Will History Repeat for the Fourth Time, Is BTC About to Start a New Super Bull Run?

- Core Viewpoint: The article analyzes the reasons behind the current divergence in performance between the cryptocurrency market (represented by Bitcoin) and traditional assets (such as precious metals and stocks). It posits that Bitcoin's weakness serves as a leading indicator for macro risks like global liquidity tightening and heightened geopolitical uncertainty, warning that the current prosperity in other markets may harbor risks.

- Key Elements:

- Market Performance Divergence: Since 2025, gold, silver, US small and mid-cap stocks, and certain sectors of the A-share market have seen significant gains. In contrast, Bitcoin has been consolidating sideways after hitting new highs, with market sentiment remaining subdued.

- Three Reasons for Bitcoin's Weakness: First, as a leading indicator for global risk assets, its stalled rally suggests momentum in other assets may be waning. Second, global US dollar liquidity continues to tighten due to the Fed's Quantitative Tightening (QT) and the Bank of Japan's interest rate hikes. Third, geopolitical "black swan" events (such as aggressive policies from a potential Trump administration) have increased market uncertainty, prompting capital to exit and adopt a wait-and-see approach.

- Different Drivers for Other Asset Rallies: The rise in gold is primarily driven by strategic purchases from global central banks based on sovereign credit concerns. Stock market gains (e.g., the US AI sector, China's IT innovation sector) are mainly fueled by national industrial policies, differing from the market-driven liquidity logic that Bitcoin relies on.

- Historical Patterns Hint at Potential Rebound: Historically, whenever Bitcoin's RSI indicator relative to gold has fallen below 30 (the oversold zone) four times, it was followed by a strong rebound or the start of a bull market in Bitcoin's price.

- Risks of Chasing Other Assets: The current leadership of US small-cap stocks could be a late-cycle bull market signal. The AI sector faces valuation bubble risks. Furthermore, with global investor sentiment extremely optimistic and cash holdings at record lows, market fragility is increasing.

"As long as you don't invest in Crypto, you can make money on anything else."

Recently, the crypto market and other global markets seem to be worlds apart.

Throughout 2025, gold rose over 60%, silver surged 210.9%, and the US Russell 2000 index gained 12.8%. Bitcoin, however, closed the year in the red after briefly hitting new highs.

This divergence has intensified at the start of 2026. On January 20th, gold and silver raced to new highs again, the Russell 2000 index outperformed the S&P 500 for 11 consecutive days, and China's STAR 50 index gained over 15% in a single month.

In stark contrast, Bitcoin, on January 21st, recorded its sixth consecutive negative day, falling headlong from $98,000 back below $90,000.

Silver's performance over the past year

Capital seems to have decisively left the crypto market after 10/11. BTC has been oscillating below $100,000 for over three months, plunging the market into a period of "historically low volatility."

A sense of disappointment is spreading among crypto investors. When asked about investors who left Crypto and profited in other markets, they even shared the "ABC" secret—"Anything But Crypto"—meaning as long as you avoid Crypto, you can make money elsewhere.

The "Mass Adoption" everyone anticipated in the last cycle seems to have arrived, but not in the form of decentralized application proliferation as hoped. Instead, it's a complete "assetization" led by Wall Street.

This cycle has seen the US establishment and Wall Street embrace Crypto with unprecedented enthusiasm. The SEC approved spot ETFs; BlackRock and JPMorgan allocated assets to Ethereum; the US incorporated Bitcoin into its national strategic reserves; pension funds in several states invested in Bitcoin; even the NYSE announced plans to launch a cryptocurrency trading platform.

This raises the question: Why, after gaining so much political and capital backing, has Bitcoin's price performance been so disappointing while precious metals and stock markets are hitting new highs?

When crypto investors have become accustomed to checking pre-market US stock prices to gauge crypto market movements, why isn't Bitcoin following the upward trend?

Why is Bitcoin So Weak?

