DEX发展趋势盘点:CeFi信任危机会开启真正的DeFi 2.0吗?

CeFi 的信任危机将成为真正的 DeFi 2.0 起点。

为什么 DeFi 是大势所趋

CeFi 信任危机

FTX 作为行业仅次于币安的第二大加密生态,在短时间内遭遇挤兑,突然暴雷,震惊了整个加密货币世界。

我们应该重新审视 CEX 的风险。回归 Crypto 本质,每个参与者都应该认真思考一个问题,中心化交易所做支撑的加密生态是否存在根本性问题?

FTX 的暴雷绝不是 Crypto 的失败,它恰恰反映了中心化金融体系的脆弱性。FTX 把自己视为银行,用部分储备来应付平常的提现需求,挪用资金为强关联方提供信用贷款,严重缺乏风控,说明一些适应传统金融体系的资管平台,CEX 和投机机构们在缺乏监管和依靠自律的环境中能够做出多么离奇的操作。

加密货币世界第二大的交易所,以合规、安全和良好声誉作为品牌形象的 FTX 在一周时间内轰然倒塌,没有比这更能展现中心化所具备的根本性问题——你无法验证中心化实体的真实情况,除了选择相信。

Crypto 为所有人提供了去中心化,自由,开放,抗审查的环境和基础设施,而很多中心化实体选择利用这种环境作恶。去中心化系统赋予了每个人自由参与,自由交互和监督的权力,每个人对于去中心化系统都是重要的,正因为如此,每个人都应该努力避免类似事件再次发生,因为大的中心化实体暴雷对于整个 Crypto 生态来说是巨大的伤害。

信任成本与乐观偏差

💡 FTX 不是第一个暴雷的中心化交易所,也不会是最后一个。在 Crypto 发展的短暂历程中,前有 Mt.Gox,Flexcoin,Bitstamp 等等中心化交易所暴雷,近有 Celsius,BlockFi,FTX 等破产,为什么在经历了这么多暴雷事件之后,用户依旧选择相信?

由于信任成本和乐观偏差的存在,大众会继续寻找下一个让自己相信的 CEX。本文定义信任成本为人们为了维持信任所需要支付的费用以及失信行为带来的损失。

区块链的最初设计目的就是解决信任问题,如何在没有中心化实体提供背书的情况下达成共识。在现有的框架下达成信任本身是有成本的,因为运行一个去中心化的公链,需要激励所有参与者持续为该系统提供达成信任所需要的资源,比如机器资源,网络资源,这些成本就需要公链的使用者们来承担,这是一个自洽的经济体系,人们为了获取足够去中心化,匿名,安全的服务,为整个体系支付一定的费用。

公链经济在信任问题上最大的贡献就是将信任成本显性化,它让每个参与者都清楚地知道,信任是有成本的,而且使用者支付的费用可以支撑整个体系的运行。在这种作用机制下,人们清楚地知道在技术上产生失信行为(如更改链上合约,公链受到攻击等)是极其困难的,体系是稳健的。

但是托管式的 CEX,信任成本的分布是极不均匀的,并且只有当 CEX 暴雷时,用户才会真正承受信任成本。其实每个中心化交易所,由于不透明性及无法验证性,都存在信任成本,但是信任成本不会在其正常运行时显现。中心化交易所可以不用提前支付信任成本,因为只要用户选择相信,那么维持信任所需要支付的费用是极少的,但是失信行为所带来的损失是巨大的,损失是事后的,用户不会立即体验到自己正在承担的信任成本。

人们普遍还存在乐观偏差的现象,即个体倾向于认为自己更可能经历好的事情,而他人更可能经历坏的事情,大家普遍认为自己是更幸运的那一个,不愿相信自己选择的交易所有可能会暴雷。

由于 CEX 拥有这种结构的信任成本,加之普遍存在的乐观偏差现象,大众在经历了一次又一次交易所暴雷之后,依旧会做出自己的判断,去选择下一个自己认为没有问题的中心化交易所。

DeFi 是解决信任问题的唯一方案

中心化金融通过引入严格的监管来保证用户的权益,但这只是权力的转移,并不能解决问题,我们都清楚,SEC 和美联储对金融市场有超乎想象的控制力和影响力。

如果不想引入更具影响力的中心化实体,比如主权国家政府,全球性监管组织等,那么 DeFi 将是解决信任问题的唯一方案。让公链承载金融活动,用密码学来保证账本的安全和透明,将选择权让渡给用户,通过保管私钥来保管自己的财富,去中心化金融活动将是整个金融体系的一个范式改变。

在上几轮牛熊中,中心化交易所占据绝对的主导地位,人们在巨大的恐慌面前只能把资金提到冷钱包中,等到交易的热度提高,还是只能选择中心化的交易所。而这个循环应该被 DeFi 来打破。

