Hướng dẫn bạn cách kiếm tiền từ việc "hối lộ" trong Curve War

Bài viết này đến từBanklesshqBài viết này đến từ

, tác giả gốc: William M. Peaster, dịch giả Katie Ku của Odaily biên soạn.Bạn đã từng cầm CRV chưa? Nghe nói về "hối lộ" tiền điện tử? Nếu từ hối lộ khiến bạn bối rối (hoặc không thoải mái), tôi khuyên bạn nên dành chút thời gian để hiểu cơ chế của Curve. Bởi vì nó là một cơ chế minh bạch, có thể kiểm tra được, không cần xin phép,

Chúng tôi đính kèm hai bài giới thiệu cơ bản về Curve War ở cuối bài viết nhằm giúp những người mới làm quen hiểu rõ hơn về “đặc quyền” cầm CRV.

tiêu đề phụ

Vì sao người ta sẵn sàng hối lộ người sở hữu CRV?

Đường cong có hiệu ứng bánh đà có thể nâng cao sức mua của CRV.

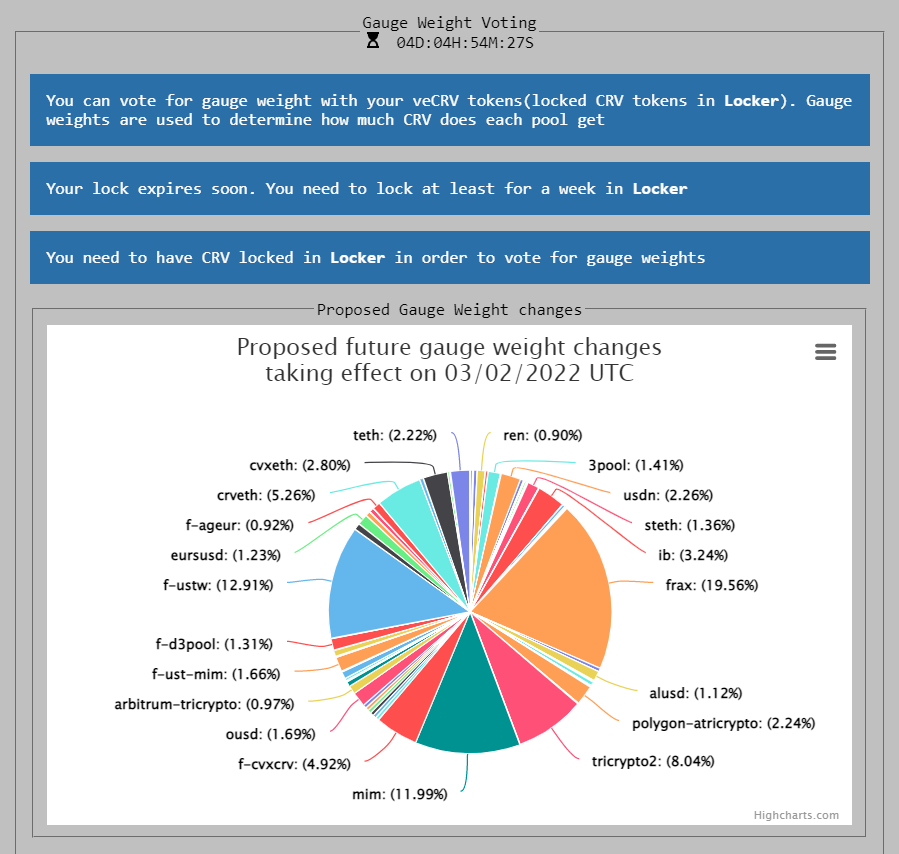

Giao thức Curve cung cấp CRV được phát hành từ tất cả các nhóm khai thác Curve LP;

Chủ sở hữu CRV bỏ phiếu bằng mã thông báo của họ để xác định CRV sẽ đi đâu sau khi phát hành;

Bạn càng nắm giữ nhiều CRV, bạn càng có nhiều ảnh hưởng đối với việc phát hành CRV.

Việc phát hành mã thông báo CRV là một động lực rất có giá trị đối với nhóm LP (thanh khoản), do đó, các giao thức khác nhau cạnh tranh giành CRV để hướng việc phát hành vào nhóm ưa thích của họ.

Đây là một ví dụ tuyệt vời về hiệu quả quản trị.

Vì vậy, làm thế nào để bạn tiếp xúc trong trò chơi này để tích lũy CRV? Đầu tiên, bạn có thể đạt được sức mua to lớn bằng cách mua CRV.

Nếu bạn muốn tăng mức độ hiển thị của mình, bạn cũng có thể tham gia vào quy trình quản trị và chấp nhận "được trả tiền để bỏ phiếu".

Bạn có thể gọi nó là hối lộ, bạn có thể gọi nó là cổ tức hoặc thanh toán thanh khoản trực tiếp. Cho dù nó được gọi bằng tên nào, tôi nghĩ mọi người quan tâm nhiều hơn đến việc tìm hiểu cách kiếm 50% tiền lãi hàng năm (APR) bằng cách tham gia Curve War.

