Structural Shift in the Privacy Track: From Anonymity Tools to Digital Financial Infrastructure

- Core Viewpoint: The privacy track is shifting from adversarial anonymity towards compliant infrastructure.

- Key Elements:

- Regulatory push is driving a shift towards optional, auditable privacy.

- Institutional participation and complex applications are generating demand for privacy.

- Technological evolution is making privacy a default capability.

- Market Impact: Provides crucial support for institutional entry and complex DeFi.

- Timeliness Note: Medium-term impact

1. The State of the Privacy Sector: Structural Recovery in 2025

Over the past several years, privacy has consistently been one of the most controversial and easily misunderstood sectors in the crypto market. On one hand, the transparent nature of blockchain is seen as its core value. On the other hand, the demand for privacy has always been real and is continuously amplified at financial, commercial, and security levels. Entering 2025, with deepening institutional participation, the gradual formation of regulatory frameworks, and the maturation of cryptographic technologies like zero-knowledge proofs, the privacy sector is shifting from early-stage adversarial anonymity towards a more systematic, composable, and compliance-ready infrastructure form. The privacy sector is becoming an unavoidable key variable in crypto finance.

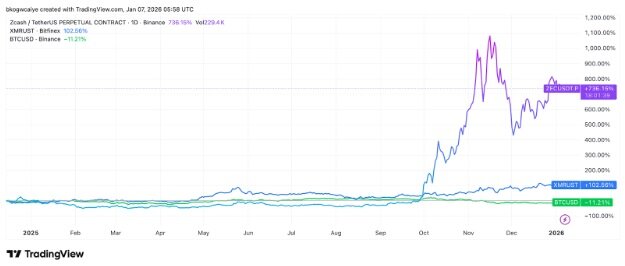

From a market perspective, a clear phase of recovery emerged in the privacy sector in the second half of 2025. Traditional privacy assets represented by Zcash and Monero generally outperformed the market. Among them, Zcash saw a peak annual increase of nearly 1100%, with its market cap once surpassing Monero, reflecting a market repricing of optional privacy and compliance resilience. Unlike previous cycles where privacy coins primarily served as niche hedge assets, this round of recovery more reflects a reassessment of the long-term value of privacy infrastructure.

From a technological and ecosystem structure perspective, the privacy sector is undergoing a paradigm upgrade. Early privacy projects mainly focused on hiding transaction paths, solving the anonymity of transfers, with typical examples including Monero, early Zcash, Tornado Cash, etc. This phase can be considered Privacy 1.0, with its core goal being to reduce on-chain traceability. However, it featured singular functionality, limited compliance flexibility, and struggled to support complex financial activities. Entering 2024-2025, privacy began evolving towards Privacy 2.0. The new generation of projects no longer merely hide data but attempt to perform computation and collaboration in an encrypted state, making privacy a general-purpose capability. For example, Aztec launched an Ethereum-native ZK Rollup supporting private smart contracts. Nillion proposed a blind computation network, emphasizing the use of data without decryption. Namada explores cross-chain private asset transfers within the Cosmos ecosystem. These projects collectively point to a trend: privacy is transforming from an asset attribute to an infrastructure attribute.

2. Why the Privacy Sector is Crucial: A Prerequisite for Institutionalization and Complex Applications

The resurgence of privacy as a core topic is not due to an ideological shift but rather the result of real-world constraints. From a longer-term perspective, privacy also possesses significant network effects. Once users, assets, and applications gather on a particular privacy infrastructure, migration costs increase substantially, giving privacy protocols a potential "underlying moat" attribute.

Institutional on-chain activity is inseparable from privacy infrastructure: In any mature financial system, asset allocation, trading strategies, compensation structures, and business relationships cannot be completely public. Fully transparent ledgers have advantages in the experimental phase but become obstacles once institutions participate at scale. Privacy does not weaken regulation; it is the technical prerequisite for achieving "selective transparency," allowing compliant disclosure and the protection of business secrets to coexist.

On-chain transparency is creating real security risks: As on-chain data analysis tools mature, the cost of linking addresses to real-world identities continues to decline. Issues like extortion, scams, and personal threats triggered by wealth exposure have increased noticeably in recent years. This transforms "financial privacy" from an abstract right into a real-world security need.

The integration of AI and Web3 imposes higher demands on privacy: In scenarios where agents participate in trading, execute strategies, and perform cross-chain collaboration, systems need to verify their compliance while protecting model parameters, strategy logic, and user preferences. Such needs cannot be met by simple address anonymity and must rely on advanced privacy-preserving computation technologies like zero-knowledge proofs, MPC, and FHE.

3. The Compliance Path for the Privacy Sector: From Confronting Regulation to Programmable Compliance

The core constraint facing the privacy sector has shifted from uncertain policy risks to highly certain institutional limitations. Represented by the EU's Anti-Money Laundering Regulation (AMLR), major jurisdictions globally are explicitly prohibiting financial institutions and crypto asset service providers from handling "anonymity-enhanced assets," covering technologies like mixers, ring signatures, and stealth addresses that weaken transaction traceability. The regulatory logic is not to reject blockchain technology itself but to systematically strip it of its "anonymous payment" attributes and push KYC, transaction tracing, and travel rules down to the vast majority of crypto transaction scenarios. Under the constraints of high fines, licensing risks, and preventive enforcement mechanisms, the tolerance space for fully anonymous assets in centralized channels has nearly vanished, fundamentally altering the survival conditions for privacy coins within the mainstream financial system.

