A Brutal Reflection from the Silver Trenches: On Leverage, Game Theory, and the Shackles of Human Nature

- Core Viewpoint: Former Bridgewater researcher Alexander Campbell provides an in-depth review of the mechanical market mechanisms that led to silver's historic crash, reflecting on the emotional and responsibility conflicts faced by public figures in investment decision-making.

- Key Elements:

- Market Crash Mechanism: This extreme ~6-Sigma drop in silver was driven by a "short Gamma" effect, specifically forming a stampede through three channels: short option hedging, leveraged ETF forced rebalancing, and excessive leverage liquidations.

- Key Trigger: The Chinese market opening and selling instead of providing expected support became the critical turning point, breaking the established narrative of "New York sells, Shanghai buys."

- Investor Behavior Reflection: The author frankly admits that delaying position reduction due to a sense of responsibility to followers was a major mistake, emphasizing that professional decisions should be independent of emotion.

- Market Data: Silver experienced one of its largest single-day declines in 275 years of data, comparable to historical extreme events; the double-leveraged ETF AGQ, with a size of $5 billion, amplified selling pressure through its rebalancing actions.

- Subsequent Outlook: Short-term price action depends on the performance of the Chinese market upon its Sunday evening opening and potential deleveraging. The core long-term bullish logic (solar demand, Chinese capital flows, supply constraints) remains unchanged, but caution is warranted against the "short Gamma" risk implied by the market.

Original Author: Alexander Campbell

Original Compilation: Shenchao TechFlow

Introduction: Following a historic washout in precious metals last Friday, former Bridgewater researcher Alexander Campbell penned this deeply reflective piece.

The article not only deconstructs the mechanical principles behind silver's 6-Sigma level decline from a financial engineering perspective—including short Gamma effects, the rebalancing stampede of leveraged ETFs, and the pricing game between Shanghai and New York markets—but also, more rarely, reveals the emotional struggle of a professional investor facing the conflict between a sense of responsibility to followers and rational decision-making.

Full text below:

Last Friday was a painful day.

This is my reflection.

In the latter part of this article, we will follow the standard process to dissect a historic event like Friday's precious metals washout: what do we think actually happened? Why? What impact did it have on the portfolio? And where do we go from here?

But first, my reflection. Please bear with me if it gets a bit... philosophical.

The quote at the beginning of this article (Translator's note: referring to "Pain + Reflection = Progress") is more than a motto to me; it's a way of life. It's one of the most profound lessons I learned during my time at Bridgewater, and a way to contextualize all the pain in life.

On the path to any goal, you will face challenges. On the path to financial goals, there will be drawdowns.

In terms of drawdowns, I've experienced worse. Maybe not in a single day, but certainly over a lifetime. Of course, things could get worse. Perhaps the volatility in silver and gold is the "canary in the coal mine," signaling a series of chain-reaction "liquidity scrambles" that push down asset prices and increase demand for safe-haven assets (like the US dollar, bonds, and Swiss francs). That is indeed a possibility.

In the coming days, you will undoubtedly see a flood of experts crawling out of the woodwork saying, "I told you so!" peddling this or that view, slapping screenshots in your face. To some extent, I've done similar things when trades went the other way (up), so I'm no different.

But the reality is, no one knows the future. There are always unknown conditions; the world is messy and dynamic. While this makes gaining an edge possible, even the best investors only have a 55-60% win rate. Gödel's machine will never be truly complete. That's why diversification, why hedging, and why you see the best investors maintain a posture of humility almost all the time—even if the compliance-speak that often follows makes it hard to read their true intentions.

Nevertheless, I think it's crucial to stare at the moments you get it wrong, diagnose what happened, and try to learn—about the world, and about yourself. It's hard to reflect when you're up 130% for the year. But when a book with an expected annual volatility of 40% loses 10% in a day, reflection becomes a requirement.

From Thursday night to Friday afternoon, many thoughts raced through my mind. Later, we'll discuss the rational process of trying to track the world's evolution, piece together the story, analyze the causes, and formulate responses. But before that, I want to talk about the emotional side.

