In-Depth Analysis of Solana DEX: Who is Capturing Order Flow, and Who is Being Eliminated?

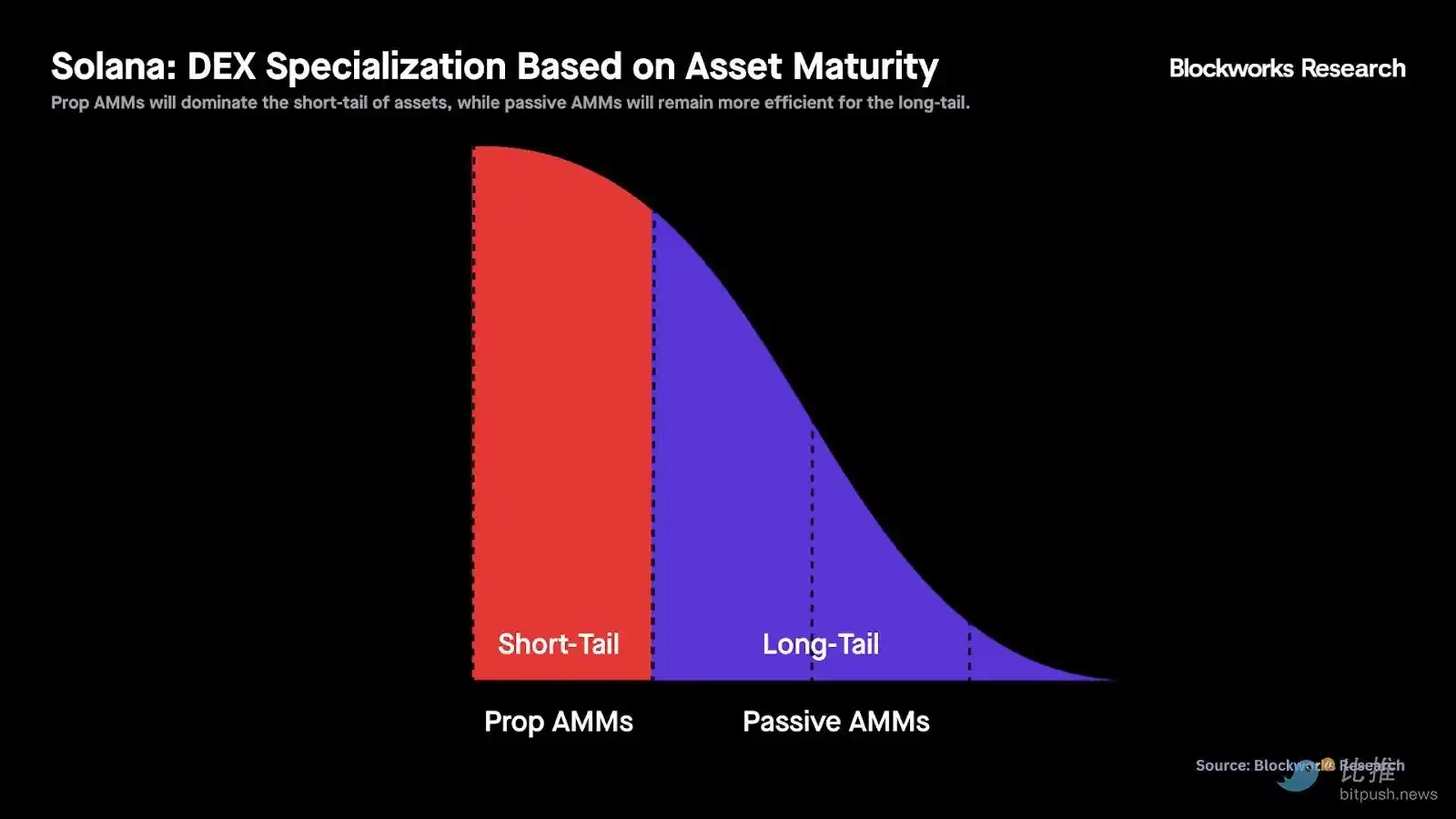

- Core Viewpoint: The Solana DEX landscape is diverging based on asset maturity.

- Key Factors:

- Active Market Making AMMs dominate high-liquidity, short-tail assets.

- Passive AMMs require vertical integration with launch platforms to survive.

- HumidiFi holds a 65% market share among active AMMs.

- Market Impact: The traditional standalone DEX model faces structural decline.

- Timeliness Note: Medium-term impact

Original Title: Solana DEX Winners: All About Order Flow

Original Author: Carlos Gonzalez Campo, Blockworks Research

Original Compilation: BitpushNews

Key Takeaways

- Solana DEX dominance will bifurcate by asset maturity: Active Market Making (AMM) AMMs will continue to dominate short-tail, high-liquidity markets, while passive AMMs will increasingly focus on long-tail assets and new token launches.

- Winning strategies for the two AMM types diverge: Both can benefit from vertical integration, but in opposite directions. Passive AMMs are moving closer to users via token launch platforms (e.g., Pump-PumpSwap, MetaDAO-Futarchy AMM), while Active Market Making AMMs are extending downstream, focusing on transaction bundling services (e.g., HumidiFi-Nozomi).

- HumidiFi leads the Active Market Making AMM category, holding approximately 65% market share, with the majority of its volume concentrated in SOL-USDC and SOL-USDT pairs. Its oracle update instruction costs are best-in-class, demonstrating superior markout spread performance compared to peers like SolFi and Tessera, as well as passive AMMs.

- The standalone passive AMM model is obsolete. Future "winner" passive AMMs will no longer be viewed as pure AMMs but will become vertically integrated token launch platforms with the AMM as a monetization layer—such as launchpads like Pump or ICO platforms like MetaDAO.

- DEXs that fit neither category face structural growth decline. Protocols that are neither Active Market Making AMMs nor vertically integrated launch platforms (most notably Raydium and Orca) are at a structural disadvantage and could be the losers in this trend.

- Valuation should reflect both business quality and token value accrual. Multiples like Price-to-Sales (P/S) are only meaningful in the context of growth prospects and credible token holder value capture. WET is a case study in trade-offs: seemingly undervalued versus peers but trading at a discount due to uncertainty around long-term token utility.

