参与度将十分有利。

Aptos 的主要目标市场是四个关键市场: 1) 游戏、 2) 金融、 3) 媒体和娱乐以及 4) 社交网络。Aptos 目前正在与万事达卡和谷歌云合作,为增长奠定基础。在韩国市场,鉴于 Aptos 获得了 Hashed、Irongrey、Hybe、YG 的投资以及与 NPIXEL 的重要合作伙伴关系,其似乎已做好进入游戏和媒体/娱乐市场的有利准备。

3-3.为公司提供专用区块空间的长期计划

在最近宣布进军 Web3 的韩国大公司中,例如 Nexon、SK Planet、Com 2 uS、Neowiz 和 NPIXEL,只有 NPIXEL 选择了单链。对于那些犹豫是否要构建自己的 L1 的人来说,这些 L1 的主要优势是开发基础设施(例如 SDK)的可用性,可以简化构建主网的过程。

构建自己的主网的主要动机是拥有 1) 网络控制和 2) 自己的区块空间。在前一种情况下,Aptos 可能是一个可行的选择,具体取决于公司的规模和商业模式,因为它消除了运营主网的负担,包括时间、成本和开发资源。

在后一种情况下,对于专用区块空间有大量需求的公司来说,整体区块链可能不是直接选择。这是因为整体区块链的运行结构中所有参与者都必须竞争相同的资源。值得注意的是,Aptos 的高可扩展性允许所有服务共享相同的区块空间,但构建自己的区块链的潜在风险,例如安全性、可靠性、流动性和数据可用性的碎片化,也不应被忽视。

Solana 在去年下半年推出了权益加权 PoS ,提供了一种根据所质押的 SOL 比例提供和保证网络带宽的替代方案。Aptos 采取了不同的方法,将分片纳入其解决方案中。演示版本将在未来 6 个月到一年内发布。

4. 游戏行业将引领生态系统增长

4-1.METAPIXEL 驱动的生态系统增长

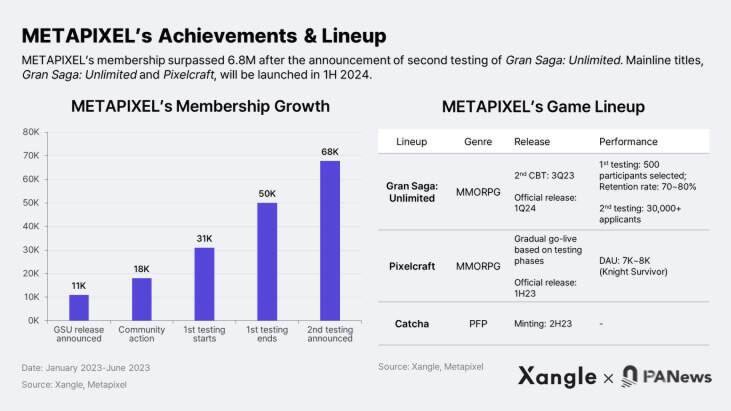

作为 2022 年 11 月与 NPIXEL 建立战略合作伙伴关系的一部分,Aptos 将独家搭载 NPIXEL 区块链部门制作的游戏。NPIXEL 成立于 2017 年,是一家韩国游戏开发商, 2022 年完成 1000 亿韩元的 B 轮投资,在最短的时间内成为游戏行业的独角兽。其旗舰游戏之一是风靡全球的手游《Gran Saga》,该游戏下载量达 420 万次,累计收入达 1800 亿韩元,每月 ARPPU(每位付费用户平均收入)达 200 美元。METAPIXEL 是 NPIXEL 公司开发的基于 Aptos 公链的Web3游戏生态系统。其第一款游戏《Gran Saga: Unlimited》将于 2024 年 1 月推出。作为 NPIXEL 旗舰 IP 的延伸,《Gran Saga: Unlimited》在首次封闭 Beta 测试中在 500 名参与者中获得了 70% 至 80% 的留存率。

