Arthur Hayes Deep Dive: Why Did Bitcoin Underperform Gold and Nasdaq in 2025?

- Core Viewpoint: The author argues that Bitcoin's weak performance in 2025 aligns with its strong correlation to US dollar liquidity. In contrast, the counter-trend rallies in gold and the Nasdaq stem from sovereign nations' de-dollarization reserve demand and the US government's strategic "nationalization" support for the AI industry, respectively.

- Key Elements:

- Gold Price Surge: The primary driver is central banks (price-insensitive buyers) accelerating gold purchases due to concerns over US Treasury asset security (e.g., the Russia case) and increasingly using gold to settle trade deficits.

- Nasdaq Decoupling from Liquidity: Despite declining dollar liquidity, the AI industry is being "nationalized" by the US and China. The US government's unconditional support for related companies, regardless of returns, provides tech stocks with capital support independent of overall liquidity.

- Bitcoin's Performance Logic: Its value appreciation relies on fiat currency depreciation, making it highly synchronized with US dollar liquidity expansion. The liquidity contraction in 2025 is the direct cause of its underperformance.

- 2026 Liquidity Outlook: The author predicts that the Fed ending QT, commercial banks lending to strategic industries, and government intervention to lower mortgage rates will collectively drive a significant expansion of US dollar credit.

- Trading Strategy: The author gains leveraged exposure to Bitcoin price increases by going long on stocks of companies holding Bitcoin, such as MicroStrategy and Metaplanet.

Original Title: Frowny Cloud

Original Author: Arthur Hayes, Co-founder of BitMEX

Original Compilation: BitpushNews

(Disclaimer: All views expressed herein are solely those of the author and should not be taken as the basis for investment decisions, nor should they be considered as advice to engage in investment transactions.)

The deities I believe in have all taken the form of adorable plush toys.

During the peak ski season in Hokkaido in January and February, I pray to the 'Little Snow Deity'—Frowny Cloud—who governs snowfall. The local climate pattern dictates that during the best part of the season, snowflakes fall almost day and night, and you never see the sun. Fortunately, I also pray to the Vitamin God—a soft, cute little pony plush—who bestows upon me Vitamin D3 tablets and various other blessings.

Although I love snow, not all snow is of good quality and safe. The carefree, aggressive skiing experience I enjoy requires a specific type of snow: low wind speeds at night, with temperatures between -5 and -10 degrees Celsius. Under these conditions, new snow can effectively bond with old snow, creating bottomless powder. During the day, Frowny Cloud blocks specific wavelengths of sunlight, preventing slopes like south-facing ones from being 'cooked' by the sun, which could lead to potential avalanches.

Sometimes, Frowny Cloud abandons us fearless skiers at night. Cold, clear nights cause the snowpack to develop 'layering' after experiencing warming and cooling cycles, creating persistent weak layers. This phenomenon can persist in the snowpack for a long time; once triggered by a skier's weight causing energy transfer and collapse, it can lead to deadly avalanches.

As always, the only way to understand what kind of snowpack Frowny Cloud has created is to study history. On the slopes, we study by digging huge pits and analyzing the different types of snow that have fallen over time. But since this isn't an article about avalanche theory, our approach in the markets is to study charts and the interaction between historical events and price movements.

In this article, I hope to examine the relationship between Bitcoin, gold, stocks (particularly US tech giants in the Nasdaq 100), and US dollar liquidity.

Those who are Gold Bugs or members of the financial establishment wearing Hermès scarves and red-soled shoes (who firmly believe in 'stocks for the long run'—my GPA at Wharton wasn't high enough to get into Professor Siegel's class) (Bitpush Note: Jeremy Siegel is a titan at Wharton and one of Wall Street's most respected economists) are ecstatic that Bitcoin has become the worst-performing mainstream asset of 2025.

These Gold Bugs sneer at Bitcoin proponents: if Bitcoin is touted as a vote against the established order, why hasn't its performance matched or exceeded gold's? Those filthy fiat stock peddlers also scoff: Bitcoin is just a 'high-beta' plaything for the Nasdaq, but in 2025 it didn't even keep up, so why consider crypto in asset allocation?

This article will present a series of beautiful charts with my annotations to clarify the interrelationships of these assets.

I believe Bitcoin's performance is entirely as expected.