Introduction

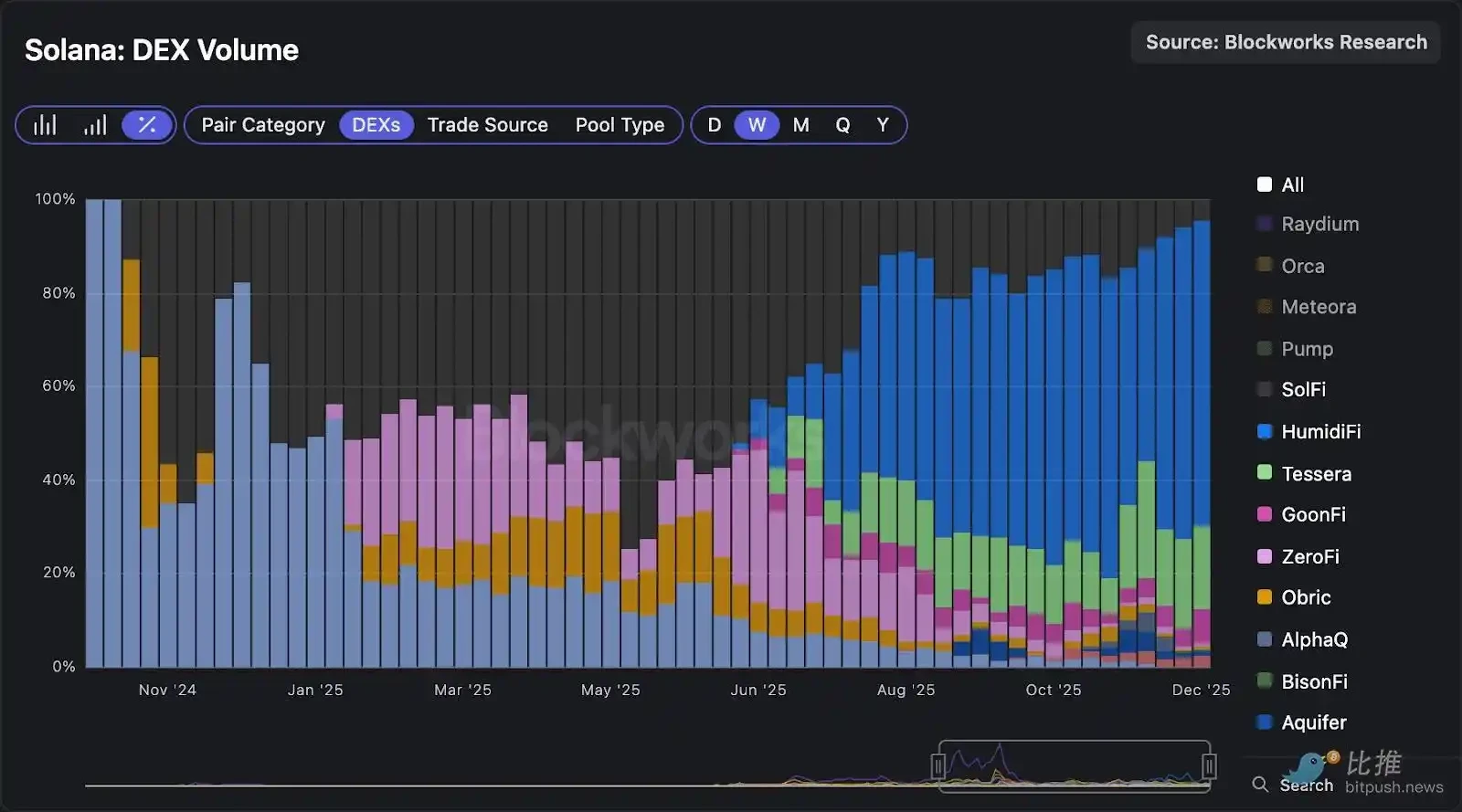

In February 2025, we published a report on the Solana DEX competitive landscape. At that time, DEX volume was at an all-time high, and we (in hindsight) anchored too heavily on a 90-day rolling window that included an anomalous period of frenzy: the post-US election rally in Q4 2024, the January TRUMP memecoin mania, and the LIBRA-driven activity in February. Back then, Raydium was the leading DEX, holding about 50% market share, and most DEX volume on Solana came from meme coins.

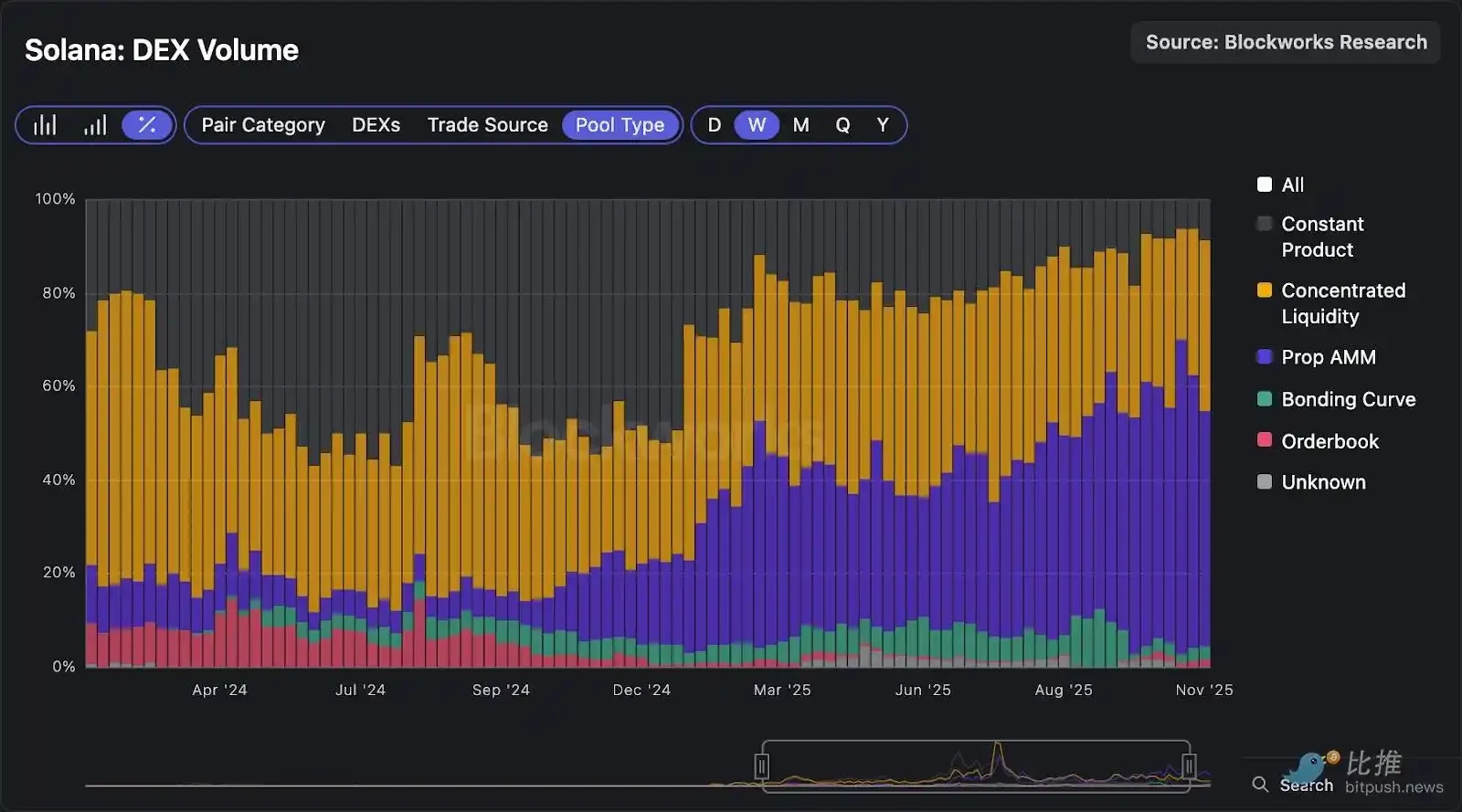

Today, the landscape has fundamentally changed. The rise of Active Market Making AMMs has reshaped market structure, with volume concentration shifting from meme coins to SOL-dollar pairs. Although Lifinity pioneered the Active Market Making AMM model, it wasn't until SolFi launched at the end of October 2024 that Active Market Making AMMs proliferated and began capturing significant share of volume in high-liquidity pairs.

