Mở cao và xuống thấp, BTC ETF có đòn bẩy đầu tiên ở Hoa Kỳ có đáp ứng được kỳ vọng của thị trường?

Sản xuất | Odaily

Tác giả | Odaily Qin Xiaofeng

Quỹ ETF tiền điện tử có đòn bẩy đầu tiên của Hoa Kỳ đã ra mắt công chúng trong ba ngày và hoạt động kém hơn kỳ vọng.

Vào ngày 27 tháng 6 (Thứ Ba tuần này), “2 x Bitcoin Strategy ETF” (2x đòn bẩy Bitcoin Strategy ETF) do nhà phát hành ETF Hoa Kỳ Volatility Shares phát hành đã chính thức cập bến sàn giao dịch BZX trực thuộc CBOE và bắt đầu giao dịch.

Theo giám sát của Odaily, 110.000 cổ phiếu đã được phát hành trong ngày đầu tiên niêm yết, với giá phát hành là 15 USD, giá trị tài sản ròng là 1,65 triệu USD và khối lượng giao dịch là 5,5 triệu USD trong ngày đầu tiên, đây là mức tốt nhất. khối lượng giao dịch ngày đầu tiên của các quỹ ETF mã hóa được phát hành trong năm nay. (Lưu ý hàng ngày: Khối lượng giao dịch của CSOP BTC Futures ETF trong ngày đầu tiên chỉ là 830.000 USD, Bitcoin ETF của Samsung chỉ là 98.000 USD).

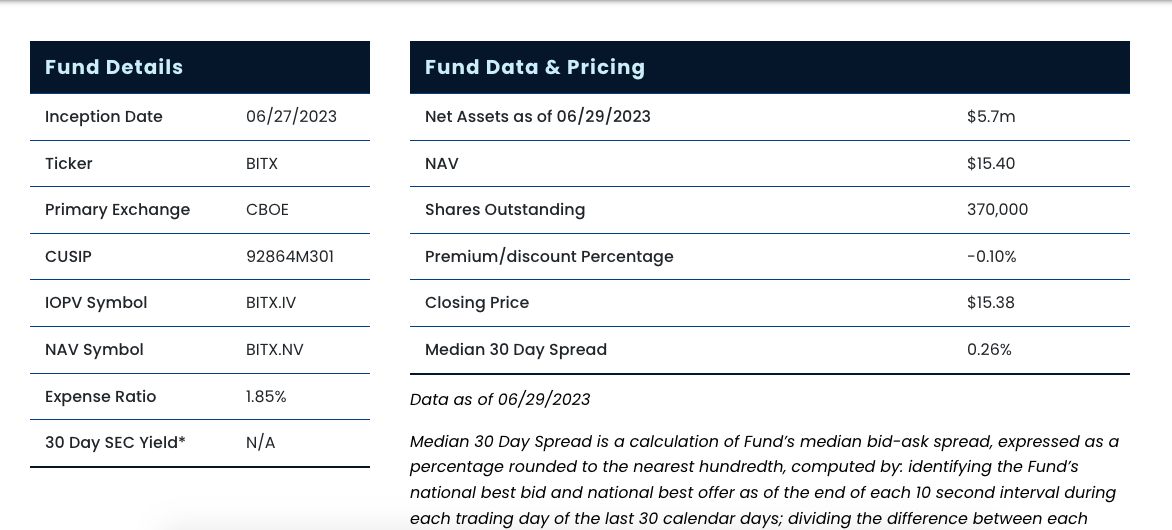

Tuy nhiên, trong hai ngày giao dịch tiếp theo, khối lượng giao dịch Bitcoin ETF có đòn bẩy của Biến động bắt đầu giảm mạnh, với một ngày có ít hơn 300.000-21.768 cổ phiếu được giao dịch vào ngày hôm qua (29), với khối lượng giao dịch là 234.000 USD; ETF của nó Lượng lưu hành đã dần dần tăng lên, hiện có 370.000 cổ phiếu đang lưu hành và giá trị tài sản ròng đã tăng lên 5,7 triệu USD, như hình dưới đây:

