Behind the Million-Dollar Long-Form Article Bounty: Musk's Anxiety, Platform Wars, and the Super App Dream

- Core Viewpoint: Faced with the strong rise of competitors like Threads and the decline in its own user base and advertising revenue, Musk is vigorously supporting the long-form content creator ecosystem in an attempt to enhance user stickiness and time spent on the X platform, laying the groundwork for its grand vision of building an "everything app."

- Key Factors:

- Intense Competitive Pressure: Threads' global mobile daily active users (143.2 million) have surpassed X's (126.2 million). Furthermore, X's daily active users have decreased by 11.9% year-over-year, while Threads has grown by 37.8%.

- Advertising Revenue Halved: X's global advertising revenue dropped from $4.4 billion in 2022 to $2.5 billion in 2024, while Threads' advertising revenue is projected to reach as high as $11.3 billion by 2026.

- Strategic Shift to Long-Form Content: X's core algorithmic metric, "User Time Well Spent," inherently favors long-form content that extends user dwell time, aiming to reduce user churn and enhance overall platform engagement.

- Incentivizing Creators: Launching initiatives like the "Million-Dollar Article Bounty" and linking creator earnings to views from paying users to incentivize high-quality content production and drive Premium subscription growth.

- WeChat Vision as Benchmark: Musk hopes to transform X into an "everything app," but its current user scale (approximately 600 million MAU) and average daily usage time (30-35 minutes) lag far behind WeChat (over 1.4 billion MAU, 82 minutes).

Entering 2026, X (formerly Twitter) has been making frequent moves. While we can't see if anxiety is written on Elon Musk's face, we can see Musk's anxiety written in his tweets.

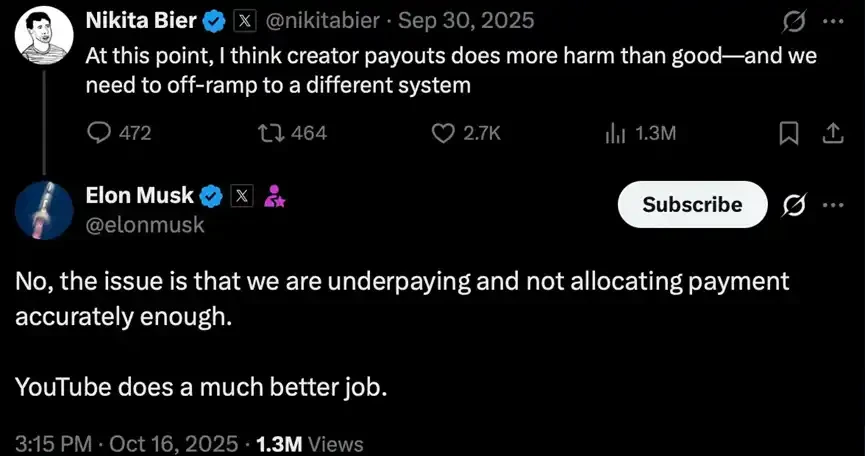

Musk said, "We are still paying creators too little, and the distribution is not done well enough. YouTube does this much better than we do."

And last weekend, X officially launched a "Million Dollar Article Bounty Campaign," sparking a wave of "long-form content fever" on the platform.

Currently, the most impactful article is "How to Fix Your Life in 1 Day" by DAN KOE, which has garnered over 150 million views and received a retweet from Elon Musk.

It has been several years since Musk acquired X. Why is he now vigorously promoting X's creator ecosystem this year? In an era where global user reading habits are fragmented, why has the focus been placed on promoting long-form content? Can the revival of long-form content truly support Musk's ambition for an "Everything App"?

Musk's Anxiety

Every family has its own troubles, and even geniuses face their own anxieties. The relentless pressure from competitors and X's own financial performance have made Musk restless.

X is facing fierce competition in user growth and engagement, especially from Meta's Threads, which has seen rapid growth since its launch in 2023 and has surpassed or is closing in on X in several metrics.

According to the latest data released by analytics firm Similarweb in early January 2026, Threads' global mobile daily active users (DAU) have surpassed X's, averaging 143.2 million compared to X's 126.2 million. In terms of growth trends, X's global DAU decreased by 11.9% year-over-year, while Threads achieved a staggering 37.8% growth. Even in X's home turf, the US market, although X still leads with 21.2 million DAU compared to Threads' 19.5 million, the gap is rapidly narrowing. Threads saw a year-over-year growth rate of 41.8%, while X declined by 18.4%.

In terms of monthly active users (MAU), Threads also performs excellently. As of January 2026, its MAU has reached 320 million, having grown from 350 million to 400 million in 2025. In comparison, although X's MAU remains at a scale of approximately 611 million, it has lost about 32 million users cumulatively since Musk's acquisition. This shifting dynamic undoubtedly puts immense pressure on Musk.