As Active Market Making AMMs continue to dominate order flow for short-tail assets, passive AMMs are struggling, increasingly pushed towards long-tail assets and launch-dependent volume. Pump's introduction of an AMM in March 2025 exemplifies this dependency: once Pump directed its graduated tokens to its own AMM, Raydium lost its largest source of volume and revenue, and its market share has been declining ever since. With liquidity for passive AMMs largely commoditized, the AMMs most likely to survive will be those that control issuance and order flow.

This report revisits Solana's DEX landscape based on this new market structure, updating competitive positioning, valuations, and outlining our views on the protocols best positioned to win.

Specialization: Short-Tail vs. Long-Tail Assets

Solana DEX dominance will continue to bifurcate based on asset maturity.

Active Market Making AMMs will dominate short-tail assets (i.e., high-liquidity markets), including SOL-stablecoin and stablecoin-stablecoin pairs.

In contrast, passive AMMs like Meteora and Raydium will remain more efficient at managing liquidity for long-tail assets. Active Market Making AMMs are virtually absent in this vertical because actively managing liquidity for new assets without real-time oracle prices is too risky for them.

Order Flow: Execution vs. Issuance

Active Market Making AMMs have no front-end, so they rely on aggregators like Jupiter and DFlow to interact with their contracts and execute trades through their pools. In other words, Active Market Making AMMs need aggregators for order flow.

