After the $250 Million Acquisition, Polygon's Long-Term Strategy Emerges

- Core Viewpoint: Polygon makes counter-cyclical acquisitions to strengthen compliance and user access.

- Key Elements:

- Acquisition of Coinme secures a U.S. money transmitter license, entering the compliant market.

- Acquisition of Sequence enhances wallet access, supporting the stablecoin strategy.

- Polymarket temporarily boosts network revenue, creating a deflationary effect.

- Market Impact: Enhances Polygon's competitiveness in the compliant finance sector.

- Timeliness Note: Medium-term impact

Original | Odaily (@OdailyChina)

Author | Ding Dang (@XiaMiPP)

On January 13, Polygon Labs announced the completion of its acquisitions of cryptocurrency startups Coinme and Sequence, with a total acquisition price exceeding $250 million. However, Polygon Labs declined to disclose the specific purchase price for each company or whether the transactions were conducted in cash, equity, or a combination of both. Based on currently disclosed information, the deals will proceed in phases: the Sequence transaction is expected to be finalized within this month, while the Coinme acquisition awaits regulatory approval and is projected to be completed no earlier than Q2 2026.

A "Counter-Cyclical Move" During the Downturn

Polygon Labs CEO Marc Boiron and Polygon Foundation founder Sandeep Nailwal stated that these acquisitions aim to support the network's stablecoin strategy. Specifically, Polygon has been actively promoting stablecoin adoption but lacks localized regulatory infrastructure. The acquisition of Coinme is intended to address this gap. As a US-based crypto financial company, Coinme holds money transmitter licenses across multiple states and operates a Bitcoin ATM network. This means Polygon can leverage Coinme's existing compliance framework to bypass lengthy approval processes and directly enter the highly regulated US market. Coinme will continue to operate its existing businesses, including its crypto exchange, wallet, and Crypto-as-a-Service offerings, as a wholly-owned subsidiary of Polygon Labs.

The value of Sequence lies more in the realm of blockchain wallet and developer infrastructure. In the Web3 context, a wallet is not just an asset storage tool but also the gateway for users to enter the entire on-chain world. Its security, usability, and scalability directly determine the network's capacity to support a larger scale of users and capital. Polygon's acquisition of Sequence is, in a way, preemptively building the "user-side" infrastructure for its stablecoin strategy.

From this perspective, Polygon's two acquisitions represent upstream and downstream deployments centered on the same goal: one end is the compliance channel, the other is the user gateway.

Zooming out to the broader industry, amidst the ongoing contraction of the L2 ecosystem and a sluggish market, Polygon has chosen to forge ahead proactively, actively self-reinforcing, and continuously invest resources in integration and expansion. Behind this counter-cyclical move lies a core principle of "compliance first," attempting to complete the transition from "crypto infrastructure" to "financial infrastructure" ahead of others in an environment of globally tightening regulations. This aims to attract more traditional capital and institutional users, thereby solidifying its own moat.

