ETH รายสัปดาห์ | ลูกค้า Ethereum Geth ใกล้จะพร้อมสำหรับการควบรวมแล้ว Wormhole โปรโตคอลข้ามสายถูกโจมตีและ 120,0

ผู้แต่ง | ฉิน เสี่ยวเฟิง

บรรณาธิการ | ห่าวฟางโจว

ผลิต | Odaily

1. ภาพรวมโดยรวม

ชื่อเรื่องรอง

ในแง่ของตลาดรอง ราคา ETH ในปัจจุบันอาจดึงกลับเล็กน้อยในระยะสั้น โดยมีแนวรับที่ 2,700 ดอลลาร์ 2,500 ดอลลาร์ และแนวต้านที่ 3,000 ดอลลาร์

ประการที่สองตลาดรอง

1. ตลาดสด

เมื่อวันที่ 3 กุมภาพันธ์ Wormhole โปรโตคอลข้ามเชนถูกแฮ็ก และสูญเสียมูลค่า 120,000 wETH (ประมาณ 320 ล้านดอลลาร์สหรัฐ) การแฮ็กเกิดขึ้นเมื่อเวลา 18:24 น. UTC ของวันที่ 2 กุมภาพันธ์ ผู้โจมตีสร้างมูลค่า 120,000 wETH (WETH) บน Solana จากนั้นแลกเปลี่ยน 93,750 wETH เป็น 254 ล้านดอลลาร์เมื่อเวลา 18:28 น. UTC ETH ไปยังเครือข่าย Ethereum แฮ็กเกอร์ได้ใช้เงินทุนบางส่วนเพื่อซื้อ SportX (SX), Meta Capital (MCAP), Crypto Karma ที่ใช้งานได้ในที่สุด (FUCK) และ Bored Ape Yacht Club Token (APE) WETH ที่เหลือจะแลกเปลี่ยนเป็น SOL และ USDC บน Solana ปัจจุบันกระเป๋าเงิน Solana ของแฮ็กเกอร์มี SOL อยู่ 432,662 SOL ($44 ล้าน)

ในแง่ของตลาดรอง ราคา ETH ในปัจจุบันอาจดึงกลับเล็กน้อยในระยะสั้น โดยมีแนวรับที่ 2,700 ดอลลาร์ 2,500 ดอลลาร์ และแนวต้านที่ 3,000 ดอลลาร์

ตามข้อมูลตลาดของ OKX ราคาของ ETH ครั้งหนึ่งเคยดีดตัวขึ้นไปมากกว่า 3,000 ดอลลาร์สหรัฐฯ ในสัปดาห์ที่แล้ว และปิดที่ 2,973 ดอลลาร์สหรัฐฯ ในระหว่างสัปดาห์ ซึ่งเพิ่มขึ้น 22.2% เมื่อเทียบเดือนต่อเดือน

2. ธุรกรรมขนาดใหญ่

ตกลงลิงค์ข้อมูลกราฟรายวันแสดงให้เห็นว่าขณะนี้ราคาอยู่บนเส้นทางกลางของ Bollinger Band และราคาอาจลดลงต่อเนื่องไปที่ 2,700 ดอลลาร์ในระยะสั้น จุดนี้เป็นจุดบังเอิญของค่าเฉลี่ยเคลื่อนที่ 10 วันและเส้นทางกลาง และแนวรับแข็งแกร่ง แนวรับล่างคือ $2,500, 2300 ดอลลาร์สหรัฐ และจุดต่ำสุดก่อนหน้าที่ 2,158 ดอลลาร์สหรัฐ แนวต้านบนคือ 3,000 ดอลลาร์สหรัฐ และ 3258 ดอลลาร์สหรัฐ

