Delphi Digital Outlook: 10 Major Paradigm Shifts in the Crypto Market by 2026

- Core Viewpoint: The crypto market is moving towards institutionalization and paradigm shifts.

- Key Elements:

- AI Agents integrating with DeFi to form autonomous economies.

- Stablecoin yields flowing back to platforms that create use cases.

- Prediction markets and similar applications will evolve into financial infrastructure.

- Market Impact: Driving crypto to become a global financial infrastructure layer.

- Timeliness Note: Medium-term impact.

Author | Delphi Digital

Compiled by | Odaily(@OdailyChina)

Translator | DingDang(@XiaMiPP)

Editor's Note: Bitcoin has surged past the $96,000 mark, rapidly reigniting market sentiment. However, beyond short-term price movements, the more pertinent discussion is perhaps the truly noteworthy directions for the next phase of the crypto market. In its latest "2026 Outlook Report," Delphi Digital presents 10 core predictions.

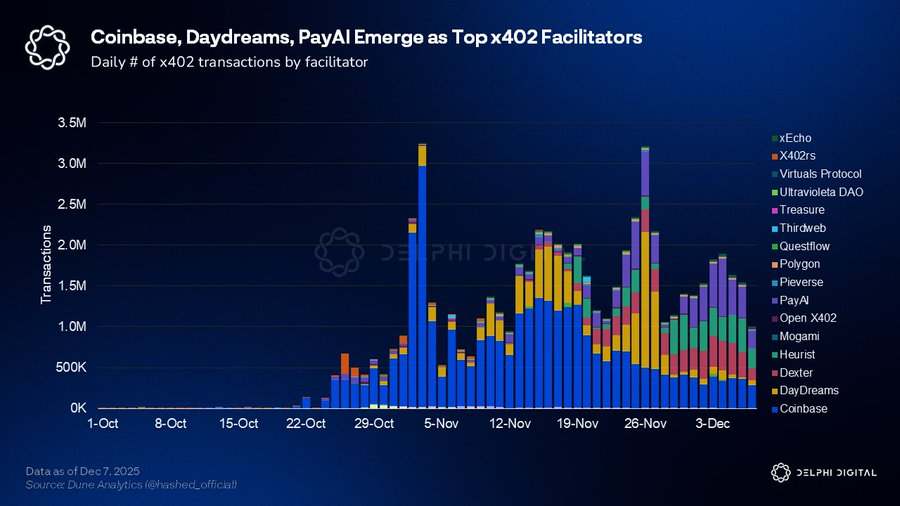

1. AI Agents Begin Autonomous Trading

The x402 protocol allows any API to control access via crypto payments. When an Agent requires a service, it can directly use stablecoins for instant payment—no shopping cart or subscription system needed. ERC-8004 introduces a trust mechanism by establishing a reputation registry for Agents: recording their historical performance and requiring them to provide staking collateral.

When combined, a true "Autonomous Agent Economy" begins to take shape. Users can fully delegate travel planning to an Agent: it will subcontract tasks to a flight search Agent, pay for data via x402, and complete the booking process on-chain, all without any human intervention.

2. Perp DEXs Consume Traditional Finance

The high cost of traditional finance stems from its highly fragmented nature: trading occurs on exchanges, settlement relies on clearinghouses, and asset custody is handled by banks. Blockchain is compressing these layers into a unified smart contract.

Today, Hyperliquid is building native lending functionality. Perpetual DEXs have the potential to simultaneously act as brokers, exchanges, custodians, banks, and even clearinghouses. Competitors like @Aster_DEX, @Lighter_xyz, and @paradex are accelerating their pursuit.

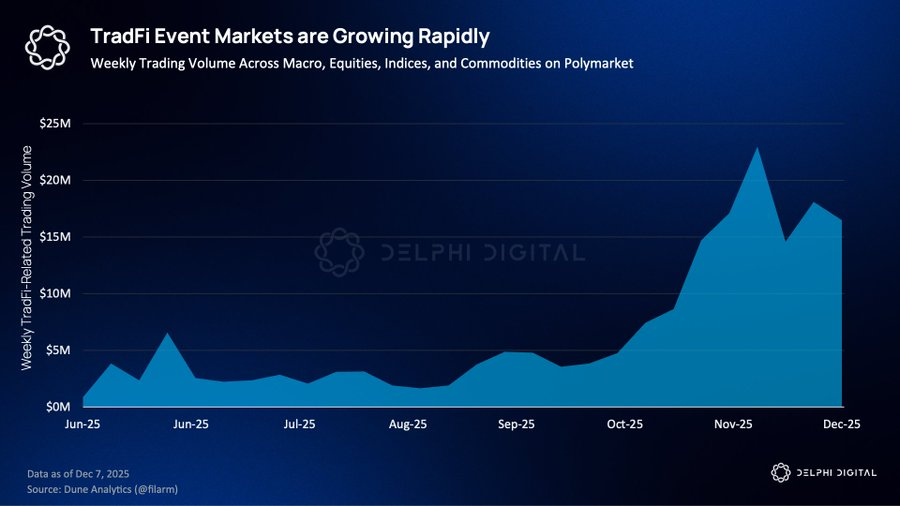

3. Prediction Markets Evolve into Financial Infrastructure

Thomas Peterffy, Chairman of Interactive Brokers (IBKR), describes prediction markets as a "real-time information layer for portfolios." Currently, early demand on IBKR is concentrated in weather contracts, used for energy, logistics, and insurance risk management.

