DAO danh tiếng: Thiết lập hệ thống tín dụng trên chuỗi và khám phá nhiều trường hợp sử dụng DeFi

Tín dụng đóng vai trò quan trọng trong các lĩnh vực như tài chính, tiêu dùng, giáo dục và giao tiếp xã hội. Hệ thống tính điểm tín dụng rất phổ biến trong cuộc sống hàng ngày của chúng ta. Ví dụ: kho báu tính phí dùng chung có thể sử dụng điểm tín dụng để tận hưởng các dịch vụ miễn phí đặt cọc, điểm tín dụng cao hơn của Taobao có thể tận hưởng dịch vụ hoàn tiền nhanh và điểm tín dụng của ngân hàng có thể được sử dụng để đánh giá xem họ có thể được hưởng các khoản vay lớn hay không. Tất cả những hành vi này đều cần được xác nhận bằng điểm tín dụng.

Vậy dữ liệu tín dụng đến từ đâu? Trên thực tế, tất cả dữ liệu đều là dữ liệu tín dụng, bao gồm số tiền cho vay, trình độ học vấn, thu nhập nghề nghiệp, email, số điện thoại và địa chỉ, thậm chí cả thói quen tiêu dùng, sở thích, v.v., có thể được thu thập thông qua dữ liệu lớn và được sử dụng làm dữ liệu tín dụng để đánh giá cá nhân.điểm tín dụng. Ngoài việc được hưởng một số dịch vụ bổ sung, điểm tín dụng còn có thể được sử dụng làm cơ sở để đánh giá liệu người dùng có khả năng trả nợ hay không.

Ngoài điểm tín dụng cá nhân, một số tổ chức lớn, cửa hàng, sản phẩm, v.v. cũng có điểm tín dụng. Họ có thể tạo điểm tín dụng dựa trên đánh giá của người dùng, doanh số bán sản phẩm, danh tiếng của cửa hàng, v.v. và sử dụng chúng làm cơ sở cho độ tin cậy (cho vay).

Trong thế giới Web3, các kịch bản tài chính, hành vi xã hội và phương thức giao dịch đã trải qua những thay đổi to lớn. Ngoài ra, DeFi cũng đã định nghĩa lại ngành tài chính toàn cầu và nó đã mang lại những lợi thế rõ ràng về khả năng tiếp cận và tiếp cận tài chính, tốc độ thanh toán và tính linh hoạt. Với việc DeFi được áp dụng rộng rãi, hệ thống tính điểm tín dụng cũng là một mắt xích quan trọng. Tuy nhiên, dữ liệu như tài sản cá nhân và giao dịch tham gia vào DeFi được ghi lại trên chuỗi, trong khi dữ liệu tài chính, điểm tín dụng và đánh giá ngân hàng truyền thống nằm ngoài chuỗi. Làm thế nào để nhận ra tương tác dữ liệu trên chuỗi và ngoài chuỗi, truyền dữ liệu trong thế giới thực sang chuỗi khối một cách an toàn và tạo hệ thống tín dụng toàn diện cho DeFi là một trong những vấn đề cần được giải quyết khẩn cấp.

Dựa trên điều này, các hệ thống tính điểm tín dụng trên chuỗi như Reputation DAO không ngừng xuất hiện và phát triển.

Reputation DAO là cầu nối giữa DeFi và tài chính truyền thống, cho phép các cá nhân tận dụng dữ liệu tài chính trong thế giới thực và danh tính của họ khi tương tác với các hợp đồng thông minh. Nó mở ra nhiều trường hợp sử dụng hơn trong DeFi bằng cách phân tích dữ liệu cụ thể từ các tài khoản trên chuỗi, oracle và DAO với sự trợ giúp của một công cụ luồng dữ liệu mạnh mẽ.

Nó được ra mắt bởi nền tảng blockchain của Úc Mycelium, sản phẩm cuối cùng của nó là Tracer DAO, một hệ sinh thái phái sinh được triển khai trên Arbitrum, với tổng khối lượng giao dịch hiện tại là 137.154.334 đô la.

Danh tiếng DAO gần đây đã công bố hoàn thành vòng tài trợ hạt giống trị giá 4,75 triệu đô la, với sự tham gia của DACM, AirTree Ventures, Koji Capital và Framework Ventures. Người đồng sáng lập Chainlink, ông Serge Nazarov cũng đã tham gia DAO danh tiếng với tư cách là cố vấn.