All professional investors, or at least those taking substantial risk in public markets, will understand what I mean when I say "investing is often emotional." You have two demons in your head: greed, telling you to press harder, to further leverage your alpha; it fights with fear, the recognition that "I could be wrong, and there's a lot I don't know."

What particularly interested me was a new feeling that evolved from Thursday night into Friday: a sense of responsibility.

You see, many people reading this blog now are new. Eyeballs chase performance; the move from $60 to $120 brought a lot of attention to these pages and filled my inbox. Some thanked me, some asked for my views. In my comment sections, there seemed to be an endless stream of people asking for minute-by-minute updates, levels, etc. This process is probably familiar to well-known public figures, but for me, it's relatively new.

If you follow my Twitter/X, you know I try to adopt an irreverent tone. It's a style I learned from my Oxford Union debating days—walking the line between insouciant and incisive. It's not entirely an act, but a worldview: I usually strongly believe I'm right, while also knowing I'm often full of shit, and these views evolve rapidly in the face of new information. I think this perspective is shared by many professional "shitposters," as people call them.

What changes when you become "micro-viral" is that, even as you try to maintain that irreverent tone to deliver the message, the actual distribution of people listening grows larger. You go from friends, colleagues, and internet personalities to countless strangers reading you, interpreting you, and interacting with you. Beyond knowing that your message's context may be diluted as it spreads (like a game of internet telephone), there's also a lag problem.

I first started writing about the silver/solar relationship in 2023. About 18 months ago, I started "pounding the table" with recommendations. Back then, my portfolio was 100% long. As the price rose, from $25 to $40, to $60 and $80, I slowly reduced that exposure from "irresponsibly long" to "dangerously long" to "still quite long." Selling a bit, or letting options roll, trying to lock in profits while maintaining exposure. The problem is, as silver climbed, its volatility increased. So I was still performing well. Critics would say this is a red flag, and it is (we'll discuss this later in the section on "signs"), but the point is, you end up in this awkward position where, even though many got on board at $25 or $40, you realize that due to the lag in people writing and reading, the eyeball-weighted average entry price might be as high as $90.

This puts you in a very interesting position. You feel guilty about "cutting and running" just because of a chill down your spine, as I felt at certain moments over the past week or so. You feel you owe it to the people who enjoy your work to stick with the trade, to put yourself in their shoes.

From a money management perspective, this is utterly foolish. You can tell yourself that if you were managing other people's money, you would have cut all positions Friday morning when the Chinese market opened not with a rescue but with massive gold selling. You can rationalize that if I managed others' money, I wouldn't have held so much copper. I would have taken risk off when it was up 10% Friday morning. But ultimately, the book is the book.

One more thing before we get to the part you probably care about most.

Some of you subscribe because you like my views on silver and markets. Some because you like my rambles.

Going forward, I'm considering separating them. Rambles—about philosophy, worldview, thoughts on process—these will remain free. If I start posting specific, actionable trade ideas with real-time updates, that might become a paid offering. That creates real accountability on my end and real value on yours.

For now, just know that not every post will be about "the rock." Some of you won't like that. That's okay.

With all that considered. What actually happened?

How Historic Was It?

Before diving into the blow-by-blow, let's contextualize what happened last Friday. Because I don't think people realize how rare a move of this magnitude is.