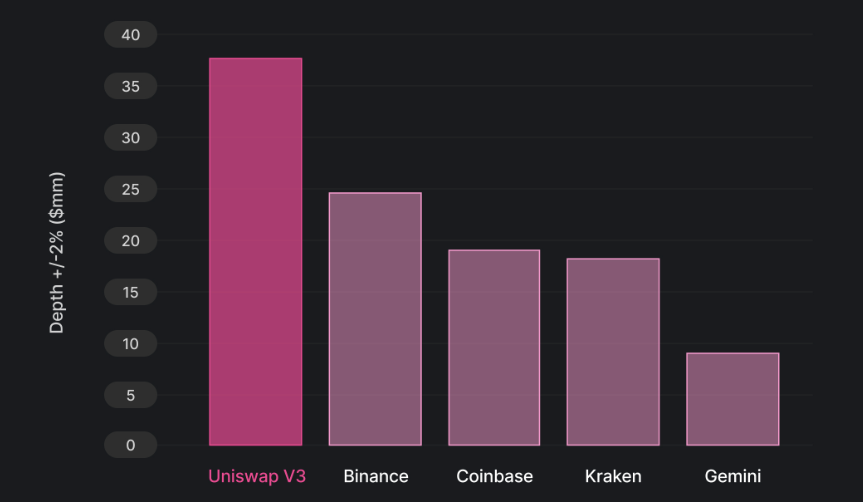

上一轮牛市,DAPP 的体验有了前所未有的提升,去中心化交易所的交易体验与中心化交易所的交易体验已经相差不大,在主流币的交易深度上,Uniswap 的 WETH/USDC 池子的交易深度甚至超过中心化交易所。

ETH-USD交易对市场深度对比(数据来源:Uniswap)

最关键的是,DeFi 的信任成本更低。虽然网络费用的存在使得摩擦成本上升,但信任问题由公链解决,整个体系的信任成本完全显性化,无托管的服务使得短时间挤兑几乎不可能发生,整个体系的不确定性会随之下降。

DeFi Summer,也即 DeFi 1.0,市场上充斥着各种高 APY 项目,整个爆发的状态也是由高收益驱动的。而我们认为真正的 DeFi 2.0 并不会由高收益驱动,而是会回归到 Crypto 的本质上来,由 DeFi 本身无托管,链上透明,解决信任的特性驱动,这将是新的叙事:

CeFi 的信任危机将成为真正的 DeFi 2.0 起点。

DeFi 所带来的范式转变,遵循代码即法律,这其中带来很多用户门槛上的问题,MEV,各种安全问题,这些问题的解决方案会被不断优化,但新范式带来的问题将会一直持续,DeFi 的发展将是漫长的道路。

掌控自己的资产,不要做鸵鸟

💡 在经济学中,鸵鸟效应指投资者对负面信息进行选择性忽视的现象。

FTX 暴雷深深冲击了每一个人,在经历了 FTX 暴雷之后,不要忽视中心化实体的风险,从掌控自己资产开始,削弱中心化实体的影响。当资产转移到钱包,你就真正进入了 Crypto 的世界,就真正掌控了自己的资产。学习使用 DeFi 的门槛较高,但当你学会使用 DeFi 协议,比如用 DEX 交易代币,使用借贷协议借出资产,你就摆脱了对中心化交易所的依赖。

在经历了 FTX 暴雷之后,普通用户也应该学会用至少一个 DEX 来做交易,消息满天飞,与其在不透明的中心化交易所中来回转移,不如一劳永逸地用 DEX 解决交易问题,同时你会发现在 DeFi 的世界中,不只有 DEX。

我们相信,第二大加密交易所的暴雷会深刻地影响市场,并将会深刻地提醒用户,不是你的私钥就不是你的钱。

DEX 的现状和发展趋势

DEX 的现状

我认为,十到二十年后,去中心化交易所的规模将超过中心化交易所。—— 币安创始人,赵长鹏

DEX 在现阶段是否可以替代 CEX 的功能?

回答是,完全可以,从交易到质押生息再到法币出入金,都有相应的 DEX 或协议提供功能。法币出入金方面有 Moonpay,Transak,Wyre,很多 DEX 都接入了他们的服务;有大量协议基于 DEX 提供质押生息服务,DEX 自带质押生息也有很多。

而从产品功能上来看,主流 DEX 比如 Uniswap,Pancake,DODO 等都支持了图表功能,前端内置 K 线工具。1inch,0x Protocol,DODO,Tokenlon,Paraswap 等都上线了限价单功能,类似于 CEX 的挂单,用户可以预先设定交易成交价格。DEX 与 CEX 在产品功能上的差距已经很小了。

DEX 目前存在一定的用户教育问题,比如私钥管理,钱包交互,在用户习惯上与 CEX 还是有一定的区别。并且 DEX 的流动性比之 CEX 尚有不足,然而这些随着时间的推移,将不再是一个问题。DEX 正经历着快速的迭代和进化,不管是产品体验还是流动性,DEX 已经越来越成熟。

