2026 Privacy Asset Landscape: Which Projects Are Truly Gaining Market Patience?

- Core Viewpoint: Privacy is evolving from a confrontational tool into crypto infrastructure.

- Key Elements:

- Monero breaking its 8-year high shows a value return for privacy assets.

- Zcash's governance turbulence highlights the resilience of decentralized protocols.

- Protocols like Railgun provide a composable privacy layer for DeFi.

- Market Impact: Driving privacy to become a core capability of sustainable crypto systems.

- Timeliness Note: Long-term impact

Original | Odaily (@OdailyChina)

Author | Ding Dang (@XiaMiPP)

Amidst the intense market volatility and the rapid creation and abandonment of Chinese Meme coins, if there's one narrative still worth our sustained attention, privacy is undoubtedly among them.

From Zcash's surge in 2025 to Monero breaking its 8-year high in 2026, the performance of privacy-related assets is no longer just a fleeting sentiment-driven resurgence. Instead, it is being repositioned within the long-term proposition of crypto infrastructure.

In its latest article "Privacy trends for 2026" released at the beginning of the year, a16z re-examined the role of privacy in the next phase of crypto technology evolution from multiple perspectives, including decentralized communication, data access control, and secure engineering methodologies (Recommended reading: Zcash is Just the Beginning, How is a16z Redefining the Privacy Narrative for 2026?).

Against this backdrop, privacy is no longer merely a tool for "resisting regulation" but a foundational infrastructural capability supporting the sustainable operation of crypto systems. In this issue, Odaily systematically reviews several privacy-related assets. Let's take a look at which projects are genuinely gaining market favor recently.

Monero (#15): The Return of Privacy Fundamentalism After 8 Years

On January 13, the price of Monero (XMR) surged past $650. This rally began at the start of 2024, with gains exceeding 500%. However, more symbolic than the gain itself is the fact that this marks the first time XMR has effectively broken through the historical high of the 2017 bull cycle after an 8-year hiatus.

In the world of cryptocurrency, Monero is perhaps one of the most thorough and resilient embodiments of privacy. Since its inception in 2014, it has consistently upheld "default privacy, mandatory privacy, and untraceability" as its core design philosophy.

In terms of implementation, Monero systematically obfuscates on-chain analyzability through multi-layered cryptographic mechanisms. Ring Signatures are used to hide the sender's identity: the real input is mixed with multiple historical "decoy" outputs from the blockchain into a "ring," allowing external observers only to determine that "someone in the ring is spending funds" but not who specifically; Stealth Addresses automatically generate a one-time receiving address for each transaction, which only the recipient can identify using their view key, thereby severing the permanent link between the recipient and a public address; Ring Confidential Transactions (RingCT) further conceal the transaction amount. Leveraging technologies like Pedersen Commitments and Bulletproofs++ for range proofs, it ensures the amount remains invisible while still allowing the network to verify the absence of coin creation out of thin air or double-spending.

The combination of these mechanisms ensures that the sender, receiver, and amount of all transactions are hidden by default. The entire chain lacks traceable transparent records, thereby providing a high degree of anonymity and fungibility far exceeding that of coins with optional privacy features.

However, as the saying goes, "the gem invites disaster." This extreme design has also made Monero one of the least friendly assets from a regulatory perspective. Under sustained compliance pressure, by 2024, major exchanges like Binance and OKX had successively delisted all XMR spot trading pairs, retaining only futures contracts.

Zcash (#28): A Severe Governance Shock

The biggest contributor to this wave of privacy resurgence is Zcash. For related reading, see Privacy Coin Revival: From Binance Delisting Candidate to a 13x Surge, ZEC's Lightning Rebirth.

However, on January 8, Josh Swihart, CEO of the Zcash (ZEC) development team Electric Coin Company (ECC), stated in a post that the majority of the Bootstrap board (the non-profit organization behind ECC, which supports Zcash by managing ECC), particularly the Zaki Manian, Christina Garman, Alan Fairless, and Michelle Lai group (referred to as the ZCAM group), had significantly deviated from Zcash's mission. Under the ZCAM group's decision of constructive dismissal, the entire ECC team chose to resign collectively. It's worth adding that since 2020, after a majority of shareholders opted to donate their shares, ECC had gradually transitioned to a non-profit structure, with Bootstrap taking on governance functions. Following the announcement, ZEC briefly fell below $362, a drop of over 40%.

