RWA Weekly Report|Stablecoin Market Cap Drops 4.3%; White House to Hold Another Stablecoin Yield Discussion Meeting Today (Feb 4-10)

- Core View: The overall RWA market maintains steady growth, with on-chain total value and user numbers continuing to rise. Simultaneously, global regulatory frameworks are accelerating their construction, with China and the US showing different developmental trajectories in stablecoin and RWA regulatory approaches.

- Key Elements:

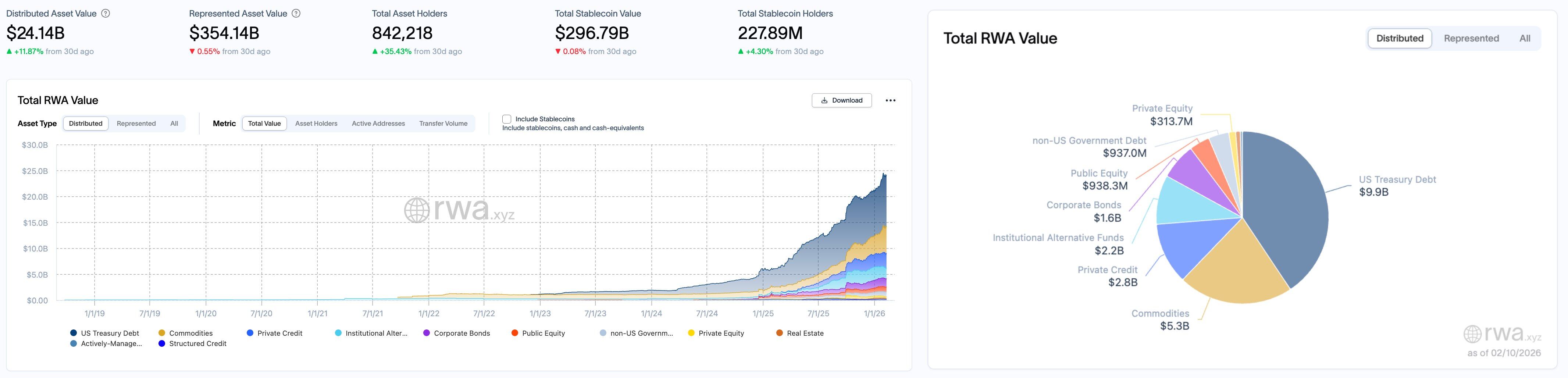

- As of February 10, the total on-chain value of RWA reached $24.14 billion, a weekly increase of 0.75%; the total number of user holders increased to 842,200, indicating sustained growth in market participation.

- Eight Chinese ministries reiterated that virtual currency-related businesses constitute illegal financial activities and clarified the regulatory division for domestic assets issuing RWA overseas. RWA involving foreign debt, equity, and asset securitization will be regulated by the NDRC and the CSRC respectively.

- In the US, the White House is negotiating issues such as stablecoin yields, and a comprehensive crypto market structure bill is predicted to potentially be submitted for the President's signature by the end of May.

- Industry giants are accelerating their layouts. Tether invested $150 million in Gold.com to expand its tokenized gold business. Japan's SBI Holdings and Startale plan to launch Strium, a Layer 1 blockchain focused on RWA.

- Market structure is experiencing rotation. Commodity-based assets and private credit have become the core directions for incremental capital, while willingness to allocate to less liquid assets like private equity remains cautious.

Original | Odaily (@OdailyChina)

Author | Ethan (@ethanzhang_web3)

RWA Sector Market Performance

According to the rwa.xyz data dashboard, as of February 10, 2026, the total on-chain value of RWA (Distributed Asset Value) continued to rise, increasing from $239.6 billion on February 3 to $241.4 billion, a weekly increase of approximately $1.8 billion, or about 0.75%. Although the pace of on-chain asset expansion did not maintain the rapid growth of the previous week, the overall trend remained steadily upward. The total value of representative assets (Represented Asset Value) rebounded this week from $199.42 billion to $354.14 billion, a weekly increase of about $154.72 billion, essentially recovering from the temporary decline caused by previous statistical adjustments.

