2025 Prediction Market Review: Total Trading Volume Exceeds $50 Billion, Top Two Players Hold Over 97.5% Market Share

- Core View: Prediction market trading volume exceeded $50 billion in 2025, showing rapid growth.

- Key Elements:

- Kalshi trading volume reached $23.8 billion, a year-on-year increase of over 11 times.

- Polymarket trading volume was approximately $22 billion, forming a duopoly with Kalshi.

- Sports, politics, and cryptocurrency are the primary betting categories.

- Market Impact: The sector's popularity continues, attracting capital and user attention.

- Timeliness Note: Medium-term impact.

Original|Odaily (@OdailyChina)

Author|Wenser (@wenser 2010 )

As 2025 concludes, the prediction market sector has presented its own report card.

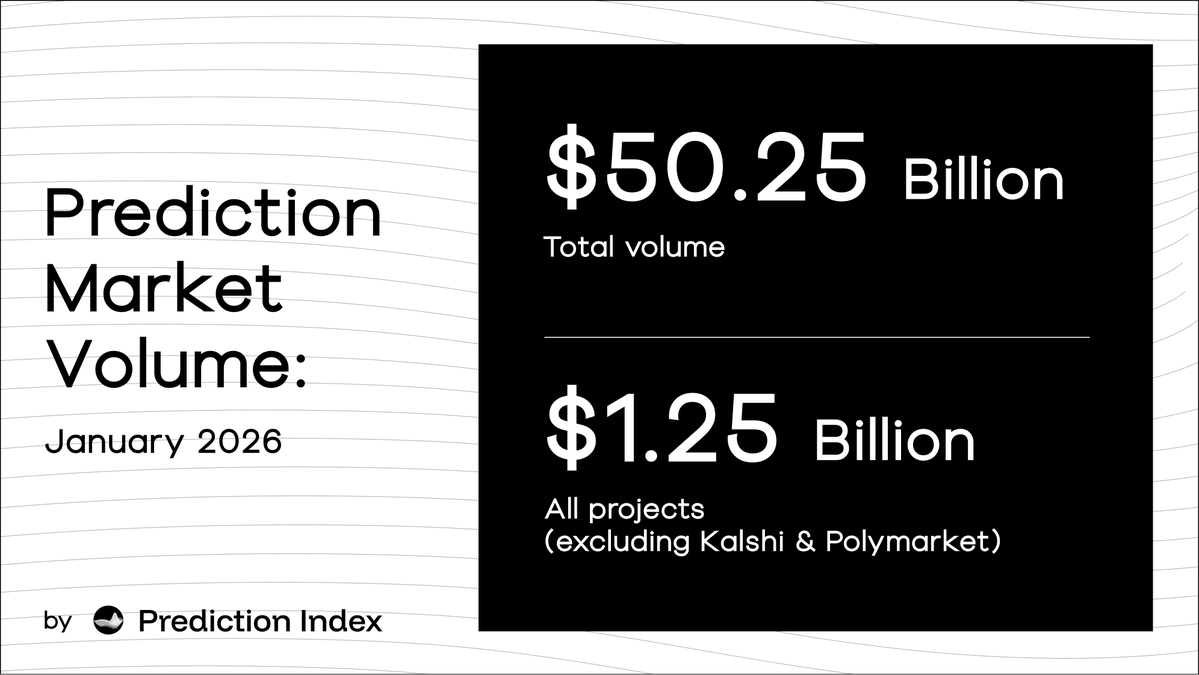

According to data from PredictionIndex.xyz, the total trading volume for the prediction market sector in 2025 reached $50.25 billion. Excluding Kalshi and Polymarket, the trading volume for the rest of the ecosystem was $1.25 billion. Additionally, data released by KalshiData shows that Kalshi's total nominal trading volume for the year amounted to $23.8 billion, a year-on-year increase of 1108%. With both Polymarket and Kalshi achieving valuations exceeding $10 billion, such performance undoubtedly injects a strong dose of confidence into the capital markets and user base. In 2026, the prediction market sector is set to remain a focal point in crypto.