It rides the wave of fiat currency liquidity—specifically US dollar liquidity, because the credit impulse of 'Pax Americana' is the most important force in 2025.

Gold's surge is because price-insensitive sovereign nations are hoarding it frantically, fearing their wealth will be confiscated by the US if left in US Treasuries (as happened to Russia in 2022).

Recent US actions against Venezuela will only further strengthen nations' desire to hold gold instead of US debt. Finally, the AI bubble and its related industries are not going away. In fact, Trump must double down on state support for AI because it is the biggest contributor to the empire's GDP growth. This means the Nasdaq can continue to rise even as the pace of dollar creation slows, because Trump has effectively 'nationalized' it.

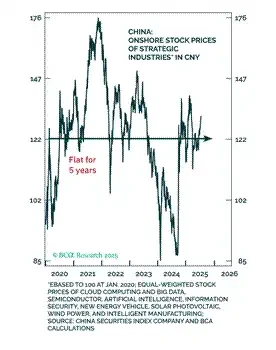

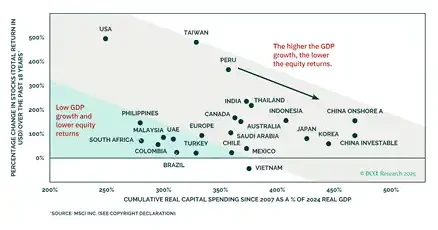

If you've studied China's capital markets, you know stocks perform very well in the early stages of nationalization but then significantly underperform as political goals take precedence over capitalist returns.

If the price movements of Bitcoin, gold, and stocks in 2025 validate my market framework, then I can continue to watch the ebbs and flows of US dollar liquidity.

Reminding readers, my prediction is: Trump will inject credit like crazy to make the economy run 'hot as hell.' A booming economy helps the Republicans win the election this November. As central bank balance sheets expand, commercial banks increase loans to 'strategic industries,' and mortgage rates fall due to money printing, US dollar credit will expand significantly.

In summary, does this mean I can continue to 'surf' carefree—that is, aggressively deploy the fiat I earn and maintain maximum risk exposure? I leave that for you to judge.

The Chart That Rules Them All

First, let's compare the returns of Bitcoin, gold, and the Nasdaq in the first year of Trump's second term. How do these assets' performances compare to changes in US dollar liquidity?

I will elaborate later, but the basic premise is: if US dollar liquidity falls, these assets should also fall. However, gold and stocks rose. Bitcoin performed as expected: like dog shit. Next, I will explain why gold and stocks managed to rise against the trend of falling dollar liquidity.

[Chart: Bitcoin (Red), Gold (Gold), Nasdaq 100 (Green) vs. US Dollar Liquidity (Purple)]

All That Glitters Is Not Gold, But Gold Is Glittering

My crypto journey began with gold. In 2010 and 2011, as the Fed-led quantitative easing (QE) ramped up, I started buying physical gold in Hong Kong. The absolute amount was pitifully small, but it was a shockingly high percentage of my net worth at the time.

Eventually, I learned a painful lesson about position management because I had to sell gold at a loss to buy Bitcoin for arbitrage in 2013. Fortunately, the ending was happy. Even so, I still hold significant amounts of physical gold coins and bars in vaults around the world, and my stock portfolio is dominated by gold and silver mining stocks. Readers might wonder: since I'm a devout believer in Satoshi, why do I hold gold?

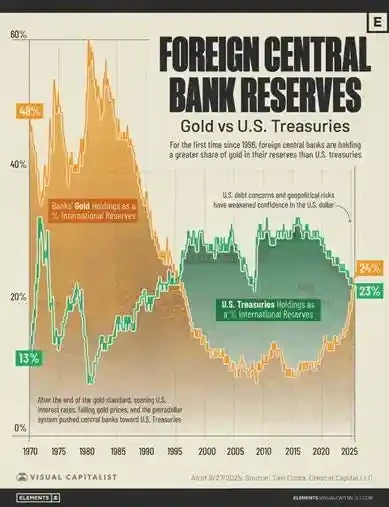

I hold gold because we are in the early stages of global central banks selling US Treasuries and buying gold. Furthermore, countries are increasingly using gold to settle trade deficits, even when analyzing the US trade deficit.

