Conversation with Blockworks Co-founder: 27 Predictions for 2026

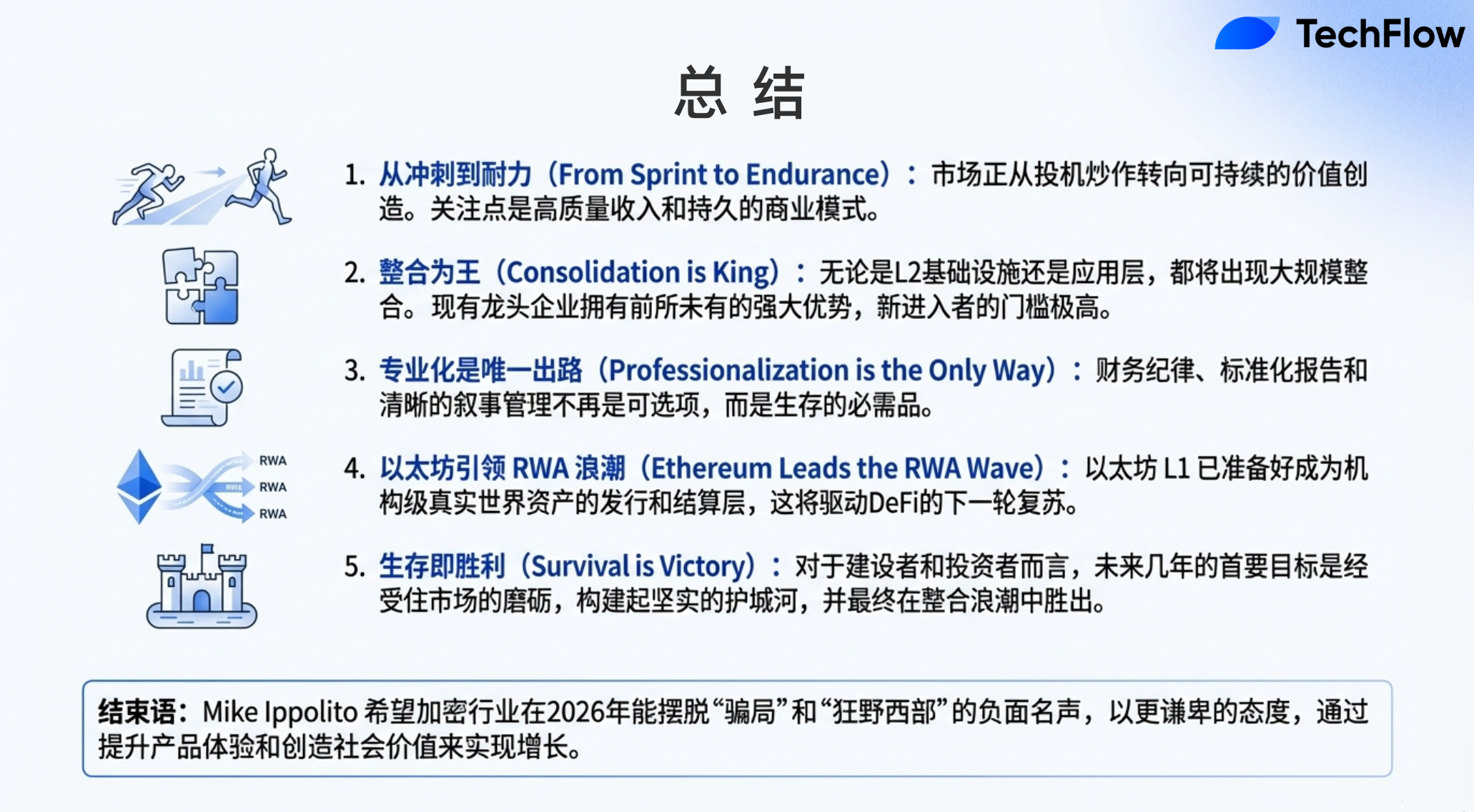

- Core View: The crypto market is entering a phase of value return and consolidation.

