Follow the clues, guess what projects a16z with $15 billion will invest in?

- Core View: a16z's massive new fundraising will focus heavily on the crypto space.

- Key Elements:

- Raised $15 billion, accounting for 18% of the total US venture capital scale.

- Clearly identifies AI and crypto as keys to winning the future.

- App, Infrastructure, and Growth funds are the primary investment channels.

- Market Impact: Injects massive capital and confidence into the crypto market.

- Timeliness Note: Long-term impact.

Original | Odaily (@OdailyChina)

Author|Azuma (@azuma_eth)

On January 9th, the highly active venture capital giant in the cryptocurrency market, Andreessen Horowitz (a16z), announced the completion of a new $15 billion fundraising round. This is the largest fundraising effort in the firm's history, accounting for over 18% of the total venture capital raised in the United States in 2025.

In the relatively brief official announcement, a16z mentioned cryptocurrency twice. The most crucial statement, "Our mission is to ensure America wins the technology competition for the next 100 years, which starts with winning the key architectures of the future—artificial intelligence and cryptocurrency technology," indicates that the now well-funded a16z will continue to expand its presence in the cryptocurrency market.

Breakdown of Six Major Directions

According to a16z's plan, this batch of funds will be allocated across six major directions: the American Dynamism fund will receive $1.176 billion, the App fund $1.7 billion, the Bio + Health fund $700 million, the Infrastructure fund $1.7 billion, the Growth fund $6.75 billion, and the Other Venture Strategies fund $3 billion.

Although a16z did not explicitly designate a dedicated cryptocurrency fund among these major directions in this fundraising round, there is significant overlap between these six areas and the cryptocurrency space.

First is the American Dynamism fund, a direction a16z has been promoting in recent years with a distinct "political" undertone. Its core goal is to use venture capital to rebuild America's "hard power" and national competitiveness. This fund will primarily invest in aerospace, defense, public safety, education, housing, supply chain, industry, and manufacturing. Objectively speaking, this fund has minimal overlap with cryptocurrency.

Next is the App fund, one of a16z's most traditional and quintessentially VC funds. Its core goal is to focus on application-layer products that can be directly used by end-users. This fund will primarily invest in consumer internet products, AI applications, creator tools, social products, content services, gaming, fintech, and Web3 applications, among others. This is also the direction where a16z's cryptocurrency narrative is most likely to materialize.

Then there's the Bio + Health fund, a long-term bet for a16z "beyond pure tech." Its core goal is to transform life sciences and healthcare systems using software, data, and engineering thinking. Its main investment areas include biotechnology, drug discovery platforms, gene editing, synthetic biology, medical data & AI diagnostics, and healthcare infrastructure software. There is not much direct overlap with cryptocurrency here, though DeSci could be a potential intersection point.

The Infrastructure fund focuses on infrastructure, with the core goal of providing indispensable technical foundations for the next generation of applications and platforms. Its main investment areas are cloud computing & distributed systems, AI infrastructure, data platforms, developer tools, networking protocols, and blockchain base-layer protocols (L1, L2, other tools). This is another core battleground for a16z in the cryptocurrency space, alongside the App fund.

The Growth fund primarily invests in Series C and later stages, including Pre-IPO. Its core goal is not to find new opportunities but to amplify returns by supporting proven winners. It mainly invests in mature tech companies, AI platforms, fintech unicorns, and established Web3 infrastructure or applications. Information on a16z's official website shows that companies like Coinbase and Kalshi are explicitly categorized here.

The Other Venture Strategies fund is relatively unique. It doesn't have a single theme and functions more like a flexible "tactical capital pool," typically used for special structured transactions, cross-fund collaborative investments, exploring emerging fields, secondary market opportunities, regional or thematic experimental funds, etc. This fund has little direct overlap with cryptocurrency, but temporary associations cannot be ruled out at special junctures, such as responsive moves during certain policy windows.

