Hashed: Top 10 Crypto Trends for 2023

Original title: "Top 10 Trends in 2023: An Overview by Hashed》

Originally written by Simon Seojoon Kim

Original compilation: Qianwen, ChainCatcher

Original compilation: Qianwen, ChainCatcher

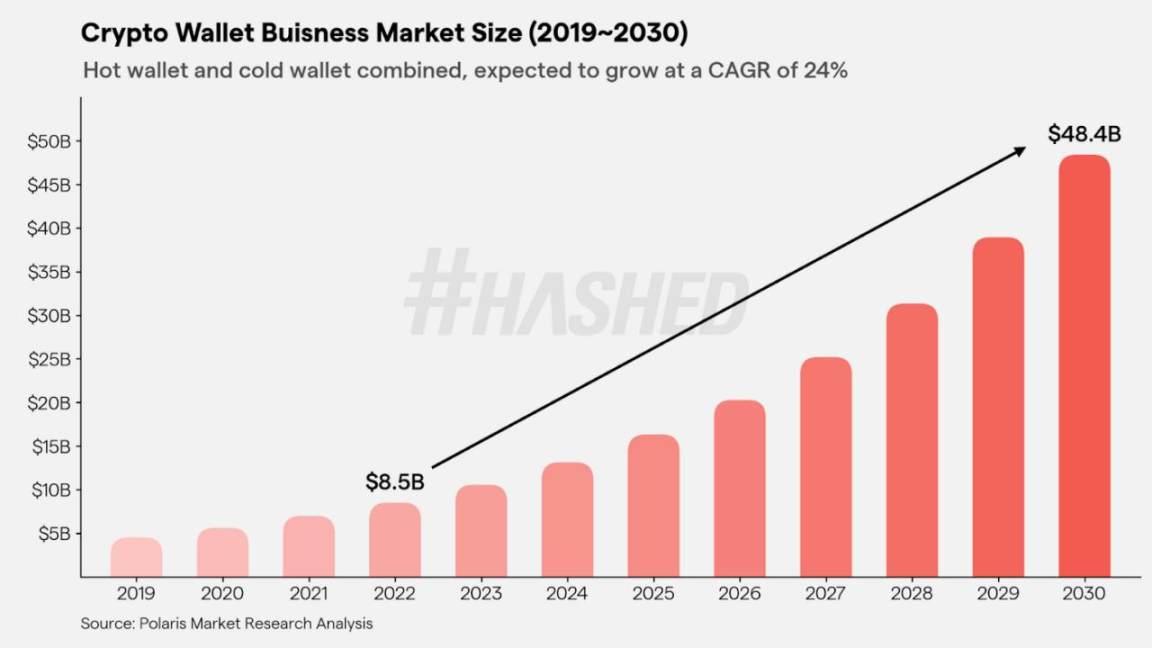

As the cryptocurrency industry continues to gain mainstream adoption and its infrastructure improves, user experience and security become increasingly important to end users. In this regard, wallet providers play a vital role in facilitating access to decentralized applications and will build bridges for thousands of new users. Of course, challenges still exist, especially for ordinary users, private key management and signing protocols are still very complicated.Web3 AuthSolutions for ordinary users to solve complex problems such as wallet key management and signature authentication are gaining more and more attention. One of the solutions isMagic, which leverages multi-party computation (MPC) technology to provide a non-managed login experience that eliminates the need for mnemonic phrases. platformRamperProvides developers with wallet and SDK options that allow logging into dApps via email and SMS without using mnemonic phrases at all. also,

Through its mobile SDK, it focuses on providing seamless social login and single sign-on (SSO) for users who are not familiar with cryptocurrencies to access blockchain applications.Coin 98 With mobile device usage growing exponentially, wallet companies should prioritize mobile services to reach a larger audience.is a fast-growing platform with 6 million users that aims to become the leading mobile super app by emphasizing enhanced security of mobile transactions and user experience enhancement. Meanwhile, Robinhood isLaunch of standalone wallet app

, allowing users to manage their assets effortlessly, while seamlessly integrating with various DApps to solve long-standing problems such as heavy design and high fees.ArgentSmart contract wallets are also a solution. They can be programmed with features such as spending limits, automated transactions, and enhanced security with multi-signatures. These wallets cater to users with different needs and levels of understanding, such asSafeProvide social recovery and limit order functions,

is a non-custodial wallet that allows users to securely store and manage their digital assets through multi-signature functionality.

MetaMaskIn addition, smart contract wallets in the Ethereum ecosystem also have room to grow. For example, Account Abstraction (AA), which aims to unify the two types of Ethereum accounts, externally owned accounts (EOA) and contract accounts (CA). AA will eliminate the need for private keys in EOA, enabling accounts to function like smart contracts, unlocking potential use cases for improved key management and multi-signature capabilities. Visa recently demonstrated the potential of AA by building an automated payment solution on StarkNet. As the focus on AA grows, we foresee the NEAR protocol gaining attention from builders whose account models already implement multiple key pairs as keys.

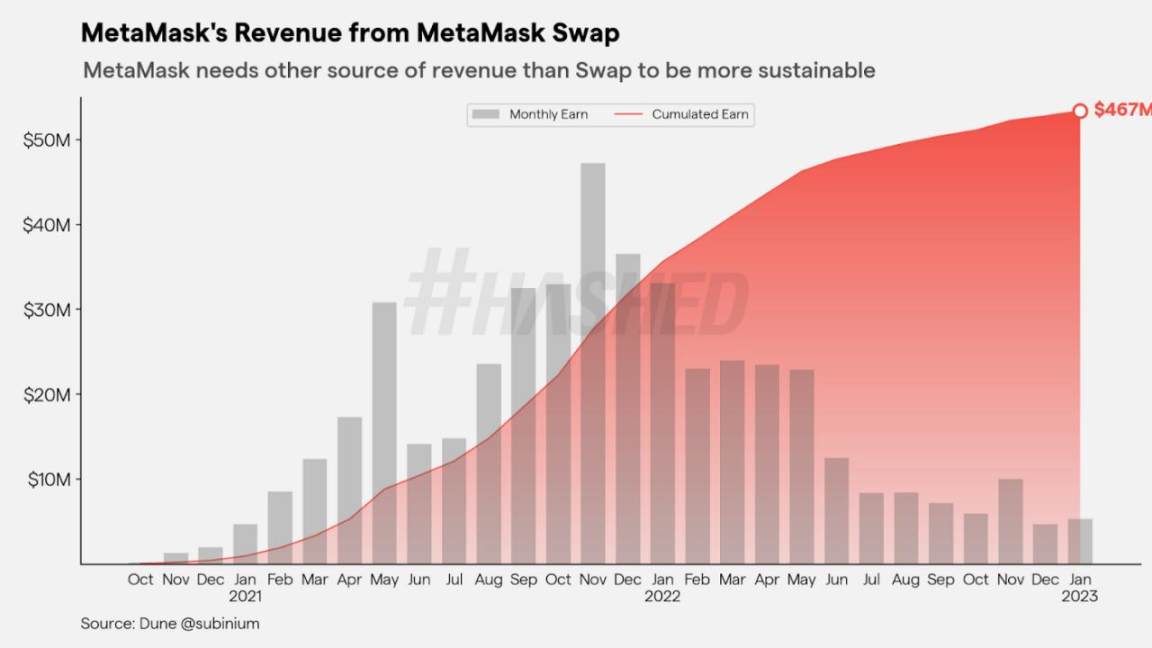

is a recognized leader in cryptocurrency wallets and uses MetaMask Flask to enter the competition. Flask enables developers to customize their own version of the MetaMask wallet. MetaMaskSnaps is a first Flask feature that allows anyone to extend the functionality of MetaMask and leverage it with different blockchain protocols. Most of their current sales sources are spot transactions, and their income sources are monotonous. This revenue model has generated over $450 million in revenue over 2 years after launch, but it is highly susceptible to market volatility. But if they succeed in building a dApp ecosystem on top of their product, they will easily stand out as a profitable ecosystem.

