Wintermute Unveils the Flow of OTC Funds in a 28-Page Report

- Core View: A fundamental shift has occurred in the liquidity mechanisms of the cryptocurrency market.

- Key Factors:

- Trading activity is concentrated in a few large tokens like BTC and ETH.

- The duration of altcoin rallies has significantly shortened, with conviction fading faster.

- Capital inflows through structured channels like ETFs and DATs are affecting liquidity distribution.

- Market Impact: Market breadth has narrowed, and recovery depends on specific catalysts.

- Timeliness Note: Medium-term impact.

Source:Wintermute

Compiled by | Odaily (@OdailyChina); Translator | Azuma (@azuma_eth)

Editor's Note: On January 13, Wintermute released its analysis report on the cryptocurrency over-the-counter (OTC) market for 2025. As the industry's leading market maker, Wintermute is undoubtedly highly sensitive to shifts in market liquidity. In this 28-page report, the firm reviews the changes in cryptocurrency market liquidity throughout 2025 and concludes that the market is transitioning from clear, narrative-driven cyclical fluctuations to a mechanism with stronger structural constraints and execution dominance. Based on this conclusion, Wintermute also outlines three key scenarios necessary for the market to achieve a recovery in 2026.

Below is the content of Wintermute's original report, compiled and edited by Odaily (some content has been condensed).

Report Summary

2025 marked a fundamental shift in the liquidity mechanism of the cryptocurrency market. Capital is no longer widely dispersed across the entire market; liquidity has become more concentrated and unevenly distributed, leading to intensified divergence between returns and market activity. Consequently, a significant portion of trading volume is confined to a small number of tokens. Uptrends have shorter durations, and price performance has become more dependent on the channels through which liquidity enters the market and how it is deployed compared to previous years.

The following report summarizes the major changes in liquidity and trading dynamics observed by Wintermute in 2025:

- Trading activity concentrated in a few large-cap tokens. BTC, ETH, and a select group of altcoins accounted for the majority of trading activity. This reflects the gradual expansion of ETF and Digital Asset Treasury (DAT) products into a broader range of altcoins, as well as the fading of the Meme coin cycle in early 2025.

- Narrative conviction fades faster; altcoin rallies exhaust at double the speed. Investors no longer follow narratives with sustained conviction, but rather trade opportunistically around themes such as Meme coin launchpads, perpetual futures exchanges, emerging payment and API infrastructure (like x402), with limited follow-through.

- Trading execution becomes more cautious as the influence of professional counterparties grows. This manifests in more deliberate cyclical trade execution (breaking the previous rigid four-year cycle), broader use of leveraged OTC products, and diversified application of options as a core asset allocation tool.

- The way capital enters the crypto market is as important as the overall liquidity environment. Capital is increasingly flowing in through structured channels like ETFs and DATs, influencing where liquidity moves and ultimately pools within the market.

This report primarily interprets the aforementioned market developments based on Wintermute's proprietary OTC data. As one of the industry's largest OTC platforms, Wintermute provides liquidity services across regions, products, and diverse counterparties, offering a unique and comprehensive off-chain perspective on crypto OTC trading. Price movements reflect market outcomes, while OTC activity reveals how risk is deployed, how participant behavior evolves, and which parts of the market remain active. From this vantage point, the market structure and liquidity dynamics in 2025 have undergone a significant transformation compared to earlier cycles.

Part1: Spot

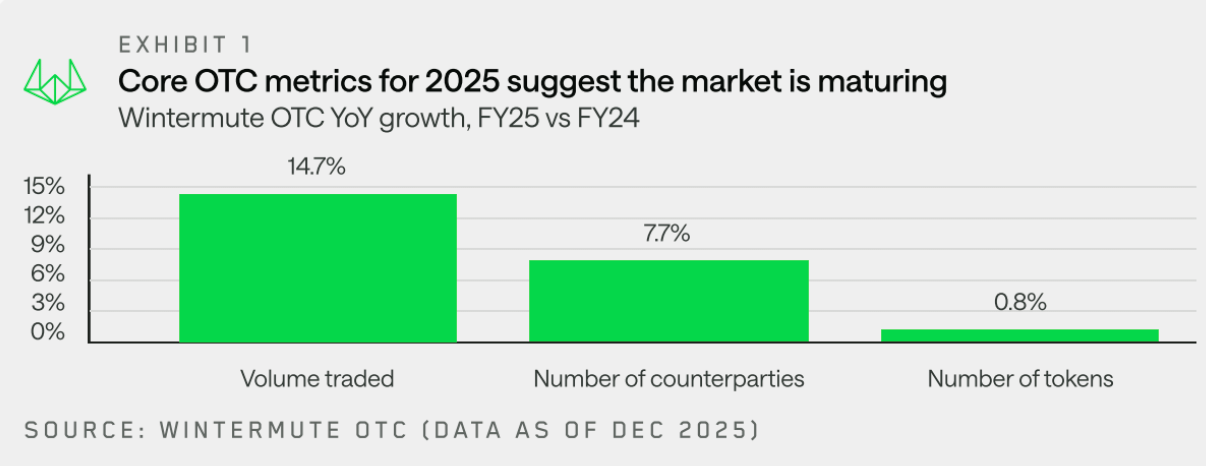

Wintermute's OTC data shows that trading activity in 2025 shifted from being purely volume-driven to a more mature, strategic trading environment. Trading volume continued to grow, but execution became more planned, with OTC trading increasingly favored for its block trading capabilities, privacy, and control.

Market positioning also evolved from simple directional trades to more customized execution plans and broader use of derivatives and structured products. This indicates that market participants are becoming more experienced and disciplined.

