CoinW Research Weekly Report (Issue: 2026.1.5 - 2026.1.11)

- Core View: The cryptocurrency market exhibited a slight correction trend overall this week.

- Key Elements:

- The total cryptocurrency market cap fell by 0.9%, with the market fear index at 26.

- Both Bitcoin and Ethereum spot ETFs recorded net outflows this week.

- The total DeFi TVL decreased slightly by 0.32%, with Ethereum still holding the dominant position.

- Market Impact: Short-term capital outflows, with market sentiment leaning towards caution.

- Timeliness Note: Short-term impact.

Key Takeaways

The total global cryptocurrency market capitalization is $3.19 trillion, down 0.9% this week from $3.22 trillion last week. As of press time, the cumulative net inflow into U.S. Bitcoin spot ETFs is approximately $56.40 billion, with a net outflow of $681 million this week; the cumulative net inflow into U.S. Ethereum spot ETFs is approximately $12.43 billion, with a net outflow of $68.57 million this week.

The total stablecoin market capitalization is $308.1 billion, with USDT's market cap at $186.6 billion, accounting for 60.56% of the total stablecoin market; followed by USDC with a market cap of $74.6 billion, accounting for 24.21%; and DAI with a market cap of $5.36 billion, accounting for 1.73%.

According to DeFiLlama data, the total DeFi TVL this week is $123.9 billion, down approximately 0.32% from $124.3 billion last week. By public chain, the three chains with the highest TVL are Ethereum, accounting for 68.2%; Solana, accounting for 8.47%; and Bitcoin, accounting for 6.61%.

In terms of on-chain data performance this week, only BNB Chain (+47.29%) and Aptos (+4.31%) saw growth in daily DEX trading volume, while all other chains declined, with Solana (-40.53%), Ethereum (-39.25%), and Ton (-33.33%) experiencing relatively larger drops. Transaction fees remained relatively stable overall, with Ethereum, BNB Chain, and Ton largely flat, Aptos slightly up 4.21%, and Solana (-6.9%) and Sui (-10.39%) declining. In terms of daily active addresses, only Solana (+29.81%) and Ethereum (+8.09%) saw growth, Sui dropped by about 55.84%, and Aptos (-11.54%) and BNB Chain (-7.11%) also declined. TVL saw limited overall fluctuations, with Ethereum (-0.97%) and Ton (-4.07%) experiencing slight declines, while all other chains saw modest growth.

New Projects to Watch: Block Security Arena is an AI-driven security infrastructure platform focused on the Web3 space. It builds a "closed-loop" security ecosystem by integrating AI technology, hands-on exercises, and an educational system to help developers and security researchers enhance their smart contract security capabilities. Ubyx is a global stablecoin clearing system designed to allow anyone, anywhere, to deposit stablecoins from multiple issuers and currencies into existing bank or fintech accounts and redeem them at face value for fiat currency, thereby transforming stablecoins from traditional crypto assets into digital cash equivalents. JPEG.fun is a Web3-native social prediction interactive gaming platform where players can bet and compete around daily themed photos. By placing bets on specific images and competing for the highest wager to win the prize pool, it combines social interaction, community engagement, and on-chain settlement mechanisms, aiming to create a new, fun, and lighthearted cultural entertainment experience.

