KPMG: Crypto investment activity in the first half of 2022 is much higher than all years before 2021

This article comes fromThe Blocksecondary title

Odaily Translator | Nian Yin Si Tang

Summary:

Summary:

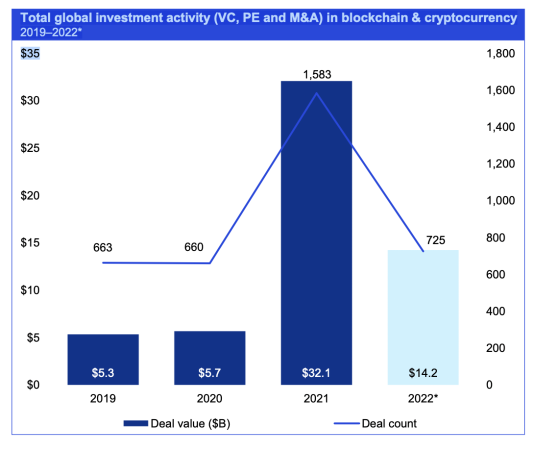

- Although the activity of crypto investment in the first half of 2022 has decreased compared with 2021, it is still higher than all years before 2021.

- Some blockchain startups may accept lower valuations to raise funds to stay in the industry.

KPMG, one of the Big Four accounting firms, stated in the "September Pulse of Fintech H1'22" ("September Pulse of Fintech in the First Half of 2022") report that despite global and ecosystem challenges, cryptocurrencies and The blockchain industry continues to show signs of maturity.

With the global instability sparked by the Russia-Ukraine conflict and the aftermath of the TerraUSD stablecoin debacle a few months ago, the blockchain ecosystem has hit its fair share of roadblocks this year. However, KPMG said that despite these events, investor sentiment remained strong, with average investment levels at mid-year this year still well above 2021, albeit down from $32.1 billion in the same period in 2021 to $14.2 billion in 2022 previous year.

image description

Source: Pulse of Fintech H1'22, Global Fintech Investment Analysis, KPMG International (data provided by PitchBook), *as of 30 June 2022.

However, for some blockchain startups, the industry outlook remains uncertain. Alexandre Stachtchenko, head of blockchain and crypto-assets at KPMG France, said the companies may need to lower their valuations to raise capital, as that is the only option. “Of course, some cryptocurrency projects will die, especially those without a clear and strong value proposition. From an ecosystem perspective, this is actually quite healthy, as it will clean up some of the confusion created by the bull market mania. Most The good companies will be the ones that survive," Stachtchenko said.

Surviving companies continue to drive interest in the blockchain space with large funding rounds such as:- At the beginning of June this year,German Broker Trade Republic Closes Circa 250 Million Euros ($268 Million) Financing

, Ontario Teachers' Pension Plan (OTPP) led the round.Last May,Trade Republic Announces $900 Million Series C Funding

, valued at over US$5 billion. Sequoia Capital led the round, with participation from TCV, Thrive Capital, Accel, Founders Fund, Creandum, and Project A. It is reported that Trade Republic has more than 1 million customers in Germany, France and Austria, and manages assets of 6 billion euros (about 7.3 billion U.S. dollars).

It is reported that Trade Republic allows customers to trade stocks, ETFs, cryptocurrencies and other financial products, and most of them have no order commissions or other fees. It was founded in Germany in 2015 and currently also offers services in Austria, the Netherlands, France, Italy and Spain.- April of this year,, with a valuation of $8 billion. SoftBank Vision Fund 2 (SoftBank Vision Fund 2), Temasek Holdings (Temasek Holdings), Paradigm, Multicoin Capital, Lightspeed Venture Partners and others participated in the investment.

- March of this year,- March of this year,, with a valuation of $7 billion, led by ParaFi Capital, new investments include Temasek, SoftBank Vision Fund II, Microsoft, Anthos Capital, Sound Ventures and C Ventures, and existing investors such as Third Point, Marshall Wace, TRUE Capital Management and UTA VC Investment participation.

secondary title

other points

In its report, KPMG said that the face of cryptocurrency investors is changing dynamically, from retail investors to institutional and corporate players, which account for an increasing proportion of capital inflows. Therefore, from the perspective of investment risk, encrypted assets start to show similarities with traditional assets.

As both El Salvador and the Central African Republic have adopted bitcoin as legal tender, the report said developing countries are increasingly interested in sovereign applications of cryptocurrencies compared to existing currencies such as the U.S. dollar.

KPMG said that while China has implemented a ban on cryptocurrency trading and there are signs that India may follow suit, regulators in other jurisdictions are more interested in promoting competition, development and growth in the cryptocurrency market while protecting consumers. Additionally, the European Union will adopt new regulations for the cryptocurrency industry by the end of 2022.