After Uniswap's Fee Switch Implementation: Is the "Report Card" of This DeFi Transformation Impressive?

- Core Viewpoint: The Uniswap Fee Switch transforms UNI from a governance token into a value-accumulating asset.

- Key Elements:

- Annualized protocol fees are approximately $26 million, resulting in a revenue multiple of 207x.

- Annualized burn of about 4 million UNI tokens, achieving programmed deflation.

- A one-time retroactive burn of 100 million UNI tokens to compensate for historical value.

- Market Impact: Drives a shift in DeFi token valuation logic towards a fee-linked model.

- Timeliness Note: Long-term impact.

Original Author: Tanay Ved

Original Compilation: Saoirse, Foresight News

Key Takeaways

- Uniswap's fee switch links the UNI token to protocol usage through a token supply burn mechanism. Currently, fees generated by the protocol are used to reduce the UNI supply. This adjustment transforms the UNI token from a purely governance asset into one that can directly capture value.

- Early data shows the protocol's annualized fees are approximately $26 million, with a revenue multiple of about 207x; around 4 million UNI tokens will be burned annually. This move has already priced high growth expectations into UNI's $5.4 billion valuation.

- DeFi is gradually shifting towards a "fee-linked" token model. Mechanisms like token burning, staker revenue distribution, and "vote-escrowed (ve)" locking all aim to better align token holders with the protocol's economic system, thereby reshaping valuation logic in the sector.

Introduction

In late 2025, Uniswap governance passed the "UNIfication" proposal, officially activating the long-awaited protocol "fee switch." This is one of the most significant tokenomic changes for a DeFi blue-chip project since 2020—a time when the market is increasingly focused on "real yield" and "fee-driven sustainable value accrual." This fee switch now establishes a more direct link between the UNI token and Uniswap's revenue and trading activity, with Uniswap being one of the largest decentralized exchanges (DEX) in the cryptocurrency space.

In this article, we will delve into Uniswap's tokenomics post-fee switch activation, assess the dynamics of UNI token burning, the fee mechanism, and its impact on valuation, and explore the implications of this shift for the broader DeFi landscape.