The Leading Indicator

Bitcoin is a "leading indicator" for global risk assets, as Real Vision founder Raoul Pal has repeatedly mentioned in his articles. Because Bitcoin's price is driven purely by global liquidity and is not directly affected by any single country's earnings reports or interest rates, its fluctuations often precede those of mainstream risk assets like the Nasdaq index.

According to MacroMicro data, Bitcoin's price turning points have led the S&P 500 index multiple times in recent years. Therefore, once Bitcoin, as a leading indicator, loses its upward momentum and fails to make new highs, it serves as a strong warning signal that the upward momentum of other assets may also be nearing exhaustion.

Liquidity Tightening

Secondly, Bitcoin's price, to this day, remains highly correlated with global US dollar net liquidity. Although the Federal Reserve cut interest rates in 2024 and 2025, the quantitative tightening (QT) that began in 2022 continues to drain liquidity from the market.

Bitcoin's new high in 2025 was largely due to new capital inflows from ETF approvals, but this did not change the fundamental macro landscape of tight global liquidity. Bitcoin's sideways movement is a direct reflection of this macro reality. In an environment of capital scarcity, it's difficult to initiate a super bull run.

Meanwhile, the world's second-largest source of liquidity—the Japanese Yen—is also tightening. The Bank of Japan raised its short-term policy rate to 0.75% in December 2025, the highest level in nearly 30 years. This directly impacts a crucial funding source for global risk assets over the past decades: the Yen carry trade.

Historical data shows that since 2024, each of the BoJ's three rate hikes coincided with Bitcoin price drops exceeding 20%. The synchronized tightening by the Fed and the BoJ has worsened the global liquidity environment.

Crypto market declines following each BoJ rate hike

Geopolitical Conflict

Finally, potential geopolitical "black swans" are keeping market nerves on edge, and a series of domestic and international moves by Trump at the start of 2026 have pushed this uncertainty to new heights.

Internationally, the Trump administration's actions are highly unpredictable. From military intervention in Venezuela to capture its president (unprecedented in modern international relations), to renewed brinkmanship with Iran; from attempts to forcibly purchase Greenland to new tariff threats against the EU. This series of aggressive unilateral actions is comprehensively intensifying major power conflicts.

Domestically, his measures have sparked deeper public concern about a constitutional crisis. He not only proposed renaming the "Department of Defense" to the "Department of War" but has also ordered active-duty troops to prepare for potential domestic deployment.

These actions, combined with his past hints of regret for not using military force to intervene and his unwillingness to accept midterm election defeat, have made public fears increasingly clear: Would he refuse to accept a midterm election loss and use force to remain in power? Such speculation and high tension are already exacerbating internal US divisions, with protests across the country showing signs of escalation.

Last week, Trump invoked the Insurrection Act and deployed troops to Minnesota to quell protests. Subsequently, the Pentagon ordered approximately 1,500 active-duty soldiers stationed in Alaska to be on standby.

The normalization of such conflicts is dragging the world into a "gray zone" between localized warfare and a new Cold War. Traditional full-scale hot wars have relatively clear paths, market expectations, and have even been accompanied by stimulus "bailouts."

These localized conflicts, however, carry extreme uncertainty, filled with "unknown unknowns." For risk capital markets that heavily rely on stable expectations, such uncertainty is fatal. When large capital cannot discern the future direction, the most rational choice is to increase cash holdings and exit the market, rather than allocating funds to high-risk, high-volatility assets.

Why Aren't Other Assets Falling?

In sharp contrast to the crypto market's stagnation, since 2025, markets like precious metals, US stocks, and Chinese A-shares have taken turns rising. However, the rise in these markets is not due to a universally improved macro and liquidity fundamental picture. Instead, it's a structural rally driven by sovereign will and industrial policy against the backdrop of great power competition.

Gold's rise is a reaction by sovereign nations to the existing international order, rooted in the credibility cracks of the US dollar system. The 2008 global financial tsunami and the 2022 freezing of Russian foreign exchange reserves completely shattered the myth of US Treasuries and the dollar as "risk-free" ultimate reserve assets. In this context, global central banks have become "price-insensitive buyers." They buy gold not for short-term profit, but to find an ultimate store of value that does not rely on any single sovereign credit.