Bootstrap subsequently issued a clarification statement, stating that the dispute stemmed from legal constraints encountered while seeking external investment. Discussions have now begun on "alternative structures for external investment and the privatization of Zashi," and they are working with legal counsel to ensure all paths comply with U.S. non-profit organization laws without deviating from Zcash's long-term mission or harming the broader community's interests.

However, this statement did not immediately reverse market sentiment.

Nevertheless, the Zcash Foundation also stated that Zcash has always been a decentralized, open-source protocol, and no single contributor, team, or organization can control Zcash.

From its inception, Zcash has considered "resilience" one of its core goals. Its codebase is fully open-source, consensus rules are maintained by independent nodes globally, and ecosystem development is supported by diverse organizations and contributors. As a protocol guardian, the Zcash Foundation's mission includes maintaining protocol security, funding independent research and engineering practices, promoting governance decentralization, and advocating for privacy as a fundamental human right.

Humanity (#215): Not a Privacy Coin, Reconstructing "Private Identity"

Unlike the aforementioned projects, Humanity Protocol (H) does not focus on "financial privacy" but attempts to reconstruct the balance between privacy and trust at the digital identity level.

Humanity verifies users as real humans through palm print biometrics combined with zero-knowledge proofs, without leaking any personal data, aiming to build a decentralized trust layer resistant to Sybil attacks. The project launched in 2023, with its token H going live in June 2025.

In terms of applications, Humanity has announced a partnership with Mastercard to integrate its open financial connectivity with the Human ID identity system, enabling users to access real-world financial services like credit and loans without exposing their privacy.

In July 2025, Nasdaq-listed company Prenetics announced it would include H tokens in its crypto asset treasury. The company had previously purchased 187 BTC for $20 million, making it one of the first healthcare companies to allocate a Bitcoin treasury. Perhaps partly due to this, alongside the treasury move, the H token price rose from $0.026 to $0.4, a peak gain of 14x, before retracing and undergoing a period of consolidation. It has since recovered to around $0.17.

Compared to other privacy projects, Humanity is still in a much earlier stage. However, the "private identity" direction it targets clearly offers another approach to the privacy narrative.

Railgun (#331): DeFi's "Private Wallet Layer"

Railgun is a decentralized privacy protocol based on zero-knowledge proofs, operating on Ethereum and multiple EVM-compatible chains. Its core goal is not simple anonymous transfers but to provide DeFi users with composable private interaction capabilities.

Unlike mixers like Tornado Cash, Railgun functions more like a "private wallet layer." Users can directly build private balances within the protocol and then interact privately with any EVM smart contract. The entire process is non-custodial, open-source, and requires no trust in a third party. It allows users to completely hide wallet addresses, transaction amounts, and strategy details while performing operations like trading, lending, liquidity provision, or yield farming, without sacrificing DeFi's decentralized nature.

The project launched in 2021. Following Tornado Cash's sanctions, Railgun introduced a "Proof of Innocence" mechanism in 2024 to reduce the risk of being misjudged as an illicit tool, while gradually expanding to Layer 2 to lower usage costs.

Ethereum co-founder Vitalik Buterin is an early supporter of Railgun and has used the protocol multiple times for donations to avoid on-chain tracking.