The Disconnect Between DeFi Tokens and Protocol Value

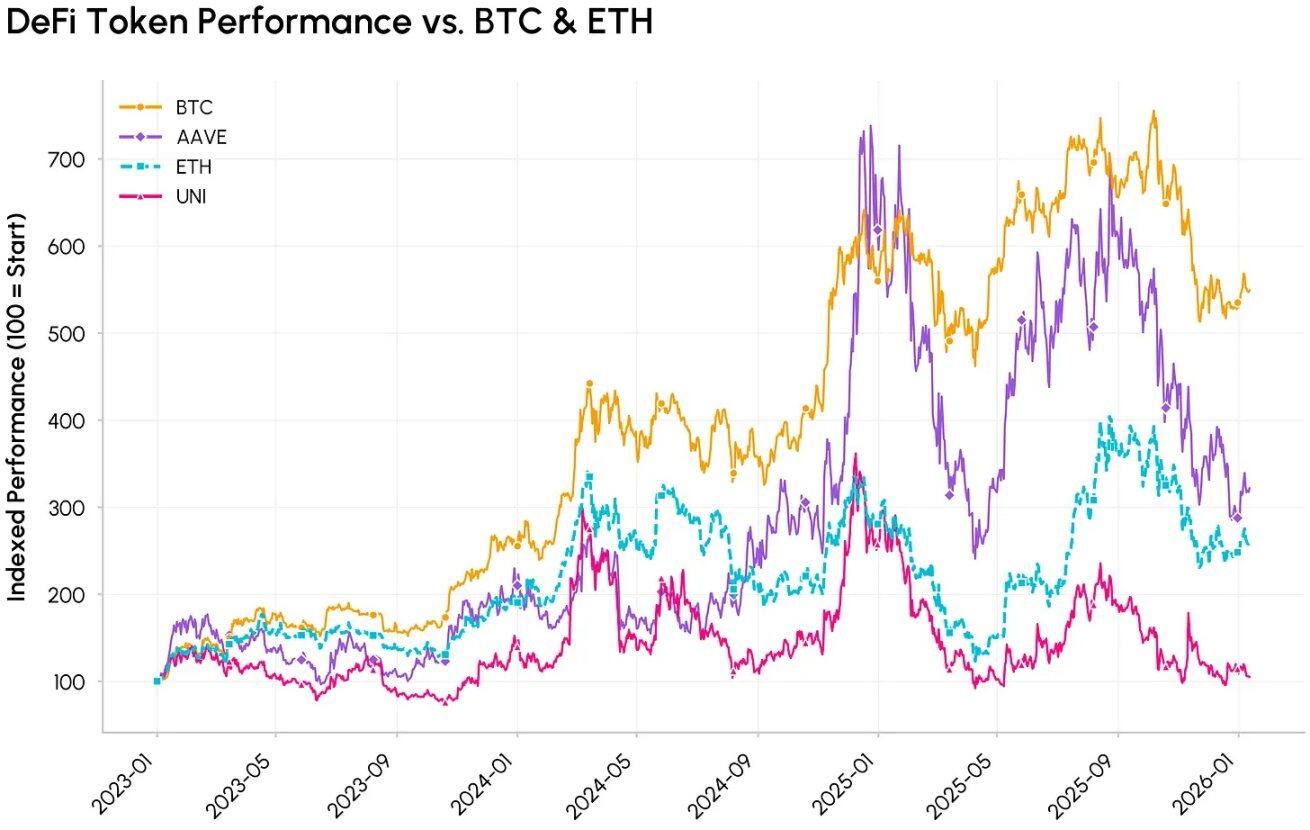

One of the core challenges in the DeFi space is the disconnect between "strong protocols" and "weak tokens." Many DeFi protocols have achieved clear product-market fit, high usage, and stable revenue, but the tokens they issue often serve only governance functions, offering holders little to no direct access to protocol cash flows. In this environment, capital increasingly flows towards Bitcoin, underlying Layer 1 blockchains (L1s), Meme coins, etc., while most DeFi tokens trade at prices severely disconnected from the actual equity in protocol growth.

Indexed performance comparison of DeFi tokens (AAVE, UNI) vs. major cryptocurrencies (BTC, ETH)

Uniswap launched as a decentralized exchange (DEX) on the Ethereum network in November 2018, designed to enable order book-less, intermediary-free swaps of ERC-20 tokens. In 2020, Uniswap issued the UNI token, positioning it as a governance token—a practice consistent with other DeFi blue-chips like Aave, Compound, and Curve, where the primary purposes of token issuance were governance voting and user incentives.