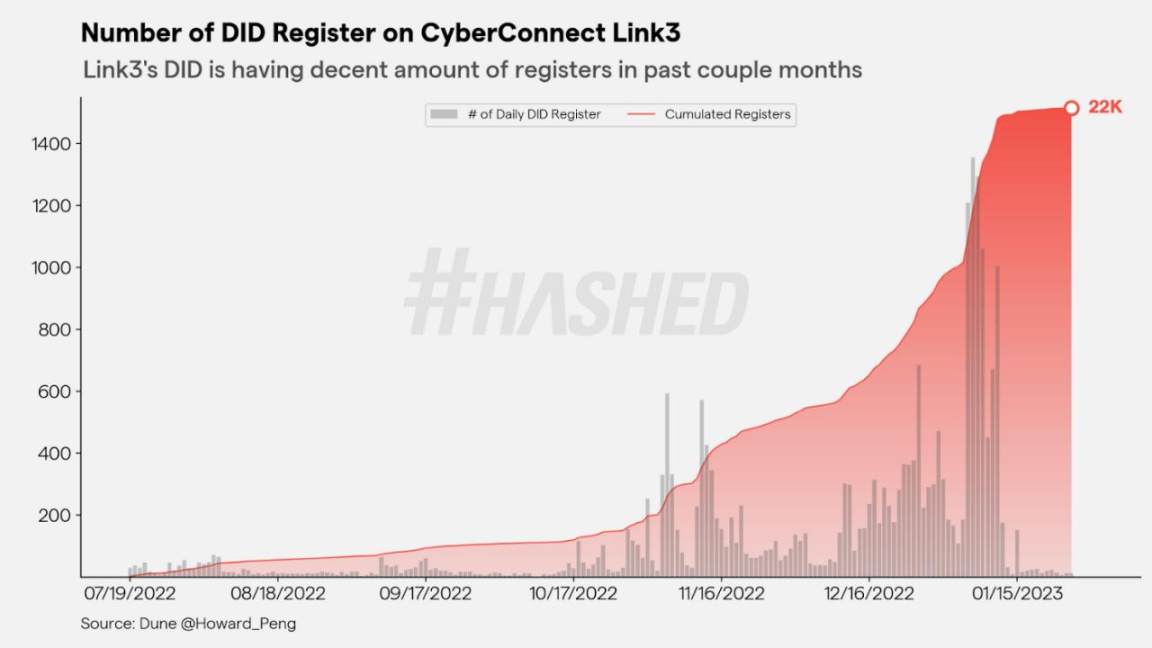

Two: Add Web3 elements to digital identity, and take a step towards a decentralized society

There are several aspects of the current digital identity system that need improvement. A major problem is fragmentation, where individuals have multiple identities on different platforms, resulting in a lack of accuracy and continuity in personal identification. Privacy and security are also concerns as individuals are often required to provide sensitive information to establish a digital identity across different platforms, which if used or shared without consent can lead to identity fraud and financial crime . In addition, the centralized control of digital identities by platform service providers has also raised concerns. Digital identities are often controlled by a few companies or organizations, which may lead to users' lack of control over their own identities.CyberConnectBlockchain technology can provide a differentiated solution to these problems through the use of private wallets, allowing individuals to verify their digital identities by proving ownership of specific tokens or NFTs. Storing assets and information on the blockchain can improve the accuracy and reliability of digital identities. Blockchain-based identities enable individuals to consolidate multiple online identities into a unified, self-sovereign entity, giving them control and autonomy over their digital identities.

Digital identities can also be created and managed without the use of tokens or NFTs. for exampleDiscoandOrange Protocoland

Several Ethereum-based projects use DIDs (Decentralized Identifiers) and VCs (Verification Credentials) as a complement to Soul-Bound Tokens (SBTs). Of course, a single solution may not be enough to meet all privacy needs. To obtain the best security and privacy, it may be necessary to combine on-chain solutions such as SBT and off-chain solutions such as VC. In addition, progress should also be made in developing better data storage solutions that provide privacy and partial decentralization, and seamlessly integrate between different identity layers.

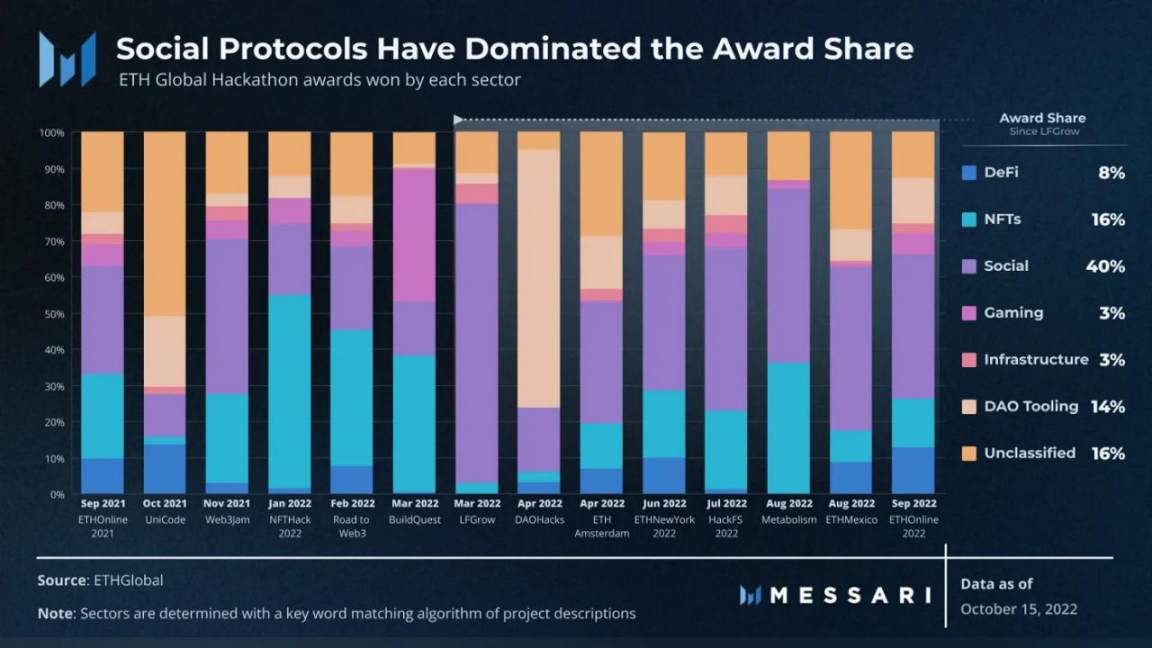

With Web3 identities, users will be able to easily find, connect, and even build thresholded communities with others with similar interests, such as leveraging the same DeFi protocols, owning NFTs, or playing blockchain games. This new form of identity can also be integrated with existing identity systems to create a seamless and interoperable digital identity, opening up a range of business opportunities.Lens ProtocolThere are more than 60 projects spun out entirely from the hackathon, experimenting with various things around the social graph.FarcasterandDeSoand

A lot of money was raised in this huge interest respectively. This year, we can expect to see the initial development of blockchain-based social applications that leverage network effects by using shared social graphs.

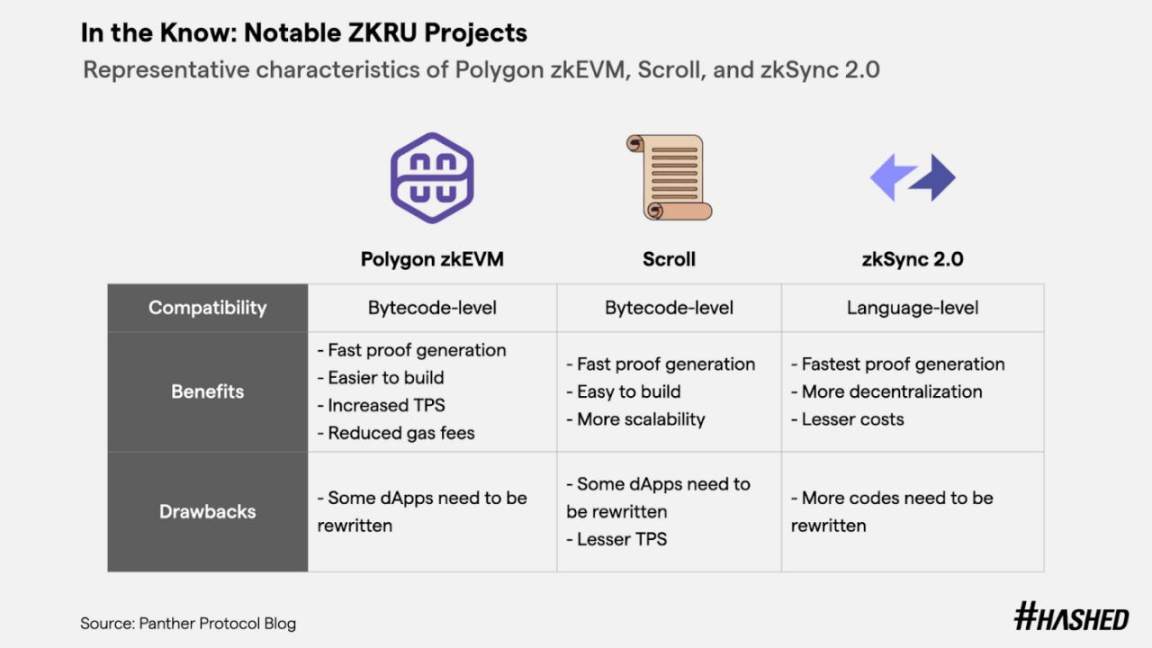

Three: Optimize the use of ZKP to realize the privacy of the account-based smart contract platform

Currently, the application of zero-knowledge proof (ZKP) in the field of encryption mainly focuses on improving scalability through verifiable off-chain computation. With the continuous advancement of scalability solutions, privacy is also more concerned, because common user experience, such as voting, governance, payment, etc., can greatly benefit from the implementation of privacy.