Table of Contents

Key Takeaways

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Dominance

2. Fear & Greed Index

3. ETF Inflow/Outflow Data

4. ETH/BTC and ETH/USD Exchange Rates

5. Decentralized Finance (DeFi)

6. On-Chain Data

7. Stablecoin Market Cap and Issuance

II. This Week's Hot Money Flow

1. Top 5 Gaining VC Coins and Meme Coins This Week

2. New Project Insights

III. Industry News

1. Major Industry Events This Week

2. Upcoming Major Events Next Week

3. Important Fundraising Last Week

IV. Reference Links

I. Market Overview

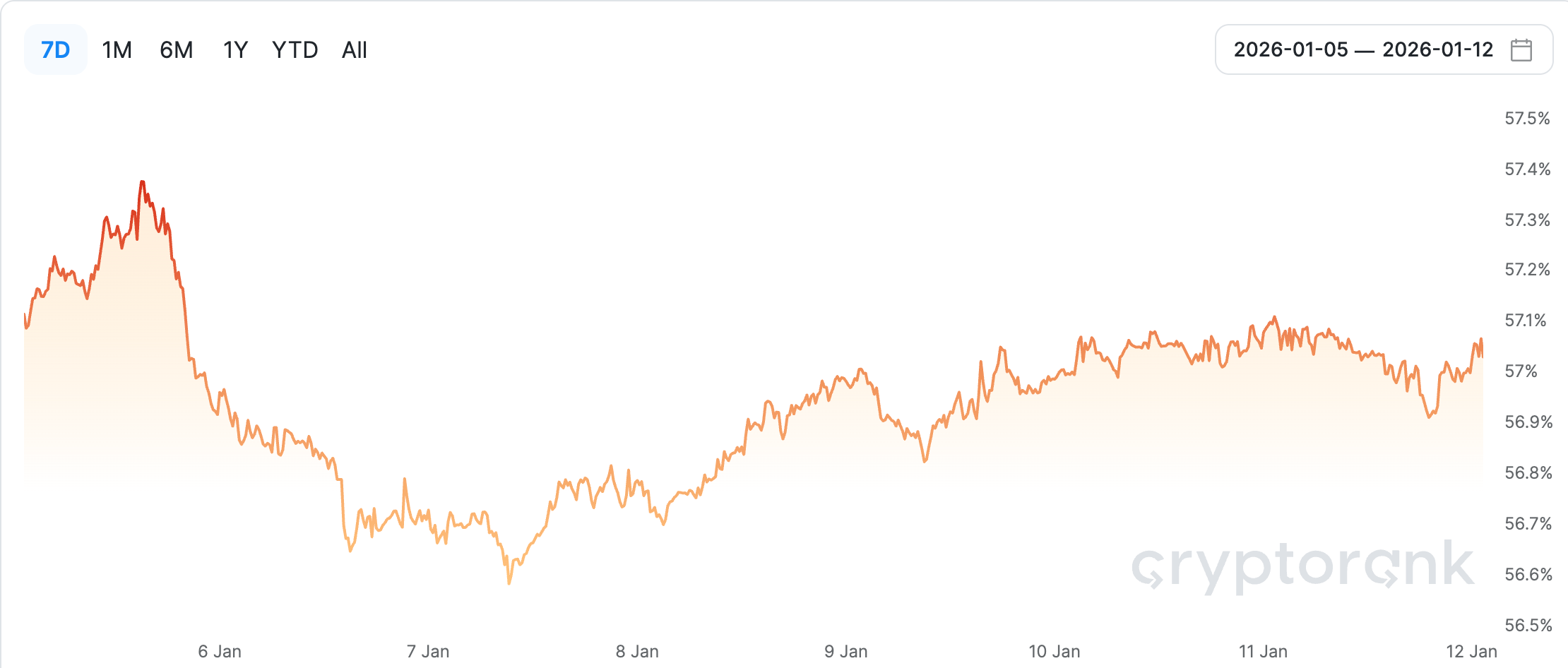

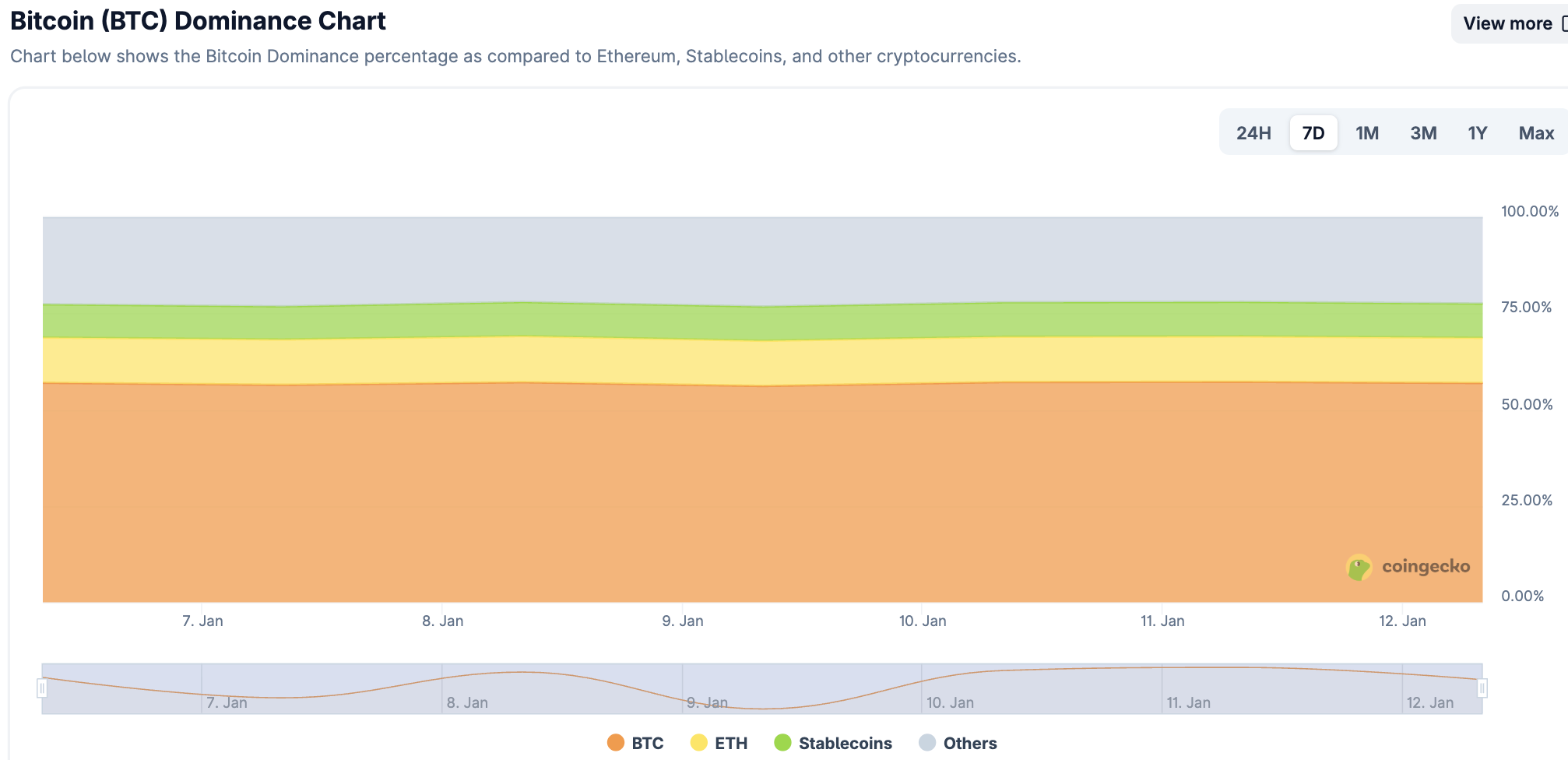

1. Total Cryptocurrency Market Cap / Bitcoin Dominance

The total global cryptocurrency market capitalization is $3.19 trillion, down 0.9% this week from $3.22 trillion last week.