Data from the World Gold Council shows that in both 2022 and 2023, global central banks' net gold purchases exceeded 1,000 tons annually, setting historical records. This gold rally is primarily driven by official forces, not market-driven speculative forces.

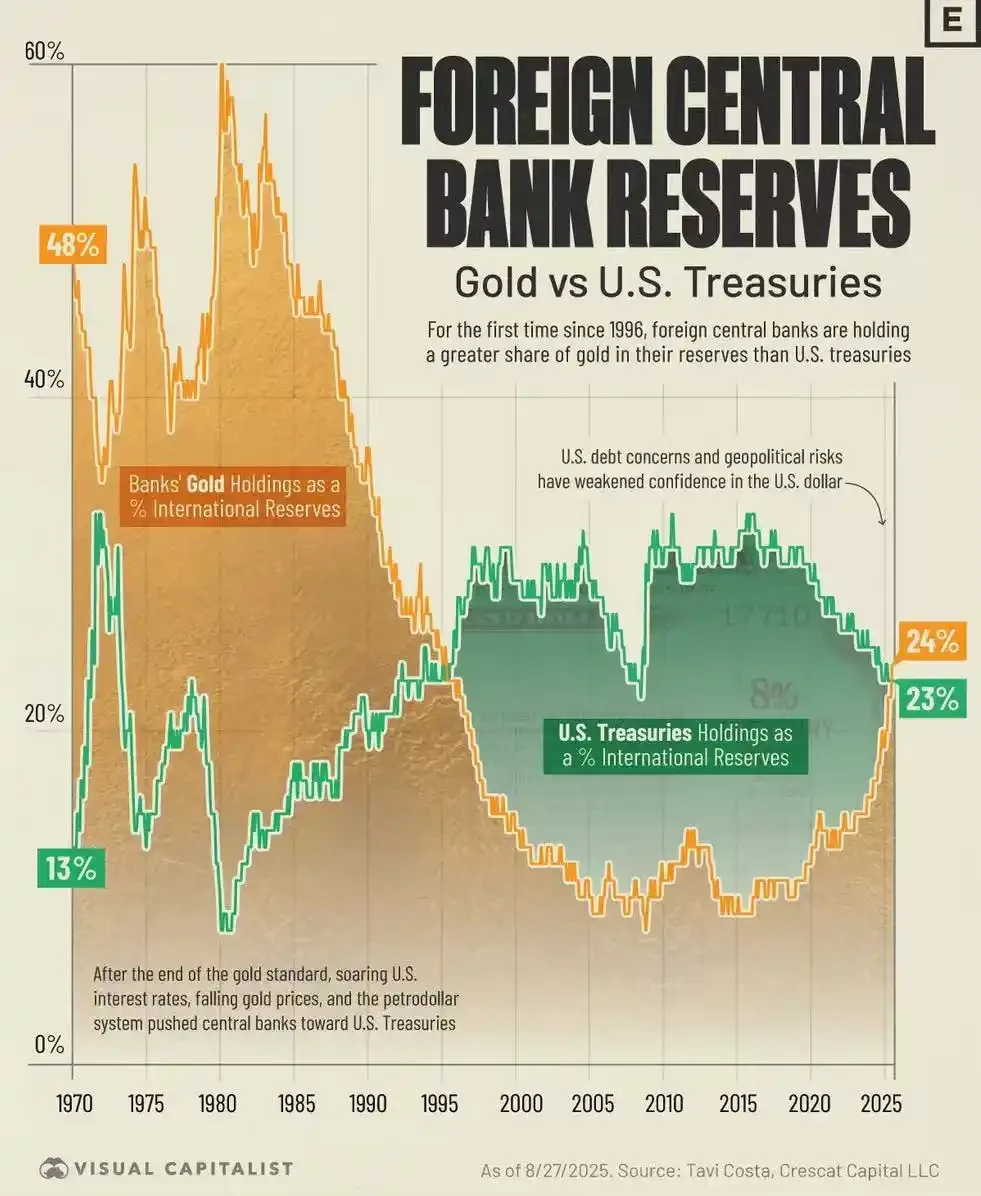

Comparison of gold vs. US Treasury holdings in sovereign central bank reserves. In 2025, total gold reserves surpassed US Treasury holdings.