Against this backdrop, the privacy sector is being reconstructed from "strong anonymity assets" to "compliant privacy infrastructure." Following the Tornado Cash incident, a consensus gradually formed within the industry: completely unauditable anonymous designs are unsustainable under the global anti-money laundering framework. Since 2025, mainstream privacy projects have begun shifting towards three types of paths: optional privacy, which reserves compliance interfaces for institutions and exchanges; auditable privacy, which enables selective disclosure through zero-knowledge proofs or viewing keys; and rule-level compliance, which embeds regulatory logic directly into the protocol layer, using cryptography to prove behavioral compliance rather than retroactively tracing data. Regulatory attitudes have also become more nuanced, shifting from whether to allow privacy to what kind of privacy to allow, with a clear distinction made between strong anonymity tools and compliant privacy technologies. This shift gives privacy infrastructure higher long-term certainty compared to traditional privacy coins. Privacy and regulation are evolving from an adversarial relationship into a technical component of the next generation of verifiable financial systems.

4. Profiles of High-Potential Privacy Sector Projects

1. Zcash: The Compliance Model in the Privacy Sector

Zcash remains one of the most representative projects in the privacy sector, but its positioning has fundamentally changed. Compared to Monero's "default strong anonymity," Zcash adopted an optional privacy architecture from its inception, allowing users to switch between transparent addresses (t-addresses) and private addresses (z-addresses). While this design was questioned by some privacy advocates in the early days, it has become its greatest advantage in the current regulatory environment. In recent years, the Zcash Foundation has continued to advance underlying cryptographic upgrades, such as the Halo 2 proof system, significantly reducing the computational cost of zero-knowledge proofs and paving the way for mobile and institutional-grade applications. Simultaneously, wallets, payment tools, and compliance modules around Zcash are continuously being improved, gradually transforming it from an "anonymous coin" into a "privacy settlement layer."

From an industry perspective, the significance of Zcash lies in providing a real-world case proving that privacy and compliance are not entirely opposed. In the context of deepening institutional participation in the future, Zcash is more likely to serve as an institutional reference for the privacy sector rather than as a speculative asset.

2. Aztec Network: The Key Execution Layer for Ethereum Privacy DeFi

Aztec is one of the projects in the current privacy sector closest to the positioning of "core infrastructure." It chooses Ethereum as its security layer and implements private smart contracts via ZK Rollup, enabling privacy capabilities to be natively composable with DeFi. Unlike traditional privacy protocols, Aztec does not pursue extreme anonymity but emphasizes programmable privacy: developers can define at the smart contract level which states are private and which are public. This design theoretically allows Aztec to support complex financial structures like private lending, private trading, and private DAO treasuries, not just transaction mixing.

From a long-term perspective, Aztec's potential value lies not in a single application but in whether it can become the default "private execution environment" within the Ethereum ecosystem. Once privacy becomes a necessary condition for institutional DeFi, native ZK privacy Rollups like Aztec will possess strong path dependency advantages.

3. Railgun: The Practical Implementation of a Protocol-Level Privacy Relay Layer

The unique aspect of Railgun is that it is not an independent public chain but provides privacy capabilities for existing assets in the form of a protocol. Users do not need to migrate assets to a new chain; instead, they achieve private interactions for assets like ERC-20 tokens and NFTs through Railgun's shielded pool. This "relay-layer privacy" model gives Railgun lower user migration costs and easier integration with existing wallets and DeFi protocols. Its rapid growth in transaction volume in 2025 reflects a strong real-user demand for "obtaining privacy without switching ecosystems." Notably, Railgun is attempting to introduce interaction methods more aligned with regulatory expectations, such as restricting sanctioned addresses from entering the privacy pool. This indicates it is not moving towards completely adversarial anonymity but exploring sustainable models under real-world constraints.

4. Nillion / Zama: Privacy-Preserving Computation as Next-Generation Infrastructure

If Zcash and Aztec still fall within the realm of blockchain privacy, then Nillion and Zama represent broader privacy-preserving computation infrastructure. Nillion's proposed "blind computation" network emphasizes completing storage and computation on data without decryption. Its goal is not to replace blockchain but to serve as a privacy collaboration layer between data and applications. Zama focuses on Fully Homomorphic Encryption (FHE), attempting to allow smart contracts to execute logic directly on encrypted data. The potential market for such projects is not limited to DeFi but covers larger-scale application scenarios like AI inference, enterprise data sharing, and RWA information disclosure. In the medium to long term, they are closer to Web3's "HTTPS layer." Once mature, their impact could far exceed that of traditional privacy coins.

