How to Find Gold in a Sluggish Market? A Complete Guide to Hedging and Farming Points on Perp DEX Platforms

- Core Viewpoint: Despite the recent weak price performance of Perp DEX sector tokens, user participation remains high. This article aims to provide a set of practical strategies, from basic to advanced, guiding users to efficiently earn point rewards through hedging trades across different platforms.

- Key Elements:

- Market Status: While Perp DEX sector tokens (e.g., HYPE, LIT) have seen price declines, users are actively "farming" points on projects that have not yet issued tokens, in anticipation of a bull market.

- Basic Hedging Strategy: Hedge price risk by opening reverse, equal-sized positions on platforms like Variational and Extended, primarily consuming trading fees to earn points stably.

- Operational Techniques: Use platform sound alerts to quickly place hedging orders and strategically keep losses in the Variational account, which features a "loss refund" lottery mechanism.

- Increasing Point Weight: Trade low-cap tokens and choose periods with low liquidity to widen spreads, and increase the number of trades and holding duration to boost point weight on Variational.

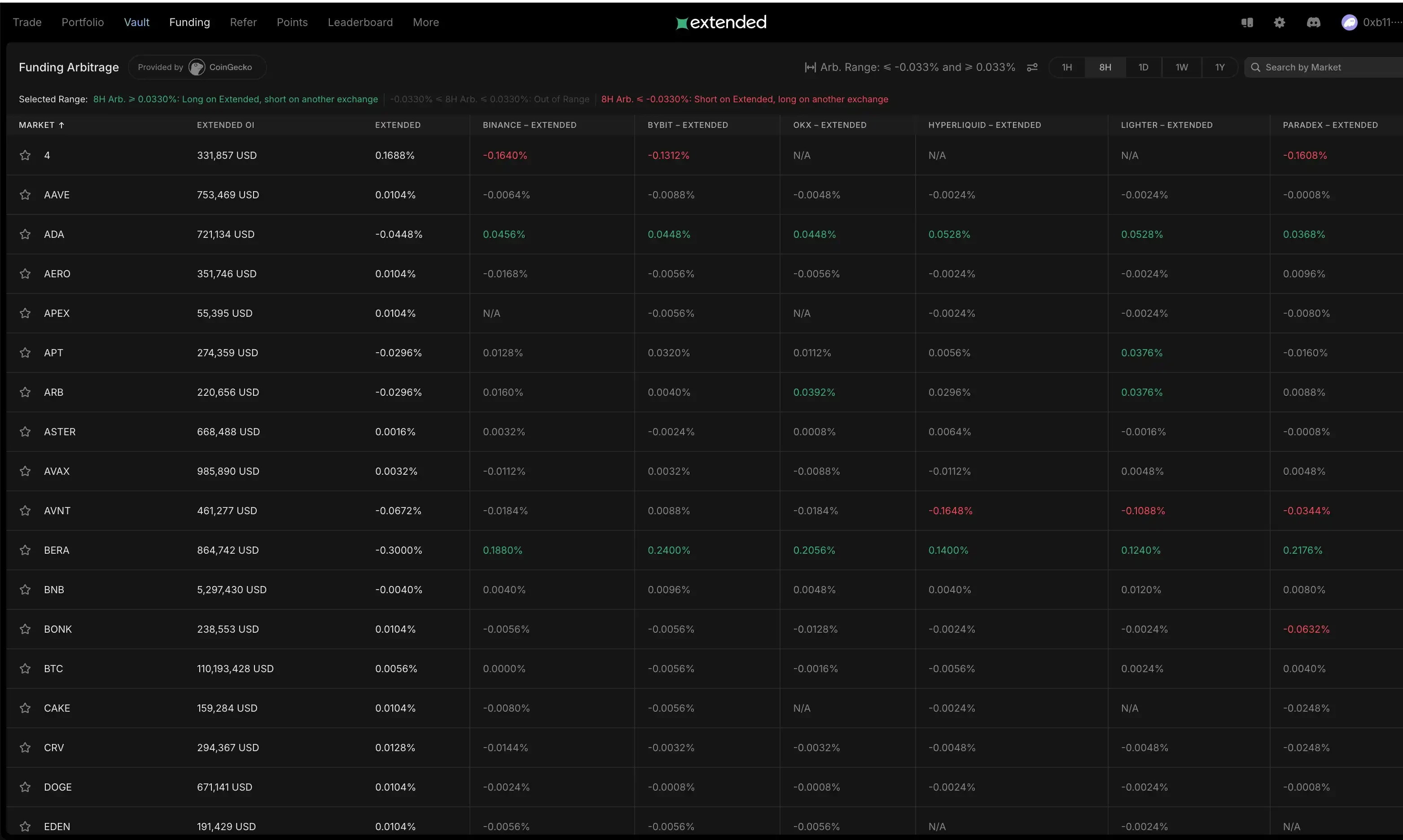

- Funding Rate Arbitrage: Exploit differences in perpetual contract funding rates across platforms by going long on platforms with low rates and short on those with high rates, earning the rate differential while hedging risk.

- Risks and Additional Tips: It is recommended to control leverage (within 20x for major coins), avoid holding positions overnight to prevent black swan events, and utilize Extended's vault feature to earn APR while trading.