- Key Elements:

- The market shifts from speculation to fundamental valuation.

- Industry consolidation accelerates; "survival is victory."

- Ethereum L1 will experience a revival, focusing on asset issuance.

- Market Impact: Beneficial for top-tier projects with solid fundamentals.

- Timeliness Note: Medium-term impact.

Compiled by: TechFlow

Guest: Mike Ippolito, Co-founder of Blockworks

Host: David Hoffman

Podcast Source: Bankless

Original Title: 27 Crypto Predictions for 2026 (Ethereum Renaissance, BlackRock Chain & More)

Release Date: December 31, 2026

Key Takeaways

David Hoffman sat down with Mike Ippolito to discuss why 2025 felt exceptionally difficult despite hitting new all-time highs, and why this tension is crucial for 2026. They believe the crypto industry is entering a phase akin to the "2002 internet era" — a period where speculation fades, fundamentals become important, and industry consolidation accelerates.

The conversation covered reasons for a potential Ethereum renaissance, why Bitcoin sentiment might face challenges, the actual performance of prediction markets and perp equity contracts, and what builders and investors should focus on as the crypto industry moves from hype to genuine value creation.

(This video is based on the 27 predictions proposed by Mike, but does not cover all of them, focusing only on selected key points for in-depth discussion.)

Highlights Summary

- I hope cryptocurrency can have a greater positive impact on the world; I'm tired of the crypto industry being labeled as the "Wild West" and a "scam."

- Bitcoin will underperform gold in 2026.

- 2026 will be a very good year for DeFi.

- 2026 will be Ethereum's year, while Bitcoin may have a bad year, Solana will be relatively quiet, and Hyperliquid will face challenges.

- 2025 was the best and the worst year; we didn't get the price bull run everyone expected.

- The cryptocurrency market is gradually becoming more rational and fundamentals-based, moving away from its past wild, irrational state.

- If you can identify projects with compounding growth potential and choose the right protocols, there will be good opportunities in 2026 and beyond.

- In 2026, we may continue to see consolidation trends across multiple key categories. Over the next three years, "survival is victory" will be the industry's theme.

- Builders need to prepare, be as creative as possible, think big, and strive to achieve their goals. They will either be acquired or win and consolidate in their own domain.

- 2025 and 2026 are years for building positions; there is no frenzy, and no one will suddenly become very rich from cryptocurrency.

- In cycles, when people feel bored, tired, or worn out by the market, it's actually the best time to persevere.

- 2026 will be a year of consolidation for multiple key categories; another theme is the convergence of stocks and crypto.

- If there's one DATS worth watching, it might be Tom Lee's.

- For traders, the hope is to complete all trading in crypto and stocks on the same platform.

- Ethereum is more like the chain for asset issuance, while Solana is more like the on-chain price discovery venue for decentralized exchanges.

- Quantum computing is not just a cryptocurrency issue; it will impact the entire society.

- Centralized exchanges will scale down or up depending on how they strategically build. We will see more acquisitions in the future, with these launchpads and CEXs actively participating.

Looking Back at 2025: The Best and Worst Year

David Hoffman: Looking ahead to 2026, how would you evaluate or summarize the state of the crypto industry in 2025?

Mike Ippolito:

In my view, 2025 was the best and the worst year. The main reason is that we didn't get the price bull run everyone expected. While Bitcoin and some major coins hit new all-time highs, the overall performance fell short, especially for investors in fringe altcoins. Unless they were very lucky to pick the few well-performing coins, most people suffered heavy losses.

Ethereum and Solana broke their all-time highs at different points, but the moves were very small, creating overall confusion. This might have been the toughest year for crypto investing, especially for those higher on the risk curve. From a price perspective, it was a year full of chaos and challenges.

I think the crypto industry makes more sense now than ever before. An important theme this year was "cognitive dissonance." Many felt this situation was irrational: U.S. regulatory sentiment towards crypto seemed to shift to a "bear hug," we saw many brilliant projects emerge, and the direction became clearer. Logically, these should have driven asset prices up, but the market didn't cooperate.

