Data Modeling: How to Improve the Quality of Polymarket Interactions?

- Core Viewpoint: Based on historical airdrop patterns and on-chain data analysis, the article speculates that a potential Polymarket airdrop will adopt a multi-dimensional weighted model. It points out that currently accumulating liquidity provider (LP) rewards is a more capital-efficient interaction strategy.

- Key Elements:

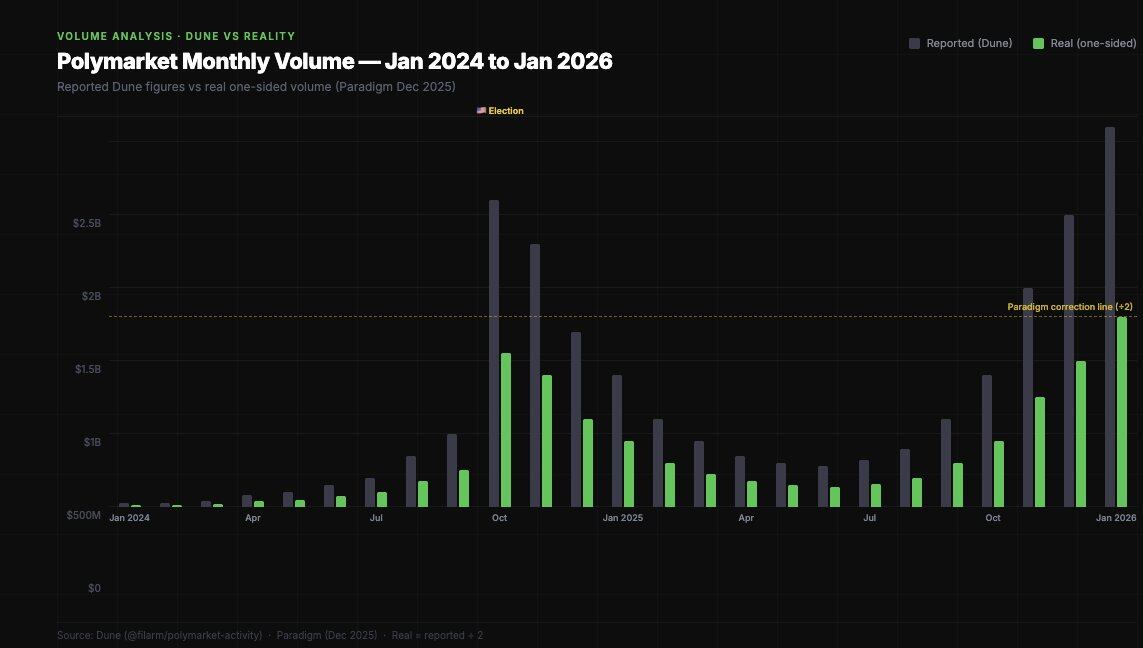

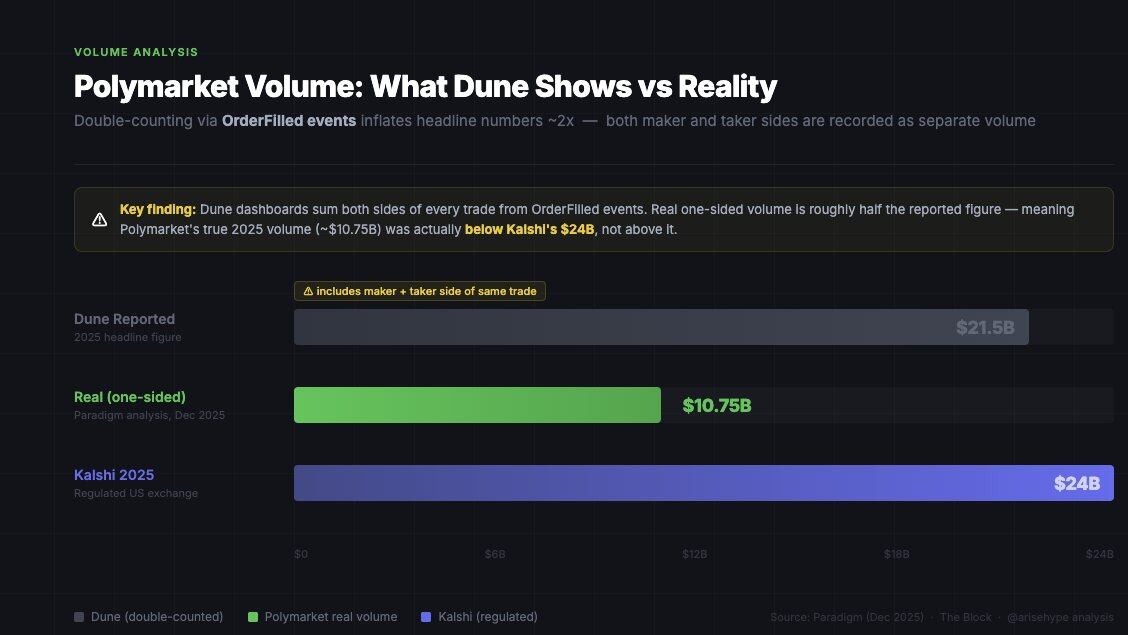

- Data Correction: Polymarket's real trading volume is approximately half of what mainstream data dashboards show. Airdrop modeling requires using one-sided volume data.