数据表现

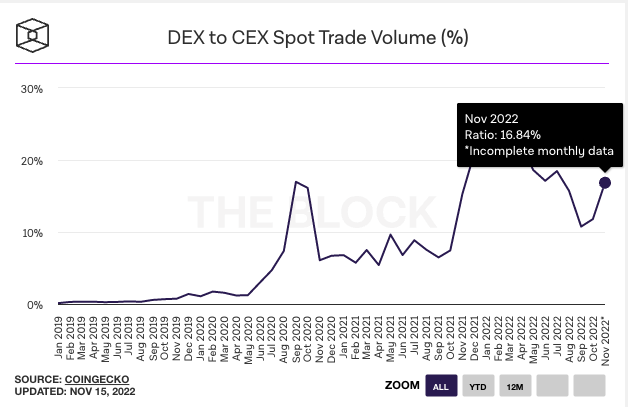

DEX 占现货总交易量在 10% 到 30% 之间,DEX 仍在追赶 CEX。相较 10 月份的 11.79%,截止15 号提升至 16.84 %,这与 FTX 暴雷有一定关联。

数据来源:The Block

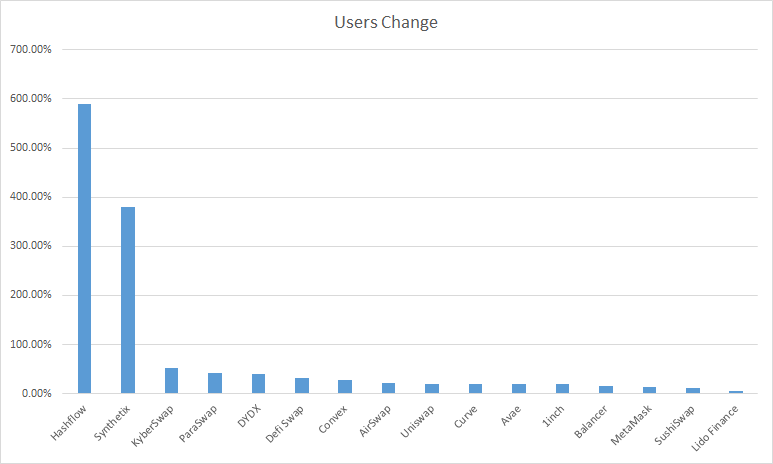

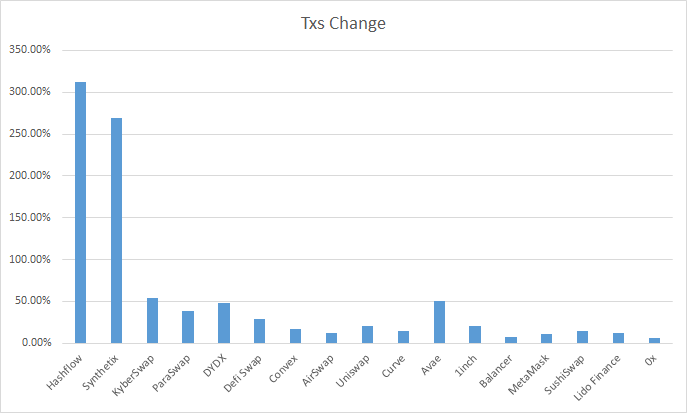

过去三十天内,一些主流的 DeFi 协议,用户数以及上链交易数量,均有着两位数的增长 ,可以看出,受到FTX暴雷事件的影响,DeFi 应用迎来的显著的用户增长,同时也间接刺激了链上交易行为。