The reason behind this is that the cryptocurrency market is gradually becoming more rational and fundamentals-based, moving away from its past wild, irrational state. This change was predicted before but is only now truly manifesting. Many excellent projects in the market are constantly improving, yet their prices keep falling. This phenomenon might become a theme for 2026, as the market shifts from speculative valuation towards fundamental valuation.

Although many projects in the market are excellent, their pricing has been unfavorable. I think this will continue to trouble investors into 2026. However, if you can identify projects with compounding growth potential and choose the right protocols, there will be good opportunities in 2026 and beyond.

David Hoffman:

Yes, if you told people at the start of 2025 that both Ethereum and Solana would hit new all-time highs, everyone would have thought a bull market was here. But in reality, these breakouts didn't have a meaningful impact. Ethereum barely touched its ATH and quickly fell back, which was disappointing. Solana's performance lasted a bit longer but wasn't particularly significant either. The only coin consistently above its ATH was Bitcoin, but even it is currently 30% to 40% below its peak.

So in a sense, while we did see all-time highs, the market didn't truly feel the bull run. Furthermore, 2025 didn't attract new crypto demographics. In fact, all crypto investors have been in the space for at least three years, with the median now probably five years. This means market participants have formed expectations for the industry, and these expectations were broken this year.

As you said, we are maturing. Things are no longer the Wild West, and the market's expectation for the Wild West wasn't met, which I think led to subdued market activity.

Mike Ippolito:

I agree. I'd like to give listeners an analogy; everyone likes to compare to the internet industry. I think we are now in a stage similar to Web 2.0 around late 2001 to early 2002. During the dot-com bubble, there were many bold ideas, and everything seemed possible. People envisioned building a complete internet world. While that vision ultimately proved correct, the path dependency and timing were clearly off, leading to massive overbuilding of infrastructure.

Recently, I've heard a lot of discussion about AI-driven topics, especially related to GPU usage. Between 2001 and 2002, the situation with dark fiber was the opposite of today's GPU situation. Back then, the construction of undersea cables and bandwidth was enormous. Investors were enthusiastic about telecom companies, believing they would own the internet's infrastructure. But the problem was severe overbuilding, which ultimately led to a massive bear market. At that time, people even thought the internet was dead, and it took years to rebuild confidence.

Meanwhile, a new generation of builders entered the market. They recognized the existing infrastructure, built upon it, found new creative opportunities, and established businesses that could last for generations. This illustrates an important theme—consolidation. In 2026, we may continue to see consolidation trends across multiple key categories. Over the next three years, "survival is victory" will be the industry's theme.

My advice is that builders need to prepare, be as creative as possible, think big, and strive to achieve their goals. Frankly, as a builder, there are basically two strategic choices: either get acquired or win and consolidate in your own domain. These are the two most viable strategic paths right now.

Looking Ahead to 2026

David Hoffman: I think 2025 and 2026 are crucial years for building positions, especially on Ethereum. I believe this view applies to other areas as well. For Ethereum, I feel the L1 protocol performed quite well this year, with things like zkEVMs. Everyone is talking about Ethereum, and its development is progressing faster than we expected.

Perhaps we are 1 to 2 years ahead on zkEVM progress, allowing us to significantly reduce block generation times in 2026. The Ethereum protocol also has a series of technical improvements that need to be built, delivered, and released, which I believe will happen in 2026. By the end of 2026, I expect Ethereum's L1 protocol to be better positioned to capture growth opportunities in tokenization, Wall Street, etc. Whatever gets put on-chain in the future, Ethereum will become a more suitable technical protocol.

Furthermore, I think we can talk about the Clarity Act. Hopefully, the Clarity Act will pass in 2026, better positioning the entire crypto industry to capture the potential of tokenization. Even Solana deserves a mention. Solana finally integrated Firedancer technology. This technology needs time to be fully integrated and accepted by the market.