- User Distribution: Only 21% of traders have ever earned LP rewards. This behavior is severely underestimated and may carry higher weight in the airdrop model.

- Historical Patterns: Major DeFi airdrops generally reward active participation rather than profitability. They employ multi-dimensional criteria like tiered levels and reward caps to limit whales and Sybil attacks.

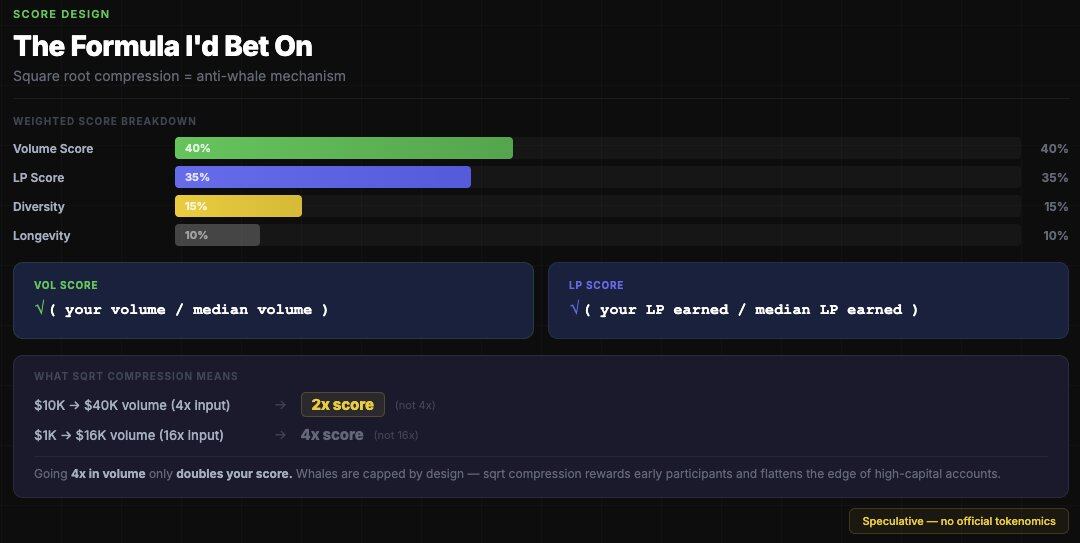

- Model Speculation: The predicted airdrop formula might be weighted as: trading volume (40%, square root compression), LP rewards (35%), market diversity (15%), and activity duration (10%), with a cap on rewards per address.