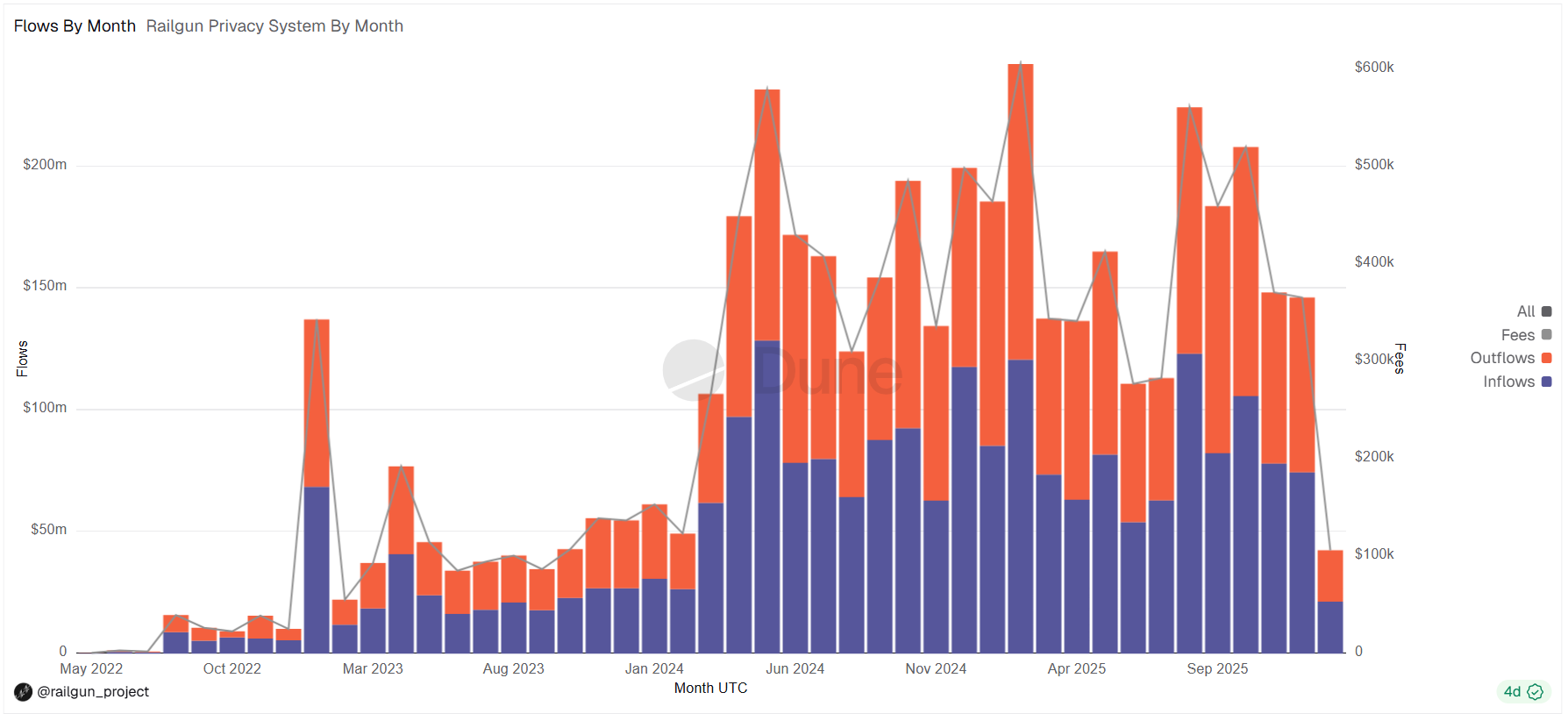

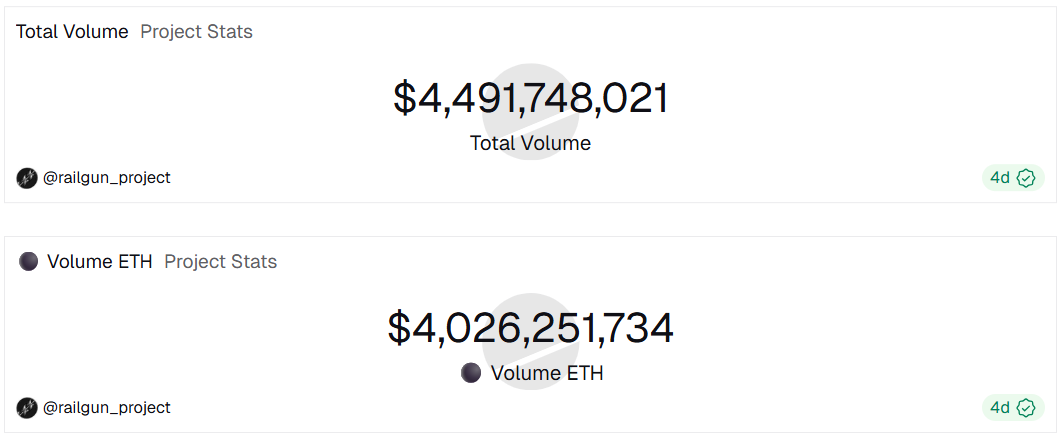

Dune data shows that Railgun's fund usage has remained active since 2022, with a noticeable increase in activity especially after Ethereum gas costs significantly decreased in 2024. To date, the cumulative transaction volume has reached $4.49 billion, with ETH accounting for approximately $4.03 billion of that value.

