Is Binance Still the World's Largest Exchange?

- Core Viewpoint: The article argues that Binance is facing structural challenges from competitors like Hyperliquid in the exchange's most crucial battleground—trading, particularly in the derivatives market and asset innovation. Its authority to define industry standards is being eroded.

- Key Factors:

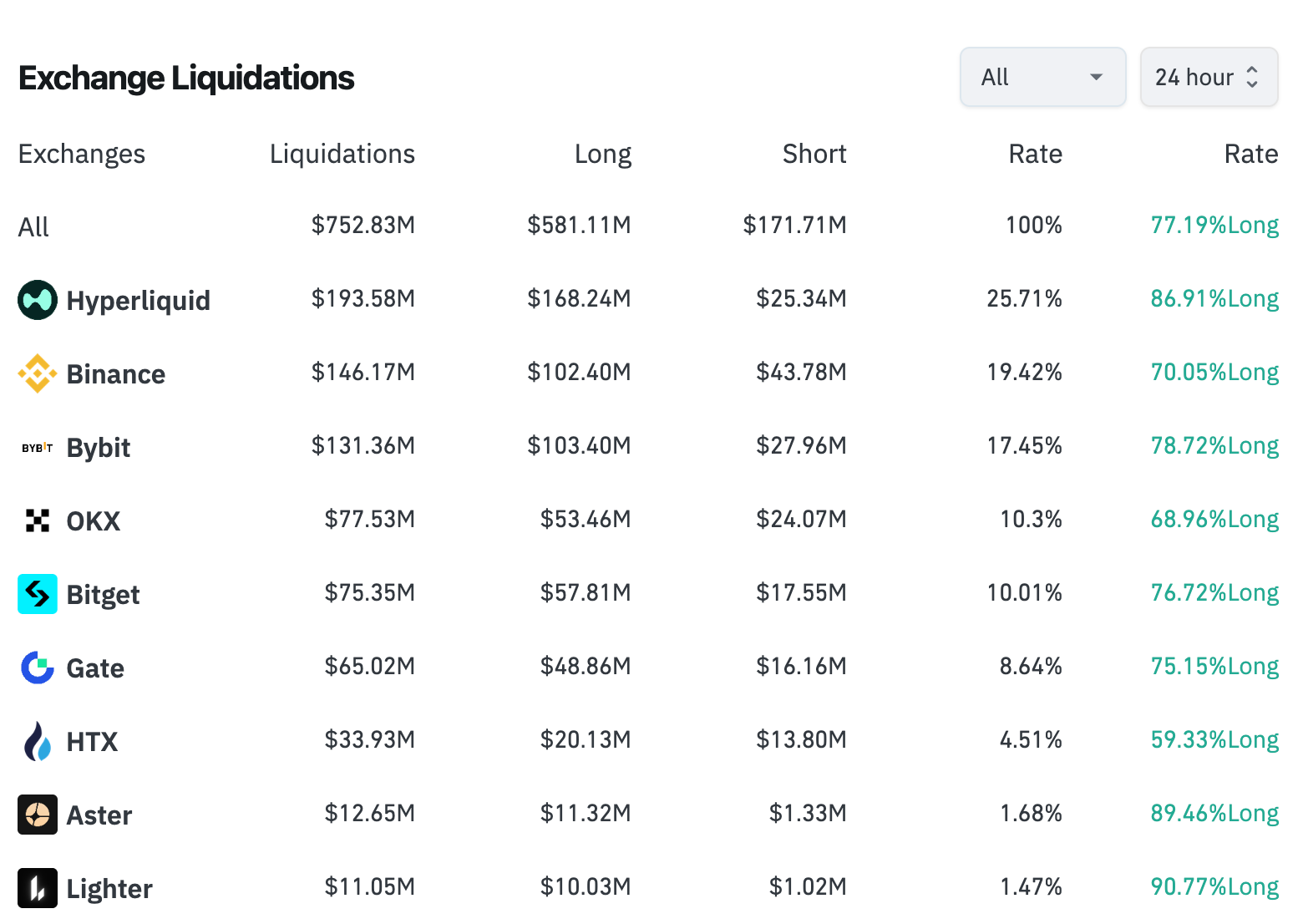

- In terms of derivatives trading volume, Hyperliquid's liquidation amounts during recent volatile market conditions have at times surpassed Binance's, attracting a group of high-net-worth traders.

