Who is the final candidate for Fed chair, and what is Rick Rieder's stance on crypto?

- Core View: Rick Rieder is a pro-crypto candidate for Federal Reserve Chair.

- Key Elements:

- Publicly supports Bitcoin's long-term value and institutional allocation.

- Advocates for significant interest rate cuts, calling for rates to be lowered to 3%.

- If elected, could attract more institutional capital into the crypto market.

- Market Impact: Could bring policy tailwinds and capital inflows to the crypto market.

- Timeliness Note: Medium-term impact

Original|Odaily (@OdailyChina)

Author|CryptoLeo (@LeoAndCrypto)

The final list of candidates for Federal Reserve Chair was finalized yesterday. Yesterday, Trump stated he would interview Rick Rieder, BlackRock's Global Chief Investment Officer of Fixed Income, on Thursday to assess his potential as the next Fed Chair. This will be the fourth and final interview for candidates to succeed Chair Jerome Powell. Besides Rieder, the final shortlist includes former Fed Governor Kevin Warsh, National Economic Council Director Kevin Hassett, and Fed Governor Christopher Waller. Trump indicated he would make his final selection in January.

Among the four candidates, Rieder is likely the least familiar to most, while the others have been covered by Odaily in previous articles. Today, we will introduce this potential Fed Chair candidate.

Related References:

《Academic Underdog: Small-Town Professor Waller Emerges as Top Contender for Fed Chair》

《Is BTC's "Strict Principal" Coming? If He Leads the Fed, the Crypto Party Might Abruptly End》

A Veteran "BlackRocker" Deeply Rooted in Fixed Income

Rieder was born in October 1961. LinkedIn data shows he attended Emory University and the Wharton School at the University of Pennsylvania, earning a Bachelor of Business Administration in Finance from Emory in 1983 and an MBA from Wharton in 1987.

After graduation, Rieder spent a long 20-year tenure at Lehman Brothers from 1987 to 2008, holding senior positions such as Global Head of Credit and Global Head of Principal Strategies.

Following Lehman Brothers' bankruptcy in 2008, Rieder ventured into entrepreneurship, founding R3 Capital (primarily focused on multi-strategy credit investments) and serving as its CEO. The firm was taken over by BlackRock in 2009. This means Rick Rieder joined BlackRock along with his startup, becoming a Managing Director and leading the Fixed Income Alternatives Portfolio Team.

To this day, Rieder has been with BlackRock for 17 years. His current roles include Global Chief Investment Officer of Fixed Income, Head of the Fundamental Fixed Income business, and Head of the Global Allocation Investment Team at BlackRock. Rieder oversees trillions of dollars in assets, is a member of BlackRock's Global Executive Committee (GEC) and its GEC Investment Subcommittee, and chairs the firm-wide BlackRock Investment Committee. He is also currently a member of the Alphabet/Google Investment Advisory Committee and the UBS Research Advisory Council.

Notably, Rieder has also served as Vice Chairman of the U.S. Treasury Borrowing Advisory Committee and as a member of the Federal Reserve's Investment Advisory Committee on Financial Markets.

How Does Rieder Differ from Other Candidates?

Compared to the other three candidates, Rieder has less extensive work experience within the U.S. government. However, for the crypto industry, the noteworthy point is: Rieder is decidedly pro-crypto. In recent years, Rieder has repeatedly expressed positive views on cryptocurrencies (especially Bitcoin) in public, gradually shifting from initial caution to recognizing Bitcoin's investment value as a durable, hard asset. Below are his public crypto-related statements:

November 2020: Rieder commented on CNBC that digital payment systems are real, cryptocurrencies are here to stay, Bitcoin's mechanism is durable, more functional, and more traceable, and it can largely replace gold, especially given millennials' high acceptance of digital payments.

2021: In an interview with CNBC, Rieder stated that Bitcoin is a durable asset and will be part of the investment landscape for the long term. BlackRock had begun "dipping its toe in the water." While Bitcoin faces challenges like high volatility and regulation, these will be overcome over time.

