Polygon's $250 Million Acquisition: L2 Competition Shifts Focus

- Core View: Polygon is making massive acquisitions to build a full-stack payment ecosystem.

- Key Elements:

- Acquired compliant payment provider Coinme, gaining U.S. money transmitter licenses and a cash network.

- Acquired development platform Sequence, integrating smart wallets and cross-chain technology.

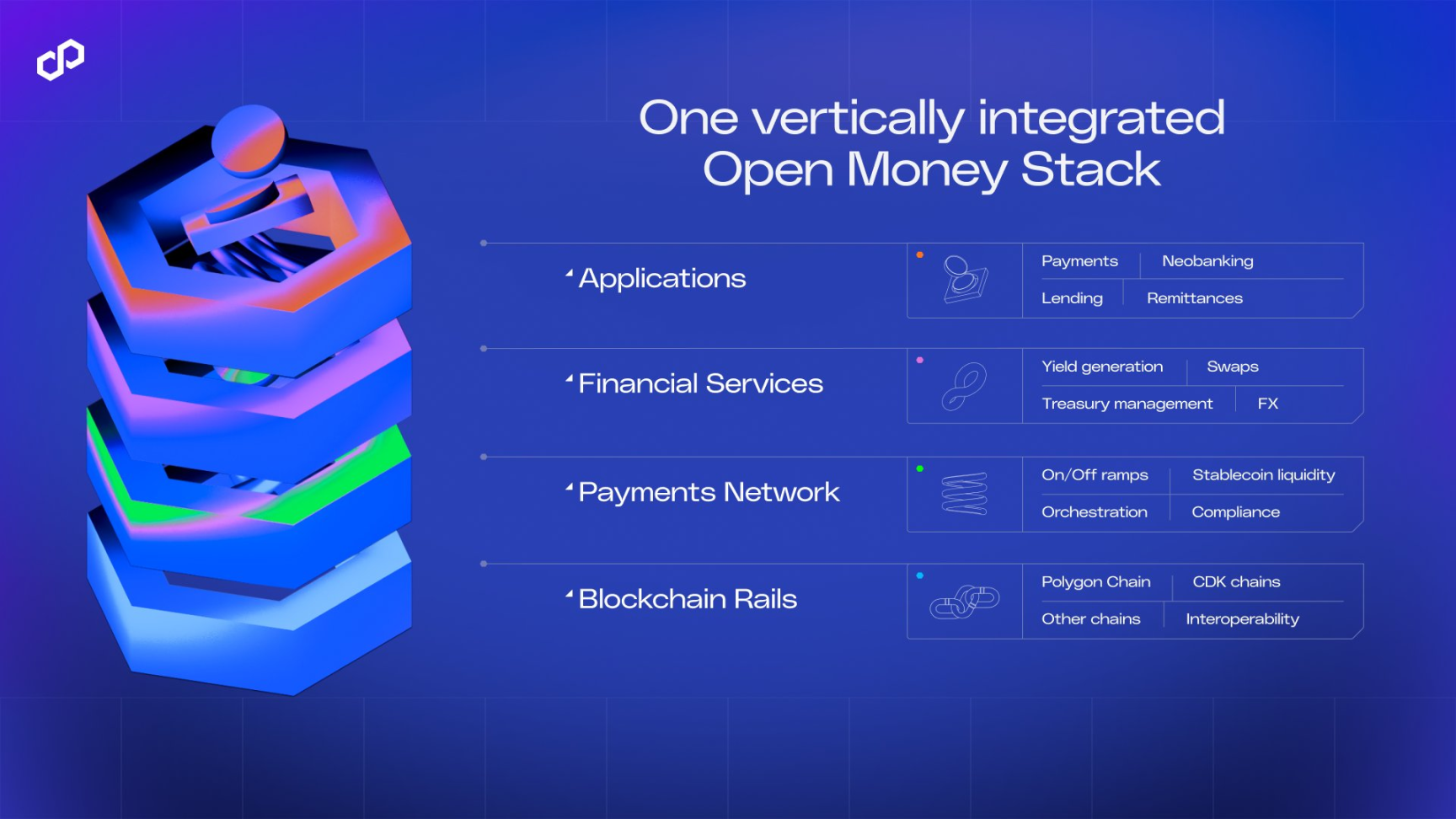

- The strategic core is the "Open Money Stack," connecting the entire chain from fiat on-ramps/off-ramps to settlement.

- Market Impact: Driving L2 competition from technology to full-stack business integration.

- Timeliness Note: Medium-term impact.

Original Author: Sanqing, Foresight News

On January 13, Polygon Labs announced the completion of its acquisitions of cryptocurrency payment infrastructure provider Coinme and blockchain development platform Sequence, with a total acquisition value exceeding $250 million. However, Polygon Labs did not disclose the specific purchase price for each company nor specify whether the transactions were conducted in cash, equity, or a combination of both.