Recently, the price performance of tokens in the Perp DEX sector has indeed been less than ideal. HYPE has dropped from its high to $21, LIT is holding around $1.7, and ParaDEX had an incident. The entire sector seems a bit sluggish.

However, interestingly, the hype around this sector doesn't seem to have cooled down because of this. On the contrary, many players are even more actively farming projects that haven't issued tokens yet. After all, a small bear market is the best time to accumulate points; it gets more competitive when the market is good and tokens are being issued.

Two weeks ago, the editor wrote a project introduction titled "After Lighter, the Next Batch of Perp DEXs Worth Farming", which received a lot of feedback from friends. Many newcomers now know which platforms are worth paying attention to, but they are still confused about the specific operations: how to open and close positions, how to maximize point weight, etc. Hence, this more detailed practical tutorial was created, which is very suitable for beginners to get started. For the purpose of demonstration, the editor has mainly chosen Variational and Extended, two Perp DEXs with decent trading volume and background.

1. Getting Started: Essential Preparations

Before starting, you need to prepare 2 EVM wallets (it is recommended to use two different wallet addresses for operations, not the same one, to reduce the risk of being flagged as a Sybil attack by the project). For wallets, I would recommend Metamask or Zerion wallet.

Currently, most Perp DEXs support deposits on the Arbitrum network, so having USDC on the Arbitrum network is generally enough to navigate Perp DEXs.