Cho vay DeFi vẫn còn ở giai đoạn sơ khai

Trong những năm gần đây, DeFi đang ở trong giai đoạn tăng trưởng mạnh mẽ, với các sản phẩm mới lần lượt xuất hiện và ngày càng có nhiều nhà đầu tư và quỹ đổ vào thị trường DeFi. Khi sản phẩm được cập nhật và lặp lại liên tục, cấu trúc và năng suất sản phẩm của nó cũng trở nên hoàn thiện và ổn định hơn. Các nhà đầu tư không bị giới hạn ở nhu cầu khai thác thanh khoản, mà còn liên quan đến việc cho vay, tiền tệ ổn định theo thuật toán, đầu tư danh mục đầu tư và các sản phẩm khác có thể thu được thu nhập đa dạng.

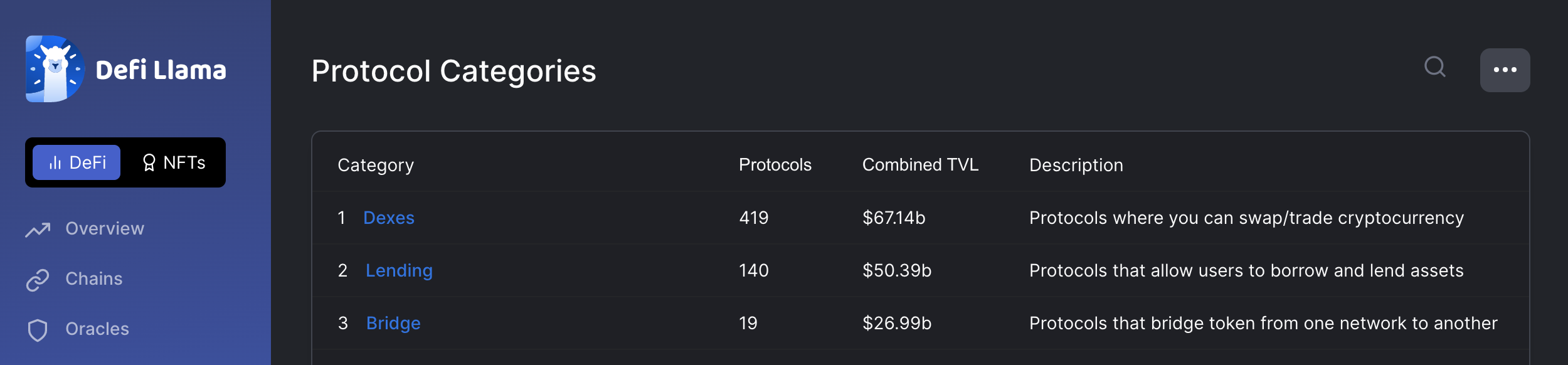

Theo dữ liệu của DefiLlama, tính đến thời điểm hiện tại, tổng giá trị bị khóa của DeFi là $211 tỷ và hợp đồng cho vay chiếm 23,69% tổng TVL, với tổng số 140 dự án, đứng thứ hai. Số một là trao đổi phi tập trung.

So với thành tích này, cấu trúc thị trường cho vay DeFi vẫn chưa trưởng thành. Thể hiện ở chỗ, khả năng tích hợp dữ liệu của DeFi còn tương đối yếu, thiếu hệ thống chấm điểm tín dụng, chưa mở rộng được chuỗi tín dụng nên hiện tượng cho vay quá thế chấp (kèm theo đó là hiệu quả sử dụng vốn thấp) vẫn tồn tại .

tiêu đề phụ

Danh tiếng DAO hoạt động như thế nào?

