BenPay DeFi Earn Adds Four New Assets: Enriching Asset Appreciation Paths and Optimizing Yield Options

- Core Viewpoint: BenPay DeFi Earn has added four new assets, lowering the barrier to entry for on-chain yield participation.

- Key Elements:

- Added assets from the Morpho, Sky, and Ethena protocols, offering diversified yield options.

- Maintains non-custodial services, on-chain transparency, and one-click operations to simplify the user experience.

- As of January 2026, Solana holdings account for nearly half of the total network, indicating high usage.

- Market Impact: Promotes DeFi adoption, attracting more users and capital into the space.

- Timeliness Note: Medium-term impact

Introduction

As the DeFi ecosystem continues to mature, ways to generate on-chain yield are no longer scarce. What truly holds users back is not the lack of opportunities, but the barriers to entry. Opaque protocol mechanisms, specialized rules, lack of fund transparency, and cumbersome operational processes often lead users to remain on the sidelines or keep their assets idle for extended periods, even when they recognize the potential for more efficient capital utilization.

To address these pain points, BenPay launched DeFi Earn in late September 2025, serving as a unified gateway connecting multi-chain DeFi protocols. Users can easily deploy their assets into protocols like Solana, Compound, and AAVE for efficient appreciation without needing to master complex operations. Since its launch, DeFi Earn has received positive market feedback. For instance, as of January 2026, the total assets in the Solana protocol within BenFen holdings have reached 10.75M BUSD, while the total network holdings have exceeded 20.73M USD, with BenPay DeFi Earn accounting for nearly half, demonstrating its high adoption rate.

To further enhance the user experience and cater to different risk appetites and liquidity needs, BenPay DeFi Earn has now officially added four new yield-generating options: Morpho USDC, Morpho USDT, Sky USD, and Ethena USDe, providing users with more flexible and diversified on-chain appreciation choices.

I. BenPay DeFi Earn Goal: Creating a Transparent, Simplified, and Diversified Yield Experience for Users

Since its inception, BenPay DeFi Earn has been committed to enhancing the user experience by ensuring on-chain transparency, simplifying operations, and providing diversified yield strategies.

1. On-chain Transparency and Traceability: Building a Foundation of User Trust

The asset operations and yield sources for every option in BenPay DeFi Earn can be verified in real-time on the blockchain. User funds always operate directly within the underlying protocols; the BenPay platform has zero touch, never privately custodies, or misappropriates assets. This design is based on the commitment to the BenFen self-custody model: users' private keys remain in their own hands, and fund flow paths are transparent and traceable in real-time.

2. Operation Simplification and User Experience Optimization: From Complex to One-Click

The operational barrier of DeFi is a pain point for many users. The traditional path might involve multiple steps: cross-chain bridging, protocol interaction, yield reinvestment, etc. BenPay DeFi Earn streamlines these complex processes into a one-click backend operation. Users simply select an option on the BenPay interface and invest with one click; the system automatically handles cross-chain transfers, protocol interactions, and yield accumulation, making participation in on-chain yield more intuitive and user-friendly.

3. Diversified Yield Strategies: Matching Multi-dimensional Needs

BenPay DeFi Earn is not limited to a single type but builds a strategy matrix to meet users' different risk preferences, liquidity needs, and ecosystem preferences:

○Conservative Type: Compound USDC/USDT Earn, AAVE USDC/USDT Earn. These offer relatively stable yields with high liquidity, suitable for users seeking capital safety and low-volatility returns.

○Growth Type: SOL USD Earn. Based on high-yield protocols within the Solana ecosystem, it offers potentially higher returns, suitable for users with stronger risk tolerance pursuing growth.

Although Solana, Compound, and AAVE provide on-chain yield, these options still have certain limitations. Taking Solana as an example, while it offers high returns, some users have concerns about its risks, and redemptions require a 10-day waiting period, which might be inconvenient for users with higher liquidity needs. While Compound and AAVE provide stable returns, they may not meet the demand for higher yields from some users during market fluctuations. To further enhance the product experience, BenPay DeFi Earn has introduced four more diversified options to enrich user choices.

II. Detailed Explanation of BenPay DeFi Earn's Four New Options: DeFi Protocol Choices for Stable Returns

The four new yield-generating options added by BenPay DeFi Earn this time are carefully selected from mainstream DeFi protocols within the Ethereum ecosystem that have been operating long-term and are widely used. The related protocols manage tens of billions of dollars in on-chain funds, with transparent mechanisms and publicly verifiable operational records, having formed a relatively stable operational framework through long-term practice. For users, this not only lowers the barrier to understanding and participation but also reduces uncertainty arising from immature protocols to some extent, making asset operations more reassuring and predictable.

1. Morpho USDC Earn: Institutional-Grade Risk Control + On-chain Lending Interest

The Morpho USDC Earn option essentially does something very close to traditional finance: lending funds to borrowers with real needs to earn interest. The difference is that this is done on-chain through Morpho's Vault model. Users' USDC is no longer deposited into a mixed large liquidity pool but is instead placed into lending vaults managed by professional institutions. Funds are only allocated to institutional borrowers or decentralized protocols that have passed a whitelist screening.