Additionally, Rieder mentioned he personally holds Bitcoin (without disclosing the amount), believing its price could rise significantly in the future and that holding Bitcoin as a speculative tool offers good value.

2022: In an interview with Yahoo Finance, Rieder said the crypto market crash was similar to the early internet days. He maintained that Bitcoin and cryptocurrencies are durable assets, but there was simply too much over-investment built around them. The crash was a recalibration for the industry, eliminating some excess leverage. He remained long-term bullish once the market healed, stating, "In just 2 or 3 years, the crypto market will be higher than it is today."

September 2025: In a CNBC interview, Rieder said an ideal portfolio should hold "hard assets" like gold and Bitcoin to hedge against fiat currency depreciation. He noted BlackRock invests 3–5% in gold but "far less" in crypto. He believes Bitcoin will rise but considers a 5% allocation perhaps too high.

From the evolution of his public statements, it's clear that from his professional investment perspective, Rieder is personally bullish on Bitcoin, affirming its long-term value and viewing institutional Bitcoin holdings as a sound investment strategy.

Potential Impact on Crypto if Rieder is Elected

Between 2020 and 2025, Rieder frequently evaluated Bitcoin from perspectives of institutional portfolio allocation, macro hedging (e.g., against inflation, fiat depreciation), and liquidity. Following his recent inclusion in the Fed Chair candidate list, these remarks warrant re-examination. Compared to other candidates, Rieder is unequivocally the most pro-crypto figure. If elected Fed Chair, his stance could indirectly bring several benefits to the crypto industry:

1. Macro Policy: Advocating for Significant Rate Cuts

Rieder has consistently advocated for lowering interest rates to 3% in recent months, implying at least a 50 basis point cut from current levels. Rieder stated: "My stance has been very clear for many months now. The Fed must cut rates, and I don't think they need to cut much—ultimately landing at 3%, a level closer to the neutral rate."

Furthermore, Rieder added that regardless of who becomes Fed Chair, the entire Federal Open Market Committee (FOMC) will make appropriate decisions based on economic data analysis and assessment.

2. Professional Angle: More Institutional Participation

As BlackRock's Global CIO of Fixed Income, Rieder spearheaded and promoted BlackRock's allocation to Bitcoin futures as early as 2021, and the subsequent launch of IBIT was highly successful. With a verifiable investment track record, if elected Fed Chair, his pro-crypto stance would likely attract more institutional investors into the space.

3. Personal Perspective: Crypto Optimism and Industry Promotion

Although Rieder hasn't publicly disclosed his Bitcoin holdings, BlackRock's evolution from early Bitcoin futures to crypto ETFs demonstrates he walks the talk. He is highly bullish on Bitcoin's long-term value, emphasizing its "upside convexity" to amplify crypto returns in a loose monetary environment.

Additionally, as a professional fixed-income analyst seeking yield in high-interest/volatility environments—areas where crypto markets can excel—Rieder would likely promote the development of asset tokenization, stablecoins, and the DeFi sector within the crypto industry.