Data Source: Bitcoin dominance from cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of January 11, 2026

As of press time, Bitcoin's market capitalization is $1.82 trillion, accounting for 57.1% of the total cryptocurrency market. Meanwhile, the stablecoin market capitalization is $308.1 billion, accounting for 9.65% of the total cryptocurrency market.

Data Source: coingecko, https://www.coingecko.com/en/charts

Data as of January 11, 2026

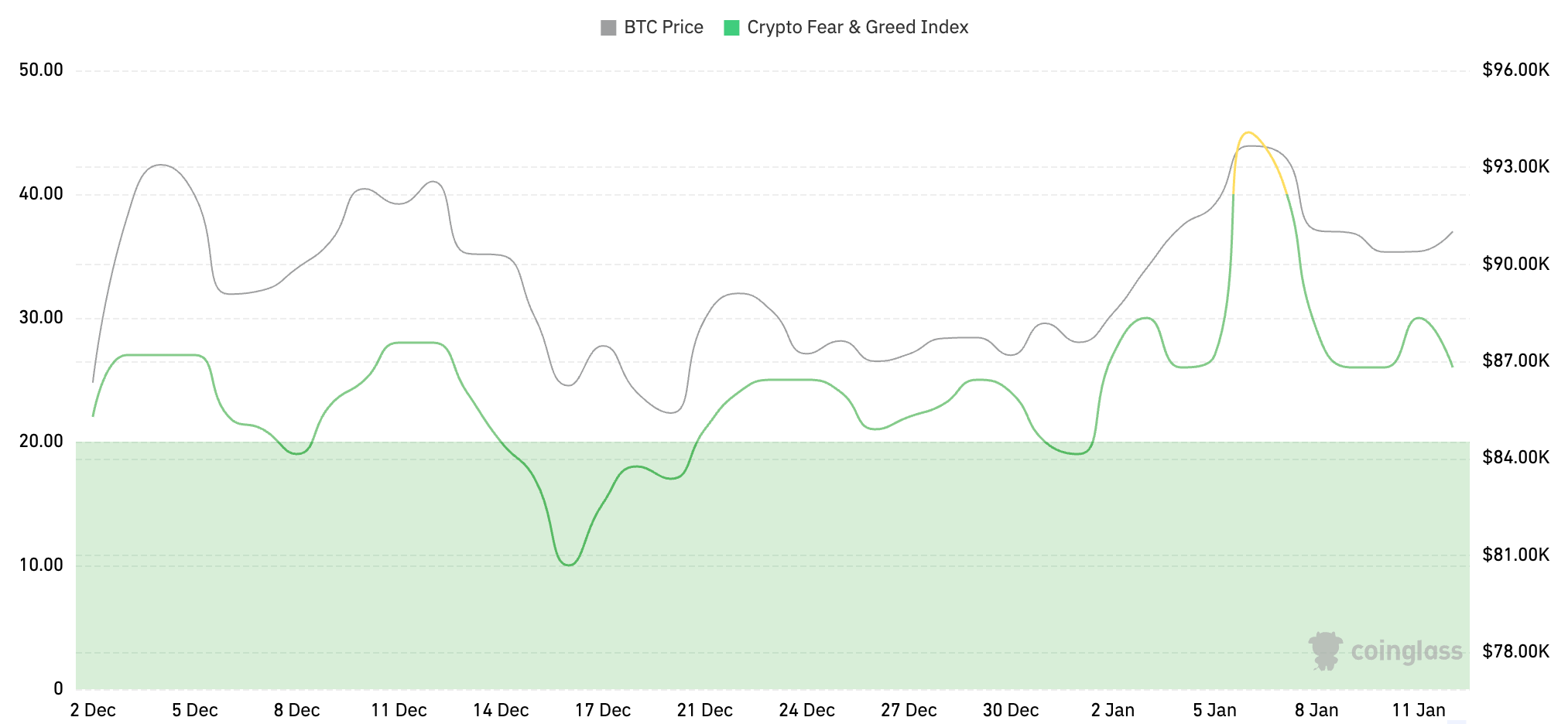

2. Fear & Greed Index

The Cryptocurrency Fear & Greed Index is 26, indicating Fear.

Data Source: coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of January 11, 2026

3. ETF Inflow/Outflow Data

As of press time, the cumulative net inflow into U.S. Bitcoin spot ETFs is approximately $56.40 billion, with a net outflow of $681 million this week; the cumulative net inflow into U.S. Ethereum spot ETFs is approximately $12.43 billion, with a net outflow of $68.57 million this week.