User-side performance remained strong, with the total number of asset holders increasing further from 830,500 to 842,200, a weekly addition of approximately 11,700 people, a growth of about 1.41%. The stablecoin market experienced a slight correction, with total market capitalization dropping from $310.15 billion to $296.79 billion, a decrease of about $13.36 billion, or roughly 4.3%; however, the number of stablecoin holders continued to increase, rising from 224.73 million to 227.89 million, adding about 3.16 million people.

In terms of asset structure, U.S. Treasury bonds continued to firmly hold their position as the core anchor for on-chain RWA, with their scale slightly increasing from $9.6 billion to $9.9 billion, a weekly increase of about $300 million, returning to the historical high range. Commodity assets grew further from $4.8 billion to $5.3 billion, a weekly increase of about $500 million, making it one of the sectors contributing the most to the total volume this week. Private credit continued its moderate expansion, rising from $2.7 billion to $2.8 billion. Institutional alternative funds saw a slight decline, dropping from $2.3 billion to $2.2 billion.

Within the risk asset sector, corporate bond and non-U.S. government debt scales remained largely unchanged, hovering around $1.6 billion and $937 million, respectively. The public equity sector grew this week from $932.5 million to $938.3 million, showing signs of recovery; whereas private equity declined further, from $322.1 million to $313.7 million, reflecting continued cautious market sentiment towards assets with weaker liquidity and longer cycles.

Trend Analysis (Compared to Last Week)

Overall, the total RWA market volume increased steadily this week, but structural rotation persisted. The total value of distributed on-chain assets continued to rise, with user numbers and stablecoin holders growing simultaneously, indicating that real participation is still strengthening. Structurally, commodities and private credit remain the core directions absorbing incremental capital. U.S. Treasuries regained allocation interest after a brief correction, while private equity and some institutional assets continued to face pressure. Market risk appetite remains within a range of moderate increase but still leans towards rationality.

Market Keywords: Steady Expansion, Structural Rotation, Commodities Continue to Lead Gains.

Key Event Review

White House to Hold Another Stablecoin Yield Discussion Meeting Today

Crypto journalist Eleanor Terrett posted on X, citing insiders, that the next round of consultations between the White House and cryptocurrency institutions regarding stablecoin yield issues is scheduled for next Tuesday. Bank staff will still participate in this meeting, but this time, representatives from various industry associations will also attend in addition to the banks' own representatives.

The specific attendance list will be disclosed further later.

Beijing Business Today published an article noting that Hong Kong maintains a steady stance on issuing stablecoin licenses, with related review and research work nearing completion. The industry views this as a choice combining global stablecoin market risks with Hong Kong's financial development reality. However, investors should clearly understand the regulatory policy differences between Mainland China and Hong Kong regarding stablecoins. It is recommended that investors stay away from various unlicensed stablecoin products both domestically and internationally. Furthermore, cross-border participation in Hong Kong's licensed stablecoin-related businesses must comply with Mainland regulations on foreign exchange, cross-border transactions, etc. Investors are advised to be vigilant against irrational investment risks arising from market hype and not blindly participate in related trading activities.

The People's Bank of China and seven other departments issued a notice on further preventing and disposing of risks related to virtual currency, stating: Virtual currency-related business activities constitute illegal financial activities. Business activities within China involving the exchange of legal tender and virtual currency, exchange between virtual currencies, acting as a central counterparty for buying and selling virtual currency, providing information intermediary and pricing services for virtual currency trading, token issuance financing, and trading of virtual currency-related financial products—all such virtual currency-related business activities—are suspected of illegal issuance of token vouchers, unauthorized public issuance of securities, illegal operation of securities and futures businesses, illegal fundraising, and other illegal financial activities. These are strictly prohibited and will be resolutely banned according to law. Overseas entities and individuals must not provide virtual currency-related services to domestic entities in any illegal form. Stablecoins pegged to legal tender partially perform the functions of legal tender in circulation and use. Without approval from relevant departments according to laws and regulations, any domestic or overseas entity or individual is prohibited from issuing stablecoins pegged to the Renminbi overseas. Without approval from relevant departments according to laws and regulations, domestic entities and their controlled overseas entities are prohibited from issuing virtual currencies overseas.