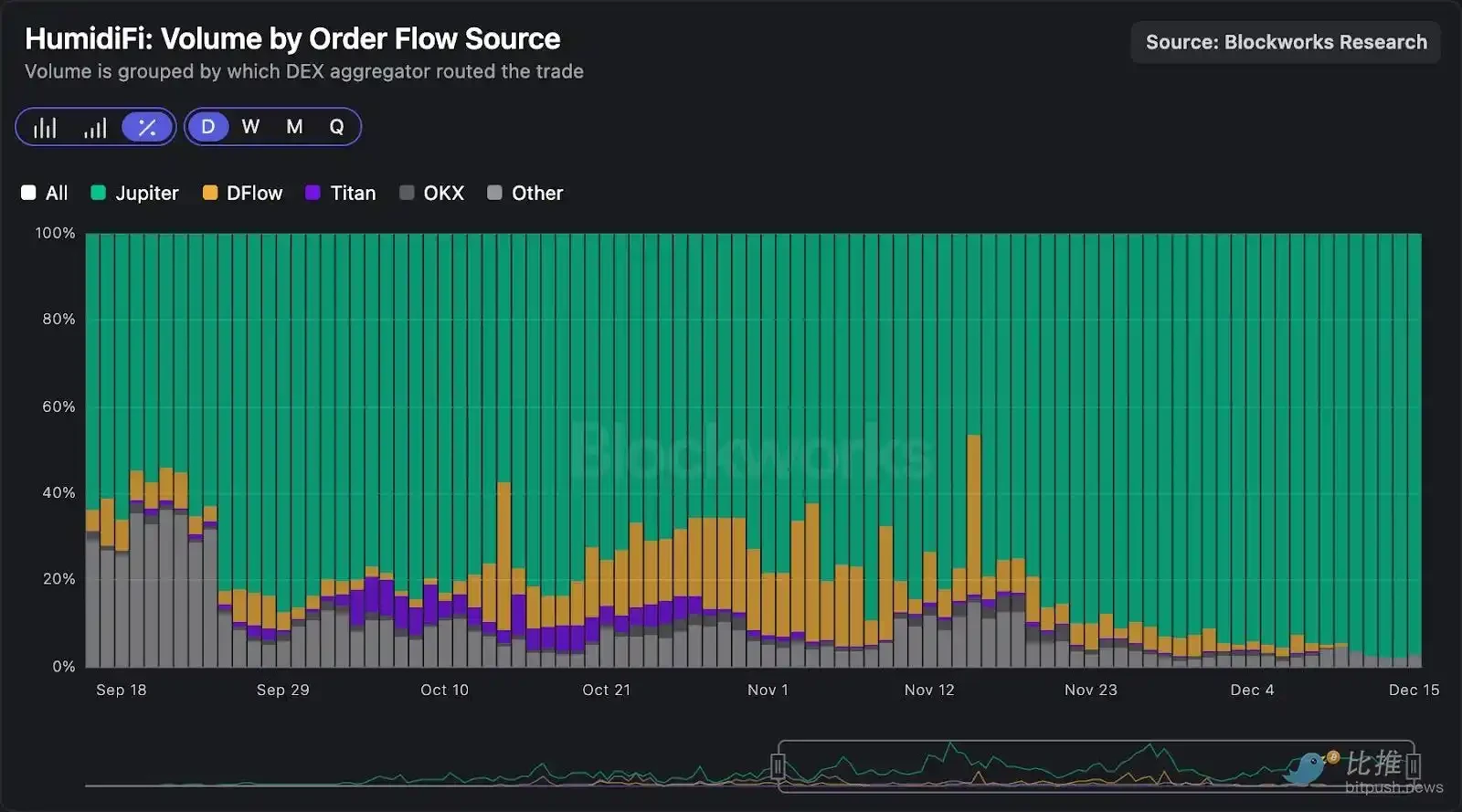

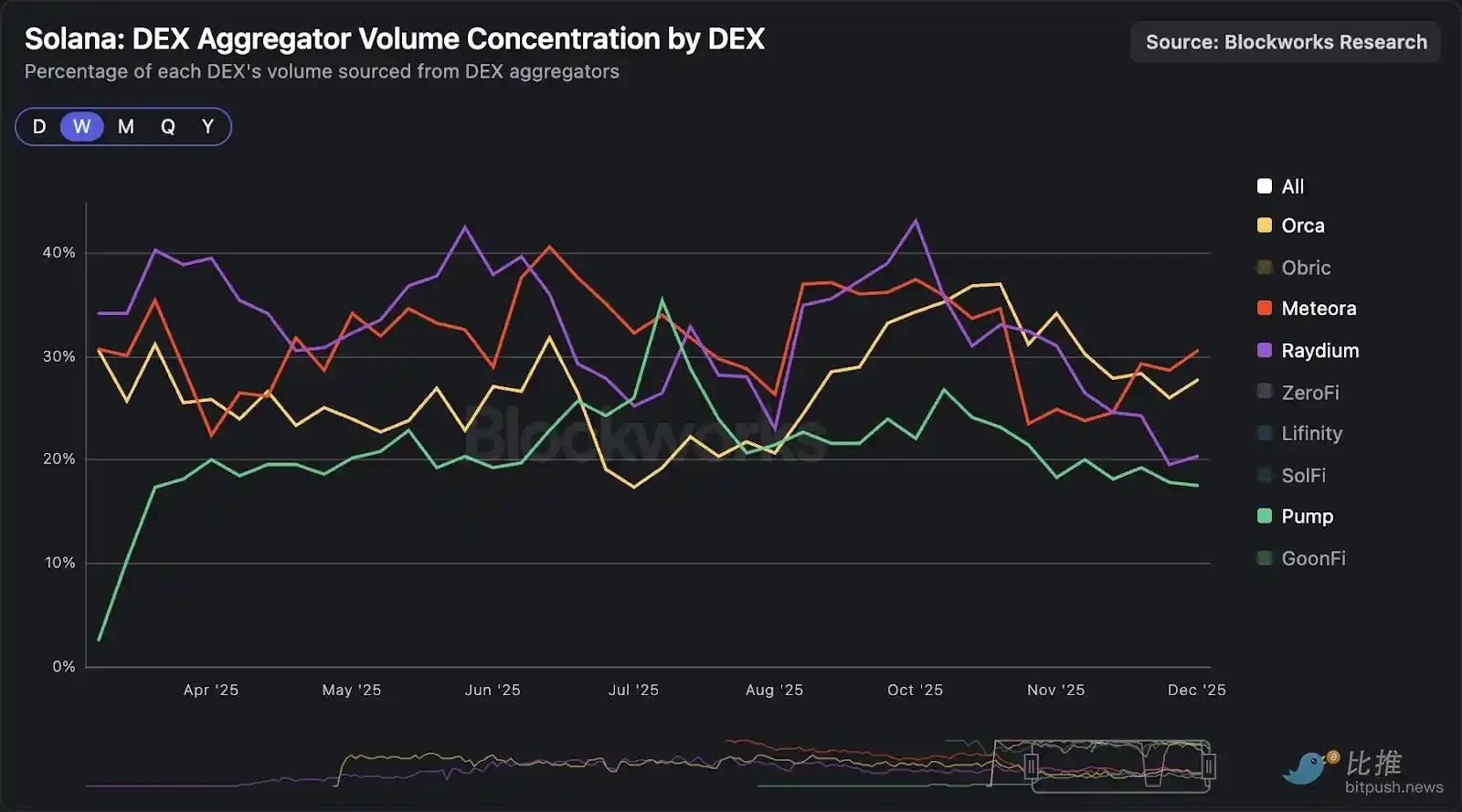

The chart below shows that over 95% of HumidiFi's volume comes from DEX aggregators, a pattern mirrored by other Active Market Making AMMs like Tessera, GoonFi, and SolFi.

On the other hand, less than one-third of passive AMM volume comes from aggregators.

Passive AMMs cannot compete with Active Market Making AMMs on price execution for major assets, and with liquidity for long-tail assets largely commoditized, they must compete on issuance channels.

In summary:

- Active Market Making AMMs must compete on price execution, as aggregators route orders to the venue offering the lowest slippage. As detailed later in the report, transaction ordering is crucial for Active Market Making AMMs (which can be viewed as market makers) because they need to race to update quotes before taker arbitrage. Therefore, Active Market Making AMMs can benefit from moving downstream and focusing on transaction bundling services.

- Passive AMMs must compete on issuance channels, meaning they need to vertically integrate or gradually lose relevance. Contrary to Active Market Making AMMs, passive AMMs need to move closer to users via token launch platforms (e.g., Pump-PumpSwap, MetaDAO-Futarchy AMM).

We believe that the passive AMMs that survive long-term will ultimately cease to be viewed as pure AMMs. Their primary function will shift to being token launch platforms—such as launchpads or ICO platforms—with the AMM itself serving merely as the underlying tool for monetizing token launches. Meteora is a potential exception, though its success heavily relies on traffic distribution from Jupiter. Here are the most typical examples of this trend:

- Pump (launchpad) — PumpSwap

- MetaDAO (ICO platform) — Futarchy AMM

- Jupiter's DTF (ICO platform) — Meteora

HumidiFi is the clearest example of a vertically integrated Active Market Making AMM, benefiting from the transaction bundling service Nozomi built by the same core team (Temporal).

The fundamental differences between Active Market Making AMMs and traditional AMMs warrant separate competitive analysis.

Active Market Making AMMs: HumidiFi's Dominance

An Active Market Making AMM is a spot exchange that actively manages liquidity via oracle updates. Each Active Market Making AMM is operated by a single market maker (no external LPs) that uses highly optimized transactions to update oracle prices, allowing quotes to be adjusted multiple times per second. With over ten Active Market Making AMMs now live on Solana, they account for over 50% of all spot volume on the chain.

As mentioned, Lifinity was the first Active Market Making AMM, pioneering the concepts of protocol-owned liquidity and adjusting quotes based on oracle prices. However, after Ellipsis Labs (the team behind Phoenix) launched SolFi at the end of October 2024, Lifinity rapidly lost market share, and its volume continued to decline. Lifinity ceased operations on November 20, 2025, a decision highlighting how competitive the Active Market Making AMM space has become.

As shown above, SolFi captured nearly half of Active Market Making AMM volume in Q1 and Q2 2025, but HumidiFi quickly rose to the top after its launch in June 2025. HumidiFi now leads Active Market Making AMM volume with a 65% market share, followed by Tessera (18%) and GoonFi (7%).

The core engineering team behind HumidiFi is Temporal, one of the most technically proficient teams on Solana.

Temporal also operates other products at the infrastructure layer, including Nozomi (a transaction bundling service) and Harmonic (a regional block building system aiming to compete with Jito). Beyond Temporal's contributions, HumidiFi co-founder Kevin Pang, who previously worked at Jump, Paradigm, and Symbolic Capital Partners, brings indispensable high-frequency trading expertise to this Active Market Making AMM.

HumidiFi exemplifies our thesis: unlike passive AMMs that need to move downstream and control end-users to capture order flow, Active Market Making AMMs are better suited to move downstream into transaction bundling and sequencing infrastructure. Temporal's infrastructure stack is highly complementary to HumidiFi, enhancing its ability to optimize compute usage and transaction bundling for oracle updates.