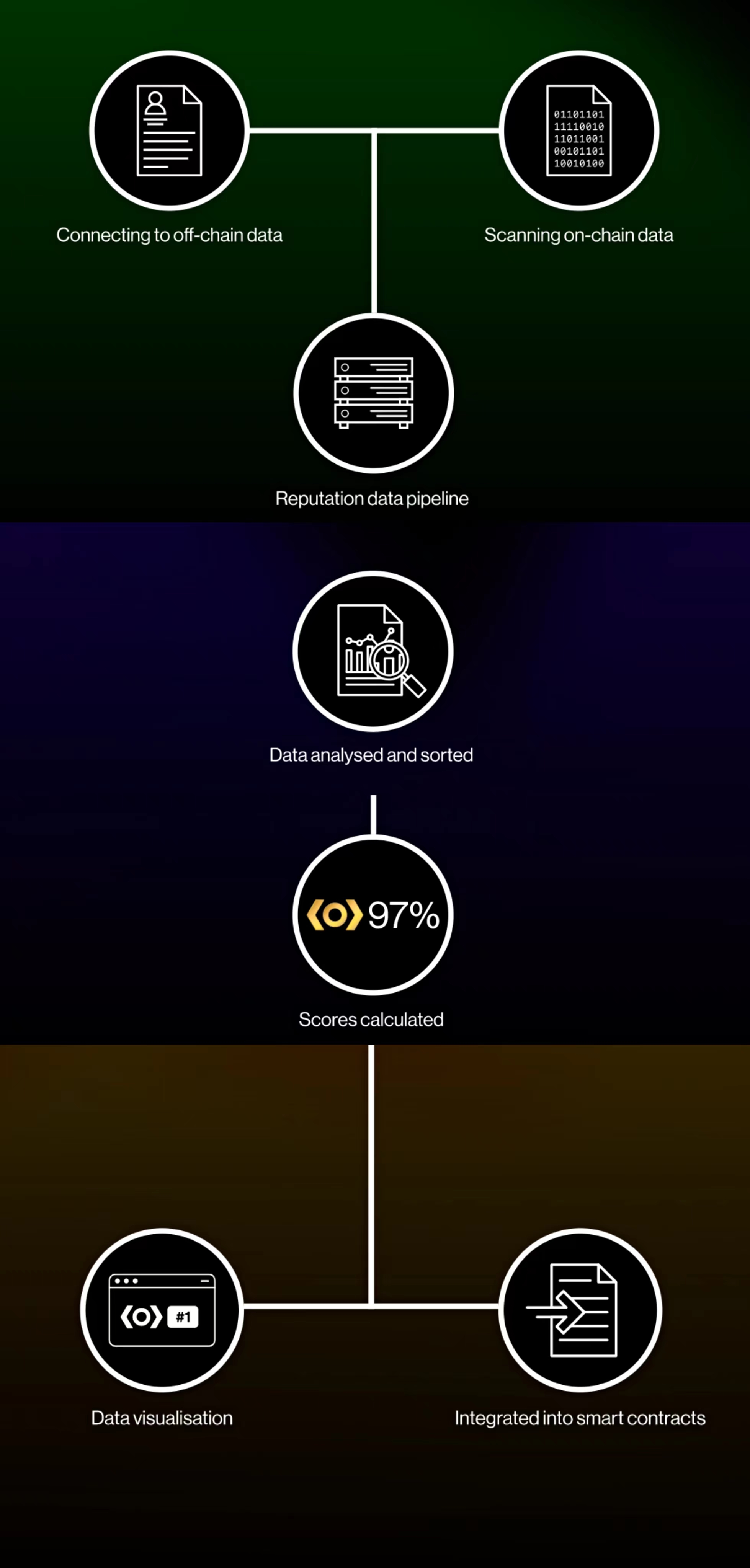

Cụ thể, Reputation DAO sẽ thu thập và phân tích dữ liệu tín dụng theo các cách sau.

1. Quét và kết nối

Sử dụng Reputation DAO, người dùng DeFi có thể quét và kiểm tra tính bảo mật của dữ liệu tiên tri cơ bản trong hợp đồng thông minh của họ. Bằng cách xây dựng một đường dẫn tổng hợp dữ liệu, bất kỳ dữ liệu dựa trên EVM nào cũng có thể được chuyển nhanh chóng. Với các liên kết tín dụng, người dùng có thể tìm hiểu về hiệu suất của nhà tiên tri và hiểu rõ hơn về các nguồn cấp dữ liệu cụ thể. Reputation DAO tập trung vào việc quét dữ liệu cho các tài khoản DeFi cá nhân, oracle và DAO.

Sau đó, một mạng tiên tri phi tập trung do Chainlink cung cấp sẽ được sử dụng để kết nối các dịch vụ tín dụng ngoài chuỗi cần thiết như dịch vụ nhận dạng, kiểm tra AML/KYC có liên quan, điểm FICO/Vantage và dữ liệu truyền thông xã hội có liên quan.