Odaily will provide a review and brief analysis of the overall data for the prediction market in 2025 in this article for readers' reference.

Overall Scale of Prediction Markets in 2025: $50 Billion Level, Kalshi and Polymarket Hold Over 97.5% Market Share

According to PredictionIndex.xyz, which conducted end-to-end indexing tracking of the prediction market ecosystem, covering markets, infrastructure, end-users, and new experimental projects, the final results are as follows—

- Based on incomplete statistics from the platform, the total trading volume for prediction markets in 2025 was approximately $50.25 billion.

- Excluding Kalshi and Polymarket, the trading volume for the rest of the ecosystem was $1.25 billion.

- This long-tail market is crucial for testing and evolving new market designs, incentives, and concepts, involving projects such as azuroprotocol, TrendleFi, hyperstiti0ns, Limitless, MyriadMarkets, overtime, footballdotfun, xodotmarket, predictonfliq, DGbet_official, and BRKTgg.

If such data reveals the current "duopoly" structure of the prediction market, then the 2025 annual data provided by KalshiData, under the Kalshi platform, offers a more detailed view of the current hot sector's fervor.

Kalshi's 2025 Report Card: Trading Volume Reaches $23.8 Billion, Up Over 11x Year-on-Year

On January 3, KalshiData announced that Kalshi achieved record growth across all metrics in 2025.