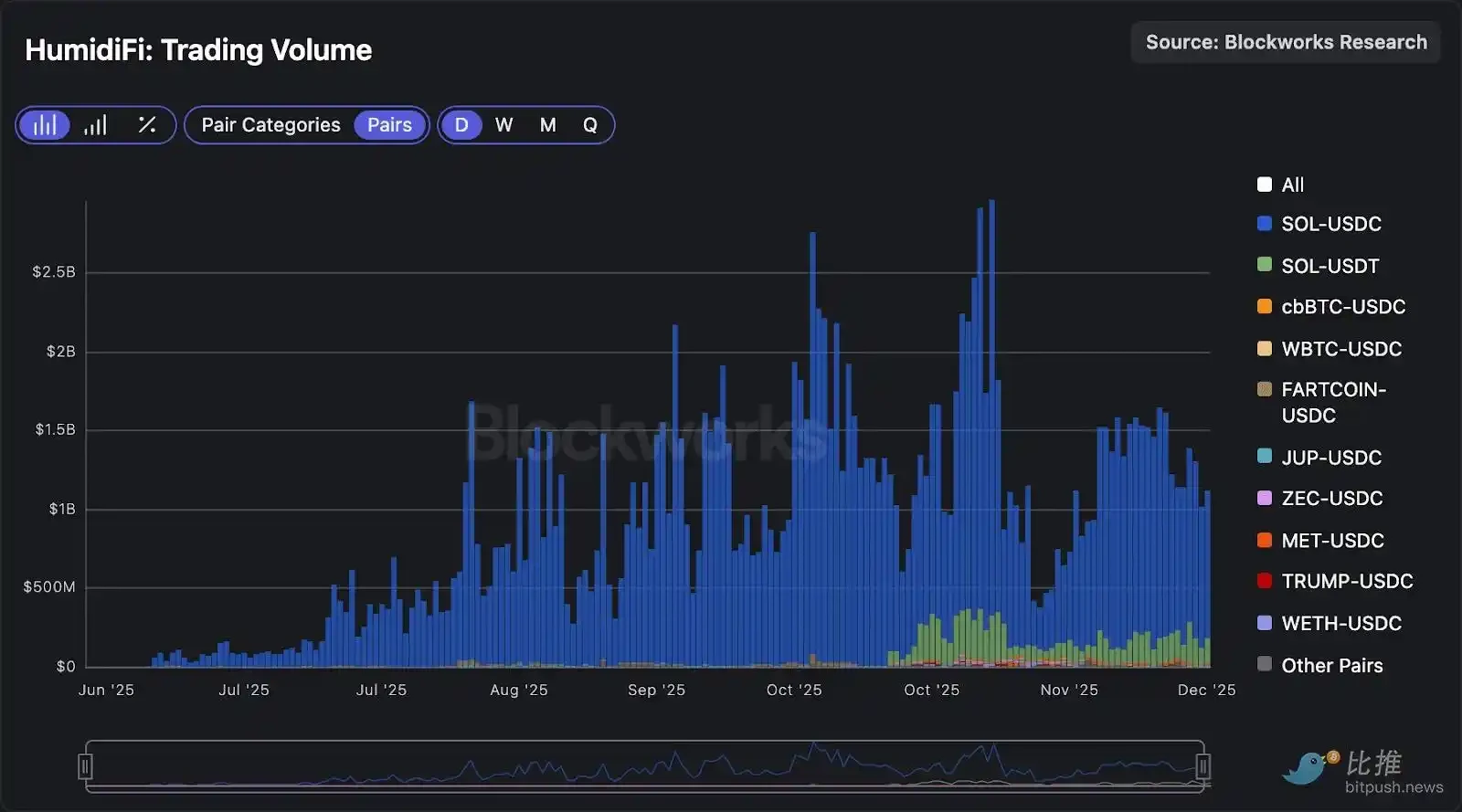

Although HumidiFi has 18 active pools, about 98% of its volume comes from the SOL-USDC (83.3%) and SOL-USDT (14.4%) pairs.