Within Wintermute's spot OTC activity, this structural shift is primarily reflected in three areas:

- Volume Growth: OTC trading volume continued to grow, highlighting the persistent market demand for off-chain liquidity and efficient execution of large trades (while limiting market impact).

- Counterparty Growth: The range of participants expanded further, driven by venture capital funds shifting from purely private allocations to liquid markets; corporations and institutions executing large trades via OTC channels; and individual investors seeking traditional venue alternatives beyond centralized and decentralized exchanges.

- Token Landscape: The overall range of active tokens has expanded beyond BTC and ETH, with capital flowing into a broader set of altcoins via DATs and ETFs. Nonetheless, full-year positioning data shows that both institutions and retail investors pivoted back towards major tokens after the large deleveraging event on October 11, 2025. Altcoin rallies were shorter-lived and more selective, reflecting the fading Meme coin cycle and an overall contraction in market breadth as liquidity and venture capital became more selective.

Next, Wintermute provides further detailed analysis on these three aspects.

Volume Growth: Cyclical Patterns Replaced by Short-Term Volatility

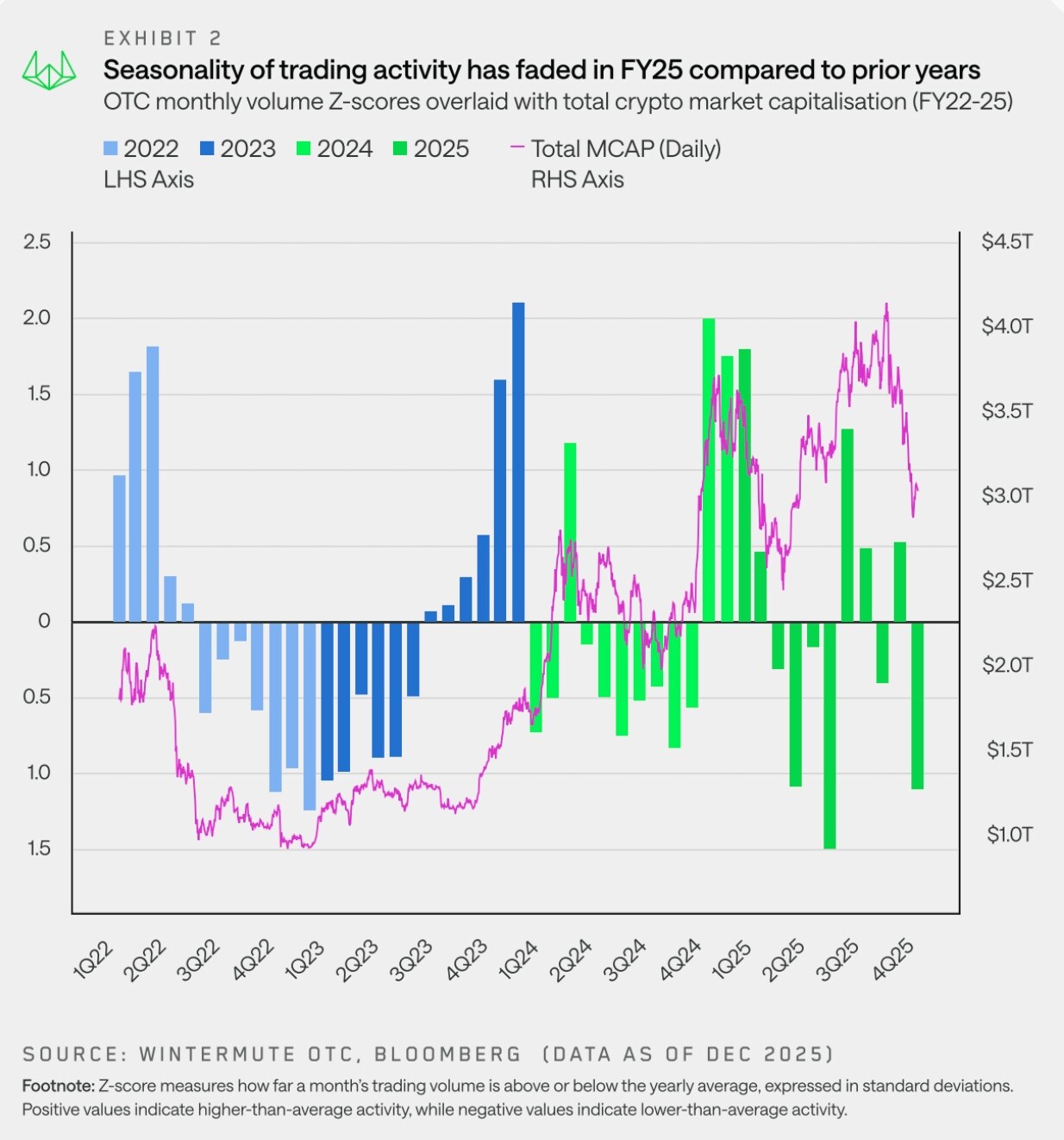

"The market in 2025 was characterized by choppy price action driven primarily by short-term trends rather than longer-term seasonal shifts."

Wintermute's OTC data shows that trading activity in 2025 exhibited distinctly different seasonal patterns, significantly diverging from previous years. Initial optimism surrounding the new pro-crypto US administration quickly faded, and risk sentiment deteriorated sharply towards the end of Q1 as the Meme coin and AI Agent narratives cooled. Top-down negative news, such as Trump's announcement of increased tariffs on April 2, 2025, further pressured the market.

Consequently, market activity in 2025 was concentrated in the first half of the year, starting strong before weakening broadly through spring and early summer. The year-end rallies seen in 2023 and 2024 did not materialize, breaking what had seemed like an established seasonal pattern—often reinforced by narratives like "Uptober." In reality, this was never a true seasonal pattern but rather year-end rallies driven by specific catalysts, such as ETF approvals in 2023 and the new US administration in 2024.

