Vitalik Endorses Algorithmic Stablecoins, Is the True Soul of DeFi Embarking on a Revival Path?

- Core Viewpoint: Vitalik Buterin's proposition that algorithmic stablecoins are the core of "true DeFi" has sparked in-depth discussions on stablecoin risk structures, governance models, and breaking free from dollar dependency. Existing market projects face multiple challenges in implementing his vision, including compliance, capital efficiency, and user adoption.

- Key Elements:

- Vitalik defines two models of "true DeFi" algorithmic stablecoins: one is purely over-collateralized by native assets like ETH, and the other is over-collateralized by highly diversified RWAs. The core lies in decoupling from centralized risks.

- He advocates that stablecoins should gradually move away from pegging to a single fiat currency (especially the US dollar) and iterate towards "purchasing power stability" based on diversified indices, to hedge against sovereign currency devaluation risks.

- MakerDAO's transformation into Sky Protocol and the launch of USDS, while achieving RWA diversification, has nearly 60% of its reserves in USDC and introduces asset freezing functionality, sparking controversy about deviating from DeFi's censorship-resistant principles.

- Liquity and its stablecoins LUSD/BOLD adhere to an ETH standard and minimal governance. V2 enhances capital efficiency and sustainability through user-set interest rates, support for liquid staking tokens, and leverage loops.

- Reflexer's RAI does not peg to fiat, employing a PID algorithm to pursue low price volatility. However, its negative interest rate mechanism and complex model lead to user comprehension barriers and liquidity scarcity, limiting its development.

- Projects like Nuon, known as "parity coins," attempt to peg to cost-of-living indices to achieve purchasing power stability, offering new options for high-inflation regions. However, they are highly reliant on oracle data, posing risks of manipulation and technical implementation.

- Algorithmic stablecoins as a whole still face constraints such as capital efficiency, insufficient liquidity, and user experience. Nevertheless, the decentralized, censorship-resistant ideals they represent are seen as a key direction for DeFi's development.

Original Author: Jae, PANews

What should "true DeFi" look like? When Ethereum co-founder Vitalik Buterin cast his vote for algorithmic stablecoins, a reflection on risk, governance, and monetary sovereignty was reignited.

A single tweet is enough to shake a narrative worth hundreds of billions of dollars.

On February 9th, Vitalik Buterin posted a tweet expressing a resounding viewpoint: algorithmic stablecoins are the "true DeFi."

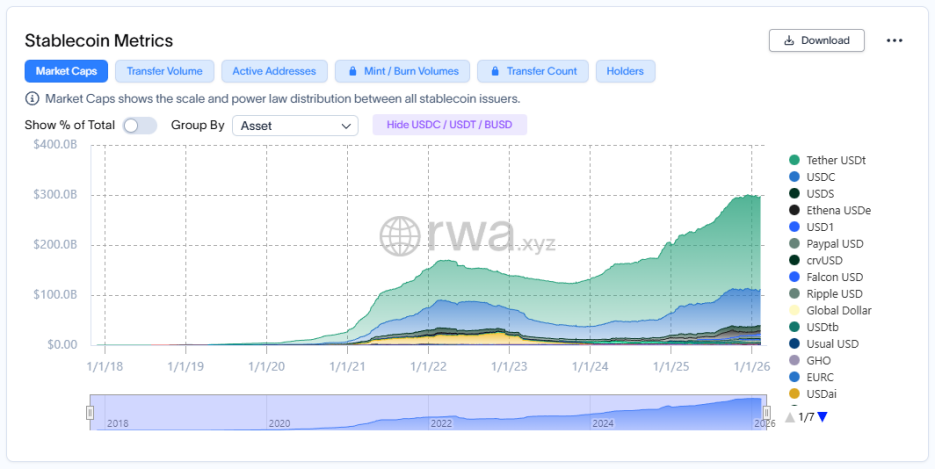

This is not a minor technical adjustment suggestion for the current stablecoin landscape, but rather an authoritative validation of the underlying logic of DeFi. At a time when centralized stablecoins like USDT and USDC dominate the market, Vitalik's statement is like a depth charge, bringing the long-dormant algorithmic stablecoin track back into the spotlight.

