Trend Research: 2026 Beyond Paradigms, WLFI Ushers in a New Era for the Financial Ecosystem

- Core View: Stablecoins will explode in 2026, with WLFI's USD1 becoming the fastest-growing project.

- Key Factors:

- The US "Genius Act" provides a clear regulatory framework.

- Tech giants and Wall Street are accelerating their deployment of stablecoin applications.

- USD1 has strong compliance, backed by top-tier custody and a presidential family endorsement.

- Market Impact: Drives the process of on-chain migration and tokenization for tens of trillions in financial assets.

- Timeliness Note: Medium-term impact

Original Source: Trend Research

2026 is poised to be a pivotal year for large-scale institutional adoption of blockchain, with stablecoins serving as the most fundamental and largest-scale blockchain application. Trend Research believes that WLFI (World Liberty Financial) and its USD1 stablecoin will become one of the blockchain projects with the fastest adoption growth and the broadest application scenarios. In the era of future on-chain finance, it possesses comprehensive advantages in compliance, brand, user base, and liquidity, positioning it as the infrastructure for a multi-trillion-dollar on-chain financial market.

I. The Stablecoin Explosion is Imminent

"In the entire history of fintech, we have almost never seen a project of this caliber that is global from day one. The stablecoin business model is giving rise to a new generation of founders, builders, and products who are no longer constrained by geographical barriers. From the moment of launch, their target is the global market."

1. The Growth Trend of Stablecoins

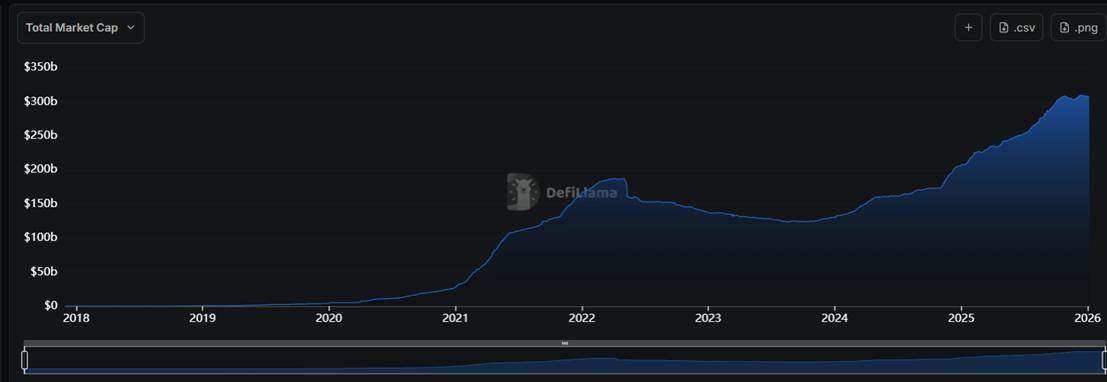

Stablecoins experienced a year of rapid growth in 2025, with their scale increasing from $130.553 billion at the beginning of the year to $308.585 billion, representing an annualized growth of 136%. Even after the 1011 event, the stablecoin market cap quickly recovered to new highs. U.S. Treasury Secretary Besant predicts that after the passage of the U.S. stablecoin bill, the stablecoin market capitalization will rapidly grow to over $2 trillion in the coming years.

We believe that, benefiting from favorable U.S. regulation, pilot programs and adoption by tech and AI companies, and the ongoing on-chain migration of Wall Street finance, stablecoins will experience "explosive growth" in 2026 driven by these three factors.

2. U.S. Regulatory Policy

The "Genius Act" passed in 2025 fills the regulatory gap for stablecoins. It is the first comprehensive federal regulatory framework for stablecoins, clearly defining issuer qualifications, reserve requirements, and operational standards. It mandates a 1:1 peg to the U.S. dollar, promoting the penetration of the dollar into the global crypto economy and cross-border payments through stablecoins, thereby consolidating the dollar's dominance in international finance. Furthermore, through mandatory reserve rules (requiring reserve assets to be short-term U.S. Treasuries or cash), it creates structural demand for the U.S. Treasury market, alleviating U.S. fiscal pressure.