Entering Q1 2025, the momentum from Q4 2024 never fully recovered. Market choppiness increased, volatility rose, and price action became more about short-term swings than sustained trends as macro factors dominated market direction.

In short, capital flows became passive and intermittent, pulsing around macro headlines but showing no sustained momentum. In this choppy environment, OTC trading remained the preferred execution method as market liquidity thinned and execution certainty became increasingly important.

Counterparties: Institutional Roots Deepen

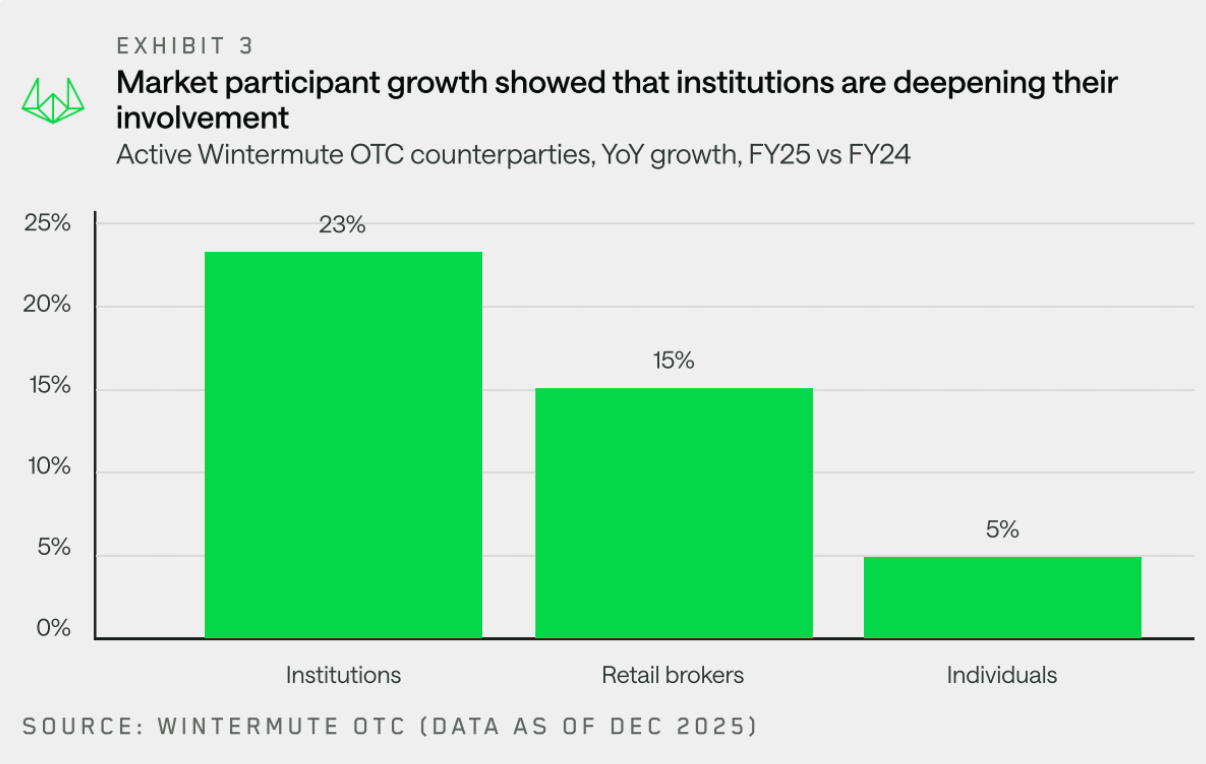

"Despite flat price action in 2025, institutional counterparties have put down roots."

Wintermute observed strong growth across most counterparty types, with institutions and retail brokers showing the largest increases. Within the institutional category, growth from traditional financial institutions and corporates remained moderate, but their participation deepened significantly—activity became more sustained and increasingly focused on deliberate execution strategies.

Despite the flat market performance in 2025, institutions have clearly established a foothold. Compared to last year's more tentative and fragmented participation, 2025 was characterized by deeper integration, larger trade sizes, and more frequent activity. These are constructive and positive signals for the industry's long-term future.

Token Landscape: Top of the Market Becomes More Diverse

"Trading volume is increasingly flowing to large-cap tokens beyond BTC and ETH, a trend driven by both DATs and ETFs."

