Tiger Research: Policy Catalysts and Liquidity Expansion Lock Bitcoin Valuation at $185,500 for Q1 2026

- Core View: Tiger Research has released its Bitcoin outlook report for Q1 2026. Despite short-term headwinds such as institutional capital outflows, the report maintains a bullish stance based on macro easing, regulatory progress, and healthy on-chain structure, setting a target price of $185,500.

- Key Factors:

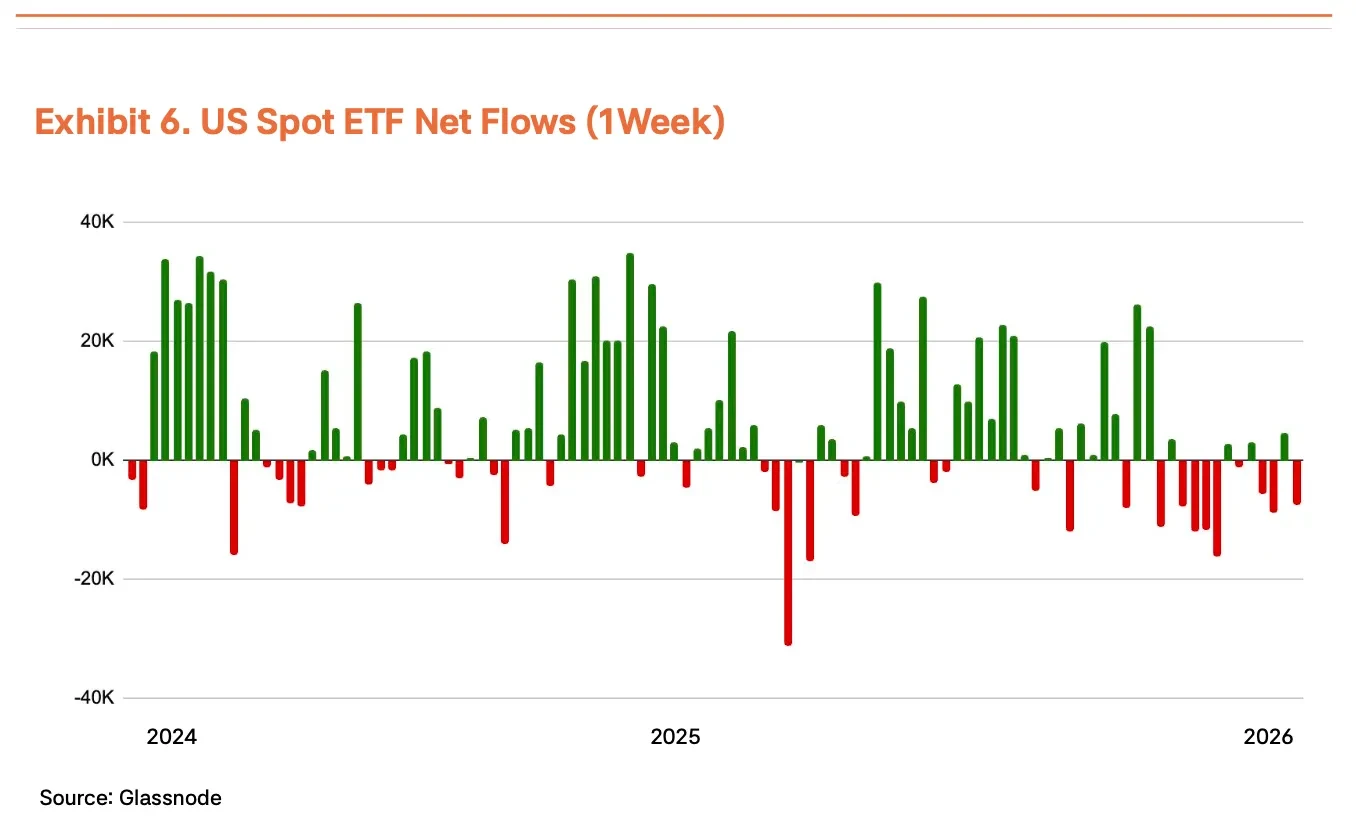

- Robust Macro Backdrop but Slowing Momentum: The Federal Reserve's rate-cutting cycle continues, and global M2 liquidity is expanding. However, spot ETFs recorded a record $4.57 billion outflow in November-December, suppressing short-term price action.

- Key Regulatory Progress Could Attract Institutions: If passed, the U.S. CLARITY Act would pave the way for banks to provide digital asset services, potentially serving as a catalyst for attracting traditional financial institutions.