- Current Strategy: It is recommended that users provide liquidity in high-volume markets to accumulate LP rewards. In trading, focus on market diversity, maintain moderate positions, and avoid wash trading to simulate genuine participation.

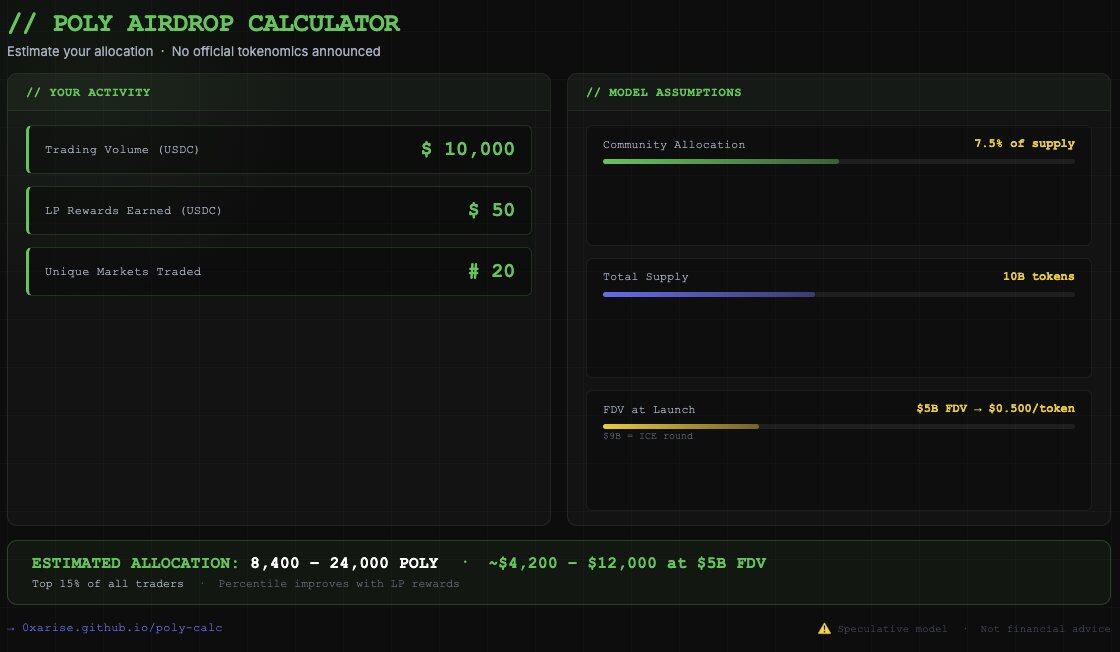

- Potential Scale: Estimated with a $9 billion FDV, the total value of the community airdrop could reach $450 million to $900 million. Capturing even a tiny fraction of this would be significant.

Source:arise

Compiled by|Odaily(@OdailyChina);Translator|Azuma(@azuma_eth)

The core message of this article is singular — how to prepare for what could be the largest airdrop in the prediction market sector.

The Data Issue That Must Be Stated

Before building any model, we need real, reliable data. Polymarket's trading volume data has been widely misreported.

In December 2025, Paradigm published a key research finding: most Polymarket data dashboards calculate volume by summing all "OrderFilled" events. However, this event is triggered on both the maker and taker sides of the same trade, leading to double-counting. The real volume is roughly half of what the dashboards show.

Dashboard Volume vs. Single-Sided Volume — the latter is the number that truly matters for airdrop modeling.

This is crucial for airdrop modeling. If Polymarket uses volume as a metric, they will only use their internal data, not the various statistics on Dune. Your actual volume "score" is likely only half of what tools like Polycool display.

User Distribution

The most important dataset for airdrop speculation comes from research by the IMDEA Networks Institute, covering over 86 million trades (April 2024 – April 2025).

