Messari Report: Comprehensive Interpretation of Terra Columbus-5 Upgrade

Compilation of the original text: The Way of DeFi

Original source: Messari

Compilation of the original text: The Way of DeFi

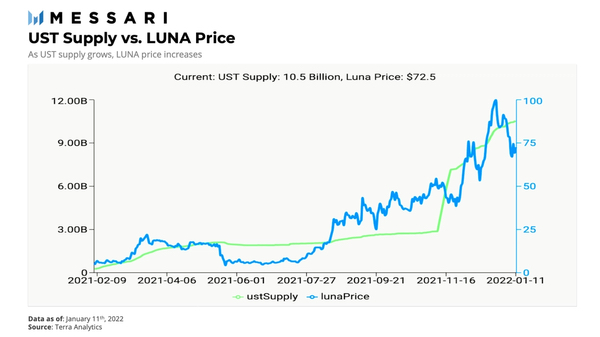

Due to the rapid growth of UST, the Terra blockchain and its native token LUNA have recently experienced unprecedented growth. In 2021 alone, LUNA’s market cap has changed by +14,000%, and the supply of UST exceeds $10 billion.

first level title

TerraBasics

Terrais a proof-of-stake (PoS) protocol that enables the creation of a decentralized algorithmic stablecoin. While Terra can create stablecoins that track any fiat currency, UST has been its primary use case.

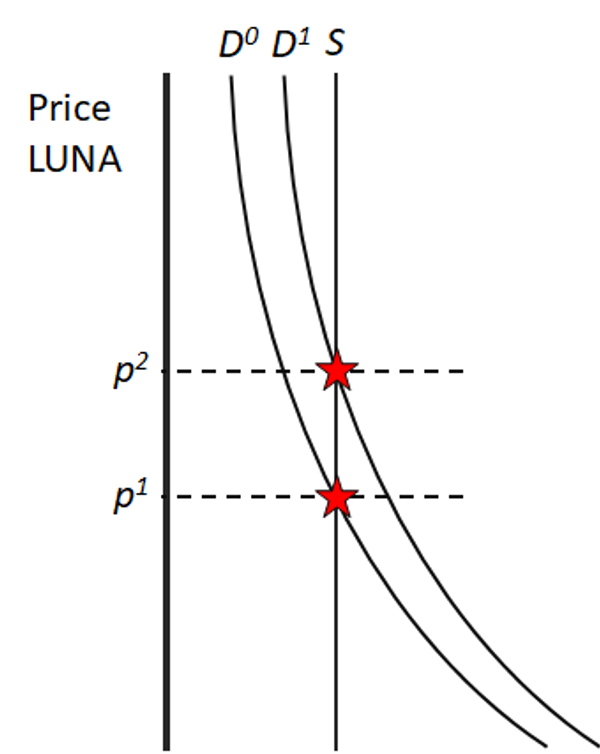

Terra maintains UST's peg to the U.S. dollar through a flexible monetary policy enabled by its UST-LUNA dual token model. When the unit value of UST is higher than the USD peg, users are incentivized to burn LUNA and mint UST. When a unit of UST is worth less than the USD peg, users are incentivized to burn UST and mint LUNA. When UST contracts, the value of LUNA will decrease, and when UST expands, the value of LUNA will increase. LUNA is the variable counterpart of UST. By regulating the supply, the value of LUNA increases as demand for UST increases.

LUNA holders secure the network by binding their LUNA to network validators. Bonded LUNA will generate mortgage rewards from three sources: gas, market stability fees, and swap fees. Users can passAnchor protocolfirst level title

Columbus-5 upgrade

economic change

Seigniorage will be generated when LUNA is exchanged for new UST. existTIP43data

according todata, about 89 million LUNA were burned from the community pool. $1 billion worth of burnt LUNA converted to UST was used to launch Ozone, an algorithm-based claims insurance protocol on Terra. Ozone was later adopted by DeFi automated risk management protocol Risk Harbortake over。

The increased number of burns makes LUNA an extremedeflationary assetsprojectprojectAlready surfaced to fund new projects.

Economically, an increase in UST demand simultaneously causes an expansion of the LUNA demand curve and a contraction of the LUNA supply curve. Given that the demand curve for LUNA is more inelastic at lower supply levels, the effect of increased demand on UST on LUNA price increases exponentially at lower LUNA supply levels. As the supply of LUNA decreases, so does the actual amount of LUNA used to mint UST. If the adoption of UST continues to grow over time, the supply of LUNA may remain largely fixed at a low level in the future.