The decline in user data directly impacts X's core revenue source—advertising. According to public data, X's global advertising revenue dropped to $2.5 billion in 2024, nearly halving from $4.4 billion in 2022. Although it is estimated to have slightly recovered to $2.26 billion in 2025, the overall downward trend remains evident, with some institutions predicting it will only recover to $2.7 billion by 2027.

Meanwhile, the competitor Threads is highly favored by the capital markets. Analysts predict Threads' advertising revenue could reach $11.3 billion in 2026, several times that of X's estimated revenue. Although X achieved quarterly revenue growth by the end of 2025, the company as a whole remains in a loss-making state due to high restructuring costs.

Although subscription users (X Premium) saw significant growth in 2025, their revenue contribution falls far short of Musk's initial goal of "accounting for 50% of total revenue." Therefore, X has directly linked Premium subscription growth to creator earnings, not only offering higher creator payouts but also explicitly basing earnings calculations on paid user views (Verified Home Timeline impressions). This incentivizes creators to produce high-quality content that attracts paying users, thereby driving more users to subscribe to Premium services.

This ultimately led to the "Million Dollar Article Bounty Campaign" initiated by Musk, akin to "buying a thousand-mile horse with a thousand pieces of gold." Users in the Chinese-speaking community jokingly say Musk is hosting the American version of the "New Concept Essay Contest" in 2026.

The Revival of Long-Form Content

Musk's choice to make long-form articles the breakthrough point for X's creator ecosystem is not a whim but a deep strategic consideration based on his vision for X's positioning.

Currently, a core metric of X's recommendation algorithm is "user time well spent," which refers to the total effective time users spend on a piece of content. Musk explicitly pointed out that this mechanism naturally favors long-form content because it can "accumulate more user seconds," thereby increasing the content's algorithmic weight and the platform's overall user engagement.

Long-form articles, by providing depth, context, and complete narratives, naturally extend user dwell time, contrasting sharply with the quick consumption model of short posts or videos. Recent algorithm updates have even introduced "content format weighting," explicitly favoring long-form content that requires more creative effort and has greater impact. This is not only an incentive for creators but also a data-driven decision: high-quality long-form articles can effectively reduce users clicking away to external links, keep users on the platform longer, and simultaneously provide more high-quality training data for Musk's AI project, Grok AI.

Musk has repeatedly emphasized his desire to make X the "Earth's primary news source," replacing traditional media by aggregating "collective intelligence" in real-time. The long-form article feature allows users to publish "complete articles or even books," enabling domain experts, eyewitnesses, and deep-dive creators to share their full insights directly on the platform, rather than fragmented information. Furthermore, compared to other platforms' massive subsidies for short videos, the incentive model for long-form articles is more easily monetized through subscriptions, creating a commercial loop that can attract more professional journalists and writers back to the X platform.

However, a question arises. You might ask, in an era where global user reading habits are fragmented, why is Musk pushing this "Renaissance"?

It is undeniable that global users' digital reading habits are showing a clear trend towards fragmentation, especially under the impact of short-video platforms. Younger groups like Gen Z tend towards "fragmented" reading—multiple times a day for 5-10 minutes each session. However, data also shows that people's overall reading volume is actually increasing. As a counter-movement, "slow, immersive reading" is on the rise. Amid digital fatigue, people are beginning to seek depth, emotional connection, and meaningful content consumption.

What X wants is not to become another entertainment platform like TikTok, but to become a "life hub" deeply integrated into every American's daily life, much like WeChat—the "Everything App" Musk keeps talking about. To achieve this, it is essential to greatly enrich the platform's content and service ecosystem, increase users' "time well spent," give them more reasons to stay on the platform, and complete more tasks here.

The Ambition for an Everything App

All of Musk's efforts ultimately point to a grand goal: turning X into an "Everything App" like WeChat. However, to realize this ambition, X still has a long way to go.

Compared to WeChat, X lags significantly in several key metrics. In terms of monthly active users (MAU), WeChat boasts over 1.4 billion users, while X has only 557 million, less than one-third of WeChat's user base. Such a vast gap in user base makes it difficult for X to develop the powerful "network effects" seen with WeChat—where users cannot leave because all their friends, family, and life services are on the platform. WeChat has become a daily necessity for many, while X, in the eyes of most users, remains a social media platform for getting news and expressing opinions—still the old Twitter, the "American Weibo."

The gap in user stickiness is equally stark. The average daily usage time for WeChat users is as high as 82 minutes, while for X users it's only 30-35 minutes. The reason behind this is that users can complete a large number of "productive" tasks within WeChat, such as chatting, payments, shopping, and accessing municipal services. In contrast, content consumption on X is still primarily passive browsing, which easily leads to "scrolling and leaving."

Musk doesn't want X to become TikTok, so his first step is to move X away from the "scrolling and leaving" entertainment-centric user experience. He needs high-quality, in-depth content to enhance user stickiness, attract and retain high-value users, and then, based on this content foundation, gradually graft on more services like payments and e-commerce, ultimately paving the way to the "Everything App."

And the grander this dream is, the deeper Musk's anxiety will be.