V3 LP lỗ khoảng 100 triệu USD, bài đăng cảnh báo Uniswap nói gì?

Bài viết này đến từ TwitterBài viết này đến từ

, tác giả gốc: Alex, do dịch giả Katie Koo của Odaily biên soạn.

Ban đầu, tôi chỉ tạo một bảng điều khiển Dune về Uniswap, nhưng nó đã gây ra một chấn động trong giới DeFi. Đáng lo ngại là nó phơi bày bản chất thực sự của những người nghĩ rằng họ đã phát minh ra "cỗ máy tài chính vĩnh cửu". Đây là câu chuyện về biểu đồ, dữ liệu cookie, sự kiêu ngạo, bằng chứng xã hội và tương lai của DeFi.

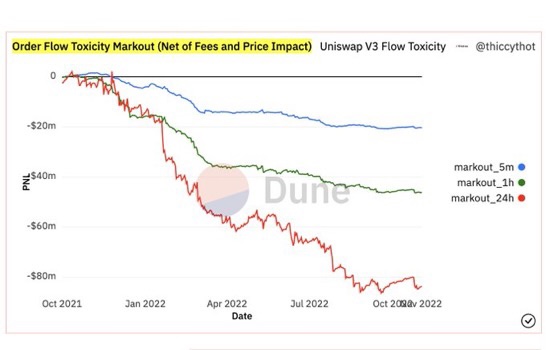

Tháng trước, tôi đã phân tích "độc tính của dòng lệnh" của nhóm Uniswap V3 ETH/USDC. Khoản lỗ LP của Uniswap V3 trên ETH/USDC ước tính là 100 triệu đô la.

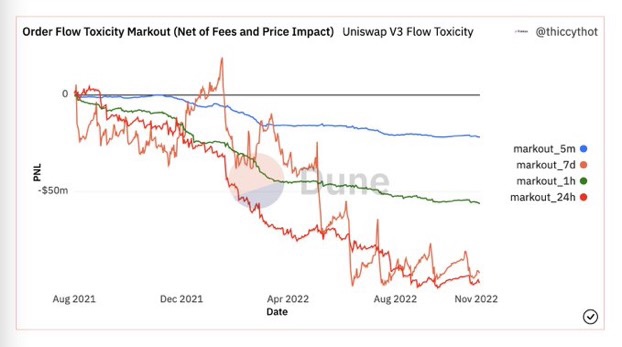

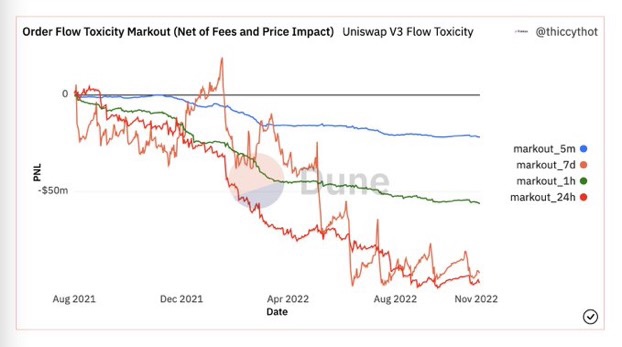

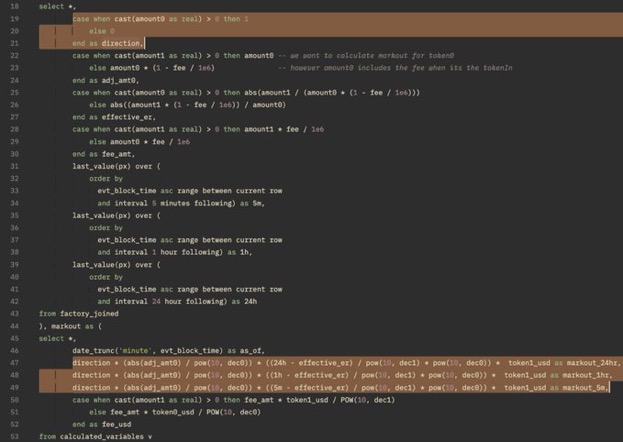

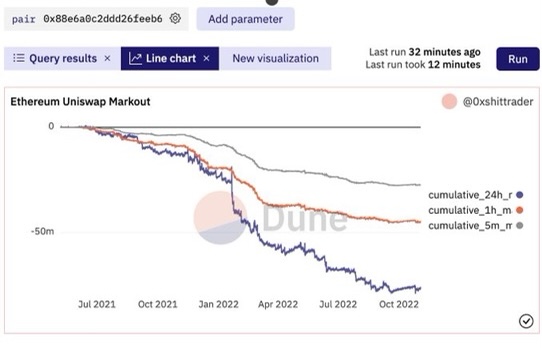

Sau khi trừ đi chi phí của đồng tiền nắm giữ LP ban đầu, kết luận được thể hiện trong Hình 1:

Mô tả hình ảnh

Hình 1< Mất trường hợp mất vô thường. Biểu đồ cho thấy phí LP thấp hơn IL khoảng 100 triệu đô la trong năm nay.

tiêu đề phụ

Giải thích thêm về dữ liệu Hình 1

Hình 1 đo lường "điểm đánh dấu" của từng giao dịch trong nhóm ETH/USDC trên Uni V3, nghĩa là lãi và lỗ sổ sách chưa thực hiện của các giao dịch sử dụng giá trong tương lai (đo lường lợi nhuận).

Ví dụ: mốc 5 phút = lãi và lỗ chưa thực hiện 5 phút sau khi giao dịch diễn ra.

Đây là một phương pháp đo lường thường được sử dụng trong tài chính truyền thống bởi nhà tạo lập thị trường cao tần HFT mà tôi đã làm việc trước đây. Nó đo lường hiệu quả chi phí của việc thực hiện các giao dịch trên nhiều khung thời gian. "Ranh giới" cho biết lãi và lỗ mà chúng tôi nhận ra và sẽ rất phức tạp để tìm chính xác từng LP và phương thức giao dịch.

LP Lãi lỗ chưa thực hiện sau 5 phút: - 21 triệu USD

LP Lãi lỗ chưa thực hiện sau 1 giờ: 56 triệu USD

LP Lãi & lỗ chưa thực hiện sau 1 ngày: -$97M

LP Lãi lỗ chưa thực hiện sau 7 ngày: -92 triệu USD

Cá nhân tôi trung lập về quan điểm này. "Ranh giới" LP của ETH/USDC đã giảm mạnh trong thời gian gần đây.

tiêu đề phụ

Phản bác của nhóm Uniswap đối với Hình 1 và cuộc đối đầu với các nhà phân tích

@teo_leibowitz, @xin__wan và @AustinAdams10 từ Uniswap Risk & Research có một bài đăng gay gắt nói rằng tôi đang cáo buộc Uniswap lập biểu đồ và bỏ qua dữ liệu "cookie" trong phân tích của tôi, cho rằng phân tích của tôi có sai sót về mọi mặt.

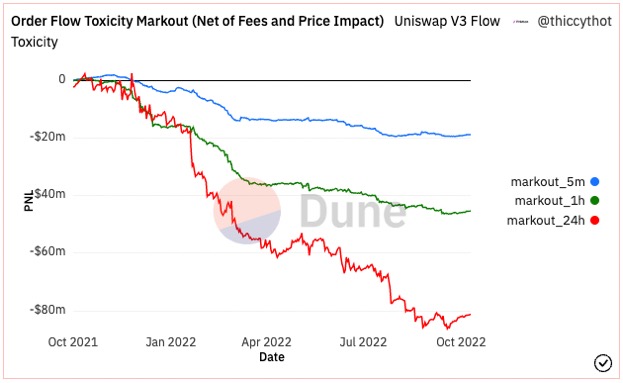

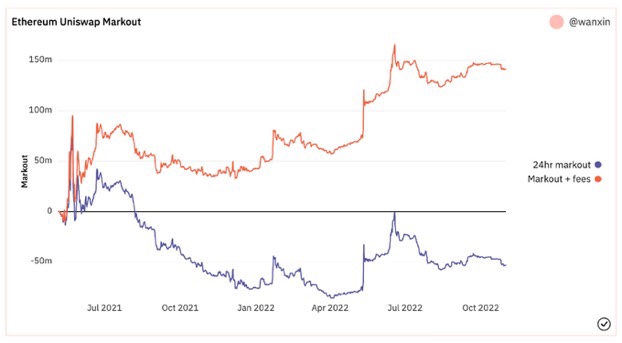

Nhóm của Uniswap tuyên bố và tôi đã không tính phí trong phân tích của mình, rằng nhóm Uniswap ETH/USDC đã thực sự kiếm được lợi nhuận 150 triệu đô la kể từ khi thành lập. Sự khác biệt là rất lớn.

@0xShitTrader đã phát hiện ra rằng Uniswap có một lỗi trong truy vấn khiến tất cả các giao dịch mua LP bị loại bỏ, hơn một nửa trong số tất cả các giao dịch LP.