Oracle development

Validator oracle voting is critical to keeping UST issued at the correct price. Before Columbus-5, oracle votes could be squeezed out of the mempool during periods of high network demand. This is exactly what happened during the market crash in May 2021, when a large number of other transactions excluded oracle votes from blocks. After Columbus-5, oracle voting was given priority in the mempool so that they are not pushed out of blocks during periods of network traffic spikes.

Before 100% of the seigniorage is burned, a portion is allocated to validators to encourage accurate oracle voting. Additionally, to compensate validators for lost seigniorage rewards, Columbus-5 distributes transaction fees to validators that would otherwise be burned. This change improves the yield of staking LUNA and significantly increases the amount of LUNA staked.

Cross-Chain Progress: Inter-Blockchain Communication (IBC)

Terra is a Cosmos SDK blockchain utilizing Tendermint consensus. All blockchains built on the Cosmos SDK come with IBC, a standardized communication protocol for IBC-compatible blockchains. Columbus-5 activates the IBC function on Terra, enabling seamless transfer of assets and data between Terra and other IBC-enabled chains (such as Cosmos Hub, Secret Network, Akash, Thorchain, etc.).

supposesupposeAs stated, UST has since become the most liquid DEX in Cosmos — the dominant stablecoin pair on Osmosis. With the continuous development of the Cosmos ecosystem, the growth of UST will also benefit a lot.

Increased demand for UST on other connected blockchains will continue to expand UST's network effect and improve its liquidity distribution. While cross-chain penetration of UST is increasing, much of the outstanding UST supply is still highly concentrated in a few protocols such as Anchor. As the cross-chain distribution of UST grows, the downward reflexivity of its peg and the risks associated with its dependence on a small number of protocols may decrease.

other development

Wormhole V2

While IBC connects Terra to application-specific blockchains on Cosmos,WormholeConnect Terra to different shared state machine blockchains such as Solana and Ethereum. While many current cross-chain bridges sacrifice some degree of decentralization for convenience, Wormhole claims to retain the benefits of both. Wormhole operates as a decentralized oracle network that relays messages between chains, relying on the consensus of connected chains to accept state changes between them.at the time of writing, $755 million in UST has been bridged to other Wormhole-integrated blockchains.

Recently, Wormhole suffered the largest DeFi breach ever,Over $326 million in ETHStolen from the bridge. Thereafter,Jump Capital addedAll stolen funds were recovered, making all Wormhole users compensated. Despite this setback, Wormhole remains one of the largest cross-chain bridges, with more than$2 billion。

Terra Ecosystem Development

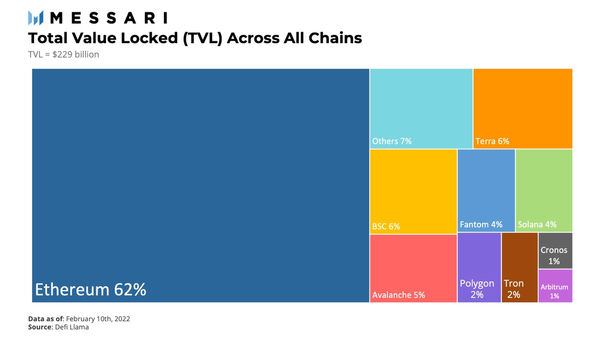

After Columbus-5, many new projects were launched on Terra, bringing new use cases and utilities to this blockchain. Recently launched projects, such as Astroport, quickly bootstrapped liquidity and propelled Terra to become the second largest blockchain after Ethereum, with a TVL of $14 billion, almost 7% of the TVL of almost all chains. In addition to new projects, increased risk management through Ozone may also increase the TVL of existing projects on Terra. Ozone is said to be rolling out this year a product specifically designed to protect Anchor, with integrations for Mirror and Orion coming soon.

incentive plan

To further adopt UST on other blockchains, LUNA holdersA governance decision was adopted in November 2021, Deploying the US$3 million community pool UST (converted to LUNA) to the liquidity pools of various protocols in the main L1. Recently, LUNA holders voted to implement an additional liquidity mining program, deploying $2 million of LUNA to various protocols on Solana, Oasis, and NEAR.