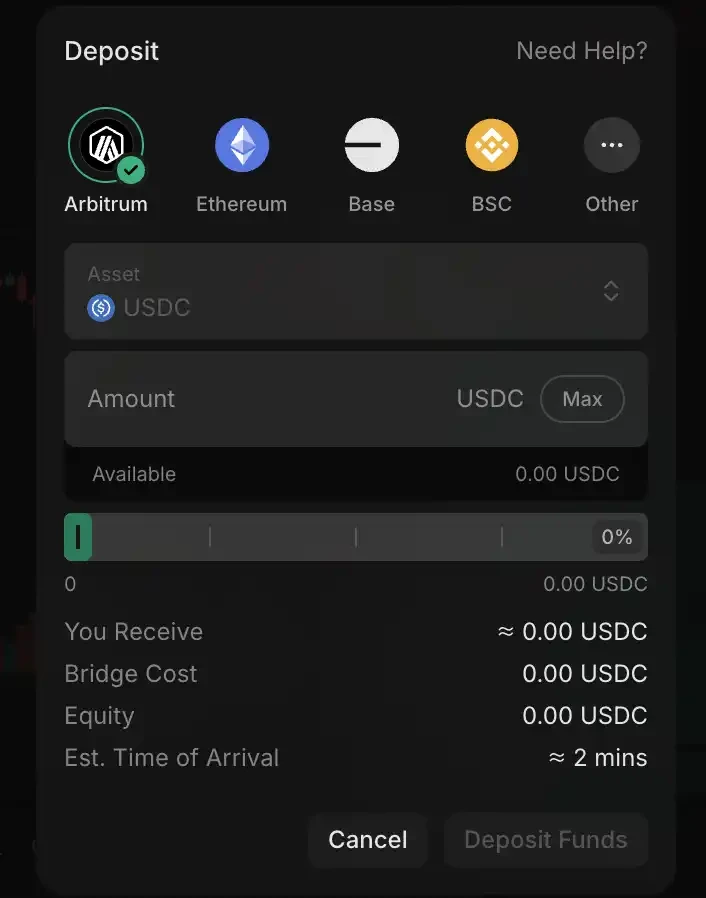

Currently, Variational only supports deposits of USDC on Arbitrum. Extended supports more deposit chain options, including Ethereum, Arbitrum, Base, BSC, Avalanche, and Polygon, but the token is still USDC.

Furthermore, the competition in the perp DEX sector is quite fierce now, with various platforms offering special rewards in their referral mechanisms. Variational still requires an invitation code to use. The editor's invitation code is OMNI796TLUPK, or you can find others on Twitter. Some high-level invitation codes or ambassador codes offer varying degrees of rebates or fee discounts. For example, on the Extended platform, referred users can enjoy a 10% discount on commissions until their total trading volume reaches $50 million.

2. Beginner-Friendly: Dual-Platform Hedging Farming Method

After completing the previous steps of depositing USDC and preparations, we now move into the practical operation phase: selecting the market, setting leverage, and placing orders. Here, we will first use the simplest and most stable hedging strategy to farm points.

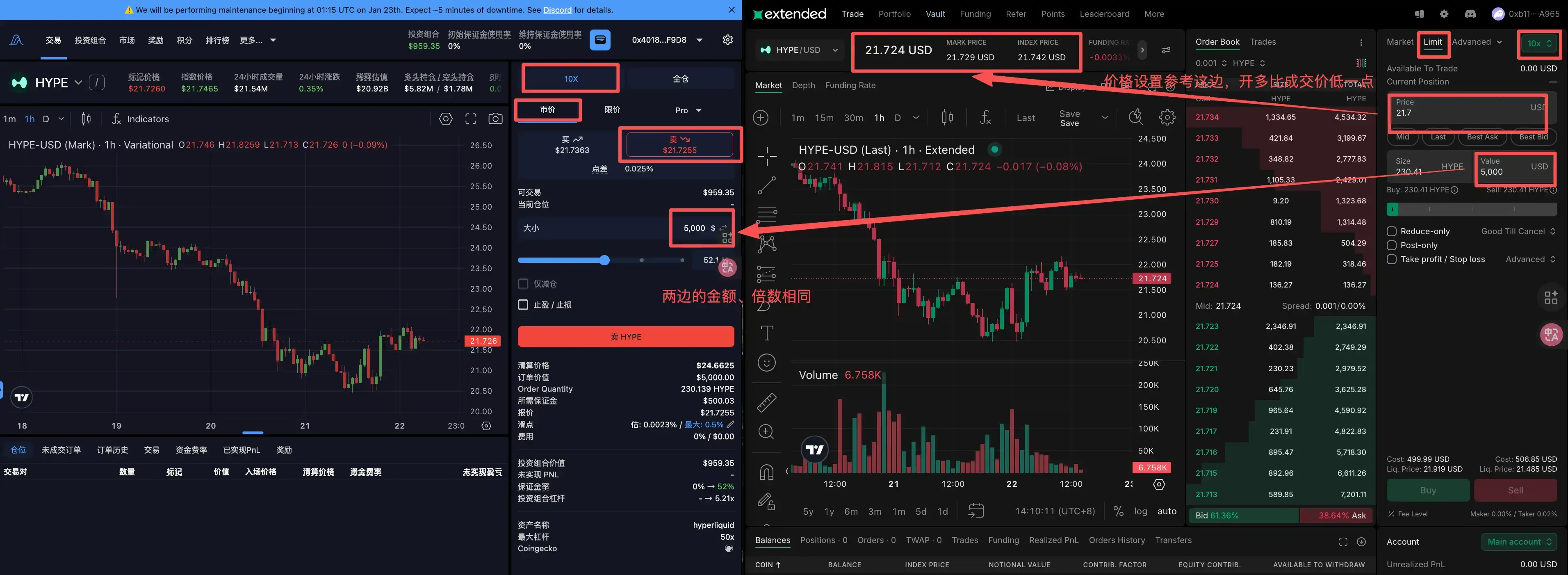

The core principle is to hedge against price fluctuation risks by opening opposite positions on different DEXs. For example, going long on Variational while simultaneously going short with an equivalent size and leverage on Extended. This way, regardless of price movements, the profits and losses on both sides offset each other. Your main cost is the trading fees, but you can steadily earn point rewards.