2. Phân tích và tính toán

Sau khi thu được dữ liệu, Reputation DAO sẽ phân tích và sắp xếp dữ liệu được quét liên quan đến các tài khoản cá nhân, nhà tiên tri và DAO. Danh tiếng DAO đã phát triển RepScores, một thuật toán chấm điểm danh tiếng sử dụng các nguồn dữ liệu trên chuỗi. Việc tích hợp RepScores vào hợp đồng có thể giảm yêu cầu về tài sản thế chấp cho các cá nhân trong DeFi.

3. Hình dung

tiêu đề phụ

Sản phẩm đầu tiên của DAO danh tiếng - Oracle Reputation

Reputation DAO sẽ tạo ra các nền tảng và ứng dụng khác nhau để đạt được tín dụng phục vụ hệ sinh thái chuỗi khối mở. Sản phẩm đầu tiên là Danh tiếng của Oracle. Danh tiếng của Oracle biến thông tin trên chuỗi về chất lượng tiên tri thành kiến thức mà con người (và máy móc) có thể sử dụng để đưa ra quyết định. Oracle Reputation sử dụng mô hình Repscore để gắn kiến thức có thể lập trình và đọc được của con người vào Web3 bằng cách điều phối và tổng hợp các chỉ số tín dụng.

Phân tích dữ liệu cho các nhà tiên tri, hợp đồng và thỏa thuận tích hợp hiện có sẵn trên Danh tiếng của Oracle.