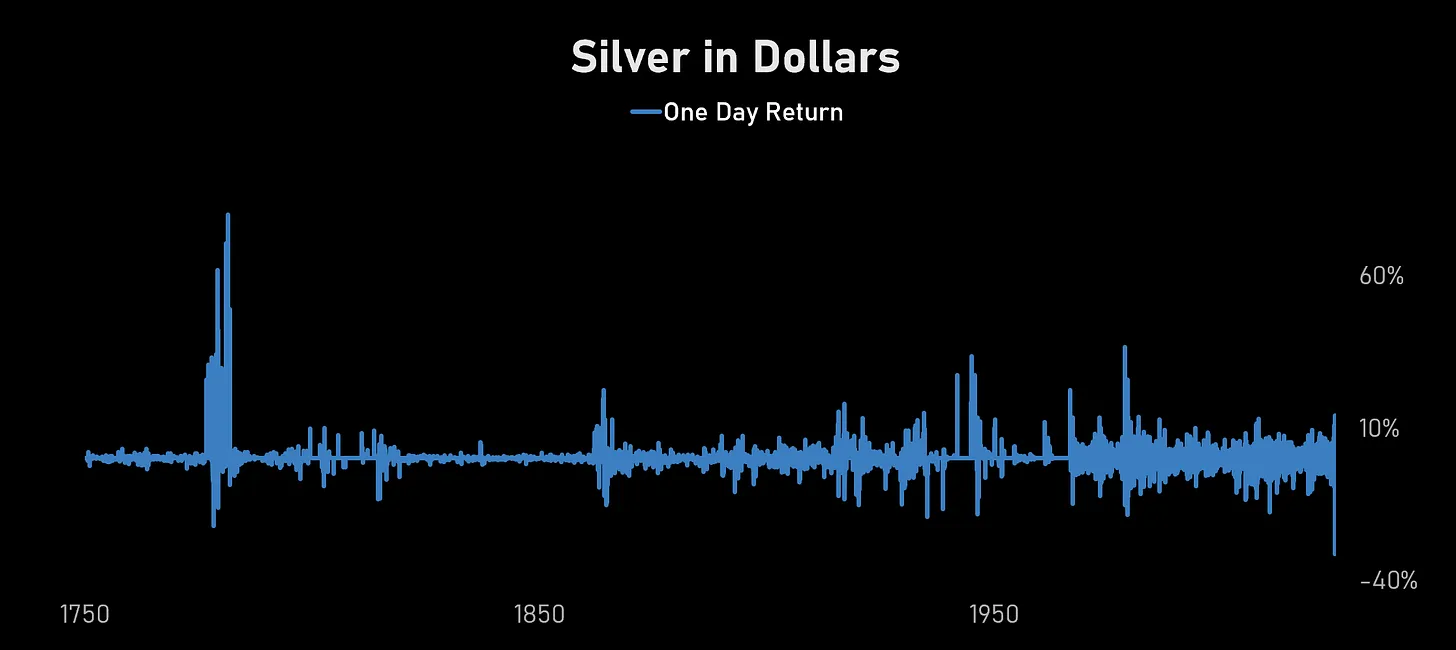

That's 275 years of daily return data for silver. Last Friday's move was one of the largest single-day declines in the metal's entire history. We're talking moves comparable to the end of bimetallism, the Hunt brothers crash, and March 2020—except this happened on an otherwise unremarkable Friday in January.

The volatility surface pricing before Friday considered a 3-Sigma move a tail event. What we got was roughly 6-Sigma. This shouldn't happen based on historical distribution, but it does precisely when everyone is positioned the same way and liquidity vanishes.

The Blow-by-Blow

If you've been tracking this story narratively, even before Friday, the past few months have been a wild ride. Silver opened November in the low $40s, rallied 74% to ~$85 by year-end, then pulled back 15% into year-end. As we outlined in the last post, the bulls then defended the trend, launching another monster 65% rally, peaking around $117 on Monday (note, this is in New York), before Western sellers stepped in, selling it down another 15%.

Gold largely mirrored these moves, with the "New York sells, Shanghai buys, metal flows East" trend appearing intact.

Even into Thursday morning, the news was dominated by copper's 10% overnight surge. (Another warning sign things were getting a bit out of hand, which we'll discuss in a subsequent post on the red metal).

Sensing the chop, I trimmed a bit and posted this tweet. It was more a note to myself. The 30% number had been lurking in the back of my mind, just dismissed as a voice of fear rather than reason.

Later Thursday, Kevin Warsh entered the scene, confirmed/leaked on Polymarket as the nominee for Fed Chair.