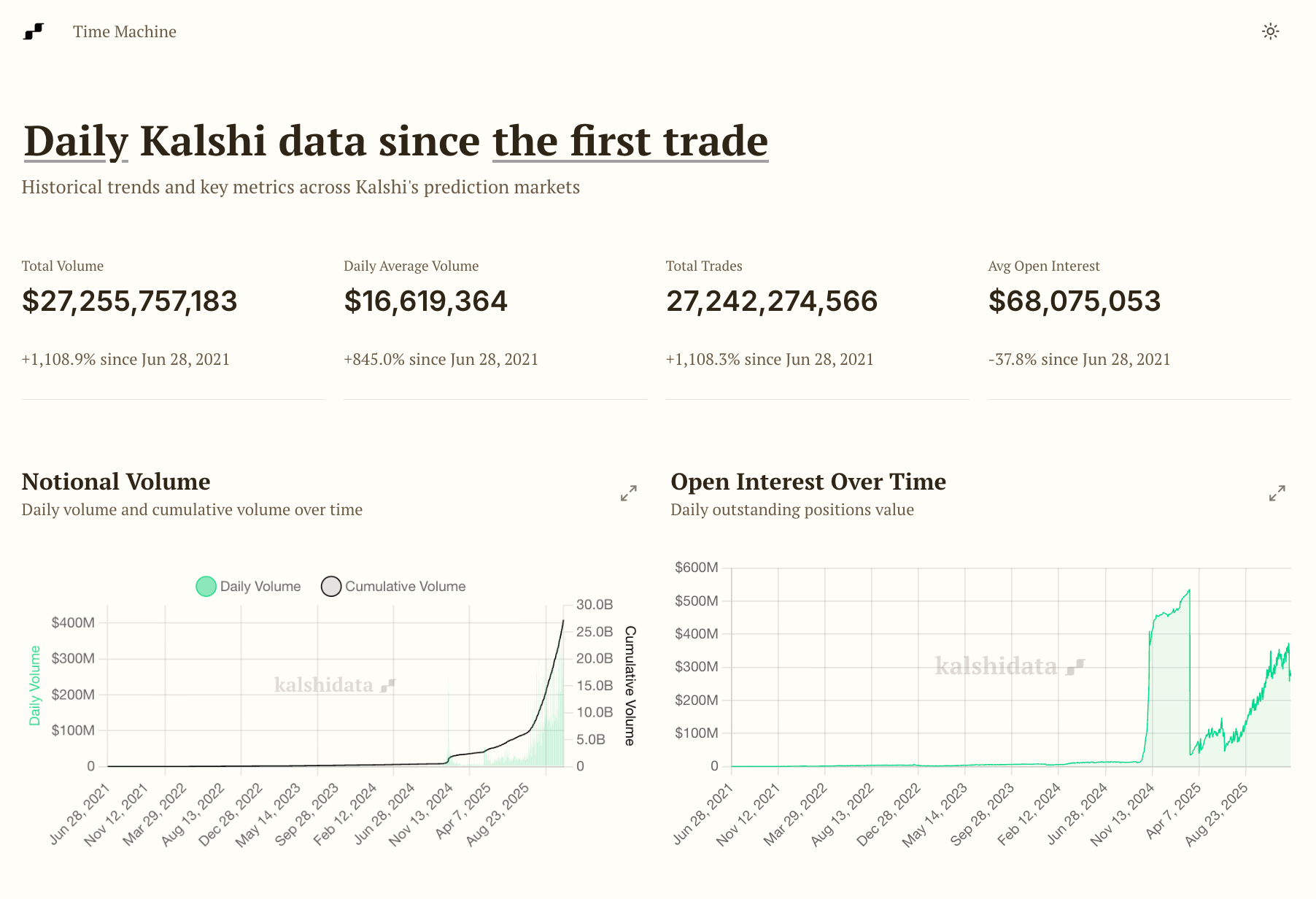

In terms of nominal trading volume, the annual total reached $23.8 billion, a year-on-year increase of 1108%, approximately 12.1 times.

- December set a new monthly all-time high of $6.38 billion;

- The 4th week of December set a new weekly all-time high of $1.7 billion;

- December 21 set a new daily all-time high of $381.7 million.

In terms of the number of trades, the annual total reached 97 million, a year-on-year increase of 1680%, approximately 17.8 times.

- December saw 27.67 million trades;

- The 4th week of December saw 7.6 million trades;

- December 21 saw 1.5 million trades, all setting new all-time highs.

In terms of open interest, the total reached $225 million, a year-on-year increase of 169%, approximately 2.7 times.

- March 9 set a new daily all-time high of $533 million,

- The 1st week of March set a new weekly all-time high of $530 million,

- February set a new monthly all-time high of $499.5 million.

In terms of the number of contracts traded, the annual total reached 23.8 billion, a year-on-year increase of 1108%, approximately 12.1 times.

- December set a new monthly all-time high with 6.38 billion contracts;

- The 4th week of December set a new weekly all-time high with 1.7 billion contracts;

- December 21 set a new single-day all-time high with 382 million contracts.