On-Chain Data: Not All L2s Are in Decline

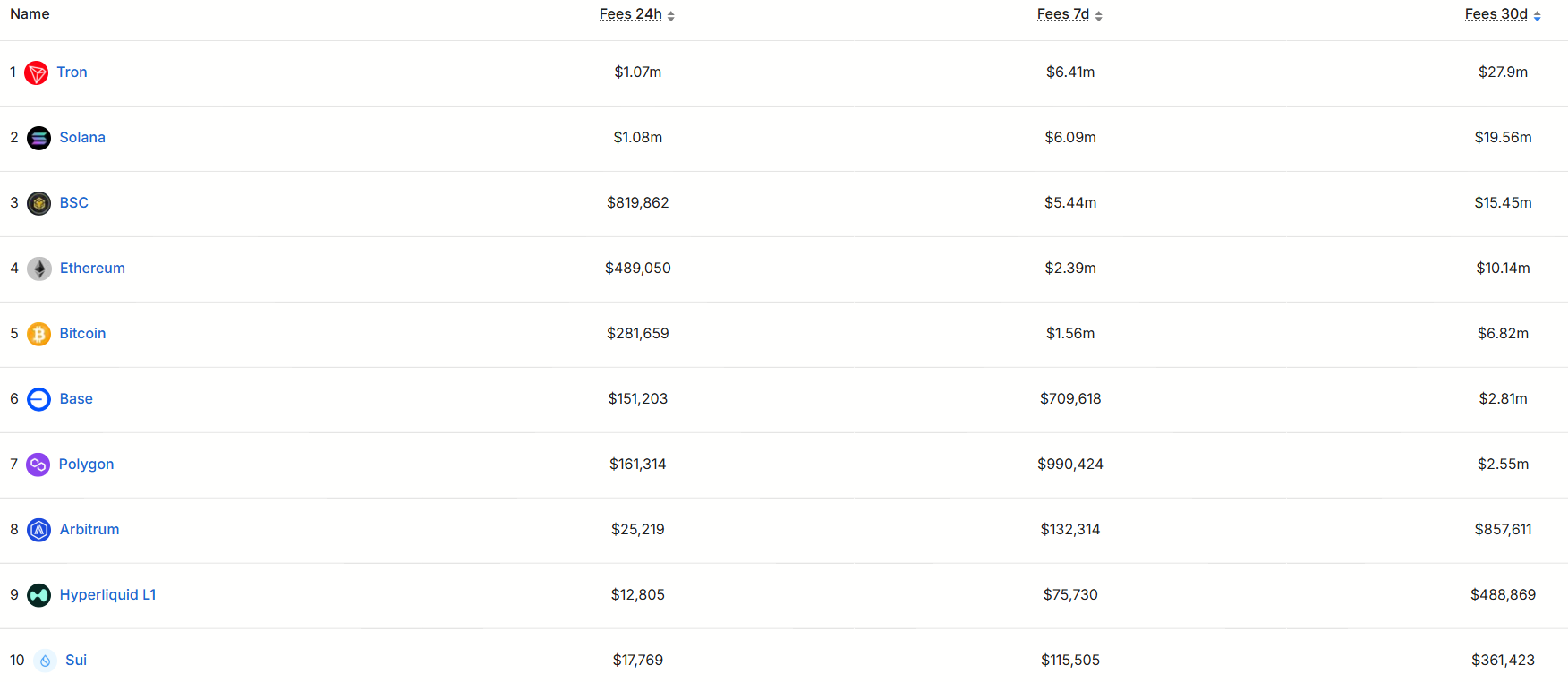

Beyond strategic deployments, Polygon's on-chain data performance is also strong. According to the defillama.com 30-day public chain revenue data, Polygon ranks seventh, maintaining a degree of resilience in the fiercely competitive public chain arena.

Of course, the overall gap remains significant. Tron, ranked first, boasts a monthly revenue of $27.9 million, while Sui in tenth place has only $360,000—a difference of over 77 times. The reality is rapidly eliminating public chain projects that "tell stories but lack real demand." Even Zero Network, an L2 network incubated by Web3 wallet company Zerion which once raised $22.5 million, has stopped producing blocks for over three weeks.

Against this backdrop, Polygon at least remains "active at the table."

The Truth Behind the Revenue Surge: The Short-Term Push from Polymarket

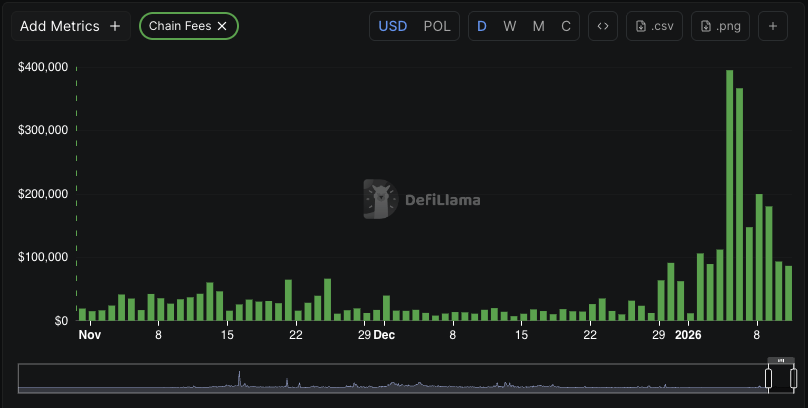

However, it must be pointed out that Polygon's significant growth in fee revenue only became apparent starting in early 2026. According to data disclosed by Castle Labs on January 13, Polygon's current monthly revenue is close to $1.7 million.

The primary driver of this revenue growth is Polymarket. Since its 15-minute price prediction market (where users bet on whether the price of mainstream coins like BTC, ETH, SOL, XRP will rise or fall in the next 15 minutes, settling every 15 minutes) began charging fees, Polygon's daily network revenue once reached $100,000.

More importantly, Polygon employs a fee-burning mechanism typical of PoS networks: higher transaction volume leads to more token burns, creating a deflationary effect. Year-to-date, Polygon has burned approximately 12.5 million POL tokens, valued at around $1.5 million, representing about 0.12% of the total supply.

Projecting based on the current pace, if this trend continues, the burn rate for 2026 could reach approximately 3.5%, significantly higher than the staking reward annual issuance rate of about 1.5%. The burn volume is already more than double the staking reward distribution, resulting in a net supply decrease.

Although Polymarket confirmed via its Discord community in late December 2025 that it would migrate to its own Ethereum Layer 2 (named POLY), the migration is not instantaneous. In the short term, Polygon will still benefit from Polymarket's high activity, accelerating the deflationary effect, which is positive for the POL price.

For more analysis on the correlation between the two, see: 《The Economic Calculus Behind Polymarket's Departure from Polygon》.

Conclusion

In summary, Polygon's current surge in fees and token burns largely still relies on the temporary boom brought by Polymarket. However, simultaneously, its long-term strategy centered on stablecoin payments and real-world financial infrastructure is gradually being implemented.

This is perhaps the most noteworthy aspect of Polygon at this moment: short-term data provides market confidence, while long-term strategy determines whether it can remain in the next round of competition.