When we say "crypto is failing," what do we really mean?

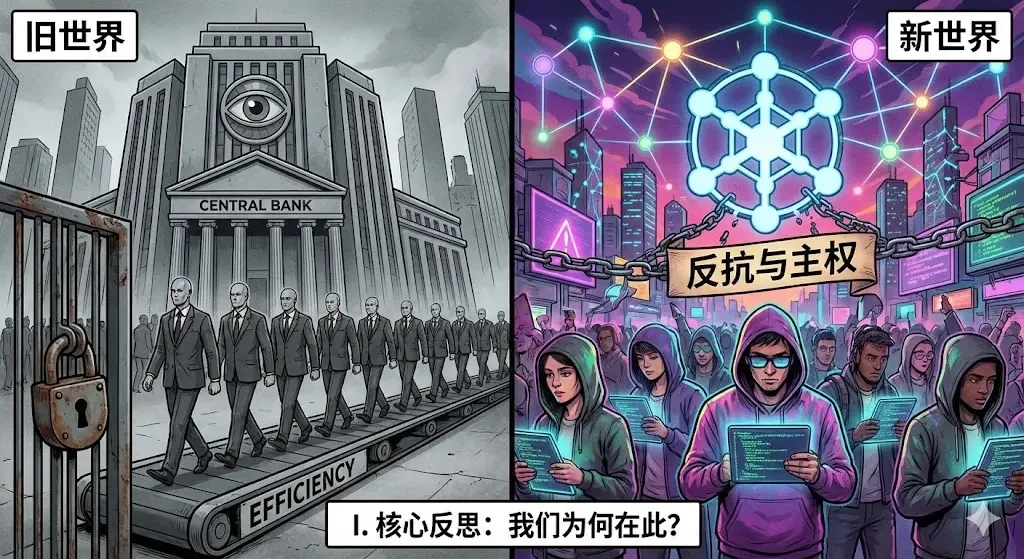

- Core Viewpoint: The article argues that the core value and success criteria of blockchain projects are not about pursuing efficiency or short-term financial returns, but about building decentralized systems with censorship resistance and user sovereignty. This requires project teams to maintain their original "adversarial" intent and effectively convert speculative users into protocol believers.

- Key Elements:

- The original purpose of blockchain is "resistance," aiming to combat inequality, censorship, and centralized power. Its "inefficiency" is a necessary cost paid for fairness and sovereignty.

- The true death of a project is not a drop in token price, but the abandonment of resistance and the sacrifice of decentralization's core to cater to external factors (e.g., efficiency, compliance), degenerating into an inferior Web2 product.

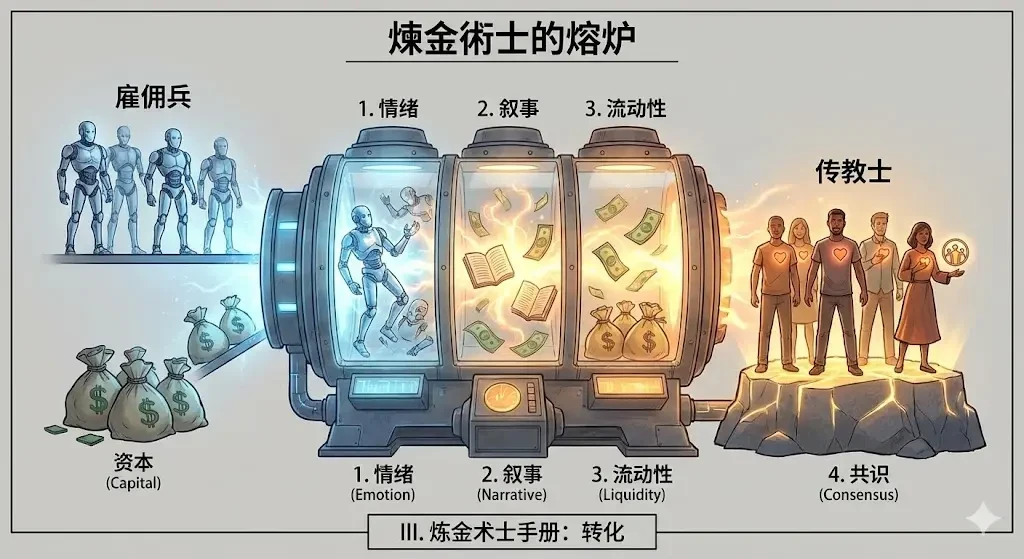

- Project teams need to identify and convert two types of users: profit-driven "mercenaries" (used for cold start) and vision-aligned "missionaries" (who form the long-term moat).

