If you are long on oil, Maduro's arrest is not good news

- Core View: A regime change in Venezuela could unleash massive oil production capacity.

- Key Elements:

- Venezuela possesses the world's largest oil reserves.

- Stable rule of law could rapidly increase production to tens of millions of barrels per day.

- Production growth would structurally impact global oil prices.

- Market Impact: Long-term downward pressure on oil prices, reshaping the energy and geopolitical landscape.

- Timeliness Note: Long-term impact.

Original Author: Alexander

Original Compilation: TechFlow

Let me quickly break down the major events currently unfolding in Venezuela. Since oil is one of my areas of expertise, I will try to present my views concisely and clearly, and make this reading free. If you appreciate my analysis, please help share it.

The dictator Nicolás Maduro, who rose from a bus driver to a dictator, has caused the deaths of tens of thousands, the exile of 8 million people, and the oppression of 34 million. The root of all this lies primarily in the curse of oil wealth, corruption, and the "breeding ground of collectivism." Yes, the resource curse is indeed real.

Today, the U.S. government announced the successful capture of Maduro in a special military operation. Reports indicate that Maduro and his wife have been transported from Caracas to the United States, are currently detained at an undisclosed location, and are planned to be prosecuted in New York on charges of "narco-terrorism" and "drug trafficking."

So, what happens next? We don't know yet. But if Trump decides to reclaim the U.S. oil assets expropriated by the Venezuelan government, or even temporarily take over the country to rebuild its institutions, I fully support it. If you think deeply, you should too.

Why? Because for decades, Venezuela's elite have proven incapable of escaping the "resource curse." Such a policy would not only benefit humanity and freedom but also be a blessing for peace. Why do I think so?

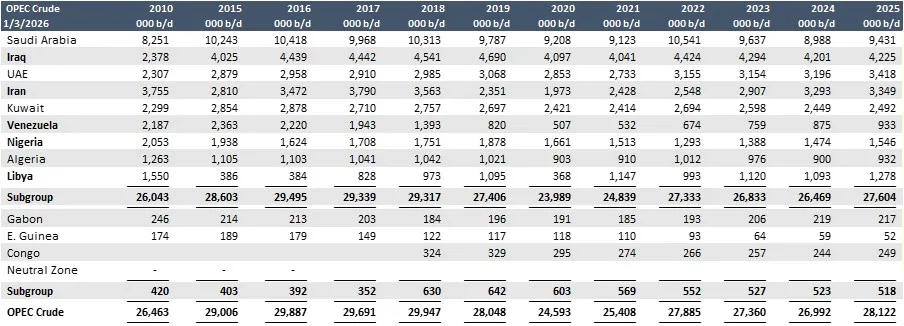

The reason is that Venezuela is not just an ordinary OPEC member, as can be seen from my OPEC production chart below. (Note: The mentioned actions by Trump and the U.S. government are hypothetical discussions, not facts. Readers should distinguish accordingly.)

Chart: OPEC Oil Production (Excluding Natural Gas Liquids)

Source: Burggraben Analysis; Multiple Data Sources

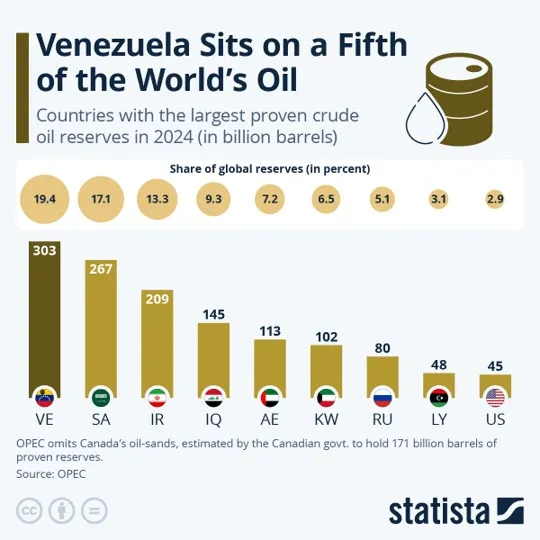

In fact, Venezuela possesses the world's largest oil reserves, with conventional oil quality comparable to Saudi Arabia's. In other words, it has the potential to significantly impact global oil prices just like Saudi Arabia. Generally, lower oil prices (which Trump desires) are considered a boon for peace and prosperity.