除了《Gran Saga: Unlimited》 之外,METAPIXEL 还在开发和运营 Pixelcraft 和 Catcha 项目。Pixelcraft 是一款 2.5 D 超休闲像素艺术 RPG 游戏,预计明年上半年上线。《Knight Survivor》是 Pixelcraft 内的一款迷你游戏,每日收入为 150 万韩元,平均每日活跃用户 (DAU) 为 7-8 千人。该游戏的成功帮助 METAPIXEL 在 2023 年 1 月至 6 月的半年内达到了 80, 000 名订阅者,并可能成为一个触发因素促进 Aptos 生态系统的进一步发展。

4-2.游戏行业有望推动生态系统蓬勃发展

在可预见的未来,游戏行业可能会成为 Aptos 生态系统指数增长的主要催化剂。Aptos 是少数具备支持 3 A 游戏技术能力的公有链之一。Aptos 还与 METAPIXEL 合作,构建简化 Web3 游戏开发和发布流程所需的必要基础设施和工具。

在选择区块链平台来构建项目时,速度和可靠性可能是游戏公司的首要考虑因素。根据游戏体验在链上实现的程度,将区块链技术应用于所有商品和物品的完全链上 MMORPG 将涉及每秒处理数千到数万笔交易,Aptos 自然成为了游戏公司的选择。

此外,Aptos 与 METAPIXEL 正在合作开发各种与游戏相关的基础设施和工具,以使游戏开发者和游戏玩家更容易加入区块链生态系统。目前,开发区块链游戏面临的最大挑战之一是开发环境较差。Aptos 和 NPIXEL 正在共同开发标准化实施值,以便游戏公司能够更顺利地从 Web2 过渡到 Web3,例如:

token 对象 (AIP 11):METAPIXEL 通过从 Aptos 的初始 token v1 模型过渡到对象模型(token v2),改进了以下领域:

NFT 与用户帐户处于同一级别:为了更直观、直接地处理资源,NFT 由 32 字节地址标识,就像用户帐户一样。

增强所有权识别:对象的所有者字段可以轻松识别 NFT 的所有者。它简化了所有权验证和转移过程,促进了可组合性。

高效的存储使用:将对象和相关资源进行分组,以及之前定义的 ObjectCore,可以有效地利用存储空间,从而降低存储成本。

动态、灵活的 NFT:通过 Token Object 模型,可以动态、灵活地管理游戏资产。单个 Token 对象可用于铸造游戏 NFT、授予 Soulbound 状态和升级属性。

代理 Gas 费支付:为了实现与 Web2 游戏相当的用户体验,Aptos 正在构建一个开源的代理 Gas 费支付系统。该系统包含两个关键功能: 1) 多代理交易,可在单个交易中激活多个操作;2) 远程签名流程,可远程签署游戏玩家的交易。

可验证随机函数(VRF):将区块链技术引入游戏的最大好处之一是透明度。METAPIXEL 和 Aptos Labs 开发了 VRF,以提高 gacha 系统的透明度和可靠性。

Stackable(TBD):正在开发一种新的代币标准,以实现类似于 ERC 1155 的半同质化 NFT。

SDK:Aptos 计划开发一个 SDK,以简化在其网络上构建游戏的过程。

4-3.方兴未艾,前景需长期观察

Aptos 主网现在才上线大约 9 个月,几乎所有指标都落后于其他一些已建立的 L1,包括基础设施、TVL、开发者社区和用户数量。以太坊作为领先的区块链持续占据主导地位的关键不仅在于其优越的基础设施,还在于资本和人才(包括开发人员和研究人员)的持续涌入:以太坊的 TVL 比 Aptos 高 615 倍,全职开发人员多 26 倍,Github 库比 Aptos 多 49 倍。因此,Aptos 的萌芽状态需要投资者和利益相关者保持耐心并进行长期观察,尽管随着上述游戏基础设施和开发工具在今年下半年的推出,全面增长可能会在明年开始显现。