Betting on Transparency: How Prediction Markets Are Pricing the 2026 Digital Asset Market Transparency Act

- Core Insight: This article analyzes the legislative prospects of the Digital Asset Market Transparency Act (H.R.3633) as reflected by trading prices on prediction markets. It argues that despite the bill's significance and its passage in the House, its actual probability of becoming law by the end of 2026 may be lower than the current market pricing suggests, due to procedural risks, partisan divisions, time pressure, and contract-specific "resolution risk."

- Key Elements:

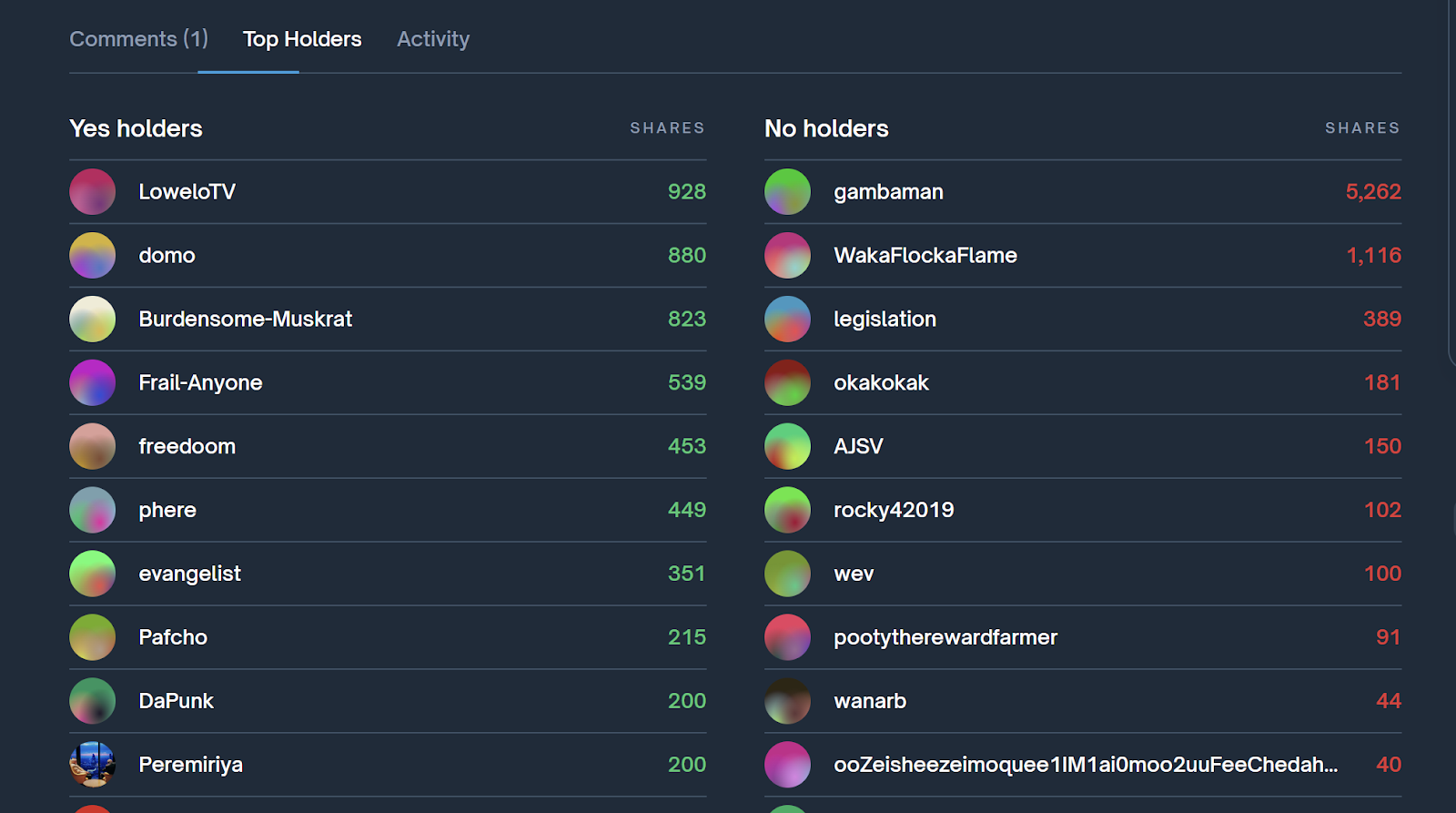

- Market Pricing Reflects Uncertainty: Prediction market contract prices are 53 cents for "Yes" and 48 cents for "No," indicating a slightly higher but far from certain probability of passage, with the small spread showing balanced risks.