Before delving into geology and production, let's return to first principles. In my humble opinion (I am Swiss, not a U.S. voter), Trump's view that "U.S. oil assets should be returned to their rightful American owners" is correct. This is clearly his stance. Therefore, yes, this intervention is not just about drugs; it's also closely tied to oil, and I fully support this position.

As a resource investor, I am tired of seeing dictators and regimes worldwide plunder Western assets without fair compensation, while Western leaders either turn a blind eye or hide behind procedures and polite statements.

We should not reward corrupt leaders, now or in the future. We should firmly uphold the rule of law when Western corporate interests are violated. Even if you disagree with me (which is perfectly fine), as a resource investor, you should be comforted that Trump may have somewhat reduced the above-ground risk for all commodities in emerging markets, at least in the short term.

Regardless, Venezuela holds the world's largest oil reserves, a significant portion of which originally belonged to Western companies that discovered and developed them. These companies not only developed part of the resources but also paid due taxes to the host country.

The Orinoco Belt alone represents the largest accumulation of oil on Earth, with an average estimated technically recoverable heavy oil volume of about 513 billion barrels. In terms of reserves, i.e., the economically proven recoverable portion, Venezuela accounts for roughly 20% of the world's known reserves.

However, in a market with total daily oil demand of about 85 million barrels (note, this excludes total liquid fuel production of about 103 million barrels per day), Venezuela's oil production accounts for only 1%.

Ladies and gentlemen, this is the consequence of socialism and corruption.

Under Maduro's rule, for years, people have even died of hunger in the streets. Remember this the next time someone tries to sell us the "warmth of collectivism."

It should be noted that OPEC's oil reserve data has incentives for exaggeration, as these figures determine production quotas. This is why every seasoned geologist will tell you that, for example, Kuwait's heavy oil reserve data is overstated.

However, careful study of U.S. Geological Survey (USGS) reports suggests that Venezuela's heavy oil resources are less likely to be overestimated.

Even if the medium viscosity of the Orinoco Belt might halve the ultimately recoverable volume, other resources are highly likely to be discovered elsewhere, including Venezuela's offshore areas (like neighboring Guyana).

Therefore, from any perspective, this is a massive "cake" and, in the long run, has the potential for substantial production growth.

Chart: Global Oil Reserves

If the U.S. oil industry and global oil services sector are allowed to develop this "treasure," Venezuela could surpass Saudi Arabia's production within the next decade.

Mark my words, I'm telling you now.

The conventionality and richness of these oil fields are so high that once today's advanced oil industry technology is fully applied to these reserves, the potential is immeasurable.

American entrepreneurial spirit has already squeezed 9.8 million barrels of oil per day from hard shale.

