The Ultimate Comeback of the "Shovel Seller": Why Did Neynar Acquire Farcaster?

- Core Viewpoint: The acquisition of the Farcaster protocol by its core infrastructure provider, Neynar, marks a shift in the protocol's development focus from the idealized "open social narrative" to a "sustainable product and platform" stage driven by commercialized operations.

- Key Elements:

- Neynar is the largest middleware and developer tool provider within the Farcaster ecosystem, offering services like hosted nodes and APIs. Its team and capital background are closely tied to Coinbase and top-tier venture capital, possessing strong commercialization and operational DNA.

- After experiencing severe revenue decline and user churn in Q4 2025, Farcaster shifted its strategic focus from "social-first" to "wallet-first," aiming to build a commercial loop centered on transactions and payments.

- This acquisition is a vertical integration, transforming Neynar from a "service provider" into the de facto operator of the protocol, aiming to reduce internal friction, drive protocol commercialization more effectively, and help developers generate revenue.

- The Farcaster co-founder team will step back from daily management. This move is seen as handing the project over to a team more adept at commercial execution as the protocol enters its operational phase, transforming it from an "experimental project" into a "manageable asset."

In the world of Web3, what is most easily overestimated is often the ideal of a protocol; what is most easily underestimated is its usability.

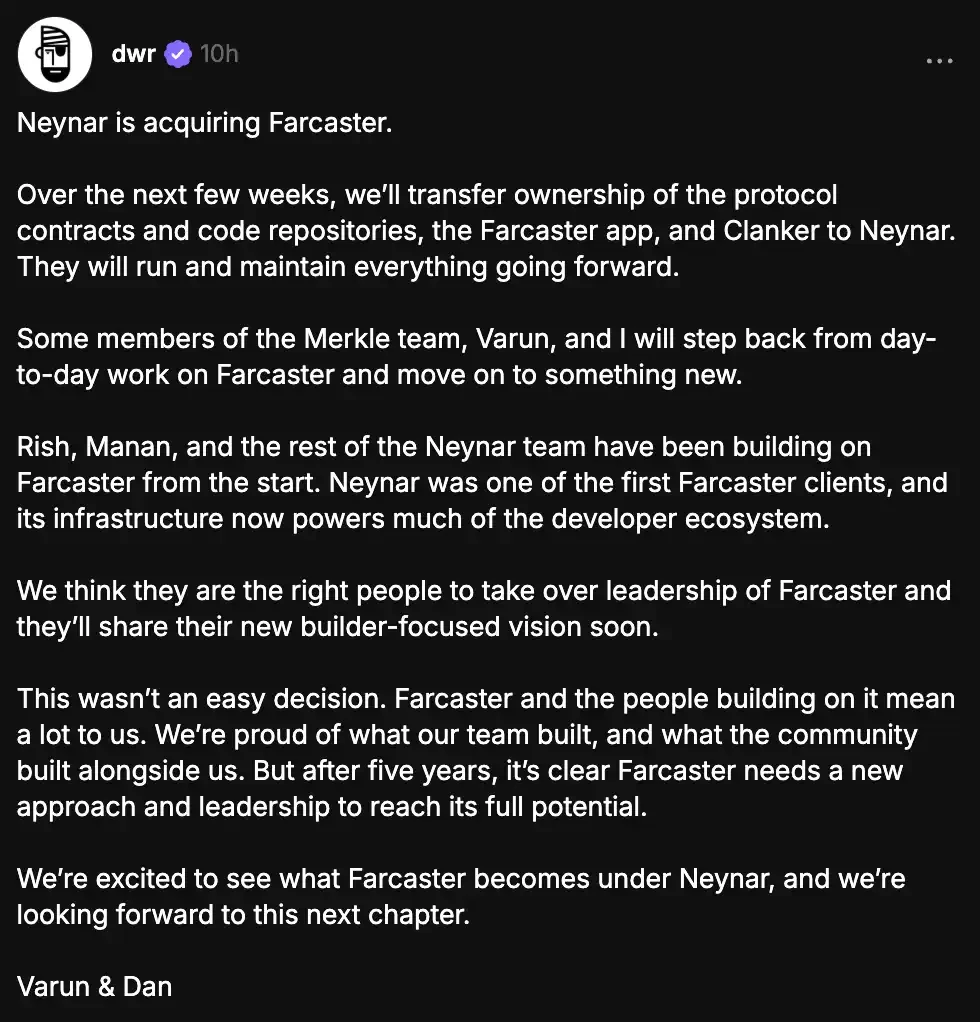

On January 21st, Dan Romero and Varun Srinivasan, co-founders of Farcaster, which had received investments from top-tier institutions like A16Z and Paradigm and reached a valuation exceeding $1 billion, announced that Neynar would acquire Farcaster. In the coming weeks, Farcaster's protocol contracts, code repositories, official client, and Clanker will be transferred to Neynar, which will continue to operate and maintain them. Some members of the founding team Merkle, along with Dan and Varun themselves, will step back from day-to-day management to pursue new ventures.

This acquisition occurs against the backdrop of Farcaster's dramatic ups and downs. The protocol reached a $1 billion valuation in 2024 but suffered severe revenue decline and user attrition in Q4 2025. Previously, community rumors suggested Coinbase would acquire Farcaster. Now, the facts are settled. Neynar, as the largest middleware and developer tool provider within the Farcaster ecosystem, has completed a transformation from a "shovel seller" to a "mine owner" through this acquisition, achieving vertical integration across the protocol layer, application layer, and infrastructure layer.