3. ที่อยู่รายการที่สมบูรณ์

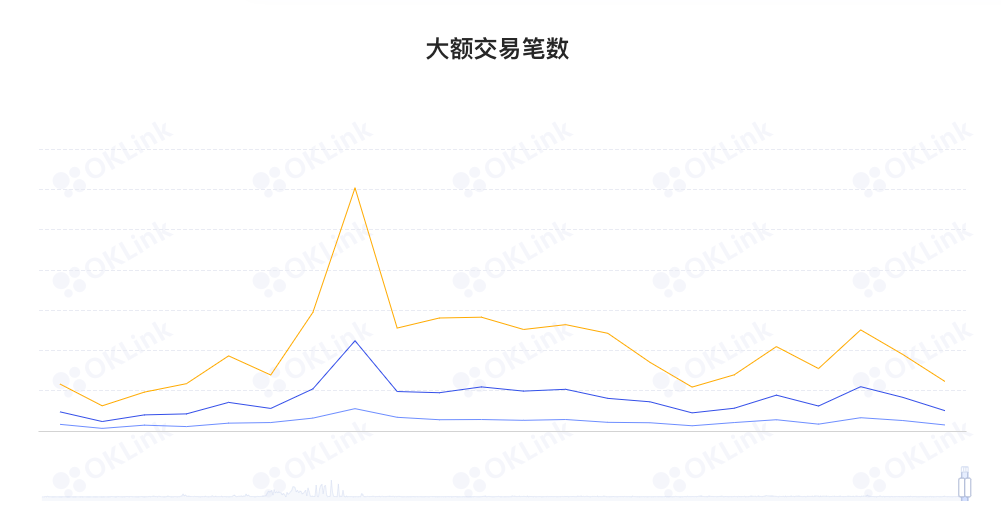

ตกลงลิงค์ข้อมูลแสดงให้เห็นว่าจำนวนการโอนบนเครือข่ายลดลงอย่างรวดเร็วในสัปดาห์ที่แล้ว โดย "สูงกว่า 1,000 ETH", "สูงกว่า 2,000 ETH" และ "สูงกว่า 5,000 ETH" ลดลง 30.5%, 22% และ 18.5% ต่อเดือนตามลำดับ .

3. นิเวศวิทยาและเทคโนโลยี

1. ความก้าวหน้าทางเทคโนโลยี

3. ที่อยู่รายการที่สมบูรณ์

ตกลงลิงค์ข้อมูล

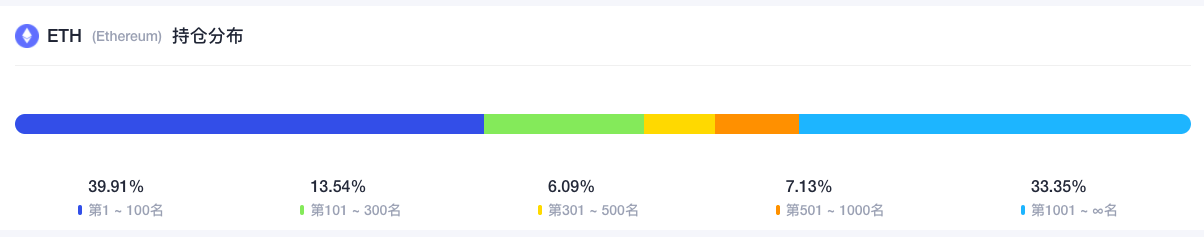

แสดงให้เห็นว่าผู้ถือครอง ETH 300 อันดับแรกในปัจจุบันถือครอง ETH ทั้งหมด 53.45% ลดลง 0.11% เมื่อเทียบเป็นรายเดือน นอกจากนี้ การกระจายตำแหน่งทั้งหมดยังแสดงโครงสร้างรูปวงรีและสัดส่วนของแต่ละส่วนคือ: อันดับที่ 1 ไปที่ 100 คิดเป็น 39.91% ลดลง 0.23% เมื่อเทียบเป็นรายเดือน 101 ถึง 300 คิดเป็น 13.54% เพิ่มขึ้น 0.12% เมื่อเทียบเป็นรายเดือน 301 ถึง 500 คิดเป็น 6.09% ต่อเดือน -เมื่อเทียบเป็นรายเดือน ลดลง 0.03% อันดับที่ 501 ถึง 1,000 คิดเป็น 7.13% ลดลงเมื่อเทียบรายเดือน 0.01% % หลังจากอันดับที่ 1001 คิดเป็น 33.35% เพิ่มขึ้น 0.14% เมื่อเทียบเป็นรายเดือน .