数据来源:Nansen

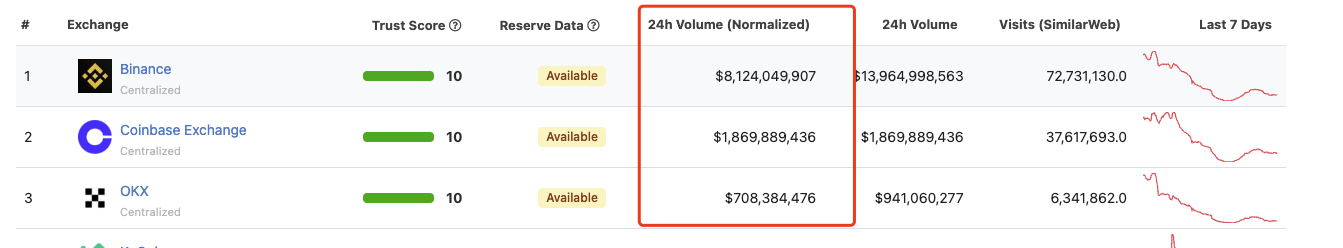

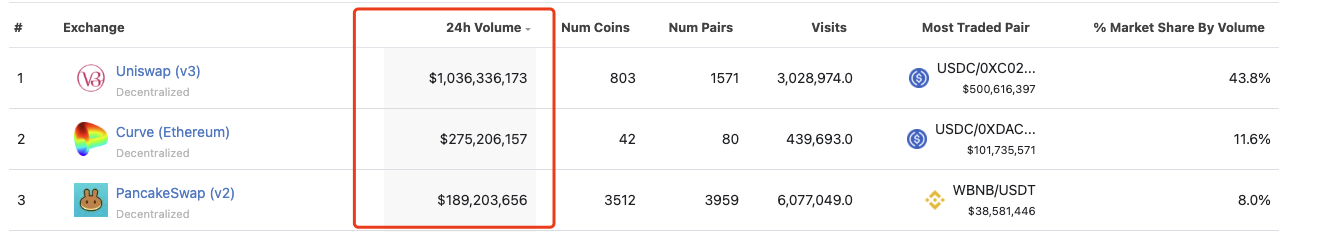

截止 11 月 16 号 2PM UTC+8, Uniswap V3 的 24h 交易量超过了 OKX,在 CEX 中可以排名第三,仅次于 Binance,Coinbase。

数据来源:Coingecko

DEX 的发展趋势

我们长期追踪 DEX 的产品动态和市场动态,通过 DEX weekly brief 的形式向市场公开。在长期的市场追踪中,我们发现了 DEX 的一些重要的发展趋势,接下来我们将深度分析这些长期趋势,并从第一性原理出发,讨论为什么会出现这些趋势。

路由聚合链上流动性

💡 路由算法将会越来越高效,链上流动性的聚合程度正在并将不断增加,链上交易将整合所有的流动性,链上流动性的潜力远超中心化交易所,这将提高整个体系的交易效率。

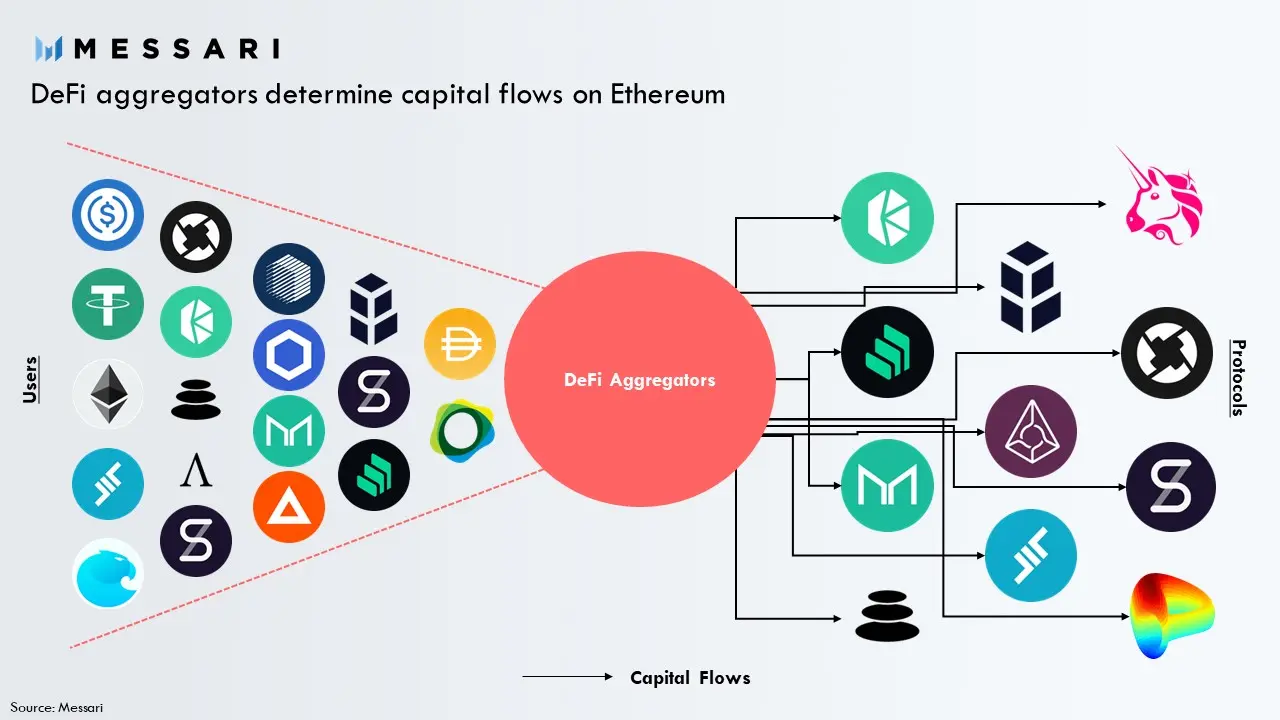

链上流动性的最大优势就是可以相互聚合,这也是 DeFi 的天然特性,任何合约或者个人都可以直接与流动性池进行交互,DeFi 的流动性是一体的。路由算法是将链上流动性聚合在一起的桥梁,每个 DEX 或者聚合器的路由算法可能有所区别,但核心原理都是一样的,用户在提出一笔交易请求时,路由算法会计算最优的交易路径,通过与多个流动性池进行交互来实现更优的交易价格和更低的滑点。