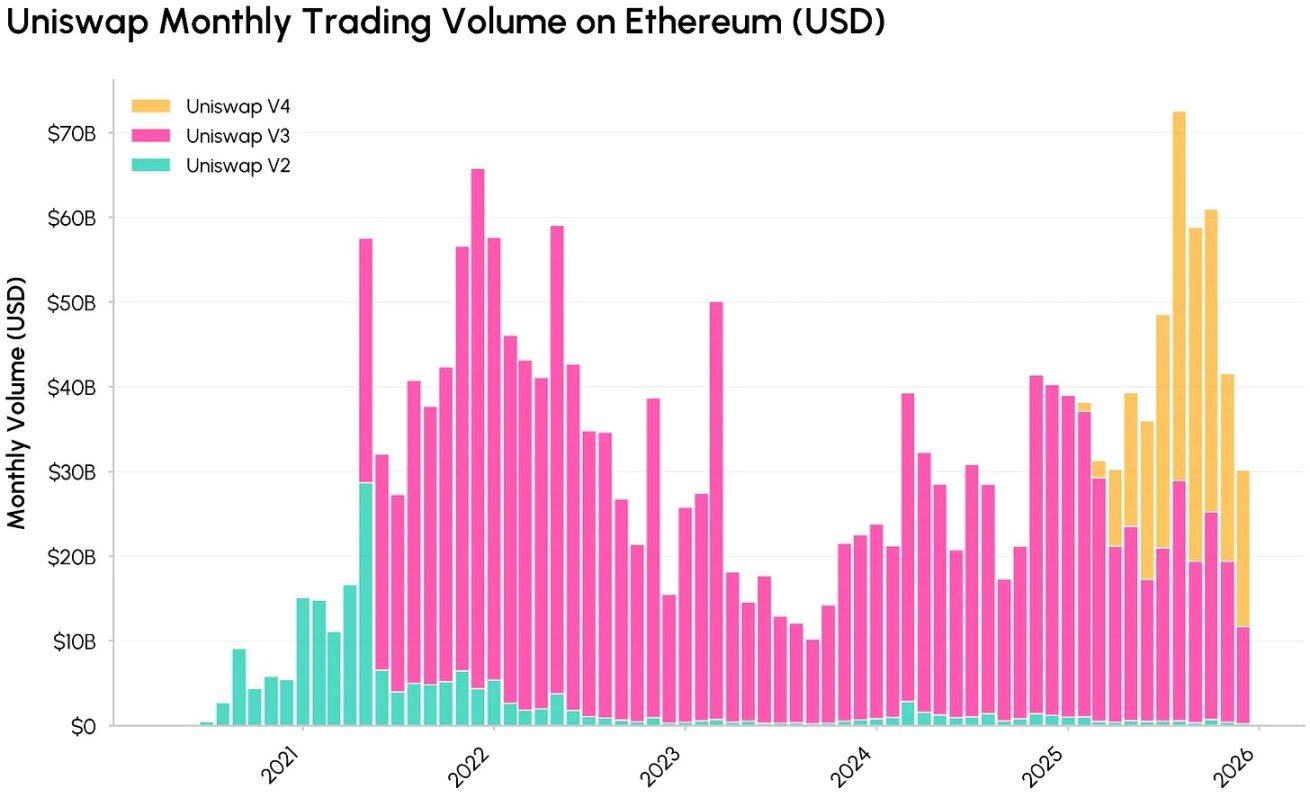

Trend of Uniswap's monthly trading volume (in USD) across versions (V2, V3, V4) on the Ethereum network. Source: Coin Metrics Network Data Pro

Through version iterations, Uniswap has become a core component of on-chain financial infrastructure, processing billions in trading volume and generating substantial fee revenue for liquidity providers (LPs). However, like most DeFi governance tokens, UNI token holders could not directly share in the protocol's revenue, leading to a growing disconnect between the scale of the protocol's underlying cash flows and the economic interests of token holders.

In reality, the value generated by Uniswap primarily flowed to liquidity providers (LPs), borrowers, lenders, and related development teams, while token holders only received governance rights and inflationary rewards. This contradiction between "governance-only" tokens and the "need for value accrual" laid the groundwork for Uniswap's fee switch and the "UNIfication" proposal—which explicitly ties UNI's value to protocol usage, better aligning token holders with the DEX's economic system.

The Uniswap Fee Switch: Fees and Burn Mechanism

With the passage of the "UNIfication" governance proposal, the Uniswap protocol introduced the following key adjustments:

- Activate Protocol Fees and UNI Burn Mechanism: Turn on the protocol "fee switch," directing protocol-level pool fees from Uniswap V2 and V3 on Ethereum mainnet into a UNI token burn mechanism. By establishing a programmatic link between "protocol usage" and "token supply," UNI's economic model shifts from "governance-only" to "deflationary value accrual."

- Execute Retroactive Treasury Token Burn: Conduct a one-time burn of 100 million UNI tokens from the Uniswap treasury to compensate token holders for years of missed fee revenue.

- Incorporate Unichain Revenue: Sequencer fees generated by the Unichain network (after deducting Ethereum Layer 1 data costs and Optimism's 15% share) will be fully integrated into the aforementioned "burn-driven" value capture mechanism.

- Adjust Organizational Incentive Structure: Consolidate most functions of the Uniswap Foundation into Uniswap Labs, and establish an annual 20 million UNI growth budget, allowing Uniswap Labs to focus on protocol promotion; simultaneously, reduce its take rate from interfaces, wallets, and API services to zero.