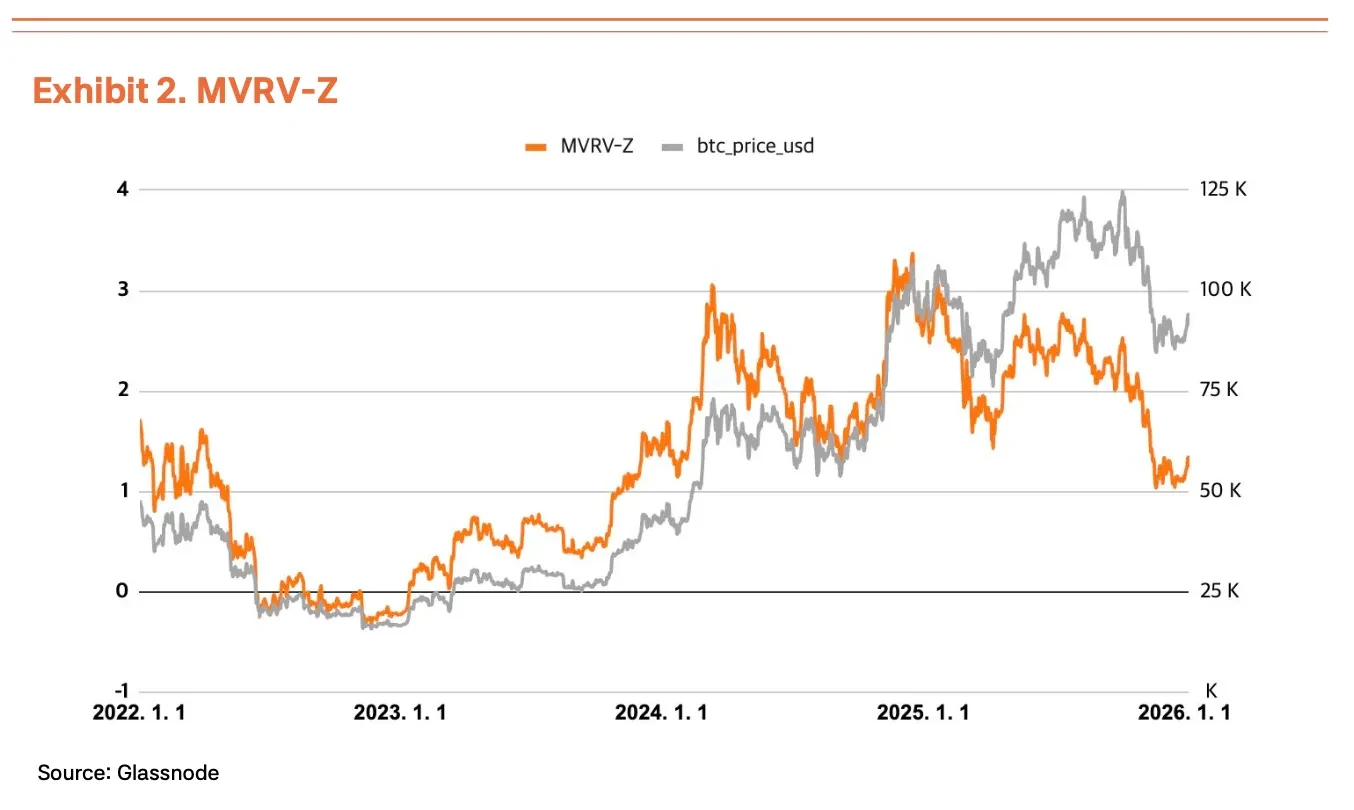

- On-Chain Metrics Indicate Healthy Market Structure: A solid support level has formed around $84,000, with $98,000 acting as short-term resistance. Key indicators like MVRV-Z show the market is in a fair value range with neutral sentiment.

- Adjusted Valuation Model Yields Clear Target: Based on a baseline valuation of $145,000, plus a +25% macro adjustment factor (down from +35% due to factors like slowing institutional inflows), a target price of $185,500 is derived, implying roughly 100% upside potential.

- Long-Term Capital Structure Changes Reduce Volatility Risk: The increased proportion of institutional and long-term capital reduces the likelihood of retail-driven panic selling. Recent pullbacks are viewed as a healthy rebalancing process.

This report is authored by Tiger Research, presenting our market outlook for Bitcoin in Q1 2026, with a target price set at $185,500.