- Proposes the "E-N-L-C" conversion model: by stimulating emotion, constructing narrative, and providing liquidity incentives, the ultimate goal is to form behavioral consensus after subsidies are removed.

- Traits of project teams that can survive cycles include: returning to first principles of solving core problems, establishing transparent covenants rather than price promises, focusing on building during bear markets, and maintaining strict self-discipline.

Original Author: danny (X: @agintender)

I wrote my first line of smart contract code during the ICO frenzy of 2017. As an old Builder who has survived until 2026, having weathered the "September 4th" crackdown, DeFi Summer, NFT mania, the FTX collapse, and countless pronouncements that "crypto is dead," I've witnessed ten thousand ways projects manage to self-destruct.

I've discovered that throughout this long Crypto journey, the definition of "winning" has never been about how many billions your FDV reached on TGE day, or whether you achieved a grand slam. It's about whether you are still fighting for your own sovereignty against the entire world.

Every team with a bit of technical background or resources can launch a token at least once. Even if the code is forked, even if the whitepaper is written by GPT, as long as you launch during a bull market hype cycle, ride on someone's coattails, or your last name is Trump, anyone can become a fleeting "unicorn."

So for project teams, what is "winning" really? Is it that you launched a token, and years later, your protocol is still running? Your contracts are still generating real interactions? Or is it about what you resisted?

After all the twists and turns, your "token launch" mindset—that heart seeking quick profits (as described by @0xPickleCati)—is the very culprit preventing you from building a great protocol.

It's not that tokens enable "decentralization"; it's that resistance necessitates tokens.

PS: The article cover is Zhang Xinzhe's song "Faith." I had this song on repeat while writing this long piece. Interested friends can look it up (I recommend the version from "I Am a Singer" where he cracks his voice).

1. When We Say "Crypto Isn't Working," What Are We Talking About?

Every bear market, at dinner parties or during Chinese New Year gatherings, you always hear these voices:

- "Has your circle gone cold?"

- "I see the US stock market hitting new highs, why are you guys still falling?"

- "Is this stuff only used in scam compounds?"

- "Precious metals are going crazy? You guys are still stuck in place?"

If you, as a Builder, feel ashamed hearing these words, or try to explain "We're working on Layer 3 to improve TPS," then you can leave. You fundamentally don't understand why you're here.

Are we competing to see who can rise faster than gold, crude oil, Nvidia, or Google? If the goal is to pursue asset appreciation efficiency, you should change your last name to Trump! Buy Nasdaq index ETFs? The "Magnificent Seven"? They are not only more stable but also legally protected!

Are we competing to see whose database write speed is faster? Don't be ridiculous. For pure efficiency, centralized products crush everything. Alipay's TPS is ten thousand times that of Ethereum; AWS costs are a billionth of on-chain storage. Let's be honest, the future of decentralization still relies on AWS after 10 years of development. If your original intention for doing Web3 was to create a "more efficient" internet? Or to bring traditional liquidity on-chain? Then you lost from the very first day you set out.

Every resurgence of Crypto, or rather, the original intention when Satoshi wrote the genesis block, was never about being "faster, cheaper." It was about resistance.

To resist the world's growing inequality. To resist the power that arbitrarily freezes your bank account. To resist the tech giants that sell the data you create without giving you a cent. To resist the central banks that recklessly print money, diluting the fruits of your labor.

The so-called "inefficiency" (gas fees, private key management, node confirmation) is the tax we must pay for "fairness" and "sovereignty."

As a project team, you must be crystal clear: Your product must contain a characteristic that centralized giants absolutely cannot provide—censorship resistance and independent sovereignty.

- If the answer is "no," it means your users are only here for speculation, and you are just an inefficient alternative.

- If the answer is "yes," it means you have built a truly decentralized path.

- Because Tencent cannot promise never to ban accounts, but you can.