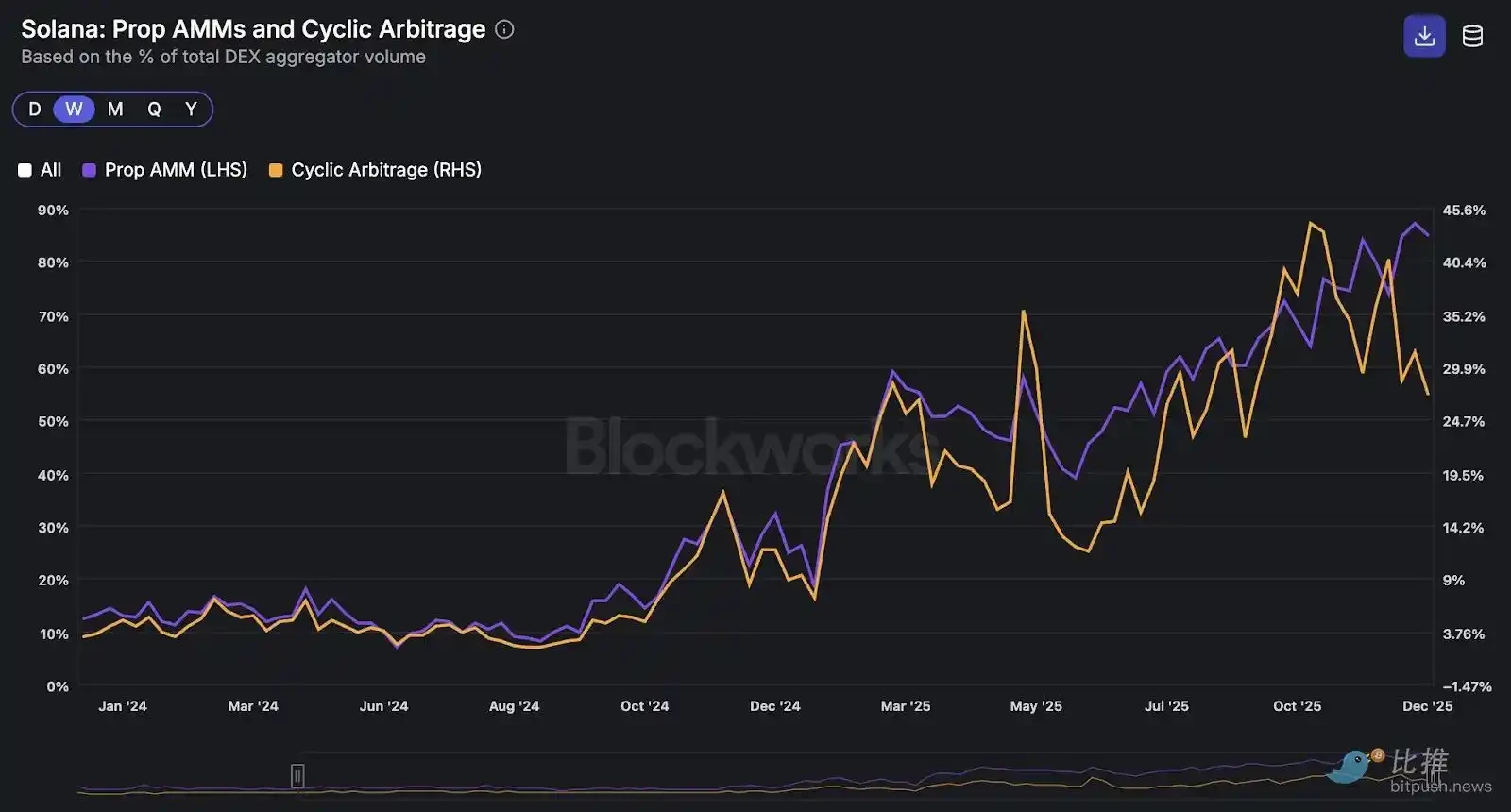

CEX<>DEX Arbitrage is Moving On-Chain

According to Dan Smith, Head of Data at Blockworks, one of the most interesting second-order effects of Active Market Making AMMs dominating SOL-dollar volume is that the CEX leg of CEX<>DEX arbitrage is moving on-chain.

Previously:

1. On-chain price was $120, Binance price jumped to $125.

2. CEX<>DEX arbitrage bots would buy on-chain and sell on Binance.

3. Arbitrage bots captured the $5 spread.

Now:

1. On-chain price is $120, Binance price jumps to $125.

2. Active Market Making AMMs quickly update their quotes to reflect the $125 Binance price.

3. Arbitrage bots can now atomically buy from on-chain venues with stale quotes and sell to the Active Market Making AMM.

4. Arbitrage bots capture the $5 spread.

Since both the stale-quote on-chain venue and the Active Market Making AMM are on-chain, arbitrage can now be done atomically in a single transaction, with lower risk for traders. Consequently, there has been an increase in arbitrage bots using flash loans to capture these opportunities.

The chart below shows an extremely tight relationship between the percentage of DEX aggregator volume going through Active Market Making AMMs (left axis) and the percentage of DEX aggregator volume classified as circular arbitrage (right axis). Here, we define circular arbitrage as trades where the input and output tokens are the same, capturing the arbitrage trades described above.

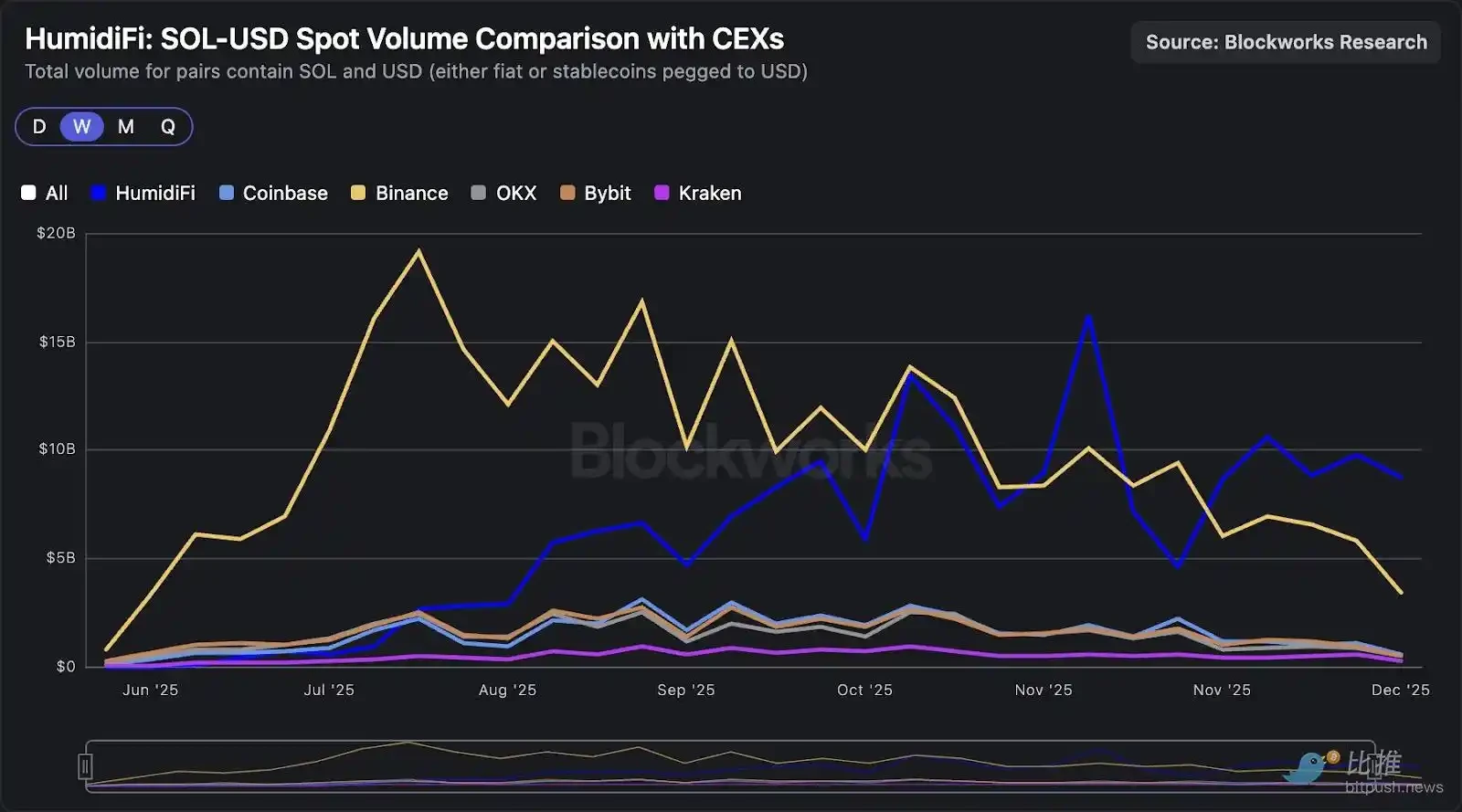

Following this trend, Active Market Making AMMs now process more volume for SOL-dollar pairs than CEXs. The chart below shows that over the past four weeks, HumidiFi's weekly average SOL-dollar volume exceeded $9 billion, surpassing Binance as the top venue.

Oracle Progress

Active Market Making AMMs adjust their pricing curves via oracle updates, making their quotes "fresher" than those of passive AMMs. Since oracle updates are approximately 100x less computationally intensive than swaps, the market maker in an Active Market Making AMM can quickly update its internal pool parameters multiple times per second, enabling tighter spreads than passive AMMs with aggregated liquidity.

