Wall Street "Exits" Bitcoin Basis Arbitrage: CME Falls Out of Favor, the Golden Age of Arbitrage Ends

- Core View: Bitcoin basis arbitrage trading has seen a sharp decline in attractiveness due to narrowing spreads, signaling the maturation of the crypto derivatives market. Institutional trading strategies are shifting from simple leveraged arbitrage to more complex options and hedging.

- Key Elements:

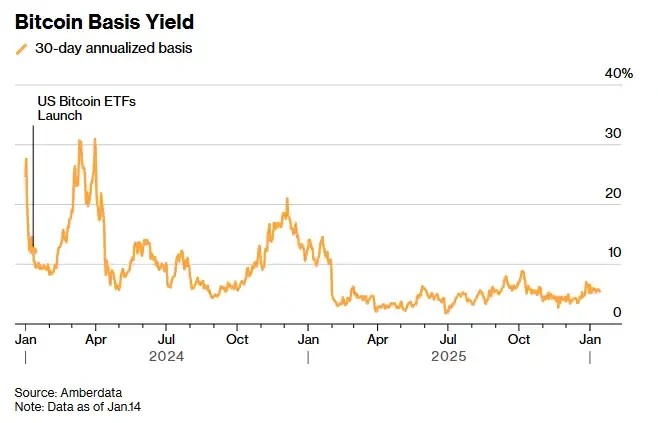

- The Bitcoin futures basis (annualized yield) has dropped from around 17% a year ago to approximately 4.7%, barely covering funding and execution costs, far below the double-digit high-yield levels seen in early 2024.

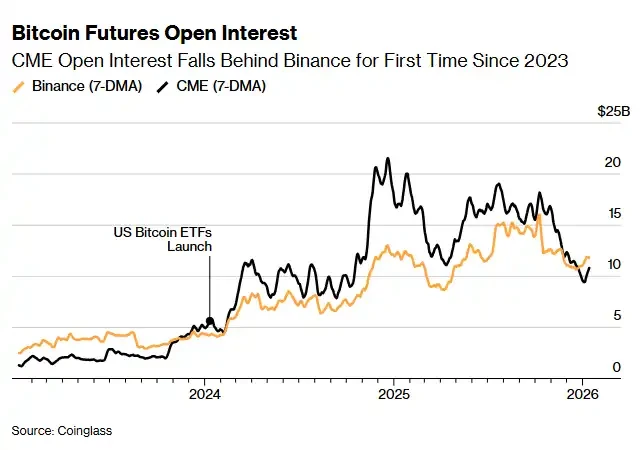

- CME Bitcoin futures open interest has fallen from a peak of over $21 billion to below $10 billion and has been overtaken by Binance (around $11 billion), indicating institutional arbitrage capital is exiting.

- Changes in market structure are key. The proliferation of spot Bitcoin ETFs and increased venue choices have rapidly narrowed price differentials across markets, compressing arbitrage opportunities.

- Institutional capital is expanding from single Bitcoin strategies to derivative trading of other tokens like Ethereum. CME Ethereum futures open interest has seen significant growth in 2025.

- Trader behavior is shifting towards using options and hedging tools to express market views, rather than direct leveraged directional bets or simple arbitrage.

Original Title: Wall Street Pulls Back From Bitcoin’s Money-Spinning Basis Trade

Original Author: Sidhartha Shukla, Bloomberg

Original Compilation: Peggy, BlockBeats

Editor's Note: The once "guaranteed profit" Bitcoin basis arbitrage is quietly losing its appeal: the open interest on CME and Binance is shifting, with the spread narrowing to a point where it barely covers funding and execution costs.

On the surface, this is a squeeze on arbitrage opportunities; at a deeper level, it signals the maturation of the crypto derivatives market. Institutions no longer need to rely on "arbitrage" for returns, and traders are shifting from leverage to options and hedging. The simple era of high returns is fading, and new competition will emerge in more complex and sophisticated strategies.

The following is the original text:

A quiet yet significant shift is underway in the crypto derivatives market: one of the most stable and profitable trading strategies is showing signs of faltering.