Sau khi sửa lỗi, phân tích của họ hoàn toàn giống với biểu đồ ban đầu, cho thấy gần 100 triệu USD lỗ LP trong 1 ngày.Vấn đề ngay lập tức được chuyển đến nhóm của họ. Đã hơn 5 ngày rồi mà họ vẫn chưa rút lại lời yêu cầu tôi giải thích sự thật. Đối với tôi, điều quan trọng là phải chia sẻ hiện trạng thực sự của thế giới DeFi.

Việc nhóm Uniswap cho rằng việc kiếm được khoản lợi nhuận 150 triệu đô la từ việc cung cấp tính thanh khoản thụ động trong nhóm ETH/USDC là điều hợp lý khiến tôi vô cùng kinh ngạc.Xu hướng của nhóm Uniswap là rõ ràng.Thông tin sai lệch và thiếu sự thật này từ Uniswap đã lan truyền như một loại vi-rút giữa các KOL trong cộng đồng DeFi, những người tin tưởng vào thương hiệu Uniswap nhưng chưa tự mình tìm hiểu kỹ dữ liệu.

tiêu đề phụ

Tình trạng của thế giới DeFi

Trong nhóm ETH/USDC, tiền được phân bổ quá mức để cung cấp tính thanh khoản. Đây không phải là cuộc tấn công cá nhân của tôi vào AMM hoặc nhóm Uniswap, đó là thực tế. DeFi đang trong một cuộc khủng hoảng hiện hữu và với tư cách là một cộng đồng, chúng ta cần trung thực về những gì chúng ta đã đạt được.AMM là một công cụ tuyệt vời để giao dịch stablecoin và tăng tính thanh khoản cho các tài sản dài hạn. Chống lại công nghệ CeFi là điều mà chúng ta với tư cách là một cộng đồng vẫn đang vật lộn với.

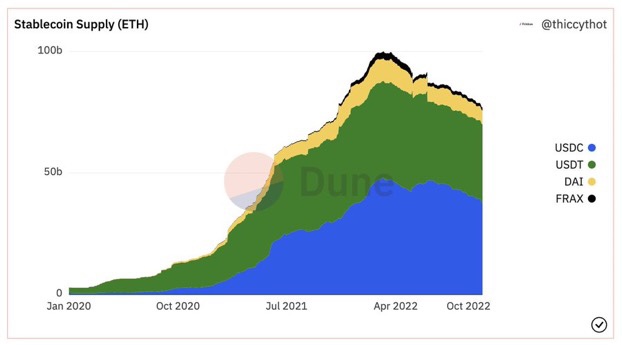

Có quá nhiều quỹ trên chuỗi đang tìm kiếm lợi nhuận, dẫn đến phần bù rủi ro âm đối với hầu hết mọi cơ hội, điều mà nhóm Uniswap không thể chi trả.

Có hơn 70 tỷ đô la tiền ổn định trên ETH đang tìm kiếm các trường hợp sử dụng. Không có đủ trường hợp sử dụng cho loại vốn này, đặc biệt là trong môi trường mà tỷ suất lợi nhuận phi rủi ro vượt quá 4%.Hầu hết mọi người không nhận ra rằng DeFi là một thiếu niên giả vờ bối rối về danh tính của mình. Chúng tôi đang bị truy đuổi bởi vốn và hầu hết cộng đồng DeFi đều coi đó là điều hiển nhiên. DeFi đang chạy đua với thời gian, cố gắng thuyết phục vốn ở lại.

Một người bạn tốt của tôi gần đây đã nói chuyện với tôi về sự khác biệt giữa độ chính xác và độ chính xác, điều mà tôi nghĩ là gốc rễ của các vấn đề của DeFi. Độ chính xác là khả năng bắn trúng mục tiêu. Độ chính xác là đảm bảo bạn đang nhắm đúng mục tiêu.

tiêu đề phụ

DeFi đang thực sự cố gắng giải quyết vấn đề gì?

Trong chu kỳ trước, thế giới cần một câu chuyện tăng trưởng (hay còn gọi là sòng bạc không được kiểm soát) để tạo ra tính thanh khoản lịch sử. Với tư cách là một cộng đồng, chúng ta cần từ bỏ lời hứa về "thuật giả kim tài chính" và "cỗ máy chuyển động vĩnh viễn tài chính" trong chu kỳ trước và tập trung vào các nguồn đổi mới bền vững dài hạn mà DeFi thực sự có thể giải quyết.