In terms of specific operations, because Extended's fee structure is more favorable for Maker orders (limit orders), the optimal way is to first place a Maker order near the market price on Extended to enjoy the platform's rebate. Then, once the order on Extended is filled, quickly open a reverse Taker order (market order) on Variational to get filled immediately. This back-and-forth creates a hedged position. We essentially incur some platform fees, spread, and slippage in exchange for point rewards.

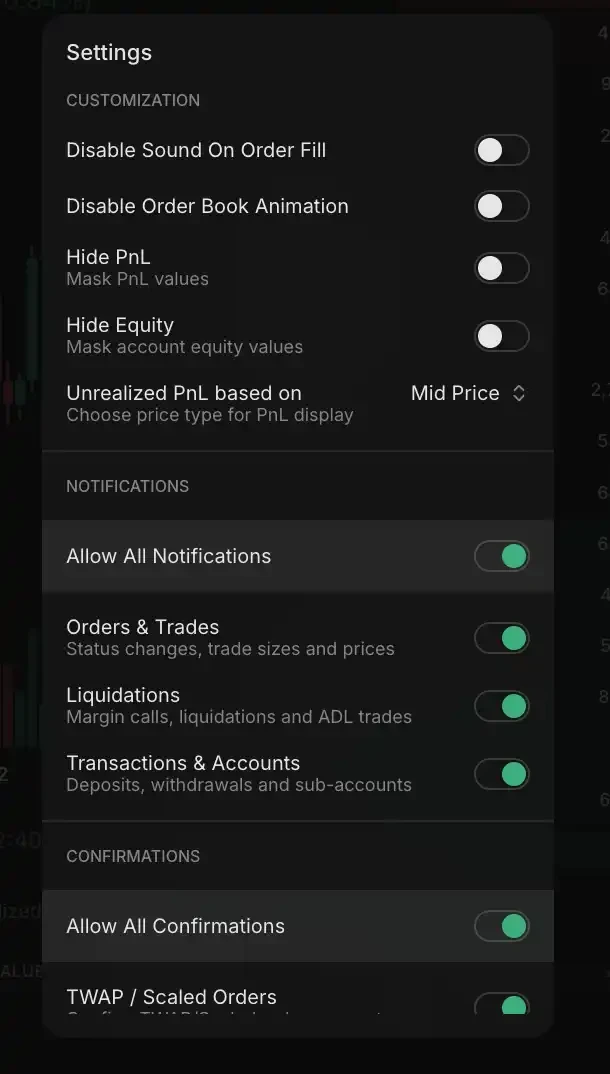

Here's another practical tip. In the settings in the top right corner of Variational, there is a "Play order fill sound" switch; remember to turn it on. Extended also has a "Disable sound" option in the top right corner; make sure not to check it. The benefit of this setup is that when your Maker order on Extended is filled, you will hear a sound prompt, allowing you to react immediately and open the Taker order on Variational. If you control this time gap well, you can effectively reduce slippage losses caused by price fluctuations.

When closing positions, set take-profit and stop-loss prices in advance, which can be at the same profit/loss ratio or price level. The editor suggests trying to keep the Extended account profitable while letting the Variational account incur a loss. Why? Because Variational has an interesting mechanism: after reaching the Bronze level (30-day trading volume of $1 million), there is a loss refund lottery mechanism. Although the probability is not high, ranging from 0% to 3%, the higher the level, the higher the chance of winning. If you win, the compensation amount will be the lower of either 100% of the actual loss or 20% of the total funds in the loss compensation pool. Therefore, keeping losses in the Variational account gives you a chance to recover some of the losses.