According to data from the KalshiData website, since its launch on June 28, 2021, Kalshi's historical total trading volume has reached $27,255,757,183, with a daily average trading volume of $16,619,364 and a total of 27,242,274,566 trades.

As for Polymarket, although it promotes the concept of "on-chain prediction markets," its 2025 trading volume data remains somewhat unclear, possibly due to differences in statistical methodologies and data sources.

Polymarket's 2025 Report Card: Trading Volume Estimated Around $22-25 Billion

According to DefiLlama data, Polymarket's full-year DEX trading volume for 2025 was approximately $10.5 billion.

According to information from a Dune dashboard, Polymarket's full-year trading volume for 2025 was approximately $22.5 billion.

According to the PredictionIndex.xyz website, Polymarket's cumulative historical trading volume is $23.2 billion.

According to the "Prediction Markets Report" jointly issued by Keyrock and platforms like Dune, the total transaction volume for prediction markets in 2025 was $44 billion, with Polymarket's trading volume being approximately $21.5 billion (Odaily Note: In contrast, Kalshi's trading volume was about $17.1 billion).

Considering the above information and the data provided by Kalshi's official platform earlier stating "Kalshi's annual trading volume is $23.8 billion," we take a relatively median estimate, projecting Polymarket's overall trading volume for 2025 to be around $22 billion.