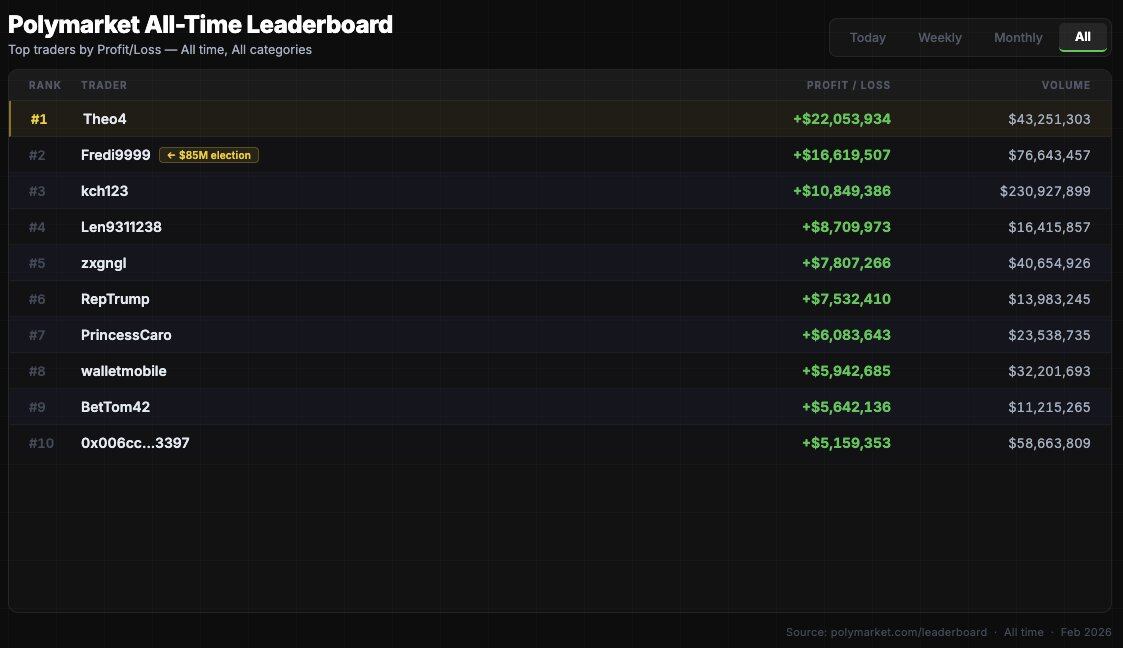

- Only 0.51% of addresses achieved profits exceeding $1,000;

- Only 1.74% of addresses (estimated) had trading volumes over $50,000;

- The top 3 arbitrage addresses alone extracted $4.2 million in "risk-free profits";

- The most elite traders profited over $10 million.

The stratification is even more pronounced regarding LP rewards.

79% of traders have never earned even $1 in LP rewards — this is currently the most overlooked interaction. Among 314,000 traders, only 66,567 wallets have ever received LP rewards. This means only 21% of traders have ever provided liquidity. This reward mechanism is significantly underutilized relative to overall participation.

Lower usage is generally seen as a signal of being "undervalued" in airdrop models.

Airdrop Precedents: What Does History Tell Us?