The "cash-and-carry" trade, commonly used by institutions—buying Bitcoin spot while simultaneously selling futures to capture the spread—is collapsing. This not only signals rapidly compressing arbitrage margins but also sends a deeper message: the structure of the crypto market is changing. The open interest for Bitcoin futures on the Chicago Mercantile Exchange (CME) has fallen below that of Binance for the first time since 2023, further indicating that the once highly profitable arbitrage opportunities are being rapidly eroded as spreads narrow and market access becomes more efficient.

Following the launch of spot Bitcoin ETFs in early 2024, CME briefly became the preferred venue for Wall Street trading desks to execute this strategy. The logic closely mirrors the "basis trade" in traditional markets: buying Bitcoin spot via ETFs while selling futures contracts to profit from the spread.

In the months after ETF approval, this so-called "delta-neutral strategy" often yielded double-digit annualized returns, attracting billions of dollars in capital—funds indifferent to Bitcoin's price direction, focused solely on capturing the yield. However, it was precisely the ETFs that fueled this trade's rapid expansion that also sowed the seeds of its demise: as more trading desks flooded in, the arbitrage spread was quickly erased. Today, the returns from this trade barely cover the cost of capital.

According to data aggregated by Amberdata, the current annualized yield for one-month contracts hovers around 5%, near multi-year lows. Greg Magadini, Head of Derivatives at Amberdata, noted that around this time last year, the basis was close to 17%, but has now fallen to about 4.7%, barely enough to cover the threshold of funding and execution costs. Meanwhile, the one-year U.S. Treasury yield is around 3.5%, rapidly diminishing the appeal of this trade.

Against the backdrop of persistently narrowing spreads, data aggregated by Coinglass shows that the open interest for CME Bitcoin futures has dropped from a peak of over $21 billion to below $10 billion; while Binance's open interest has remained relatively stable at around $11 billion. James Harris, CEO of digital asset management firm Tesseract, stated that this shift reflects more of a pullback by hedge funds and large U.S. accounts, rather than a wholesale retreat from crypto assets following Bitcoin's price peak in October.

Crypto exchanges like Binance are the primary venues for trading perpetual contracts. These contracts feature continuous settlement, pricing, and margin calculations, often updated multiple times a day. Commonly referred to as "perps," they account for the largest share of crypto trading volume. Last year, CME also launched smaller-sized, longer-dated futures contracts covering crypto assets and stock indices, offering futures positions closer to the spot market, allowing investors to hold contracts for up to five years without frequent rollovers.

Tesseract's Harris noted that historically, CME has been the preferred venue for institutional capital and "cash-and-carry" trades. He added that CME's open interest being overtaken by Binance "is a significant signal that the structure of market participation is shifting." He described the current situation as a "tactical reset," driven by lower yields and thinner liquidity, rather than a loss of market confidence.

According to a note from CME Group, 2025 marks a key inflection point for the market: as regulatory frameworks become clearer and investor expectations for the sector improve, institutional capital is also expanding from a singular focus on Bitcoin to tokens like Ethereum, Ripple's XRP, and Solana.

CME Group stated: "Our average daily nominal open interest for Ethereum futures in 2024 was around $1 billion, and by 2025, this figure has grown to nearly $5 billion."

Although Federal Reserve rate cuts have lowered funding costs, this has not spurred a sustained rally in the crypto market since the broad token price crash on October 10th. Current borrowing demand is weak, DeFi yields are low, and traders are increasingly favoring options and hedging tools over direct leveraged directional bets.

Le Shi, Managing Director of Hong Kong at market maker Auros, said that as the market matures, traditional participants now have more channels to express directional views, from ETFs to direct exchange access. This increase in choice narrows price discrepancies between different trading venues, naturally compressing the arbitrage opportunities that once inflated CME's open interest.

Le said: "There's a self-balancing effect here." He believes that as market participants converge on the venues with the lowest costs, the basis narrows, and the incentive to engage in carry trades diminishes accordingly.

On Wednesday, Bitcoin fell as much as 2.4% to $87,188 before paring losses. This decline briefly erased all its year-to-date gains.

Bohumil Vosalik, Chief Investment Officer at 319 Capital, stated that the era of near-risk-free high returns may be over, forcing traders to turn to more complex strategies in decentralized markets. For high-frequency and arbitrage-focused institutions, this means they need to look elsewhere for opportunities.