3. นิเวศวิทยาและเทคโนโลยี

1. ความก้าวหน้าทางเทคโนโลยี

(1) V God เผยแพร่แผนงานที่นำไปสู่ "เส้นทางสู่จุดสิ้นสุดของ single slot"

เมื่อวันที่ 25 มกราคม V God ผู้ก่อตั้ง Ethereum ได้เผยแพร่บทความวิสัยทัศน์ "เส้นทางสู่จุดสิ้นสุดของช่องเดียว" วันนี้ บล็อก Ethereum ใช้เวลา 64-95 ช่อง (ประมาณ 15 นาที) เพื่อให้เสร็จสมบูรณ์ซึ่งถือเป็นการเลือกสื่อบนเส้นการกระจายอำนาจ/เวลาปลายทาง/ค่าโสหุ้ยในทุกมิติ บทความกล่าวว่า ไม่ใช่การแลกเปลี่ยนที่ไม่ดี -ปิด: 15 นาทีไม่นานเกินไป และเทียบได้กับเวลายืนยันการแลกเปลี่ยนที่มีอยู่ และช่วยให้ผู้ใช้สามารถรันโหนดบนคอมพิวเตอร์ปกติได้ แม้จะมีขนาดเงินฝาก 32 ETH (เทียบกับ 1500 ETH ก่อนหน้านี้) ในกรณีของ สร้างผู้ตรวจสอบจำนวนมาก อย่างไรก็ตาม มีข้อโต้แย้งที่ดีมากมายสำหรับการลดเวลาสุดท้ายลงเหลือช่องเดียว

การย้ายไปยังการยืนยันช่องเดียวเป็นแผนการทำงานหลายปี และแม้ว่าจะมีการดำเนินการในเร็วๆ นี้พร้อมกับงานพัฒนาจำนวนมาก มันก็จะเป็นหนึ่งในการเปลี่ยนแปลงครั้งใหญ่ที่จะเกิดขึ้นกับ Ethereum ในภายหลัง เป็นเวลานานหลังจาก Proof-of-stake, Sharding และ Verkle ต้นไม้ออกผลเต็มที่ เส้นทางการใช้งานมีดังนี้:

เพิ่มความพยายามในการเพิ่มประสิทธิภาพการรวมการรับรองความถูกต้อง

เห็นด้วยกับพารามิเตอร์ทั่วไป

ค้นคว้า ตกลง และระบุฉันทามติในอุดมคติและกลไกการเลือกทางแยกเพื่อให้ได้ข้อสรุปช่องเดียว

ตกลงในเส้นทางการใช้งานและดำเนินการตามนั้น

ประโยชน์ขั้นสูงสุดจะมีความสำคัญ และเทคโนโลยีสามารถปรับปรุงเมื่อเวลาผ่านไปเพื่อให้ได้ประโยชน์อื่นๆ ที่ไม่ได้อธิบายไว้ที่นี่ (เช่น การใช้ตัวตรวจสอบความถูกต้องจำนวนสูงสุดที่เพิ่มขึ้นเพื่อลดขนาดเงินฝากขั้นต่ำ) ดังนั้นจึงคุ้มค่าที่จะเริ่มต้นการวิจัยและพัฒนาที่เจาะลึกและมุ่งเน้นมากขึ้นเกี่ยวกับความท้าทายทางเทคนิคที่อธิบายไว้ในบทความนี้โดยเร็วที่สุดเท่าที่จะเป็นไปได้

(2) นักพัฒนา: ลูกค้า Ethereum Geth ใกล้จะพร้อมสำหรับการควบรวมกิจการแล้ว

Geth ซึ่งเป็นไคลเอนต์ Ethereum หลักที่ใช้งานเครือข่าย PoW อยู่ในขณะนี้ เกือบจะพร้อมสำหรับการรวมแล้ว Péter Szilágyi ผู้ดูแล Geth กล่าวว่า "แม้ว่าภายนอกอาจยังไม่ชัดเจน แต่ codebase ของ go-ethereum นั้นอยู่ห่างจากความพร้อมสำหรับการควบรวมเพียงขั้นตอนเดียว และ PR เองก็เสร็จสิ้นแล้ว 'เพียงแค่ต้องได้รับการทดสอบ'"

สิ่งนี้คาดว่าจะเกิดขึ้นในเดือนมิถุนายนหรือกรกฎาคมของปีนี้ แต่ผู้พัฒนา eth2 Ben Eddington คิดว่าไทม์ไลน์นั้นก้าวร้าวเกินไป เขาอธิบายว่า: "อาจเป็นไปได้ แต่ไม่มีที่ว่างเพียงพอสำหรับจัดการกับปัญหาที่อาจเกิดขึ้น เราจะเปิดตัวไทม์ไลน์การควบรวมกิจการในอุดมคติภายในกลางเดือนกรกฎาคม แต่เราจะมีแผนฉุกเฉินที่จะชะลอออกไปหากจำเป็น ระเบิดความยากที่สุด สิ่งสำคัญคือการทำให้สิ่งทั้งหมดถูกต้อง "