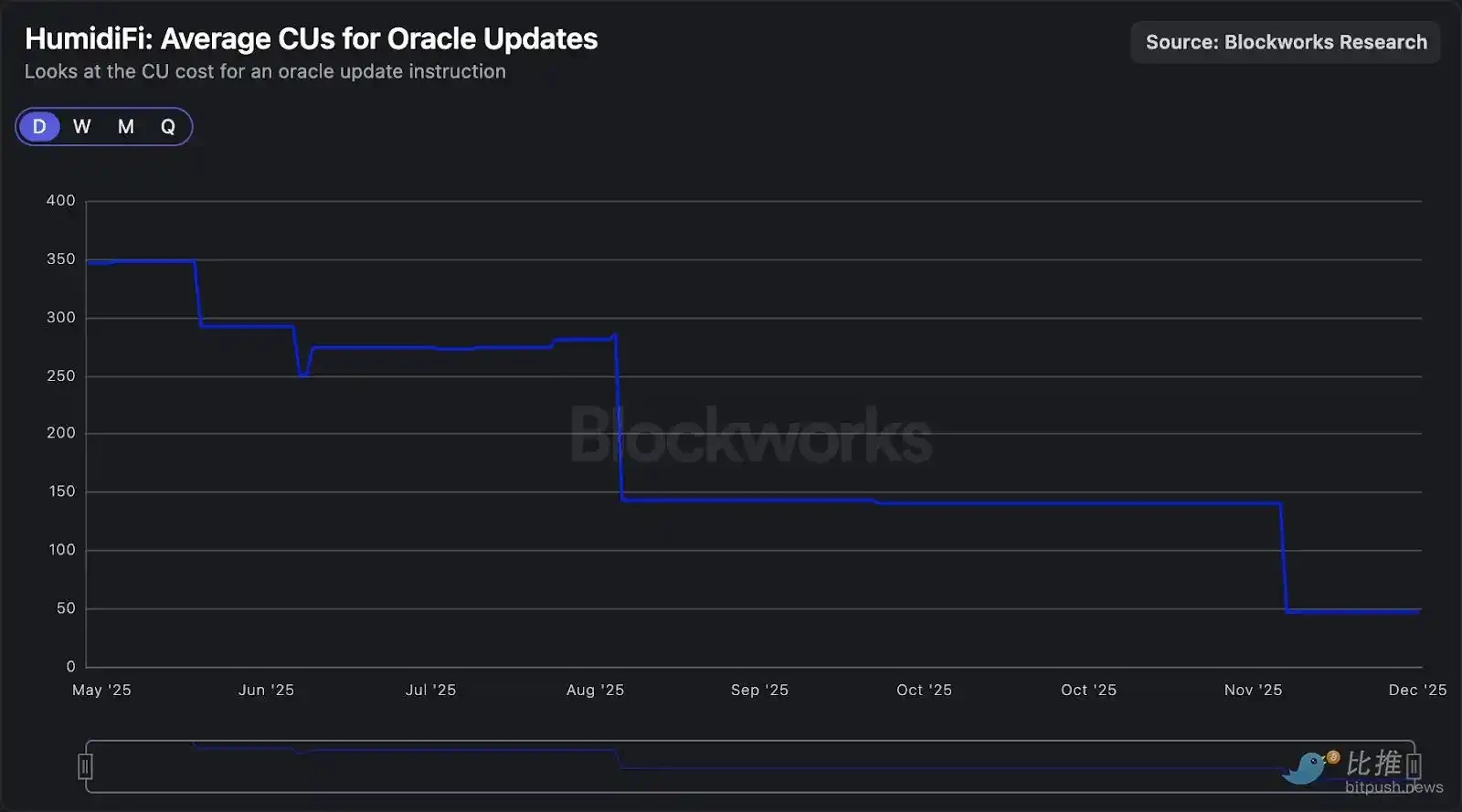

These oracle update transactions are highly optimized to consume as few compute units (CUs) as possible. Since transactions in a block are ordered by priority fees paid per CU, lighter oracle updates can achieve higher placement in the block at a lower total transaction cost. Transaction ordering is crucial due to the race to update quotes before taker arbitrage. The chart below shows that HumidiFi has aggressively optimized its oracle update instruction, reducing compute to 47 CUs, an over 85% decrease since its June launch.

However, the chart above only considers CUs consumed by the oracle update instruction itself. A more relevant metric is total transaction CUs, because an Active Market Making AMM cannot update its oracle without a full transaction, which includes any additional program calls and account handling overhead required to execute the update.

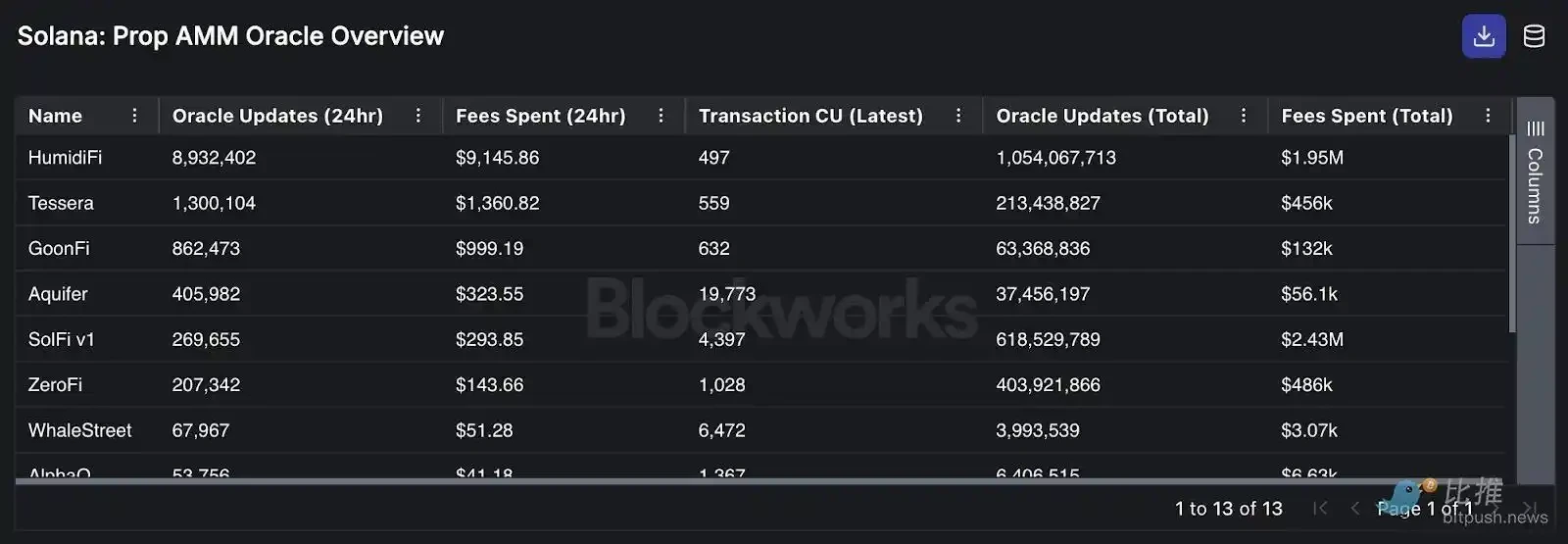

The table below shows that HumidiFi has reduced its oracle update transactions to <500 CUs, the lowest in its class. Besides HumidiFi, only Tessera and GoonFi are below 1,000 CUs.