By 2026, prediction markets will expand into more categories: equity event markets around corporate earnings beats and guidance ranges, macro data markets for CPI and Fed decisions, and cross-asset relative value markets. A trader holding tokenized AAPL can hedge earnings risk with a simple binary contract, bypassing complex options structures. Prediction markets will officially become a first-class derivative instrument.

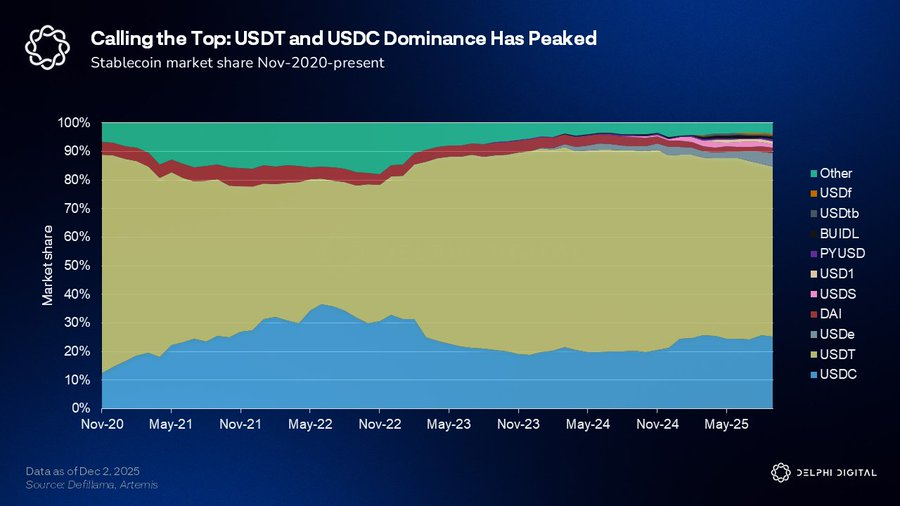

4. Ecosystems "Reclaim" Revenue from Stablecoin Issuers

From distribution rights alone, Coinbase earned over $900 million from USDC reserves last year. Meanwhile, public chains like Solana, BSC, Arbitrum, Aptos, and Avalanche generate a combined annual fee revenue of approximately $800 million, yet they support over $30 billion in USDC and USDT. The platforms driving stablecoin usage have been "leaking" more revenue to issuers than the value they capture themselves.

This dynamic is being disrupted. Hyperliquid initiated a competitive bidding process for USDH and allocates half of the reserve yield to its Assistance Fund. Ethena's "Stablecoin-as-a-Service" model has been adopted by Sui, MegaETH, and Jupiter. Revenue that once passively flowed to legacy issuers is now returning to the platforms that create real utility.

5. DeFi Breaks the Low-Collateral Lending Dilemma

DeFi lending protocols have locked in billions in TVL, but almost entirely rely on over-collateralization. The real breakthrough lies in Zero-Knowledge Transport Layer Security (zkTLS): users can prove their bank balance exceeds a certain threshold without revealing account numbers, transaction history, or identity.

@3janexyz already offers instant low-collateral USDC credit lines based on verified Web2 financial data, with algorithms monitoring borrower status in real-time and dynamically adjusting rates. The same framework can incorporate "historical performance" as a credit score to provide credit for AI Agents. @maplefinance, @centrifuge, and @USDai_Official are entering adjacent fields. In 2026, uncollateralized/low-collateral lending will move from proof-of-concept to an infrastructure phase.

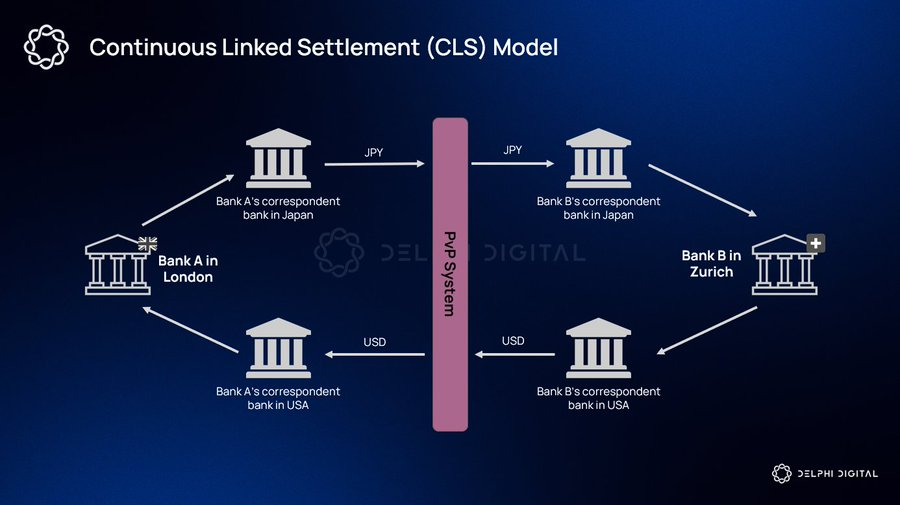

6. On-Chain Forex Finds Product-Market Fit

Currently, USD stablecoins account for 99.7% of total supply, but this dominance may be nearing a cyclical peak. The traditional forex market is worth trillions of dollars but is riddled with intermediaries, fragmented settlement systems, and high fees. On-chain forex compresses the entire intermediary chain by allowing various currencies to coexist as tokenized assets on the same execution layer.