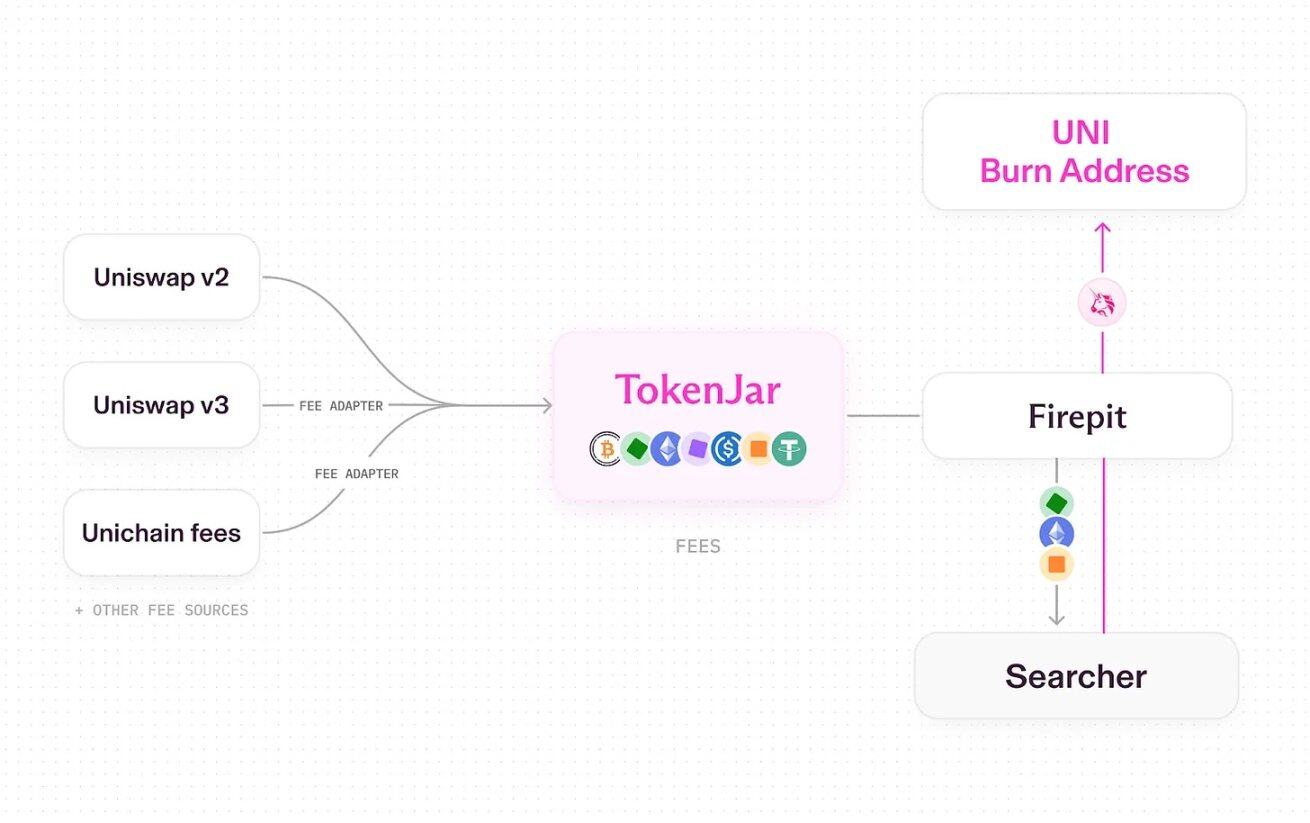

Complete flow of protocol fees converting to UNI token burns after Uniswap's fee switch activation. Source: Uniswap UNIfication

Currently, Uniswap operates in a "pipeline" model, using dedicated smart contracts to handle asset release and conversion (e.g., UNI token burning). The specific process is:

- Trades on Uniswap V2, V3, and Unichain generate fees;

- A portion of these fees belongs to the protocol (the rest is distributed to liquidity providers);

- All protocol-level fees flow into a single treasury smart contract called "TokenJar" on each chain;

- Value within TokenJar can only be released when UNI tokens are burned via the "Firepit" smart contract.