Aztec Connect SDKAchieving privacy in an account-based smart contract platform such as Ethereum is challenging due to the complexities of both encrypting the ledger state and maintaining its verification. Some notable teams are working on this problem. A common approach among these protocols is to incorporate "notes" from the UTXO model into an account-based system, making ownership and its transfer more explicit.Polygon MidenAllows the Ethereum protocol to integrate with Aztec's private rollup, which utilizes a cryptographic UTXO architecture for privacy. Based on Aztec Connect, ZK.Money provides a private DeFi yield aggregator, integrated with major projects such as AAVE and Uniswap. also,

A "hybrid UTXO and account-based state model" is being introduced for EVM-compatible ZK rollups to support private transactions, which consist of local execution of off-chain data.

To facilitate experimentation and innovation in privacy-enhancing technologies, developer friction on these infrastructures needs to be reduced. Web3 development already brings with it an unfamiliar set of headaches such as fragmented indexing, additional security concerns, etc., so the complexity of increasing privacy should be abstracted as much as possible. There is no doubt that this effort will further mature in 2023, fostering a more mature proving ground for exciting applications.

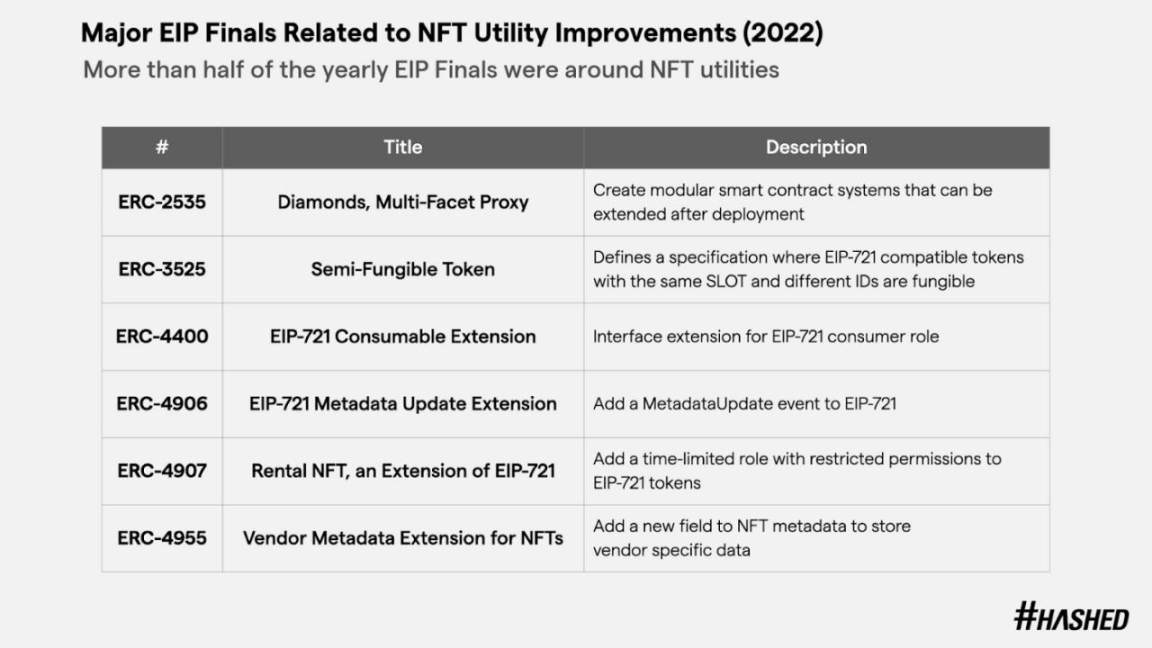

Four: Programmable NFT technology represented by dynamic NFT will continue to developThe NFT landscape has changed dramatically over the past few years, especially those in the form of profile pictures (PFPs). However, in the second half of 2022, the volume of image-based NFT transactions will decrease significantly, as users have begun to desire more functions. As such, the NFT ecosystem is undergoing a transformation to respond to this changing need. Ethereum improvement proposals have become a measure of the direction of the Ethereum community, and most recent proposals have focused on NFT standards, indicating that the community wants to have NFTs with additional utility. We believe that 2023 will be a pivotal year for various NFTs, includingDynamic NFT

, will address these issues by providing new functionality.

Dynamic NFTs are a unique type of NFT that can adapt and evolve based on certain triggers in their smart contracts. These triggering events can be the result of on-chain or off-chain events, or even events happening in the real world. Changes in the characteristics of a dynamic NFT are usually achieved by modifying its metadata.

In addition to dynamic NFTs, there is growing discussion in the community about other programmable NFTs with advanced features, such as executable NFTs, NFTs with separated permissions, and shared ownership. This opens up multiple possibilities for creators, collectors and gamers to interact and participate. Programmable NFTs are expected to gain enormous popularity in the blockchain ecosystem as they enable advanced use cases beyond the traditional means of representing digital ownership through images or records. These NFTs offer a plethora of possibilities, such as creating interactive experiences, representing unique and complex digital assets, and developing new financial instruments.

At the same time, the widespread adoption of dynamic NFTs requires addressing the reliability of trigger events that cause NFTs to change. In order to achieve this, it is necessary to implement more reliable oracles and establish clear NFT standards to verify the authenticity of triggering events, while also promoting the transparency and fairness of smart contract rules governing dynamic NFTs.

As the blockchain ecosystem continues to attract more game developers, artists, and entrepreneurs, the level of their creations continues to increase. The advent of dynamic NFTs is expected to add a new level of excitement to the NFT ecosystem in 2023. The abundance of talented creators in the field will open up endless possibilities for new imaginative use cases.