- Core Arguments for Passage: Republican support, coordinated industry lobbying (aimed at resolving regulatory uncertainty), and the legislative momentum demonstrated by the bill's passage in the House.

- Major Risks to Passage: The bill faces procedural delay risks in Senate committees; concerns from Democratic lawmakers over issues like investor protection could lead to partisan gridlock; the legislative calendar is compressed by the election cycle.

- Unique "Resolution Risk": The prediction contract stipulates that only the specific bill H.R.3633 completing the legislative process within the timeframe counts as a "Yes." If it is replaced or merged into another bill, even if the policy direction aligns, the market outcome would be "No."

- Key Signals to Watch: Catalysts that could change the outlook include H.R.3633 clearing a Senate committee, the emergence of clear bipartisan public support, and confirmation that this specific bill number will not be superseded.

In the first article, we explained why the Digital Asset Market Clarity Act has become one of the most talked-about pieces of crypto legislation in recent years. We detailed the bill's core structure, its classification of digital assets, why this classification matters for institutions, and its current legislative progress. In short, the Clarity Act aims to reduce regulatory uncertainty, has passed the House, and is now at a critical stage in Senate committees.

This second article shifts the perspective from policy design to probability. The question is no longer whether the Clarity Act matters, but whether it can ultimately become law—and whether the market is pricing this outcome correctly. Today, prediction markets are actively trading this question, forcing participants to translate complex legislation into a binary outcome: yes or no.

