Lazy Investor's Guide | Cap's Stablecoin Airdrop Announcement Boosts New Pool APY; hyENA Increases LP Quota (January 22)

- Core Viewpoint: This article compiles several current low-risk (relatively) investment opportunities in the market primarily focused on stablecoins or related derivatives, covering both centralized exchanges and on-chain protocols. It provides a detailed analysis of each strategy's expected yield, capacity, and potential risks.

- Key Elements:

- Exchange Savings: Bitget's collaboration with Arbitrum Morpho offers a USDC/USDT flexible savings APY of up to 9.2% with a high quota (up to $400k per account), but involves on-chain protocol risks.

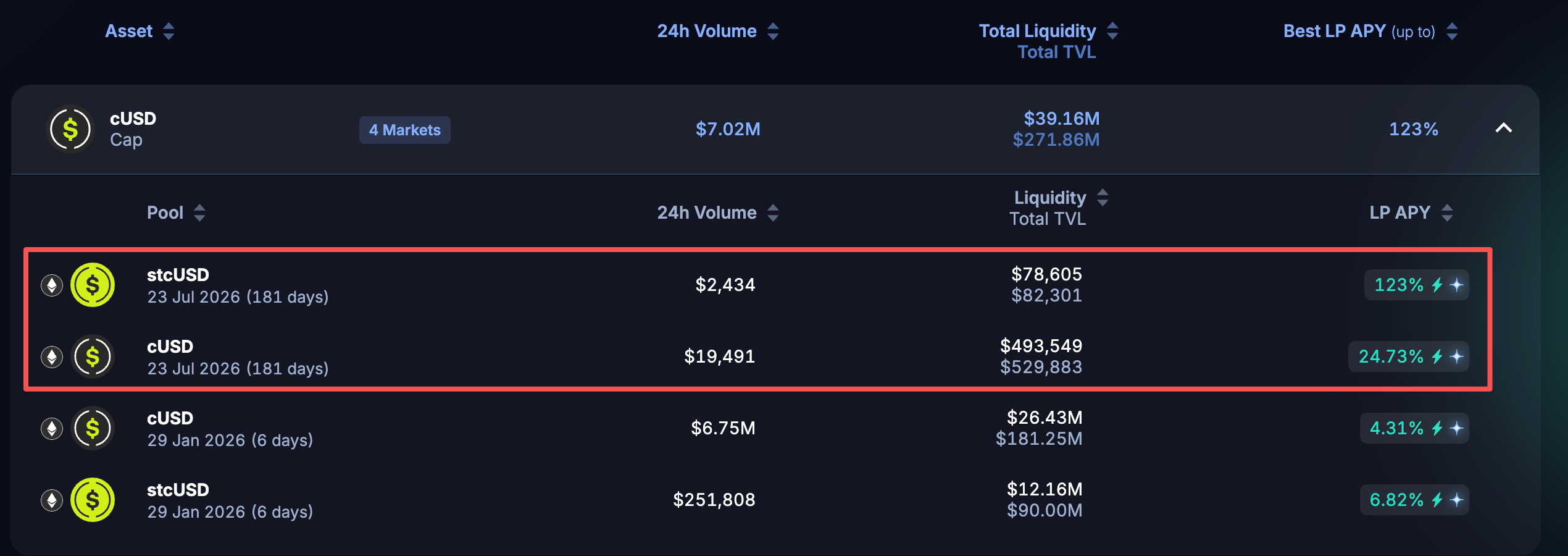

- Cap Project Pendle LP: Participating in Cap's Homestead points program, cUSD LP can achieve a maximum APY of 24.73%, while stcUSD LP can reach up to 123% APY (subject to rapid decay), along with high multiplier points bonuses.