In short, I buy gold because central banks are buying it. Gold, as civilization's true money, has a 10,000-year history. Therefore, no significant central bank reserve manager would store Bitcoin when distrusting the current dollar-dominated financial system; they are and will buy gold. If gold's share of total global central bank reserves returns to 1980s levels, the gold price will rise to $12,000. Before you think I'm dreaming, let me prove it to you intuitively.

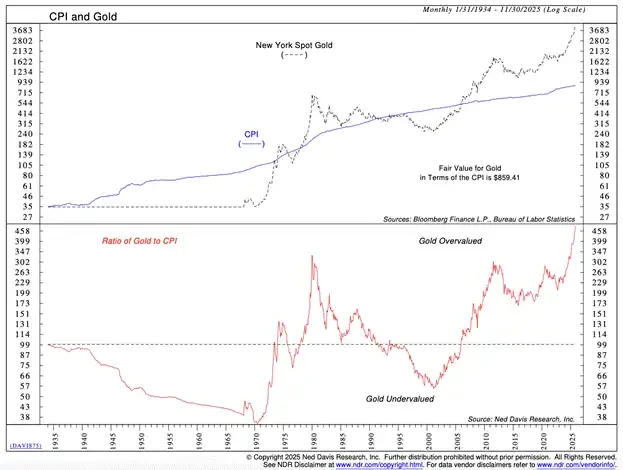

In the fiat system, the traditional view of gold is as an inflation hedge. Therefore, it should roughly track the empire-manipulated CPI index. The chart above shows that since the 1930s, gold has roughly tracked that index. However, starting in 2008 and accelerating after 2022, the gold price has risen far faster than inflation. So, is gold in a bubble, ready to harvest gamblers like me?

[Chart: Gold Price vs. US CPI]

If gold were in a bubble, retail investors would be flocking to it. The most popular way to trade gold is through ETFs, with GLD being the largest. When retail goes crazy buying gold, GLD's shares outstanding increase. To compare across different periods and gold price regimes, we must divide GLD's shares outstanding by the physical gold price. The chart below shows this ratio is falling, not rising, meaning true gold speculation mania has not yet arrived.

[Chart: GLD Shares Outstanding Divided by Gold Spot Price]

If it's not retail pushing up the gold price, who are these price-insensitive buyers? Central bankers around the world. Over the past two decades, there have been two key moments that made these people realize: US currency is only fit for wiping one's ass.

In 2008, US financial titans created a global deflationary financial crisis. Unlike in 1929 when the Fed did not intervene, this time the Fed violated its duty to maintain the dollar's purchasing power, printing money like crazy to 'save' specific large financial players. This marked a watershed moment for sovereign nations' holdings of US Treasuries versus gold.

In 2022, President Biden shocked the world by freezing the Treasury holdings of a nation with a vast nuclear arsenal and the world's largest commodity exporter (Russia). If the US is willing to nullify Russia's property rights, it can do the same to any weaker or less resource-rich nation. Unsurprisingly, other nations can no longer comfortably increase their exposure to US debt at risk of confiscation. They began accelerating gold purchases. Central banks are price-insensitive buyers. If the US President steals your money, your assets instantly go to zero. Since buying gold eliminates counterparty risk, what does it matter if the price is a bit high?

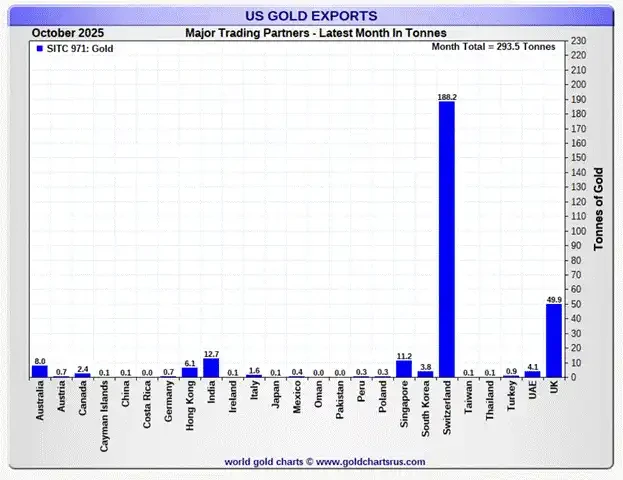

The most fundamental reason for sovereign nations' seemingly infinite appetite for this 'barbarous relic' is that net trade settlement is increasingly conducted in gold. The record contraction of the US trade deficit in December 2025 is evidence of gold re-establishing itself as the global reserve currency. Over 100% of the change in the US net trade balance was attributable to gold exports.