From Policy Framework to Market Game

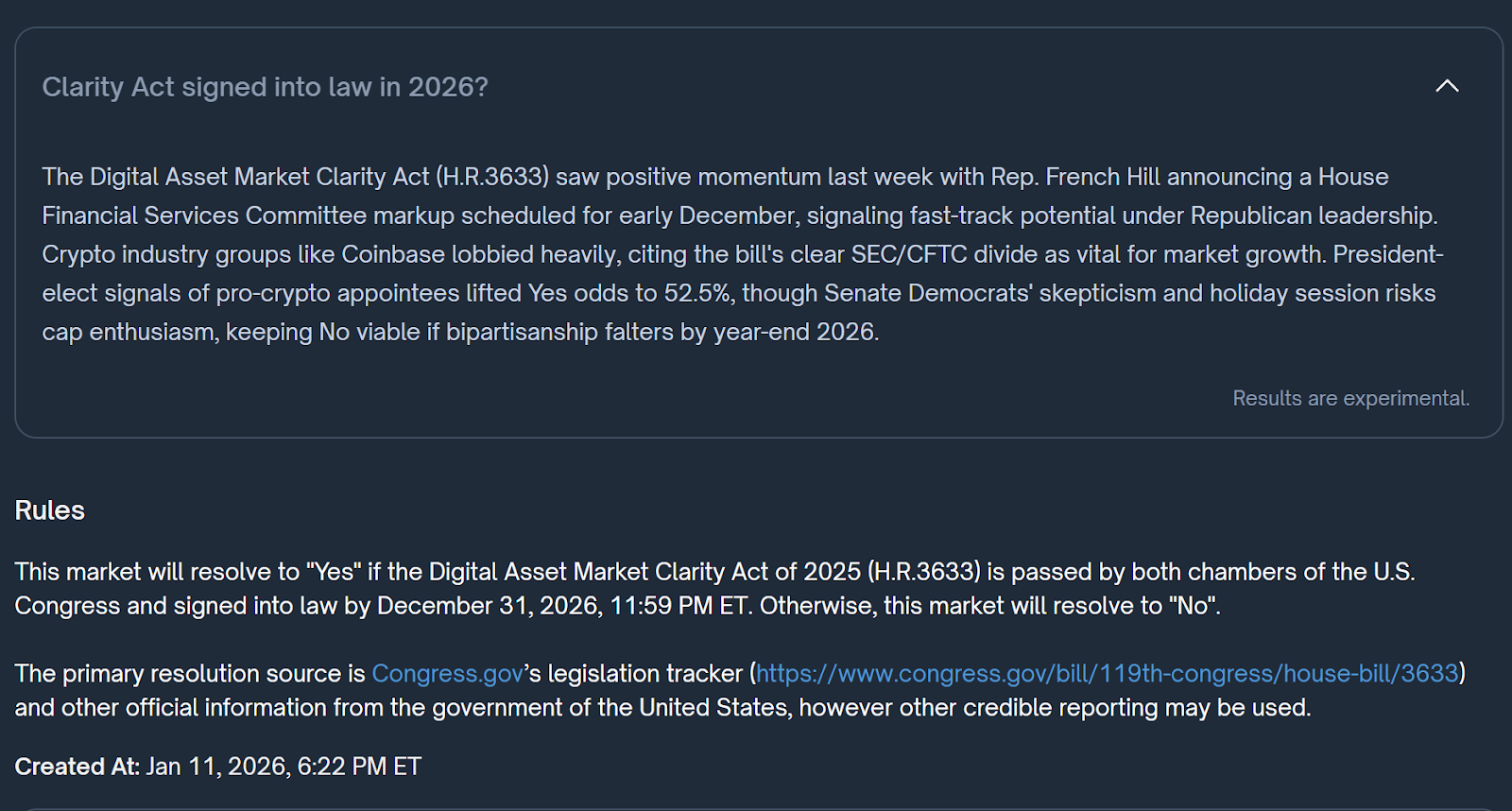

Prediction markets rely on specificity. In this case, the contract isn't asking whether U.S. crypto regulation will improve or if lawmakers will become more supportive of digital assets. It poses a narrower, more demanding question: Will the Digital Asset Market Clarity Act of 2025 (specifically numbered H.R.3633) be passed by both chambers of Congress and signed into law by December 31, 2026?

This framing is crucial. It means that broad regulatory progress alone is insufficient. A similar bill, a revised package, or a Senate-led alternative that ultimately passes under a different bill number would still result in a "no" for this market. Participants are betting not on direction, but on procedural success.

Against this backdrop, the current pricing—approximately 53 cents for "yes" and 48 cents for "no"—suggests the market sees the bill's passage as slightly more likely than not, but far from a certainty. The narrow spread itself reflects how finely balanced the risks are perceived to be.

The Case for "Yes": Why Proponents Believe the Bill Can Pass

Those leaning towards "yes" typically frame their argument around three pillars: political alignment, industry pressure, and strategic timing.

First, Republican lawmakers have been the most consistent champions of digital asset market structure legislation. Their support isn't purely ideological; it aligns with a broader narrative of innovation, competitiveness, and reining in what they see as regulatory overreach. From this view, the Clarity Act aims to replace enforcement-driven uncertainty with legal boundaries. Clear rules, even strict ones, are preferable to unchecked discretion.

Second, industry lobbying has been unusually coordinated. Major exchanges, asset managers, and infrastructure providers have argued for years that the primary barrier to institutional capital is market uncertainty, not volatility. The Clarity Act directly addresses this pain point by clarifying which assets fall under SEC or CFTC jurisdiction. For many market participants, this alone is worth compromising on other aspects.

Third, proponents point to the bill's momentum. Its passage in the House is significant. It demonstrates that a substantial bloc of lawmakers is willing to back a crypto market framework. From a legislative standpoint, it means the Clarity Act has already cleared the stage where most bills die quietly. If Senate leadership can agree on amendments that preserve the bill's core while addressing key objections, proponents believe passage in 2026 remains highly plausible.

From this perspective, the current price for "yes" looks reasonable. It reflects optimism that bipartisan pragmatism will eventually prevail once the cost of continued uncertainty becomes too high.