อย่างไรก็ตาม นี่เป็นความพยายามครั้งใหญ่ เนื่องจากเครือข่ายทั้งหมดจะทำงานบนฉันทามติใหม่ และอัตราเงินเฟ้อของ Ethereum จะลดลงจากประมาณ 4% ต่อปีเป็นน้อยกว่า 1%

2. เสียงของชุมชน

(3) Vitalik เสนอที่จะแนะนำรูปแบบการทำธุรกรรมใหม่ใน hard fork เพื่อปรับปรุงความสามารถในการปรับขนาดของ Rollup และลดค่าธรรมเนียมการทำธุรกรรม

ตาม Vitalik แผนสำหรับ hard fork ล่าสุดอยู่ในระหว่างการพัฒนา และการแนะนำของ "การทำธุรกรรมที่แบกรับหยด" จะช่วยปรับปรุงความสามารถในการปรับขนาดของ Rollup ด้วยการใช้รูปแบบที่จะใช้สำหรับการชาร์ดดิ้งแต่ไม่ใช่การชาร์ดดิ้งธุรกรรมจริง ๆ EIP นี้จะเตรียมการหยุดชั่วคราวจนกว่าจะใช้รูปแบบธุรกรรมสำหรับการชาร์ดดิ้ง ตาม Vitalik ผ่านทาง fork ใหม่นี้ ค่าธรรมเนียมการทำธุรกรรม Ethereum อาจลดลงเหลือหนึ่งในห้าของระดับปัจจุบันภายในสิ้นปี 2565 (เอฟเอ็กซ์สตรีท)

2. เสียงของชุมชน

ในบล็อกโพสต์ V God of Ethereum ได้อธิบายแนวคิดของ NFT ที่ไม่สามารถถ่ายโอนได้ด้วย Soulbounds V God เชื่อว่าขอบเขตวิญญาณช่วยทำให้เกมมีความท้าทายและน่าสนใจมากขึ้น ทำให้แน่ใจว่ามีไอเท็มเฉพาะที่ทรงพลังซึ่งไม่สามารถซื้อได้ด้วยเงิน นอกจากนี้ ไอเทมเหล่านี้จะหาได้หลังจากทำภารกิจยากๆ สำเร็จเท่านั้น ซึ่งจะช่วยเพิ่มความสนุกให้กับเกม ในแง่เดียวกัน เขาเชื่อว่า NFT ที่ไม่สามารถถ่ายโอนได้สามารถเปิดโอกาสใหม่ ๆ และช่วยปรับปรุงประสบการณ์ของ Web 3 ซึ่งเป็นการทำซ้ำใหม่ของอินเทอร์เน็ตที่ขับเคลื่อนโดยเทคโนโลยีบล็อกเชน นอกจากนี้ แม้ว่า NFT ที่ถ่ายโอนได้จะมีตำแหน่งและมีค่าอย่างยิ่งสำหรับการสนับสนุนศิลปินและองค์กรการกุศล แต่ก็ยังมีพื้นที่การออกแบบขนาดใหญ่ที่ยังไม่ได้ใช้สำหรับสิ่งที่ NFT ที่ถ่ายโอนไม่ได้อาจกลายเป็น หมายเหตุ: โซลบาวด์เป็นไอเท็มในเกม MMORPG World of Warcraft ยอดนิยม และไม่สามารถโอนหรือขายได้เมื่อหยิบขึ้นมาแล้ว (ข่าวคริปโต)

3. แนวโน้มของโครงการ

(2) Vitalik Buterin ยืนยันว่าเขากำลังช่วย Dogecoin เปลี่ยนไปใช้เครือข่าย PoS

Vitalik Buterin ผู้ร่วมก่อตั้ง Ethereum ยืนยันในการสัมภาษณ์ล่าสุดกับ UpOnly ว่าเขากำลังช่วย Dogecoin (DOGE) เปลี่ยนไปใช้เครือข่าย PoS Vitalik กล่าวว่า: "เกือบทุกบล็อกเชนที่สำคัญในขณะนี้มีแผนที่จะเปลี่ยนไปใช้ PoS และ Dogecoin ก็ไม่มีข้อยกเว้น" (Finbold)