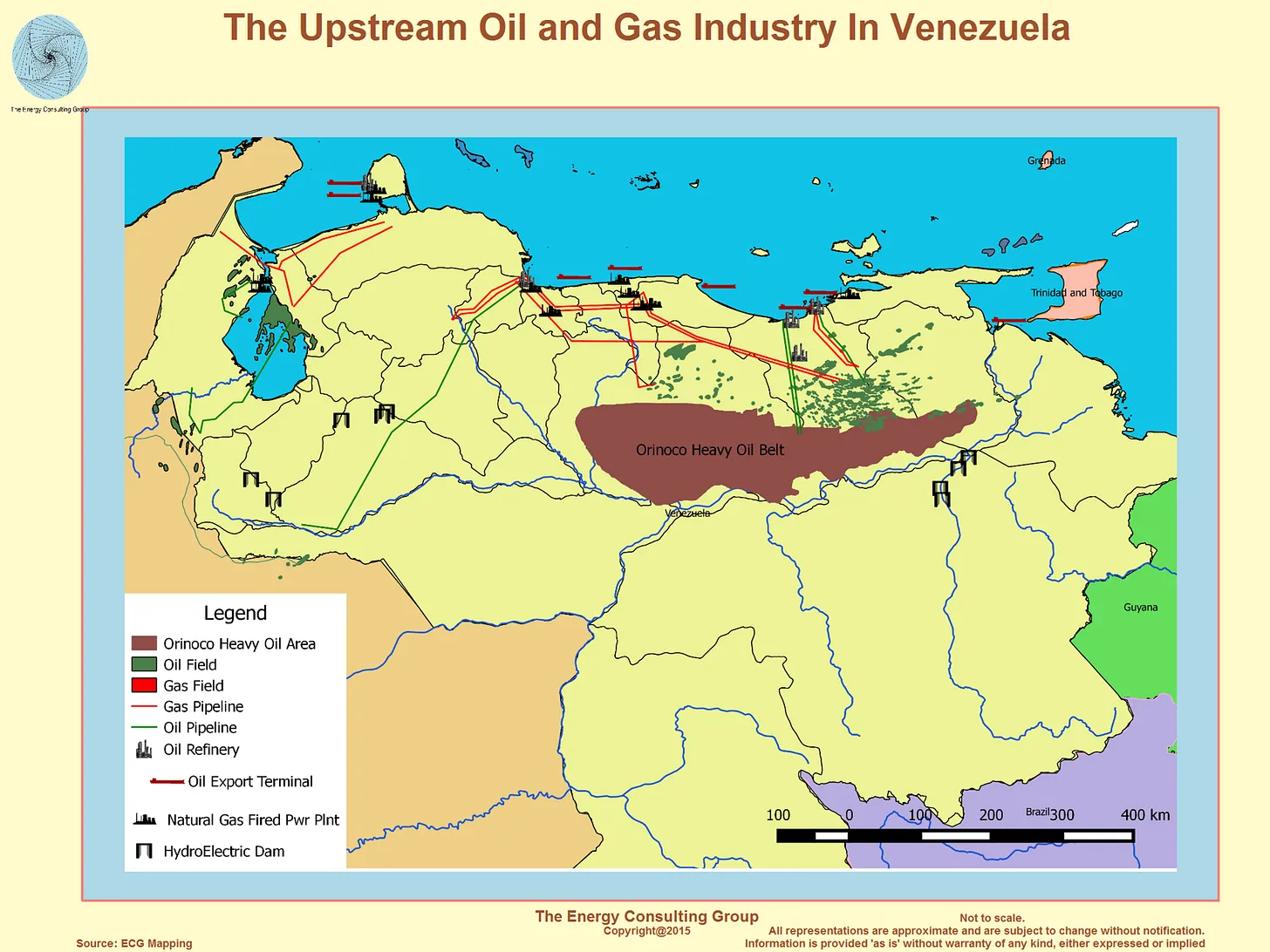

Venezuela's oil resources are like a Texas-sized swimming pool filled with oil, just waiting to be extracted, pipelined, and utilized. This is the last frontier of oil wealth.

Chart: Geological Map of Venezuela's Oil Resources

Increased oil production would be a boon for all aspects of Venezuela: massive tax revenues, high-paying jobs, and explosive growth in related service industries—from oil services to construction, from leisure and entertainment to hospitality, a complete ecosystem would form.

Imagine the prosperity of Texas, but on a larger scale.

The left might describe this as "colonialism." But as Texas and Norway have shown, this is called capitalism.

Capitalism works well in environments with sound institutions but struggles in emerging markets lacking effective ones.

This is a fact; you can quote me anytime, anywhere.

Chart: Venezuela's Oil Production Since 1965 (Thousand Barrels Per Day)

Source: Bloomberg

Under the right conditions, Venezuela's oil production could ramp up quickly; even a "modest" increase would have a huge impact in a commodity market determined by marginal pricing.