compete

compete

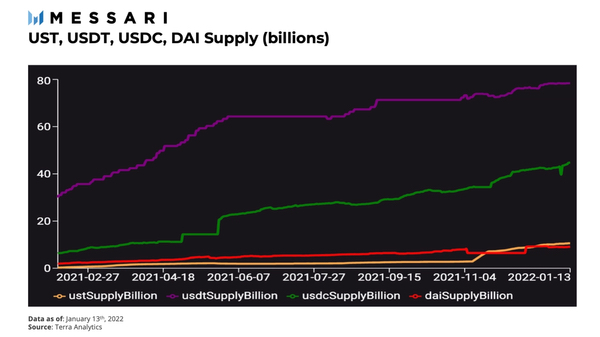

DAI and centralized stablecoins

While DAI is technically a decentralized stablecoin, it is primarily collateralized by USDC, making it relatively centralized relative to UST. DAI was the largest decentralized stablecoin by market cap until UST surpassed it on Nov. 18. Currently, the supply of UST exceeds that of DAI by 17%. Incentive programs can dramatically accelerate adoption, as UST's recent period of rapid growth has shown. While UST is far from eclipsing USDC or USDT, the recent regulatory issues around centralized stablecoins, combined with UST, MIM and FRAX working together to improve decentralized stablecoin liquidity on Curve, has the potential to outperform Other competitors are quicker to change this.

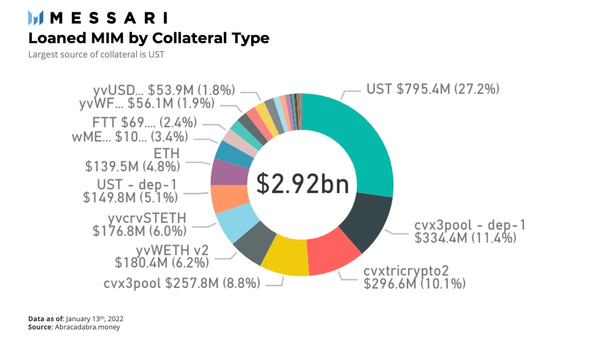

MIM

In this regard, MIM is not so much a competitor as a partner. However, it is still the second largest decentralized stablecoin in UST. While many types of yield assets provide collateral for MIM, UST primarily provides collateral for it through its Degenbox strategy. It contributes a significant amount of deposits to Terra's Anchor protocol. Like Terra, Abracadabra stimulates the growth of UST and MIM on Curve by committing millions of dollars in SPELL to the Votium UST-MIM incentive mechanism.

MIM and Abracadabra are also part of a larger ecosystem of projects led by developer Daniele Sestagalli, dubbed "Frog Nation" (SPELL, TIME, ICE and SUSHI). In addition to Abracadabra, Wonderland is also building on its most recent $48 millionUST Yield Farming Strategyfuture development

future development

As of January 14, 2022, Terra will putits tax rate dropped to0. LUNA stakers are currently rewarded through a combination of on-chain transaction fees and network tax revenue. Currently, tax rates are a disincentive for cash-strapped developers looking to deploy contracts on-chain. Terra seeks to incentivize more new developers to build on the blockchain and further promote innovation by lowering tax rates.

proposalproposalContinue to bring UST liquidity outside its ecosystem, further strengthening UST's status as a cross-chain stablecoin. The distribution is as follows:

$60 million in UST for MarketXYZ, Themis and Rari Fuse pools.

$1.7 million in UST for bonds and incentives for OlympusDAO and InvictusDAO.

$18 million in UST to increase incentives for Votium.

50 million USD for farming TOKE.

$1.4 million for leading protocols on Avalanche, Fantom, and Moonbeam.

$15 million to bootstrap liquidity on the ZigZag exchange, which will bring UST into zkSync and StarkNet.

AnnounceAnnouncein conclusion

in conclusion

Terra's Columbus-5 upgrade pushes UST into the largest decentralized stablecoin and creates tremendous value for LUNA holders. This upgrade paves the way for UST adoption to continue growing on other IBC-enabled blockchains and major L1s. After Columbus-5's improved burning and staking mechanism, the supply of LUNA will also experience a greater contraction in the future. Recently, there have been active initiatives by Terra participants in an attempt to boost UST supply growth by increasing cross-chain penetration and real-life use cases. If these initiatives prove to be successful, LUNA holders will directly gain significant value from the changes implemented by Columbus-5.