(3) V God: NFT ไม่ควรแพงเกินไป เราควรใส่ใจกับการทำงานของมัน

Vitalik Buterin กล่าวในการถ่ายทอดสดของชุมชน Ethereum ชาวจีนว่า NFT ไม่ควรแพงเกินไปและควรมุ่งเน้นไปที่ฟังก์ชั่นของมัน

3. แนวโน้มของโครงการ

(1) โปรโตคอลตลาด NFT ZORA ได้เปิดตัวเวอร์ชัน V3 ซึ่งเปิดตัวบน Rinkeby และ Ethereum mainnets

ZORA ซึ่งเป็นโปรโตคอลของตลาด NFT ได้ประกาศเปิดตัวเวอร์ชัน V3 ซึ่งช่วยให้ผู้สร้างได้รับค่าสิทธิและรวมการลงทะเบียนค่าลิขสิทธิ์ ซึ่งหมายความว่าเจ้าของ NFT สามารถกำหนดค่าค่าลิขสิทธิ์ของตนได้บน Zora Marketplace Protocol ZORA V3 เป็นการปรับใช้งานแบบทางเดียว หมายความว่าแม้ว่าแพลตฟอร์มจะล่ม ตลาดจะยังคงทำงานได้ตามปกติ เนื่องจากสมุดคำสั่งซื้อดำเนินการแบบออนไลน์ ไม่ใช่ฐานข้อมูล นอกจากนี้ กลไกค่าก๊าซและเครื่องมือการพัฒนายังได้รับการปรับปรุงให้เหมาะสม ทีมงานกล่าวว่าได้สร้างโครงสร้างความเป็นเจ้าของใหม่ในรูปแบบของ Zora Fee Switch NFTs (ZORFs) ซึ่ง Zora DAO เป็นเจ้าของ ZORA V3 เปิดตัวบน Rinkeby และ Ethereum mainnets นักพัฒนาสามารถใช้มันในเครื่องมือสำหรับนักพัฒนาและผู้ใช้สามารถลงชื่อเข้าใช้เว็บไซต์อย่างเป็นทางการ

(2) ทีมผู้ก่อตั้ง Etherscan ได้เปิดตัวแอปพลิเคชันส่งข้อความโต้ตอบแบบทันที Ethereum รุ่นเบต้า "Blockscan Chat"

Blockscan ซึ่งเป็นทีมผู้สร้าง Etherscan blockchain explorer ได้เปิดตัว Blockscan Chat รุ่นเบต้า ข้อมูลที่เปิดเผยในหน้าแรกของเว็บไซต์แสดงให้เห็นว่า Blockscan Chat เป็นแพลตฟอร์มการส่งข้อความที่ผู้ใช้สามารถส่งข้อความหากันได้อย่างง่ายดายและทันทีผ่านกระเป๋าเงินถึงกระเป๋าเงิน เว็บไซต์อ่าน: "ในการใช้งาน คุณต้องเชื่อมต่อกับกระเป๋าเงิน Ethereum เช่น MetaMask ผู้รับข้อความที่มีที่อยู่ Ethereum จะได้รับแจ้งผ่านทาง block explorer (ข้อความจะไม่ถูกเปิดเผยต่อสาธารณะใน block explorer)"

ผู้ใช้ชุมชนบางคนเรียกเครื่องมืออย่างไม่เป็นทางการว่า "Ethereum Instant Messenger" Ryan Sean Adams จาก Bankless กล่าวว่าผู้ใช้สามารถใช้เครื่องมือนี้เพื่อสื่อสารกับแฮ็กเกอร์ได้ ซึ่งจะเป็นประโยชน์ในสถานการณ์ที่พยายามเจรจาขอคืนเงิน (ถอดรหัส)

(3) Risk Harbor Core V2 เปิดตัวบน Ethereum mainnet

เมื่อวันที่ 26 มกราคม Risk Harbor ซึ่งเป็นตลาดการจัดการความเสี่ยงของ DeFi ประกาศว่า Risk Harbor Core V2 ได้เปิดตัวบน Ethereum mainnet แล้ว

ConsenSys ผู้พัฒนาโครงสร้างพื้นฐาน Ethereum ประกาศการเข้าซื้อกิจการ MyCrypto กระเป๋าเงินเข้ารหัสแบบโอเพ่นซอร์สซึ่งคาดว่าจะรวมเข้ากับกระเป๋าเงิน Ethereum MetaMask เพื่อปรับปรุงความปลอดภัยในการทำธุรกรรมและการใช้งาน จำนวนเฉพาะของการซื้อกิจการยังไม่ได้รับการเปิดเผยต่อสาธารณะ