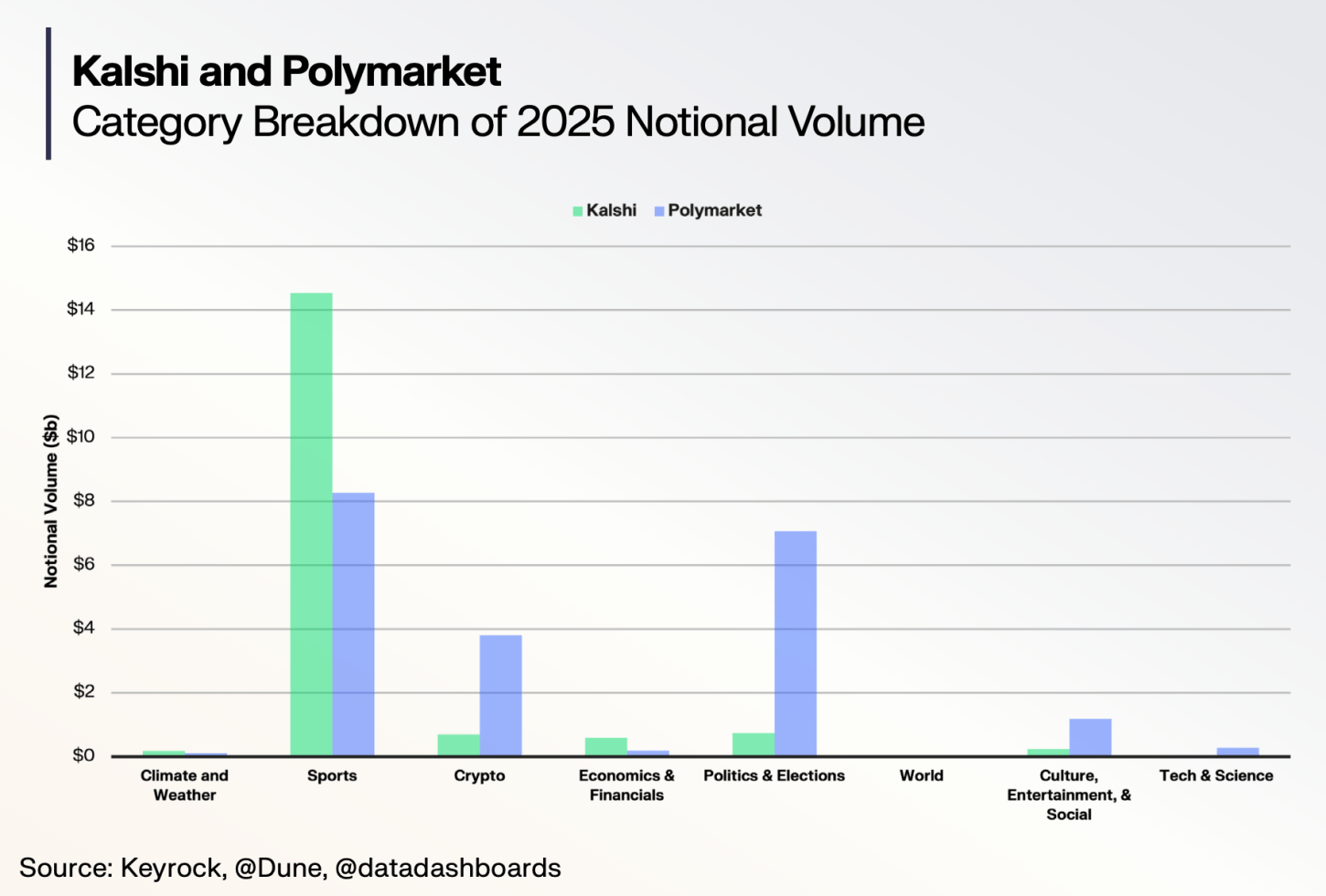

Prediction Market Segments: Sports Ranks First, Political Events and Cryptocurrency Follow in Second and Third Place

According to relevant information from the "Prediction Markets Report" jointly issued by Keyrock and platforms like Dune, specifically regarding prediction market betting events,

In 2025, Kalshi remained focused on sports, with sports accounting for approximately 85% of its nominal trading volume.