Stablecoin Risk Decoupling and De-Dollarization Define the "True DeFi" Standard

Vitalik's definition of "true DeFi" is built upon the decoupling of risk structures. He categorizes algorithmic stablecoins into two models.

First, purely native asset collateralization. The protocol uses ETH and its derivative assets as collateral. Even if 99% of the system's liquidity comes from CDP (Collateralized Debt Position) holders, its essence is transferring the counterparty risk on the dollar side to market participants and market makers.

This means there are no bank accounts that can be frozen, and no centralized institutions that can suddenly collapse.

Second, highly diversified RWA (Real World Asset) collateralization. Even if the protocol introduces RWAs, as long as it hedges the risk of a single asset failing through asset diversification and over-collateralization, it can be seen as a significant optimization of the risk structure.

If an algorithmic stablecoin can guarantee that no single RWA exceeds the system's over-collateralization ratio, then even if one asset defaults, the principal of stablecoin holders remains safe.

A more forward-looking view is that Vitalik advocates for stablecoins to gradually break free from their peg to the US dollar. Given the long-term devaluation risks sovereign currencies may face, stablecoins should gradually iterate towards more universal, index-based units of account to reduce dependence on any single fiat currency, especially the US dollar.

This also signifies an evolution in the connotation of stablecoins, for example, from "price stability" to "purchasing power stability."

In response to Vitalik's definition of algorithmic stablecoins, PANews has identified projects in the market that best fit these standards, but they generally face challenges in user acquisition, which might be why Vitalik is once again championing such projects.

USDS: "The Dragon-Slayer Becomes the Dragon," Mainstream Expansion Sparks Controversy

After Vitalik's tweet, the price of MKR, the protocol token of the first-generation algorithmic stablecoin leader MakerDAO, surged by up to 18%.

Interestingly, the price of its post-transformation SKY token remained relatively stable. This divergence itself expresses a market sentiment.

As one of the most representative protocols in DeFi history, MakerDAO officially rebranded as Sky Protocol in August 2024 and launched the new-generation stablecoin USDS, completing its "Endgame" transformation.

USDS is positioned as an upgraded version of DAI and is Sky's flagship product. As of February 12th, USDS has rapidly grown to become the third-largest stablecoin in the entire crypto market, with a market cap exceeding $10 billion.

On the surface, this is a successful evolution for a DeFi giant. On a deeper level, it is a costly "coming-of-age ceremony."

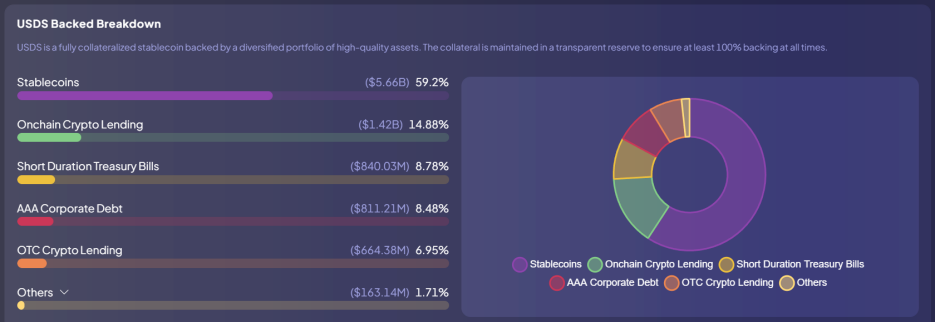

The yield of USDS primarily comes from the diversified allocation of its underlying assets. Sky allocates collateral to RWAs, including short-term treasury bonds and AAA-rated corporate bonds, through its Star modular ecosystem, i.e., sub-DAOs.

From a risk diversification perspective, this aligns with Vitalik's second category of algorithmic stablecoins, but the issue lies in the shift in asset structure focus.

Although USDS has taken steps towards asset diversification, stablecoins (USDC) account for nearly 60% of its reserves, far exceeding the over-collateralized portion (20%).

This means the underlying value support of USDS is essentially highly dependent on another centralized stablecoin. Therefore, the protocol's transformation has been accompanied by controversy.