แพลตฟอร์มจูงใจนักพัฒนา DoraHacks HackerLink ได้เสร็จสิ้นการรวมโมดูลการลงคะแนนความเป็นส่วนตัวของ Dora Factory MACI และเริ่มสนับสนุนการลงคะแนนแบบกำลังสองและรอบการระดมทุนกำลังสองตามการพิสูจน์ที่ไม่มีความรู้

Pixel Vault แพลตฟอร์มการพัฒนา NFT ประกาศเมื่อวันพุธว่าได้เสร็จสิ้นการจัดหาเงินทุน 100 ล้านดอลลาร์ นักลงทุนคือ Velvet Sea Ventures และ 01A การจัดหาเงินทุนรอบนี้จะใช้เพื่อพัฒนาแพลตฟอร์มการพัฒนา NFT แบบหลายแฟรนไชส์ (หลายแฟรนไชส์) ซึ่งช่วยให้ศิลปิน ผู้สร้าง และนักสะสมมีสิทธิ์เป็นเจ้าของเนื้อหาดิจิทัลของ NFT

Pixel Vault ซึ่งเปิดตัวเมื่อเดือนพฤษภาคมปีที่แล้ว มีตัวการ์ตูนจริงและตัวการ์ตูนดิจิทัลจาก CryptoPunks บริษัทมีคอลเลกชัน NFT ซูเปอร์ฮีโร่และวายร้ายจำนวนมาก และหวังว่าจะพัฒนาให้เป็นบริษัทบันเทิงระดับสตูดิโอแบบกระจายอำนาจ นอกจากนี้ยังเป็นผู้สร้างแพลตฟอร์มโซเชียลและเกม MetaHero Universe

โดยเฉพาะอย่างยิ่ง เงินทุนจะสนับสนุนการพัฒนาโครงการโทรทัศน์ ภาพยนตร์ และวิดีโอเกม Pixel Vault กล่าวว่าธุรกรรมในตลาดหลักและตลาดรองมีจำนวนเกือบ 100,000 Ethereum (ประมาณ 286 ล้านดอลลาร์สหรัฐ) (โต๊ะคอยน์)

Pixel Vault แพลตฟอร์มการพัฒนา NFT ประกาศเมื่อวันพุธว่าได้เสร็จสิ้นการจัดหาเงินทุน 100 ล้านดอลลาร์ นักลงทุนคือ Velvet Sea Ventures และ 01A การจัดหาเงินทุนรอบนี้จะใช้เพื่อพัฒนาแพลตฟอร์มการพัฒนา NFT แบบหลายแฟรนไชส์ (หลายแฟรนไชส์) ซึ่งช่วยให้ศิลปิน ผู้สร้าง และนักสะสมมีสิทธิ์เป็นเจ้าของเนื้อหาดิจิทัลของ NFT

4. การยืม

DefipulsePixel Vault ซึ่งเปิดตัวเมื่อเดือนพฤษภาคมปีที่แล้ว มีตัวการ์ตูนจริงและตัวการ์ตูนดิจิทัลจาก CryptoPunks บริษัทมีคอลเลกชัน NFT ซูเปอร์ฮีโร่และวายร้ายจำนวนมาก และหวังว่าจะพัฒนาให้เป็นบริษัทบันเทิงระดับสตูดิโอแบบกระจายอำนาจ นอกจากนี้ยังเป็นผู้สร้างแพลตฟอร์มโซเชียลและเกม MetaHero Universe

4. การยืม

5. การขุด

(ข้อมูลจาก etherchain.org)

etherchain.orgจากมุมมองของแต่ละโปรเจกต์ ค่า Lock-up 3 อันดับแรก ได้แก่ Maker 16.89 พันล้านดอลลาร์ Curve 11.45 พันล้านดอลลาร์ Aave 10.43 พันล้านดอลลาร์

4. ข่าว

คำอธิบายภาพ

(ข้อมูลจาก etherchain.org)