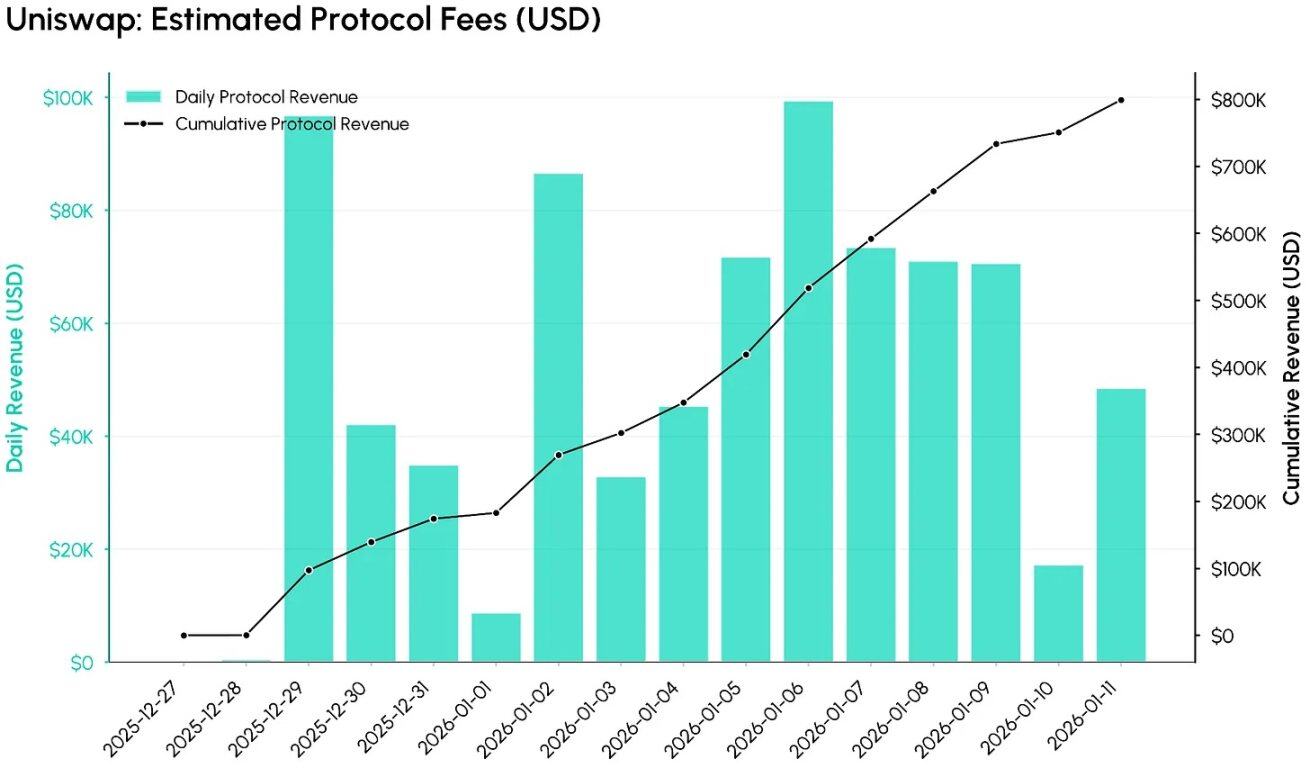

Protocol fee data after Uniswap's fee switch activation (starting December 27, 2025). Source: Coin Metrics ATLAS

According to Coin Metrics ATLAS data, a significant volume of protocol fees has flowed into the system in the first 12 days post-activation. The chart below tracks daily estimated protocol fees (in USD) and the cumulative total, showing that under the initial configuration, the fee switch rapidly monetized Uniswap's trading volume—accumulating approximately $800,000 in protocol-level fees in just 12 days.

If current market conditions remain stable, the protocol's annualized revenue is projected to be around $26-27 million (for reference only), though actual revenue will depend on market activity and the rollout progress of fee mechanisms across pools and chains.