Currently, Venezuela's oil production is about 900,000 barrels per day. If property rights and the rules of the game are repaired, raising production to 1.5 million barrels per day within 18 months is a realistic initial target. This growth would be led by international oil majors with the most experience, strongest financials, and largest outstanding claims, including Chevron, ConocoPhillips, Exxon, and possibly Shell and Italy's ENI.

These companies have suffered losses in the past and still have significant outstanding amounts to recover. Reports suggest ConocoPhillips alone has over $10 billion unpaid. However, it's important to note that, except for Chevron, these majors are unlikely to engage actively until political stability is achieved, the country's actual managers are clear, and a solid, non-arbitrary legal framework is established.

Restoring production to 3.5 million barrels per day is achievable if bottlenecks in infrastructure like pipelines, electricity, upgrades, and ports are addressed. But note, large numbers can sometimes be misleading. Assuming $60 billion is needed to restore pipeline, power, and export infrastructure to normal, that may sound huge, but consider that in 2010 alone, the U.S. shale oil industry spent more than that on drilling.

Capital exists, capability exists, and the key determinant of speed is the legal framework.

Without a stable legal environment, little will change.

If the rules after Trump are rewritten, or if Venezuela merely transitions from one corrupt mess to another, production would at best plateau between 1.5 and 3 million barrels per day. That's the worst-case scenario. However, if the rule of law is genuinely implemented, reaching 10 million barrels per day within a decade is not a fantasy. It's simply the natural outcome of world-class resources being developed by a world-class industry.

The key point: Even without the best-case scenario, merely making Venezuela a stable 5 million barrel per day producer (similar to Canada today) and maintaining that level for decades would at least offset future production declines from maturing U.S. shale fields. In a market where the marginal barrel sets the price, this would be a massive impact.

In fact, you don't even need to wait for Venezuela to reach 5 million barrels per day. Just the trend of increasing from the current 900,000 barrels per day to 1.5 million next year would be enough to pressure Brent crude prices, as the market is already in a "surplus" for 2026 and 2027 supply.

Yes, physical commodities are priced based on current demand, not future expectations. But in the oil market, the number of "paper barrels" traded far exceeds the physical volume, and market expectations often move prices before the physical oil arrives.

Recall Q4 2018, when Trump alone pulled Brent crude from $90 to $55 per barrel merely with changes in Iran sanction waivers and tone, with almost no actual supply change.

Regardless, long-term low oil prices are a blessing for all humanity.

I want to further explain my views and preemptively address critics who might question my predictions. After all, consultancies like Energy Aspects always try to make things sound more complicated.

First, no false modesty: I have invested directly or indirectly in the oil industry for twenty years. I have visited more remote oil fields than many industry "keyboard experts." I have experienced success and failure with my own capital, not someone else's money.

I have spent hundreds of hours analyzing this market from scratch, from single wells to countries to every barrel globally. I have used almost all serious data tools, from Kpler to OilX, Kayrros, JODI, and major agency services. For a while, I genuinely felt I could almost track every barrel's flow in real-time. So trust me, when I simplify the analysis here, I have a basis.

Second, of course, I cannot accurately predict future production; it's not a physics problem. It's path-dependent, meaning it entirely depends on what happens next. If Trump doesn't follow through, if property rights aren't resolved, if Venezuela after Maduro just shifts from one corrupt mess to another, then nothing changes, or only marginally.

But if Trump gets it half right, believe me, Venezuela's prospects exceed expectations. These wells will be "monsters," and the industry will be able to develop these resources at record speed, provided political interference is excluded.

However, these key conditions must be established first. The starting point for driving oil production growth lies in property rights protection, rule of law, and a free-market economy. Without these foundations, even with abundant oil reserves, significant growth is difficult. Perhaps by the end of 2027, production could reach 1.5 million barrels per day? Who knows.

Third, and this is what most people miss, Venezuela is not starting from zero. In the industry, it's called a "brownfield," meaning its oil fields already have some development foundation. Currently, Chevron produces about 300,000 barrels of oil per day in Venezuela. They received a license during the Biden administration, and Chevron's history in Venezuela dates back nearly 100 years.

