오데일리 프론트라인 | 전염병 아래 암호화된 전장에서 중소기업은 생존을 위해 필사적으로 자금을 조달한다

이 기사는The Block, 원작자: Celia Wan

오데일리 번역기 |

오데일리 번역기 |

세계적인 유행병은 초기 단계의 암호화 회사에 불균형적으로 영향을 미치는 상황인 벤처 캐피털 자금의 신생 기업으로의 흐름을 동결했습니다.

암호화폐 스타트업 옐로우카드(Yellow Card)의 크리스 모리스(Chris Maurice) CEO는 "지난주 반 동안 실사 막바지 단계에서 우리에게 말을 걸었던 3명의 VC가 펀딩에서 손을 뗐다. 그들은 이것이 당신의 이유는 아니지만, 시장 상황을 감안할 때 그들은 앞으로 6개월 동안 자금을 투입하지 않을 것입니다."

크런치베이스(Crunchbase) 데이터에 따르면 신종 코로나바이러스의 영향이 아직 완전히 느껴지지 않았지만 2020년 전 세계적으로 보고된 자금 조달 건수는 작년 같은 기간에 비해 거의 절반으로 줄었습니다.

암호 화폐 공간도 어려움을 겪고 있습니다. 피치북 데이터에 따르면 올해 초부터 총 125건의 블록체인 및 암호화폐 스타트업 파이낸싱 거래가 보고돼 2019년(326건)과 2018년(363건) 데이터의 절반에도 미치지 못한다. 어느 정도까지 암호화 공간은 벤처 캐피탈 투자 속도의 둔화에 특히 민감합니다. 왜냐하면 대부분의 암호화 스타트업은 아직 초기 단계에 있으며 운영을 유지하기 위해 1~2년 전의 소량의 벤처 캐피탈 자금에 의존하기 때문입니다.