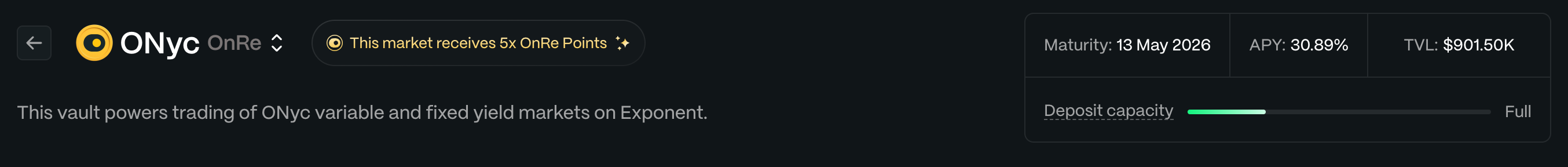

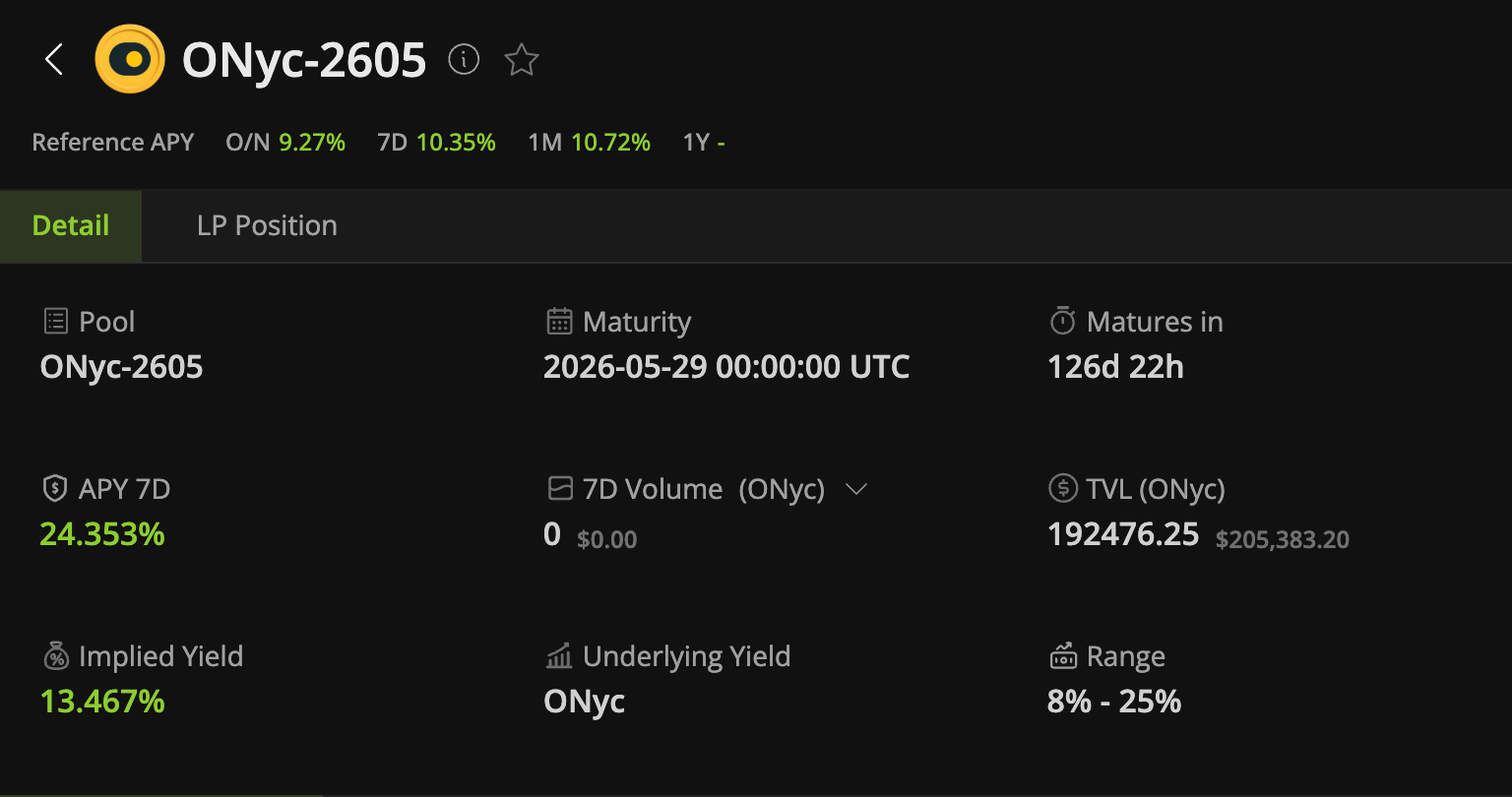

- Onre Protocol ONyc LP: Providing ONyc liquidity on Exponent currently offers an APY of approximately 30.89% (including incentives), with a total pool capacity of $3.5 million. It also grants high multiplier Onre points rewards.