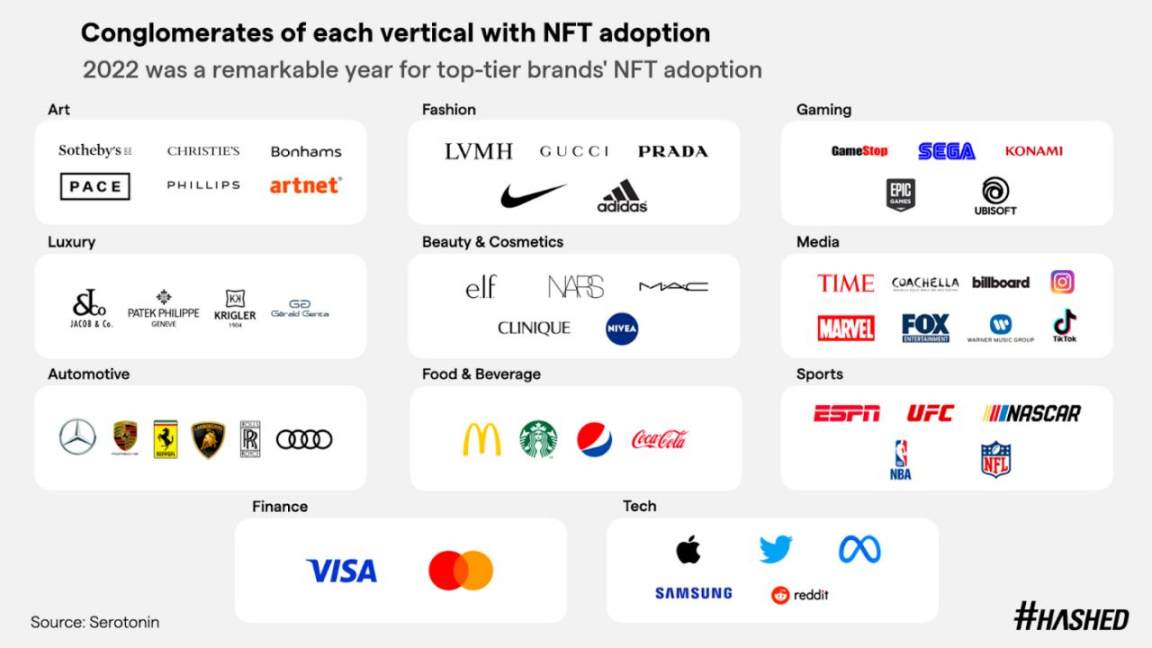

Five: Exploring the utility of diverse NFTs, small and medium-sized brands and creators will drive a new round of adoptionMarvelDespite the ongoing bear market and subsequent drop in sales, NFTs are becoming an increasingly popular way for companies to connect with customers. Major companies such as Coca-Cola, Twitter, and Visa have already started using NFTs as a way to enhance their brand image. Disney has partnered with one of its subsidiaries

Launched NFT-based digital collectibles. To support this effort, they are actively seeking to hire experts with knowledge and experience in this field.

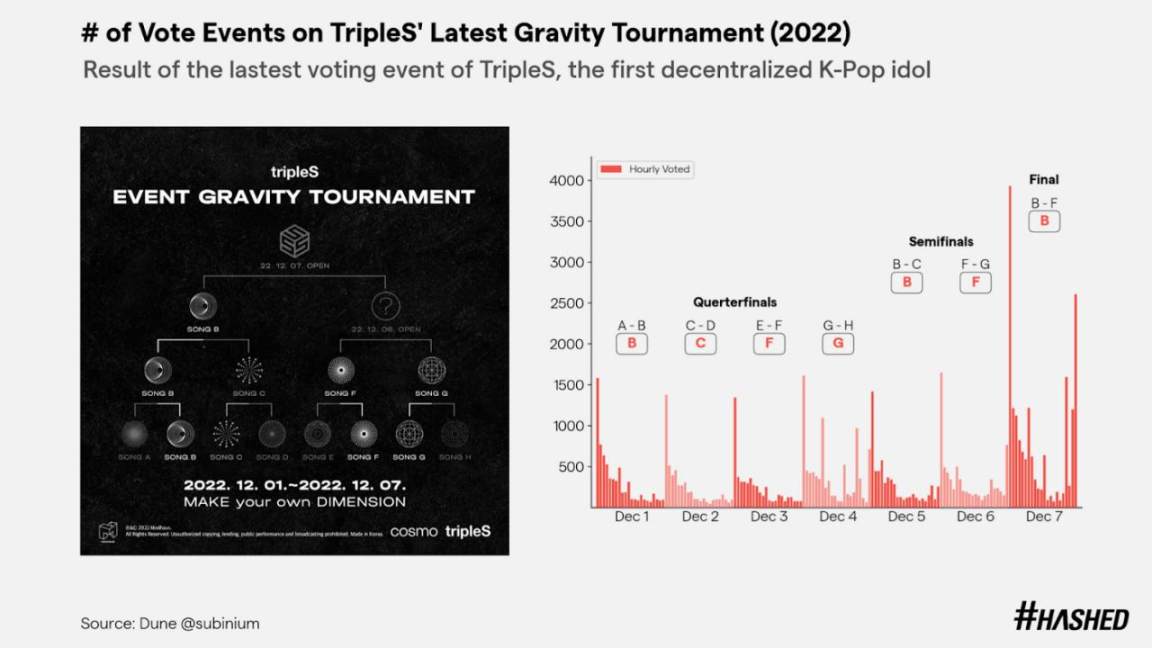

Despite the foreseeable mainstream success of NFTs, NFTs often lack sentimental value for holders and are not sustainable. In layman's terms, after acquiring an NFT, the holder may not feel a strong connection to it over time, and may not know what owning it brings. While many NFT projects or studios offer the staged benefits described in their roadmaps, they often fail to provide a sense of belonging and true ownership of the underlying IP and content, such as the sense of community and exclusivity.ModhausTo address these barriers, several teams are working to demonstrate how NFTs can provide real, ongoing utility and a sense of belonging/ownership to a community of holders. for example,TripleSis revolutionizing the K-pop entertainment industry, allowing fans to actively participate at a higher level, providing ownership through NFT-based governance and voting.

is a unique K-Pop group that utilizes blockchain technology to give fans more influence in important decisions, such as being able to choose TripleS' subgroups from the very beginning and determine the individual members of each subgroup.

In 2023, small and medium-sized brands and individual creators will embrace NFTs as a means of increasing and maintaining customer loyalty, which echoes the previous year's leading position in the use of NFTs by large enterprises. This includes membership and loyalty programs that incorporate NFTs into real-world communities, such as local restaurants and social events. The practical benefits of NFTs, such as exclusive offers at offline events, will promote the widespread adoption of NFTs.Reddit Vault For NFTs to gain wider adoption, barriers to user entry need to be reduced through easy-to-use wallet services. for example

Enables users to easily claim collectible avatars. At the same time, it is equally important to enable users who do not understand cryptocurrencies to effectively use the Web3 stack tools. Long-tail brands and businesses are increasingly demanding an enhanced user experience in the NFT community, which will drive demand for services like RareCircles or CIETY that enable communities to be launched without the need for coding or technical expertise.

Leading NFT marketplace OpenSea also recently launched “Drops,” a tool for creators to kickstart their NFT projects. It also launched a customizable landing page on the EVM chain, aimed at improving the experience for small and medium-sized brands and creators.

Six: Chain games will use powerful IP, which is more friendly to ordinary users

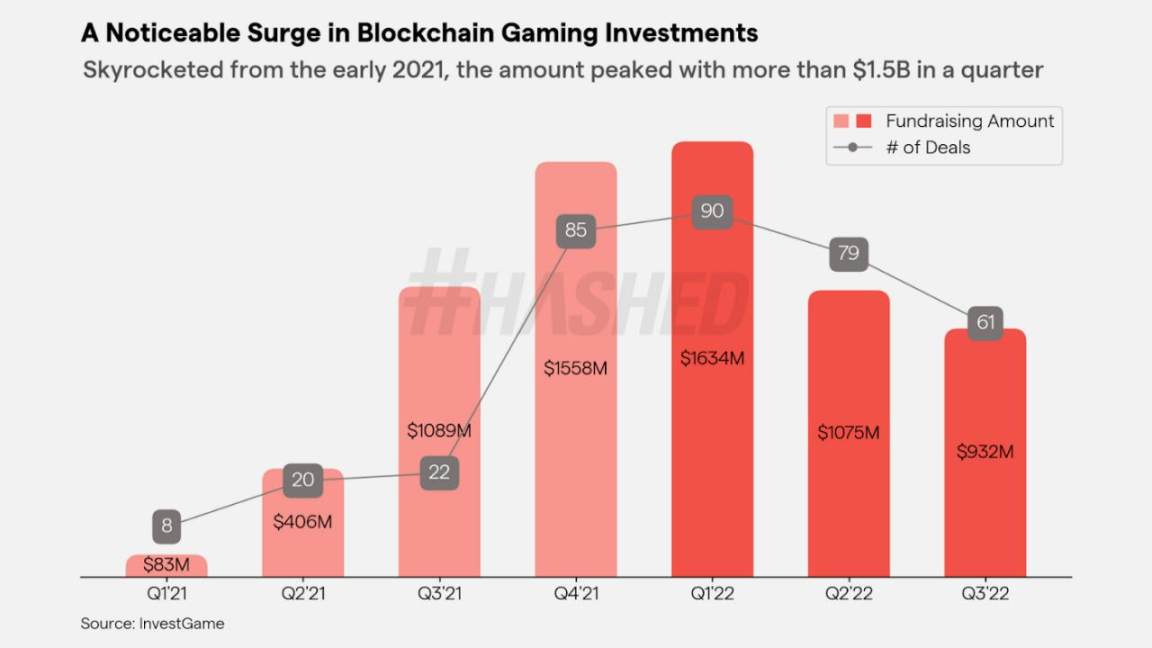

Although blockchain games have only been launched in the past two years, late 2021 has seen unprecedented growth. In addition, with the emergence of novel concepts such as game guilds, the growing game ecosystem in the Southeast Asian market has also made GameFi an area of high concern for cryptocurrency builders and traditional game groups.