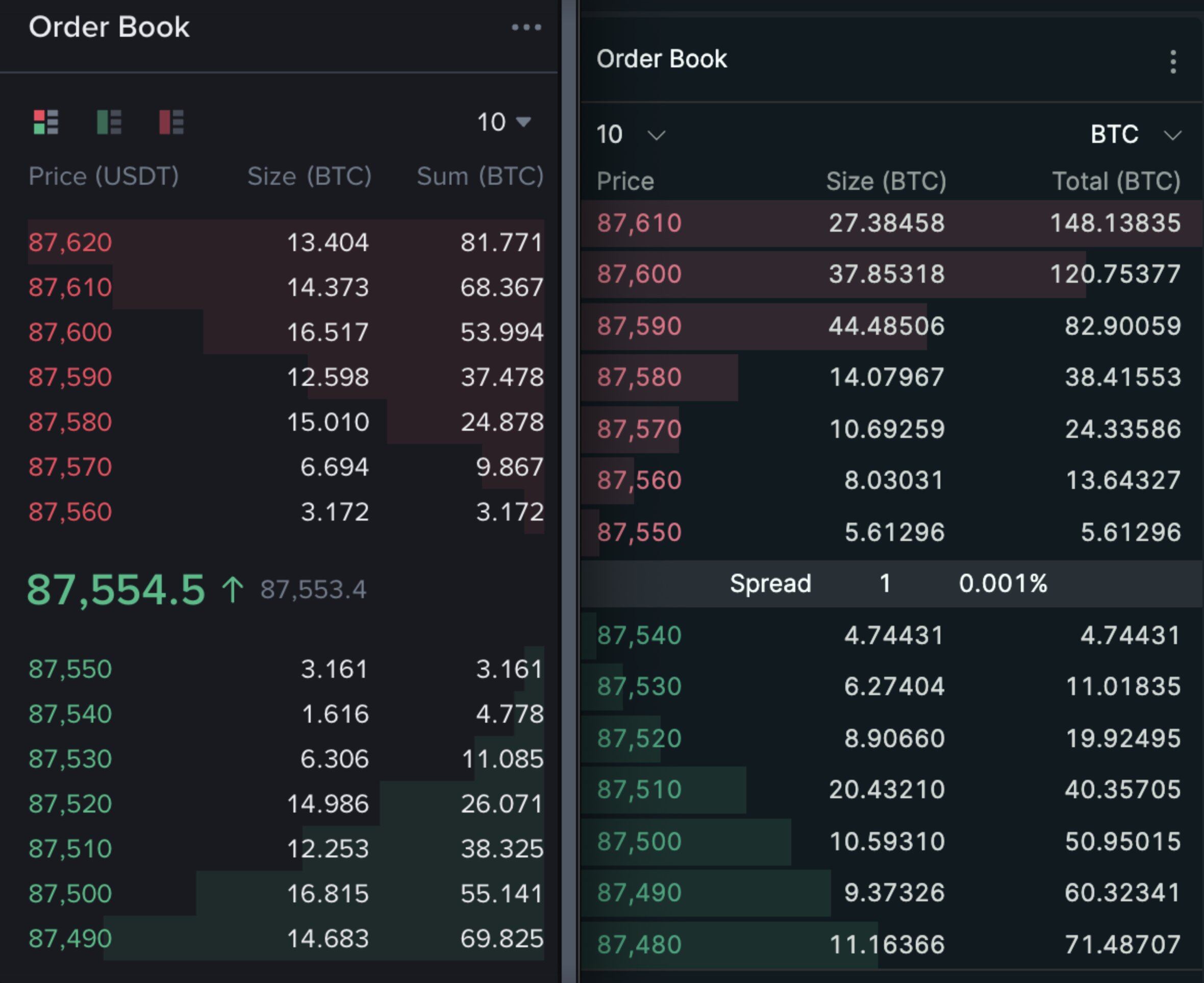

- Regarding liquidity for major cryptocurrencies, the BTC futures order book displayed by Hyperliquid is no longer inferior to, and even locally superior to, Binance's in terms of bid-ask spread and depth.

- In expanding new asset offerings, Binance's progress in traditional financial assets (e.g., tokenized stocks) lags behind competitors like Gate.io and Bitget.

- Through on-chain execution and an open architecture, Hyperliquid has established differentiated advantages in trading transparency, fairness, and flexibility in asset listing.

- The industry's default choices for new asset launches and price discovery are diversifying, impacting Binance's previously absolute dominant position.

Original | Odaily (@OdailyChina)

Author|Azuma (@azuma_eth)、Mandy (@mandywangETH)

For a long time, Binance has been crowned the "largest exchange in the crypto universe." However, recently, I have begun to harbor increasingly strong doubts about this label, which has long been solidified in the minds of retail investors.

Of course, with its vast matrix comprising a public chain, ecosystem, wallet, and VC portfolio, Binance remains the super-platform with the widest influence coverage in the current Crypto industry—this point is undisputed.

What truly deserves re-examination is another, more core question: In the most essential and critical battleground for an exchange—trading itself, especially in the high-volume, high-fee futures market that determines price discovery, does Binance still firmly hold the industry's top spot? Does it still possess an unshakable absolute advantage over other competitors? And in terms of innovation leadership in other emerging areas, are there entities surpassing Binance?

The reason for raising this question is not due to any short-term data fluctuations, but because of several minor incidents that have occurred in succession recently. Individually, they might seem insignificant, but together, they are continuously eroding my established perception of Binance's market position.