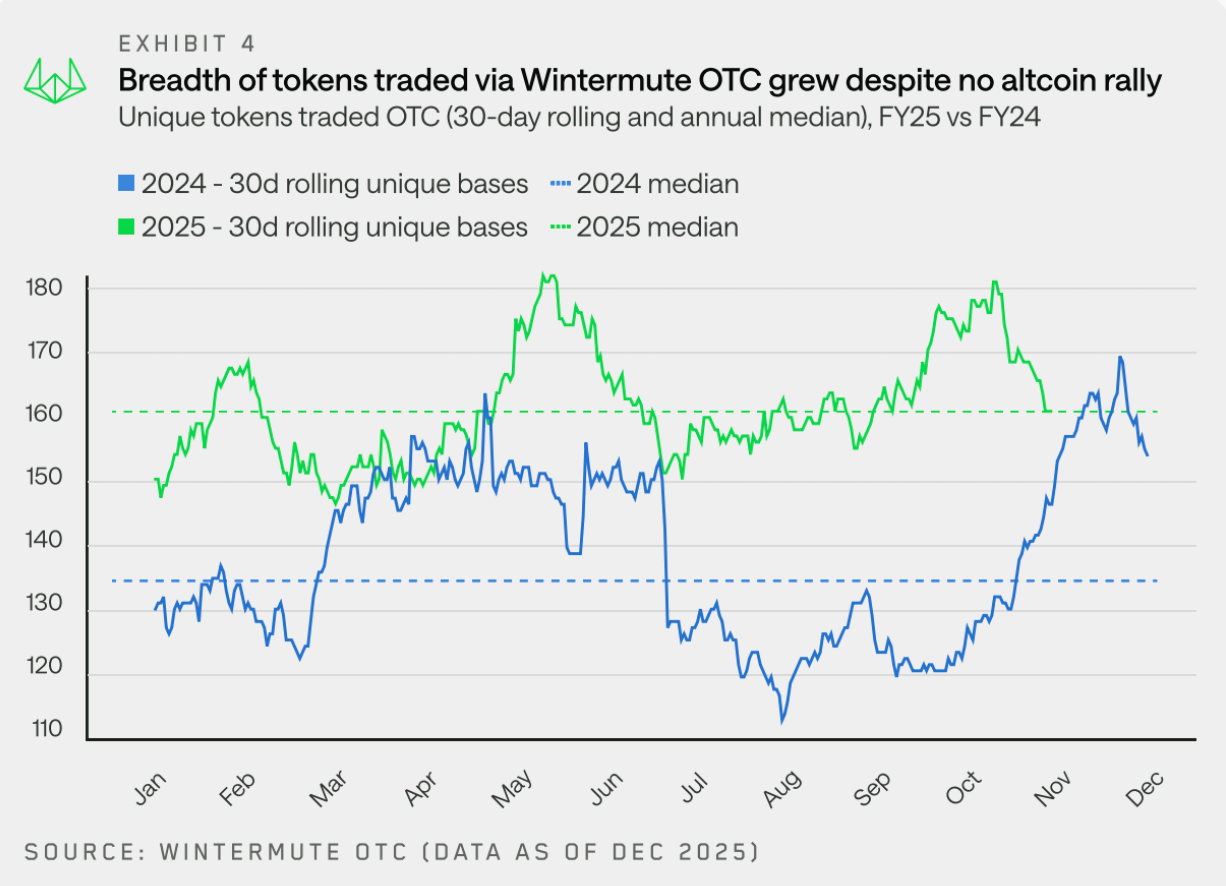

In 2025, the total number of tokens traded overall remained stable. However, on a 30-day rolling basis, Wintermute traded an average of 160 different tokens, up from 133 in 2024. This indicates OTC activity expanded to a broader and more stable range of tokens.

A key difference from 2024: token activity in 2025 was less driven by hype cycles—the range of traded tokens remained relatively flat throughout the year, rather than seeing sharp spikes in token breadth around specific themes or narratives.