Warsh is seen as somewhat of a "hard money" advocate, which I took in stride. You see, I briefly met him at Stanford a decade ago. Back then (~2011-2015), he was known for calling for the Fed to normalize after the massive post-crisis QE. At the time, he seemed more politician than economist, and I always felt his hawkishness was a way to make a name in a sea of easy-money advocates. After all, it's easy to call for rate hikes and balance sheet reduction when you're not in the driver's seat.

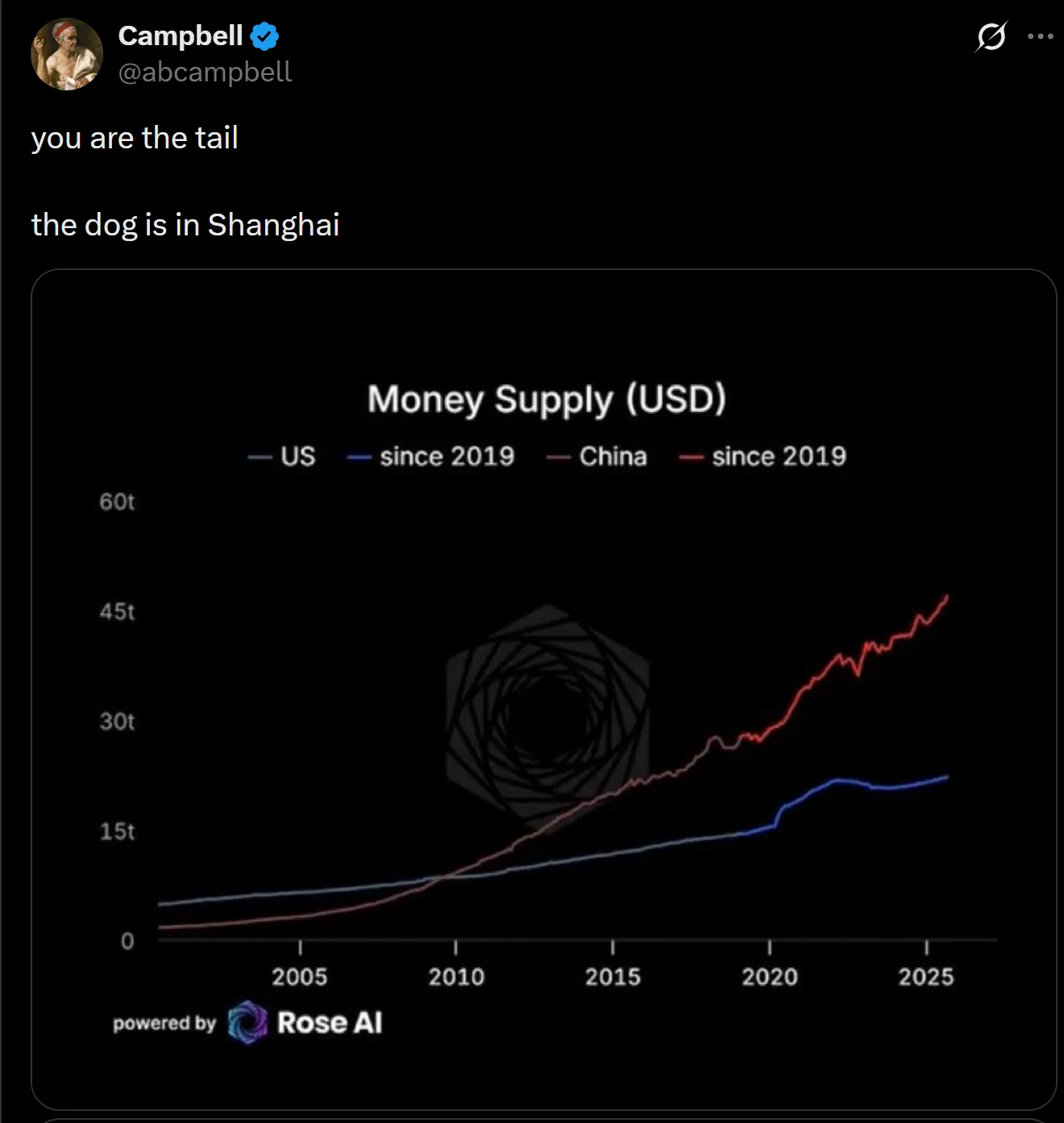

So, despite having decent commodity exposure (actually more in copper and gold than silver), I thought I'd take a small hit and wait for the Chinese market open. A reminder, as I've been posting for months, to me, Western metal investors seem unaware that today "you are the tail, the dog is in Shanghai." They underestimate:

a) How concentrated the actual demand for these metals is in the East:

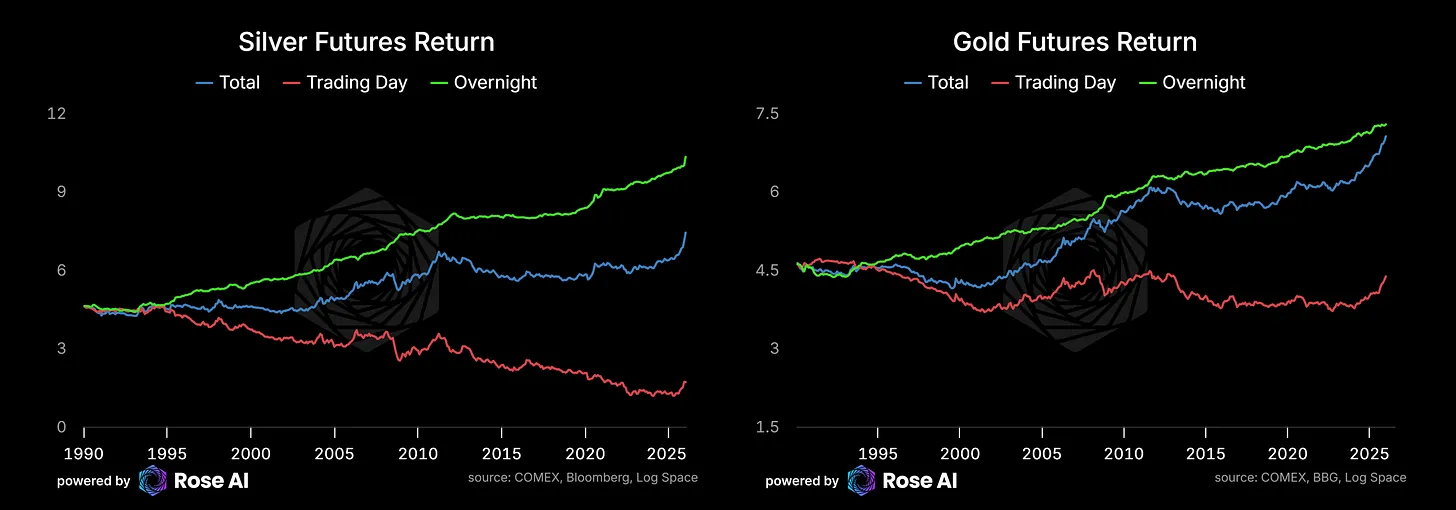

b) How much of the total return in these metals comes from the "overnight" market (measured by returns from yesterday's close to today's open):

c) How much money China actually has compared to the West:

Yes, there's a lot of confusion online about how much of the "China premium" is due to VAT on retail physical delivery. Macro has many things that are both hard and messy, so folks online don't run the calculators, they throw charts at each other, bulls ignore it, bears weaponize it to sow doubt in the "China is pushing prices higher" narrative. To me, this is a classic "look at changes, not levels" case, because it's clear: a) this premium (or discount) has increased recently, b) this is happening in India too.