The stock market's rise, on the other hand, reflects national industrial policies. Whether it's the US "AI Nationalization" strategy or China's "Industrial Autonomy" policy, state power is deeply intervening and directing capital flows.

Take the US, for example. Through the CHIPS and Science Act, the AI industry has been elevated to a strategic height of national security. Capital is clearly flowing out of large-cap tech stocks and pouring into more growth-oriented small and mid-cap stocks that align with policy direction.

In China's A-share market, capital is also highly concentrated in sectors closely related to national security and industrial upgrading, such as "信创" (IT application innovation) and "国防军工" (national defense and military industry). This government-strongly-led rally has a fundamentally different pricing logic compared to Bitcoin, which relies on purely market-driven liquidity.

Will History Repeat Itself?

Historically, this is not the first time Bitcoin's performance has diverged from other assets. And each divergence has ultimately ended with a strong Bitcoin rebound.

Historically, there have been four instances where Bitcoin's RSI (Relative Strength Index) against gold fell below the extreme oversold level of 30: in 2015, 2018, 2022, and 2025.

Each time Bitcoin became extremely undervalued relative to gold, it foreshadowed a rebound in the exchange rate pair or Bitcoin's price.

Historical Bitcoin/Gold price chart with RSI indicator below

In 2015, at the end of a bear market, Bitcoin's RSI against gold fell below 30, subsequently launching the 2016-2017 super bull run.

In 2018, during a bear market, Bitcoin fell over 40% while gold rose nearly 6%. After the RSI fell below 30, Bitcoin rebounded over 770% from its 2020 low.

In 2022, during a bear market, Bitcoin fell nearly 60%. After the RSI fell below 30, Bitcoin rebounded, again outperforming gold.

From late 2025 to now, we are witnessing this historic oversold signal for the fourth time. Gold surged 64% in 2025, while Bitcoin's RSI against gold has once again fallen into oversold territory.

Is It Still Time to Chase Other Assets?

Amid the "ABC" noise, hastily selling crypto assets to chase other seemingly more prosperous markets could be a dangerous decision.

Historically, when US small-cap stocks start leading the rally, it's often the final frenzy before liquidity dries up at the end of a bull market. The Russell 2000 index has risen over 45% from its 2025 low, but most of its constituent companies have relatively poor profitability and are highly sensitive to interest rate changes. Once the Fed's monetary policy falls short of expectations, the fragility of these companies will be immediately exposed.

Secondly, the frenzy in the AI sector is showing typical bubble characteristics. Whether it's Deutsche Bank's survey or warnings from Bridgewater founder Ray Dalio, the AI bubble is listed as the biggest market risk for 2026.

Valuations for star companies like Nvidia and Palantir have reached historical highs, and whether their profit growth can support such high valuations is increasingly being questioned. A deeper risk lies in the possibility that AI's massive energy consumption could trigger a new round of inflationary pressure, forcing central banks to tighten monetary policy and burst the asset bubble.

According to Bank of America's January fund manager survey, global investor optimism is at its highest since July 2021, with global growth expectations soaring. Cash holdings have fallen to a record low of 3.2%, and protection against a market correction is at its lowest level since January 2018.

On one side, we have sovereign assets soaring wildly and overwhelmingly optimistic investor sentiment. On the other, geopolitical conflicts are intensifying.

Against this macro backdrop, Bitcoin's "stagnation" is not simply "underperforming the market." It is more like a sobering signal—an early warning of greater future risks and a period of accumulating strength for a grander narrative shift.

For true long-termists, this is precisely the moment to test convictions, resist temptation, and prepare for the impending crisis and opportunity.