Pirate Chain (#488): Treating "Privacy" as the Sole Prerequisite, Making No Compromises

Pirate Chain (ARRR) is another cryptocurrency project focused on privacy protection, aiming to provide the most anonymous digital currency. The project launched in 2018, inspired by Zcash's zk-SNARKs technology. However, unlike Zcash's optional privacy, Pirate Chain enforces 100% mandatory privacy, creating the world's largest organic anonymity set to prevent information leakage through network activity, supporting fast verification without exposing data. The project had no ICO, no pre-mine, and no developer tax. Development and maintenance rely primarily on community contributions. Its core developers have backgrounds spanning multiple ecosystems including Bitcoin, Zcash, Komodo, and Monero, with talent being the project's core asset.

In terms of consensus mechanism, Pirate Chain uses Equihash Proof of Work (PoW) and introduces Delayed Proof of Work (dPoW) as an additional security layer. dPoW significantly increases the cost of launching a 51% attack by notarizing blocks on an external chain, a common defense mechanism for smaller PoW networks.

It is worth noting that after Komodo announced its acquisition by Gleec in December 2025, the market might have concerns about Pirate Chain's reliance on Komodo's infrastructure. In response, the project team announced on January 7, 2026, that dPoW has been successfully migrated from the original Komodo to Komodo Classic, ensuring the security mechanism continues seamlessly and the network operates independently.

Tornado Cash (#769): Still Operating After Sanctions

Tornado Cash (TORN) is a mixing protocol operating on Ethereum, using zk-SNARKs technology to break the direct link between on-chain transactions. Simply put, it uses a "pool mixing" method to make ETH or ERC-20 tokens untraceable between deposit and withdrawal.

It was once one of the star projects on Ethereum. However, in 2022, the U.S. Treasury's OFAC directly placed Tornado Cash's smart contracts on the SDN sanctions list, marking the first time in history that immutable smart contracts were sanctioned. Subsequently, developer Alexey Pertsev was sentenced in the Netherlands, while Roman Storm and Roman Semenov faced trial in the U.S. Affected by this, Tornado Cash's governance token TORN was also delisted from major exchanges.

A turning point came at the end of 2024. The Fifth Circuit Court of Appeals ruled that OFAC had overstepped its authority—immutable smart contract code does not constitute "property" and cannot be sanctioned, thereby overturning the sanctions decision against the contracts themselves.

But the legal disputes did not end there. In 2025, Storm was partially convicted on charges of "operating an unlicensed money-transmitting business," while the jury failed to reach a verdict on money laundering and sanctions-related charges. Related cases may continue into 2026.

It is noteworthy that since its launch in 2019, Tornado Cash has operated as a DAO. The protocol is fully open-source, and the original developers lost control long ago; the contracts are immutable once deployed.

According to monitoring by crypto regulatory technology firm Bitrace, Tornado Cash addresses received a total inflow of 693,412 ETH in 2025, valued at approximately $2.5 billion. In USD terms, the net inflow for the year was about $1.4 billion, primarily in ETH. This indicates that, even after the sanctions turmoil, demand for private Ethereum transfers remains significant among crypto-native users.

Dusk Network (#781): Embedding Privacy Within the System, Not Fighting It

If most of the aforementioned projects choose to keep their distance from regulation, then Dusk Network represents another path within the privacy sector—attempting to coexist with compliance frameworks from the protocol level.

Dusk Network (DUSK) was founded in 2018. It is a Layer 1 blockchain protocol focused on privacy protection and compliance, founded by technical experts Jelle Pol and Emanuele Francioni, primarily targeting financial applications and real-world asset (RWA) tokenization. Its mainnet officially launched in early 2025, and it uses a variant of Proof of Stake (PoS) as its consensus mechanism.

Dusk's technical core is not "hiding everything completely" but revolves around "auditable privacy." By combining zero-knowledge proofs (ZK) with homomorphic encryption (HE), Dusk allows transaction information to remain private by default but enables auditing through selective disclosure when required by compliance or law.

Precisely because of this, Dusk has positioned itself from the outset as compliant financial infrastructure, explicitly supporting MiCA, MiFID II, and the EU DLT pilot regime. This design subjects it to less pressure and grants it a larger space for survival.

From a narrative perspective, Dusk straddles two currently high-market-attention themes: privacy + RWA. As traditional financial institutions begin exploring on-chain asset issuance and settlement, "regulatable privacy" is likely to become a real-world demand.

Latest data disclosed by the Dusk Foundation on December 29 shows that over 200 million DUSK are currently staked, accounting for 36% of the supply. This, to some extent, reflects token holders' recognition of its long-term positioning.