What's even harder for DeFi purists to accept is the introduction of a "freeze function." This design allows Sky to remotely freeze USDS in user wallets upon receiving a legal order or in the event of a security incident.

For Sky, this is a pragmatic compromise to navigate global regulation: without compliance, there is no mainstream adoption. Technically, the freeze function for USDS aims to combat illegal activities like hacking and money laundering, making it a compliant financial instrument in the eyes of regulators.

But for DeFi believers, this is an unforgivable "capitulation." Some community members believe Sky has betrayed DeFi's original promise of censorship resistance. Once the protocol is granted the power to freeze assets, USDS is essentially no different from USDC.

Clearly, the protocol is moving further away from the direction Vitalik envisioned. Compared to the current Sky and USDS, the market might miss the old MakerDAO and DAI more.

LUSD/BOLD: Adhering to ETH Standard, Pursuing Minimal Governance

If Sky chose outward expansion, then Liquity chose inward exploration.

Vitalik has praised Liquity highly on multiple occasions, noting its leading form of "minimal governance," which almost eliminates reliance on human governance in its design.

The stablecoins LUSD/BOLD issued by Liquity are fully backed by ETH and its Liquid Staking Tokens (LSTs), making them the most typical representatives of Vitalik's first category of algorithmic stablecoins.

Liquity V1 established its authoritative position in ETH-collateralized stablecoins through its pioneering 110% minimum collateral ratio and hard redemption mechanism. However, V1 also faced trade-offs between capital efficiency and liquidity costs:

- Zero Interest Rate: Users only pay a one-time borrowing fee (typically 0.5%) when taking a loan, without needing to repay accumulating interest over time. While zero interest is highly attractive to borrowers, to maintain LUSD liquidity, the protocol must continuously pay rewards (e.g., by minting LQTY tokens), a model lacking long-term sustainability.

- 110% Minimum Collateral Ratio: Through its instant liquidation system (Stability Pool), Liquity achieved higher capital efficiency than competitors. If the ETH price drops, the system prioritizes using LUSD in the Stability Pool to offset bad debt and distribute collateral.

- Hard Redemption Mechanism: Any user holding LUSD can redeem an equivalent value of ETH from the protocol at a fixed value of $1. This creates a hard price floor for LUSD, maintaining its peg even in extreme market conditions.

However, the single collateral limitation is a double-edged sword. Since LUSD only supports ETH collateral, users face a significant opportunity cost as Ethereum's staking rate continues to rise—they cannot earn staking rewards while borrowing. This has led to a continuous decline in LUSD's supply over the past two years.

To address V1's limitations, Liquity launched V2 and the new-generation stablecoin BOLD, with its core innovation being the introduction of "user-set interest rates."

In Liquity V2, borrowers can set their own borrowing rate based on their risk tolerance. The protocol sorts troves based on interest rates; the lower a trove's rate, the higher its risk of being prioritized for "redemption" (liquidation).

- Low-Interest Strategy: Suitable for users sensitive to funding costs but willing to accept the risk of early redemption.

- High-Interest Strategy: Suitable for users who wish to hold positions long-term and resist redemption risk.

This dynamic game-theoretic mechanism allows the system to automatically find market equilibrium without human intervention: To avoid passively losing collateral during ETH downturns, borrowers tend to set higher rates. These rates flow directly to BOLD depositors, thereby creating real yield without relying on token emissions.

Furthermore, V2 breaks the single-asset limitation by adding support for wstETH and rETH. This allows users to earn staking rewards while obtaining BOLD liquidity.

More importantly, V2 also introduces a "one-click multiplier" function, allowing users to leverage their ETH exposure up to 11x using recursive leverage, significantly improving the system's capital efficiency.

Liquity's evolution is a solid step for algorithmic stablecoins moving from idealism to pragmatism.

RAI: A Monetary Experiment Driven by Industrial Control Theory, High Holding Opportunity Cost

If Liquity is pragmatic, then Reflexer is an uncompromising idealist.