In 2026, following the passage of the "Genius Act," more participants will enter the stablecoin development space, accelerating institutional adoption and blockchain integration.

3. Tech and AI Company Strategies

Traditional Web2 tech companies and AI companies are piloting stablecoin deployments to prepare for large-scale adoption when the time is ripe.

Among traditional Web2 tech companies, PayPal has expanded its PYUSD stablecoin to enterprise applications, including a partnership with YouTube allowing creators to receive payments via stablecoins; Stripe acquired Bridge for over $1 billion and partnered with Visa to launch a stablecoin-linked card product, allowing users to spend their stablecoin balances directly at merchants accepting Visa. In 2025, Visa expanded multi-stablecoin support (e.g., USDC) and reported a shift in stablecoin usage from holding to spending, indicating that stablecoins are becoming a mainstream payment tool.

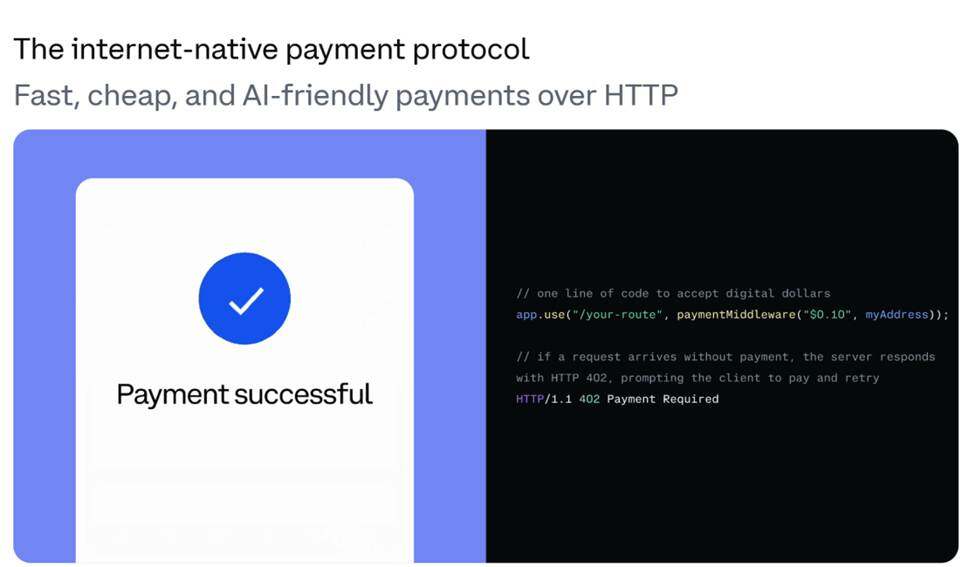

In the AI field, 2025 was a year of accelerated AI development. The further advancement of AI will inevitably create demand for machine-to-machine transactions and micropayments. Blockchain may become the ultimate infrastructure for AI and machine interaction. The emergence of the x402 protocol represents a strategic integration of AI and Crypto, backed and adopted by entities including Coinbase, Google, Cloudflare, Circle, Visa, and AWS. With its vast existing customer base and consumption scenarios, the new narrative around AI and payments is visibly gaining momentum.

Companies outside the U.S. are also competing for stablecoin application scenarios. Trip.com, the overseas version of Ctrip, has enabled stablecoin payment functionality for global users, currently supporting USDT and USDC. Tech and payment companies including Ant Group, JD Group, and Grab have explicitly entered the stablecoin space.