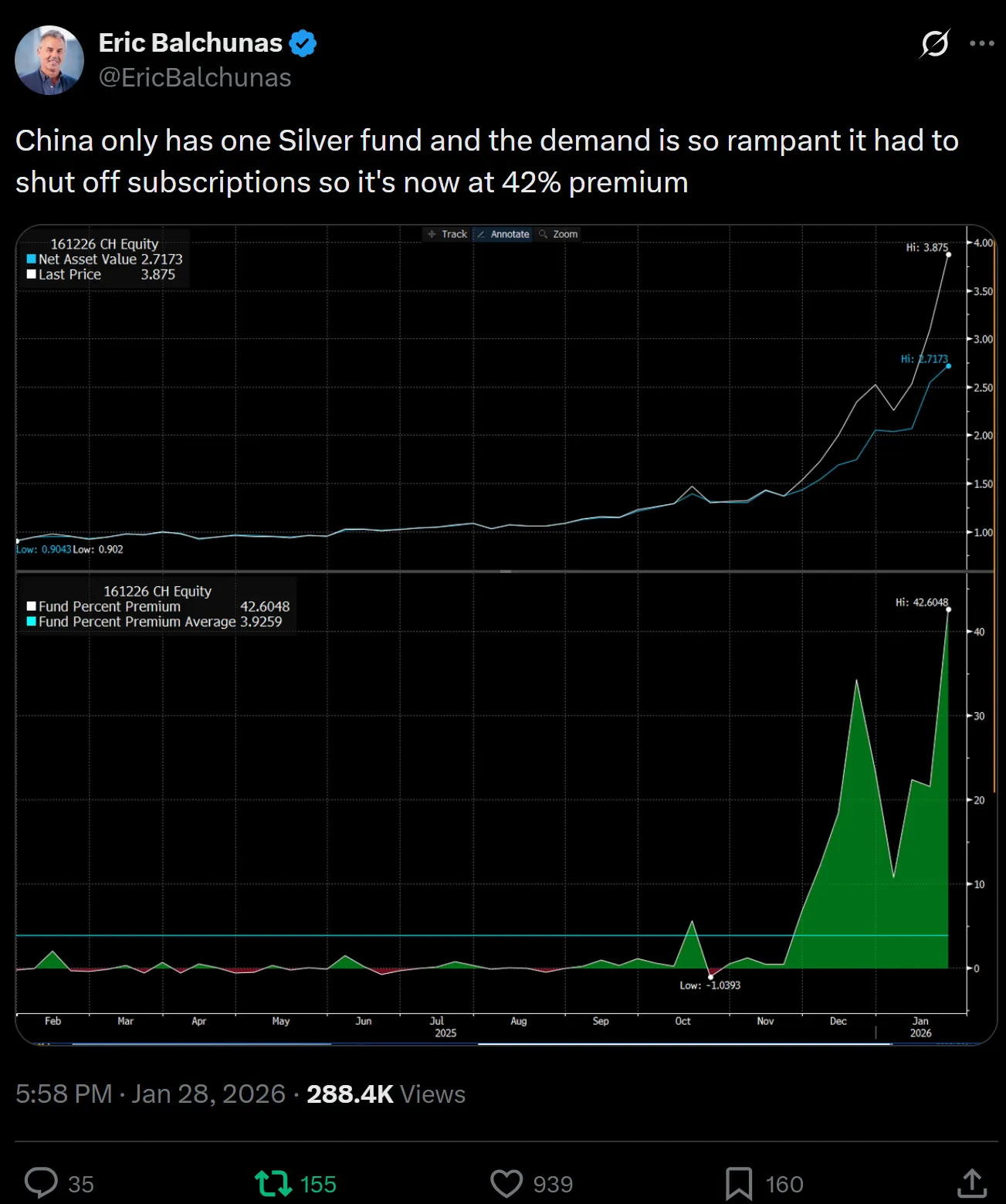

But I could feel the bear narrative gaining momentum. Even with demand evidence like the insane premium on the only pure onshore silver fund.

And indeed, there was some evidence physical buying pressure had eased, most directly in the "front end" of the London silver curve. Its degree of backwardation had decreased significantly over the past month.

I cut my delta to nearly flat before going to bed, but thought "wait for China's open." This was perhaps my biggest mistake.