The stablecoin RAI issued by the protocol is not pegged to any fiat currency. Its price is regulated by a PID (Proportional-Integral-Derivative) algorithm derived from the field of industrial control.

RAI does not pursue a fixed price of $1, but rather extremely low price volatility.

When RAI's market price deviates from its internal "redemption price," the PID algorithm automatically adjusts the redemption rate, which is the effective interest rate within the system.

- Positive Deviation: Market Price > Redemption Price → Redemption Rate becomes negative → Redemption Price decreases → Borrower debt decreases, incentivizing them to mint and sell RAI for profit.

- Negative Deviation: Market Price < Redemption Price → Redemption Rate becomes positive → Redemption Price increases → Borrower debt increases, incentivizing them to buy back RAI on the market to close positions.

Despite receiving praise from Vitalik multiple times, RAI's development path has been fraught with challenges.

- User Cognitive Barrier: RAI is jokingly called the "bleeding coin" because its long-standing negative interest rate phenomenon often causes the asset value of RAI holders to continuously shrink over time.

- Liquidity Scarcity: Due to its non-peg to the dollar, RAI struggles to gain widespread adoption in payment and trading scenarios. Its use as collateral is largely confined to a narrow circle of geeks.

- Computational Complexity: Compared to Liquity's constant $1 peg, RAI's PID adjustment model makes it difficult for investors to establish predictive models.

RAI demonstrates the theoretical elegance of algorithmic stablecoins while exposing the harsh reality of user adoption.

Nuon: A Flatcoin Pegged to a Purchasing Power Index, Highly Dependent on Oracles

As global inflationary pressures intensify, a more radical stablecoin paradigm, Flatcoins, may rise. The goal of these stablecoins is not to peg to a paper currency, but to anchor real living costs or purchasing power.

The purchasing power of traditional stablecoins (USDT/USDC) erodes in inflationary environments. Assuming the US dollar's purchasing power declines by 5% annually, users holding traditional stablecoins are actually suffering implicit capital losses. In contrast, Flatcoins dynamically adjust their face value by tracking an independent cost-of-living index (CPI).

Taking Nuon, the first Flatcoin protocol based on the Cost of Living, as an example, it dynamically adjusts its peg target by integrating real-time, on-chain verified inflation data.

- Target Asset: A basket of consumer indices including food, housing, energy, and transportation.

- Purchasing Power Parity: If index data shows a 5% increase in the US cost of living, Nuon's target price would also increase by 5%, ensuring that 1 Nuon in a holder's hand can still buy the same quantity of goods and services in the future.

- Mechanism Logic: Nuon employs an over-collateralization mechanism. When the inflation index changes, the algorithm automatically adjusts the minting/burning logic to protect holders' real value from erosion.

For residents in high-inflation countries like Turkey and Argentina, traditional dollar stablecoins can alleviate pressure from local currency depreciation but still cannot escape the "hidden tax" of dollar inflation. The emergence of Flatcoins provides a non-dollar, decentralized new option for inflation resistance and purchasing power preservation.

Although the design philosophy of Flatcoins is highly forward-looking, it carries significant technical risks in practice. The composition of a cost-of-living index is quite complex, and the authenticity of its data primarily depends on the robustness of the oracle system.

However, the process of bringing inflation data on-chain could become a breeding ground for attackers. Any minor manipulation of the data source could directly cause the purchasing power of Flatcoin holders to evaporate instantly.

Furthermore, the dynamic balance of Flatcoins requires sufficient liquidity support. Whether arbitrageurs are willing to maintain a constantly rising peg target under extreme market conditions remains to be seen.

Flatcoins represent a bold leap in the algorithmic stablecoin narrative, but a deep chasm of technology and finance lies between concept and adoption.

From Liquity's adherence to its standard, to Reflexer's monetary experiment, to the radical attempts of Flatcoins, the landscape of algorithmic stablecoins is displaying unprecedented diversity and intellectual depth.

Currently, algorithmic stablecoins remain constrained by capital efficiency, liquidity scarcity, and user experience hurdles. However, the principles they represent—risk decoupling, minimal governance, and monetary sovereignty—remain the holy grail of DeFi.

The revival of algorithmic stablecoins has only just begun.