In contrast, Polymarket exhibited a more diversified portfolio—

Sports (39%), politics (34%), and cryptocurrency (18%) collectively drove over 90% of prediction market betting activity.

Furthermore, calculated by trading volume,

- Trading volume for prediction events in the economics field grew 905%, reaching $112 million;

- Trading volume for prediction events in technology and science grew 1637%, reaching $123 million;

- Open betting events were led by economics (growing 7x to a market size of approximately $800 million) and social & culture (growing 6x to a market size of approximately $700 million), indicating increasing use for macro hedging and long-term positioning.

- Other categories (e.g., culture, society) also showed significant growth. The overall contract opening trading size grew from around $3.3 billion at the beginning of 2025 to approximately $13 billion, with substantial improvements in market depth and liquidity.

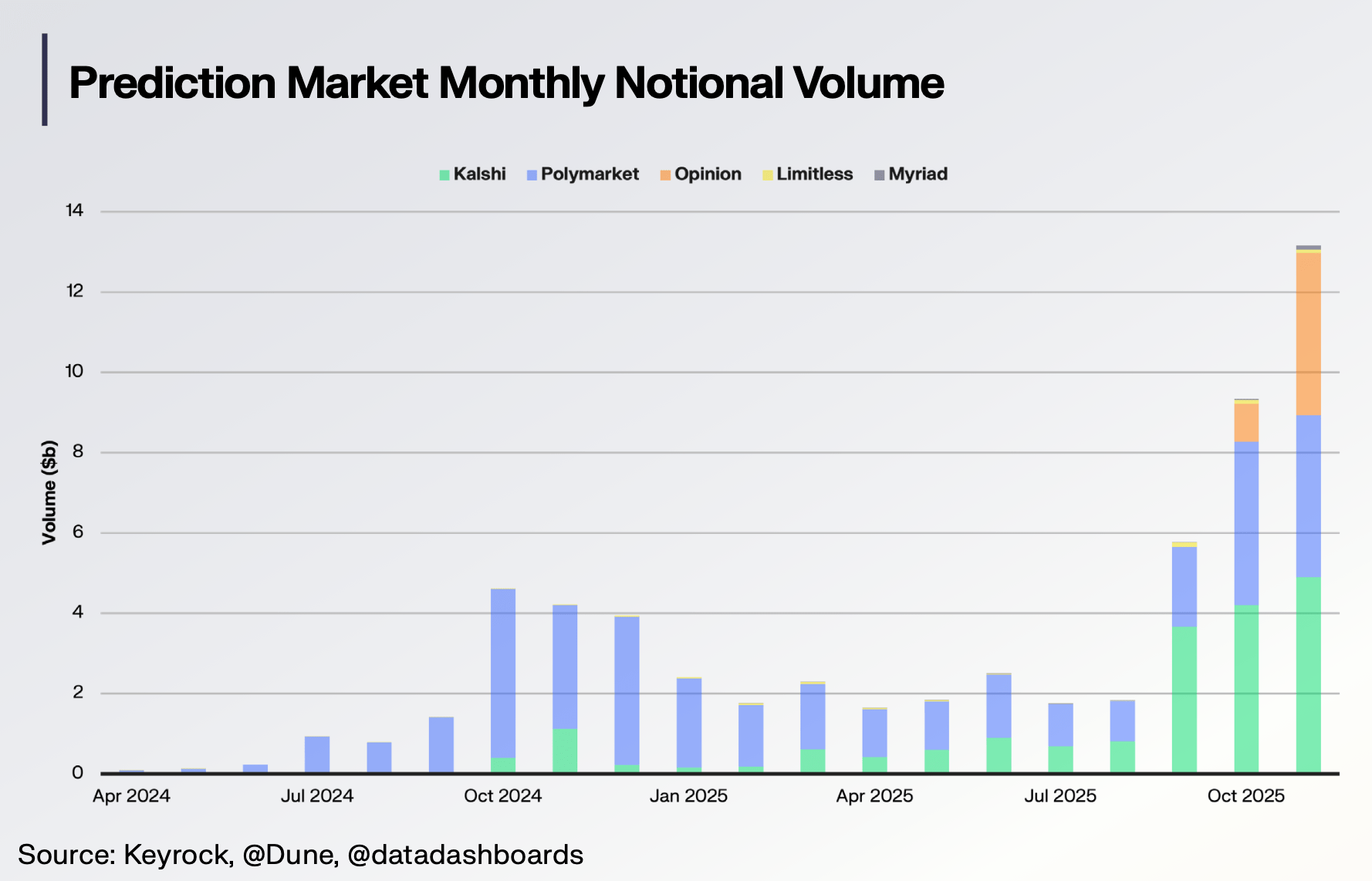

Prediction Markets Also Have "Peak and Off-Peak Seasons": The Second Half of the Year Sees a Surge in Trading Volume

It is worth noting that as of late August 2025, data showed that Polymarket's trading volume remained around $7.5-8 billion. However, with the surge of various unexpected events, political events, and sports competitions in the second half of the year, both Polymarket and Kalshi entered a "trading explosion period":

In September, the combined trading volume of Kalshi and Polymarket reached $1.44 billion;

In October, prediction market trading volume reached $8.7 billion, with Kalshi leading and Polymarket following;

In November, the combined trading volume of Kalshi and Polymarket approached $10 billion. Specifically, Kalshi's trading volume reached $5.8 billion, a month-on-month increase of 32%; Polymarket's trading volume reached $3.74 billion, a month-on-month increase of 23.8%.

In December 2025, analyst Patrick Scott stated that prediction market trading volume exceeded $13 billion in November 2025, more than three times the volume during the peak of the 2024 election. Polymarket, Kalshi, and OPINION accounted for the vast majority of the trading volume. Binary options are now applied to political speeches, sports events, and listed company earnings reports, becoming a probability layer for world events and news.

Considering Kalshi's December trading volume of $6.38 billion, Polymarket's trading volume is likely equally impressive. The overall prediction market trading volume for December 2025 might have reached a scale of $13-15 billion.