"The goods import-export gap shrank 11% from the previous month to $52.8bn, according to data released on Thursday by the US Commerce Department. That left the deficit at its smallest since June 2020... Exports rose 3 per cent to $289.3bn in August, driven by non-monetary gold." — Source: Financial Times

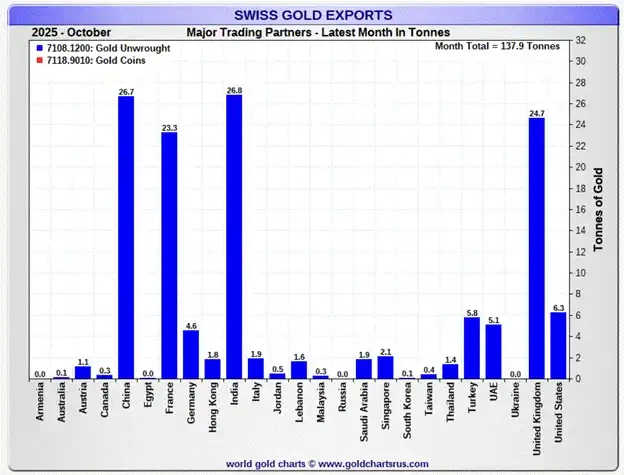

The gold flow path is: the US exports gold to Switzerland, where it is refined and recast, then shipped to other countries. The chart below shows it is mainly China, India, and other emerging economies that manufacture goods or export commodities that buy this gold. The physical goods flow to the US, while the gold flows to the more productive regions of the world.

By 'productive,' I don't mean they are better at writing bullshit reports or crafting complex email signatures, but that they export energy and other key industrial commodities, and their people make steel and refine rare earths. Gold rises despite falling dollar liquidity because sovereign nations are accelerating the restoration of a global gold standard.

[Chart: Gold Import/Export Flow Map by Country]

Long-Termists Love Liquidity

Every era has its high-flying tech stocks. In the roaring 1920s US bull market, radio manufacturer RCA was the hot tech darling; in the 1960s-70s, IBM making new mainframe computers was the focus; today, AI hyperscalers and chipmakers are all the rage.

Humans are inherently optimistic. We love to predict a glorious future: every dollar tech companies spend today will bring a social utopia tomorrow. To realize this vision in investors' minds, companies burn cash and take on debt. When liquidity is cheap, betting on the future is easy. Therefore, investors are happy to spend cheap cash today on tech stocks for the chance of massive future cash flows, driving up P/E ratios. So, during periods of excess liquidity, tech growth stocks rise exponentially.

Bitcoin is monetary technology. The value of this technology is only relative to the degree of fiat currency debasement. The innovation of Proof-of-Work (PoW) blockchains is great, which itself ensures Bitcoin's value is greater than zero. But for Bitcoin's value to approach $100,000, it requires continuous fiat currency debasement. Bitcoin's asynchronous growth is a direct result of the explosion in US dollar supply after the 2008 global financial crisis.

Therefore, I say: When US dollar liquidity expands, Bitcoin and the Nasdaq rise.

The only current contradiction is the recent divergence between Bitcoin's price and the Nasdaq.

[Chart: Bitcoin vs. Nasdaq Price Trend]