I think 2025 and 2026 are quiet years for building positions; there is no frenzy, and no one will suddenly become very rich from cryptocurrency. If anyone does get rich, it's an exception, an outlier. We are collectively working to put all the pieces on the table correctly, preparing for potential value capture in the coming years. I think this is characteristic of a post-bubble era. Now is the time to realign, build infrastructure the right way, and prepare for future growth.

Mike Ippolito:

I completely agree, and I think this is a positive sign. Usually, when people talk about these things, there's an atmosphere: yes, these things will eventually happen; it's inevitable. But at the same time, people feel frustrated because they can't get 100x returns on altcoins.

However, I want to say that from a long-term perspective, building real wealth now might be easier than in 1995. Over the past five years, almost no one has made money in crypto, although they might publicly claim otherwise. The reason is that it's been a very difficult investment environment, with hardly any assets providing stable returns.

Aside from Bitcoin, Ethereum, and Solana, almost all other assets are more like trading instruments than investments. I know there are exceptions, but overall, I remain very optimistic. I think we have finally entered an environment where we can build something truly sustainable, and the winners that achieve compounding growth will achieve great success.

Therefore, when we talk about the future, this potential pull effect is very exciting. This is the best time for the crypto industry in the past eight years.

David Hoffman:

I think we all know that in cycles, when people feel bored, tired, or worn out by the market, it's actually the best time to persevere. If you can endure these difficulties, you'll be in a favorable position. I remember in 2019, the situation was that everyone in the Ethereum ecosystem basically only focused on Bitcoin and Ethereum. While there were Cardano and Ripple communities, the Solana community wasn't that active.

For example, if you held on and Ethereum positioned itself reasonably, you benefited from DeFi Summer. And you just had to survive the 2017, 2018, and 2019 bear market to get there because everyone else had left. The result was that opportunities in the market became very abundant because there weren't many people competing. My feeling is that this will happen again because people are being worn down by the market, and the market isn't inspiring investor enthusiasm.

David Hoffman: Your 27 industry predictions cover different ecosystems. We'll try to go through them one by one. Before we officially start, how do you think we should guide the listeners?

Mike Ippolito:

I think we can first focus on some general themes. For example, we will validate or overturn some long-held beliefs in the industry. In the past, the crypto market was relatively irrational and very early-stage. In most cases, creating real value wasn't necessary, so there was no effective feedback mechanism.

It wasn't clear in the past which beliefs were right or wrong, but I think by 2026, many things will have clear determinations. I also think 2026 will be a year of consolidation for multiple key categories. We've seen similar situations before. My favorite example is the prime brokerage space.

Additionally, I think another theme is the convergence of stocks and crypto. I mean, we might see something like equity perps in 2026, although I'm skeptical about the actual implementation of that model. But I think crypto will move towards a more fundamentals-based, real-value approach, while the stock market will also borrow some characteristics from crypto. I think this convergence has already begun.

These are my main themes for 2026.

Investor Relations in Crypto

David Hoffman: Let's move to the first theme. This is a current topic—investor relations will become increasingly important. Investors will demand standardized financial disclosures. While investor relations will borrow some aspects from traditional IR, it will also focus more on social media and community, ultimately redefining its performance in the stock market. This aligns with what you mentioned: community-managed investor relations might converge with the traditional stock market, and the traditional market might also realize this and think, we need to do this too.

Mike Ippolito:

Yes, I think people need to build a mental model. When a business doesn't have a publicly traded financial instrument, it only has one product: its business. But once it launches a publicly traded financial instrument, like a token or stock, the CEO or founder of the company effectively has two products: one is the business, and the other is the financial instrument. This means you need to constantly tell the market the story of this asset, making sure everyone understands it.

You have your business product, and you have your financial instrument. This means you need to constantly tell the market the story of this asset, telling it to everyone. You need narrative management; a company can't just "build it and they will come." Therefore, besides ensuring your product and business make sense to investors, you need to constantly tell the market the story of this asset. Historically, this narrative management has been