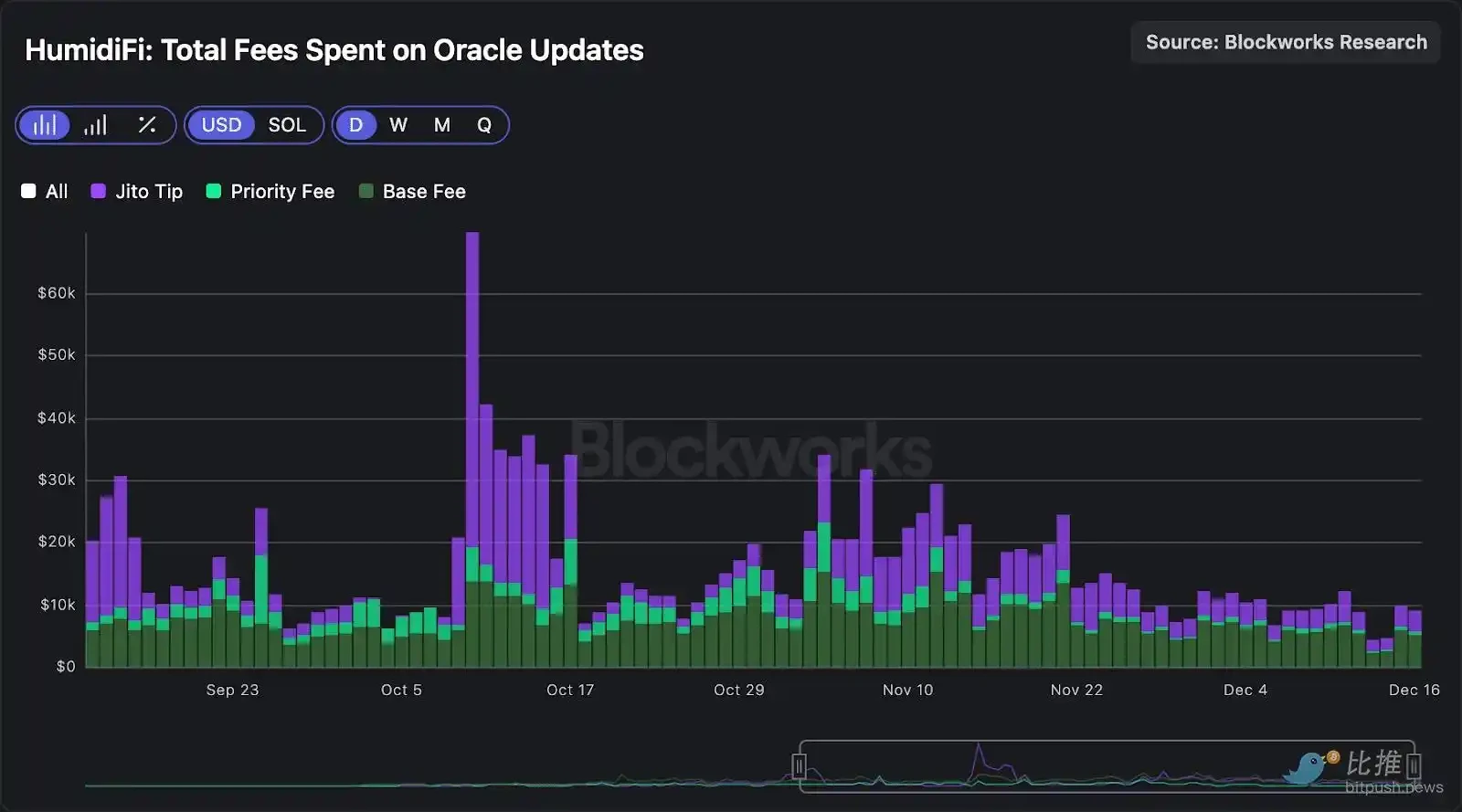

Although each oracle update transaction costs approximately $0.0016, HumidiFi averages about 6 million updates per day (around 70 per second!) since reducing total compute below 500 CUs. At this rate, HumidiFi spends roughly $9,000 to $10,000 daily on transaction bundling fees (base fee + priority fee + Jito tip).

HumidiFi's Revenue

While HumidiFi's revenue is not public, we can estimate it by observing the change in its token inventory since inception. The core idea is that since HumidiFi essentially acts as a market-making desk (there's only one LP in an Active Market Making AMM), every trade with it has a winner and a loser. Over time, the net inventory change for the market maker reflects trading P&L. Therefore, we can track the cumulative net trading flow of various tokens from HumidiFi's perspective as a proxy for its revenue.

The chart below shows HumidiFi's cumulative net trading flow in SOL (which accounts for 98% of its volume), at approximately 25,000 SOL as of December 2, 2025. By measuring the daily change in HumidiFi's SOL inventory and multiplying these balances by the daily SOL price, we estimate cumulative trading revenue of about $4.1 million from its June 2025 launch to December 2, equivalent to approximately $24,000 in daily gross revenue.

The above method estimates on-chain trading P&L, but it may differ from actual net income if HumidiFi hedges inventory on CEXs, and funding rates, fees, and hedging P&L occur off-chain.

Another important caveat is that the above estimate reflects gross revenue. After subtracting the $9,000 to $10,000 daily oracle update costs, HumidiFi's implied net income is approximately $14,000 to $15,000 per day. Again, this is just an estimate based on available on-chain data. A more accurate revenue estimate would need to incorporate any off-chain hedging activities, as mentioned.

Markout Spread Analysis: Active vs. Passive Liquidity

Markout spread is a measure of execution quality and market maker adverse selection, serving as a useful evaluation tool for Active Market Making AMMs competing with the same strategy (providing delta-neutral top-of-book liquidity).

For this analysis, our data team focused solely on the SOL-USDC pair traded on HumidiFi, SolFi, and Tessera. Using a 30-second post-execution interval, on-chain fill prices were compared to the Binance SOL-USDC mid-price.

The P&L calculation is: `((Binance future mid-price – execution price) / execution price) * market maker direction * trade volume in USD`.

Here, market maker direction is defined from the market maker's perspective: +1 when the Active Market Making AMM buys SOL (taker sells SOL to it), and -1 when the Active Market Making AMM sells SOL (taker buys SOL from it). Additionally, note that using the Binance mid-price as a reference