Top 5 Star Players in Prediction Markets: Kalshi, Polymarket, and Others

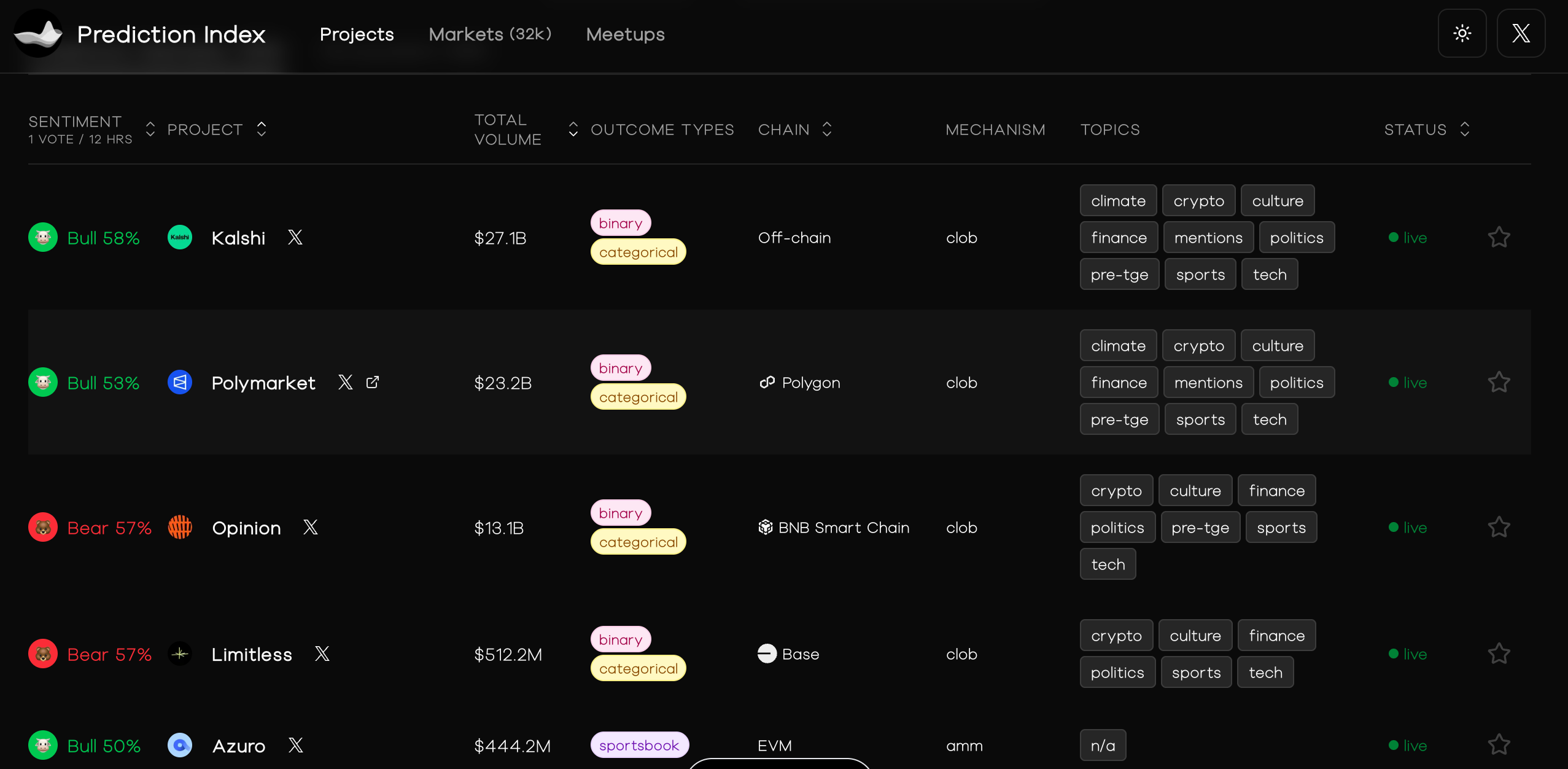

Finally, we can refer to the existing statistical data on the PredictionIndex.xyz website. As of the time of writing, the Top 5 prediction market platforms by trading volume are as follows:

- Kalshi, with a historical platform trading volume of approximately $27.1 billion;

- Polymarket, with a historical platform trading volume of approximately $23.2 billion;

- Opinion, with a historical platform trading volume of approximately $13.1 billion (Odaily Note: Considering the platform's launch time and mechanism, there may be issues with wash trading. This data is presented based on the statistical platform's information.);

- Limitless, with a historical platform trading volume of approximately $512 million;

- Azuro, with a historical platform trading volume of approximately $444 million.

Previously, Kalshi's CEO stated that the prediction market size is around $150 billion. Although the final total trading volume for 2025 was only one-third of that claim, considering that the prediction market sector was not even fully formed in 2024, his statement of a "$150 billion market size" is not unfounded. With a series of hot prediction events such as the 2026 US midterm elections and the World Cup already confirmed, the overall market size of prediction markets may continue to grow by 10x in 2026.

Of course, as we mentioned earlier in "Only One in Ten Prediction Markets Will Survive Until Year-End, Not an Exaggeration", a hot sector does not mean all projects and platforms will thrive. For ordinary players like us, considering limitations such as liquidity depth and capital allocation, focusing on 1-3 mainstream platforms might be a better choice.