When an open protocol has passed a five-year experimental phase, what truly determines its continued growth is often no longer narrative, community, or vision, but rather who can operate it stably into a sustainable product and platform.

Who is Neynar: Farcaster's Cloud Service Layer, the Company Most Like Alchemy in the Ecosystem

If we understand Farcaster as an open social protocol, then Neynar's role is not in front-end content distribution but in a more foundational layer. It provides developers with capabilities such as hosted hubs, REST APIs, signer management, new account creation, and webhooks, enabling external teams to read and write Farcaster's social data (users, follow relationships, casts, interactions, etc.) without needing to build their own nodes and indexing systems.

Precisely because of this, Neynar has long played a highly pragmatic function within the Farcaster ecosystem, compressing the cost of building a social application from DevOps-heavy drudgery into a paid service call. Many applications default to using Neynar as their data entry point; even Dune's Farcaster data tables exist in the form of `dune.neynar.dataset_farcaster_*`. Some third-party analyses explicitly state that Dune's Farcaster table data is regularly supplied by Neynar.

This explains why the community harbors a subtle misconception: Neynar appears to be a tool surrounding Farcaster, but in reality, it is closer to being Farcaster's general infrastructure agent.

Neynar's leadership is deeply rooted in the Coinbase network, a highly influential Web3 entrepreneurial network composed of former employees of the largest US cryptocurrency exchange, Coinbase. This background not only defines Neynar's corporate culture but is also a key interpersonal connection facilitating this acquisition.

Rishav (Rish) Mukherji (CEO/Co-founder): Rishav Mukherji is a Harvard graduate who previously served as a Group Product Manager at Coinbase. During his tenure at Coinbase, he accumulated deep experience in scaling crypto products and building compliant infrastructure.

Manan Patel (CTO/Co-founder): As the technical lead, Manan Patel is also a Coinbase alumnus, having served as an Engineering Manager responsible for leading engineering teams. He also possesses extensive experience at Uber and in game development—a technical background in handling high concurrency and real-time data streams crucial for building social network infrastructure.

Understanding this acquisition cannot bypass an easily overlooked fact: Neynar is not a late-stage third-party parachuting in; it has been deeply intertwined with Farcaster from the early days.

On one hand, it started by building applications on Farcaster and gradually productized into a developer platform. This is the growth path repeatedly emphasized in Fortune's funding coverage—tools born from frontline development needs, not designed in a vacuum.