Mục tiêu: Tìm hiểu cách đặt cược trên Convex Finance

Kỹ năng: Trung cấp

Kỹ năng: Trung cấp

ROI: lên tới 50% APR ở mức lãi suất hiện tại

tiêu đề phụ

Chào mừng đến với Cuộc chiến đường cong

Vào tháng 1 năm 2020, nhà vật lý Michael Egorov đã triển khai Curve, một DEX cho thị trường stablecoin hiệu quả, trên Ethereum.

Cho đến nay, Curve đã mở rộng ra ngoài stablecoin, triển khai tới bảy chuỗi công khai khác và nâng cấp cơ sở hạ tầng của mình để trở thành một trong những ứng dụng DeFi lớn nhất và có ảnh hưởng nhất.

Tác động này chủ yếu đến từ việc phát hành mã thông báo CRV của Curve, đồng thời cũng đã trở thành nguồn thu nhập cốt lõi của nhiều dự án DeFi. Lý do tại sao CRV phổ biến là chủ sở hữu có thể hướng dẫn và tăng cường phát hành CRV cho các nhóm thanh khoản Curve cụ thể thông qua quản trị Curve.

Cuộc chiến này đã tăng cường gần đây với sự gia tăng của "nền tảng hối lộ". "Nền tảng hối lộ" cho phép người dùng dễ dàng thu được lợi nhuận cao hơn bằng cách cho thuê "quyền mua vé" của CRV.

tiêu đề phụ

Sơ lược về lịch sử của Curve War

Tháng 8/2020, CRV và Curve DAO chính thức ra mắt. Mặc dù hầu hết hệ sinh thái không nhận ra điều đó vào thời điểm đó, nhưng sự kiện này đã đánh dấu sự khởi đầu của Cuộc chiến đường cong.

Sự kiện lớn đầu tiên sau khi ra mắt CRV là việc Yearn phát hành kho bạc "BackCratcher" vào khoảng tháng 11 năm 2020. Kho bạc một chiều này cho phép những người khai thác ký gửi vào CRV, sau đó số tiền này sẽ bị khóa vĩnh viễn trong CRV ký quỹ bằng phiếu bầu (veCRV) để đổi lấy yveCRV và thu nhập được tối ưu hóa.