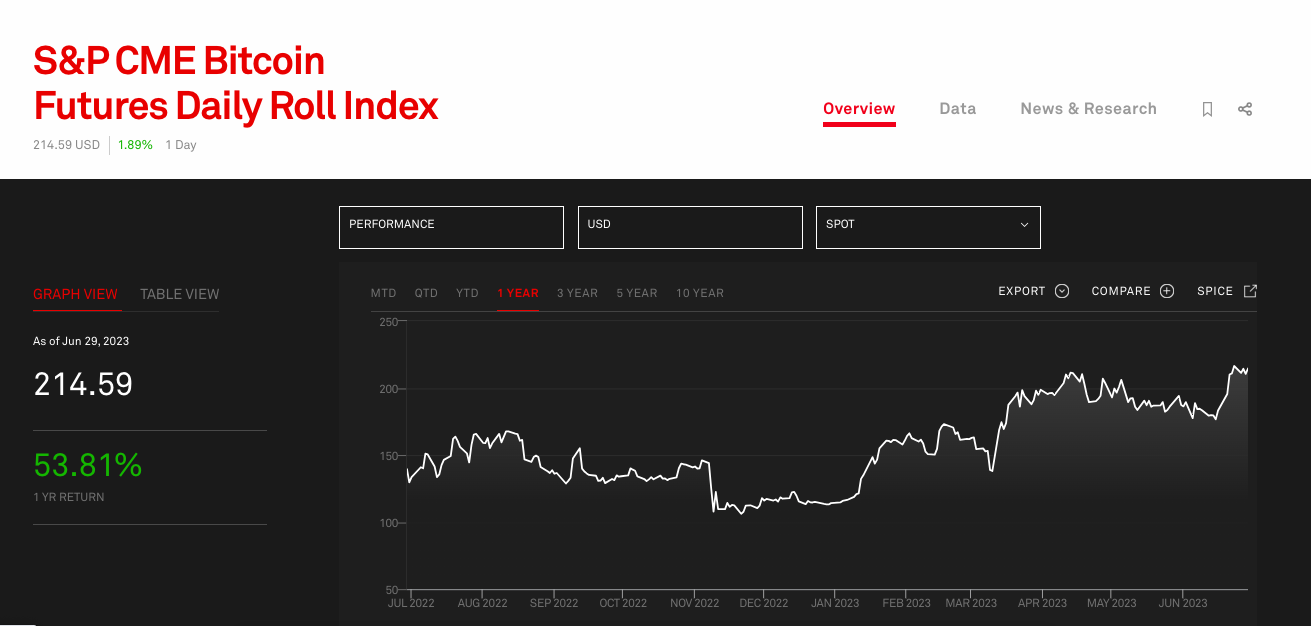

ETF Bitcoin có đòn bẩy là gì? Theo hồ sơ đăng ký do Volatility Shares gửi tới SEC, kết quả đầu tư mà ETF phát hành lần này tương đương với gấp đôi lợi nhuận vượt quá trong một ngày của Chỉ số Rollover hàng ngày của S&P CME Bitcoin Futures (gọi tắt là Chỉ số Rollover ). Ví dụ: nếu chỉ số mở rộng tăng 1% mỗi ngày thì giá trị ròng của ETF cần tăng 2% và nếu chỉ số mở rộng giảm 1% thì giá trị ròng của ETF cần giảm 2%.