Under this mechanism, interest paid by borrowers is continuously accrued to the vault assets, gradually increasing the overall vault size, thereby driving up the asset value corresponding to each vault share. In the current market environment, this option offers an annualized yield of approximately 4.09%, with performance primarily stemming from relatively stable lending interest accumulation.

Since funds always operate within the highly liquid on-chain lending market, this option supports instant investment and redemption, achieving relatively steady yield accumulation while maintaining fund availability. The entire process's lending relationships, fund flows, and yield sources can be verified on-chain, reflecting the operational characteristics of "institutional-grade risk control + on-chain transparency".

2. Morpho USDT Earn: Algorithm-Driven Dynamic Lending Yield

Morpho USDT Earn is also based on the lending framework of the Morpho protocol, but it shows noticeable differences from Morpho USDC Earn in terms of yield performance and user experience. For users, the USDC option leans more towards relatively stable, structurally clear interest accumulation, while the USDT option more directly reflects changes in market funding supply and demand, with slightly higher yield elasticity.

In terms of specific mechanisms, Morpho USDT Earn dynamically adjusts lending parameters through algorithmic models. All loans are over-collateralized, with collateral assets screened by the professional risk management firm Gauntlet using models, accepting only assets with sufficient liquidity and clear risk structures. This allows interest rates to adjust naturally with market changes while controlling risk.

In this model, user yield also comes from real interest paid by borrowers, but the interest rate fluctuates with market demand for USDT funding. Under current conditions, this option offers an annualized yield of approximately 3.55%: when market funding demand rises, the yield level increases accordingly; when demand falls, the yield also declines accordingly.

For users, there's no need to understand complex collateral ratio calculations or liquidation logic. Assets are continuously lent out and accrue interest under safety mechanisms, while also supporting instant investment and redemption. It is more suitable for users who wish to participate in the market's elastic yield while maintaining fund flexibility.

3. Sky USD Earn: The Form Closest to an "On-chain Savings Account"

Sky (formerly MakerDAO) is a crucial infrastructure within the stablecoin system. Its yield model does not involve using user funds separately to invest in a specific asset class. Instead, through the protocol's operational mechanisms, overall systemic revenue is distributed to participating users according to rules. Revenue sources include yields generated from investments in US Treasury bonds and interest formed during on-chain lending and stablecoin issuance processes.

After users deposit funds, they receive a cumulative deposit certificate. The number of certificates remains constant, but its exchange rate against USD increases unidirectionally over time. At the current stage, this option offers an annualized yield of approximately 4.04%, with overall yield performance characterized by continuous, low-volatility accumulation.

Since the yield comes from unified protocol-level settlement and distribution, rather than relying on high-frequency operations or complex strategies, users do not need to frequently adjust positions or monitor market changes during use, while also supporting instant investment and redemption. The overall experience is closer to a structurally clear, stably operating form of on-chain yield.

4. Ethena USDe Earn: Strategy-Based Appreciation Leveraging Market Structure

The Ethena USDe Earn option does not generate yield by lending funds to others to earn interest. Instead, it leverages the operational mechanics of the crypto market itself to create returns. USDe is a synthetic dollar, primarily built around mainstream crypto assets like Ethereum (ETH): the system holds these assets on one side while conducting corresponding price hedging in the futures market on the other, thereby minimizing the impact of price volatility and focusing the yield on the funding rates generated by the market.

Within this structure, the system can continuously capture funding rates from the market. Additionally, the underlying Ethereum assets held generate staking rewards. In the current market environment, this option offers an annualized yield of approximately 4.79%, with overall returns stemming more from the market structure itself rather than mere price fluctuations.

Because this type of strategy requires orderly adjustment and settlement of related positions, fund redemptions typically require a processing cycle of around 10 days. This arrangement stems from the strategy's operational method itself, not an additional restriction. It is more suitable for users with lower liquidity requirements who wish to participate in strategy-based yield.

Overall, these four new options do not pursue short-term high volatility or complex structures. Instead, they represent several proven yield pathways within the current DeFi ecosystem: on-chain lending models based on real borrowing demand, emphasizing institutional-grade risk control and liquidity; systemic yield distribution based on protocol operations; and strategy-based solutions capturing funding rates by leveraging market structure. By integrating these mature mechanisms into a unified gateway, BenPay DeFi Earn aims to enable users to choose more suitable on-chain participation methods based on their asset situations without delving deeply into protocol details.

Note: Annualized yields are based on historical performance; actual returns may vary with market conditions.

III. How to Choose: Not About Comparing Yields, But Matching Fund Characteristics

After understanding the yield logic of different options, the truly important question is not "which one has a higher yield?" but rather: which one is more suitable for your fund usage pattern?

Different options have fundamental differences in yield sources, use cases, and asset liquidity: some emphasize liquidity for on-demand use, some are more suitable for long-term placement with low-frequency management, and others rely on specific market structures, resulting in inherent differences in redemption timing.