4. Wall Street's On-Chain Finance Migration

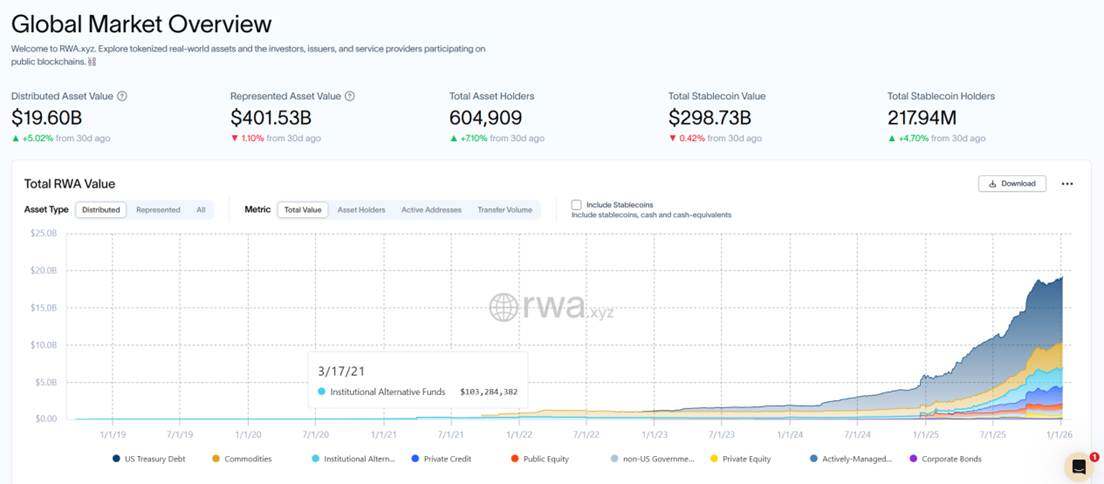

Stablecoins are the most critical foundational layer for integrating traditional finance onto the chain. They make money programmable and decentralized, serving as the basis for the circulation and settlement of all on-chain financial assets. A key motivation for Wall Street to promote stablecoin development is to facilitate the "tokenization of everything" after completing the infrastructure. SEC Chair Paul Atkins once declared, "The next step will be digital assets, market digitization, and tokenization... all U.S. markets will be on-chain within two years." BlackRock CEO Larry Fink stated, "The tokenization of all financial assets is the future trend, and we have already entered this stage... ETFs are the first step in the technological revolution of financial markets. The second step will be the tokenization of all financial assets."

BlackRock has launched and operates the BUIDL fund, tokenizing U.S. Treasuries into blockchain assets, enabling 24/7 instant settlement and institutional-grade liquidity; JPMorgan conducts on-chain trading and settlement business through its Kinexys platform, having processed over $1.5 trillion in transactions; Goldman Sachs operates a digital asset platform for issuing and trading tokenized bonds; Depository Trust & Clearing Corp. (DTCC), after SEC approval, provides tokenization services, handling the on-chain version of securities transactions exceeding $3.5 trillion. These businesses, leveraging blockchain technology for asset tokenization, on-chain trading, and settlement, represent the trend of traditional finance moving on-chain. They are based on institutional pilots and production-level deployments, aiming to enhance liquidity, efficiency, and global access.

Currently, the total market capitalization of traditional finance exceeds $400 trillion, the total crypto market cap is $3.3 trillion, the total stablecoin market cap is $0.3 trillion, and the total RWA market cap is $0.02 trillion. According to industry forecasts from Standard Chartered, Redstone, RWA.xyz, etc., by 2030–2034, 10%-30% of global assets may be tokenized, representing a scale of $40–120 trillion. The total RWA market cap is expected to expand by over 1000 times from current levels.

II. WLFI Ushers in a New Era of Panoramic Finance

In the future, every company globally must have a blockchain and AI strategy. Otherwise, it will not be able to adapt to the competitive efficiency of new technologies or achieve new scale. Stablecoins will become the intersection point for finance, internet, AI companies, cross-border trade, and local payments. Against the backdrop of stablecoins entering an explosive growth year, Trend Research believes WLFI and USD1 will be among the crypto companies that benefit the most from this wave, surpassing past paradigms to become the fastest-growing blockchain project.