Data Source: sosovalue, https://sosovalue.com/zh/assets/etf

Data as of January 11, 2026

4. ETH/BTC and ETH/USD Exchange Rates

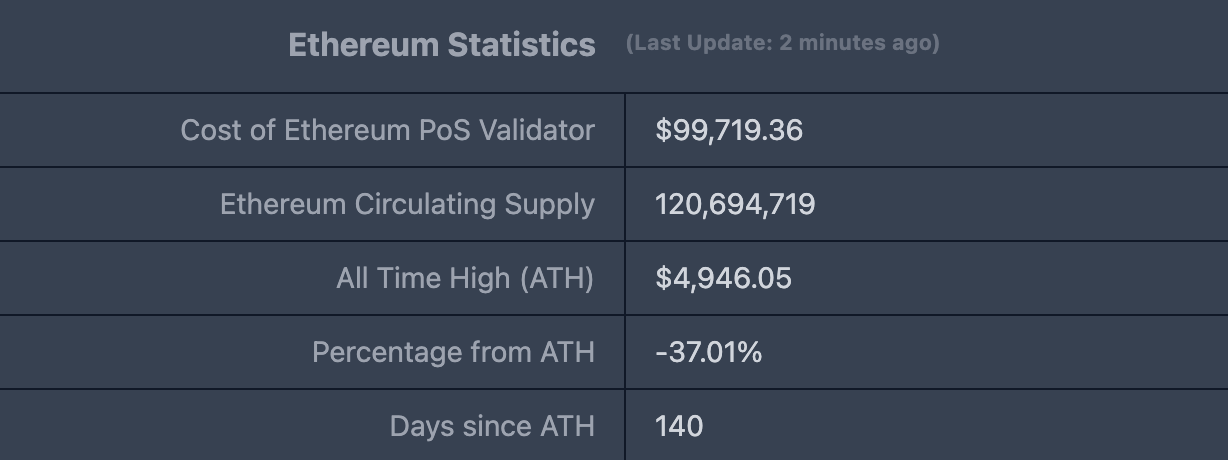

ETHUSD: Current price $3,116.79, all-time high $4,878.26, down approximately 37.01% from the high.

ETHBTC: Currently 0.034207, all-time high 0.1238.

Data Source: ratiogang, https://ratiogang.com/

Data as of January 11, 2026

5. Decentralized Finance (DeFi)

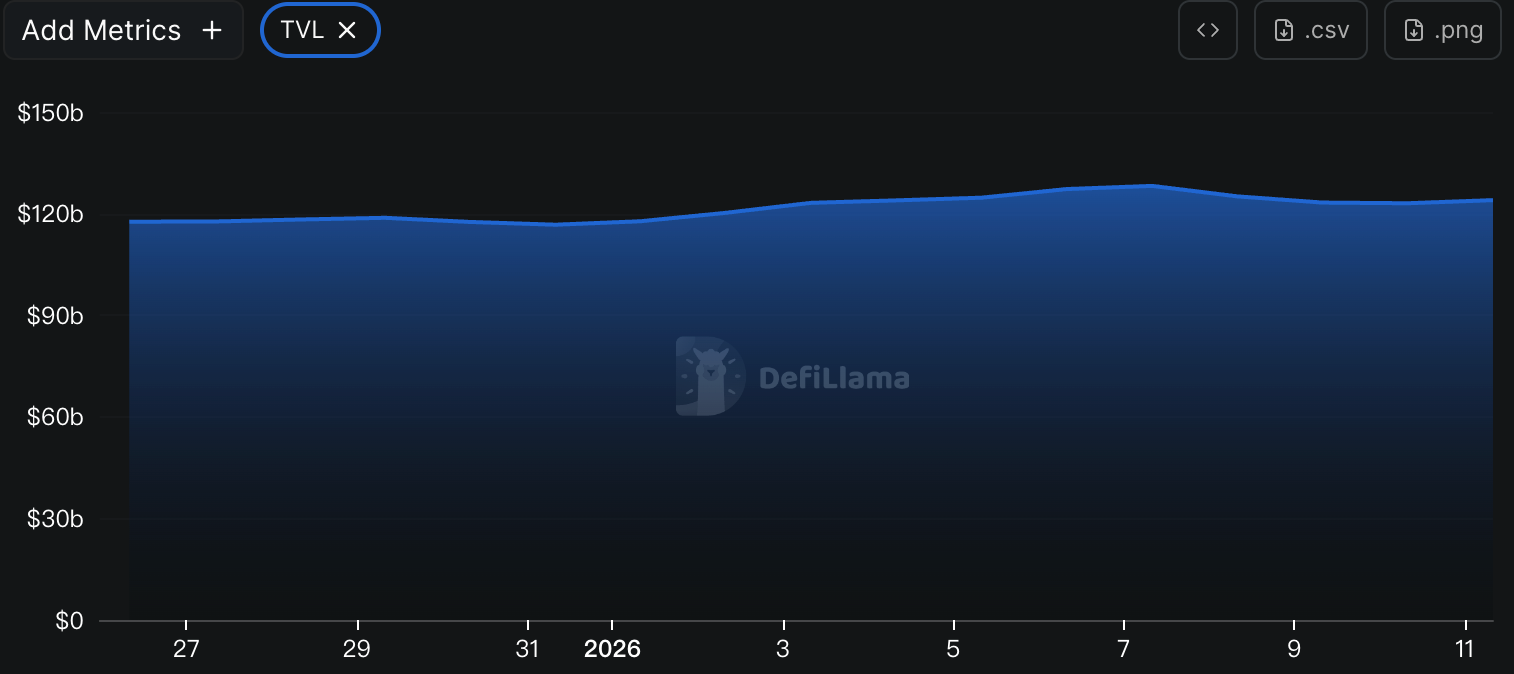

According to DeFiLlama data, the total DeFi TVL this week is $123.9 billion, down approximately 0.32% from $124.3 billion last week.

