Wagyu v2 Breaks the Deadlock, Can Monero Undergo a Value Reassessment?

- Core Viewpoint: The monopoly of instant exchange services has led to long-term price suppression for Monero.

- Key Factors:

- Instant exchange services monopolize XMR trading, creating over $100 million in annual selling pressure.

- Their high fees and random fund freezes severely distort true price signals.

- Wagyu v2 provides exchange-level liquidity, breaking the monopoly and eliminating selling pressure.

- Market Impact: May drive price discovery for XMR, challenging the existing exchange model.

- Timeliness Note: Medium-term impact.

Original Author: PerpetualCow.hl

Original Compilation: AididiaoJP, Foresight News

A few days ago, I exposed the trillion-dollar instant swap industry. Today, I'm connecting the dots that no one on Crypto Twitter has pieced together yet.

Since 2018, while almost every other cryptocurrency has been skyrocketing, Monero (XMR) has been stuck in a price range.

Most people attribute this to exchange delistings, regulatory pressure, or the narrative that "privacy coins are dead."

They are all wrong.

To understand what's happening, you must first dive deep into the history of Monero (XMR), including all the exchange delistings, and how most people actually buy this coin.

The Real Demand for Monero (XMR)

People have always wanted Monero, not just for privacy, but because it's seen as an alternative store of value to Bitcoin, like a 21st-century Swiss bank account.

Its utility hasn't changed just because exchanges, fearing regulation, were forced to delist it.

This can be compared to illegal drug trade: when you can't buy from a legitimate pharmacy, addicts find more dubious channels, paying higher prices to get what they need.

As a result, the demand for Monero flowed to instant swap services, not centralized exchanges.

Think from the perspective of an average user in 2024:

You want to buy Monero, but Binance just delisted it, and Coinbase never dared to touch it. Other small exchanges still trading Monero are likely to freeze your funds for dealing with such a coin.

You only have two choices:

- Find a third-tier exchange that still lists Monero and pray they don't run off with the funds.

- Use an instant swap service, pay high fees, and pray they don't freeze your funds indefinitely under the pretext of "AML review."

Over 60% of users chose the second path.

These services became the de facto on-ramp and off-ramp for the Monero ecosystem.

They are, of course, unregulated and offer terrible exchange rates, but users have no other choice.

After all legitimate exchanges abandoned Monero, the instant swap industry became the only channel, absorbing all Monero trading volume.

Tracking the Flow of Funds

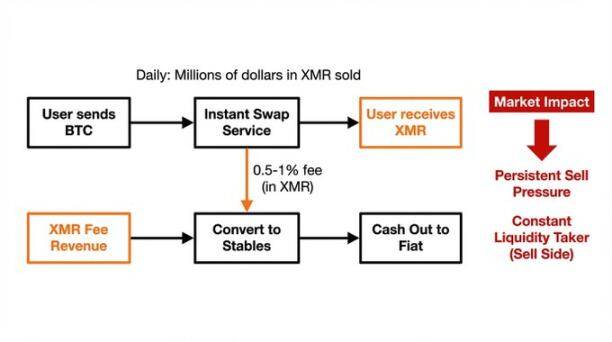

All instant swap services operate the same way:

Users send Bitcoin and receive Monero, with the service secretly charging 3-4% fees (while advertising only 0.5-1%).

But these fees are priced in Monero.

So, what do these services do with the Monero they receive?

They don't hold it long-term; they are not believers. These are offshore companies chasing fiat profits, who immediately swap Monero for stablecoins and cash out.

Thus, millions of dollars worth of Monero are sold into the market every day.

In market microstructure terms, this creates a persistent one-way capital outflow. Regardless of overall market conditions, these services are constantly selling. While this is just their business model, its impact on price is devastating.

Quantifying the Capital Drain

In my previous article, I estimated the instant swap industry handles about $150 billion in volume annually (across all chains), and that's just the on-chain verifiable part.

Monero's volume is invisible due to its privacy features, but industry estimates suggest it accounts for about 20% of total instant swap traffic.

Assume $30 billion worth of Monero is swapped through these services annually.

Conservatively, the actual figure might be half of that, around $15 billion.

At an average fee of 0.75% (most actually charge 1%), the Monero fees collected annually are worth about $112.5 million.

All this Monero is sold into the market.

This means over $300,000 in passive selling pressure every day. It's like an invisible pump constantly draining Monero's value.

And this is a conservative estimate. If Monero truly accounts for 20% of volume and fees are 1%, that's $300 million annually, approaching $1 million in daily selling pressure.

But that's not all. There's also the "AML Trap."

The AML Trap

This is the "dirty secret" I exposed in my last article: these services, while advertising "no KYC," arbitrarily freeze user funds under "AML review."

It's estimated that 2-5% of transactions through instant swap services get frozen. The rate is even higher for large transactions.

This creates a vicious cycle:

- Small transactions go through but are charged fees 10-20 times higher than normal

- Large transactions are completely frozen, often permanently

- Only a fraction of the actual buying demand actually reaches the market

This creates the most brutal price discovery barrier: buyers who could actually move the price are systematically excluded from the market.

The real demand for Monero has always been far higher than its price reflects. The instant swap industry either extracts from this demand or outright blocks it.