Futures Trading Volume Faces Challenges

The first is that during the recent volatile market conditions, Hyperliquid's liquidation data has surpassed that of Binance. As shown in the chart below, Hyperliquid's liquidation amount in the last 24 hours was approximately $193 million, while Binance's was $146 million.

Odaily Note: Data sourced from Coinglass, as of 14:00, February 2.

A point of doubt here is that Binance's liquidation data push frequency is limited to a maximum of once per second, so data platforms like Coinglass might experience some delay when scraping.

However, based on our observations, it is indeed true that an increasing number of large traders are choosing to place orders on Hyperliquid. Typical representatives include "Machi Big Brother," the "1011 Insider Whale," James Wynn, AguilaTrades, "CZ's Counterparty," the "14-Win Streak Whale," Gambler@qwatio, Low-Stack Degen, among others—the so-called "Eight Vajras"... You can criticize them all as gamblers, but where the gamblers go, the volume follows, and volume is the lifeblood of an exchange.

The reason for this situation is that compared to the inevitable "black box" suspicion surrounding CEXs, all orders, trades, liquidations, and settlements on Hyperliquid are executed on-chain, inherently possessing advantages in transparency and fairness. In the first half of last year, a prominent figure who had founded several well-known projects over the years (name omitted) experienced a targeted liquidation on a certain CEX (clarification: not Binance), resulting in losses exceeding $100 million. The platform never publicly disclosed the internal order matching and liquidation details.

Mainstream Coin Liquidity Partially Surpassed

The second incident occurred last week when Hyperliquid's founder, Jeff, posted on X a comparison of the BTC futures order books on his platform (right side of the image below) and Binance (left side). The chart shows that Hyperliquid has narrower bid-ask spreads and thicker order book depth for BTC.

Jeff boldly proclaimed: "Hyperliquid has become the world's best cryptocurrency price discovery platform in terms of liquidity."

This is not an isolated case. Real-time checks of order books for other mainstream tokens like ETH and SOL on both Hyperliquid and Binance reveal that the former's liquidity performance is no longer inferior to the latter's.

Slow Progress in New Asset Expansion

Over the past year, compared to many second-tier exchanges, Binance has noticeably tightened its pace regarding "official listings," shifting the high-frequency testing window more towards Binance Alpha. However, the post-listing performance of many assets has been unsatisfactory. Furthermore, with the hype around Chinese Memes, Alpha's focus has further tilted towards the BSC ecosystem. After the 10.11 incident, controversies surrounding Binance's listings have continued to ferment, leading the industry to question Binance's listing path.

A few days ago, Solana co-founder Anatoly Yakovenko (toly) criticized Binance on X, leading CZ to unfollow him. Even before this, a sentiment had emerged in the market that Solana ecosystem projects were shifting their exit strategies towards Bybit. Following this trend, Binance may no longer hold a monopoly on future project listing premieres and pricing power as it once did.

More importantly, in the current climate of persistently sluggish crypto-native assets, the industry has begun viewing asset classes originating from traditional finance—such as tokenized stocks and precious metals—as new breakthroughs. However, on this path, Binance's progress appears somewhat slow compared to both Hyperliquid and several other highly proactive CEXs (Bitget, Gate, Bybit, etc.).

Last Monday, Binance officially launched its first stock futures contract, TSLA (Tesla), and today followed up with INTC (Intel) and HOOD (Robinhood). Meanwhile, Binance's competitors like Gate and Bitget are more aggressively expanding into traditional asset categories—from tokenized stocks to precious metals, from indices to commodities. The competition for potential users has already begun.

On the decentralized front, Hyperliquid, leveraging its open HIP-3 architecture, has long ago listed dozens of traditional asset types, including Pre-IPO stocks like OpenAI and Anthropic, through more flexible custom market mechanisms. It has already accumulated considerable trading volume around these assets—traditional assets recently accounted for nearly half of Hyperliquid's trading volume rankings.

What Has Changed?

Looking at the current evidence together, it's difficult to conclude that "Binance has lost its throne." Binance remains the most important liquidity hub. However, what I believe is truly worth vigilance is not Binance's market share being temporarily surpassed by a specific second-tier exchange, but rather that Binance is continuously facing structural challenges on its most core trading battleground.

What Binance is losing is not market share, but the discursive power to "define what an exchange is."

For a long time, the reason Binance was the "largest exchange in the crypto universe" was not just because it had the largest liquidity, but also because—the default industry answers to where price discovery happens, where mainstream capital trades, and which exchange new assets should first test the waters, were all Binance.

But as more high-net-worth accounts prioritize "verifiable, fair, traceable" over fees and brand, as price discovery begins to be reorganized on-chain, and as the testing ground for new assets gradually shifts from exchange backends to front-end, verifiable market mechanisms, Binance is encountering on its most proficient and core track not the challenges of past, similar competitors, but competitors that might bring about a paradigm shift for the industry.

Although the article discusses specific categories, the underlying question is about the most core value of the exchange species itself: where does price originate, and who backs the trust?

Perhaps Binance should contemplate how deep its moat still is.