Data Source: defillama, https://defillama.com

Data as of January 11, 2026

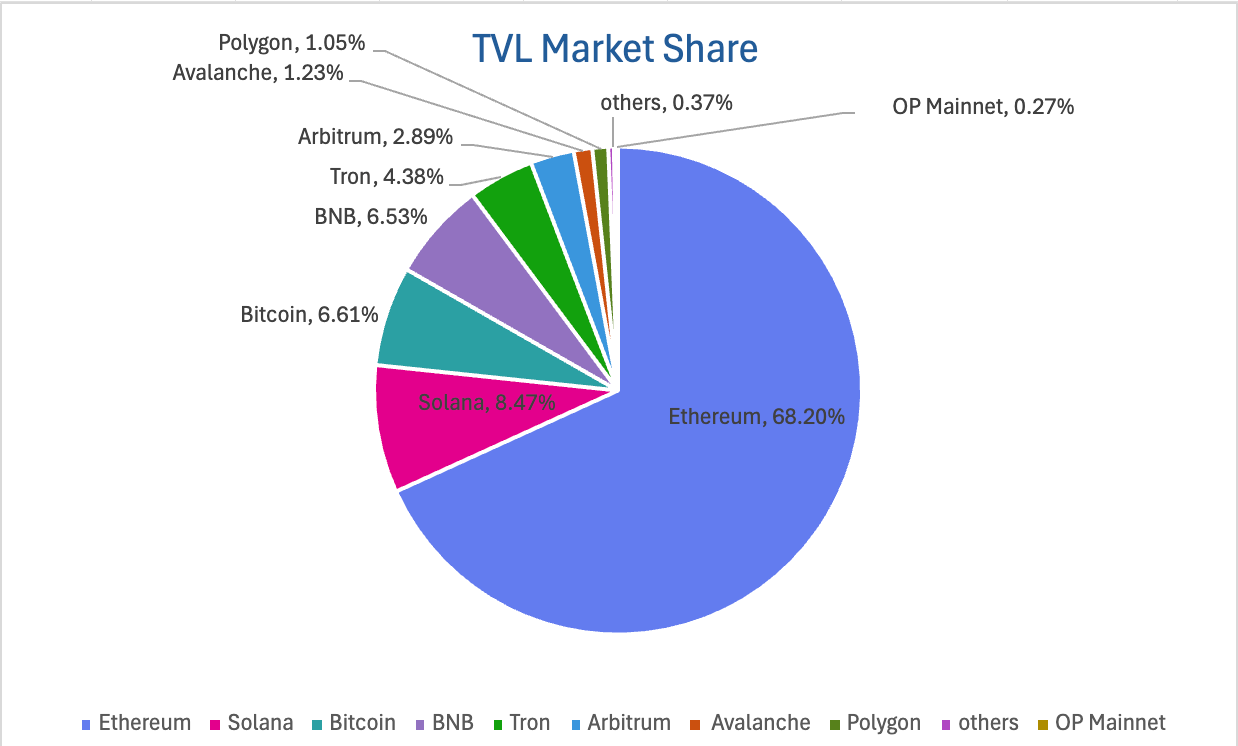

By public chain, the three chains with the highest TVL are Ethereum, accounting for 68.2%; Solana, accounting for 8.47%; and Bitcoin, accounting for 6.61%.

Data Source: CoinW Research Institute, defillama, https://defillama.com

Data as of January 11, 2026

6. On-Chain Data

Layer 1 Related Data

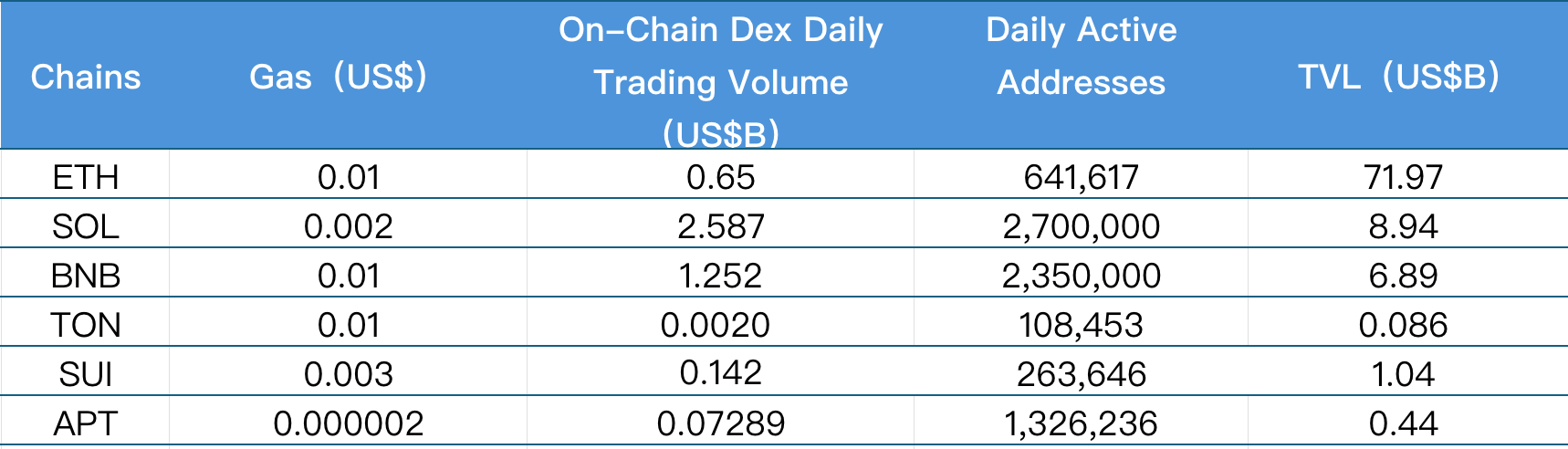

This section analyzes the current data for major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APTOS, focusing on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, https://defillama.com

Data as of January 11, 2026

On-Chain DEX Daily Volume and Transaction Fees: On-chain DEX daily volume and transaction fees are core metrics for measuring public chain activity and user experience. In terms of on-chain DEX daily volume this week, only BNB Chain and Aptos increased by 47.29% and 4.31%, respectively; all other chains declined: Solana (-40.53%), Ethereum (-39.25%), Ton (-33.33%), and Sui (-21.11%). Regarding transaction fees this week, Ethereum, BNB Chain, and Ton remained flat compared to last week; Aptos saw a slight increase of 4.21%; Solana and Sui decreased by 6.9% and 10.39%, respectively.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of a public chain, while TVL reflects user trust in the platform. In terms of daily active addresses this week, only Solana (29.81%) and Ethereum (8.09%) saw increases, while all other chains declined. Sui saw the largest drop at 55.84%, followed by Aptos and BNB Chain, which decreased by 11.54% and 7.11%, respectively, and Ton saw a slight decline of 0.33%. Regarding TVL, changes across all chains were minimal this week. Ethereum and Ton saw slight declines of 0.97% and 4.07%, respectively; all other chains saw modest increases: Sui (4.75%), Solana (2.24%), BNB Chain (1.04%), and Aptos (0.91%).