Key Takeaways

- Macro Stability, Momentum Slows: The Fed's rate-cutting cycle and M2 money supply growth remain on track. However, $4.57 billion in ETF outflows have impacted short-term price action. Progress on the CLARITY Act could be a key catalyst for attracting major banks.

- On-Chain Indicators Shift to Neutral: Buy-side demand around $84,000 has formed a solid bottom support; meanwhile, $98,000, representing the cost basis for short-term holders, currently constitutes the main resistance level. Key indicators like MVRV-Z show the market is currently at fair value.

- Target Price $185,500, Maintaining Bullish View: Based on a baseline valuation of $145,000 and a +25% macro factor adjustment, we set our target price at $185,500. This implies approximately 100% upside potential from current levels.

Macro Easing Continues, Growth Momentum Weakens

Bitcoin is currently trading around $96,000. Since our previous report on October 23, 2025, the price has declined by 12%. Despite the recent pullback, the macro backdrop supporting Bitcoin remains solid.

Fed Path Maintains Dovish Stance

Source: Tiger Research

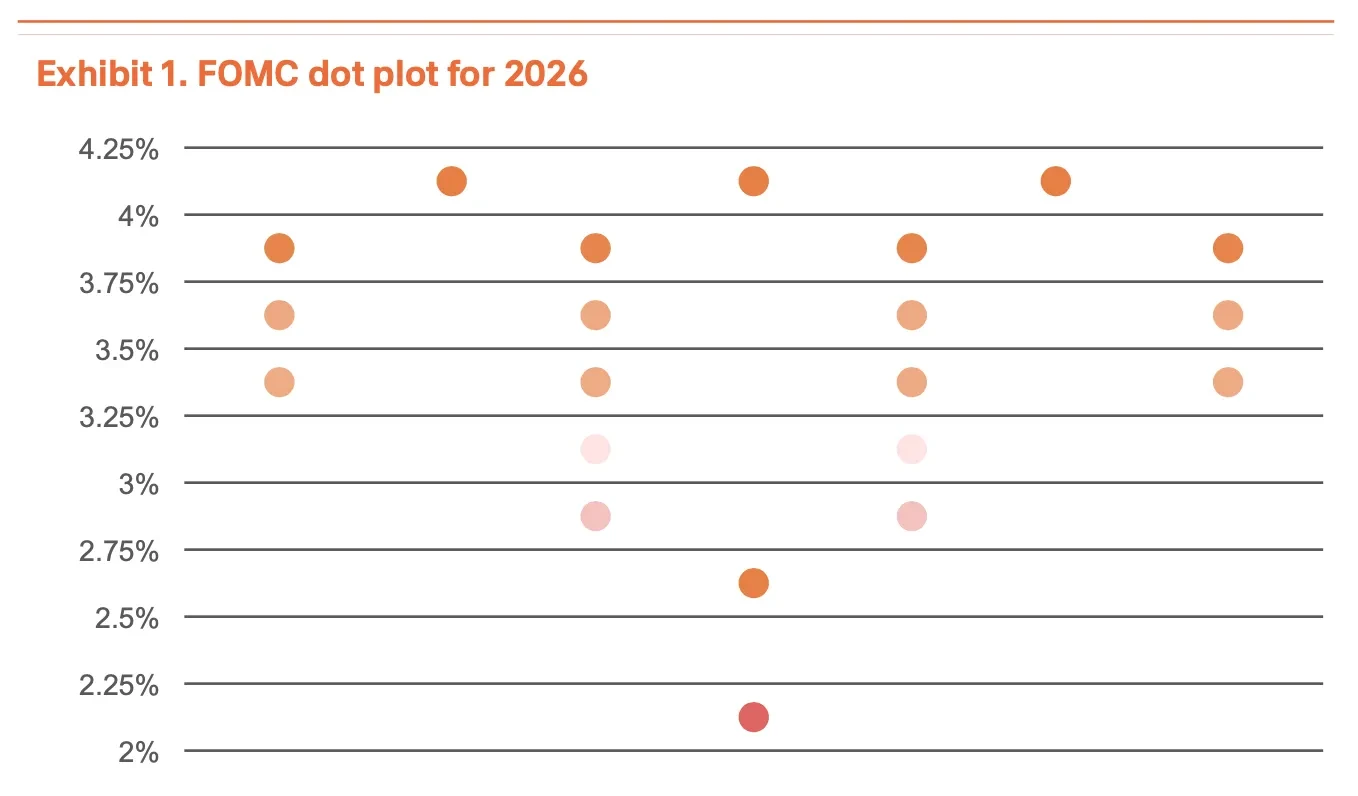

The Federal Reserve implemented three consecutive rate cuts from September to December 2025, totaling 75 basis points, bringing the current target range to 3.50%–3.75%. The December dot plot projects the rate to fall to 3.4% by the end of 2026. While a single 50-basis-point or larger cut this year is unlikely, with Powell's term ending in May, the Trump administration may appoint a more dovish successor, ensuring the continuation of monetary easing.