Due to macroeconomic conditions and market turmoil, the development of blockchain games in 2021-22 has not reached the height assumed We expect that more AAA games will be officially launched in this field in 2023.

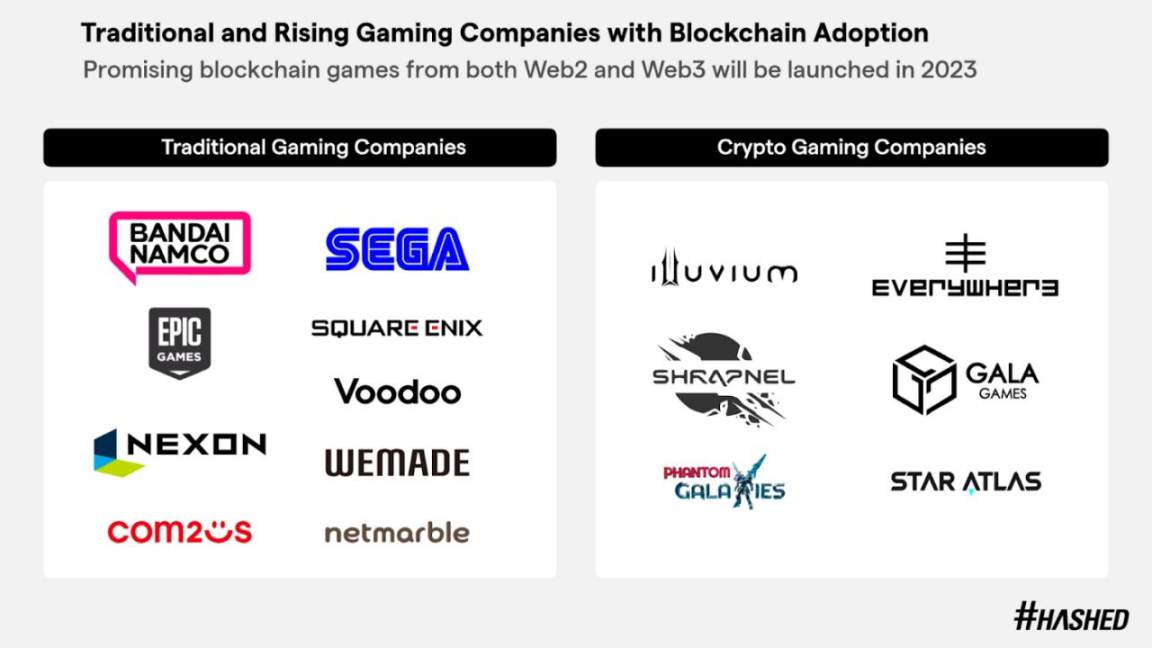

In order to provide gamers with an innovative experience, we often see the adoption of well-known IPs, such as popular web comics and movies, or even full-fledged blockbuster game IPs combined with blockchain technology. Korean conglomerates such as Nexon and Netmarble, as well as global players such as SEGA, BandaiNamco and SquareEnix, are also working hard to incorporate their IP into games. For example, user-generated content (UGC) platforms using popular images and plots (such as Gundam Metaverse) are gaining attention. Nexon also announced a creator-driven ecosystem blueprint, which will rely on the main IP MapleStory Universe to access the blockchain. In the future, more content companies will expand the IP of games by utilizing blockchain.

However, blockchain games have high barriers to entry for ordinary users, and this urgent problem has not yet been resolved. Axie Infinity is one of the very successful blockchain games with over 2 million MAUs in 2021, but it has had challenges attracting more users due to difficulties in creating wallets and purchasing assets. In the future, it is expected that the barriers to entry will be lowered, players will be able to play blockchain games without needing a wallet, or wallet creation will be smoother.

In 2023, it is expected that simplified onboarding tools will be gradually promoted to attract more players, while the blockchain infrastructure provides convenient mobile SDKs to facilitate the launch of top games. Multi-chain wallet services dedicated to the gaming space, such as Sequence and FaceWallet, will work with numerous blockchain gaming companies to improve accessibility, and infrastructure companies will also make similar efforts, such as ImmutableX, which recently announced the launch of Immutable Passport. These collaborations will help create a more seamless and user-friendly experience for all gamers.

Seven: Build a resilient infrastructure for the next generation of DeFi, and NFT-based virtual goods will rise

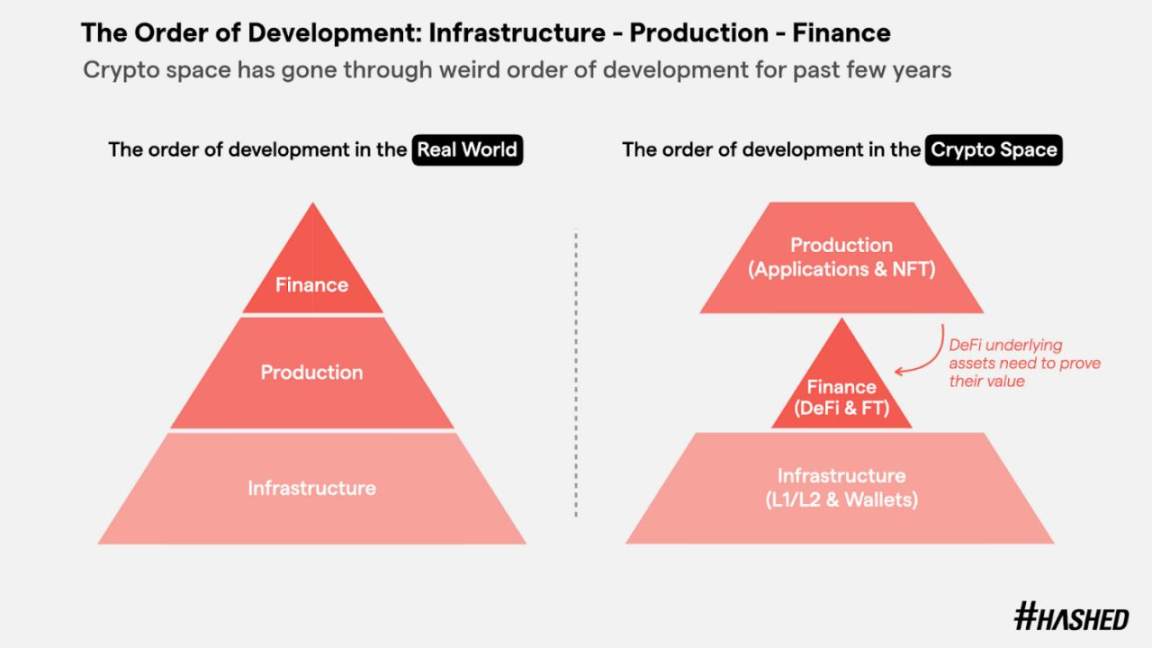

In real-world economies, production and finance are closely related. The financial sector enhances the growth of productive activities based on natural resources and infrastructure by providing loans and other financial instruments. For example, a farmer might set up a ranch and raise cats (production), banks and securities firms can take advantage of this by providing financing or listing on exchanges (finance) and help the farmer expand their business.

However, until 2022, this balance will be absent in the cryptoeconomy. Projects at the infrastructure level, such as cryptocurrency exchanges and currency markets collapse (financial), causing instability in financial markets, and projects affecting utilities and communities unable to thrive (production). The foundation of the crypto economy, blockchain technology (infrastructure), is already in place, but the development of more production-focused projects is needed to support its growth.

Major DeFi tokens have interdependent value, where the value of a token depends on the usage and value of other tokens in the DeFi ecosystem. This creates a fragile structure where a drop in the value of one token affects the entire DeFi market, a structure that leads to a sharp drop in value in times of regulatory uncertainty or skepticism about the entire industry.

The number one challenge for the blockchain industry is to build a solid infrastructure that will make it more accessible to the masses and enable real added value in the commodity production market. Fortunately, blockchain transaction volumes have been growing steadily. Currently, 5 leading L1 projects with a transaction volume of over 1 million offer scalable and proprietary modular solutions that are user-friendly and easy to get started, as well as digital identity solutions.