Marc Boiron, CEO of Polygon Labs, and Sandeep Nailwal, founder of the Polygon Foundation, stated that these acquisitions aim to support the blockchain network's stablecoin strategy. Coinme holds a series of money transmitter licenses in the United States, while Sequence is focused on building blockchain infrastructure, including crypto wallets.

Coinme: Complementing the Offline Entry Point for the Stablecoin Ecosystem

As reported by CoinDesk on January 9, sources revealed that Polygon was in talks to acquire Bitcoin ATM operator Coinme. Polygon planned to spend between $100 million and $125 million to complete this acquisition.

Founded in 2014, Coinme has been a long-term operator in the compliant U.S. crypto business. It launched the first licensed Bitcoin ATM in the U.S. and has partnered with traditional brands like Coinstar and MoneyGram to establish a cash network across over 50,000 retail locations in 48 states.

Regulated by the U.S. Nationwide Multistate Licensing System (NMLS) and state financial regulators, Coinme provides online wallet and vending machine transaction services. It supports the exchange and withdrawal of major cryptocurrencies including Bitcoin, Ethereum, and Litecoin, making it easier for users to trade crypto assets.

As early as 2024, Coinme's transaction volume surpassed $1 billion and it achieved profitability for the first time, demonstrating sustained demand for its compliant payment model.

For Polygon, acquiring Coinme means directly obtaining a series of money transmitter licenses across the U.S., allowing Polygon to connect cash, debit cards, and on-chain assets directly within a compliant framework. This further advances its strategy to integrate stablecoin payments with off-chain capital inflows.

Sequence: Simplifying the Web3 User Experience

While Coinme handles "money," Sequence focuses on the "user." Sequence is dedicated to eliminating blockchain complexity through its modular stack, which includes a smart wallet, account abstraction, and the Trails cross-chain orchestration engine.

Sequence's core technology includes a Smart Contract Wallet (Smart Wallet). By leveraging account abstraction, it makes wallet behavior more akin to a Web2 account experience, supporting features like social recovery, gas fee abstraction, and automated transactions.

The key component for its cross-chain execution is Trails. It allows users to automatically find and execute the optimal path for cross-chain or cross-protocol transactions after expressing an intent, without the user needing to be aware of cross-chain complexities, gas fees, or token compatibility.

By combining chain abstraction and account abstraction, Sequence not only enables developers to "build once, run on multiple chains" but also allows end-users to trade, pay, and interact across multiple chains with a single identity, similar to using internet services. This lowers the barrier to entry for new users into the on-chain world.

Building the Open Money Stack Strategy

Polygon Labs stated that the core objective of these acquisitions is its stablecoin strategy and the Open Money Stack, aiming to reduce system fragmentation through a unified API.

Open Money Stack | Source: Polygon Tweet

On/Off & Cash Ramps Layer: Leverages Coinme's compliant network and U.S. regulatory licenses to enable instant on/off-ramps for cash and fiat currency. Whether physical cash or electronic fiat, it can be converted into stablecoins or other on-chain assets.

Wallet & Interaction Layer (Wallet Infrastructure): Relies on Sequence's enterprise-grade smart wallet and account abstraction technology, coupled with one-click cross-chain transactions and cross-chain interaction capabilities. This allows end-users to receive, send, and make on-chain payments without needing to concern themselves with the underlying chain, gas, or intermediary assets.

Cross-Chain Interoperability Layer (Crosschain Interop): Combines Sequence's Trails cross-chain orchestration engine with Polygon's interoperability protocol. This makes value flow between different chains completely transparent to users and supports cross-chain transactions for any chain and any token.

Settlement Layer (Blockchain Rails): Relies on the Polygon network and its scaling technologies to provide high-speed, low-cost, and secure on-chain clearing infrastructure. This enables stablecoin payments and value transfer to operate at a commercial scale and efficiency.

Furthermore, the Open Money Stack plans to integrate modules for stablecoin orchestration, compliance, identity, and yield generation, providing enterprises with payment and treasury management solutions.

L2 Competition Shifts to "Full-Stack Integration"

Polygon's $250 million acquisitions reflect a shift in the focus of L2 competition from underlying technical parameters to full-stack business integration.

This path is highly consistent with the logic behind Coinbase's support for Base. For compliant entry points, acquiring Coinme is to address the shortcoming in fiat on/off-ramps, targeting Coinbase's core CEX advantage. For interaction experience, integrating Sequence is to lower the barrier to on-chain entry, targeting the ease of use of Coinbase Wallet (Base).

In the context of gradually converging L2 technologies, ecosystems with compliant channels and low-barrier experiences will more easily attract incremental capital. Through this series of acquisitions, Polygon is attempting to build its own full-chain moat in competition with rivals like Base, which possess inherent centralized advantages.