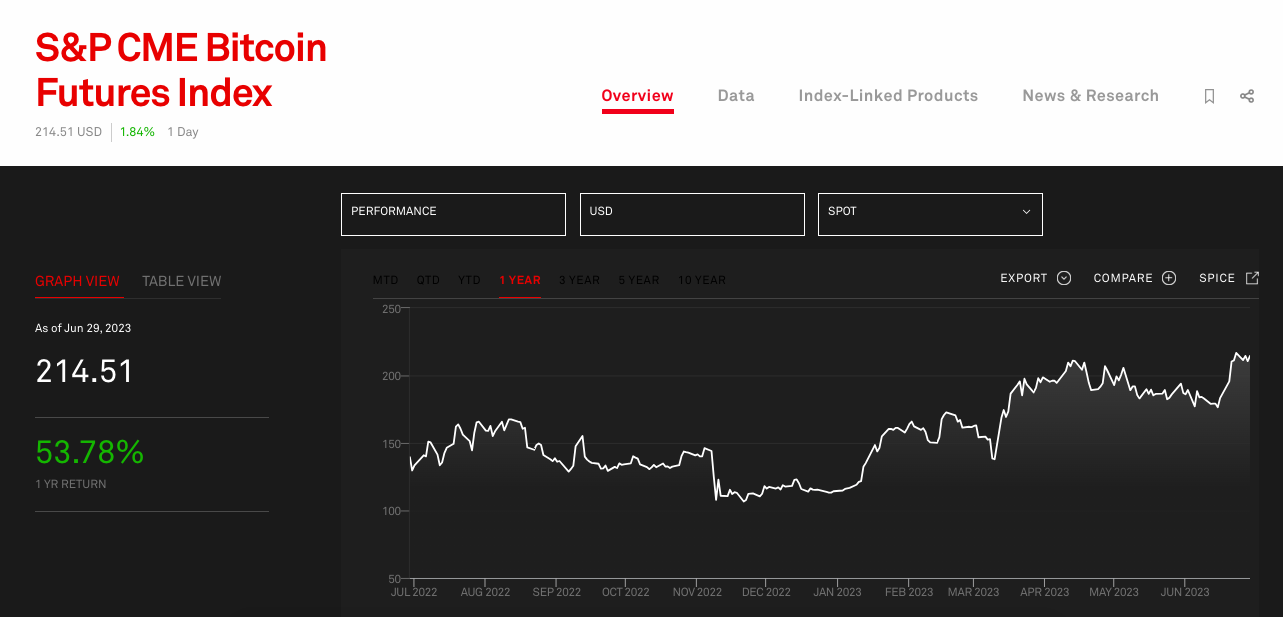

Chỉ số cuộn được sử dụng để đo lường hiệu suất của thị trường tương lai Bitcoin CME, tái cân bằng hàng ngày giữa hợp đồng tương lai của tháng hiện tại và hợp đồng tương lai của tháng tiếp theo. Sẽ không có vấn đề gì nếu bạn không hiểu, bạn chỉ cần biết rằng Chỉ số chuyển đổi hàng ngày của Hợp đồng tương lai Bitcoin của CME về cơ bản giống với Chỉ số Hợp đồng tương lai Bitcoin của CME về mặt dữ liệu và xu hướng — cả hai đều bị ảnh hưởng bởi xu hướng giá giao ngay của Bitcoin. . Như sau:

Do đó, ETF có đòn bẩy được phát hành lần này thực sự giống với chỉ số chuẩn của ETF tương lai Bitcoin đã phát hành trước đó, tất cả đều là dữ liệu tương lai.

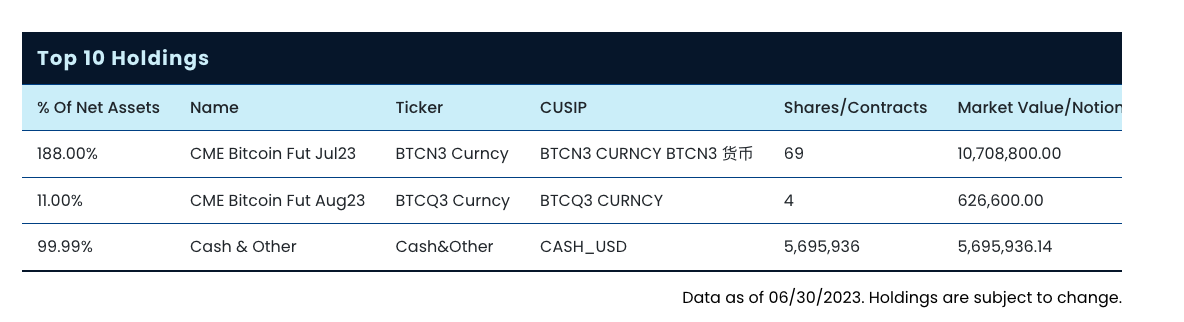

Để đạt mục tiêu lợi nhuận gấp 2 lần, ETF sẽ lấy 25% tổng tài sản của quỹ thành lập công ty con 100% vốn để đầu tư vào hợp đồng tương lai Bitcoin CME (trở nên mua); tài sản còn lại sẽ được đầu tư trực tiếp bằng tiền mặt, tiền mặt -như các công cụ hoặc chứng khoán chất lượng cao, bao gồm chứng khoán của chính phủ Hoa Kỳ, quỹ thị trường tiền tệ, chứng khoán nợ doanh nghiệp, v.v., những tài sản này sẽ được sử dụng để cung cấp thanh khoản hoặc làm tiền ký quỹ trong tương lai.