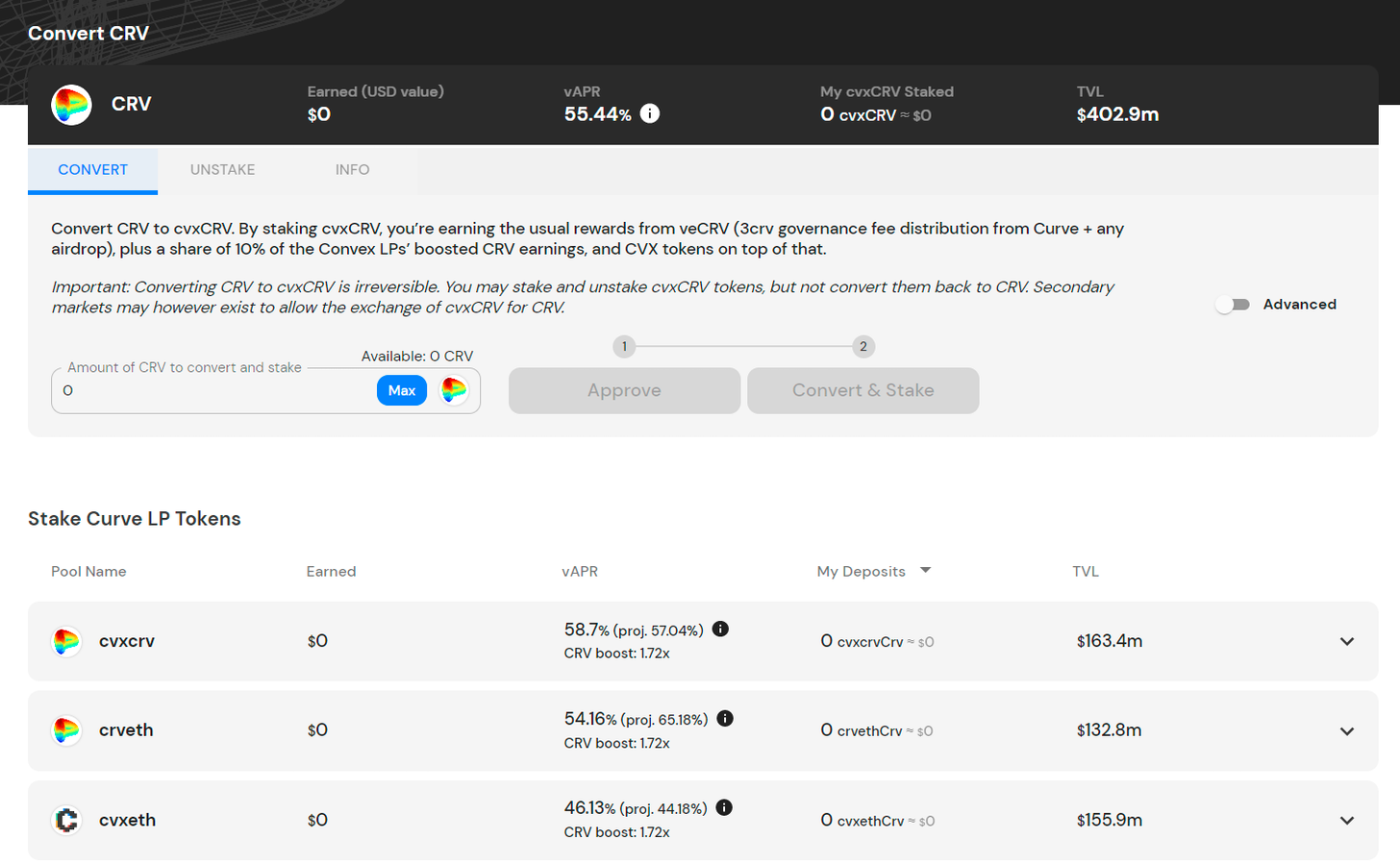

Lần nâng cấp lớn tiếp theo của Curve War sẽ diễn ra vào tháng 5 năm 2021, khi Convex Finance được triển khai trên Ethereum. Convex cho phép Nhà cung cấp thanh khoản Curve (LP) duy trì tính thanh khoản và cổ phần với cvxCRV thay vì khóa CRV để kiếm phí giao dịch Curve và tăng cường phát hành CRV.

Do việc phát hành CRV ở trung tâm DeFi, mức độ phổ biến và số vốn đáng kể của Convex nhanh chóng trở thành một làn sóng trên thị trường. Các dự án DeFi khác cũng đang bắt đầu chuyển sang Convex một cách dứt khoát (chẳng hạn như Badger vào tháng 6 năm 2021), khi họ bắt đầu nhận ra rằng thỏa thuận có thể trở thành vua quản trị Curve trong tương lai.

Mọi thứ càng nóng lên vào tháng 8 năm 2021 khi người sáng lập Yearn, Andre Cronje, công bố nền tảng brith.crv.finance. Nền tảng này cho phép các dự án như Abracadabra và CREAM cung cấp phần thưởng mã thông báo để hướng dẫn các bản phát hành CRV bỏ phiếu cho họ.

Sau đó, vào tháng 11 năm 2021, chúng tôi chứng kiến sự ra mắt của REDACTED Cartel, một nhánh của Olympus DAO, REDACTED không cố gắng trở thành một loại tiền dự trữ, thay vào đó, nó đang tích lũy CRV và CVX nhiều nhất có thể để DAO của nó trở thành Vua của Curve và Quản trị lồi.Quan hệ đối tác cho thấy Yearn ủy quyền 23 triệu veCRV cho Convex. Với động thái này, cả hai bên đã củng cố sự thống trị của họ trong việc tác động đến việc phát hành CRV.

tiêu đề phụ

Làm thế nào để chấp nhận "hối lộ" quản trị

Hiện tại, Convex TVL đã vượt quá 10 tỷ đô la, khiến nó trở thành "nền tảng hối lộ" DeFi lớn nhất và tích cực nhất. Vì vậy, nếu bạn muốn tối ưu hóa thu nhập của mình bằng cách tham gia Curve War, Convex là một nơi tốt để bắt đầu.

Nếu cơ hội này là thứ bạn đang tìm kiếm, thì trước tiên bạn cần có mã thông báo CRV (được chuyển đổi thành cvxCRV để đặt cược) hoặc mã thông báo Curve LP (mã thông báo nhận được từ việc gửi vào nhóm CRV-ETH phổ biến của Curve); sau đó, hãy làm theo các bước bên dưới:

Truy cập lồifinance.com/stake và chọn trong số các nhóm mã thông báo CRV hoặc Curve LP có sẵn. Xin lưu ý rằng việc chuyển đổi CRV sang cvxCRV để đặt cược không thể đảo ngược. Tuy nhiên, bạn vẫn có thể bỏ đặt cược và giao dịch cvxCRV thông qua thị trường thứ cấp.

tiêu đề phụ

tóm tắt

tóm tắtCái gì cũng có mặt lợi và mặt hại, thử tưởng tượng khi Curve Wars kết thúc, sẽ có giới siêu giàu thống trị thế giới DeFi? Hay đây chỉ là một giai đoạn nền kinh tế mã thông báo tạm thời mà cuối cùng sẽ bị loại bỏ? Câu trả lời vẫn chưa được biết.

Nhưng có một điều rõ ràng là Curve War sẽ không sớm biến mất.Trên thực tế, có những dự án hối lộ mới lần lượt xuất hiện trực tuyến, chẳng hạn như Thị trường ẩn của Votium và REDACTED cung cấp các dịch vụ hối lộ chưa từng có. Chúng tôi cũng đã thấy "vở kịch hối lộ" có liên quan được mở rộng sang các chuỗi công cộng khác, chẳng hạn như Fantom (nghĩ rằngtiêu đề phụ

đọc liên quan

Con hào hay Con ngựa thành Troia? Chiến tranh đường cong leo thang thành trận chiến CVX