- Because banks cannot promise 24/7 cross-border transfers arriving instantly and without interception, but you can.

- Because game companies can modify drop rates anytime, but your smart contract cannot.

So, Builders, stop worrying about TPS. Start thinking about how to return power to users, how to write open source into the code of anti-monopoly. This is the only battlefield where you can beat Web2 giants. This is the meaning of blockchain.

If it's for the sake of freedom, both can be forsaken. If you're not fighting for freedom, why are you even on this battlefield?

2. True Death Isn't a Falling Token Price, Nor Just the Collapse of Those False Prosperity Metrics; It's When You Stop Resisting

Understanding this underlying logic, let's re-examine "death."

In the depths of a bear market, when your token price has dropped 95%, when your Discord is left only with disgruntled investors and porn bots, you might think this is hell, this is death.

No. True death often occurs in moments of seeming prosperity, the moment you sell your soul to appease something.

2.1 When the "Dragon-Slaying Youth" Becomes "Inferior Web2"

We criticize metrics like TVL, trading volume, and daily active users as "false prosperity indicators." Now, let's dig deeper: Why do project teams become obsessed with these metrics? Because chasing these metrics is the safest, easiest, and path requiring the least "resistance."

This kind of death usually begins quietly, disguised as "pragmatism," "compliance," or "optimizing user experience":

- "To get listed on an exchange, we'll give the tokens originally meant for users to the exchange as a protection fee?"

- "To make it easier for users to onboard, let's use centralized servers to store data for now; decentralized storage can come later."

- "To suppress competitors, to meet exchange demands, we must incentivize wash trading, buy negative PR articles."

One step back, every step back.

When you sacrifice "decentralization" for "efficiency," what you get isn't a better Web3 product, but an inferior Web2 product. You inherit all the drawbacks of blockchain (slow, expensive, complex, hard to use) but lose its only advantage (permissionless, immutable, censorship-resistant).

At this point, your project becomes the so-called "Web2.5"—a freak that is neither efficient nor free. This is true death. You are no longer the rebel trying to overthrow the old order; you become a clumsy imitator of the very behemoth you once sought to resist.

Only then do you realize you're not so cyberpunk anymore, or perhaps you never were.

2.2 "Can't be evil" vs "Don't be evil"

Why is "stopping the resistance" considered death?

Because Crypto's core value proposition is built on a foundation of "distrust." Because you trust no one, this means you need to assume the external environment is hostile: you need to assume someone will challenge you, someone will censor you, someone will freeze you, someone will shut you down.

As a Builder, your mission is to build a system that can still operate even when these assumptions hold true.

- If the DEX you build requires front-end KYC to trade under regulatory pressure, what's the fundamental difference between you and Nasdaq?

- If the L2 you build keeps the sequencer forever in your own hands, able to front-run or reject transactions anytime, what's the fundamental difference between you and Alipay?

- If the GameFi you build has item drop rates that you can tweak anytime in a backend database, what's the fundamental difference between you and Tencent Games?

Google's motto is "Don't be evil," but that depends on their conscience and mercy; Bitcoin's logic is "Can't be evil," and that's determined at the code level.

When you abandon that adversarial design of "even if the whole world wants to shut me down, they can't," and instead seek gentle compromise with the old world, your protocol loses its reason for existence. Why would users endure high gas fees and the risk of losing private keys to use you? Just to read your so-called "decentralization" manifesto on X?

Come on, bro, wake up—you (once) were that youth wielding a wooden sword against the evil dragon!

3. Alchemist S's Handbook: How to Refine "Mercenaries" into "Missionaries," Becoming Your M?

I know what you're thinking. "Old-timer, I understand everything you're saying—resistance, sovereignty, no compromise... But if we don't do points tasks, don't offer high APY, no one will come at all! How do we do a cold start?"

This leads to the core pain point of Web3 entrepreneurship: Your initial funding usually comes from the "enemy" (speculators), but your final line of defense must be held by "comrades" (believers).

Many projects die because the founders are schizophrenic: either arrogantly rejecting all speculators, leading the project to starve; or groveling to speculators, ultimately getting drained dry.

You need to turn yourself into an S, clarifying at every stage of this upward spiral which M you are dealing with, and how to discipline mercenary capital (Mercenary Capital) into missionary consensus (Missionary Consensus).