1. Nhà tiên tri

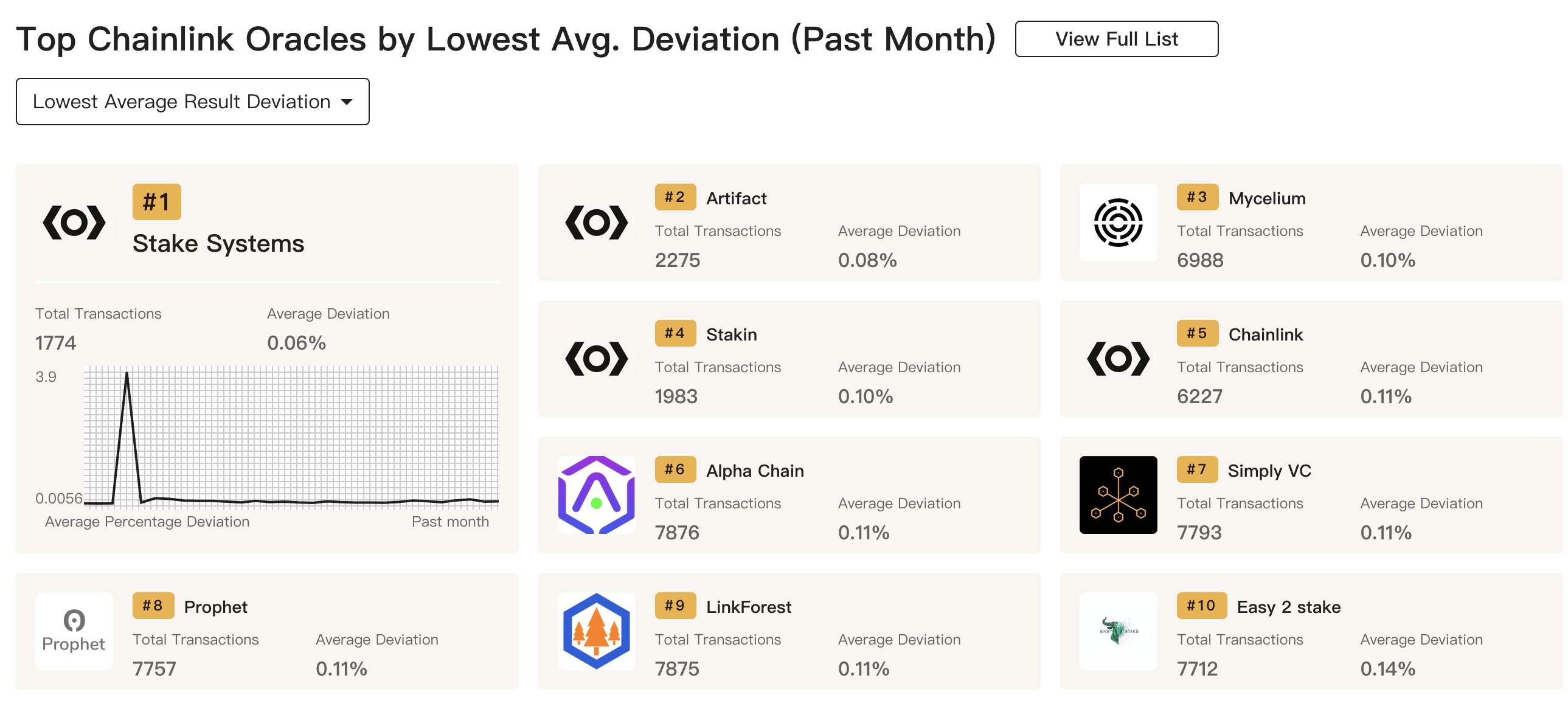

Ví dụ, Oracle Reputation xếp hạng các nhà tiên tri dựa trên độ lệch trung bình hoặc tổng khối lượng giao dịch được gửi. Những bảng xếp hạng này cung cấp cho người dùng cái nhìn tổng quan về độ tin cậy của Oracle.

2. Hợp đồng

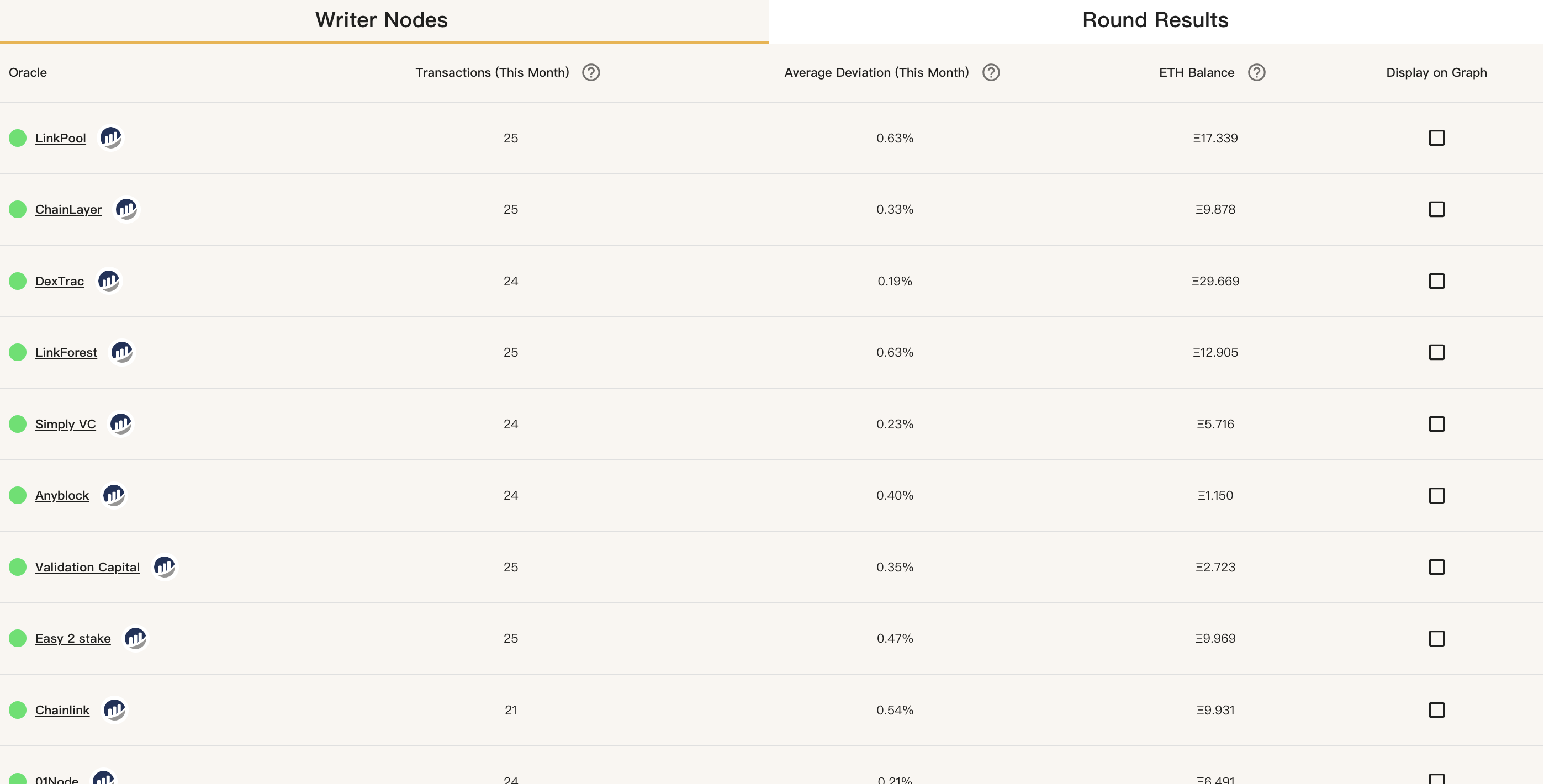

Bạn có thể xem thời gian khi hợp đồng tiên tri được gửi trên chuỗi, độ lệch giữa dữ liệu tiên tri và dữ liệu thực và lượng ETH được giữ bởi địa chỉ tiên tri.