1. USD1 Will Become the Fastest-Growing Stablecoin

Following WLFI's TGE, USD1 entered a new phase of rapid growth, increasing from $2.462 billion to $3.438 billion in three months, a growth rate of 40%, making it the fastest-growing major stablecoin in the recent three months. It ranks seventh in stablecoin market cap, soon to surpass PYUSD (PayPal USD), with a daily trading volume of approximately $1-3 billion. It is currently primarily distributed on BNB Chain (55.61%) and Ethereum (37.38%).

Trend Research predicts that the scale of USD1 will rapidly exceed $10 billion in 2026, becoming the fastest-growing stablecoin, and in the long term, grow into a trillion-dollar scale stablecoin.

2. USD1 Will Become the Most Legitimate Stablecoin

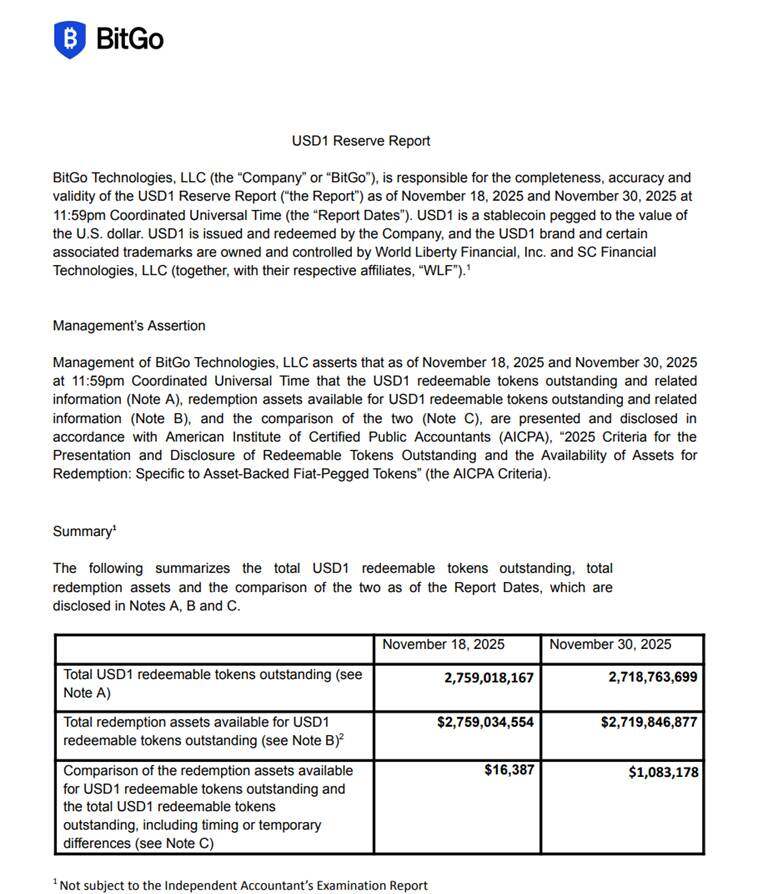

USD1 complies with the requirements of the Genius Act. Regarding reserves and collateral assets, it is 100% backed by real U.S. dollar-equivalent assets, including U.S. dollar cash or deposits, short-term U.S. Treasury securities, and other cash equivalents (such as money market funds), ensuring that each USD1 is backed by an equivalent amount of U.S. dollar assets, theoretically enabling 1:1 redemption and settlement.