Looking across these six intended deployment directions for the $15 billion, the App fund, Infrastructure fund, and Growth fund will be a16z's main channels for injecting capital into the cryptocurrency primary market. Among them, the App fund and Infrastructure fund will respectively focus more on native cryptocurrency market application-layer and protocol-layer projects. The Growth fund will lean more towards platform-type services like exchanges and prediction markets, with investments favoring leading players who have already demonstrated a competitive edge.

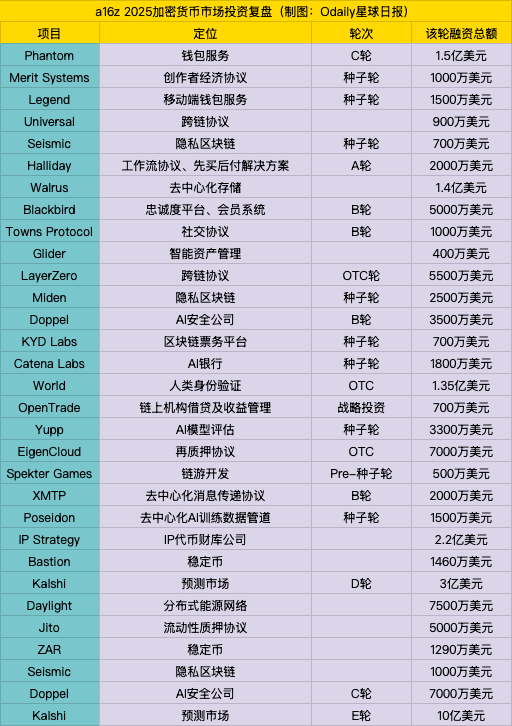

a16z's Investment Review for 2025

According to incomplete statistics by Odaily, a16z made a total of 31 investments in the broader cryptocurrency field over the past year, with two investments each in prediction market Kalshi, AI security company Doppel, and privacy blockchain Seismic. Particularly for Kalshi, a16z first co-led a $300 million Series D round in October with Sequoia, valuing the company at $5 billion; then in November, it invested again, participating in the company's $1 billion Series E round at an $11 billion valuation — this was also a16z's biggest bet in the cryptocurrency space last year.

As can be seen from the statistics in the chart above, aside from the heavy bet on prediction markets, wallet services, privacy blockchains, stablecoins, and AI-crypto crossover opportunities were a16z's key focus areas in 2025. These sub-sectors can be categorized under the blockchain base-layer protocols and tools covered by the Infrastructure fund, and the fintech and AI applications covered by the App fund.

a16z's Predictions for 2026

On New Year's Day 2026, a16z Crypto officially published a New Year outlook article. In it, a16z mentioned 17 potential developments it is excited about for 2026, which may hint at the firm's focus areas for future investments.

These 17 potential developments are:

- Privacy will become the most important moat in crypto;

- Prediction markets will become bigger, broader, and smarter;

- Thinking about real-world asset tokenization and stablecoins in a more "crypto-native" way;

- Trading is just a waystation for crypto businesses, not the destination;

- From "Know Your Customer" (KYC) to "Know Your Agent";

- Better, smarter on/off-ramps for stablecoins;

- Stablecoins will kick off a bank ledger upgrade cycle and spawn new payment scenarios;

- The future of instant messaging is not just quantum-resistant, but decentralized;

- From "code is law" to "norms are law";

- Crypto is providing a new kind of foundational primitive usable beyond blockchains themselves;

- We can now use AI to perform substantive research tasks;

- "Invisible taxes" in the open internet;

- The rise of Staked Media;

- "Secrets-as-a-Service";

- Wealth management for everyone;

- The internet is becoming the bank;

- When legal architecture finally matches technical architecture, the full potential of blockchains will be unlocked.

Among these 17 potential developments, some explicitly mention specific business models, including sectors a16z has already heavily invested in, such as privacy, prediction markets, stablecoins, and AI. a16z even suggests optimization paths for these models, such as the need for smarter on/off-ramp solutions for stablecoins.

Meanwhile, another part of the potential developments consists of visions for the future state, such as the internet eventually becoming the bank. However, a16z does not provide clear answers on how these visions will materialize. This question is left for entrepreneurs who can bring innovative solutions — and they are precisely the targets a16z's $15 billion is most eager to find.