由于链上流动性都是分散的,即使是在一个 DEX 中,一个交易对也可能存在多个相关的流动性池,因此 DEX 在追求最优交易价格和最低滑点的过程中,需要聚合其他的流动性来源,已提供更好的交易价格。这个趋势将是长期的,因为接入聚合功能或者自研路由算法会带来更优的价格,用户对价格是敏感的,这种市场竞争将迫使越来越多的 DEX 使用路由来聚合链上流动性。

现在的 DEX 都接入聚合功能,有些接入聚合器,有些自研路由算法,聚合器与 DEX 的界限变得模糊。 图片来源:Messari

在长期对 DEX 市场的观察中,我们发现,路由聚合的竞争越来越激烈,越来越多的 DEX,聚合器,钱包相互聚合,使得链上流动性的整合程度越来越高。而且聚合的方式有很多种,包括聚合器接入 DEX 的流动性,DEX 接入聚合器,DEX 聚合其他 DEX,钱包、DAPP 集成 DEX 或聚合器,跨链聚合。

从聚合器的角度来看,1inch,Matcha,0x Protocol 是头部的聚合器协议,从年初以来,有许多 DEX 集成了他们的 API,比如 Woofi,Chainge Finance,Wirex,Aurora 等集成 1inch;Bancor,DODO 等集成 0x。聚合器也在不断增加接入的 DEX,比如 1inch 接入 Babyswap,Elasticswap,Kyberswap 等;0x 接入 Balancer 等;RoketX 接入 Paraswap 等。许多较新的聚合器也表现不错,比如主打跨链聚合交易的 Atlas DEX,以及聚合了中心化交易所的 RoketX。

使用聚合功能的 DEX 在增加,比如年初 Sushiswap 推出了 Trident,接入聚合器并聚合 DEX 的流动性,之后还升级了路由算法;Jupiter 聚合了整个 Solana 上的流动性;Canoe Finance 集成了 DODO 的路由聚合算法,实现聚合功能。

钱包和 DAPP 对 DEX 流动性的集成也在增加,路由聚合本质上是把链上分散的流动性整合到一起,最理想的情况将会是,不管在前端调用何种协议,都将与整个链上流动性进行交互。

引入专业做市商,提供 RFQ 功能

💡 CEX 的流动性很大一部分是由专业做市商提供的,而 DEX 通过 RFQ 功能向做市商询价,让专业做市商成为交易对手方,提供更大的流动性。

为什么为做市商提供服务是趋势所在?专业做市商为市场提供了大量流动性,但是由于链上交易成本过高,专业做市商很难发挥自身优势。因此,如果 DEX 想超过中心化交易所,那么如何给做市商提供更好的解决方案,吸引更多专业做市商做市就是重要一环。

对于专业做市商来说,链上做市主要是成本问题。假如说订单簿是在无摩擦情况下最优的选择,AMM 是在链上高成本下的最优选择,那么 RFQ 功能介于两者之间,大部分 RFQ 功能会通过私钥签名在链下完成询价过程,双方确认后再上链交易,通过链下签名和轮询的方式降低交易成本,提高交易效率,但是链下询价过程的引入也不可避免的产生一定的信任问题,这也是 RFQ 功能设计的焦点所在。而专业做市商除了通过 RFQ 功能做市,也有相当一部分做市商积极适应链上流动性池的做市模式,比如 Wintermute,Wootrade 等。

对于用户来说,RFQ 功能带来的核心体验是更少的 gas fee 或者无 gas 以及抗 MEV 攻击。更少或没有 gas 支付是因为做市商帮用户支付了 gas fee,并没有从整体上降低交易成本(因为与区块链交互必然会有开销)。结合限价单等功能可以给用户提供良好的交易体验,由于报价和撮合在链下完成,因此抗 MEV 攻击,降低了链上 swap 的不确定性。

Cowswap,Hashflow,0x Protocol,Tokenlon,Matcha,DODO 都有 RFQ 功能。Cowswap 的 RFQ 功能在其自己的表述中叫做 Batch Auction,用户授权一笔 token 转账,然后在链下签名交易信息,Solver 在确认签名信息后会根据收到的所有订单来算出最优的解决策略,然后报给协议选择,协议选择最优方案上链执行,通过竞争机制保证 Solver 不会作恶。Hashflow 也是主打 RFQ 功能的交易所,通过准入审核机制来筛选做市商。0x,Matcha,Tokenlon 和 DODO 提供比较典型的 RFQ 功能,对于链下信任问题没有特殊的设计。而在我们的市场观察中,有越来越多的 DEX 引入 RFQ 功能,比如 Matcha 和 DODO 都是今年上线的 RFQ 功能,Sushiswap也在今年上线了 Gasless 交易,实际上也是 RFQ 功能,而原本就主推 RFQ 功能的 DEX 接入了更多的做市商,比如 Hashflow 新接入了 GSR,Ledger Prime 和 Kronos。总之,有越来越多的 DEX 引入 RFQ 功能,也有越来越多的做市商加入进来。