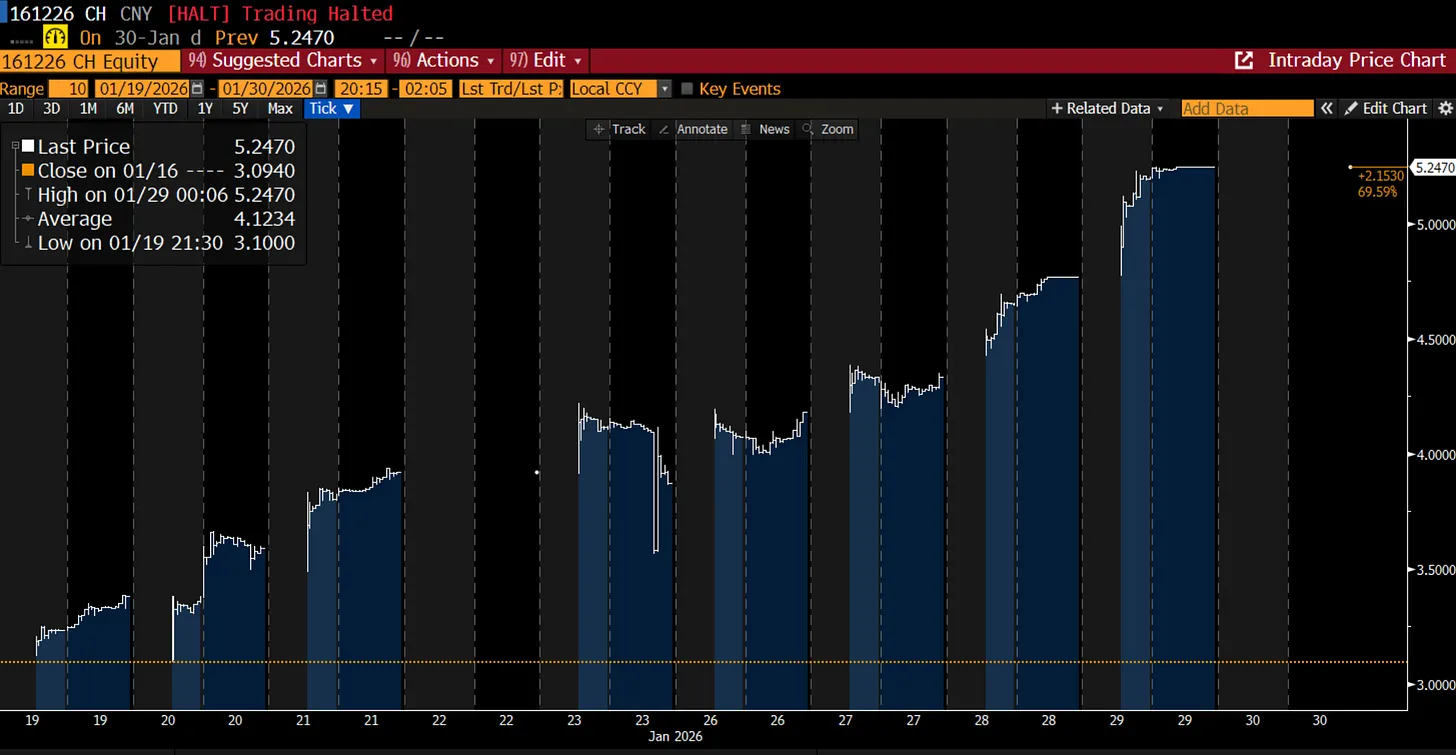

China opened, and instead of a counterattack, it was met with selling. Not just silver, gold was down 8%. That was strike one. I didn't know it then, but the local Chinese silver ETF had actually halted trading.

This meant Chinese retail wasn't coming to the rescue.

This should have been the signal to retreat. I checked the book, drafted a position list, felt good about myself because most of my long exposure was in options, so a true washout would be painful but not blow me up. That was strike two. Not only because I should have sold outright in futures (GLD and SLV weren't open yet, and I have an aversion to futures due to a few painful forgotten rolls when not trading full-time in recent years), but I should have committed to reducing immediately at market open. Yes, my day was packed with meetings, making it impractical to unwind a book of 20 option positions, but I didn't want to slink away like a dog in the night with so many still long. That was strike three, perhaps my worst decision.