5. Arcium: The Privacy-Preserving Computation "Collective Brain" for AI and Finance

If some privacy projects still primarily serve blockchain-native scenarios, then Arcium's goal points towards broader data-intensive industries. It is a decentralized, parallel privacy-preserving computation network attempting to become the "collective brain" for highly sensitive fields like AI and finance. Its core innovation lies in not betting on a single technological path but integrating Multi-Party Computation (MPC), Fully Homomorphic Encryption (FHE), and Zero-Knowledge Proofs (ZKP) into a unified framework. It can dynamically schedule the optimal combination between privacy strength and performance based on different tasks, enabling collaborative computation on data that remains encrypted throughout the process. This architecture earned Arcium official attention from NVIDIA and inclusion in its Inception program, focusing on privacy-AI related scenarios. At the application level, Arcium is building a decentralized trading dark pool, allowing institutional-sized large orders to be matched under complete privacy, avoiding front-running and market manipulation. Therefore, Arcium represents the frontier direction of deep integration between the privacy sector and real-world industries like AI and high-end finance.

6. Umbra: The Invisibility Cloak and Compliance Pioneer for the DeFi Ecosystem

Umbra's positioning is clear and pragmatic: to become an easily integrable privacy payment layer within mainstream DeFi ecosystems. It initially gained attention for its "stealth address" mechanism on Ethereum and has since expanded its focus to high-performance public chains like Solana. By generating one-time, unlinkable stealth addresses for recipients, Umbra makes each transfer difficult to trace back to the main wallet, effectively providing an "invisibility cloak" for on-chain payments. Unlike solutions emphasizing absolute anonymity, Umbra proactively incorporates an "auditable privacy" mindset into its protocol design, reserving technical space for compliance audits. This orientation significantly enhances its potential for institutional adoption. In October 2025, Umbra raised over $150 million through an ICO, validating market recognition of its path. Its ecosystem expansion follows a "Lego-like" strategy, using simplified SDKs to allow wallets and DApps to integrate privacy payment capabilities at low cost. Its long-term key lies in whether it can successfully embed itself into the core application stacks of mainstream public chains like Solana, becoming the de facto privacy payment standard.

7. MagicBlock: The TEE-Centric High-Performance Privacy Execution Layer for Solana

MagicBlock is a representative case of transitioning from an on-chain gaming tool to a high-performance public chain privacy infrastructure. Its core product is the TEE-based Ephemeral Rollup, aiming to provide a low-latency, high-throughput privacy computation layer for the Solana ecosystem. Unlike solutions relying on complex zero-knowledge proofs, MagicBlock chooses to execute standard Solana transactions directly within hardware secure enclaves like Intel TDX, ensuring computation and data confidentiality through a verifiable "black box," thereby achieving performance close to the native chain. This engineering-oriented design allows developers to introduce privacy features for DeFi or gaming applications with minimal changes, significantly lowering the development barrier. MagicBlock precisely addresses Solana's structural weakness in privacy and has consequently received investment support from core figures within the ecosystem. Of course, its solution relies on hardware trust, has an upper limit in cryptographic purity, and will face long-term competition as zero-knowledge technology matures. Overall, MagicBlock embodies the realist path within privacy infrastructure that emphasizes usability and implementation efficiency, serving as an important sample for observing how the market balances "ease of use" and "technical idealism."

5. 2026 Outlook for the Privacy Sector: From Optional Feature to System Default

Looking ahead to 2026, the privacy sector is unlikely to explode in a highly volatile, narrative-driven manner but will likely complete its penetration via a slower, yet more certain, path.

On the technical front, the engineering maturity of zero-knowledge proofs, MPC, and FHE will continue to improve, with performance bottlenecks and development barriers constantly decreasing. Privacy capabilities will no longer exist as "independent protocols" but will be embedded as modules into account abstraction, wallets, Layer 2s, and cross-chain systems, becoming default options rather than add-on features. On the compliance front, the crypto regulatory frameworks of major economies are stabilizing. As market structure bills and stablecoin regulations gradually take effect, institutional participation in on-chain finance is expected to increase significantly, which will directly amplify the demand for compliant privacy infrastructure. Privacy will transform from a "risk point" into a "necessary condition for institutional on-chain activity." On the application front, privacy will gradually become "invisible." Users may not perceive they are using a privacy protocol, but their assets, strategies, and identity information will be protected by default. DeFi, AI Agents, RWA settlement, and enterprise on-chain collaboration will all assume privacy as a prerequisite, not a post-hoc patch.

From a long-term perspective, the real challenge for the privacy sector is not "whether to be anonymous," but whether it can continuously prove the system's trustworthiness and compliance without exposing data. This capability is precisely the final piece of infrastructure that crypto finance must complete as it moves from the experimental phase to the mature phase.

Risk Disclosure:

The above information is for reference only and should not be considered as advice to buy, sell, or hold any financial asset. All information is provided in good faith. However, we make no express or implied representations or warranties regarding the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

All cryptocurrency investments (including financial products) are inherently highly speculative and carry significant risk of loss. Past performance, hypothetical results, or simulated data do not necessarily indicate future results. The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve substantial risks. Before engaging in transactions or holding digital currencies, you should carefully evaluate whether such investments are suitable for you based on your investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.