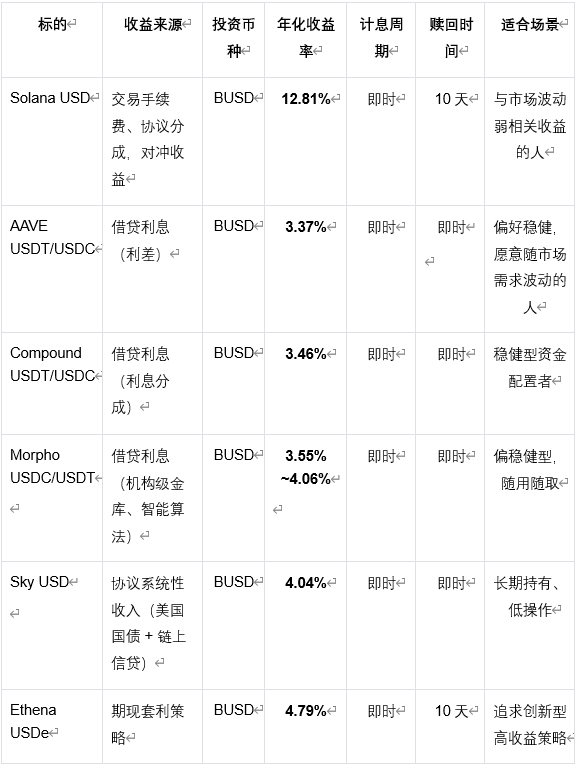

To help users quickly establish clear selection criteria without delving into protocol details, the following provides an intuitive comparison combining BenPay DeFi Earn's core existing options with the newly added yield-generating options, across dimensions such as yield source, annualized yield, investment currency, interest accrual cycle, redemption time, and applicable scenarios.

Annualized yields are based on historical performance; actual returns may vary with market conditions.

IV. Future Evolution Direction: One-Click Access to BenPay's All-in-One On-chain Financial Experience via DeFi Earn

As on-chain yield is no longer just a feature used by a minority of users but gradually enters broader usage scenarios, user focus has shifted from "whether there is yield" to "whether it is stable enough, user-friendly, and sustainable." In line with this trend, BenPay does not attempt to cover all complex DeFi scenarios. Instead, with DeFi Earn as the core gateway, it naturally integrates on-chain yield into daily fund management. The addition of these four new yield-generating options represents a milestone achievement in BenPay's ongoing process of optimizing user experience and refining product functionality.

In terms of product design, the act of adding new options itself reflects BenPay's judgment on the long-term evolution direction of the DeFi Earn product. On one hand, by introducing options with different yield mechanisms, it reduces reliance on a single yield pathway. On the other hand, during the option selection process, greater emphasis is placed on redemption efficiency, clarity of yield sources, and overall predictability, thereby enhancing the robustness and usability of DeFi Earn while expanding choices.

At the user experience level, DeFi Earn still adheres to the product principle of simplification first. Users do not need to understand underlying protocol differences; they can complete investment, redemption, and yield viewing through a unified gateway. Complex protocol selection and risk structures are integrated and presented by the product backend, making on-chain yield an asset allocation method suitable for daily use, rather than a tool exclusive to professional users.

Furthermore, DeFi Earn is no longer an isolated yield module but an important starting point within BenPay's full-stack product ecosystem. Centered around the core needs of "earning, transacting, and security," BenPay is integrating on-chain yield capabilities with payment, trading, and liquidity tools: the BenPay On-chain Interest-Bearing Card allows account balances to continuously participate in on-chain yield during daily spending; BenPay DEX provides efficient, low-fee decentralized trading support; BenPay Lending releases fund liquidity through decentralized collateralized lending; additionally, leveraging BenFen's on-chain private payment capabilities, BenPay further enhances security and privacy protection during fund transfers.

If DeFi Earn is the gateway for users to enter BenPay, then through this continuously evolving, mutually synergistic product ecosystem, BenPay is connecting on-chain yield, asset transfers, and daily use, gradually building a comprehensive, all-in-one on-chain financial experience that is more stable, user-friendly, and closer to daily needs.

Conclusion

With the addition of the four new yield-generating options—Morpho USDC, Morpho USDT, Sky USD, and Ethena USDe—BenPay DeFi Earn has further enriched users' on-chain appreciation choices. As the DeFi ecosystem moves towards a new stage of institutionalization and sustainable yield, BenPay adheres to the principles of non-custodial services, one-click operations, and on-chain transparency, providing users with a low-barrier, high-efficiency unified gateway.

Whether for conservative users pursuing instant liquidity and capital safety or proactive players willing to embrace market structure innovations and pursue potentially higher returns, these four new options can precisely meet diverse user needs, allowing idle funds to appreciate quietly without requiring complex operations.

In the future, BenPay DeFi Earn will continue to adapt to trends, integrate more leading protocols, further refine the product, enhance the user experience, and help users easily seize on-chain opportunities.

Friendly Reminder

Although the aforementioned protocols have undergone multiple rounds of audits and have operated long-term in practical applications, all on-chain protocols still carry risks such as smart contract vulnerabilities, market volatility,