Layer 2 Related Data

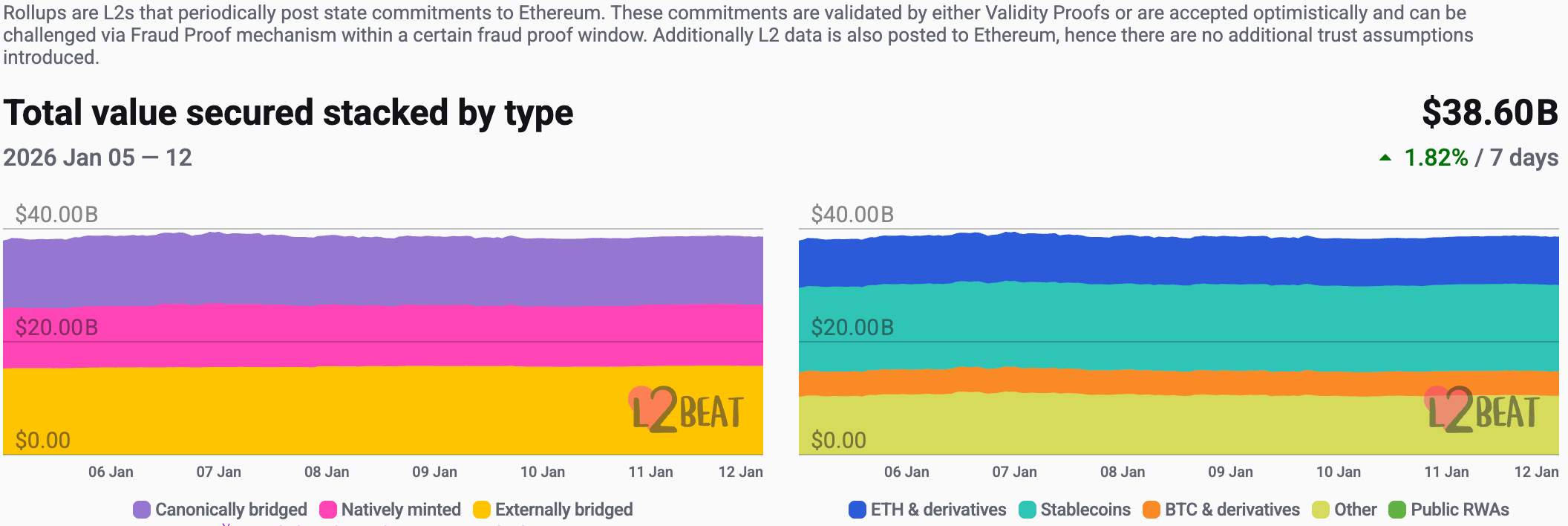

According to L2Beat data, the total TVL of Ethereum Layer 2 is $38.60 billion, representing an overall increase of 1.82% this week compared to last week ($37.91 billion).

Data Source: L2Beat, https://l2beat.com/scaling/tvs

Data as of January 11, 2026

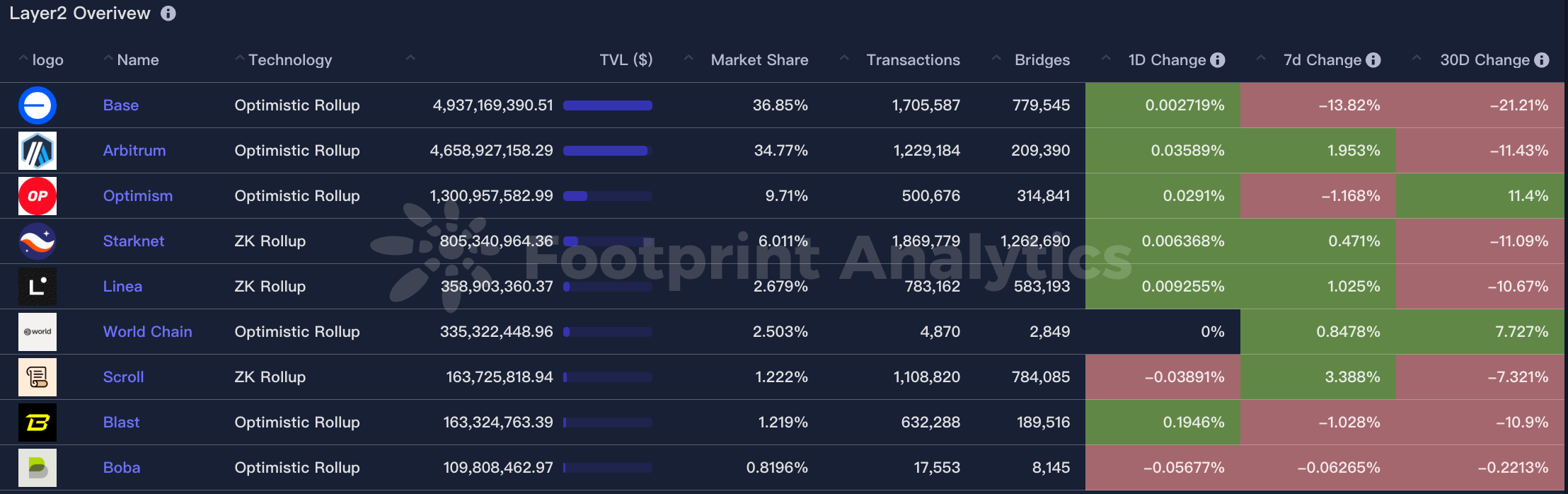

Base and Arbitrum occupy the top positions with market shares of 36.85% and 34.77%, respectively. Base's market share declined slightly over the past week, while Arbitrum's increased slightly.