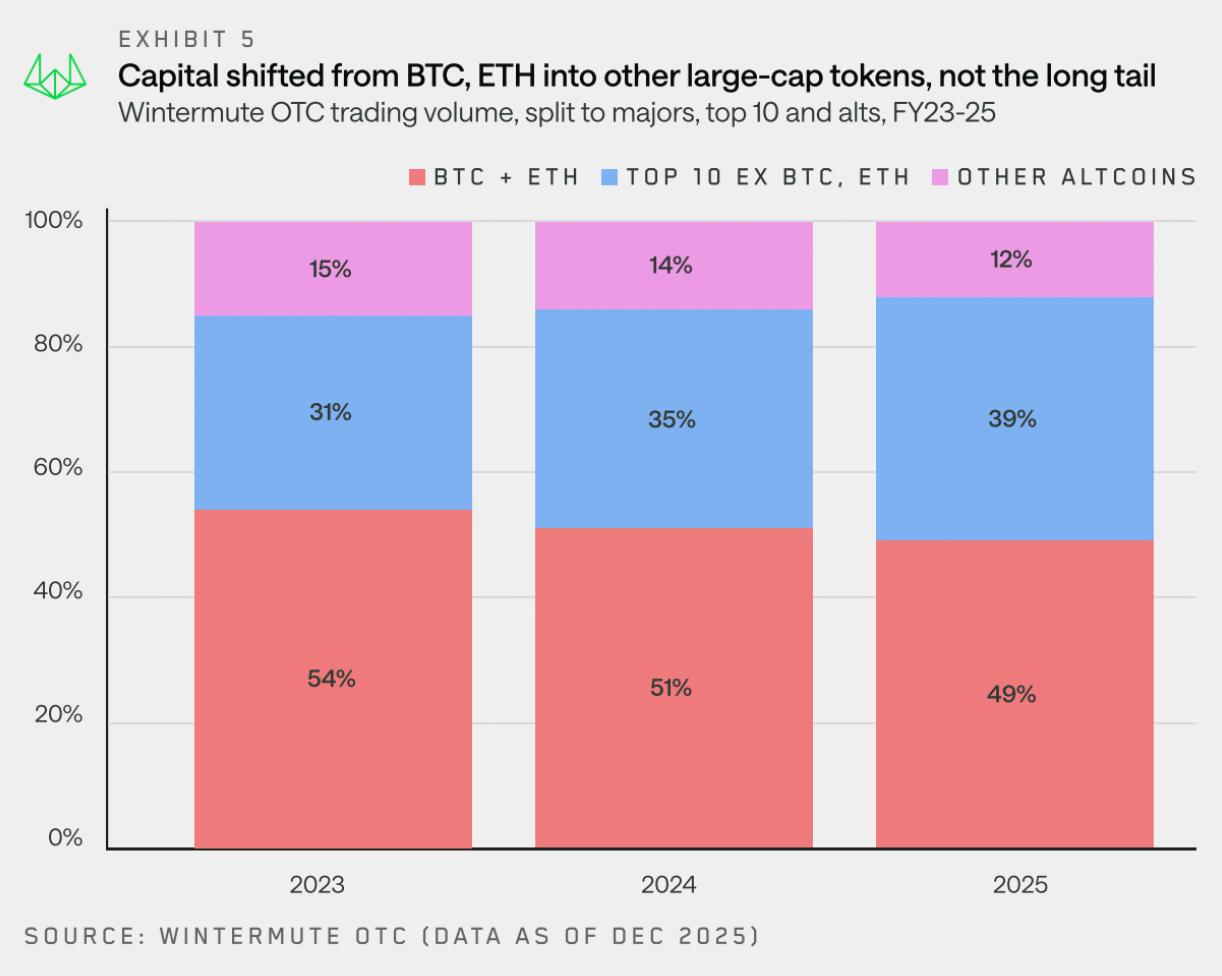

Since 2023, Wintermute's total notional trading volume has become increasingly diversified, with the "Other" portion surpassing the combined volume of BTC and ETH. Although BTC and ETH remain significant components of the trading flow, their combined share of total volume has decreased from 54% in 2023 to 49% in 2025.

Notably, where this flow is going—while the long-tail's share of trading volume continues to decline, blue-chip assets (top 10 by market cap, excluding BTC, ETH, wrapped assets, and stablecoins) increased their share of total notional trading volume by 8 percentage points over the past two years.

Although there was some concentration into large-cap tokens by funds and individuals this year, the growth in trading volume also benefited from ETFs and DATs expanding their investment mandates beyond the largest assets. DATs received authorization to invest in these assets, while ETFs also broadened their scope, including the launch of staking ETFs (e.g., for SOL) and index funds.

These investment vehicles continue to favor OTC trading over exchange trading, particularly when the required liquidity is not available on exchanges.

Analysis of Spot Capital Flows by Token Type

Major Tokens: Capital Gradually Flowed Back by Year-End

"By the end of 2025, both institutional and retail investors were reallocating back to major tokens, indicating their expectation that majors would rebound before an altcoin recovery."

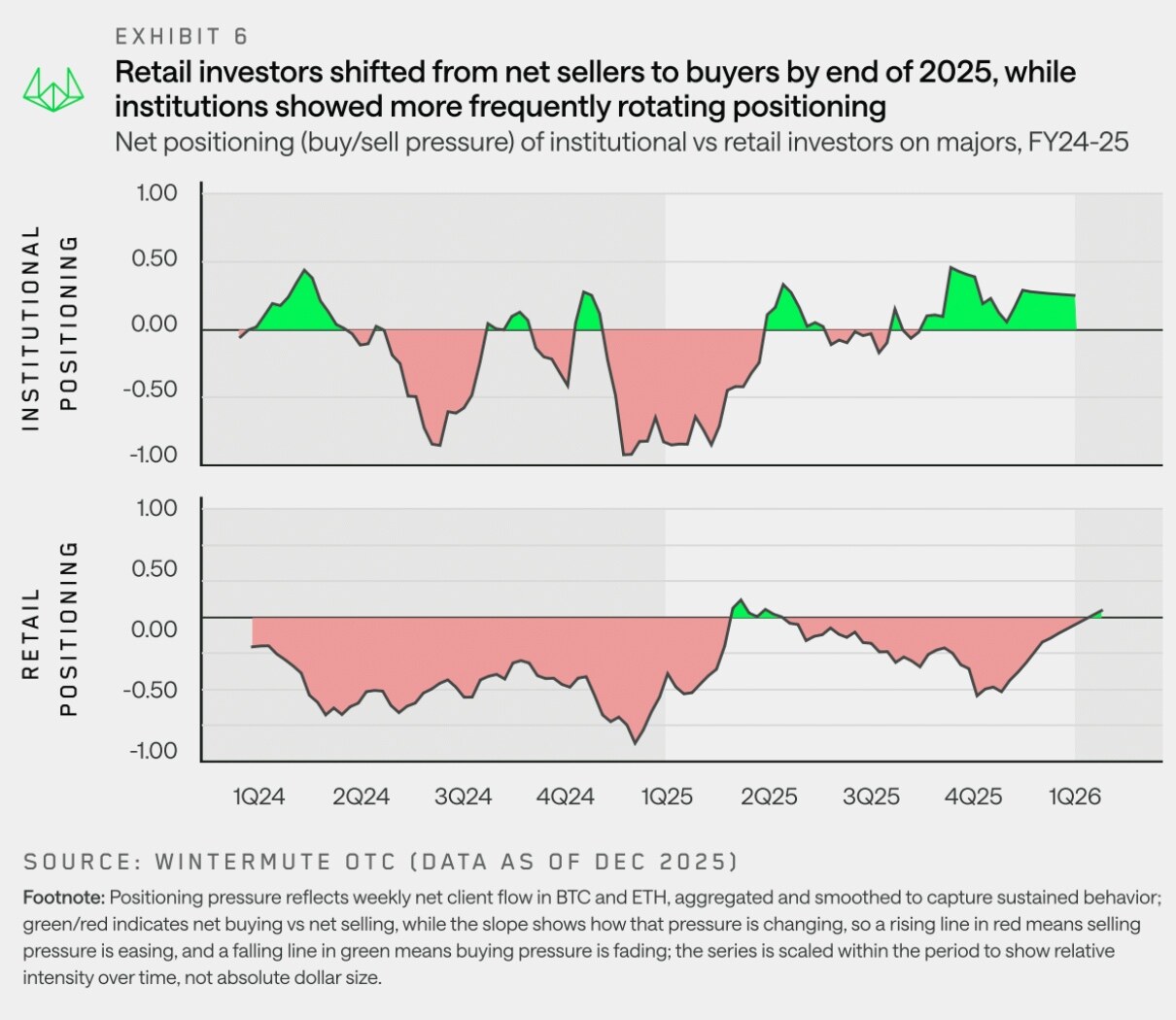

As altcoin narratives faded and macro uncertainty resurfaced in early 2025, capital allocation shifted back to BTC and ETH. Wintermute's OTC flow data shows that institutional investors maintained an overweight position in major tokens starting from Q2 2025; however, retail investors rotated into altcoins in Q2 and Q3 2025, anticipating an altcoin market rebound, but quickly rotated back to majors after the October 11 deleveraging event.