不断改进做市算法和做市体验,追求更高的资本效率

💡 流动性池是原生的链上解决方案,这里是 DEX 的主战场,从 AMM 开始,各个主要的 DEX 都在持续不断优化自己的做市算法,以提高做市的资本效率。

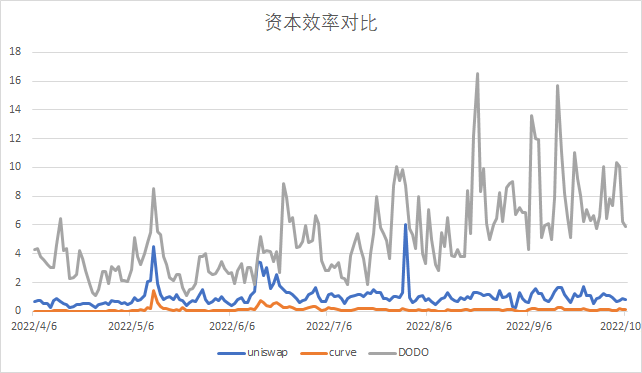

资本效率

AMM 的推出是颠覆性的创新,人人都可以做市提供流动性,提高了链上流动性的潜在上限,但 AMM 存在资本效率的问题。资本效率衡量的是如何用更少的 TVL 提供更高的交易量,也即如何用相同的 TVL 支撑更高的交易量,对于交易体验来说就是更低的滑点和更高的市场深度。而核心做市算法决定了 DEX 的资本效率和与之伴随的核心交易体验,算法的迭代将会持续,如何用更少的 TVL 覆盖更高的交易量,这将是 DEX 探索的永恒话题。

我们在前面论证了链上流动性的聚合性,在市场上的流动性趋于整合的趋势下,DEX 的竞争直接而激烈,谁能更加高效的做市,谁能在聚合中占据更大的市场份额。

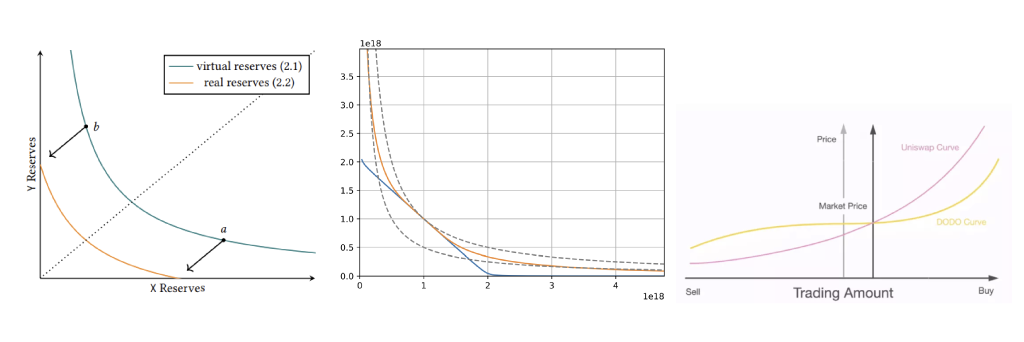

做市曲线图例(来源:Uniswap,Curve,DODO)

集中流动性是主流趋势

AMM 的资本效率并不高,是因为恒定乘积做市曲线的流动性是均匀分布在曲线上的,为此,Curve 将恒定乘积曲线和恒定价格曲线混合,推出了 stableswap 曲线,V2 在此基础上推出了根据内部预言机价格动态调整的做市曲线,将流动性集中在预言机价格附近。Uniswap V3 提出了范围挂单的概念,用户可以在选定价格范围内提供流动性,提升了资本效率。DODO 通过 PMM 算法,引入外部做市商提供报价,将流动性集中在市场价格附近,DODO 通过 PMM 算法极大提高了资本效率,是目前市场上资本效率最高的 DEX。这三家头部的 DEX 都采用了集中流动性的方式来提高资本效率,而我们也认为,集中流动性,主动做市将会是未来做市算法迭代创新的主流。

三大交易所资本效率对比(数据来源:Coingecko,Defillamma)

还有一些较新的交易所不断在做市算法上做出创新和改进,比如 Maverick AMM,提供更低的滑点;3xcalibur 的 Tri-AMM,将借贷和交易结合起来;Trader Joe 的新 AMM;Elasticswap 为动态调整代币供应的稳定币设计的弹性 AMM 等。Delphi 在前段时间也提出了 SLAMM 的设计,来实现跨链流动性。也有一些交易所舍弃订单簿和池模式,比如 Contango 既不采用 AMM 机制,也不使用订单簿模式,而是通过固定利率市场实现代币交换。