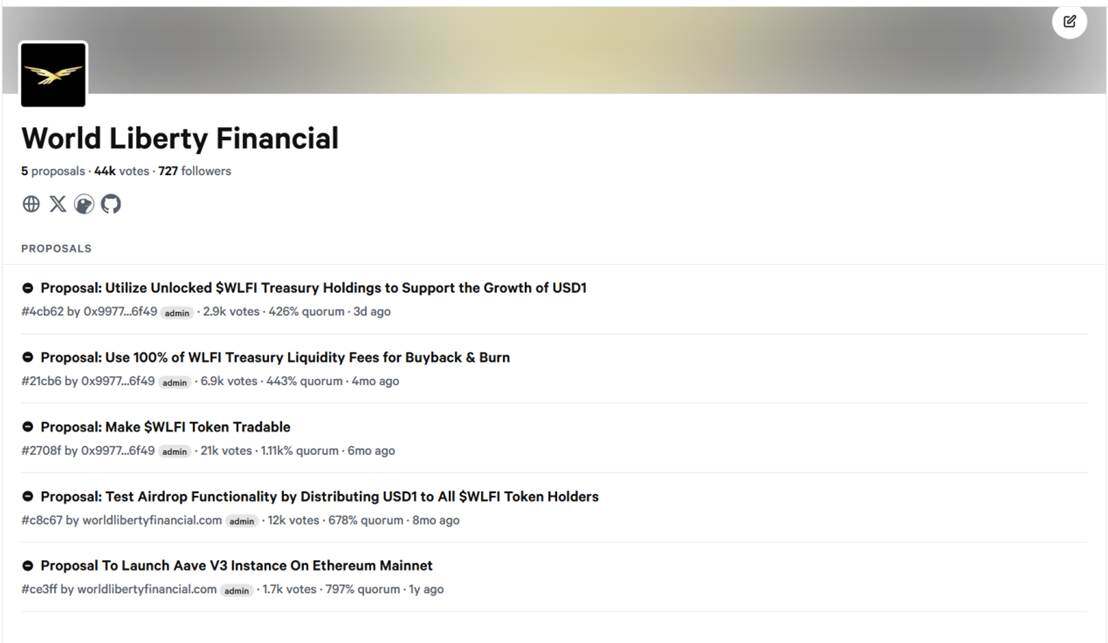

Regarding reserve proof and audit mechanisms, the USD1 team publishes regular reserve reports/verifications, transparently disclosing reserve quantities and asset distribution to the public. The U.S. dollar reserves will be regularly audited by an independent third-party company.

Regarding custody, USD1's reserve custodian is BitGo Trust. The company manages over $100 billion in reserve assets, processes transactions worth over $3 trillion, and serves more than 1,500 institutional clients in over 50 countries globally, including handling 20% of the value of on-chain Bitcoin transactions. BitGo Trust's custody service clients include Circle, Paxos, WBTC, Bitstamp, Fidelity Digital Assets, Vanguard, etc.

Compared to other projects, WLFI and USD1 are backed by the endorsement of the most powerful presidential family. Trend Research believes USD1 will further advance on the path of compliance, becoming one of the most legitimate stablecoins.

3. The Adoption Wave for USD1 is Beginning

Since WLFI's TGE, the adoption wave for USD1 has gradually begun. Currently, Binance has listed nearly 20 USD1 trading pairs. Trading platforms like StableStock are expanding USD1's trading adoption to include U.S. stocks. As the scale and compliance of USD1 further strengthen, it is foreseeable that in 2026, USD1 will expand from the crypto space to multi-scenario adoption in traditional finance, internet transactions, and offline payments.

4. WLFI Builds a Panoramic Financial Ecosystem

Starting with the USD1 stablecoin, WLFI is building a panoramic financial ecosystem aimed at bringing 6 billion people onto the blockchain, integrating with technology and financial services.

In the future, WLFI will also develop the WLFI App to serve as a wallet entry point aggregating various scenarios, launch DeFi products like lending to enable efficient asset circulation and yield, introduce a series of RWA products to form a comprehensive blockchain financial ecosystem, and expand WLFI's adoption through native methods such as wealth management returns, point systems, and governance voting.

Trend Research predicts that blockchain will experience a breakout year for institutional adoption in 2026. Starting with USD1, WLFI will surpass the development paradigms of past blockchain projects and, with astonishing speed, scale, and a panoramic ecosystem, usher in a new era of integration between blockchain and finance.