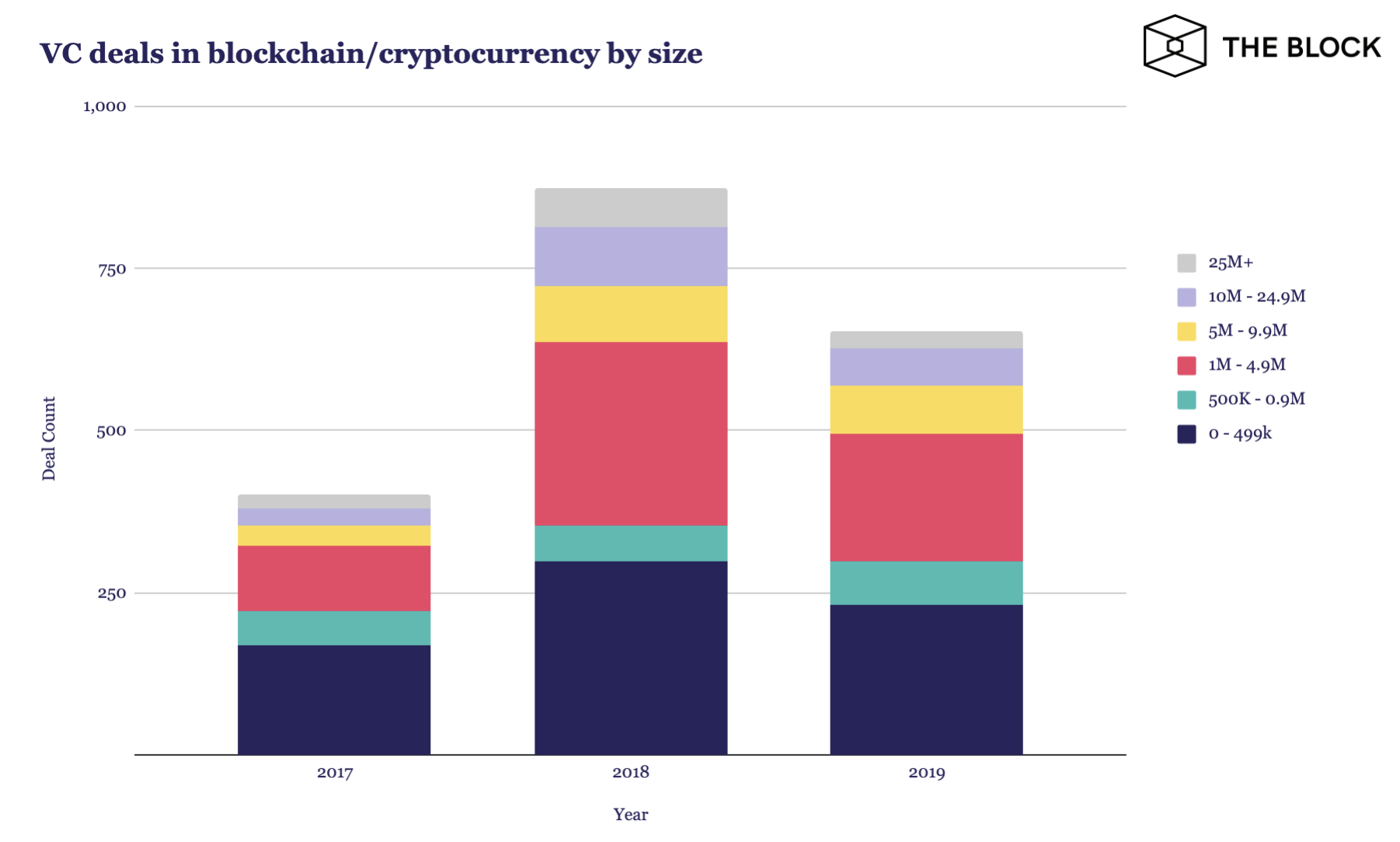

피치북 데이터에 따르면 2017년부터 2019년까지 공공재정 규모의 약 87.7%가 500만 달러 미만이었으며, 2018년과 2019년에는 후속 자금 조달 없이 많은 거래가 성사됐다.

현재 일부 암호화 신생 기업은 대부분의 자금을 소진했습니다. 따라서 이러한 기업은 새로운 자금을 보충하거나 파산 및 폐쇄의 위험에 직면해야 합니다.

실제로 2020년 첫 3개월 동안 일부 기업이 자금 조달을 완료했거나 일부 기업이 추가 자금을 조달하기를 희망한다는 소식이 쌓였습니다. 이러한 거래는 Bakkt의 3억 달러 시리즈 B 라운드에서 Amber의 2,800만 달러 시리즈 A 라운드, 일부 초기 단계 회사의 수십만 달러 소액 수표에 이르기까지 다양합니다.

동시에 일부 회사(프로젝트)도 문을 닫을 수밖에 없었고(Sparkswap 및 Paradigm Labs) "자금 부족 또는 사용자 견인력 부족"이 이러한 회사의 실패의 주요 원인이었습니다.

Outlier Ventures의 창립자이자 CEO인 Jamie Burke는 "지난해 말 기준으로 주로 유럽(심지어 미국)에서 암호화폐 관련 분야에 집중하는 VC의 수가 크게 감소했습니다."라고 지적했습니다.

"이것은 이미 고군분투하고 있는 암호 산업에 그림자를 드리우는 검은 백조의 축소판입니다."

첫 번째 희생자는 누구입니까?DeFi입니까?

암호화 공간에서 어떤 산업이 가장 큰 타격을 받을 것 같습니까? DeFi가 VC 자금 동결의 첫 번째 희생자 중 하나일 수 있다는 징후가 있습니다. 초기 생태계로서 DeFi는 아직 실험 단계에 있습니다.

DeFi 프로젝트는 일반적으로 탈중앙화와 수익 창출 간의 균형 잡힌 관계를 달성하기 위해 노력하기 때문에 수익성에 대한 명확한 경로가 부족합니다. 사용자 유치에 실패한 프로젝트는 팬데믹이 발생하기 오래 전에 투자자들의 관심을 잃었습니다.

Paradigm Labs는 이달 초 폐쇄를 발표했습니다. 창립자 Liam Kovatch는 2018년 성공적인 시드 라운드 이후 회사가 끊임없이 변화하는 탈중앙화 거래소(DEX) 환경에 적합한 제품 시장을 찾지 못해 강제로 문을 닫았다고 말했습니다. .

최근 인터뷰에서 판테라 캐피털의 폴 베라디타킷 부사장은 벤처캐피탈이 투자 대상에 대해 더 까다로워짐에 따라 DeFi 프로젝트에 대한 자금 조달이 느려질 수 있다고 경고했습니다.

Fenbushi Capital의 상무이사인 Peter Yang은 The Block과의 인터뷰에서 "많은 DeFi 프로젝트는 사용자가 많지 않거나 수익을 내기 어렵습니다. 우리는 이를 변형하거나 수입을 가져올 수 있다”며 “여러 팀이 이에 대해 컨설팅을 하고 있다”고 말했다.