True product-market fit may first emerge in emerging market currency pairs—where traditional forex channels are most expensive and inefficient, precisely where crypto's value proposition is clearest.

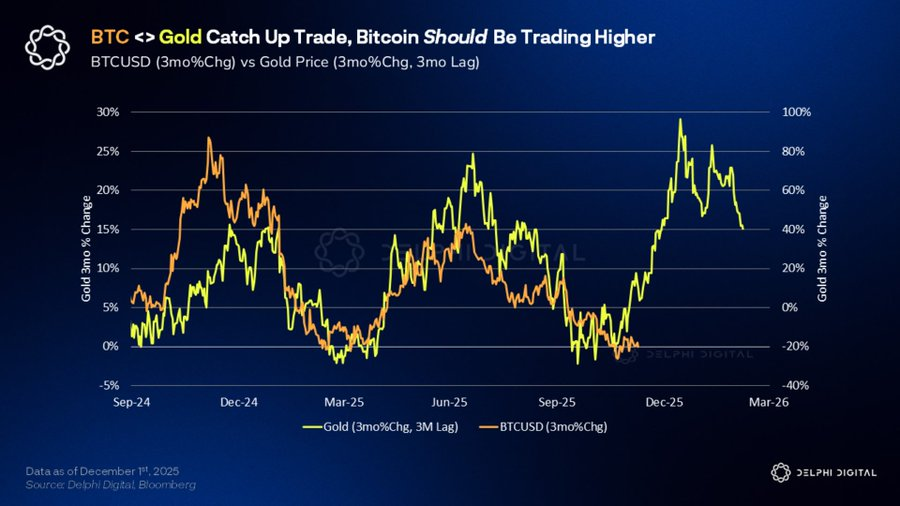

7. Gold and Bitcoin Lead the "Devaluation Trade"

Since we listed gold as the "chart to watch," its price has risen by approximately 60%. Even at historic highs, central banks have cumulatively purchased over 600 tons of gold, with China being one of the most active buyers.

The macro environment continues to support its strength: global central banks continue to cut rates, fiscal deficits persist at least until 2027, global M2 hits new highs, and the Fed is ending quantitative tightening. Historical patterns show gold typically leads Bitcoin by 3 to 4 months. When "currency devaluation" becomes a mainstream issue ahead of the 2026 midterm elections, both assets will see significant safe-haven inflows.

8. Exchanges Are Becoming "Everything Apps"

Coinbase, Robinhood, Binance, and Kraken are no longer just exchanges; they are building true super apps.

Coinbase has Base as its operating system, Base App as its user interface, USDC revenue as its underlying cash flow, and is expanding into derivatives via Deribit. Robinhood's Gold membership grew 77% year-over-year, gradually becoming its core retention engine. Binance has long reached super app scale, with over 270 million users and $250 billion in payment volume. As distribution costs approach zero, value will concentrate on platforms that "own the user." In 2026, the leading effect will become significantly more pronounced.

9. Privacy Infrastructure Is Catching Up with Demand

Privacy is under systemic pressure: the EU passed the "Chat Control Act," cash transaction limits are set at €10,000, and the ECB plans to launch a digital euro with a holding limit of €3,000.

Meanwhile, privacy infrastructure is accelerating to fill the gap. @payy_link launched a private crypto card, @SeismicSys offers protocol-level encryption solutions, @KeetaNetwork enables on-chain KYC without exposing personal data, and @CantonNetwork provides privacy infrastructure for large financial institutions. Without private rails, stablecoin adoption will hit a ceiling.

10. Altcoin Returns Will Continue to Diverge

The era of "across-the-board rallies" is unlikely to return. Future token unlocks still exceed $3 billion, competition from AI, robotics, and biotech is intensifying, and ETF flows will concentrate more on Bitcoin and a few large-cap assets.

Capital will reallocate around "structural demand": tokens with ETF inflows, protocols with real revenue and buyback mechanisms, and applications that achieve true product-market fit. The ultimate winners will be teams that build defensive moats within real economic activity.

Conclusion

The crypto industry is entering its next phase; institutionalization is no longer the future but the present reality. Prediction markets, on-chain credit, the Agent economy, and stablecoins as infrastructure are driving a genuine paradigm shift.

Crypto is becoming the foundational infrastructure layer for global finance. The teams that truly understand this trend will define the next decade.