White House Advisor Patrick Witt and former House Financial Services Committee Chairman Patrick McHenry stated during an interview with CoinDesk Live at the Ondo Summit that a comprehensive crypto market structure bill could pass within months. Patrick McHenry predicted the bill could be sent to the President for signing by May 25. Patrick Witt said that following the passage of the Genius Act, Trump has prioritized this legislation. The White House is currently mediating core disagreements such as stablecoin yields. Consensus has been reached on aspects like prohibiting false advertising, but disputes remain over whether centralized exchanges should be allowed to pay interest on idle stablecoins. Patrick McHenry emphasized that DeFi is central to the market structure legislation, with its decentralized nature being the source of cryptocurrency's efficiency and transparency. The drafting team has now entered the stage of specific legal text negotiations, and the Senate may take action before the Easter recess in April.

Caixin published an article titled "Chinese Government Allows Domestic Assets to Issue RWA Overseas, Regulatory Framework Announced," which states: The issuance of RWA (Real World Asset Tokenization) by Chinese domestic assets overseas will no longer be a grey area. Regulatory authorities believe that foreign debt RWA, equity RWA, and asset securitization RWA should be regulated according to the principle of "same business, same risk, same rules," referring to the corresponding traditional financing businesses for these three categories. Therefore, foreign debt RWA will fall under the regulation of the National Development and Reform Commission (NDRC); equity RWA and asset securitization RWA will fall under the regulation of the China Securities Regulatory Commission (CSRC). Similar to traditional overseas financing businesses, overseas RWA also involves the repatriation of funds raised overseas to China, which will be regulated by the State Administration of Foreign Exchange (SAFE). Other forms of RWA will be jointly regulated by the CSRC and relevant departments according to their respective responsibilities.

In short, for foreign debt RWA, equity RWA, asset securitization RWA, and other forms of RWA, the first three correspond respectively to traditional overseas financing businesses: corporate foreign debt is reviewed and registered by the NDRC, stock issuance follows "exchange review, CSRC registration," and asset securitization is reviewed by exchanges. All other cases beyond these three are categorized as the fourth type.

Tether Invests $150 Million in Gold.com, Boosting Tokenized Gold Distribution

Stablecoin issuer Tether announced a $150 million investment to acquire approximately a 12% minority stake in Gold.com, aiming to expand the distribution channels for its gold-pegged token XAUT. The two parties plan to integrate XAUT into Gold.com's infrastructure and explore using USDT and its newly launched U.S.-compliant stablecoin USAT to purchase physical gold. Driven by rising gold prices, the tokenized gold market has exceeded $5 billion, with XAUT accounting for over 60% of that. Additionally, Tether announced an investment in Anchorage Digital to support the compliant rollout of USAT in the United States. (CoinDesk)

Pharos Network announced the launch of a builder incubation program named "Native to Pharos," with a funding pool exceeding $10 million. The program aims to accelerate innovation within its on-chain financial ecosystem, focusing on the intersection of real-world assets (RWA), DeFi, and blockchain infrastructure.

The incubation program is supported by partners including Hack VC, Draper Dragon, Lightspeed Faction, and Centrifuge. Participating projects will receive technical guidance, strategic advice for product launch and scaling, and access to a network of investors and ecosystem partners. Pharos Network is a RealFi Layer 1 blockchain developed by former Ant Group executives and engineers. The program is now open for applications, with the first recruitment event to be launched in Hong Kong.