Data Source: footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of January 11, 2026

7. Stablecoin Market Cap and Issuance

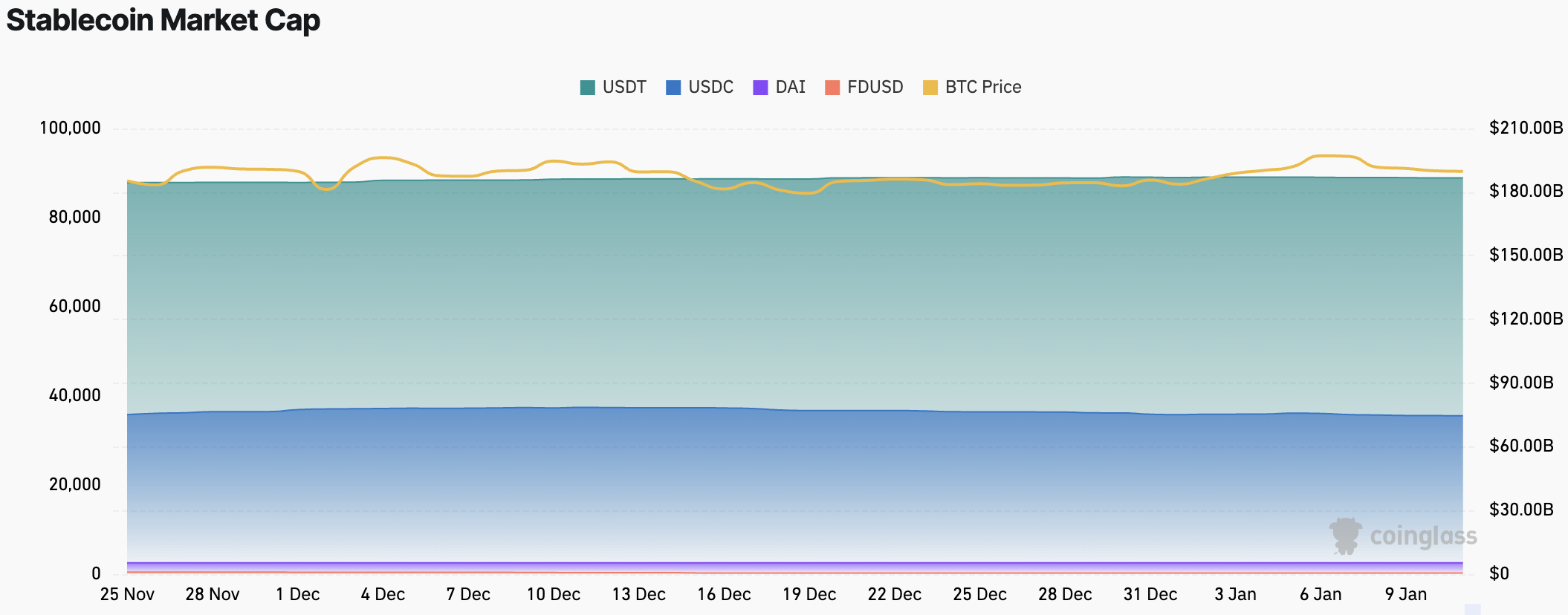

According to Coinglass data, the total stablecoin market capitalization is $308.1 billion, with USDT's market cap at $186.6 billion, accounting for 60.56% of the total stablecoin market; followed by USDC with a market cap of $74.6 billion, accounting for 24.21%; and DAI with a market cap of $5.36 billion, accounting for 1.73%.

Data Source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of January 11, 2026