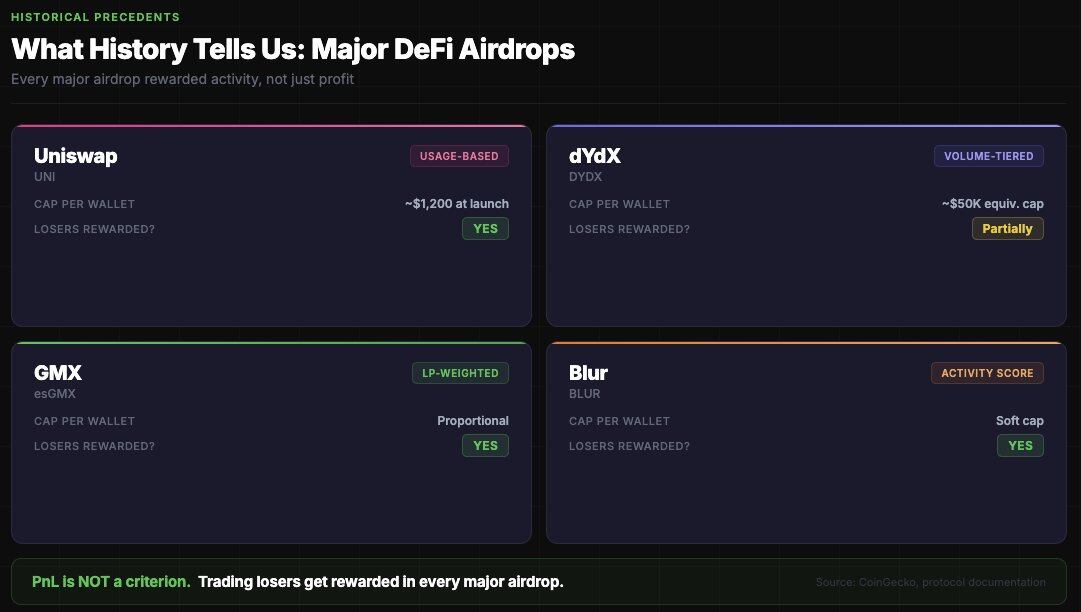

All major DeFi airdrops reward "active behavior," not "profitability." Polymarket will likely follow the same logic.

Commonalities across all large-scale airdrops include:

- Pure equal distribution is abused by Sybil attacks (Polymarket certainly won't distribute equally);

- Pure distribution based on volume leads to airdrops being overly concentrated among whales (PR risk + SEC risk);

- Optimal strategy: tiered hierarchy + reward caps + multiple dimensions (volume + LP + diversity + active duration);

- In all major airdrops, losers are also rewarded — Profit and Loss (PnL) is not a criterion.

The last point is crucial: if you traded $100,000 and lost $20,000, you are more likely to be rewarded than someone who traded $1,000 and made $500. Platforms don't want to incentivize only profitable trades — that more easily filters for insiders.

Thinking in Reverse: How to Limit Whales?

Some airdrop calculators on the market use the simplest volume ratio model: Airdrop share = (Individual volume / Total volume) × Airdrop allocation.

This is wrong because mainstream airdrops consistently use a "diminishing returns curve."

The model I'm more inclined to bet on is that Polymarket will use square root compression to limit whale airdrop size — for example, a 4x increase in volume only yields a 2x increase in score. This would completely change the airdrop outcome for the whale demographic.

So how much would top wallets get? Assuming a total POLY supply of 10 billion, with 7.5% allocated for community airdrop (750 million POLY), and an FDV at TGE of $3–9 billion.

Without a per-address airdrop cap, a volume of $85 million (using top trader fredi999 as an example) could yield about 3–5 million POLY according to the model. At a $9 billion FDV, that's equivalent to $3–4.5 million. Theoretically possible, but terrible for PR.

A more realistic scenario involves a per-address airdrop cap, perhaps 500,000–2 million POLY. At a $5 billion FDV, top addresses could receive about $450,000–$1 million.

"LP" vs. "Volume": Where is the Opportunity Now?

If starting to interact with Polymarket in February 2026 with a $5,000 principal, mathematically, deploying as an LP is more favorable for new participants.