The shift towards major tokens was driven by market fatigue, as the anticipated "altseason" failed to materialize, leading to gradual disappointment. This trend was initially led by institutions (who were consistent net buyers of majors), but by year-end, retail investors also became net buyers.

This positioning aligns with the prevailing market view: BTC (and ETH) needs to lead the market first before risk appetite returns to altcoins. Retail investors now seem to increasingly share this view.

Altcoins: Rallies Became More Fleeting

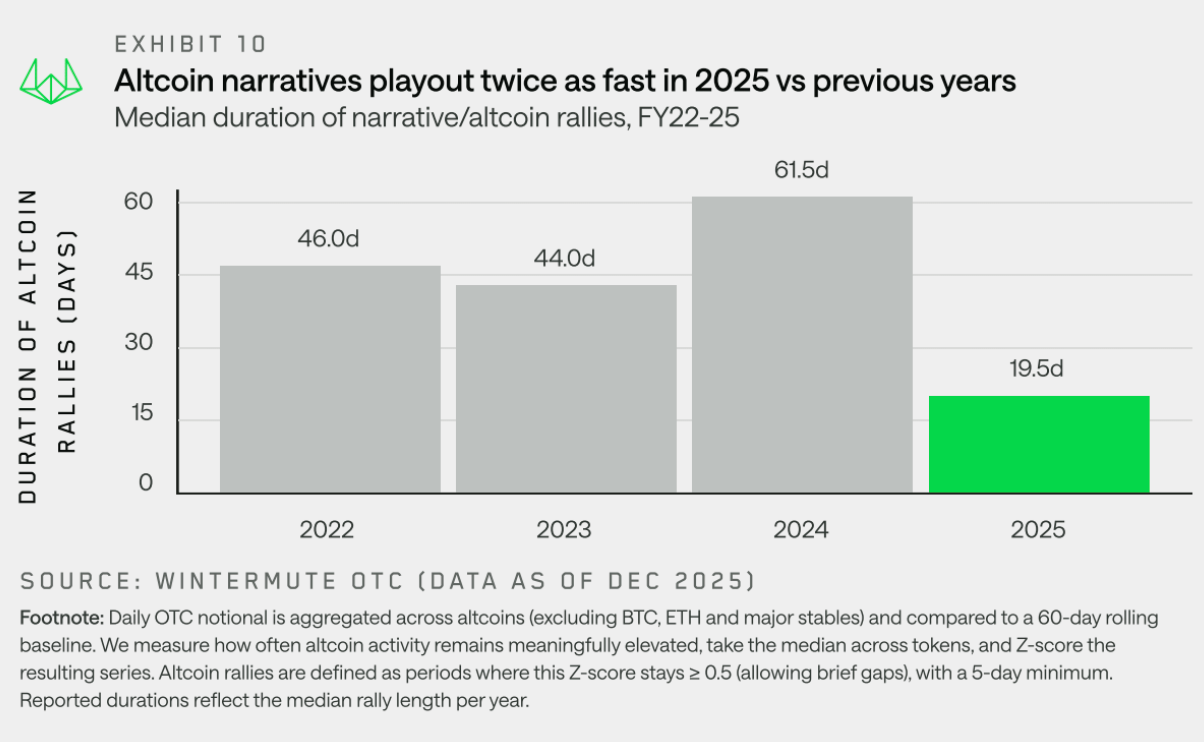

"In 2025, the average duration of narrative-driven altcoin rallies was approximately 19 days, significantly shorter than the 61 days of the previous year, indicating a degree of market fatigue following last year's excessive gains."

Altcoins significantly underperformed overall in 2025, with comprehensive annual returns sharply negative and failing to achieve any meaningful sustained recovery beyond brief bounces. While individual themes captured attention intermittently, they consistently struggled to build momentum or translate into broader market participation. From a flow perspective, this was not due to a lack of narratives, but rather clear signs of exhaustion—rallies were repeatedly tested but quickly faded as conviction failed to coalesce.

To understand this dynamic, we look beyond price action to persistence analysis. Here, "persistence" is defined as the duration for which altcoin participation in OTC flows remains above recent normal levels. In practice, the persistence metric measures whether a rally can attract sustained follow-through from participants or if market activity dissipates quickly after initial volatility. This perspective allows us to distinguish between altcoin rallies with staying power and those that are merely intermittent, rotational bursts that fail to develop into broader trends.

The chart above shows a clear shift in altcoin rally dynamics. Between 2022 and 2024, altcoin rallies typically lasted around 45 to 60 days, with 2024 being a strong year for BTC, driving wealth effects rotating into altcoins and sustaining narratives like Meme coins and AI. In 2025, despite the emergence of new narratives including Meme coin launchpads, Perp DEXs, and the x402 concept, the median persistence plummeted to around 20 days.

These narratives could spark brief market activity but failed to develop into lasting, market-wide rallies. This reflects volatile macro conditions, market fatigue following last year's excessive gains, and insufficient altcoin liquidity to support narratives beyond their initial stages. The result is that altcoin rallies resemble tactical trades more than high-conviction trend plays.