散户提供资金,协议提供策略

普通用户缺乏持续追踪市场信息的能力,做市效率低,如果跟不上市场变化,有可能遭受较大损失,虽然 AMM 等极大降低了用户参与做市的门槛,但是做市本身需要较高的专业水平。因此,协议基于 DEX 的做市机制,为普通用户提供辅助做市的功能,从需求上来说是成立的。头部的 DEX 都改进了 AMM 机制,朝集中流动性和主动做市的方向发展,这进一步提升了用户做市的难度。在长期的市场观察中,我们也发现有协议基于 DEX 开发了流动性管理的功能,并且还有协议为做市资金提供借贷等服务,我们认为这些协议或者集成这些功能的 DEX 本身将会发展成去中心化的资管平台,这将是 DEX 的一个发展趋势。比如基于 Balancer 开发的 Aura Finance,Euler Finance 对 Uniswap 的集成。Visor Finance,Method Finance 等基于 Uniswap V3 提供主动流动性管理。

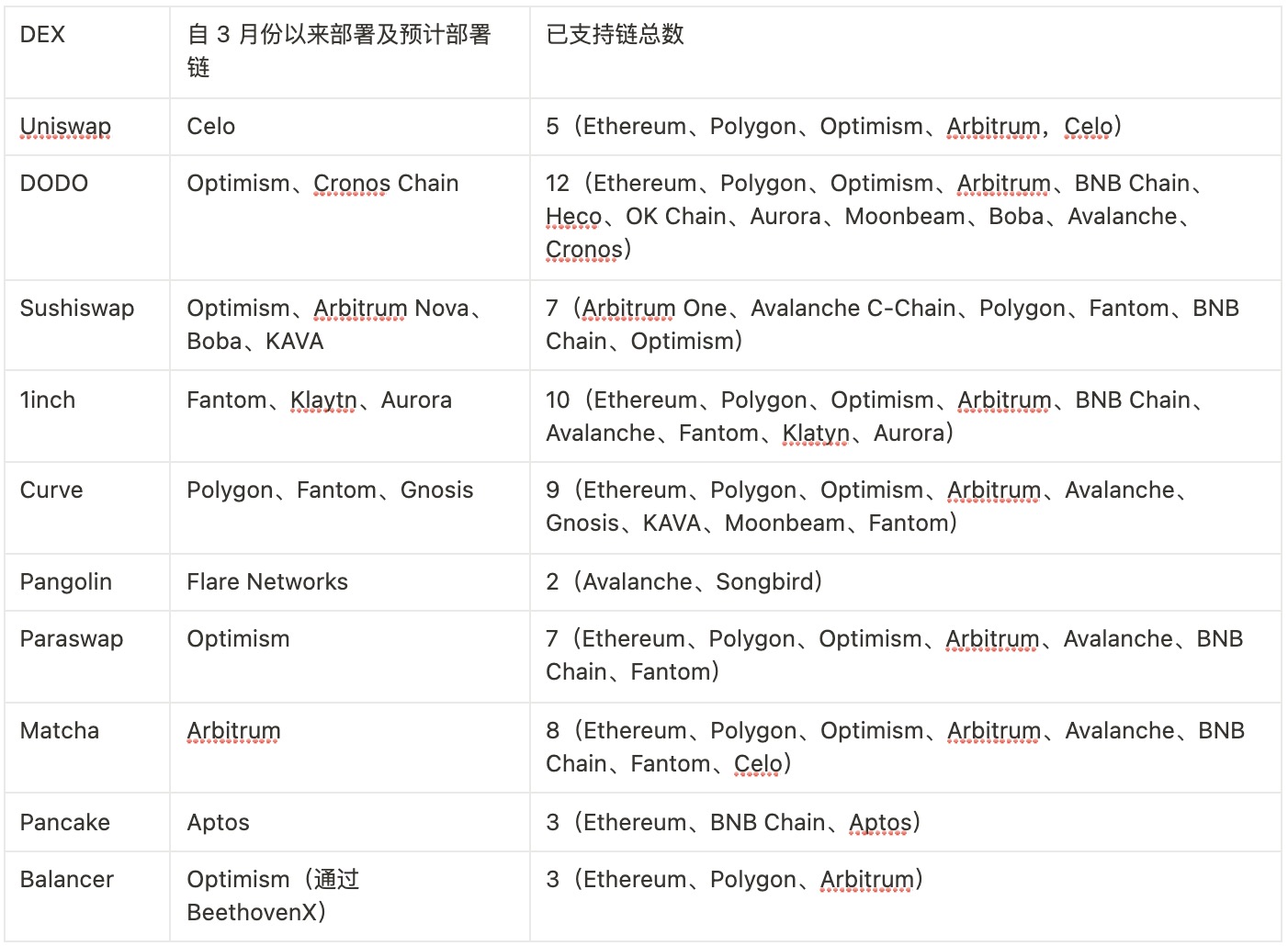

多链部署

💡 公链赛道竞争激烈,虽然无法预知谁将是下一个以太坊杀手,但是 DEX 正在广泛部署和押注,以求得更大程度的扩张。

我们不讨论未来是多链还是跨链还是超级公链的形态,仅从市场观察的角度,我们发现,大部分 DEX 都选择了通过多链部署实现扩张。多链部署虽然有额外的开发成本,但是好处也是显而易见的,那就是稳定的交易体验且无需担心跨链的安全性问题。L2 是各家 DEX 部署的热门,更低的交易费用使得 DEX 的交易体验非常接近于 CEX,做市商也可以更好的提供报价和做市。

各 DEX 自 3 月份以来新部署链(不完全统计)

真正的 DeFi 2.0 将会到来吗?

在市场进入熊市以来,不断有人唱衰 DeFi,以下降的交易量和 TVL 来佐证 DeFi 已死,去中心化金融真的失败了吗?并不是,与大家的感知相反,DeFi 并没有失败,反而运行良好,DeFi 下降的交易量和 TVL 就如同 ETH 下降的市场价格一样,这只是市场情况的变化,并不影响其背后的运转。

从 Luna 事件以来,接连暴雷的都是中心化的金融实体,比如 Celsius,3AC,Voyager Digital,BlockFi,FTX 等,他们与传统金融公司并没有什么区别,杠杆化,缺乏透明,在波动中崩溃,使其客户遭受重大损失。而去中心化金融协议,比如 Uniswap,DODO,Curve,AAVE,Compund,MakerDAO 等都运行良好。

尽管交易量和 TVL 下降,但比起中心化金融实体不透明的资产负债表,这些 DeFi 协议的运行状况可以被清晰的看到,决定生死的是代码而不是随着环境变化的市场行情和资产价格。这恰恰证明了 DeFi 的优越,即为所有参与者提供一个公开透明稳定的金融系统。

FTX 将会使人们深刻认识到 DeFi 的真正价值,或许由信任和透明驱动的 DeFi 叙事将会成为真正驱动 DeFi 发展的引擎,真正的 DeFi 2.0 或许不久就会到来。

Reference

https://messari.io/article/dex-education-uniswap-optimistic-rollups-and-the-layer-2-dex-landscape

https://members.delphidigital.io/reports/uniswap-vs-curve-which-is-the-best-dex