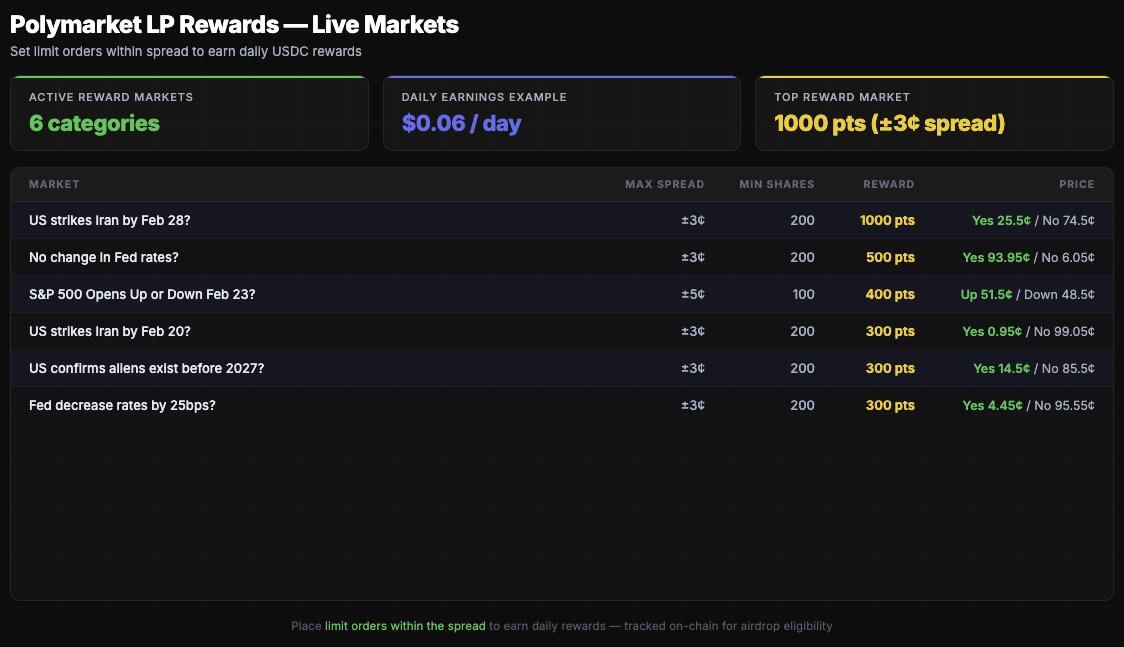

- To earn $49 in LP rewards (top 10%), you need to consistently place limit orders in high-reward markets. This is achievable in 30–60 days with $500–$1,000 capital.

- To earn $1,563 in LP rewards (top 1%) requires higher capital or sustained high-frequency participation.

As for volume, you need to accumulate genuine volume without wash trading:

- Trade in 5+ different market categories (Politics, Crypto, Sports, Science, Culture);

- Hold positions for at least 1–24 hours before closing;

- Avoid wash trading the same market across different addresses;

- Accept moderate losses — proof of "genuine participation";

- Aim for markets with volume > $500,000 (Polymarket might filter out micro-markets);

- Single bet size: $50–$500.

Airdrop Model Speculation

The airdrop will not be as most people expect.

Most airdrop speculation is based on the simplest volume-weighted distribution, but Polymarket will be smarter and more interesting. They have on-chain LP data, which is clean, verifiable, and all denominated in USD. They have volume data that can filter out Sybil patterns. They have wallet age, market diversity, and geographic distribution data.

This is my model — Polymarket hasn't confirmed anything, so this is just my speculation.

- Volume weight: 40% — Will use a square root compression formula, with a minimum threshold around $500;

- LP reward weight: 35% — On-chain verifiable, Sybil-resistant;

- Market diversity weight: 15% — Number of unique markets participated in;

- Active duration weight: 10% — Number of active months before the snapshot.

Additionally, Polymarket will likely cap rewards per address (perhaps $500,000), otherwise the top 50 addresses would take too large a share, damaging the community narrative. Losers will receive the same reward as profitable traders with equivalent volume; profitability is not a criterion — this cannot be philosophically justified and creates perverse incentives.

79% of traders have never earned $1 in LP rewards. If LP weight constitutes 35% of the airdrop formula, the most capital-efficient action right now is to place limit orders in high-volume markets and start accumulating on-chain, trackable proof of contribution.

In short, the POLY airdrop could become the largest in prediction market history. At a $9 billion FDV, the total value of the community airdrop could reach $450–900 million. Even capturing just 0.1% of that is $450,000. That's why optimizing your LP data now is more important than most people realize.