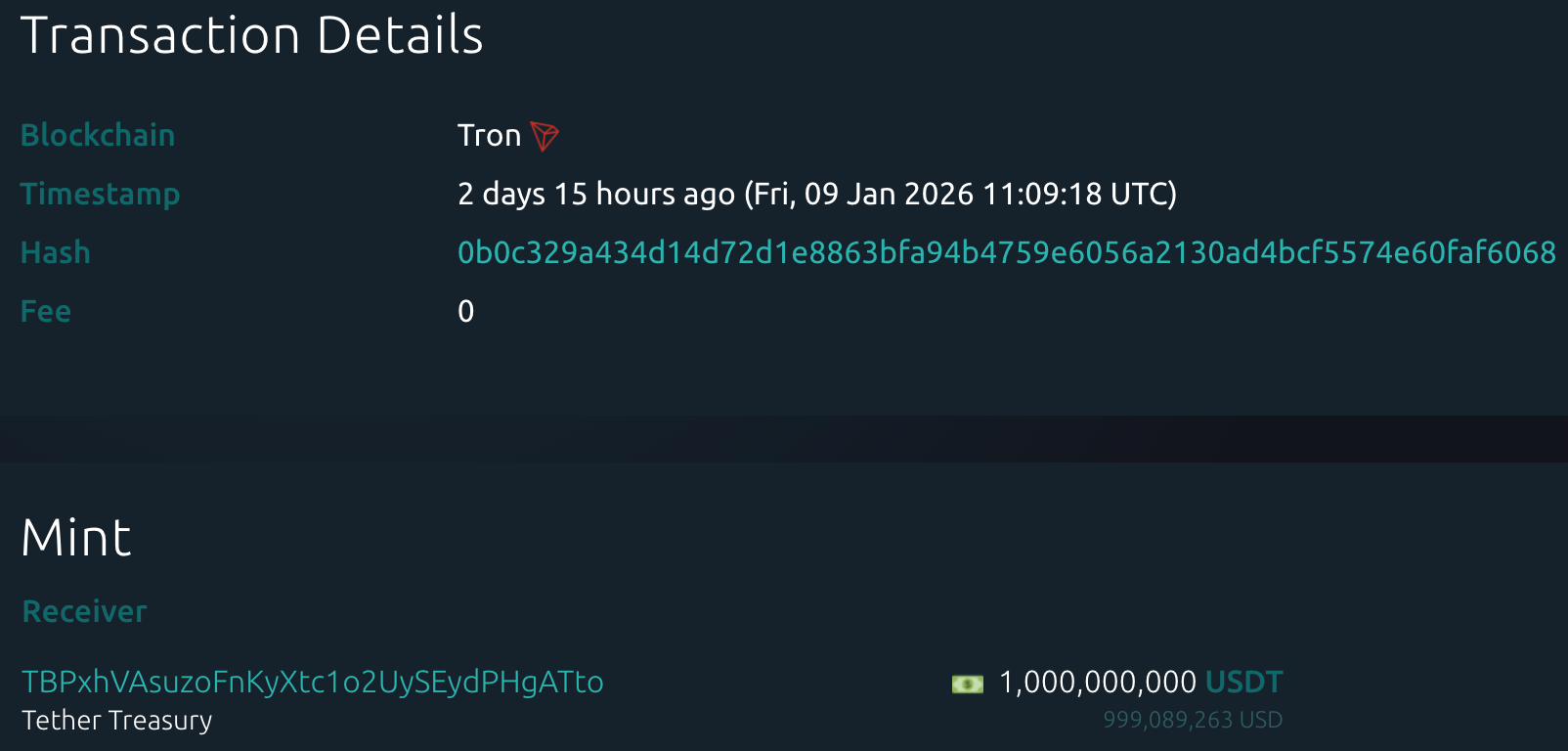

According to Whale Alert data, the USDC Treasury issued a total of 1.74 billion USDC this week, and the Tether Treasury issued a total of 1 billion USDT this week. The total stablecoin issuance this week was 2.74 billion, an increase of 27.79% compared to last week's total issuance (2.111 billion).

Data Source: Whale Alert, https://x.com/whale_alert

Data as of January 11, 2026

II. This Week's Hot Money Flow

1. Top 5 Gaining VC Coins and Meme Coins This Week

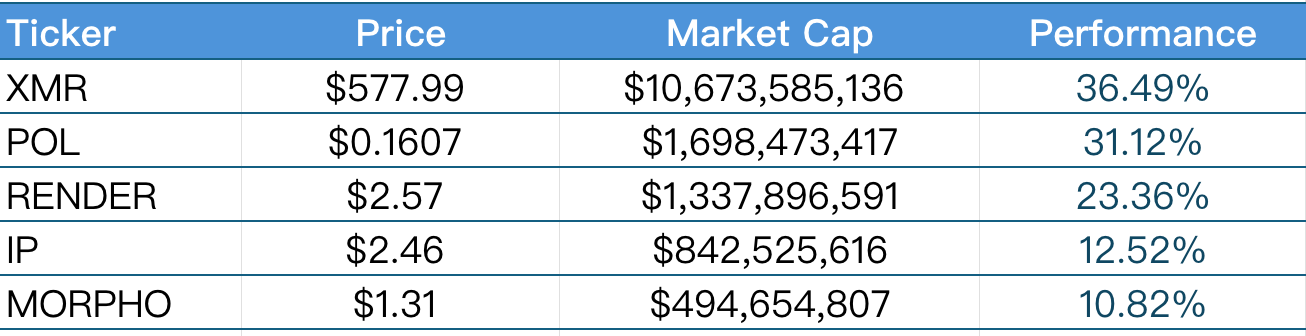

Top 5 Gaining VC Coins Over the Past Week

Data Source: CoinW Research Institute, coinmarketcap, https://coinmarketcap.com/

Data as of January 11, 2026

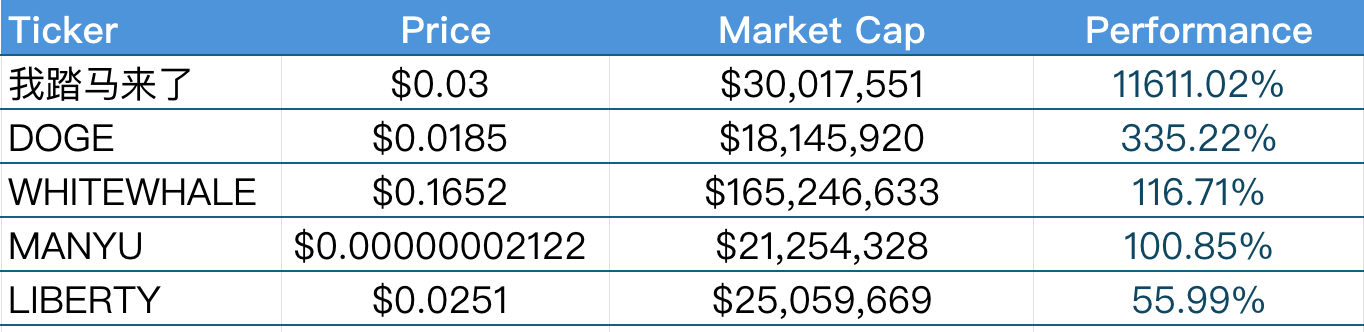

Top 5 Gaining Meme Coins Over the Past Week

Data Source: CoinW Research Institute, coinmarketcap, https://coinmarketcap.com/

Data as of