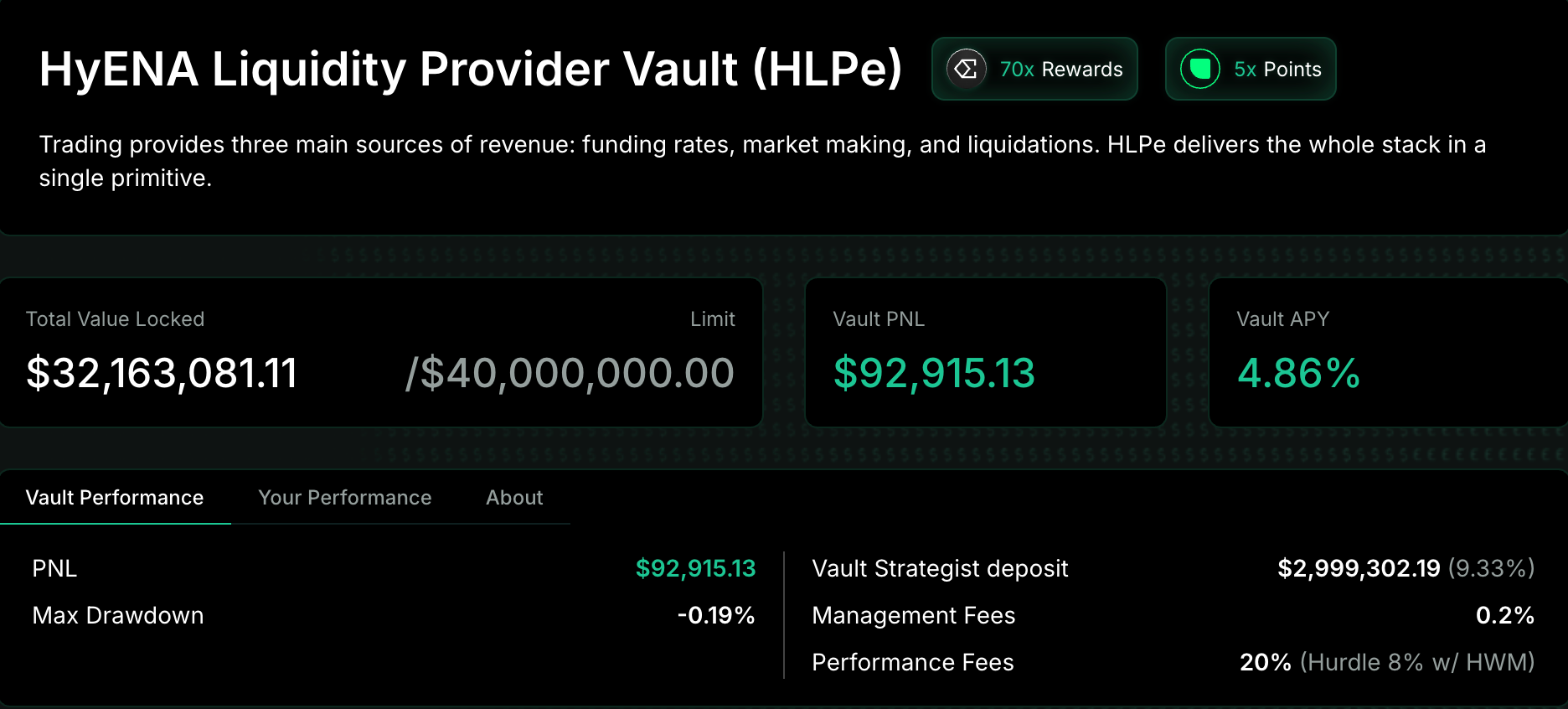

- hyENA LP: Offers a base APY of around 4.86%. Its main appeal lies in providing a 70x Ethena points multiplier, making it an efficient channel to accumulate these points. Deposit quota is currently still available.