3.1 Identifying People: The Two M's You Face

A. The Mercenaries — They are the rational profit-seekers of the Pump and Dump church.

- Characteristics: Large capital, sensitive to slippage, no loyalty, use scripts to operate.

- Behavior: Go wherever the APY is high. You offer subsidies, they come; you stop subsidies, they withdraw capital faster than the speed of light.

- Your Misconception: You think they are using your product. No, they are mining your token. You think those beautiful daily active user numbers are growth, but actually, you are selling your tokens cheaply.

- Tactical Value: They are excellent stress testers and cold start fuel. Use them to test your contract security, use their money to create early wealth effects (Attention). This M's love is intense but has an expiration date, so never fall in love with them, and don't expect them to love you.

B. The Missionaries — They are those with IQ 5 / 150, who (truly?) identify with your narrative, culture, or technical vision.

- Characteristics: Capital not necessarily large, high tolerance, spontaneously answer questions in the community, defend you on Twitter.

- Behavior: They use your product because it's "useful," "cool," or "represents justice," not just because "there's money to be made."

- Tactical Value: They are your moat. When the token price drops 90%, those still discussing product improvements in Discord are these people who are used to being M.

3.2 Alchemy: The E-N-L-C Four-Step Transformation Method

How do you transform those mercenaries who only farm and dump into die-hard missionaries? You need to construct a spiral model of E-N-L-C (Emotion-Narrative-Liquidity-Consensus) in your mind. (The author has been driven mad by some unknown cone theory, reference: https://x.com/agintender/status/2013595231027900486?s=46 )

Step One: Emotion — Light the Fuse

- Goal: Attract attention.

- Method: Don't start by talking about industry scale or technical details. Talk about "anger" or "greed."

- Tell the mercenaries: "Here's the last chance to get rich quick." (Greed)

- Tell the missionaries: "Banks are stealing your money; we have a plan to fight back." (Anger)

A project without emotion is like bread without yeast—it won't rise. Slaying the dragon is an emotion.

Step Two: Narrative — Encapsulate Value

- Goal: Give the incoming capital a reason.

- Method: A narrative is not a lie; it's a "falsifiable grand vision."

- If you're building an L2, don't say "cheaper fees," say "Ethereum's private sanctuary." (Does that have a bit of an A16Z feel?!)

- The role of the narrative is to make mercenaries think "this isn't just a scheme, it's a big scheme," and to make missionaries feel "we are making history."

The narrative is a sieve. It filters out pure gamblers, leaving those willing to listen to the story.

Step Three: Liquidity — Buying Time (The Most Dangerous Step)

- Goal: User habit formation.

- Method: This is the sole purpose of your token launch, airdrops, and high APY.

- You pay mercenaries to buy their time.

- During this time bought with money, you must frantically polish the product, making users develop path dependency.

If you haven't taught users to use your product without incentives before the subsidies stop (before liquidity dries up), then that's it.

Step Four: Consensus — Solidifying Form

- Goal: Form inertia.

- Method: When subsidies stop and the token price falls, who remains?

- The behavioral habits that remain are consensus; the infrastructure that remains is consensus.

Consensus is the product of alchemy. It is the "behavior" that persists after "profit" disappears.

3.3 Soul-Searching Questions: Has Your Alchemy Succeeded?

In the quiet, reflective moments late at night, ask yourself these three questions:

- "Stripping Test": If tomorrow I stopped all token incentives (points, airdrops, mining), would anyone still open my DApp?

- "Topic Test": In my community, do more people discuss "token price/listing/airdrop," or "product/governance"?

- "Distribution Test": When I do an airdrop, am I rewarding "capital" or "contribution"?

A harsh reality: historically, no mercenary band has ever been happy to see the moment their lord conquers the world.

Mercenaries can help you capture cities (pump the price), but only missionaries (IQ 5 or 150) can accompany you to expand the territory.

4. What Exactly Did Those Cycle-Surviving Project Teams Do Right?

Finally, let's talk about mindset. In a bear market, watching other meme projects rise 100x in a day, or friend-group tokens achieve a grand slam, while the code you painstakingly wrote goes unnoticed—that sense of loneliness and self-doubt is fatal.

Based on personal observation, the Found