Once you become proficient with such operations, we can increase the difficulty slightly by widening the spread on Variational. (The spread is the difference between the bid and ask prices, which is also the transaction cost for users entering a trade. A smaller spread means lower transaction costs).

Even though Variational's point weight changes slightly every week, in essence, because Variational profits through its Omni Liquidity Provider spread arbitrage mechanism, there is only one market maker on Variational: Variational itself. So when you open a position on Variational, the platform charges a spread of 4-6 basis points and simultaneously opens a reverse position on external trading platforms to hedge the risk, profiting from the price difference between internal and external markets. Many experienced players, through repeated testing, have discovered a pattern: the larger the spread, the more Variational earns, and correspondingly, the higher the point weight given to users. This gives us an idea: to maximize point weight, we need to find ways to increase the spread.

Based on the principles discussed earlier, we know ways to reduce the spread include: trading mainstream cryptocurrencies like BTC or ETH; and choosing times with good liquidity. Conversely, ways to increase the spread are: trading small-cap altcoins, as illiquid altcoins have larger spreads than mainstream ones; additionally, choose times with poor liquidity, such as weekends or Asian nighttime hours. This will result in a relatively higher weight. On this basis, you can further diversify the tokens traded (don't always trade the same ones), increase the number of trades, holding duration, single trade amount, etc., to expand trading volume data.

Furthermore, besides common cryptocurrencies in the crypto space, platforms like Extended and edgeX also support trading traditional financial assets. Extended currently offers a relatively richer selection, covering indices like the S&P 500 and Nasdaq, forex like EUR/USD, precious metals like gold and silver, and commodities like oil, totaling six varieties. edgeX currently only lists the S&P 500 and Nvidia.

So, since both platforms have the S&P 500 index, that presents another hedging opportunity. We can also perform matched trades on the S&P 500 between Extended and edgeX to diversify the entire trading system. The operation method is exactly the same as the same-token hedging between Variational and Extended mentioned earlier: go long on one and short on the other to lock in risk and earn points. However, since TradFi assets involve market closure mechanisms, it's better to trade during US stock market hours for simpler operations.

3. Advanced Play: Long-Term Holding Strategy for Mainstream Tokens

The hedging strategies for small-cap tokens and TradFi assets mentioned earlier, while offering large spreads and high point weight, also have an obvious weakness—relatively poor liquidity. This means such strategies are only suitable for short-term operations, quickly entering and exiting to farm trading volume, and are not suitable for long-term holding. After all, when liquidity is poor, price fluctuations can be more volatile, and holding for too long can increase risk.

Therefore, to make the entire trading system more robust and also to boost the IO (holding duration) metric, which is a very important point weight factor, we can intersperse some long-term holdings of mainstream tokens during non-monitoring times. For example, before going to work during the day or sleeping at night, open some hedged positions on liquid mainstream tokens like BTC and ETH to naturally extend the holding time.

Specifically for operations, you can implement a hedging strategy between BTC and ETH on Variational. You can observe the relative strength between these two tokens. When one rises 2-3% more than the other, go long on the one that rose slower and simultaneously short the one that rose faster. The logic of this strategy is that BTC and ETH have high long-term correlation, and short-term deviations often mean reversion. The holding time can be slightly longer, 8 to 12 hours or even more. You can consider closing the position once one side starts to profit. Even if there is a temporary floating loss, don't rush to stop loss; just hold according to plan.

The advantage of this strategy is that it compensates for the flaw of the previous strategy, which only used market orders on Variational. This strategy allows for more use of limit orders, making the activity appear more like genuine trading rather than volume farming.

However, a reminder here: even for mainstream tokens, it's not advisable to hold positions overnight. The crypto market operates 24/7. If you encounter a sudden market crash or some black swan event, your hedged positions might get liquidated before you can adjust, which would be counterproductive. Also, don't use excessively high leverage; keeping it within 20x for mainstream tokens is sufficient. Safety first.

Additionally, you can develop some strategies based on the characteristics of Extended's vault. Extended Vault Shares, abbreviated as XVS, has a clever design: 90% of the XVS value is simultaneously counted towards your account equity and available trading balance, which is more comprehensive than what Hyperliquid does.