- Risk Warning: The article repeatedly cautions about potential smart contract risks, the possibility of yields decaying rapidly, and limited quotas requiring quick action. Users are advised to participate based on their own risk tolerance.

Original | Odaily (@OdailyChina)

Author|Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies in the current market primarily focused on stablecoins (and their derivative tokens) (Odaily Note: code risk can never be fully eliminated), to help users who wish to gradually increase their capital scale through USD-pegged wealth management find relatively ideal interest-earning opportunities.

- Odaily Note: For past records, please refer to "Lazy Man's Wealth Management Restart|Ethereal Earns 27% APR While Farming Points; Huma Opens New 28% APY Pool (January 6th)".

Exchange Wealth Management

The previous issue mentioned Binance's USD1 deposit campaign and OKX Pay's USDG holding interest-earning campaign. Currently, the former is about to end, while the latter has relatively limited capacity (capped at 10,000 USDG).

For friends who still wish to conduct wealth management directly on exchanges, consider Bitget's on-chain Earn campaign in collaboration with Arbitrum Morpho. With platform subsidies, the flexible APY for both USDC and USDT can reach 9.2%. The advantage of this campaign is its large capacity (up to $400,000 per account per token, with flexible deposits and withdrawals). The drawback is the additional layer of security risk from the on-chain protocol. Participate based on your own risk tolerance.

Another popular wealth management opportunity is various deposit campaigns on Binance Wallet, such as yesterday's Unitas (real-time APY 37.04%). However, these usually have limits, and slots are fiercely contested. It is recommended to monitor announcements closely and set alarms to participate.

On-Chain Strategy One: Pendle Cap LP (Up to 123% APY + Points)

On January 19th, the stablecoin project Cap officially announced its 1CO and Stabledrop plan. The so-called Stabledrop means Cap will airdrop to participants of the first-season points campaign, Frontier, in the form of its stablecoin cUSD.

Simultaneously, Cap announced that the Frontier campaign will end on January 29th, followed immediately by the launch of the next season's points campaign, Homestead. Related liquidity pools for the Homestead campaign have already been deployed on Pendle, and participants can continue accumulating first-season points (Caps) rewards until Frontier ends.

Stimulated by the innovative stablecoin airdrop mechanism, the yields for Homestead-related liquidity pools on Pendle are currently very attractive. Among them, the base APY for the cUSD LP is 11.33%, which can be amplified to 24.73% with sufficient PENDLE staking, while also receiving a 20x points efficiency multiplier. The base APY for the stcUSD LP is 52.9%, which can be amplified to 123% with sufficient PENDLE staking (the pool is newly opened and small in scale, so the yield is expected to decay relatively quickly), while also receiving a 5x points efficiency multiplier.

On-Chain Strategy Two: Exponent and RateX ONyc LP (Up to 30.89% APY)

On January 20th, Onre, an on-chain reinsurance protocol backed by Solana Ventures and Ethena Labs, renewed its ONyc (Onre's yield-bearing stablecoin) liquidity expiring in May on Exponent and RateX.

Currently, with additional incentives from Onre, providing ONyc LP on Exponent offers a real-time APY as high as 30.89% — the total pool capacity is $3.5 million, which is not huge. Currently, only 25.76% is filled. It is expected that the overall APY will dilute to around 20% once full (currently, 14.44% of the yield comes from additional incentives, which will be significantly affected by dilution). Besides the yield, LPs can also receive 8x Onre points rewards until January 31st, after which it will revert to the regular 5x multiplier.

Although the ONyc LP pool on RateX does not have Onre incentives, RateX itself subsidizes RTX incentives, resulting in an overall APY of around 25%. The Onre points aspect is consistent with Exponent, but participants can also earn 8x RateX points.

The project is relatively niche, making it more suitable for small capital participation.

On-Chain Strategy Three: hyENA LP (4.86% APY + 70x Ethena Points Multiplier)

hyENA, the decentralized perpetuals exchange and "son" of Ethena, recently increased its LP deposit limit again. The current limit is $40 million, with approximately $8 million of space remaining.

Currently, the LP APY on hyENA is about 4.86%. The base yield is not ideal, but participants can simultaneously earn 70x Ethena points (currently the most efficient points channel besides YT) and 5x Upshift points. Consider participating if you are optimistic about Ethena's future development.