그러나 모든 DeFi 프로젝트가 벨트를 조이는 것은 아니며 대차 대조표가 더 나은 일부 프로젝트도 시장에서 "사냥"할 기회를 잡을 수 있습니다.

Zion은 Placeholder, Blockchain.com Ventures 및 Gnosis를 포함한 투자자들과 함께 지난 12월 200만 달러의 새로운 자금 조달 라운드를 마감했습니다. 이 프로젝트는 최근 유사한 서비스를 제공하는 MyDeFi를 인수했습니다.

Zerion의 CEO인 Evgeny Yurtaev는 "우리는 현재 자금이 풍부하고 투자를 위한 현금을 보유하고 있습니다... 그래서 우리는 더 기회주의적일 수 있습니다. DeFi를 보고 이 분야에 많은 투자를 하는 사람들은 관심을 잃지 않았습니다. - 기간 유입이 감소할 가능성이 있습니다."

새로운 이야기

일부 신생 기업은 어려운 시기를 견디기 위해 자금 조달 협상에서 더 적은 자금 조달과 더 낮은 가치 평가를 받아들였습니다. 동시에 다른 회사들은 장기적인 생존에 대해 걱정하고 있습니다. 즉, 제품을 팬데믹 이후 세계에 어떻게 적응시킬 것인지에 대해 걱정하고 있으며, 이는 다른 내러티브와 투자자 관심의 변화로 이어질 수 있습니다.

현재 이더리움 기반 쿠폰 교환 플랫폼인 Redeemeum을 운영하고 있는 Justin Banon은 "우리가 투자자들과 나누는 대화 중 일부는 큰 변화가 있을 때 수익을 낼 수 있다는 것입니다. 느리게 움직이는 사업이 아닙니다."라고 말했습니다. 시장에서는 [전염병이 끝난 후] 많은 억눌린 수요가 풀리는 것을 보게 될 것입니다. 그것이 우리 시장에서 변화하고 있는 것이며 우리는 가속화하고 현재 상황에서 벗어나기를 희망합니다."

Evgeny Yurtaev(Zerion CEO)는 비트코인의 가격이 다른 자산 등급과 함께 하락하고 일부 잠재적인 투자 관심을 몰아냈기 때문에 암호화폐 신생 기업은 팬데믹 이후 시장에 적합한 이야기를 시급히 만들어야 한다고 말했습니다.

"우리(DeFi 프로젝트)의 경우 암호화폐가 많은 사람들이 희망하는 것처럼 상관관계가 없는 자산으로 입증되지 않았기 때문에 미래의 자금 조달은 확실히 더 복잡해질 것입니다. 아마도 더 많은 돈이 이러한 자산에 들어가는 것을 고려하기 시작할 다른 많은 회사가 있을 것입니다. 디파이.”

여전히 희망

일부 투자 기관은 시장 혼란 중에 낮은 프로필을 유지하기로 선택하지만 시장에는 여전히 많은 "급진적"이 있습니다.

투자자와 설립자 사이에서 회람되는 오픈 소스 전자 문서에는 Accel, Index Ventures, Kindred Capital 및 Techstars를 포함하여 여전히 프레젠테이션을 수락하는 250개 이상의 VC가 나열되어 있습니다. 목록에 있는 대부분의 기관은 여전히 초기 단계의 신생 기업에 대한 투자를 고려하고 있다고 말했습니다. VC는 최근 투자가 지난 금요일이라고 밝혔다.

The Block의 뉴스 디렉터인 Frank Chapparo는 a16z 및 Polychain Capital과 같은 암호화 분야의 VC 그룹이 최근 자금 조달을 완료했거나 많은 현금을 보유하고 있다고 지적했습니다. 이들 기관은 시장 침체가 스타트업 가치를 떨어뜨리는 상황에서 탄약을 사용할 준비가 되어 있습니다.

그러나 벤처 캐피탈 거래, 인수 합병, 심지어 회사 폐쇄까지 모두 결론에 도달하는 데 오랜 시간이 걸리며 단기간에 대중의 눈에 띄지 않을 수 있습니다. 실제로 최근 공개된 거래 중 일부는 팬데믹과 그에 따른 시장 침체 이전에 실제로 발생했습니다. 따라서 지금 우리가 보고 있는 것은 여전히 빙산의 일각에 불과할 수 있습니다.

제이미 버크(Outlier Ventures 설립자)는 많은 스타트업이 "다음 분기에도 손익분기점을 넘기고 6개월 이내에 수익을 낼 것"이라고 말했다.