This means Chevron possesses decades of geological data, production history, and operational experience. ConocoPhillips and Exxon left in 2007 when then-President Hugo Chávez forcibly renegotiated contracts with all oil majors, including European companies.

Thus, these oil majors already know where the fields are, what technology works, which equipment is prone to failure, and how to scale up. They likely have more detailed data than Venezuela's state oil company PDVSA. This provides a massive first-mover advantage for any revival plan.

Therefore, Venezuela's situation is not like post-Soviet Union scenarios, where Western companies were barred for political reasons and had to learn everything from scratch. The oil industry is not just pipes and pumps; it involves logistics, engineering, process management, and massive data. Once that knowledge is in place and the rules of the game are clear, capital and capability will naturally follow.

Of course, many uncertainties remain. But even a medium outcome, like 4 to 5 million barrels per day, would structurally alter the global supply-demand balance for liquid energy. Believe me, it would be a brutal shock, as Venezuela would produce some of the world's cheapest oil. This change would be profound. We can only hope it materializes.

For those skeptical of a massive production increase in Venezuela, I offer another perspective. The U.S. once accomplished a feat that seemed equally absurd. U.S. shale oil production grew from 1.8 million barrels per day in 2010 to 9.8 million by the end of 2025. In other words, American entrepreneurial spirit squeezed a "Saudi Arabia" worth of oil out of rock. Adding Alaska and Gulf of Mexico production, total U.S. oil output is now about 13.8 million barrels per day, a whole new level higher than what most thought possible 15 years ago.

Chart: U.S. Shale Oil Production (Million Barrels Per Day)

Source: Bloomberg

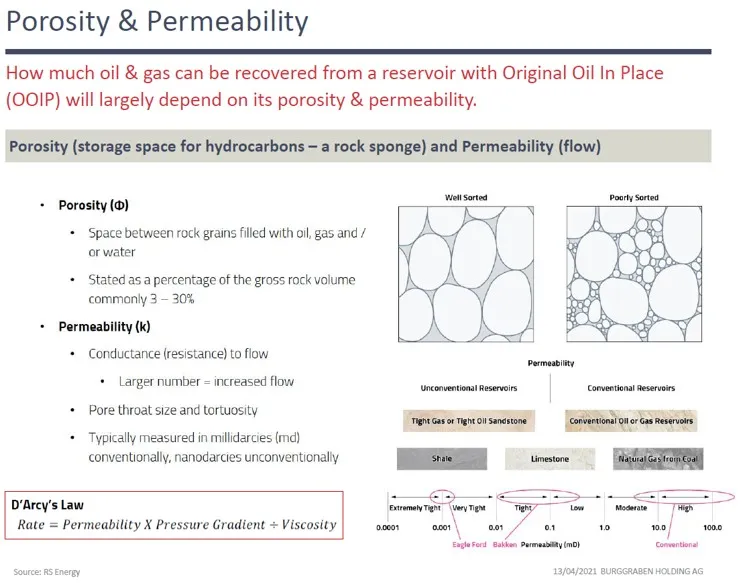

So, the question: Why is shale oil so complex? Compared to conventional onshore fields, shale oil extraction is exceptionally difficult. Oil in conventional fields is typically stored in "natural tanks" of limestone or sandstone, flowing naturally. Shale oil is trapped in dense source rock with extremely low porosity and permeability, meaning oil can hardly flow on its own.

In shale fields, you don't simply "drill a well" and let it produce. Instead, you need to "assault" the rock with horizontal drilling, multi-stage fracking, and massive inputs of equipment, personnel, water, sand, steel, and capital, just to release small amounts of oil.

Moreover, each shale well yields only hundreds of thousands of barrels, not millions or tens of millions over many years like conventional fields. Shale well production typically lasts only months before the next well needs drilling.

This phenomenon is known in the industry as the "Drilling Frenzy."

Chart: Key Factors for Oil Recovery & Potential of Venezuela's Orinoco Belt

Data Source: Burggraben Analysis

The shale revolution is one of the greatest industrial