Thông tin trên trang web chính thức cho thấy quỹ ETF có đòn bẩy hiện đang nắm giữ hợp đồng tương lai Bitcoin CME đáo hạn vào ngày 23 tháng 7 trị giá 10,708 triệu USD, hợp đồng tương lai Bitcoin CME đáo hạn vào ngày 23 tháng 8 trị giá 626.000 USD và các khoản tương đương tiền mặt trị giá 5,69 triệu USD. Từ góc độ tỷ lệ, tổng vị thế tương lai chính xác gấp đôi giá trị ròng của quỹ, có thể đáp ứng yêu cầu rủi ro về rủi ro đòn bẩy gấp đôi.

Tuy nhiên, tác giả vẫn tin rằng quy mô của thị trường ETF có đòn bẩy lần này sẽ không tăng trưởng nhiều.

Trước hết là nút phân phối chưa tốt, sản phẩm đồng nhất không có điểm sáng. ETF có đòn bẩy gấp 2 lần về cơ bản là một ETF tương lai và thị trường Hoa Kỳ đã phát hành một số ETF tương lai Bitcoin như ProShare, VanEck, Valkyrie và Hashdex trong hai năm qua và CME cũng đã tung ra hợp đồng tương lai Bitcoin từ lâu. hơi nhạt nhẽo và không có nhiều lợi thế của người đi đầu, điều này có thể thấy được từ khối lượng giao dịch trong hai ngày qua.

Hơn nữa, phí quản lý là yếu tố quan trọng ảnh hưởng trực tiếp đến sự lựa chọn của nhà đầu tư, phí quản lý Cổ phiếu biến động tương đối cao trong số các quỹ ETF. Theo thống kê của Odaily, quỹ ETF tương lai bitcoin của CSOP hiện có phí quản lý cao nhất trên thị trường ETF, đạt 2%, trong khi phí quản lý của các quỹ ETF được tung ra ở Hoa Kỳ và Canada trong hai năm qua thường là khoảng 1%, và phí quản lý Cổ phiếu Biến động cao tới 1,85%. Sự thật là không hấp dẫn.

Cuối cùng, các trường hợp thất bại của ETF có đòn bẩy cũng đã gióng lên hồi chuông cảnh báo cho Cổ phiếu Biến động. Ngay từ ngày 16 tháng 4 năm 2021, Beta Pro Bitcoin ETF (mã: HBIT), quỹ ETF sử dụng tiền điện tử đầu tiên trên thế giới, đã được niêm yết trên Sở giao dịch chứng khoán Toronto. Sau khi ra mắt, thị trường ETF hoạt động khá chậm chạp, trong năm qua, khối lượng giao dịch trung bình hàng ngày chỉ là 5.769 cổ phiếu (với khối lượng giao dịch là 100.000 đô la Mỹ) và tổng quy mô tài sản chỉ là 3,76 triệu đô la Mỹ; -Tháng 4 năm nay, nhà phát hành Horizons cuối cùng đã đóng cửa quỹ ETF.

Mặc dù điều này có những hạn chế riêng trên thị trường tài chính Canada, nhưng nó cũng chứng tỏ rằng các quỹ ETF có đòn bẩy không có tiềm năng phát triển cao, đặc biệt là so với hai quỹ ETF giao ngay được tung ra ở Canada trong cùng thời kỳ——ETF giao ngay BTC có mục đích ($85,13 triệu) Và 3iQ BTC giao ngay ETF (77,95 triệu USD), đủ để chứng minh rằng các quỹ ETF giao ngay tiền điện tử hấp dẫn hơn đối với các nhà đầu tư.