The Case for "No": Why Skepticism Remains Strong

Simultaneously, many traders and lawmakers remain cautious for equally compelling reasons.

The first is procedural risk. The Clarity Act is currently stalled at the Senate committee level, where complex financial legislation often faces its toughest hurdles. Committee delays aren't just about scheduling; they often signal unresolved disagreements over scope, jurisdiction, or political impact. Each delay shrinks the remaining calendar and increases the chance the bill gets caught up in unrelated fights.

The second point is partisan asymmetry. While Republicans largely frame the bill as pro-innovation, many Senate Democrats see it differently. Their skepticism isn't rooted in anti-crypto sentiment but in risk concerns. Issues like investor protection, systemic stability, and AML enforcement are paramount. For lawmakers prioritizing these, any framework perceived to weaken the SEC or accelerate financialization without adequate safeguards raises red flags.

Stablecoins, DeFi regulation, and the treatment of tokenized securities have all become focal points. Even subtle wording changes can shift power balances between agencies, with implications far beyond crypto. Hesitation, therefore, is rational, not obstructionist.

The third risk is calendar-driven. Legislative time is not continuous. Congressional recesses, holidays, and election cycles interrupt momentum. As 2026 progresses, attention will increasingly shift toward year-end politics and the midterm elections. In that environment, contentious financial legislation becomes harder, not easier, to prioritize. A bill that doesn't clear committee early risks indefinite shelving.

Finally, and most crucially for traders, the contract directly incorporates resolution risk. Even if Congress passes a crypto market structure bill in 2026, the outcome is still "no" unless it's H.R.3633. If Senate negotiators choose to advance a revised version under a different bill number or fold it into a broader legislative package, the policy outcome might be positive, but traders' bets would still lose.

This condition alone warrants a significant discount to the probability of "yes."

How Politics and Timing Affect the Odds

The coming months are less about making headlines and more about sending signals. A rescheduled committee mark-up, a public bipartisan cosponsorship, or clear backing from Senate leadership would materially shift public expectations. Conversely, silence, repeated postponements, or public disagreement among industry backers would reinforce the "no" case.

Holiday recesses add further complexity. They shorten the legislative calendar and scatter lawmakers' focus. Even a popular bill can lose momentum if it doesn't align with Congress's rhythm. By the time lawmakers return, their priorities may have shifted.

Elections add another layer of uncertainty. Legislative trade-offs change as political incentives evolve. What seems feasible in early 2026 may become politically risky by year-end, especially if crypto regulation morphs into a campaign issue rather than a technical policy discussion.

Reading the Price: My Current Lean is "No"

At current prices—53 cents for "yes," 48 cents for "no"—I personally lean toward "no." This doesn't mean I think the Clarity Act is doomed. Rather, I believe the probability of H.R.3633 clearing all legislative hurdles by the end of 2026 is lower than the market currently implies.

The "no" side benefits from multiple, interlocking failure modes: procedural delay, partisan gridlock, calendar compression, and the possibility that a different bill number ultimately becomes law. Each risk alone might be manageable, but in combination, they cast serious doubt on feasibility.

From a probability standpoint, I would need stronger confirmation to pay a premium for "yes."

What Would Make Me Change My Mind to "Yes"?

That said, this isn't a static view. Certain developments would prompt a swift reassessment.

Most important would be a successful committee mark-up and passage of H.R.3633 in the Senate. This event would remove the biggest bottleneck and signal compromise on the most contentious issues.

A second catalyst would be clear bipartisan cooperation, especially public support from influential Senate Democrats. This would reduce the risk of the bill getting bogged down in partisan negotiations.

Finally, clear confirmation that H.R.3633 will remain the legislative vehicle, rather than being replaced by a new Senate bill, would significantly lower resolution risk.

If these signals emerge, the price for "yes" would likely rise, but its underlying probability would also increase. At that point, the risk-reward balance might be enough to flip the position.

For now, the prediction market is doing its best work: forcing participants to confront the difference between policy importance and procedural success. The Clarity Act will likely shape the future of U.S. crypto regulation. But whether it becomes law under this specific bill number and timeline remains the question the market is trying to answer.