Startale Group and Japanese financial giant SBI Holdings publicly announced Strium Network (Strium), a Layer 1 platform focused on tokenized securities and real-world asset (RWA) trading. As the core product of their joint venture, Strium aims to build the trading layer infrastructure for Asia's on-chain securities market, supporting 24/7 spot and derivatives trading to address limitations in traditional market issuance and custody.

Currently, the platform's proof-of-concept (PoC) is ready, focusing on verifying its settlement efficiency and interoperability with traditional financial systems and blockchain networks. Strium plans to launch a testnet this year and leverage the customer base of the SBI Holdings ecosystem to drive the on-chain development of institutional-grade capital markets.

ETHZilla Launches Aircraft Engine Cash Flow RWA Token

Nasdaq-listed company ETHZilla (ETHZ) announced it will launch the Eurus Aero Token I this week, splitting the monthly cash flow generated from leasing aircraft engines through tokenization to provide investors with on-chain yield exposure.

The token is issued by its subsidiary ETHZilla Aerospace, with the underlying assets being two commercial aircraft engines leased to a "leading U.S. airline." Token holders will receive monthly cash flow distributions via an ERC-20 token, derived from base rent and usage fees.

ETHZilla is backed by Peter Thiel's Founders Fund. The company was previously known for its Ethereum reserve strategy but has gradually shifted towards real-world asset (RWA) tokenization since last year. Previously, the company completed a pilot tokenizing a portfolio of 95 housing loans.

As the blockchain industry accelerates the on-chain movement of traditional assets, RWA is seen as one of the fastest-growing sectors. Ark Invest estimates that tokenized asset scale could reach $11 trillion by 2030, while the current market size is approximately $22 billion.

Vitalik: Algorithmic Stablecoins Are True DeFi

Vitalik Buterin posted on X, stating that algorithmic stablecoins belong to true DeFi. He believes that if there exists a high-quality algorithmic stablecoin with ETH as the underlying asset, even if most liquidity is supported by CDP holders holding negative algorithmic dollars, the ability to transfer counterparty risk to market makers remains an important feature. Even if an algorithmic stablecoin is backed by RWA, if it can ensure sufficient collateral through over-collateralization and diversification in case a single RWA fails, it represents an effective improvement in risk characteristics for holders. He pointed out that the industry should develop in these directions and gradually move away from using the dollar as the unit of account, shifting towards more generalized diversified indices. Furthermore, the current practice of depositing USDC into Aave does not fall into the above categories.

After announcing his departure from Multicoin Capital, Kyle Samani responded intensively to community concerns on X. Dragonfly managing partner Haseeb likened his departure to "Jordan leaving the Bulls," to which Kyle Samani replied, "won't be going back to the Bulls," hinting he would not return to Multicoin Capital. He also stated he would support Solana's rapid development and claimed that Ethereum has no clear advantage in RWA besides stablecoins, whereas Solana has achieved significant leads in payments, applications, and DePIN.

Hot Project Updates

Ondo Finance (ONDO)

One-Sentence Introduction:

Ondo Finance is a decentralized finance protocol focused on structured financial products and the tokenization of real-world assets. Its goal is to provide users with fixed-income products, such as tokenized U.S. Treasury bonds or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, high-liquidity assets while maintaining decentralized transparency and security. Its ONDO token is used for protocol governance and incentive mechanisms. The platform also supports cross-chain operations to expand its application within the DeFi ecosystem.

Latest Updates:

On February 7, Bloomberg senior ETF analyst Eric Balchunas stated on X that 21Shares is applying to launch an Ondo ETF.

On February 3, Ondo Finance announced in an official blog post that Ondo Global Markets has confidentially submitted a registration statement to the U.S. Securities and Exchange Commission (SEC). Once effective, this filing will provide global investors with SEC-standard issuer-level information disclosure.

MSX (STONKS)

One-Sentence Introduction:

MSX is a community-driven DeFi