More crucially, there's the capital structure. Neynar announced the completion of an $11 million Series A round in May 2024, led by Haun Ventures and USV, with participation from a16z CSX, Coinbase Ventures, and others. The early investor list also included the names of Farcaster's two founders. Pre-seed information aggregated by CypherHunter shows Dan Romero and Varun Srinivasan were also among Neynar's early investors/supporters.

This relationship means Neynar is less like an outsourced team for a protocol and more like a product growing along a very typical Silicon Valley crypto path: Coinbase talent network + top-tier fund backing + developer tool business model. It is naturally more adept at building paid products, APIs, and platform services, rather than pursuing a purely idealistic "decentralized social movement."

This makes the relationship between Neynar and Farcaster more like an ecosystem symbiont: the protocol side nurtures the infrastructure, and the infrastructure, upon scaling up, in turn becomes the protocol's default entry point. When Farcaster entered a stage requiring stronger operational and commercialization capabilities, this structure naturally tended towards convergence.

Why Now?

Before the acquisition, Farcaster had already undergone a significant strategic pivot in its narrative.

In December 2025, Farcaster shifted its strategic focus from "social-first" to "wallet-first." Dan Romero stated candidly that the team had tried the social-first route for 4.5 years but never found a sustainable growth mechanism, whereas wallet and trading tools showed clearer product-market fit.

Farcaster is no longer just a social protocol; it increasingly resembles a potential financial gateway. The social feed is merely the interface; what can truly form a commercial loop are asset behaviors, transactions, subscriptions, and payment pathways.

And this is precisely where Neynar is closest to revenue. When the core actions of developers and users shift from "posting" to "trading and distribution," the infrastructure layer's permission management, real-time events, signing, and account systems become the heart of the entire network—and Neynar is already positioned there.

Judging from Neynar's own acquisition announcement, they did not package this transaction as "expanding territory" but explicitly stated a goal: to maintain the protocol, run the client, operate Clanker, and help builders go from an idea to recurring revenue.

When you provide critical infrastructure for an ecosystem long-term, you gain call volume, data pathways, and developer mindshare. But you remain constrained by the protocol's direction, product priorities, and the official client's strategy. If the protocol is to push more aggressively towards walletization, transactionization, and subscriptionization in the future, an infrastructure company maintaining an "outsourced identity" would only amplify friction.

Here, the acquisition resembles a vertical integration, upgrading the de facto control of the infrastructure layer into the formal responsibility for the protocol and client. This reduces internal friction and clears up issues of ownership and decision-making for future commercialization paths.

What's Next for Farcaster

From Neynar's perspective, Farcaster will not be suddenly shut down nor undergo immediate drastic changes in the near future; they emphasize "no immediate changes" in the short term and will first prioritize tasks. The focus will be on the builder network, promoting easier building, smoother distribution, and more direct revenue loops. This suggests Farcaster's goal may increasingly resemble a programmable social-economic operating system: the social graph provides the distribution soil, wallets and trading provide pricing tools, Frames/mini-apps enable actions within content, and the infrastructure layer standardizes, productizes, and monetizes these actions.

Dan and Varun did not reveal their next move in the announcement, only stating they would step away from Farcaster's daily operations to pursue new things.

From a business motivation perspective, this is not hard to understand. When Farcaster's main battlefield shifts from the protocol exploration phase to the operational and product management phase, it requires stronger execution and commercialization discipline, not the continuous telling of an idealistic open social story. Handing the steering wheel to a team known for developer tools, commercialization, and operations essentially pushes Farcaster from an experimental creation towards a manageable asset.

The founders' departure does not equate to an exit; it's more like a role switch. They validated a paradigm to a deliverable stage, then handed the system to those who can operate it as a business, while they themselves seek the next larger structural opportunity—this is not uncommon in Silicon Valley tech startup history and is particularly common in the crypto industry.