This article sorts out the IDO platforms on the Solana chain: Solanium, Raydium AcceleRaytor, Solstarter

Solana is a popular public chain, and its ecology is developing rapidly. As more and more projects choose to issue tokens through IDO this year, a number of IDO platform projects have emerged on Solana. This article will start with the mechanism and sort out Solana IDO platform on the chain.

Solanium

"Determine the distribution amount based on the pledge amount and pledge time of the platform tokens"

image description

Source: https://solanium.medium.com/

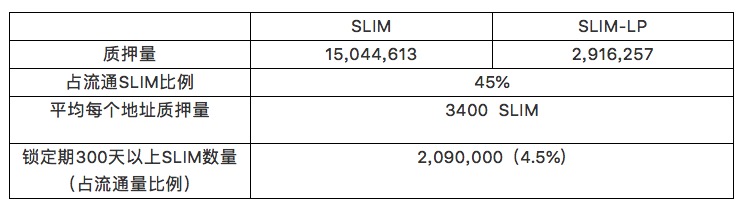

Under Solanium’s locking time reference mechanism, the number of xSLIMs that participants can obtain will be proportional to the locking time. The longest locking time is 365 days, that is, 100 SLIMs are locked for 100 days, and 100*100/365=27.4xSLIM can be obtained. At present, the number one user of xSLIM holdings is SkyVision. After querying, it can be found that this is a professional institution engaged in blockchain investment and one of the investors of Solanium. The number of xSLIM held by SkyVision is about 580,000, and the lock-up period is as long as one year.

image description

Source: https://www.solanium.io/

In order to encourage participants to provide liquidity on Raydium, the agreement gives 2.5 times the number of xSLIM to traders who provide liquidity in the SLIM/SOL fund pool on Raydium. At the same time, 2.5% of the funds raised by the project will also be airdropped to xSLIM holders, and SolaniumTreasury will draw a certain percentage of fees from the project side. Users who have reached Tier4 and Tier5 will be guaranteed to be allocated a certain percentage of the issued tokens.

As the core function of Solanium, the protocol has certain standards for the screening of projects: the project will be comprehensively judged based on the quality of the project and the team, the token economy, the current market situation, the size of the project community, the degree of marketization, etc. Conduct IDO on the platform.

During the entire sale process, the price and total amount of tokens are always fixed. Although such a mechanism can prevent the occurrence of front-running, it lacks an effective price discovery mechanism. In addition, in order to obtain a higher probability of winning the lottery, participants need to pledge to the agreement More platform tokens will virtually increase the cost of participants.

At present, the IDO issuance of 2 projects has been completed on the platform:

Yield aggregator CropperFinance aims to enable users on Solana to conveniently and quickly carry out income farming of different tokens. The project completed token issuance on Solanium on August 23 at a price of 0.05 USDC, with a total issuance of 4,000,000 CRP. As of At present, the highest return on investment (ROI ATH) reaches 29 times.

Port Finance, a money market project, provides users with a series of fixed-income products including floating-rate loans, fixed-rate loans, and interest rate swaps. It has completed token issuance on Solanium on August 9, with an issue price of 0.4 USDC. A total of 400,000 PORT has been issued. Up to now, the highest investment income has reached 21.1 times.

first level title

Raydium AcceleRaytor

"Pledge platform tokens in advance to meet the quantity and time requirements, and distribute tokens accordingly"

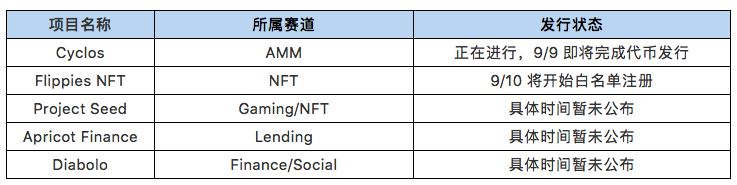

Raydium AcceleRaytor is an IDO platform owned by Raydium, an automated market maker. The platform has successfully completed 7 IDO projects, including the recently popular chain game StarAtlas, which also chose to conduct IDO on Raydium.

In terms of mechanism, Raydium AcceleRaytor is similar to Solanium, and also divides the fund pool into Ray Pool and Community Pool. The Community Pool can be set according to the requirements of the project party, allowing participants to participate in the issuance of IDOs by completing the requirements of the project party, such as social platform interaction, without pledging platform tokens.

The rules of the pledge pool Ray Pool are relatively more complicated. Participants need to pledge the platform token Ray before the specified deadline to meet the quantity and time requirements (7 days, 30 days). The platform will record qualified participants through snapshots, and then distribute the lottery tickets accordingly. Participants must Deposit a certain amount of purchase funds (USDC, such as 100 USDC for a lottery ticket) to the fund pool within the specified time. If the participant gets 5 lottery tickets, he can deposit up to 500USDC, or less than this amount, but the deposit amount is not enough The requested lottery tickets will not be added to the lottery pool for lottery. If only 400USDC is deposited, only 4 lottery tickets can participate in the lottery).

According to the official introduction, in addition to the lottery model, the IDO issuance model also has distribution models according to the ratio of deposited funds to the total fund pool, and first-come-first-served, and the fundraising ends after reaching the number. Currently, most IDO projects on the platform adopt mode of drawing lots.

For IDO projects, Raydium Acceleraytor will conduct a certain screening. First, the project party needs to have formed products to ensure that the tokens sold can be applied in a short period of time. Secondly, it will conduct due diligence on the project party and pay more attention to the project party. team situation. In addition, the economic model of the token is also the focus of screening. At present, 7 projects have completed token issuance on the platform:

first level title

Solstarter

"Issuing in rounds, distributed sequentially according to the number of pledged tokens"

According to the official introduction, Solstarter divides the IDO process into three rounds. The price and quantity of the token sale are determined by the project party and remain fixed during the sale process. Solstarter will divide participants into 4 levels according to the number of staked platform tokens (SOS). In the first round, tokens will be distributed proportionally among participants who meet the pledge requirements, and the unsold tokens will enter the second round on a first-come, first-served basis, starting with the highest-ranked participants, each Participants of each level have 8 hours to apply for purchase, and proceed sequentially. After the second round, if there are unsold tokens, it will be open to all investors (including users who have not staked platform tokens).

Compared with the lottery mode adopted by Solanium and Raydium, under the mechanism of Solstarter, the issuance of tokens is further tilted towards pledge users. Users with larger pledges will get more tokens, while participants who do not pledge platform tokens , IDO may have ended before the third round.

image description

Source: https://solstarter.org/files/solstarter-whitepaper.pdf

The characteristics of the IDO platform in the Solana ecosystem are summarized as follows:

Solana is a popular high-performance public chain emerging this year, and the project ecology is developing rapidly. Although the current mechanism of the IDO platform in the ecology is relatively single and conservative, with the rapid development of the ecology, various new issuance mechanisms will continue to emerge to promote encryption. The community is developing in an open, transparent and fair direction.

This article is from IDEG, reproduced with authorization.