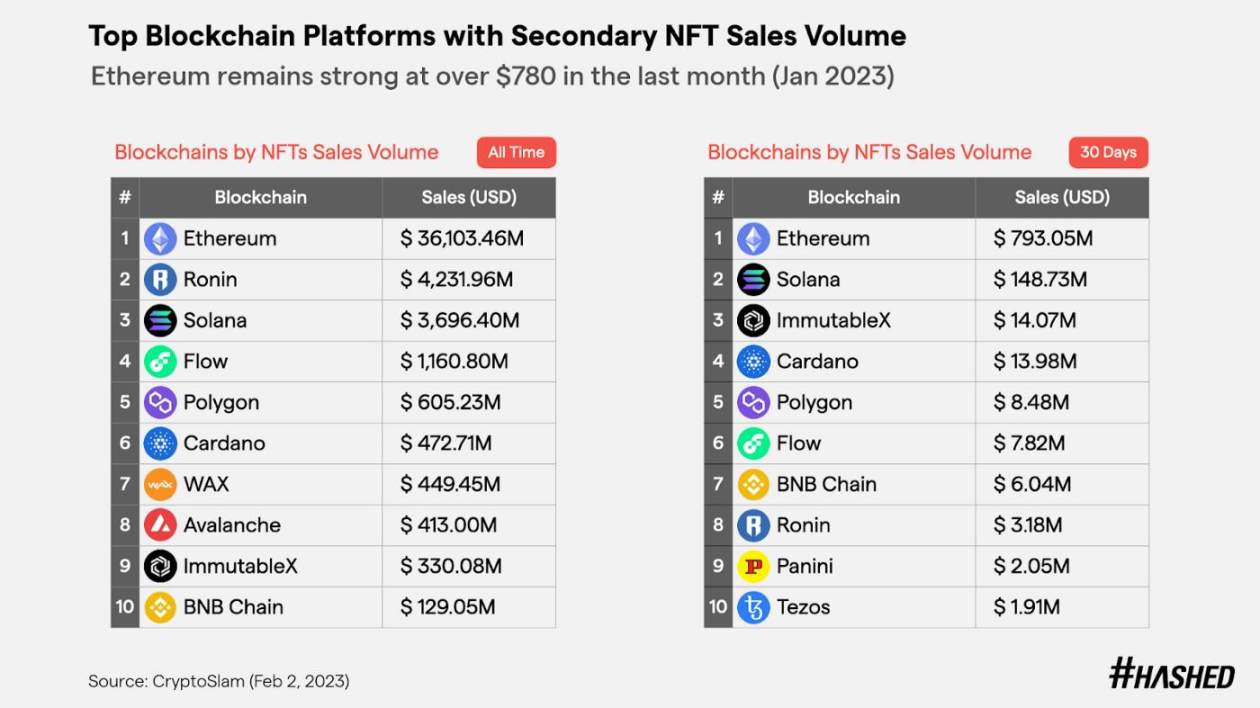

In addition, digital products are slowly emerging, including non-homogeneous assets generated through the L1 block space. Ethereum is the largest smart contract platform in existence, and after the last NFT summer, it is still generating a large number of NFT transactions, with a total transaction volume of more than 35 billion US dollars. Despite reduced activity in the NFT community and declining trading volumes on OpenSea, secondary NFT transactions have remained strong at more than $780 million per month.

Ethereum is no longer the only ecosystem, with other communities thriving on the scarcity of non-fungible goods. Polygon's adoption of large enterprise NFT projects such as Starbucks "Odyssey" and the popularity of Reddit Collectible Avatars have attracted millions of Web2 users. Despite an over 80% drop in TVL and accelerating DeFi user churn, Solana maintained a secondary transaction volume of nearly $150 million per month. In mid-2022, Solana NFT, like Y 00 ts, has successfully created a unique community different from the Ethereum NFT community. In the bear market from August to October 2022, the number of UAW of Solana NFT increased by nearly 4 times.

New types of virtual goods will emerge, possibly starting with blockchain games and metadata. These industries account for the largest amount of funding in the first quarter of 2022. Additionally, the use of programmable NFTs to represent real assets in virtual worlds will be discussed in more depth.

As the participants in the infrastructure gradually accumulate valuable virtual items and the stability of the infrastructure, the financial model that has been developed will operate within the specific infrastructure. Exchange primitives like OpenSea and Blur, lending platforms like NFTFi and BendDAO, and various experimental models including derivatives platforms are all evolving, although there is no clear winner yet.

DeFi smart contracts can be quickly applied to other blockchains, however, products such as NFTs and the communities built around them can never be copied and pasted. In 2023, the development of the blockchain ecosystem will focus on creating the smallest production scale to support these financial primitives, rather than being limited to DeFi infrastructure. Mainstream blockchains will focus on building a strong ecosystem around NFT-based products that are difficult to replicate, such as NFT communities and blockchain games.

Eight: Artificial intelligence will play an important role in blockchain game development and other aspects

The field of artificial intelligence has made significant progress since its inception. It has grown from early research in natural language processing (NLP) and problem solving in the 1950s to recent developments in data synthesis and machine learning (ML). This has led to widespread adoption of AI across various industries, including healthcare, finance, media, and transportation.

With the success of large language models (LLM), people are increasingly expecting that artificial intelligence will be widely used in 2023, such as ChatGPT is a prime example. The blockchain gaming industry will greatly benefit from advances in artificial intelligence, especially in terms of simplifying the traditional game development process and enhancing the gaming experience — all through generative artificial intelligence.

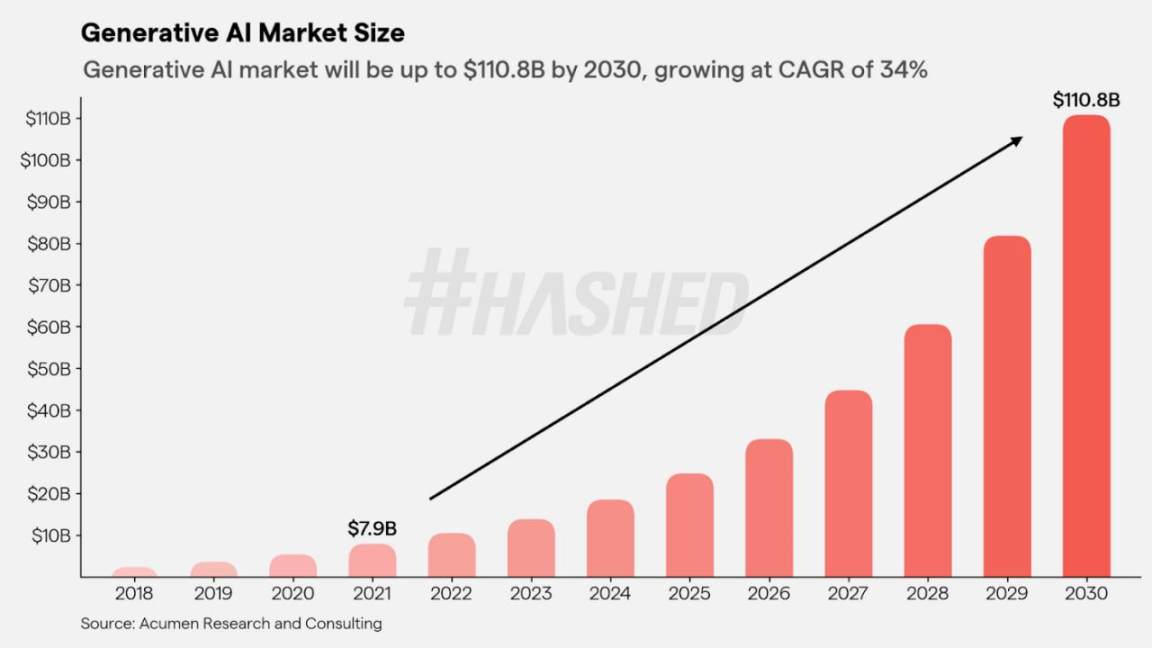

Generative artificial intelligence is a field that has been developing for more than a decade, but only recently has it advanced enough to mimic or even surpass human abilities in image, language and speech recognition. The market was valued at $8 billion in 2021 and is expected to reach over $63 billion by 2028.