Institutional Outflows vs. Corporate Accumulation

Despite a favorable macro environment, institutional demand has recently been weak. Spot ETFs recorded $4.57 billion in outflows during November and December, the largest since their launch. Annual net inflows were $21.4 billion, down 39% from last year's $35.2 billion. While January's asset rebalancing brought some inflows, the sustainability of the rebound remains to be seen. Meanwhile, companies like MicroStrategy (holding 673,783 BTC, ~3.2% of total supply), Metaplanet, and Mara continue to accumulate.

CLARITY Act as a Policy Catalyst

Against the backdrop of stagnant institutional demand, regulatory progress is becoming a potential driver. The CLARITY Act, passed by the House, clarifies jurisdictional boundaries between the SEC and CFTC and allows banks to offer digital asset custody and staking services. Furthermore, it grants the CFTC regulatory authority over the digital commodity spot market, providing a clear legal framework for exchanges and brokers. The Senate Banking Committee is scheduled for review on January 15th. If passed, it could prompt long-hesitant traditional financial institutions to formally enter the market.

Ample Liquidity, Bitcoin Lags

Liquidity is another key variable besides regulation. Global M2 supply hit a record high in Q4 2024 and continues to grow. Historically, Bitcoin often leads liquidity cycles, typically rising before M2 peaks and consolidating during the peak phase. Current signs point to further liquidity expansion, suggesting Bitcoin still has upside potential. If equity market valuations appear stretched, capital could rotate into Bitcoin.

Macro Factor Adjusted to +25%, Outlook Remains Solid

Overall, the macro direction of rate cuts and liquidity expansion remains unchanged. However, considering slowing institutional inflows, uncertainty around the Fed leadership transition, and rising geopolitical risks, we have lowered our macro adjustment factor from +35% to +25%. Despite this reduction, the weight remains in positive territory. We believe regulatory progress and continued M2 expansion will provide core support for medium-to-long-term price appreciation.

$84,000 Support and $98,000 Resistance

On-chain indicators provide supplementary signals to macro analysis. During the correction in November 2025, dip-buying was concentrated around $84,000, forming a clear support zone. Bitcoin has since broken above this range. The $98,000 level corresponds to the average cost basis for short-term holders, constituting a near-term psychological and technical resistance.

On-chain data shows market sentiment shifting from short-term panic to neutral. Key indicators like MVRV-Z (1.25), NUPL (0.39), and aSOPR (1.00) have all moved out of undervalued territory into an equilibrium range. This means the likelihood of a panic-driven explosive rally has decreased, but the market structure remains healthy. Combined with the macro and regulatory backdrop, the statistical basis for medium-to-long-term price appreciation remains strong.

Notably, the current market structure differs significantly from previous cycles. The increased proportion of institutional and long-term capital reduces the probability of panic-driven sell-offs fueled by retail investors. Recent pullbacks have manifested more as gradual rebalancing. While short-term volatility is inevitable, the overall upward structure remains intact.

Target Price Adjusted to $185,500, Bullish Outlook Firm

Applying the TVM valuation framework, we derive a neutral baseline valuation of $145,000 for Q1 2026 (slightly below the previous report's $154,000). Combining a 0% fundamental adjustment and a +25% macro adjustment, we set the revised target price at $185,500.

We have raised the fundamental adjustment factor from -2% to 0%. While network activity shows little change, renewed market focus on the BTCFi ecosystem has effectively offset some bearish signals. Concurrently, due to the aforementioned slowdown in institutional inflows and geopolitical factors, we have lowered the macro adjustment factor from +35% to +25%.

This target price reduction should not be interpreted as a bearish signal. Even after the adjustment, the model still indicates approximately 100% potential upside. The lower baseline price primarily reflects recent volatility, while Bitcoin's intrinsic value is expected to continue rising over the medium to long term. We view the recent pullback as a healthy rebalancing process, and our medium-to-long-term bullish outlook remains unchanged.