Suppose you have 1000 USDC in your account; your equity and available balance are both $1000. When you deposit this 1000 USDC into the vault and receive an equivalent value of XVS, your equity and available balance become $900. Then, you open a $1000 long position on BTC with 4x leverage. At this point, your equity is still $900, but your available balance becomes $650 (900 minus the margin requirement of 1000 divided by 4). If this BTC long position has a floating profit of $100, your equity increases to $1000, and your available balance correspondingly rises to $750. Throughout this process, your principal is continuously earning APR in the vault while simultaneously supporting your trading positions.

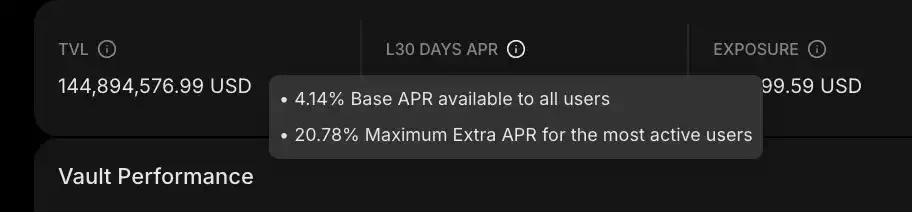

The yield from the Extended vault consists of two parts: base yield and extra yield, with a 30-day APR of 24.92%. The base yield is available to all depositors and is currently 4.14% APR, reflected through the continuous price appreciation of XVS. The vault's revenue sources are similar to other Perp DEXs, primarily from market making, trading fees, and liquidation fees. The extra yield is linked to the trading activity of the account. Starting from the Knight level, you can enjoy extra yield, currently up to 20.78% APR.

4. Expert Must-Learn: Funding Rate Arbitrage

The previous sections discussed farming points through hedging. Now, let's talk about a more advanced play: profiting from funding rate differences between different platforms. The strength of this strategy is that it not only earns points but also generates real profits. However, the operation is slightly more complex and not suitable for beginners.

Before explaining the strategy, let's first explain what the funding rate is. Unlike traditional futures, perpetual contracts have no expiry date. To anchor the contract price to the spot price, exchanges designed a mechanism where long and short positions periodically pay each other a funding fee. When market sentiment is bullish and the contract price is above the spot price, the funding rate is positive, meaning longs pay shorts. Conversely, when there is panic and the contract price is below the spot price, the funding rate is negative, meaning shorts pay longs.

Because the funding rate for the same token can vary significantly across different platforms, this creates arbitrage opportunities. Ideally, you go long on the platform with a lower (or more negative) rate and short on the platform with a higher (or more positive) rate, collecting fees on both sides. But generally, finding a rate difference is sufficient to meet trading conditions. Then, the operation is the same as before, with the same leverage and position size.

What are the benefits of this operation? First, after hedging long and short, you are completely neutral to BTC price movements; neither gains nor losses affect your total assets. Second, on Variational, you pay funding fees for being long, but on Extended, you receive funding fees for being short. If Extended's rate is higher, you profit from the difference.

For example, on January 15th, the funding rate arbitrage opportunity for the IP token across different platforms reached an annualized rate of 953%. What does that mean? Hypothetically, if you invest $10,000, you could theoretically earn $9,530 in a year. Of course, this is an ideal scenario; in reality, funding rates fluctuate and cannot remain that high indefinitely. The arbitrage opportunity for the BERA token that day also had an annualized rate of 435%. For specifics, you can refer to @0xfarmed's post.

In practice, these high-yield opportunities often appear in new tokens with low FDV (Fully Diluted Valuation). Such tokens have small circulating supplies, making market sentiment prone to extremes, leading to particularly volatile funding rates.

Here, we need to monitor the funding rates on different platforms to identify the funding rates in the perpetual contract markets of the two platforms. Therefore, we can use some tools. For example, the SmartArbitrage tool can display real-time arbitrage opportunities across various platforms. Variational's API and Extended also have visual interfaces for rate comparison. Additionally, there is the Telegram bot @lighter_arbitrage_bot, which automatically pushes alerts for arbitrage opportunities. Once you notice the rate difference starting to narrow or the rate on one side turning negative, you can consider closing the position.