Currently, AAA game developers spend a significant portion of their budgets on content creation, which is a major bottleneck in the gaming industry today. Top game studios take at least 3+ years to complete a production, so developers must anticipate consumer trends years before a product is released. In cryptocurrency games, the development cycle becomes even more challenging, as crypto player preferences can change rapidly and unpredictably.

Generative AI can be a powerful solution to this problem. By collecting user behavior data from a core group of community testers over multiple game iterations, developers can train models to create unique, generated content tailored to specific groups of people, such as levels, characters, and thing. This content is procedurally generated and evolves based on real-time changes in user behavior. Not only does this provide players with a diverse and dynamic gaming experience, but it also helps developers reduce the need to manually create content.

Besides gaming, we are excited to see the potential of AI in other cryptocurrency verticals as well. Predictive risk management is gaining popularity among trading teams who train generative AI models to generate synthetic financial data to simulate different market conditions - price, CEX/DEX volume, order book depth, AMM liquidity, etc. . This helps traders understand how to identify and respond to potential risks in various market conditions.

Smart contract auditing driven by artificial intelligence solutions is another area we are focusing on. The current audit process is cumbersome, inefficient and expensive. We hope that future AI models for auditing can be trained with existing large datasets of smart contract code, as well as information about vulnerabilities, bugs, and attack patterns. After sufficient data processing and cleaning, the model should be able to automatically analyze and audit new smart contract code inputs.

The most effective AI solutions are those that refine the data collection process—both in terms of quantity and quality of information. The future we envision is an incentivized data marketplace. Decentralized computing protocols, such as Filecoin and dFinity, and distributed GPU rendering protocols, such as RenderNetwork, are leading examples. With the advent of distributed AI protocols, parts of the ecosystem can be tokenized while leveraging incentives in exchange for user participation and data sharing to further strengthen AI-based models. This symbiotic relationship between users, AI, and tokens has enormous potential to revolutionize the industry.

Nine: Institutional finance will enter the encryption market through blockchain infrastructure

It is predicted that in 2023, the size of institutional financing will grow significantly, due in part to the increasing adoption of tokenized real world assets (RWA: representing claims on Progress on secured loans.

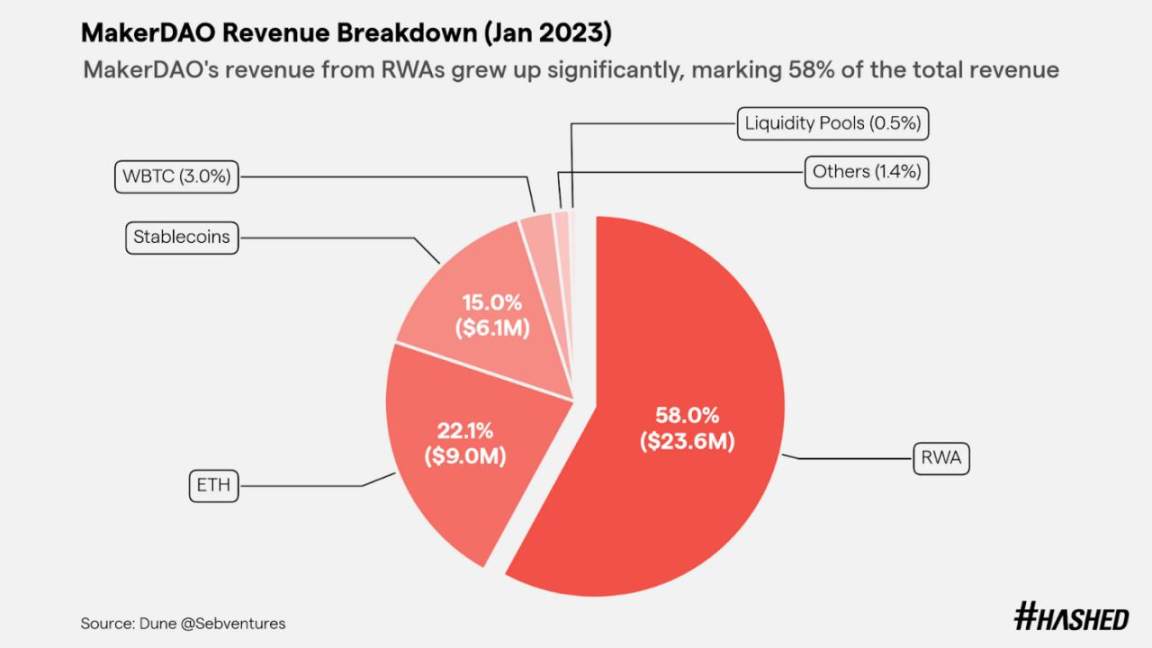

Currently, the most successful application of Real World Assets (RWA) is stablecoins, with market leaders including the seven largest tokens by market capitalization including USDT, USDC, and BUSD. Crypto-native organizations have shown clear initiatives with RWA, such as MakerDAO investing $500 million in U.S. Treasury and corporate bonds, and diversifying into other types of RWA, such as real estate, invoices, and business loans. RWA now accounts for nearly 60% of Maker’s total protocol revenue, showing the potential in this space.

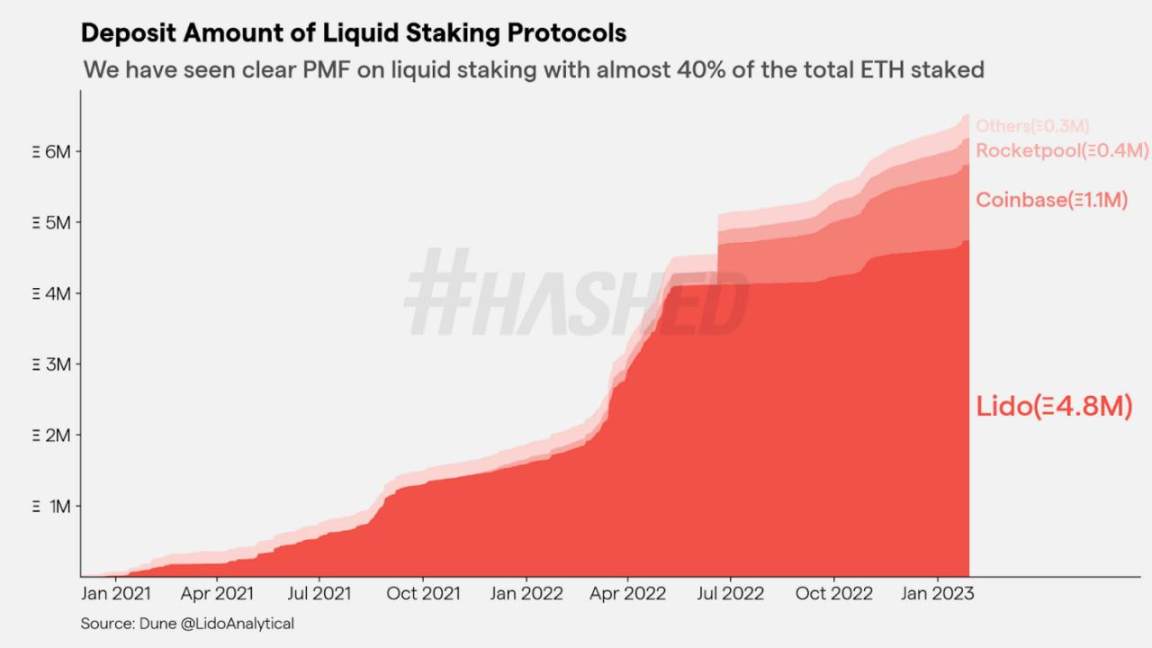

Another significant development in institutional finance has been the growth of corporate-grade liquid staking, driven by the expansion of the LSD (Liquid Staking Derivatives) sector. Companies like Alluvial are building enterprise-grade liquidity staking standards, bridging institutional capital and PoS blockchains. This allows token holders to stake their tokens, obtaining tokens that can be used as collateral, increasing capital efficiency. The effectiveness of the demand for liquidity staking has been demonstrated by the expansion of this market, with the total token collateralization rate improving from 21% to nearly 40% within a year.

Decentralized lending has developed rapidly in the past two years, but most current lending models require over-collateralized debt positions, and on-chain borrowers lack access to universal credit. The DeFi space has become complex, has a high learning curve, and is fragmented across multiple dApps and infrastructure, making it difficult to manage positions and generate sustainable returns. The bear market has revealed that yield farming cannot last, with the rise of unsecured P2P lending seen as a more sustainable source of yield. On-chain unsecured lending provides transparency and enables guarantors to lend proactively. Projects like Maple Finance and Goldfinch are actively working to provide capital to real-world institutional businesses in a decentralized manner.