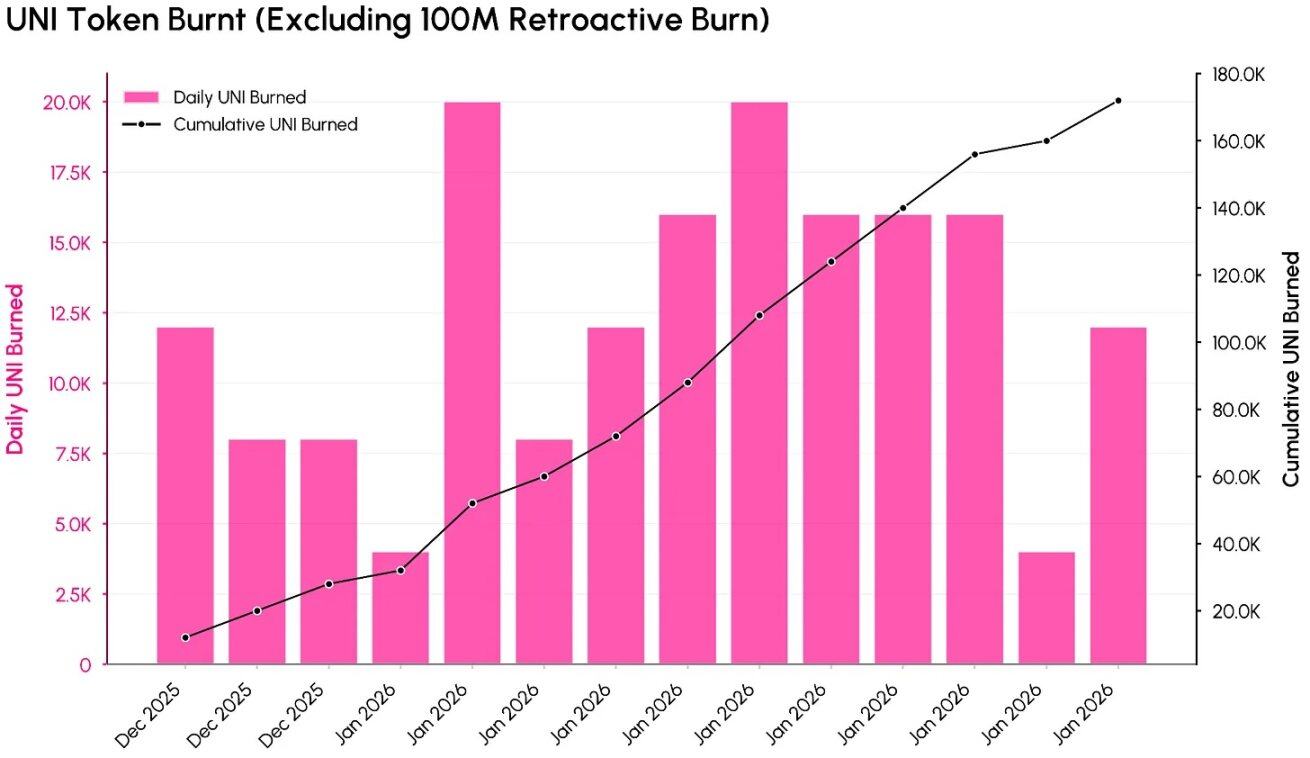

UNI token burn data after Uniswap's fee switch activation (excluding the 100 million retroactive burn). Source: Coin Metrics ATLAS

The chart above shows how protocol fees translate into a reduction of the UNI token supply (excluding the 100 million retroactive burn). As of the data snapshot, the total UNI tokens burned reached approximately 100.17 million (worth about $557 million), accounting for 10.1% of the initial 1 billion total supply.

Extrapolating from the burn data of the first 12 days after the "UNIfication" proposal took effect, the annualized burn rate for UNI tokens is estimated to be around 4 to 5 million. This data highlights that protocol usage now generates "periodic, programmatic" UNI burns, rather than purely inflationary token issuance.

Valuation and Impact on the DeFi Sector

With the fee switch activated, UNI's valuation can now be assessed beyond just "governance utility" through a "cash flow lens." Using UNI's current $5.4 billion market cap against the initial ~$26 million annualized protocol fees indicated by TokenJar data yields a revenue multiple of about 207x—a valuation more akin to high-growth tech assets than a mature decentralized exchange (DEX). Excluding the treasury burn portion, UNI's annualized burn is about 4.4 million tokens, representing only 0.4% of the current supply, indicating a relatively low "burn rate" relative to its valuation.

Trend of Uniswap token UNI's market capitalization. Source: Coin Metrics Network Data Pro

This situation highlights a new trade-off: while a clearer value capture mechanism enhances UNI's investment appeal, the current data implies the market has extremely high expectations for its future growth. To reduce this revenue multiple, Uniswap would need a combination of measures: expanding fee capture scope (e.g., covering more pools, launching V4 "hooks," conducting fee discount auctions, optimizing Unichain), achieving sustained trading volume growth, and offsetting the annual 20 million UNI growth budget and other token releases through deflationary mechanisms.

From an industry structure perspective, the "UNIfication" proposal pushes the DeFi sector towards a direction where "governance tokens must be explicitly linked to protocol economics." Whether it's Uniswap's token burning, Ethena's "direct fee distribution to stakers," "ve-locking + fee/bribe sharing" by DEXs like Aerodrome, or hybrid mechanisms like Hyperliquid's perpetual model, these are essentially different forms of "protocol fee sharing," with the core goal of strengthening the link between tokens and protocol economics. As the world's largest DEX adopts a "fee-linked + burn-driven" design, future market evaluation of DeFi tokens will likely shift beyond just "Total Value Locked (TVL)" or "narrative hype" to focus more on "the efficiency of converting protocol usage into lasting value for holders."

Conclusion

The activation of Uniswap's fee switch marks a critical inflection point: the UNI token transforms from a "pure governance asset" into one "explicitly linked to protocol fees and usage." This shift makes UNI's fundamentals more analyzable and investable, but also subjects its valuation to stricter scrutiny—as the current valuation already embeds strong expectations for future fee capture capabilities and growth potential.

Moving forward, two key variables will influence UNI's long-term trajectory: first, the extent to which Uniswap can increase protocol-level fees without harming the economic interests of liquidity providers (LPs) and trading volume; and second, the evolving stance of regulators towards "fee-linked tokens" and "buyback-and-burn token" models. These two factors will jointly shape the long-term risk-return profile of the UNI token and provide important reference points for how other DeFi protocols share value with token holders.