3. Thỏa thuận

Nền tảng Oracle Reputation V2 đã được cập nhật với một tính năng mới - Môi trường trực quan hóa giao thức (PVE), có thể được sử dụng cho các giao thức DeFi được tích hợp với DAO danh tiếng. Nó là một tiện ích được hiển thị trên giao diện người dùng. Khi người dùng nhấp vào tiện ích, nó sẽ hướng họ đến bảng điều khiển dữ liệu của thỏa thuận trong Danh tiếng của Oracle, nơi bạn có thể xem dữ liệu liên quan đến thỏa thuận.

Hiện tại, Oracle Reputation đã tích hợp Aave, Tracer DAO, Arbitrum và DeFi Safety. Người dùng có thể xem bảo mật dữ liệu của máy tiên tri của một giao thức cụ thể theo nhu cầu của họ.

Ví dụ: nó cung cấp cho Aave dữ liệu sau:

Hợp đồng Aave đọc giá và thời gian từ Chainlink, cũng như cập nhật giá từ các nhà tiên tri riêng lẻ và mạng lưới các nhà tiên tri.

TVL hàng ngày và hàng giờ, gas và gas dự kiến được trả, quy mô và số tiền vay.

Tổng quan về tất cả các nguồn dữ liệu mà Chainlink sử dụng trên nền tảng của mình, bao gồm nhật ký các giao dịch gần đây.

Widget Danh tiếng hiển thị chuỗi cung ứng dữ liệu đầu cuối cho mỗi hợp đồng Aave. Người dùng Aave có thể hiểu rõ hơn về cách các nhà tiên tri và hợp đồng Chainlink tương tác với các hợp đồng thông minh trên giao thức Aave.

Giúp người dùng thực hiện thẩm định dễ dàng hơn và giúp người dùng yên tâm khi giao dịch trên mạng Aave. Điều này giúp người dùng xây dựng niềm tin vào giao thức.

DAO danh tiếng con đường phát triển trong tương lai

Danh tiếng DAO đang được phát triển:

1. Repscore——Mô hình chấm điểm tín dụng của Oracle

Repscores sử dụng mô hình Xếp hạng hiệu suất tương đối (RPR) mã nguồn mở để đánh giá hiệu suất của từng nhà tiên tri và tạo ra "điểm tín dụng" từ 1 đến 100. Mô hình này sẽ cung cấp một khung tiêu chuẩn để đánh giá và đo lường toàn diện hiệu suất của Oracle.

2. Theo dõi và cảnh báo về lời tiên tri

2. Theo dõi và cảnh báo về lời tiên tri

Tính năng này cho phép thông báo ngay lập tức khi một tiên tri bị lỗi. Người dùng sẽ có thể chọn thời điểm họ được thông báo và cách họ nhận thông báo.

Richard Galvin, đồng sáng lập và Giám đốc điều hành của Capital DACM, cho biết: "Chấm điểm tín dụng là chức năng chính của các ngân hàng và nhà cung cấp bên ngoài trong hệ thống tài chính truyền thống. Cho đến nay, đối với người vay và người cho vay, DeFi chưa có chức năng rõ ràng này. Như hệ sinh thái trưởng thành và các DAO thông tin độc lập, đáng tin cậy xuất hiện, chúng tôi coi các DAO danh tiếng là cơ sở hạ tầng cho giai đoạn tăng trưởng tiếp theo của ngành.”

Thật vậy, khả năng tương tác giữa DeFi và tài chính truyền thống có thể cung cấp hàng nghìn tỷ đô la vốn và hàng tỷ luồng người dùng, và hệ thống tín dụng là một phần không thể thiếu trong đó. DAO danh tiếng cung cấp một đường dẫn để dữ liệu này chảy vào các hợp đồng thông minh, cùng với việc tăng cường bảo mật, lãi suất và bảo lãnh.