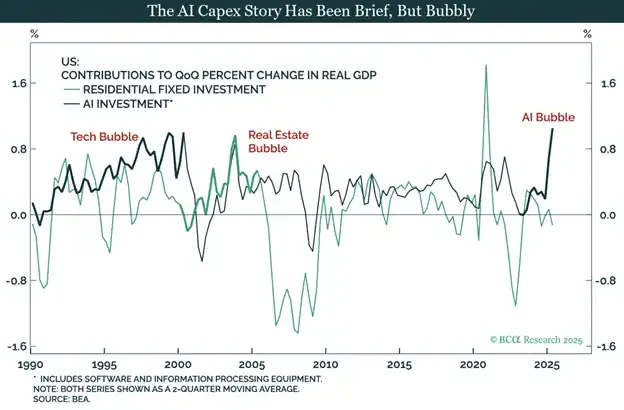

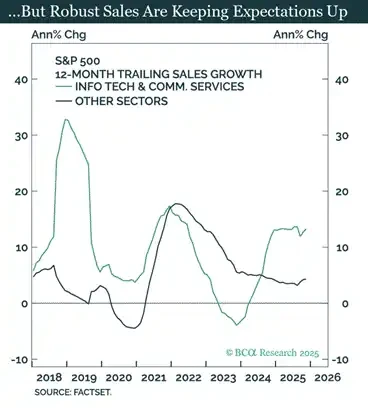

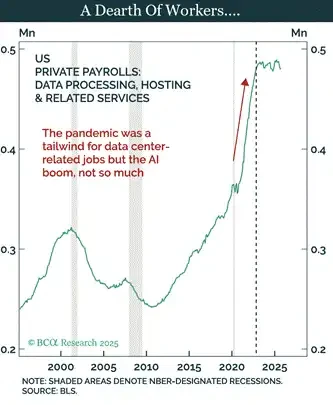

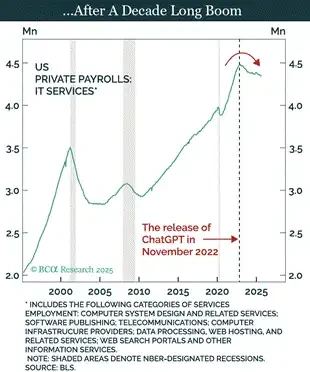

My theory for why the Nasdaq didn't correct in 2025 alongside falling dollar liquidity is: AI has been 'nationalized' by both the US and China.

AI tech titans have sold the world's two great leaders on the idea that AI solves everything. AI can reduce labor costs to zero, cure cancer, increase productivity, and most importantly, achieve military dominance over the globe. Therefore, whichever country 'wins' in AI rules the world. China bought into this long ago; it fits perfectly with its five-year plans.

In the US, this analysis is new, but industrial policy is just as entrenched as in China, only marketed differently. Trump drank the AI 'Kool-Aid,' and 'winning the AI race' became his economic platform. The US government has effectively nationalized any component deemed helpful to 'winning.' Through executive orders and government investment, Trump is dulling market signals, causing capital to flood into AI-related areas regardless of returns. This is why the Nasdaq decoupled from Bitcoin and the decline in dollar liquidity in 2025.

[Chart: Nasdaq vs. US Dollar Liquidity Decoupling]

Bubble or not, increased spending to 'win' AI is driving the US economy. Trump promised to make the economy run hot; he can't stop just because the return on this spending might be below the cost of capital a few years later.

US tech investors should be cautious. Industrial policy aimed at 'winning AI' is a great way to burn money. Trump's (or his successor's) political goals will diverge from the interests of shareholders in strategic enterprises. This is a lesson Chinese stock investors learned the hard way. As Confucius said, 'Study the past to know the future.' Clearly, given the Nasdaq's stellar performance, this lesson hasn't been absorbed by US investors yet.

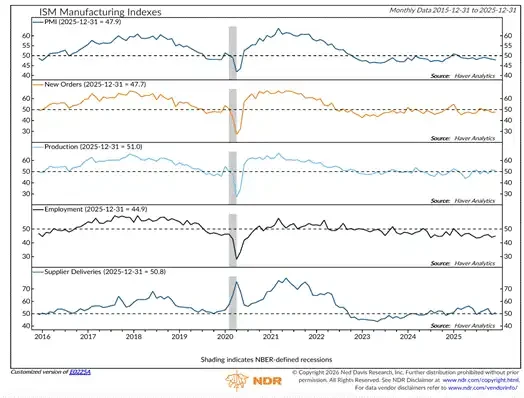

[Chart: US PMI and Economic Growth Data]

PMI readings below 50 indicate contraction. All the GDP growth hasn't brought a manufacturing renaissance. I thought Trump was for the white blue-collar worker? No, bro, Clinton sold your job to China, Trump brought the factory back, but now the factory floor is full of AI robot arms owned by Musk. Sorry, you got played again! However, US Immigration and Customs Enforcement (ICE) is hiring (dark humor)!