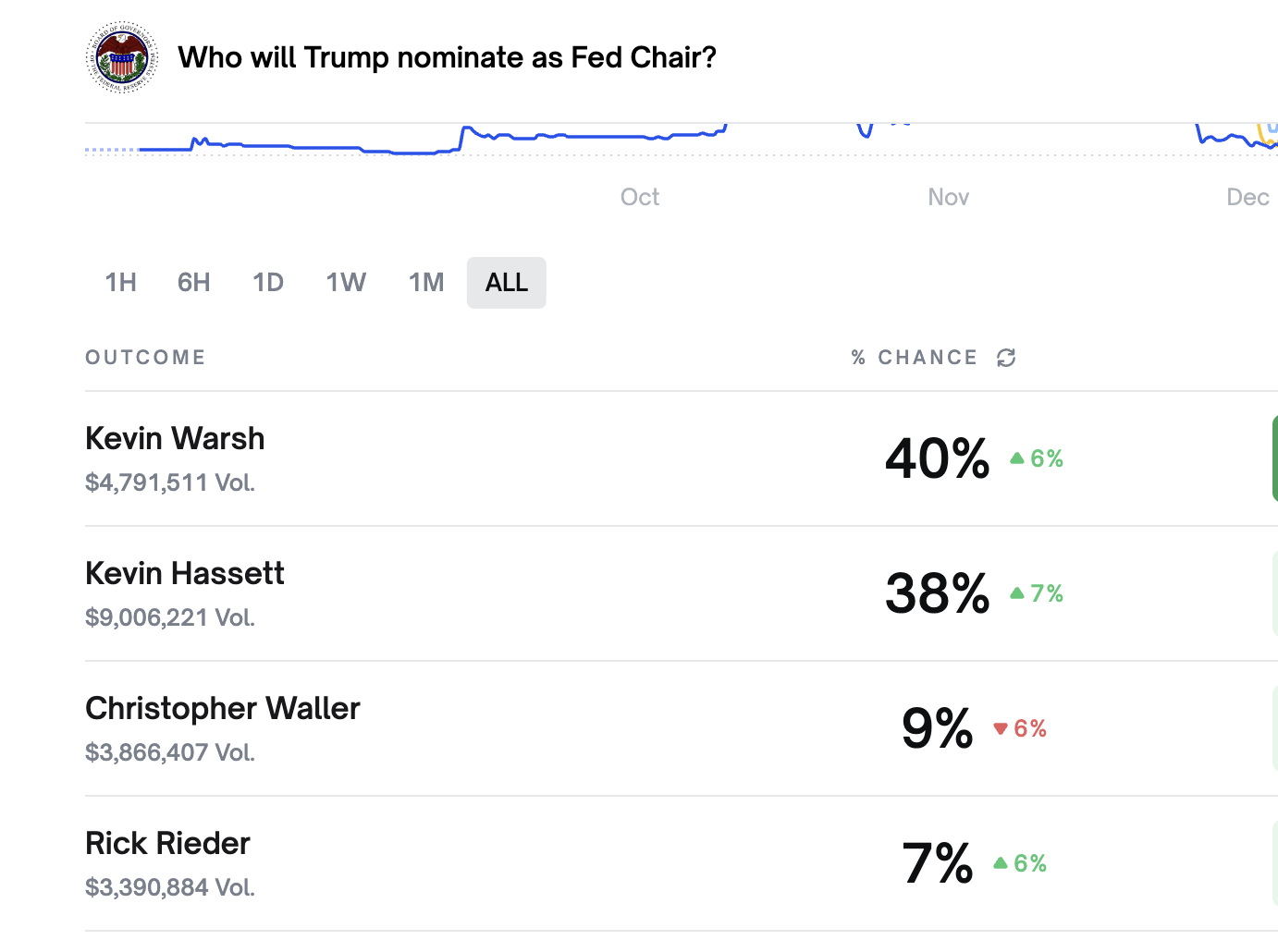

As of writing, Polymarket data shows Kevin Warsh's probability of becoming Fed Chair is temporarily at 40% (up 6%), Kevin Hassett's at 38% (up 7%), Christopher Waller's at 9% (down 9%), and Rick Rieder's is the lowest at 7% (up 6%). Although his odds are lower compared to Warsh and Hassett, the 6-point increase at least puts him close to overtaking Waller.

Furthermore, if Trump's chosen candidate is not currently a member of the Federal Reserve Board of Governors, that person must first join the Board. For Rieder, to become Chair, he would need Trump's nomination and Senate confirmation to become a Fed Governor—a process that could take months before potentially becoming Chair.

The outcome depends on his meeting with Trump and [presumably a typo, likely meant "and his team" or similar] on Thursday. Odaily will provide timely updates on developments. Readers can also closely monitor data changes for the corresponding contracts on Polymarket.