However, the DeFi space is not without its challenges. The lack of clear regulations for cryptocurrencies is a major uncertainty in the industry. If the industry can drive forward iterations of on-chain tokenization and securitization, with clear guidelines, it will greatly benefit the industry and open up a wide range of possibilities for real, cash-flow-generating activities.

Overall, we believe institutional growth is an inevitable progression for DeFi, and CeFi will continue to solidify its position. Traditional financial institutions are expected to experiment more with established DeFi protocols such as MakerDAO, AAVE, and Centrifuge. Additionally, a flood of start-ups is expected to focus on enabling traditional financial institutions to enter the cryptocurrency market in a regulatory-compliant manner. This feature will make it possible to generate a larger financial layer, especially in emerging markets where millions of entrepreneurs are kept out of the financial system.

Ten: The rise of emerging markets led by India challenges the US’s dominance in innovation and open source

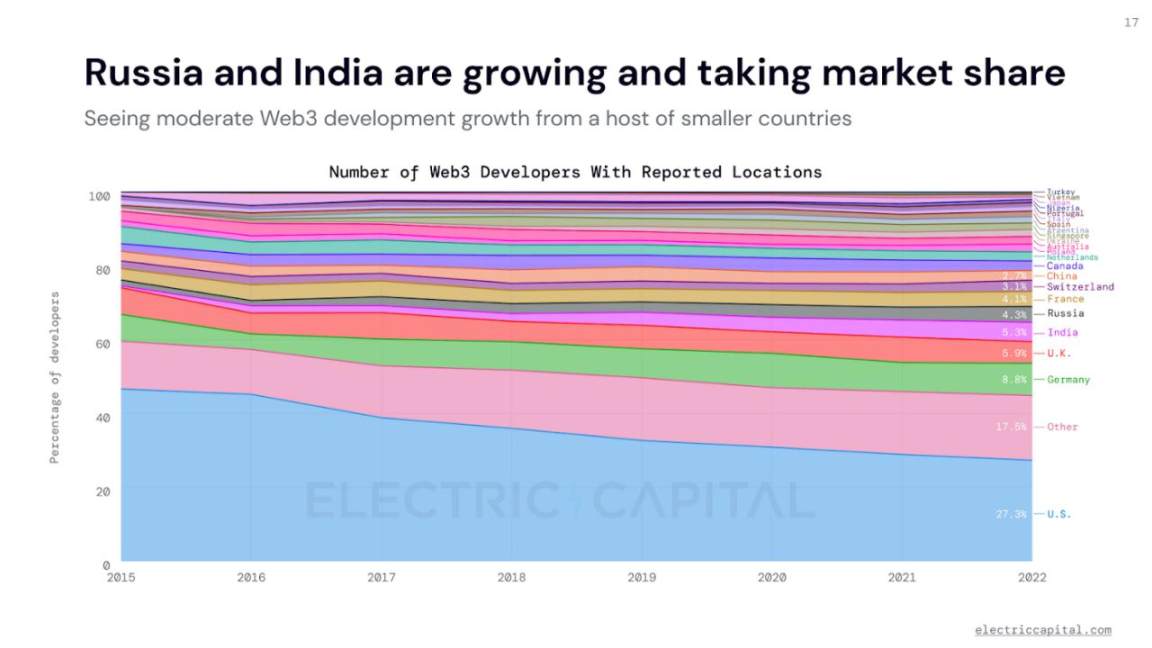

The cryptocurrency space is witnessing a continuous inflow of new players, especially in emerging markets like India. According to the 2022 Global Cryptocurrency Adoption Index published by Chainalysis in September last year, India leads in both centralized and decentralized amounts transferred, showing significant cryptocurrency adoption among emerging economies. At the same time, from the perspective of suppliers, the United States has long been the center of global blockchain innovation, but the rapid technological progress that is taking place in emerging countries represented by India, the United States is now facing challenges.

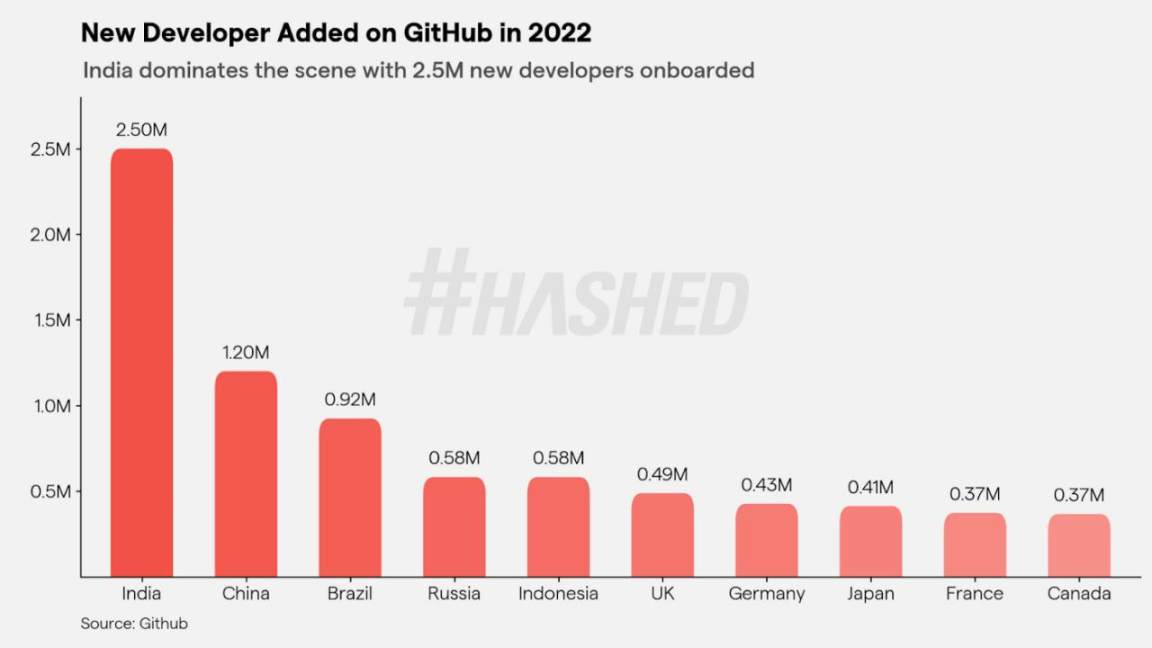

Over the past decade, India has developed into a tech innovation hub and is considered one of the world's leading sources of tech talent. More than 3,500 engineering colleges producing more than 1.5 million engineering graduates each year will propel India to become the world's largest software developer base, surpassing the US by 2024. Moreover, this talent base has moved beyond the executive level of multinational corporations to innovative, high-value roles.Additionally, India is witnessing the fastest growth in the world in terms of open source contributions, with a developer community of 9.7 million on GitHub in India, second only to the United States. In 2022 alone, there will be。

2.5 million new users from India join GitHub

The biggest beneficiary of this technical talent pool is the "software as a service" industry. India's SaaS industry is predicted to grow 25-fold to $50-70 billion in the next decade. Founders in India have delivered several globally recognized SaaS products and developer tools including Freshworks, Zoho, Hasura, Postman, and more. With the support of the right ecosystem, India can also lead the next wave of innovation in the emerging world of blockchain. According to the Power Capital Developer Report 2022, while the US's Web3 developer market share continues to decline, India has steadily increased its market share to over 5% in a relatively short period of time and is already among the top 10 countries in terms of the number of Web3 developers Top 4 in the world.

SaaS in India has seen exponential growth and activity with over 500 ex-employees from Indian SaaS companies turned entrepreneurs. This trend continues in terms of blockchain infrastructure, as some founders have broken away from Web3 companies to start their own businesses. Early employees from leading Web3 projects in India, such as Polygon, have started building blockchain infrastructure projects.

The evolution of SaaS and infrastructure in the blockchain space may mirror the course of the SaaS revolution in India, albeit due to low cost, technical proficiency, large English-speaking talent base, improved technical infrastructure, software-first and modularity of cryptocurrencies nature, and the COVID-accelerated digital GTM trend at a much faster pace.