A Captive Market

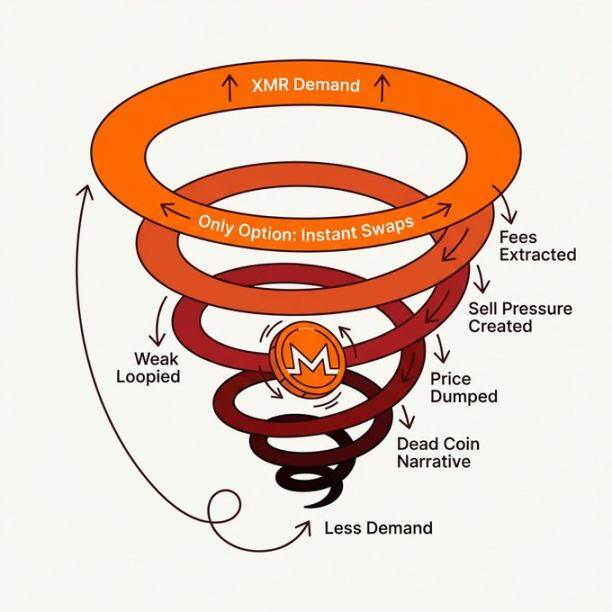

Let me be clear about this vicious cycle:

The instant swap industry didn't win the market through competitiveness. They gained a monopoly when all exchanges delisted Monero, and then extracted the maximum possible from users with nowhere else to go.

1% fees plus terrible exchange rates, plus random fund freezes.

Users tolerate it because they have no choice, and these services know it.

This is what happens when an entire asset class is forced into a single channel controlled by anonymous offshore operators: they extract with an uncompetitive product.

Every cent they extract becomes selling pressure on Monero.

Wagyu's Solution

Two days ago, Wagyu v2 launched.

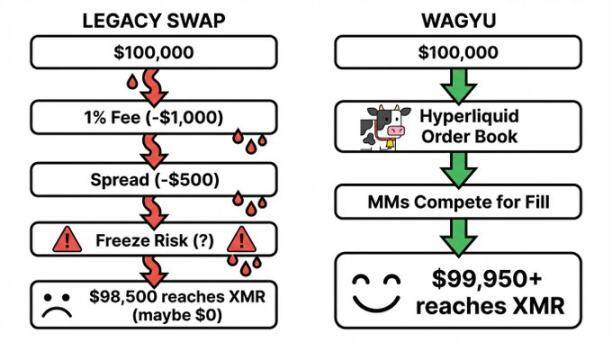

The core idea is simple: give Monero users the same pricing level as exchange traders.

When you swap through Wagyu, your order is routed to @Hyperliquidx—where the most competitive market makers in crypto compete for orders.

These same market makers provide liquidity for Binance, Bybit, and OKX, offering razor-thin spreads.

The result: you get exchange-level prices and fees. No more 1% or 0.5%, but the ultra-low fees professional traders get.

For the first time since Monero was delisted from exchanges, users don't have to get "fleeced" for using their own asset.

A single $100,000 trade prevents over $1,000 in selling pressure from hitting the market.

In its first 48 hours, Wagyu v2 has already processed millions in swaps, offering the best prices in the market:

Trades that would have gone through traditional services, been charged over 1% in fees, and caused tens of thousands in instant market selling pressure are now happening through Wagyu.

- $1 million swap through traditional service = $10,000 worth of Monero sold

- The same $1 million swap through Wagyu = zero forced selling

Multiply this effect by every large Monero buyer who discovers they no longer have to be "robbed."

The Vicious Cycle Reversing

For years, Monero has been trapped in a negative feedback loop:

The instant swap industry sat as a value extraction layer between buyers and the true price. They intercepted demand, extracted profits, and distorted price signals. Users couldn't bypass them because there was no alternative.

Now, that has changed.

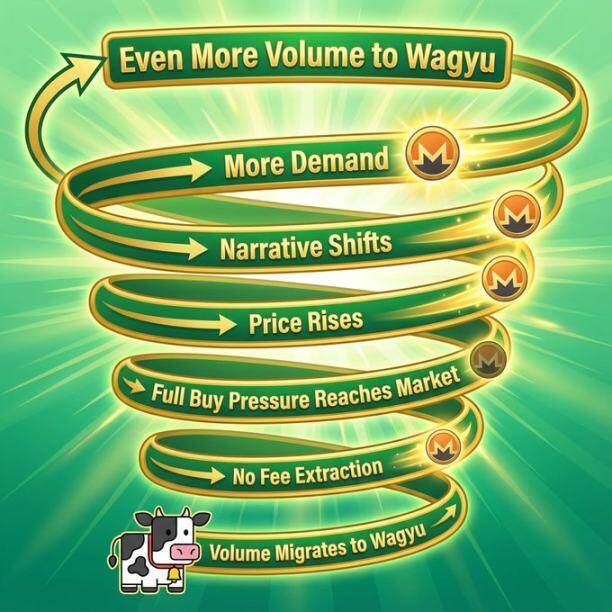

Just two days after launch, volume is already migrating to Wagyu. People are realizing they can get Binance-level pricing for an asset Binance won't even list, and the word is spreading fast.

The cycle is reversing:

It's no coincidence that Monero broke $600 and began its first real price discovery in years.

Wagyu is Saving Monero

I'm not going to be humble about this:

Every swap through Wagyu instead of a traditional service is real buying demand that reaches the market.

Every million-dollar trade that flows through us means over $10,000 that isn't sold to other holders.

We are not extracting from the Monero ecosystem; we are plugging it directly into real liquidity.

The parasitic layer that has suppressed Monero for years finally has competition. And we're not competing on their terms—we're making their entire model obsolete.

When users can get exchange-level pricing through Wagyu with zero freeze risk, who will pay 1% to anonymous offshore services that might freeze their funds?

No one.

What This Means

I'm not here to give price predictions. I don't know if Monero will go to $1,000, $2,000, or fall back to $400.

But I know this for sure: for the first time since being delisted from exchanges, demand for Monero can actually translate into price.

We've been live for just two days and are already processing millions in trades—trades that would have been a constant "bleed" on the market.

With the "ceiling" removed, Monero at $600 is still undervalued. At least now, the market will truly decide its value.

Price discovery is finally possible, and Wagyu is making it happen.