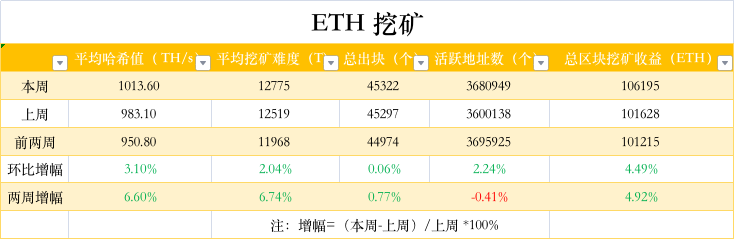

ข้อมูลแสดงให้เห็นว่าสัปดาห์ที่แล้ว พลังการประมวลผลเฉลี่ยเพิ่มขึ้น 3.1% ต่อเดือน รายงานชั่วคราวที่ 1013TH/s ความยากในการขุดโดยเฉลี่ยเพิ่มขึ้น 2% ต่อเดือน รายงานชั่วคราว 12775T กิจกรรมบนห่วงโซ่ ลดลง 2.2% เมื่อเทียบเป็นรายเดือน และรายได้จากการขุดทั้งหมดเพิ่มขึ้น 5% เมื่อเทียบเป็นรายเดือน

4. ข่าว

(1) ข้อมูล: ปริมาณการซื้อขายรายเดือนของ NFT แตะระดับสูงสุดใหม่ที่ 6 พันล้านดอลลาร์สหรัฐในเดือนมกราคม

ในเดือนมกราคม ปริมาณธุรกรรม NFT สูงถึง 6.13 พันล้านดอลลาร์สหรัฐ ซึ่งสูงเป็นประวัติการณ์ เมื่อเทียบกับเดือนธันวาคม ปริมาณธุรกรรม NFT ในเดือนมกราคมเพิ่มขึ้น 129% ส่วนใหญ่เป็นเพราะ LookRare สะสมปริมาณธุรกรรมเกือบ 2 พันล้านดอลลาร์นับตั้งแต่เปิดตัวเมื่อวันที่ 10 มกราคม นอกจากนี้ นอกเหนือจาก NFT ที่ใช้ Ethereum แล้ว NFT ที่ใช้ Solana ยังทำยอดขายรวมทะลุ 1 พันล้านดอลลาร์ในเดือนมกราคมอีกด้วย (เดอะบล็อค)

เมื่อวันที่ 3 กุมภาพันธ์ Wormhole โปรโตคอลข้ามเชนถูกแฮ็ก และสูญเสียมูลค่า 120,000 wETH (ประมาณ 320 ล้านดอลลาร์สหรัฐ) การแฮ็กเกิดขึ้นเมื่อเวลา 18:24 น. UTC ของวันที่ 2 กุมภาพันธ์ ผู้โจมตีสร้างมูลค่า 120,000 wETH (WETH) บน Solana จากนั้นแลกเปลี่ยน 93,750 wETH เป็น 254 ล้านดอลลาร์เมื่อเวลา 18:28 น. UTC ETH ไปยังเครือข่าย Ethereum

ข่าวก่อนหน้า เมื่อวันที่ 17 พฤศจิกายน 2021 ConsenSys บริษัทเทคโนโลยีบล็อกเชนในนิวยอร์กเสร็จสิ้นการระดมทุน 200 ล้านดอลลาร์ โดยมีส่วนร่วมจาก HSBC, Animoca Brands, Dragonfly Capital, Coinbase Ventures, Marshall Wace, IOSG Ventures และ Third Point กองทุนเฮดจ์ฟันด์ของอเมริกา การประเมินมูลค่าของ ConsenSys สูงถึง 3.2 พันล้านเหรียญสหรัฐ

(3) OpenSea คืนเงิน 1.8 ล้านดอลลาร์ใน Ethereum ให้กับผู้ใช้ที่สูญเสีย NFT เนื่องจากข้อบกพร่อง "รายชื่อที่ไม่ใช้งาน"

OpenSea ได้ชำระคืน 750 Ethereum หรือประมาณ 1.8 ล้านดอลลาร์ ให้กับผู้ใช้ที่ขาย NFT โดยไม่ตั้งใจในราคาที่ต่ำกว่าราคาตลาดอย่างมาก เนื่องจากข้อผิดพลาดที่เกี่ยวข้องกับ "รายการที่ไม่ใช้งาน" (ถอดรหัส) ตามข่าวก่อนหน้านี้ OpenSea ล้มเหลวในการแก้ปัญหา ส่งผลให้ NFT ราคาแพงถูกขายในราคาต่ำ