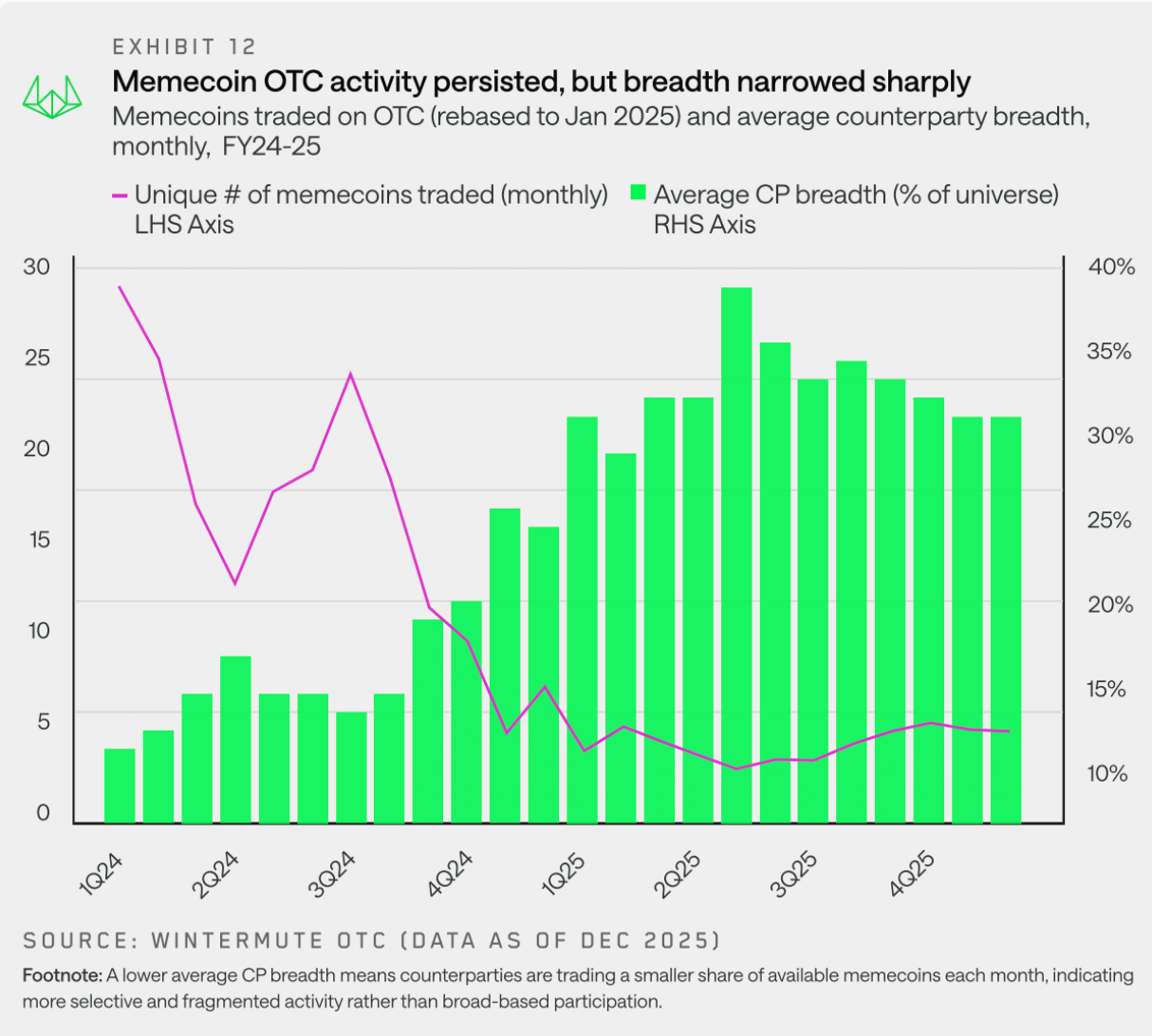

Meme Coins: Active Range Narrowed

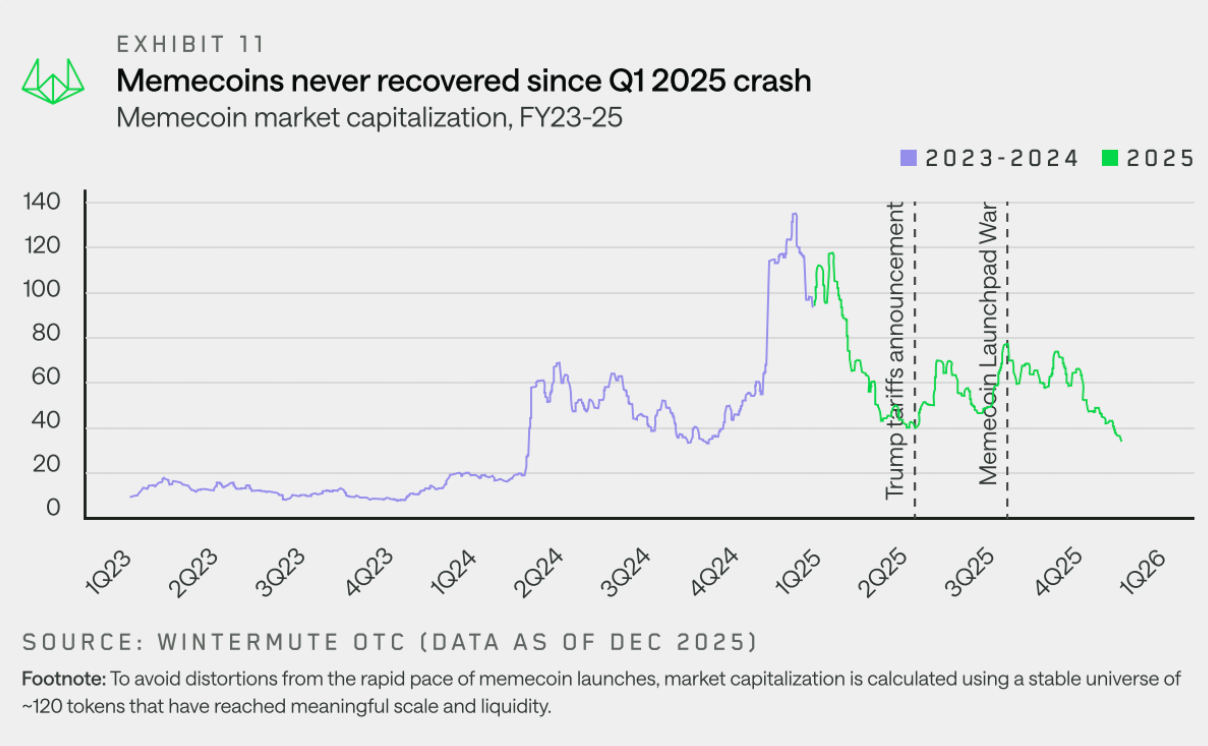

"Meme coins peaked in Q1 2025 and failed to recover, unable to regain support as trading became more fragmented and narrow."

Meme coins entered 2025 as the most crowded part of the market, characterized by intense issuance, persistently bullish sentiment, and price action reinforcing the narrative, but this state came to an abrupt halt. Unlike other higher-beta sectors, meme coins turned lower earlier and more decisively and never managed to rebuild upward momentum.

Alongside significant price retracements, the absolute number of meme coins traded OTC remained healthy at any given point. Even by the end of 2025, the monthly number of tokens traded remained in the 20s, indicating that trading interest did not disappear. The change was in how activity manifested. In practice, this meant the number of tokens involved per counterparty per month decreased significantly, with activity concentrated on specific tokens rather than broad trading across the meme coin space.

Part 2: Derivatives

Wintermute's OTC derivatives data shows strong growth, with OTC becoming the venue of choice for executing complex, capital-efficient structured products due to increased market volatility and larger trade sizes, as it offers price certainty and operational privacy.

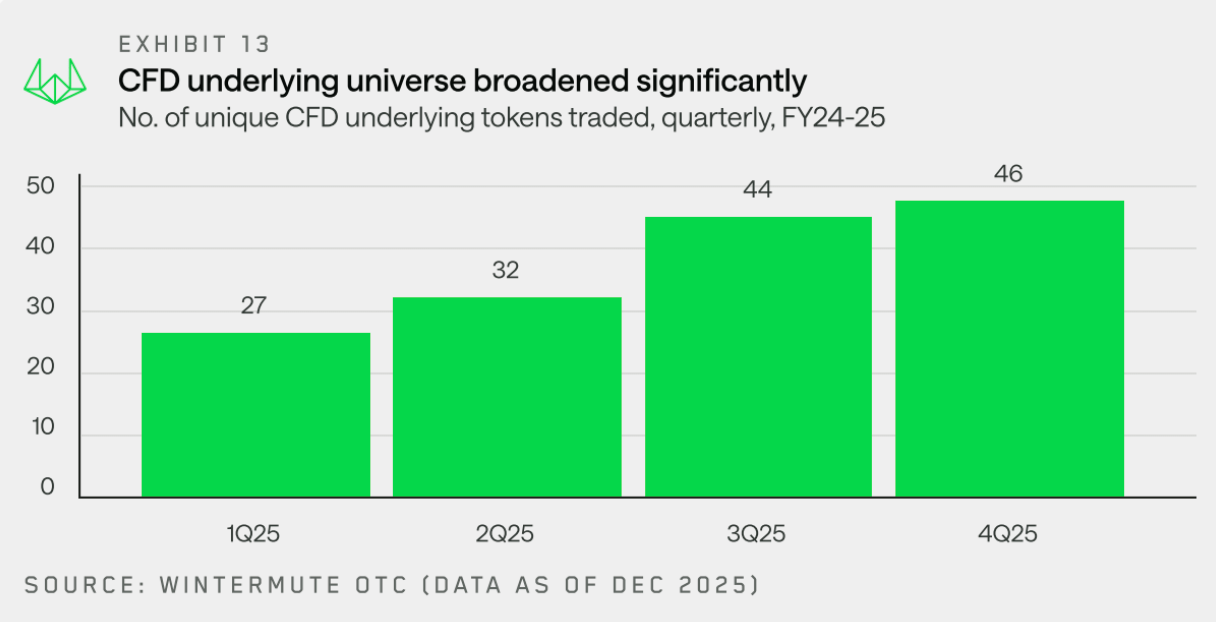

CFDs: Underlying Asset Range Expands

"In 2025, the range of underlying assets for CFDs expanded further, with futures increasingly favored as a capital-efficient way to gain market exposure."

The number of tokens used as underlying assets for CFDs on Wintermute's OTC desk grew two-fold year-over-year, increasing from 15 in Q4 2024 to 46 in Q4 2025. This continued growth reflects the market's increasing adaptation to CFDs as a capital-efficient way to gain exposure to a broader range of assets, including long-tail tokens.

The growing demand for CFDs reflects a broader market shift towards using futures for capital-efficient exposure. Perpetual futures open interest grew from $120 billion at the start of the year to $245 billion in October, before risk appetite sharply retreated during the October 11 liquidation event.

Options: Strategy Complexity Continues to Increase

"As systematic strategies and yield generation become primary drivers of volume growth, the options market is maturing rapidly."

Building on earlier growth in CFD and futures activity, Wintermute's OTC data shows that counterparties are increasingly turning to options to construct more customized and complex crypto asset exposures.

This shift drove a sharp increase in options market activity: from Q4 2024 to Q4 2025, both notional trading volume and the number of trades grew approximately 2.5x year-over-year. This was primarily driven by more counterparties—especially crypto funds and digital asset treasuries—adopting options strategies for passive yield generation.

<