https://www.paradigm.xyz/2021/06/uniswap-v3-the-universal-amm

https://messari.io/article/the-chronicles-of-uniswap-the-token-the-switch-and-the-wardrobe

https://www.nansen.ai/research/the-market-making-landscape-of-uniswap-v3

https://blog.dodoex.io/五分钟读懂-dodo-背后的-pmm-算法-一个通用性的流动性框架及多种用例-39a49c222aff

https://resources.curve.fi/base-features/understanding-curve

https://docs.dodoex.io/chinese/dodo-xue-yuan/pmm-suan-fa-gai-lan/pmm-suan-fa-xi-jie

https://www.nansen.ai/research/the-market-making-landscape-of-uniswap-v3

https://uniswap.org/blog/uniswap-v3-dominance

https://dune.com/msilb7/Uniswap-v3-Pair-Deep-Dive

免责声明

本研究报告内的信息均来自公开披露资料,且本文中的观点仅作为研究目的,并不代表任何投资意见。报告中出具的观点和预测仅为出具日的分析和判断,不具备永久有效性。

版权声明

未经 DODO 研究院授权,任何人不得擅自使用(包括但不限于复制、传播、展示、镜像、上载、下载、转载、摘编等)或许可他人使用上述知识产权的。已经授权使用作品的,应在授权范围内使用,并注明作者来源。否则,将依法追究其法律责任。

关于我们

「DODO 研究院」由院长「Dr.DODO」带领一群 DODO 研究员潜水 Web 3.0 世界,做着靠谱且深度的研究,以解码加密世界为目标,输出鲜明观点,发现加密世界的未来价值。「DODO 」则是一个由主动做市商(PMM)算法驱动的去中心化交易平台,旨在为 Web3 资产提供高效的链上流动性,让每个人都能轻松发行、交易。

更多信息

Official Website: https://dodoex.io/

GitHub: https://github.com/DODOEX

Telegram: t.me/dodoex_official

Discord: https://discord.gg/tyKReUK

Twitter: https://twitter.com/DodoResearch

Notion: https://dodotopia.notion.site/Dr-DODO-is-Researching-6c18bbca8ea0465ab94a61ff5d2d7682

Mirror:https://mirror.xyz/0x70562F91075eea0f87728733b4bbe00F7e779788

Dr.DODO 正在招聘,详细信息请点击:https://twitter.com/DodoResearch/status/1587274217082404864?s=20&t=kXXdXn7UsY7GCUw9uM4YTA